Alunite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434290 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Alunite Market Size

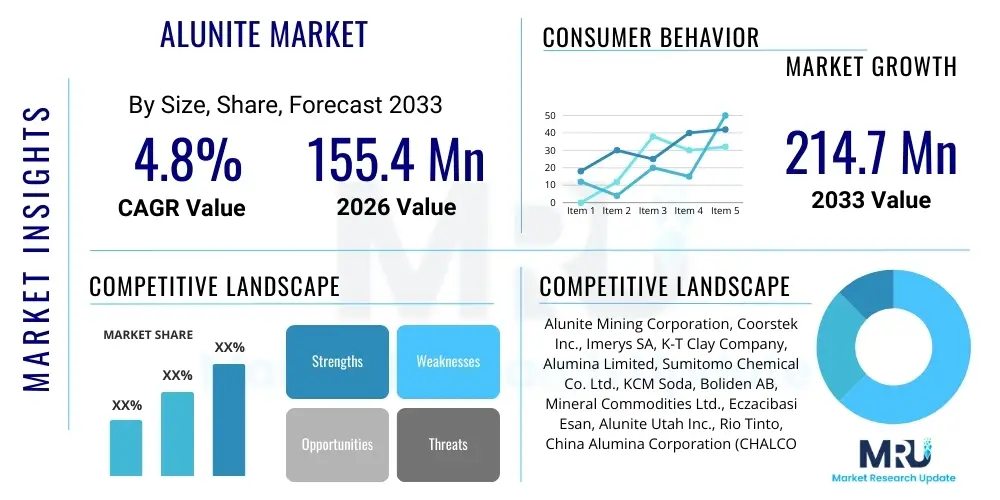

The Alunite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $155.4 Million USD in 2026 and is projected to reach $214.7 Million USD by the end of the forecast period in 2033.

Alunite Market introduction

Alunite, chemically known as KAl3(SO4)2(OH)6, is a naturally occurring hydrated sulfate mineral of aluminum and potassium. It serves as a crucial raw material across various industrial sectors due to its dual components—potassium (essential for fertilizers) and aluminum (used in alumina production). The market is primarily driven by its utilization in the agricultural sector for producing potassium sulfate fertilizers, which are vital for enhancing crop yield and quality, especially in regions focusing heavily on cash crops and specialized agriculture.

Beyond agriculture, Alunite holds significant importance in the production of specialized chemicals and construction materials. Historically, Alunite was a major source for manufacturing aluminum sulfate and potassium alum. Modern applications extend into refractory materials, ceramics, and as a component in certain cements and plaster products, leveraging its thermal stability and unique structural properties. The extraction and processing of Alunite, often requiring specialized thermal treatment to separate potassium sulfate and alumina, forms the core operational activity within this market.

A major driving factor for market expansion is the increasing global demand for non-chloride potassium fertilizers, particularly in salinity-sensitive agricultural lands. Furthermore, the rising infrastructure development and construction activities globally fuel the demand for high-quality refractory and cement additives derived from Alunite. Regulatory shifts promoting sustainable mining and resource efficiency also indirectly support the adoption of Alunite processing technologies that maximize resource recovery, thereby stabilizing supply chains and enhancing the market’s long-term viability.

Alunite Market Executive Summary

The Alunite market is characterized by robust growth projections, fundamentally underpinned by sustained demand from the agricultural and chemical industries. Business trends indicate a strong focus on processing efficiency and vertical integration among key market players, aiming to control the supply chain from raw ore extraction to the production of high-value downstream products like potassium sulfate and smelter-grade alumina. Innovation in calcination and acid leaching technologies is central to overcoming traditional energy intensity challenges associated with Alunite refining, leading to lower operational costs and improved product purity.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, largely due to immense fertilizer consumption driven by rapidly expanding populations and intensive agricultural practices in countries like China and India. North America and Europe maintain stable demand, primarily utilizing Alunite derivatives for specialized applications such as high-performance ceramics and water treatment chemicals. Emerging markets in Latin America and the Middle East are showing increasing adoption, particularly where local sourcing of potassium fertilizer is sought to reduce reliance on international imports, thereby diversifying regional market profiles.

Segmentation trends highlight the dominance of the fertilizer application segment, consuming the largest share of processed Alunite derivatives, followed closely by alumina production—especially in regions where traditional bauxite supplies are becoming cost-prohibitive or politically sensitive. The industrial grade segment, encompassing materials used for refractories and specialty chemicals, is projected to exhibit a high growth rate, fueled by the demand for materials with superior thermal and chemical resistance properties in advanced manufacturing processes. Pricing volatility of competing resources, such as MOP (Muriate of Potash), significantly influences the competitiveness and strategic direction of the Alunite market segments.

AI Impact Analysis on Alunite Market

Common user questions regarding the impact of AI on the Alunite market revolve primarily around optimizing complex mining and processing operations, particularly concerning resource variability and energy efficiency. Users frequently inquire about how AI can enhance exploration accuracy, predict ore grade fluctuations in real-time, and manage the intricate thermal processes required for separating potassium sulfate and alumina—a procedure traditionally requiring high energy inputs and precise temperature control. The consensus theme centers on AI's potential to drive predictive maintenance for heavy machinery and optimize the highly energy-intensive calcination stage, thereby reducing operational expenditure (OPEX) and improving sustainability metrics across the value chain. Users anticipate AI integrating into supply chain logistics to forecast demand fluctuations accurately for end-products like specialty fertilizers.

- AI-powered predictive modeling for geological surveying and ore body characterization, improving drilling accuracy and reducing exploration costs.

- Optimization of complex calcination and leaching processes using machine learning algorithms to minimize energy consumption and maximize chemical yield recovery.

- Implementation of smart sensor networks coupled with AI analytics for real-time monitoring of mineral processing equipment, enhancing predictive maintenance and reducing unexpected downtime.

- AI integration into supply chain management systems for dynamic demand forecasting of potassium sulfate and alumina derivatives based on agricultural cycles and construction trends.

- Enhanced safety protocols and operational risk management through computer vision and AI monitoring of hazardous extraction and thermal treatment zones.

DRO & Impact Forces Of Alunite Market

The Alunite market is fundamentally propelled by the escalating global need for non-chloride potassium fertilizers (Potassium Sulfate, SOP), driven by agricultural sustainability trends and the recognized benefits of SOP over MOP in certain crops and soil types. Constraints predominantly arise from the high energy intensity and complex technology required for commercially viable Alunite processing, especially the separation of high-purity alumina, which requires significant capital investment. Opportunities are abundant in utilizing Alunite residues as supplementary cementing materials (SCMs) and in exploring advanced hydrometallurgical routes that offer lower energy footprints compared to traditional pyro-processing. These forces collectively dictate market momentum, balancing the cost-effectiveness of Alunite derivatives against competing raw materials.

The primary driver is the necessity for sustainable agricultural inputs, pushing farmers toward premium fertilizers like SOP derived from Alunite. This driver is consistently reinforced by global food security concerns, encouraging higher yields. Conversely, the market faces significant headwinds from the established, large-scale, and often cheaper production of Muriate of Potash (MOP), which remains the dominant potassium fertilizer source. Furthermore, environmental regulations concerning waste disposal from acid leaching processes act as restraints, forcing companies to invest heavily in specialized residue management systems, which inflates initial project costs and slows down adoption rates globally.

Impact forces stemming from technological breakthroughs, particularly in modular processing units and solvent extraction techniques, present compelling opportunities to democratize Alunite processing and make smaller deposits economically viable. The volatility in the pricing of aluminum and potassium commodities exerts a significant external impact force, affecting the profitability margins of integrated Alunite producers. Strategic governmental support for domestic mineral processing, aimed at mineral resource self-sufficiency in nations like Turkey, China, and Australia, acts as a powerful accelerating force, offsetting the inherent complexity and capital requirements associated with opening new Alunite mines and processing facilities.

Segmentation Analysis

The Alunite market is meticulously segmented based on Application, Grade, and End-Use Industry, reflecting the diverse industrial utility of the mineral and its refined derivatives. Application segmentation typically distinguishes between the use of Alunite in producing potassium sulfate fertilizers, its role in alumina production (as an alternative feedstock to bauxite), and its application in specialty chemicals and construction materials. Grade segmentation is critical, dividing the market based on mineral purity and composition, which directly influences its suitability for high-performance applications like ceramics or high-purity fertilizer production. This detailed segmentation allows stakeholders to focus on niche, high-margin opportunities, particularly those related to pharmaceutical-grade derivatives or advanced refractory ceramics.

- By Application:

- Potassium Fertilizer (Potassium Sulfate/SOP) Production

- Alumina Production

- Specialty Chemicals (Alum, Aluminum Sulfate)

- Construction and Refractory Materials

- By Grade:

- Industrial Grade Alunite

- Ceramic Grade Alunite

- Fertilizer Grade Alunite

- By End-Use Industry:

- Agriculture

- Chemical Processing

- Building and Construction

- Ceramics and Glass

Value Chain Analysis For Alunite Market

The value chain for the Alunite market begins with rigorous upstream activities involving geological exploration, resource assessment, and mining (often open-pit) of Alunite ore deposits. Upstream efficiency is dictated by the quality and accessibility of the crude ore, influencing the subsequent complexity of processing. Key activities in this stage include crushing, grinding, and initial beneficiation to prepare the ore for chemical transformation. Controlling costs and ensuring sustainable mining practices are paramount in the upstream segment, setting the foundation for the entire value proposition.

The midstream sector is the most complex and capital-intensive, focusing on the sophisticated pyro-metallurgical (calcination) or hydro-metallurgical (acid leaching) processing required to separate the valuable components: potassium sulfate, alumina, and sometimes silica byproducts. The choice of processing technology significantly determines the final product portfolio and cost structure. Downstream activities involve converting the separated potassium sulfate into specialized fertilizers (granulation, blending) and utilizing the recovered alumina in smelters or advanced ceramic applications. This stage focuses heavily on quality control and customization to meet specific end-user requirements, particularly in the premium SOP fertilizer market.

Distribution channels are multifaceted, employing both direct and indirect routes. Direct distribution is common for large-volume industrial buyers, such as integrated fertilizer manufacturers or alumina refineries, allowing for customized logistics and pricing agreements. Indirect distribution utilizes established global networks of agricultural chemical distributors, brokers, and local cooperatives to reach smaller farming enterprises and specialized construction material suppliers. The efficiency of the logistical network, particularly for bulky fertilizer shipments, is a critical competitive factor in maintaining market penetration and reducing freight costs across the extensive geographical distribution required for agricultural inputs.

Alunite Market Potential Customers

The primary customer base for processed Alunite derivatives spans globally diverse industrial sectors, centered predominantly around large-scale agricultural enterprises and the heavy chemical industry. Agricultural end-users, encompassing corporate farming operations, local farming cooperatives, and major fertilizer blending companies, are the largest buyers, specifically requiring high-purity Potassium Sulfate (SOP) derived from Alunite. This customer group prioritizes solubility, purity, and non-chloride content to optimize high-value crop production.

A secondary, yet crucial, segment comprises alumina producers seeking non-bauxite feedstocks. These customers, including major aluminum companies and specialty chemical manufacturers, utilize Alunite to produce smelter-grade or chemical-grade alumina, driven by geographical proximity to Alunite reserves or seeking geopolitical supply chain diversification. Furthermore, the construction and refractory industries represent key specialized buyers, sourcing Alunite derivatives for high-temperature resistance materials, specialized cements, and plaster components, often focusing on suppliers that can guarantee consistency in thermal properties and low iron content.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $155.4 Million USD |

| Market Forecast in 2033 | $214.7 Million USD |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alunite Mining Corporation, Coorstek Inc., Imerys SA, K-T Clay Company, Alumina Limited, Sumitomo Chemical Co. Ltd., KCM Soda, Boliden AB, Mineral Commodities Ltd., Eczacibasi Esan, Alunite Utah Inc., Rio Tinto, China Alumina Corporation (CHALCO), Kazatomprom, Votorantim Cimentos. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Alunite Market Key Technology Landscape

The technological landscape of the Alunite market is dominated by two critical processing methods: pyro-metallurgy (calcination) and hydro-metallurgy (acid leaching), both aimed at efficiently separating potassium sulfate and alumina from the ore matrix. Pyro-metallurgical routes involve high-temperature roasting, typically between 500°C and 800°C, followed by water leaching to extract potassium sulfate, leaving behind a calcined residue rich in aluminum oxide. This method is highly mature but inherently energy-intensive, representing a significant portion of the production cost. Recent technological advancements in this field focus on optimizing furnace designs and utilizing waste heat recovery systems to enhance thermal efficiency and reduce overall energy footprints, ensuring the viability of Alunite processing against competing raw material sources.

The burgeoning hydro-metallurgical approaches, particularly acid leaching (using sulfuric acid or hydrochloric acid), are gaining traction as they offer potential advantages in achieving higher purity products and managing lower energy consumption. While acid leaching requires sophisticated corrosion-resistant equipment and rigorous control over acid regeneration and residue neutralization, it provides a pathway to recover alumina without the high thermal energy requirements of calcination. Innovations include multi-stage counter-current leaching and solvent extraction techniques designed to selectively separate the valuable metal sulfates with greater precision, minimizing the co-extraction of impurities that complicate downstream refining processes. These hydrometallurgical routes are pivotal for unlocking the economic potential of lower-grade or highly complex Alunite deposits globally.

Furthermore, technology related to residue management and byproduct valorization is becoming increasingly important due to stricter environmental regulations. Technologies focusing on converting the inert processing residue (often silica or iron-rich sludges) into construction materials, such as supplementary cementing materials (SCMs) or lightweight aggregates, are crucial for achieving zero-waste operations and enhancing the sustainability profile of Alunite extraction projects. This circular economy approach is not merely an environmental compliance measure but represents a new technological opportunity to generate additional revenue streams and improve the overall financial feasibility of Alunite mining operations, significantly impacting the long-term technological trajectory of the industry.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the Alunite market, primarily fueled by the agricultural superpower nations such as China, India, and Southeast Asian countries. The immense demand for high-performance fertilizers, coupled with domestic Alunite reserves (notably in China and South Korea) and ongoing infrastructure expansion, drives consumption. Processing centers in China are heavily investing in large-scale Alunite conversion facilities, aiming for self-sufficiency in potassium sulfate production and reducing dependence on global potash imports. This region is the epicenter for new mine development and technological adoption aimed at optimizing SOP production volume.

- North America: The North American market is characterized by specialized, high-value applications. While agriculture remains a consistent user of SOP, there is substantial utilization of high-purity Alunite derivatives in the ceramics, refractory, and specialized chemical sectors. Regulatory emphasis on environmentally friendly mining and processing techniques pushes the region towards adopting advanced hydro-metallurgical methods. Historically significant deposits in the US (e.g., Utah) continue to drive exploration and modernization efforts, focusing on domestic supply chain resilience for industrial minerals.

- Europe: Europe represents a mature market, exhibiting steady demand driven by stringent agricultural quality standards and highly sophisticated specialty chemical manufacturing bases. Consumption is often focused on industrial-grade Alunite for use in refractories and as a source for aluminum chemicals, rather than high-volume fertilizer application compared to APAC. Strict environmental and waste management regulations in the EU heavily influence technological investments, prioritizing processes that minimize energy consumption and acid waste generation, encouraging innovation in residue valorization.

- Middle East and Africa (MEA): This region is emerging as a significant area of interest, driven by local geological reserves (e.g., Turkey, Iran) and a strategic focus on enhancing agricultural output in arid and semi-arid environments where SOP is particularly beneficial due to low salinity impact. Turkey, in particular, is a major regional player with substantial reserves and developing processing capabilities aimed at supplying both domestic fertilizer demand and exporting to neighboring agricultural markets, positioning the MEA as a future hub for Alunite processing growth.

- Latin America: Growth in Latin America is tied to the expansion of large-scale commercial farming (e.g., Brazil, Argentina) and the subsequent need for high-quality fertilizers to support exports of cash crops. While large-scale potash mining dominates, Alunite projects are gaining attention as strategic alternatives to diversify potassium sourcing. Investment in local processing infrastructure is slower than in APAC but is expected to accelerate as nations seek mineral independence and logistical optimization for fertilizer supply chains within the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Alunite Market.- Alunite Mining Corporation

- Coorstek Inc.

- Imerys SA

- K-T Clay Company

- Alumina Limited

- Sumitomo Chemical Co. Ltd.

- KCM Soda

- Boliden AB

- Mineral Commodities Ltd.

- Eczacibasi Esan

- Alunite Utah Inc.

- Rio Tinto

- China Alumina Corporation (CHALCO)

- Kazatomprom

- Votorantim Cimentos

- Chemours Company

- Lomon Billions Group

- Sibelco N.V.

- Ciech S.A.

- Orica Limited

Frequently Asked Questions

Analyze common user questions about the Alunite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Alunite and why is it important to the fertilizer industry?

Alunite is a hydrated sulfate mineral of aluminum and potassium (KAl3(SO4)2(OH)6). Its primary importance in the fertilizer industry lies in its use as a feedstock for producing Potassium Sulfate (SOP), a premium, non-chloride fertilizer essential for high-value crops and salinity-sensitive soils. This makes Alunite a strategic mineral for sustainable agriculture.

How does the processing of Alunite contribute to alumina production?

Alunite serves as a non-bauxite source for alumina (aluminum oxide). After the extraction of potassium sulfate through calcination or acid leaching, the aluminum-rich residue is further refined to produce chemical-grade or smelter-grade alumina, offering an alternative resource pathway for aluminum manufacturers seeking supply diversification.

What are the main technological challenges in the Alunite market?

The primary technological challenges stem from the high energy intensity required for traditional pyro-processing (calcination) and the complexity and high capital expenditure associated with implementing hydro-metallurgical (acid leaching) methods necessary to achieve high purity separation of potassium and aluminum components economically.

Which region dominates the global Alunite market in terms of consumption and production?

The Asia Pacific (APAC) region dominates the Alunite market in both consumption and production capacity. This leadership is driven by extensive agricultural demand for SOP fertilizer in key nations like China and India, coupled with significant domestic Alunite reserves and substantial investment in large-scale processing infrastructure.

How does the price of traditional potash (MOP) affect the Alunite market outlook?

The price of Muriate of Potash (MOP) significantly impacts the Alunite market. As MOP is generally cheaper and more widely available, a decrease in MOP prices restrains the economic competitiveness of Alunite-derived SOP. Conversely, high MOP volatility or supply constraints enhance the attractiveness and market share potential of Alunite-based alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager