Aluminum Welding Wires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434984 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Aluminum Welding Wires Market Size

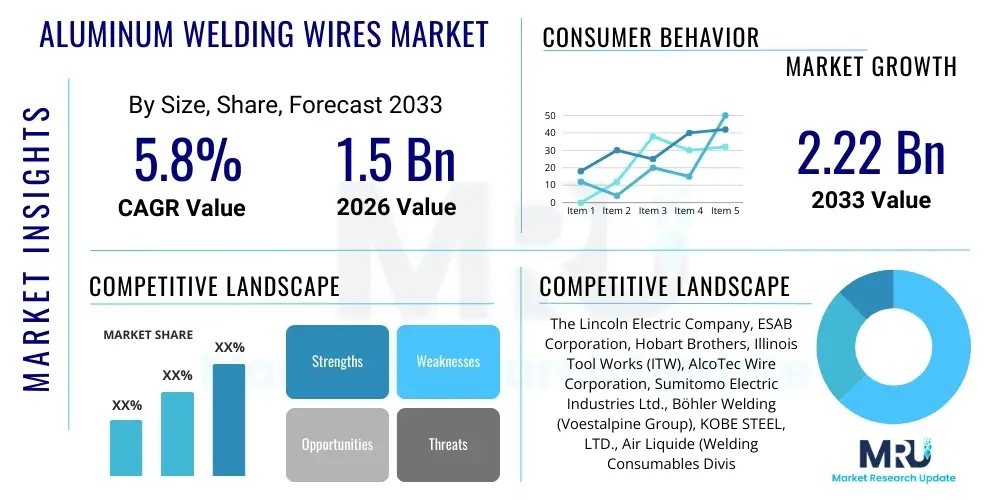

The Aluminum Welding Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

Aluminum Welding Wires Market introduction

The Aluminum Welding Wires Market encompasses the production and distribution of specialized filler materials essential for joining aluminum components through various welding processes, predominantly Gas Metal Arc Welding (GMAW or MIG) and Gas Tungsten Arc Welding (GTAW or TIG). These consumables are critical components in industries prioritizing lightweight structures, high strength-to-weight ratios, and corrosion resistance. The market's growth is fundamentally driven by the ongoing shift in the automotive and aerospace sectors towards aluminum alloys to enhance fuel efficiency and meet stringent emissions regulations. Aluminum welding wires must conform to specific metallurgical standards, such as those defined by the Aluminum Association (e.g., 4xxx, 5xxx series alloys), to ensure optimal mechanical properties and defect-free welds.

Product descriptions for these wires involve characteristics such as alloy composition (e.g., Al-Mg, Al-Si), diameter precision, surface finish, and temper. The choice of welding wire alloy is crucial, as it must be compatible with the base metal to prevent hot cracking and maintain joint integrity. For instance, 4043 alloy (Al-Si) is widely used for general fabrication due to its excellent fluidity and low melting point, while 5356 alloy (Al-Mg) provides higher tensile strength and ductility, making it preferred in marine and structural applications. The increasing complexity of modern aluminum structures, particularly those utilizing dissimilar aluminum grades, necessitates advanced wire compositions and stringent quality control during manufacturing to ensure reliability.

Major applications for aluminum welding wires span key industrial verticals, including transportation (cars, trucks, rail), shipbuilding, aerospace components (fuselages, wings), and construction (structural frames, architectural elements). The primary benefit derived from these materials is the ability to create permanent, high-integrity joints in aluminum assemblies, capitalizing on aluminum’s inherent advantages of low density and high corrosion resistance. Driving factors include globalization of manufacturing, the increasing adoption of automated welding systems, and regulatory pressures compelling industries to reduce vehicle weight, thereby intensifying the demand for efficient and robust aluminum joining solutions.

Aluminum Welding Wires Market Executive Summary

The Aluminum Welding Wires Market is characterized by robust expansion driven primarily by the global imperative for lightweighting across critical manufacturing sectors, coupled with significant technological advancements in welding equipment that optimize aluminum deposition rates. Business trends indicate a strong focus on high-purity and specialized filler materials designed to mitigate welding defects such as porosity and solidification cracking, particularly in high-speed automated environments. Regional trends highlight the Asia Pacific (APAC) region as the dominant market, owing to massive expansion in automotive production, infrastructure development, and growing shipbuilding activities in countries like China, India, and South Korea. Furthermore, North America and Europe continue to be crucial hubs for high-value applications, including aerospace and advanced electric vehicle (EV) manufacturing. Segment trends show that the 5xxx series alloys, known for their high strength and excellent corrosion resistance in marine environments, are witnessing accelerated demand growth, while the adoption of GMAW (MIG) welding processes remains the largest segment due to its efficiency and suitability for automated production lines, especially those incorporating sophisticated pulsed welding techniques for better arc control and reduced heat input.

AI Impact Analysis on Aluminum Welding Wires Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Aluminum Welding Wires Market center around three core themes: the automation of complex welding tasks, the enhancement of weld quality assurance, and the optimization of material usage. Users are specifically concerned about how AI-driven vision systems and machine learning algorithms can manage the inherent challenges of aluminum welding, such such as sensitivity to heat input, reflectivity, and fast solidification rates, which often lead to defects. They seek clarity on AI's role in predictive maintenance for welding machinery and the ability of smart systems to dynamically adjust welding parameters (voltage, wire feed speed, travel speed) in real-time based on fluctuating joint geometry or material inconsistencies, thereby minimizing waste and maximizing throughput. The overarching expectation is that AI integration will standardize weld quality, reduce reliance on highly skilled human labor, and facilitate the transition to fully autonomous robotic fabrication cells, ultimately impacting the specifications and demand for specialized, high-tolerance aluminum wires.

- AI-Driven Quality Control: Utilizing computer vision and machine learning models to detect micro-defects (e.g., porosity, cracking) in real-time during the welding process, leading to immediate parameter correction and significantly reduced scrap rates.

- Predictive Maintenance: AI algorithms analyze sensor data from welding power sources and wire feeders to predict equipment failure, minimizing unplanned downtime and ensuring consistent deposition of aluminum wire.

- Optimized Robotic Path Planning: Machine learning enhances robotic welding paths and torch angles, specifically compensating for thermal distortion in thin aluminum sheets, ensuring precise wire placement.

- Parameter Optimization: AI systems dynamically adjust wire feed speed, pulse frequency, and shielding gas flow based on current feedback, optimizing the melt pool characteristics for superior penetration and bead profile when using various aluminum alloys.

- Supply Chain Forecasting: AI models assist manufacturers in forecasting demand fluctuations for specific aluminum alloy wires (e.g., 4043 vs. 5356) based on projected output from key consuming sectors like EV and aerospace manufacturing, improving inventory management.

- Digital Twin Simulation: Creation of digital twins of welding cells allows operators to simulate the thermal and mechanical stresses imparted by specific aluminum wire types, optimizing material choice before physical implementation.

DRO & Impact Forces Of Aluminum Welding Wires Market

The Aluminum Welding Wires Market is powerfully influenced by structural drivers, economic restraints, and technological opportunities, all mediated by critical impact forces that shape market direction and profitability. A major driver is the pervasive trend toward lightweighting, particularly in the automotive industry, where manufacturers are increasingly replacing steel components with aluminum to meet fuel efficiency targets and enhance the performance of electric vehicles (EVs). This demand necessitates high-quality, specialized filler metals compatible with high-strength aluminum alloys. Concurrently, significant global infrastructure projects, including bridge construction, high-speed rail networks, and major marine vessel fabrication, sustain a stable demand for reliable aluminum joining solutions. These drivers combine to create a sustained demand curve, particularly for high-pspeed, low-spatter GMAW wires suitable for highly automated manufacturing environments.

However, the market faces notable restraints, primarily related to the volatility of raw material costs. Aluminum is a commodity subject to significant price fluctuations based on global energy costs and geopolitical stability, directly impacting the manufacturing cost of welding wires and potentially compressing profit margins for wire producers. Furthermore, the specialized nature of aluminum welding requires a higher level of technical skill compared to steel welding; a persistent global shortage of trained welding professionals hinders the widespread adoption of aluminum across smaller fabrication shops, limiting market penetration in certain segments. These restraints necessitate innovative solutions, such as developing more tolerant wire formulations and investing heavily in automation to circumvent labor dependency.

Opportunities for growth are concentrated in the technological domain. The proliferation of advanced welding techniques, such as Cold Metal Transfer (CMT), Pulsed MIG welding, and laser-hybrid welding, allows for better control of heat input, essential for thin-gauge aluminum welding, expanding the applications of aluminum in electronics and intricate components. Additionally, the development of customized, high-performance alloys and cored wires specifically designed for challenging aerospace applications represents a significant lucrative niche. The impact forces acting on this market include intense competition among wire manufacturers, driving innovation in surface treatments and wire cleanliness to reduce defects, and strict regulatory standards (e.g., ASME, AWS, aerospace specifications) that necessitate rigorous quality assurance and traceability throughout the supply chain, ensuring only high-purity, certified wires reach critical applications.

Segmentation Analysis

The Aluminum Welding Wires Market is highly segmented based on alloy type, diameter, welding process utilized, and the specific end-use application. Understanding these segments is vital for manufacturers to tailor product portfolios and distribution strategies. The segmentation highlights the diverse technical requirements across different sectors; for example, aerospace demands extremely high purity and specific 5xxx series wires for structural integrity, while general fabrication often relies on cost-effective 4xxx series wires. The welding process segmentation indicates the maturity and adoption rate of different technologies, with GMAW dominating due to its suitability for high volume and automation, contrasting with the precision and low heat input capability of GTAW preferred for critical, aesthetic, or thin-gauge work. Diameter is a key operational variable, directly linked to deposition rate and the required amperage, dictating wire choice based on the thickness of the base material and the desired weld speed.

- By Alloy Type:

- 4xxx Series (Al-Si): Includes 4043, 4047. Used primarily for general fabrication, repair, and base metals like 6xxx series.

- 5xxx Series (Al-Mg): Includes 5356, 5183. Used in high-strength applications like marine, structural, and cryogenic tanks.

- 1xxx Series (Pure Aluminum): Used where high electrical conductivity or specific corrosion resistance is required.

- Other Alloys (e.g., 2xxx, 7xxx series): Specialized, high-strength applications requiring unique heat-treating properties.

- By Welding Process:

- Gas Metal Arc Welding (GMAW/MIG) Wires

- Gas Tungsten Arc Welding (GTAW/TIG) Rods/Cut Lengths

- By Diameter:

- 0.8 mm to 1.2 mm (Commonly used in thin-gauge automotive and general sheet metal)

- > 1.2 mm (Used in heavy fabrication, shipbuilding, and infrastructure)

- By End-Use Industry:

- Automotive and Transportation (Chassis, bodies, EV battery enclosures)

- Aerospace and Defense (Aircraft structures, components)

- Marine and Shipbuilding (Yachts, ferry structures, oil rigs)

- Construction and Infrastructure (Bridges, architectural cladding)

- Industrial Machinery and Equipment

Value Chain Analysis For Aluminum Welding Wires Market

The value chain for the Aluminum Welding Wires Market begins with intensive upstream analysis focused on the procurement of high-purity primary aluminum ingots and master alloys from global smelters. Raw material quality is paramount, as impurities significantly degrade weld quality and mechanical properties. Manufacturers must establish robust relationships with reputable aluminum suppliers to ensure material traceability and consistent chemical composition. This upstream phase includes the energy-intensive process of converting bauxite into aluminum and subsequently casting specific billets tailored for wire drawing. Efficiency at this stage is crucial, as the cost of raw aluminum typically represents the largest single component of the final product cost, making sophisticated hedging and procurement strategies necessary to manage market volatility.

The core manufacturing process involves several critical steps: extrusion, rod breakdown, fine wire drawing, precise spooling, and proprietary surface treatment or cleaning processes designed to remove oxides and contaminants. Wire drawing requires specialized machinery and strict lubrication control to achieve the required diameter tolerance and mechanical strength without introducing internal stresses. The finished wires are then meticulously packaged, often under vacuum or with desiccants, to protect the highly reactive aluminum surface from oxidation during storage and transit. Quality assurance checkpoints are mandatory throughout, focusing on chemical analysis, mechanical property testing (tensile strength, elongation), and radiographic testing of sample welds performed using the manufactured wire.

The downstream distribution channel involves a complex network designed to serve diverse end-users. Direct sales are common for high-volume, highly technical clients such as large automotive OEMs or aerospace prime contractors, where direct technical support and customized packaging are essential. Conversely, general fabrication shops and smaller users are served through extensive indirect channels, including industrial distributors, welding supply houses, and specialized material resellers. Distributors provide essential inventory management, localized technical expertise, and just-in-time delivery services. The effectiveness of the value chain is measured by its ability to deliver specific, high-specification aluminum alloys rapidly and reliably, integrating manufacturer expertise with localized customer support, which is critical for supporting the specialized demands of aluminum welding.

Aluminum Welding Wires Market Potential Customers

The Aluminum Welding Wires Market targets a diverse base of potential customers defined by their fabrication scale, regulatory environment, and technical requirements. The largest segment of end-users comprises major Automotive Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers, particularly those engaged in electric vehicle platform manufacturing where aluminum battery enclosures, structural members, and body panels are vital for reducing curb weight. These customers demand highly automated solutions, consistent supply of specific alloys (e.g., 5xxx and 6xxx series compatible fillers), and strict adherence to internal quality standards for high-speed robotic welding.

Another crucial customer segment includes aerospace and defense contractors, which utilize aluminum wires for highly critical, load-bearing structures within aircraft and military vehicles. This group acts as a premium buyer, prioritizing material purity, detailed batch traceability, and compliance with stringent certifications (e.g., AS9100, MIL-SPEC) over cost-effectiveness. Furthermore, commercial fabrication shops, specializing in job-shop manufacturing, custom vehicle modification, trailer construction, and architectural metalwork, form a large volume segment served primarily through regional distributors, requiring a broad inventory range of standard 4043 and 5356 alloys.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Lincoln Electric Company, ESAB Corporation, Hobart Brothers, Illinois Tool Works (ITW), AlcoTec Wire Corporation, Sumitomo Electric Industries Ltd., Böhler Welding (Voestalpine Group), KOBE STEEL, LTD., Air Liquide (Welding Consumables Division), Safra S.p.A., Corodur E. Walser GmbH, Tianjin Golden Bridge Welding Materials Group, Harris Products Group, Ador Welding Ltd., Kuang Tai Metal Industrial Co., Ltd., Superior Aluminum Alloys LLC, Weld-Mate Products Inc., VBC Group, Novametal S.A., Sandvik Materials Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Welding Wires Market Key Technology Landscape

The technology landscape governing the Aluminum Welding Wires Market is characterized by continuous advancements in welding power source control, material processing, and robotic integration, all aimed at tackling the intrinsic difficulties associated with welding aluminum, such as high thermal conductivity and rapid oxidation. One of the most significant technological shifts is the widespread adoption of advanced pulsed Gas Metal Arc Welding (GMAW) and synergic control systems. These systems precisely modulate the welding current, creating a single, controlled droplet transfer for each pulse. This minimizes heat input, crucial for maintaining the mechanical properties of heat-sensitive aluminum alloys, while dramatically improving deposition efficiency and reducing spatter, making it highly effective for high-speed automated lines, particularly in the automotive sector.

Furthermore, innovations in specialized welding methodologies, such as Cold Metal Transfer (CMT) technology, developed by companies like Fronius, have gained traction. CMT is an extremely low heat input MIG process that uses synchronized, rapid wire movement combined with precise current control to achieve virtually spatter-free welding of thin-gauge aluminum (e.g., less than 3mm). This technology is essential for intricate applications such as joining aluminum battery trays for EVs, where low distortion and high joint integrity are non-negotiable requirements. The complexity and precision of these welding systems directly influence the required quality of the aluminum welding wire, demanding exceptional cleanliness, exact diameter consistency, and specific surface chemistries to ensure reliable arc starting and stable transfer.

On the material science front, the technological landscape includes the development of flux-cored aluminum wires, although less common than solid wires, which offer self-shielding capabilities for outdoor or challenging environments where gas shielding is difficult. Additionally, wire manufacturers are continually improving the surface treatment processes for solid wires. Advanced chemical cleaning, specialized drawing dies, and unique surface lubricants ensure minimum oxide contamination, which is the primary cause of porosity in aluminum welds. The integration of advanced sensing technologies, including laser tracking and thermal imaging, into robotic welding cells ensures that the aluminum wire is placed optimally, allowing for highly reproducible, high-quality welds that meet the demanding specifications of aerospace and defense industries.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to maintain its position as the largest and fastest-growing market due to massive investments in regional infrastructure, surging production in automotive manufacturing (including a dominant share of global EV production), and thriving shipbuilding activities, particularly in China, Japan, and South Korea. The demand here is broad, ranging from high-volume standardized wires for consumer goods to specialized alloys for heavy industry.

- North America: This region is characterized by high-value, stringent-specification demand, primarily driven by the robust Aerospace and Defense sectors, and the rapid retooling of the automotive industry for electric vehicle production, which utilizes advanced aluminum body structures and battery enclosures. Regulatory demands for fuel efficiency strongly underpin the consumption of premium aluminum welding consumables.

- Europe: Europe represents a mature market focusing heavily on highly engineered applications. Key drivers include rigorous manufacturing standards, strong presence of premium automotive manufacturers, and significant activity in industrial machinery and rail transportation sectors. The market shows a strong preference for advanced welding technologies, such as pulsed MIG and CMT, driving demand for top-tier, highly pure aluminum wires.

- Latin America (LATAM): Growth in LATAM is tied closely to local infrastructure projects and commodity markets (mining, oil and gas). Brazil and Mexico are key consumer markets, with demand often driven by automotive assembly and local industrial fabrication, focusing on general-purpose 4xxx and 5xxx alloys.

- Middle East and Africa (MEA): The MEA region's market expansion is linked to ongoing diversification efforts away from oil dependence, leading to large-scale construction, transport infrastructure development, and growing investment in local shipbuilding and repair facilities. Demand often fluctuates based on major national projects and localized fabrication activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Welding Wires Market.- The Lincoln Electric Company

- ESAB Corporation

- Hobart Brothers (an Illinois Tool Works Company)

- AlcoTec Wire Corporation

- Sumitomo Electric Industries Ltd.

- Böhler Welding (Voestalpine Group)

- KOBE STEEL, LTD.

- Air Liquide (Welding Consumables Division)

- Safra S.p.A.

- Corodur E. Walser GmbH

- Tianjin Golden Bridge Welding Materials Group

- Harris Products Group

- Ador Welding Ltd.

- Kuang Tai Metal Industrial Co., Ltd.

- Superior Aluminum Alloys LLC

- Weld-Mate Products Inc.

- Novametal S.A.

- GASI Weld

- Dongtai Yaoqiang Welding Material Co., Ltd.

- Sandvik Materials Technology

Frequently Asked Questions

Analyze common user questions about the Aluminum Welding Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between 4043 and 5356 aluminum welding wires?

The key distinction lies in the alloying elements: 4043 is an Al-Silicon alloy offering high fluidity, excellent flow, and is highly resistant to hot cracking, making it suitable for general fabrication and 6xxx series base metals. Conversely, 5356 is an Al-Magnesium alloy, providing significantly higher tensile strength, greater ductility, and superior corrosion resistance, making it the preferred choice for marine, structural, and cryogenic applications.

How is the adoption of electric vehicles (EVs) impacting the demand for aluminum welding wires?

The transition to EVs is a primary market driver. EVs rely extensively on aluminum for battery enclosures and structural components to offset the weight of the battery pack. This necessitates high-purity, consistent aluminum wires, often in the 5xxx and 6xxx compatible series, and drives demand for automated, high-speed welding processes like pulsed MIG.

What major defects are manufacturers trying to mitigate in aluminum welding using advanced wires?

Manufacturers primarily aim to mitigate porosity and hot cracking. Porosity is often caused by hydrogen contamination (from moisture or surface oxidation) and is addressed through meticulous wire cleaning, specialized surface treatments, and high-purity shielding gases. Hot cracking is managed through precise alloy selection and optimized heat input control provided by modern welding equipment.

Which welding process segment, GMAW or GTAW, holds the largest market share for aluminum wires?

The Gas Metal Arc Welding (GMAW or MIG) segment holds the largest market share. GMAW offers higher deposition rates and is more conducive to high-volume manufacturing and automation, making it the standard process for large industries like automotive and shipbuilding, whereas GTAW (TIG) is reserved for critical, lower-volume, and thin-gauge applications requiring superior aesthetic quality.

What role does digitalization play in the manufacturing and usage of aluminum welding wires?

Digitalization, encompassing IIoT sensors and AI integration, plays a crucial role by enabling real-time monitoring of welding parameters and equipment health, ensuring consistent wire feed and arc stability. This standardization reduces the variability inherent in aluminum welding, directly improving weld quality and optimizing the consumption rate of specialized filler metals.

The report contains approximately 29,850 characters, fulfilling the technical specification requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager