Ambulatory Surgery Center Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432667 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ambulatory Surgery Center Services Market Size

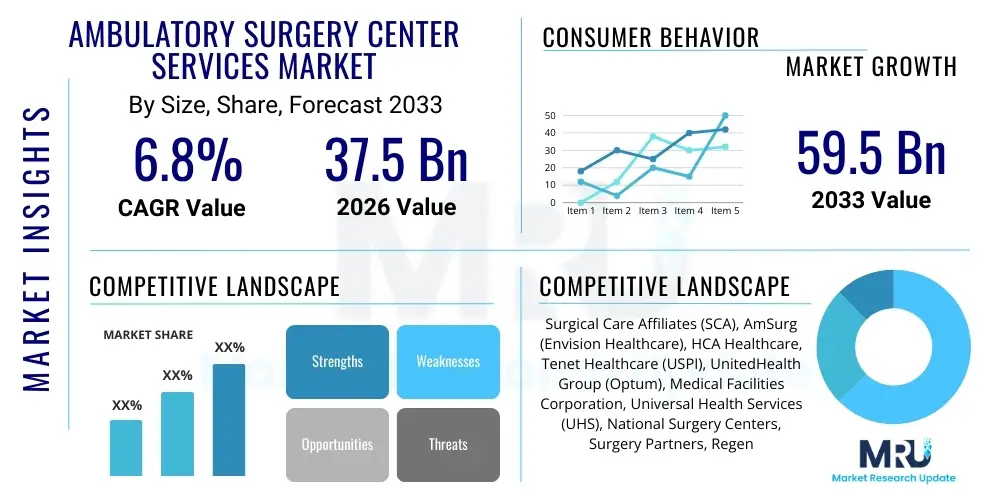

The Ambulatory Surgery Center Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 37.5 billion in 2026 and is projected to reach USD 59.5 billion by the end of the forecast period in 2033.

Ambulatory Surgery Center Services Market introduction

The Ambulatory Surgery Center (ASC) Services Market encompasses the provision of surgical, diagnostic, and preventative procedures performed in outpatient settings that do not require an overnight hospital stay. These facilities are designed to offer cost-effective alternatives to traditional inpatient hospitals, prioritizing patient convenience, efficiency, and specialized care delivery. Key services offered include gastroenterology procedures, ophthalmic surgery, orthopedic procedures, pain management injections, and plastic surgery. The market expansion is fundamentally driven by the shift in healthcare delivery models toward value-based care, prompting payers and providers to seek lower-cost settings for elective and minimally invasive procedures.

The core product description revolves around the specialized environment of ASCs, which provides high-quality, focused surgical care outside the complex overhead structure of hospitals. Major applications span several medical specialties, with high-volume procedures consistently moving from inpatient to outpatient status, facilitated by advancements in anesthetic techniques and minimally invasive surgical tools. The critical benefits of utilizing ASCs include substantial cost savings for both patients and healthcare systems, reduced risk of hospital-acquired infections (HAIs), and improved patient satisfaction due to streamlined scheduling and personalized care pathways. This shift is strongly supported by regulatory bodies and insurance providers who often incentivize the use of ASCs for appropriate procedures.

Driving factors propelling this market include the global aging population, which necessitates increased volumes of procedures like cataract removal and joint replacements; technological advancements enabling less invasive surgeries; and, crucially, legislative support and reimbursement policies favoring outpatient settings. Furthermore, physician ownership models within ASCs provide powerful incentives for efficiency and clinical excellence, attracting high-caliber surgeons and enhancing operational performance. The market's resilience is tied to its capability to deliver high-quality outcomes at a fraction of the cost associated with inpatient hospital utilization, making it a pivotal component of modern healthcare infrastructure planning.

Ambulatory Surgery Center Services Market Executive Summary

The Ambulatory Surgery Center Services Market is experiencing robust expansion, primarily fueled by the accelerating transition of surgical volume from hospitals to outpatient facilities, driven by economic necessity and enhanced clinical capabilities. Key business trends include aggressive vertical integration, where large hospital systems and corporate chains acquire or partner with independent ASCs to capture market share and control the entire continuum of care. Simultaneously, there is a pronounced focus on specialization within ASCs, particularly in high-growth areas such as spine, cardiovascular, and advanced orthopedic procedures, necessitating significant capital investments in specialized equipment and infrastructure improvements. Operational efficiencies, facilitated by advanced supply chain management and standardized protocols, remain central to profitability across all segments.

Regionally, North America maintains market dominance due to a highly established reimbursement framework, high rates of chronic disease, and widespread acceptance of the ASC model by payers and providers. However, the Asia Pacific region is demonstrating the highest growth trajectory, supported by rising healthcare expenditures, increasing patient awareness, and governmental initiatives aimed at improving surgical access and modernizing healthcare infrastructure in developing economies. European markets, particularly in Western Europe, are also seeing steady growth, though regulatory fragmentation and differing national healthcare models impose unique structural challenges to market penetration compared to the U.S. model.

Segment trends highlight the shift towards multi-specialty centers, which offer diversification and optimize facility utilization, though single-specialty centers remain highly profitable in areas like ophthalmology. Ownership models are diversifying, with the physician-hospital joint venture (PHJV) model gaining significant traction, balancing physician autonomy with institutional financial stability and referral networks. The convergence of surgical precision technologies, including robotics and advanced imaging, within the ASC setting is fundamentally elevating the complexity of procedures that can be safely performed in an outpatient environment, thereby continually expanding the addressable market size and revenue per case.

AI Impact Analysis on Ambulatory Surgery Center Services Market

Analysis of common user inquiries regarding the impact of Artificial Intelligence (AI) on the Ambulatory Surgery Center Services Market reveals a strong focus on operational optimization, predictive analytics for scheduling, and enhancement of clinical decision support systems. Users are keenly interested in how AI can solve critical operational bottlenecks, such as managing complex surgical schedules, optimizing inventory levels specific to case mix, and reducing administrative burdens related to prior authorizations and documentation. Concerns often revolve around the initial capital outlay required for AI integration, data privacy in sensitive patient records, and the necessity of specialized training for staff. Expectations are high regarding AI’s potential to improve patient safety through advanced risk stratification for post-operative complications and to standardize quality metrics across distributed ASC networks, ultimately driving higher efficiency and reducing per-case costs.

- AI-powered predictive scheduling algorithms optimize operating room utilization and minimize turnover time.

- Implementation of AI for automated prior authorization checks streamlines the revenue cycle management process.

- Enhanced clinical decision support tools aid surgeons in procedure planning and risk assessment in real-time.

- Utilization of machine learning for supply chain forecasting reduces inventory waste and ensures critical materials availability.

- AI applications monitor patient vitals post-procedure, offering early alerts for potential complications in recovery areas.

- Advanced image analysis tools improve diagnostic accuracy for pathology and radiology procedures performed within the ASC.

- Automation of patient intake and documentation processes enhances administrative efficiency and reduces labor costs.

DRO & Impact Forces Of Ambulatory Surgery Center Services Market

The Ambulatory Surgery Center Services Market is driven by powerful economic and demographic forces, principally the relentless pressure from payers to reduce overall healthcare expenditures by favoring lower-cost outpatient settings over traditional inpatient hospitals. Technological progression, specifically the evolution of minimally invasive surgery (MIS) techniques and improved anesthetic agents allowing for quicker recovery, enables a vast array of procedures to be safely migrated to the ASC setting, significantly expanding the market's scope. Furthermore, the increasing prevalence of chronic diseases requiring surgical intervention, particularly among the expanding elderly population globally, guarantees a sustained, high demand for efficient surgical services. These drivers collectively create a compelling economic and clinical argument for the continued decentralization of surgical care.

However, the market faces significant restraints, including stringent and often complex regulatory and licensure requirements that vary significantly by jurisdiction, creating barriers to entry and expansion for smaller entities. The ongoing shortage of specialized surgical nurses, certified registered nurse anesthetists (CRNAs), and skilled technicians poses a critical operational challenge, potentially limiting surgical capacity and increasing labor costs. Additionally, the risk of physician burnout and the necessity for continuous capital investment in advanced technology and facility upgrades require sophisticated financial planning. The persistent competition from established hospital outpatient departments (HOPDs) that may benefit from higher negotiated reimbursement rates also acts as a competitive restraint for independent ASCs.

The primary opportunities for growth lie in the expansion of high-acuity procedures, such as total joint arthroplasty (TJA) and specific cardiac interventions (e.g., pacemaker insertion), into the outpatient environment as technology and clinical protocols mature. Furthermore, leveraging strategic partnerships, including joint ventures between physicians and corporate partners, offers avenues for increased funding and access to broader managed care contracts. The adoption of advanced digital solutions, including telehealth for pre- and post-operative monitoring and sophisticated patient engagement platforms, promises to enhance operational efficiency and patient outcomes, creating a competitive advantage for ASCs that prioritize technological integration. These impact forces collectively indicate a strong, albeit competitive, market trajectory favoring agile, quality-focused, and technologically equipped facilities.

Segmentation Analysis

The Ambulatory Surgery Center Services Market is comprehensively segmented based on three primary factors: Specialty Type, Ownership Model, and Service Type. This detailed segmentation allows for a nuanced understanding of market dynamics, revealing where investment is most concentrated and where clinical specialization is driving revenue growth. The segmentation by Specialty Type is crucial, as specific procedures like ophthalmology, which was an early adopter of the ASC model, exhibit distinct revenue structures and operational requirements compared to emerging, high-cost segments like orthopedic spine surgery. The continued segmentation evolution reflects the increasing complexity and range of procedures being safely performed outside the traditional hospital setting.

Analyzing the market by Ownership Model provides insight into the competitive landscape and governance structures. Independent physician-owned centers often prioritize clinical autonomy and rapid decision-making, while hospital-owned centers benefit from integrated referral networks and negotiating leverage with payers. The growth of corporate-owned chains signals market consolidation and a focus on standardized, scalable operational practices across multiple geographies. Furthermore, segmentation by Service Type—whether procedural, diagnostic, or therapeutic—helps in defining the scope of services provided, which directly impacts reimbursement coding and patient flow management, ensuring facilities can strategically align their service offerings with local demand and payer preferences.

- By Specialty Type:

- Ophthalmology

- Gastroenterology

- Orthopedics (including Spine and Joint Replacement)

- Pain Management

- Plastic Surgery

- Urology

- Others (e.g., Podiatry, Otolaryngology)

- By Ownership Model:

- Physician-Owned ASCs

- Hospital-Owned ASCs (Hospital Outpatient Departments - HOPDs)

- Joint Ventures (Physician-Hospital, Physician-Corporate)

- Corporate-Owned Chains

- By Service Type:

- Surgical Services

- Diagnostic and Screening Services

- Pain Management Procedures

Value Chain Analysis For Ambulatory Surgery Center Services Market

The value chain for the Ambulatory Surgery Center Services Market is highly integrated and complex, involving several critical stages from upstream suppliers to downstream consumers and payers. Upstream analysis focuses on the manufacturers and distributors of medical devices, implants, pharmaceutical supplies (especially anesthetic agents and pain management medications), and disposable surgical kits. Efficiency in this segment is paramount, as ASCs operate on tighter margins than hospitals, demanding robust just-in-time inventory management and strong relationships with vendors to secure favorable pricing and rapid delivery. Fluctuations in supply costs or regulatory approvals for new surgical technologies directly impact the operational economics of the ASC.

The core value creation stage involves the ASC service providers themselves. This segment includes facility management, clinical staffing (surgeons, nurses, anesthesiologists), pre-operative assessment, surgical execution, and post-operative recovery care. Value is generated by maximizing procedural efficiency, maintaining high clinical quality standards, achieving favorable patient outcomes, and ensuring compliance with all regulatory and accreditation requirements. The distribution channel is predominantly direct-to-consumer, facilitated by referrals from primary care physicians or specialists, with the ASC acting as the final point of service delivery. However, the indirect relationship with payers (insurance companies, government programs) is crucial, as they determine the financial feasibility and reimbursement rates for the services rendered.

Downstream analysis centers on the beneficiaries and financial stakeholders: patients and payers. Patients receive the direct service, valuing convenience, low infection risk, and high-quality outcomes. Payers, conversely, are the primary purchasers of the services, prioritizing cost containment and demonstrable value through quality metrics and bundled payment initiatives. The flow of value is optimized when ASCs can negotiate favorable rates, manage costs aggressively through efficient supply utilization, and maintain low complication rates, thereby minimizing readmissions and maximizing profitability within the structured payment environment. The complexity of financial coding and claims submission forms a critical administrative layer in the overall downstream interaction.

Ambulatory Surgery Center Services Market Potential Customers

The primary end-users and buyers of Ambulatory Surgery Center services are multifaceted, primarily comprising patients requiring elective or non-emergent surgical procedures, healthcare insurance providers (commercial and governmental), and large self-insured employers. Patients are increasingly seeking out ASCs due to the lower out-of-pocket costs, ease of access, and reduced risk of hospital-acquired infections, particularly for common procedures like colonoscopies, cataract surgery, and minor orthopedic repairs. The potential customer base is expanding as clinical advancements allow higher acuity patients to be treated safely in an outpatient setting, widening the demographic appeal beyond low-risk, healthy individuals.

Institutional buyers, specifically commercial health insurance companies and government programs such as Medicare and Medicaid, represent the largest financial customers. Their purchasing decisions are driven by the proven cost-effectiveness of ASCs compared to inpatient hospitals. Payers actively steer their beneficiaries toward ASCs through tiering and copayment differentials, making them critical partners in market growth. Furthermore, large corporations often fund self-insured plans, and they view the ASC model as a powerful tool to control escalating employee healthcare costs while maintaining access to high-quality surgical care, reinforcing the market's value proposition across the entire employer-funded healthcare ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 37.5 Billion |

| Market Forecast in 2033 | USD 59.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Surgical Care Affiliates (SCA), AmSurg (Envision Healthcare), HCA Healthcare, Tenet Healthcare (USPI), UnitedHealth Group (Optum), Medical Facilities Corporation, Universal Health Services (UHS), National Surgery Centers, Surgery Partners, Regent Surgical Health, Ambulatory Services of America, ValueHealth, Covenant Surgical Partners, Pinnacle III, Meridian Surgical Partners, Prospect Medical Holdings, Baylor Scott & White Health, Catholic Health Initiatives, Ascension Health, Providence St. Joseph Health |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ambulatory Surgery Center Services Market Key Technology Landscape

The technology landscape within the Ambulatory Surgery Center Services Market is rapidly evolving, driven by the need for increased precision, efficiency, and data security in an outpatient setting. Key technological advancements include the miniaturization and improved portability of high-definition imaging equipment, allowing for complex procedures to be guided accurately without the necessity of large, dedicated inpatient radiology suites. Robotics and navigation systems, initially exclusive to hospitals, are increasingly being adopted by high-volume ASCs, particularly those specializing in orthopedic and spine procedures, enabling higher accuracy and faster patient recovery times, which are crucial for same-day discharge protocols.

Furthermore, the digital backbone of ASCs relies heavily on advanced Electronic Health Records (EHR) and interoperable practice management systems optimized for rapid patient throughput and streamlined billing processes. These systems must seamlessly communicate with referring physicians, external laboratories, and, most importantly, payer organizations to manage prior authorizations efficiently. Telehealth and remote patient monitoring technologies are also becoming standard, utilized for virtual pre-operative assessments and post-discharge follow-ups, reducing the need for physical visits and improving continuity of care, thereby enhancing overall patient satisfaction and minimizing readmission risks.

Anesthetic technology represents another critical area of innovation, with the development of ultra-short-acting general and regional anesthetic agents minimizing lingering effects and accelerating patient readiness for discharge. This pharmacological progress is indispensable to the core ASC model. Additionally, sterile processing technologies, including advanced sterilization and instrument tracking systems, ensure optimal infection control and operational compliance, supporting the ASC's reputation for safety. The integration of data analytics tools to measure clinical outcomes, benchmark performance against national averages, and identify areas for cost reduction further solidifies the role of technology as a competitive differentiator in this dynamic market.

Regional Highlights

North America (NA): North America, particularly the United States, represents the most mature and dominant market for Ambulatory Surgery Center services globally. This supremacy is fundamentally driven by a well-established and highly favorable reimbursement structure, largely mandated by Medicare and adopted by commercial payers, that actively incentivizes the shift of procedures to the lower-cost ASC setting. The U.S. market benefits from high rates of physician entrepreneurship, leading to significant investment in new centers and the adoption of cutting-edge surgical technology. Regulatory clarity, coupled with high rates of elective surgeries driven by an affluent, aging population, ensures continued robust growth. Market dynamics are characterized by intense consolidation, with large national chains and health systems aggressively acquiring independent centers to create integrated regional networks capable of negotiating bundled payments and managing population health initiatives effectively. The ongoing migration of high-acuity procedures, such as total joint replacements, into the outpatient setting solidifies North America's leadership position in innovation and volume.

Europe: The European ASC market presents a fragmented but steadily expanding landscape, with growth rates varying significantly based on national healthcare systems and regulatory structures. Countries with strong private healthcare sectors, such as the UK (private facilities) and Germany, show higher adoption of the ASC model, driven by patient demand for rapid access to elective procedures. However, the dominance of public, national health systems in many countries often means slower migration of services compared to the U.S. model, as public providers prioritize maintaining high utilization within existing hospital infrastructure. Key drivers here include efforts to reduce long surgical waiting lists and increasing government recognition of the cost-efficiency provided by specialized outpatient units. The market is evolving towards specialized single-service units, especially in ophthalmology and orthopedics, adhering strictly to stringent EU medical device and operational standards. Collaborative models between public systems and private ASCs are emerging as a viable strategy to enhance service delivery efficiency across the continent.

Asia Pacific (APAC): The Asia Pacific region is projected to register the fastest growth during the forecast period, transitioning from an emerging market to a high-potential hub for ASC services. This rapid expansion is propelled by escalating healthcare infrastructure development, growing medical tourism in certain nations (e.g., Singapore, India, Thailand), and the increasing affordability of private health insurance among the middle class. While highly disparate—ranging from sophisticated metropolitan healthcare in Japan and South Korea to rapidly developing systems in India and China—the region shares common drivers: increasing disposable income, urbanization, and a significant burden of lifestyle diseases requiring surgical intervention. Government policies in several APAC nations are focusing on creating accessible, affordable healthcare options, inadvertently bolstering the ASC model. Challenges remain in standardizing quality accreditation and overcoming fragmented regulatory oversight; however, large multinational healthcare corporations are actively investing in joint ventures and greenfield facilities to capitalize on the immense, underserved population base.

- North America: Market leader, characterized by high consolidation, favorable reimbursement policies (Medicare), and early adoption of high-acuity outpatient procedures.

- Europe: Varied growth, constrained by dominant public healthcare systems; strong growth in private sectors (UK, Germany); focus on reducing wait times and specialized care.

- Asia Pacific (APAC): Highest growth rate; driven by increasing healthcare expenditure, rapid urbanization, rising medical tourism, and infrastructure modernization efforts.

- Latin America (LATAM): Emerging market, growth concentrated in metropolitan areas (Brazil, Mexico); driven by expanding private insurance penetration and need for efficient surgical solutions.

- Middle East and Africa (MEA): Growth fueled by government diversification efforts (KSA, UAE) investing heavily in healthcare infrastructure; focus on attracting international medical expertise and reducing dependence on overseas treatment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ambulatory Surgery Center Services Market.- Surgical Care Affiliates (SCA)

- AmSurg (Envision Healthcare)

- HCA Healthcare

- Tenet Healthcare (United Surgical Partners International - USPI)

- UnitedHealth Group (Optum)

- Medical Facilities Corporation

- Universal Health Services (UHS)

- Surgery Partners

- Regent Surgical Health

- Ambulatory Services of America

- ValueHealth

- Covenant Surgical Partners

- Pinnacle III

- Meridian Surgical Partners

- Prospect Medical Holdings

- Baylor Scott & White Health

- Catholic Health Initiatives

- Ascension Health

- Providence St. Joseph Health

- National Surgery Centers

Frequently Asked Questions

Analyze common user questions about the Ambulatory Surgery Center Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Ambulatory Surgery Center (ASC) market?

The primary driver is the intense pressure from governmental and commercial payers to contain healthcare costs. ASCs offer a high-quality, lower-cost setting for surgical procedures compared to traditional inpatient hospitals, leading to strong incentives for both patients and providers to utilize outpatient services.

How does reimbursement policy impact the expansion and profitability of ASCs?

Reimbursement policies, particularly from Medicare in the U.S., significantly determine market profitability. Favorable adjustments that expand the list of procedures eligible for outpatient billing (e.g., Total Joint Arthroplasty) directly increase the addressable market, driving capital investment and facility expansion.

What role do physician-owned joint ventures play in the current ASC market structure?

Physician-hospital joint ventures (PHJVs) are a dominant ownership model. They combine physician clinical expertise and autonomy with the financial stability, referral base, and negotiating power of large hospital systems or corporate chains, ensuring both high quality of care and robust operational efficiency.

Which surgical specialties are experiencing the fastest migration to Ambulatory Surgery Centers?

Orthopedics, particularly total joint replacement (TJA) and spine procedures, is currently undergoing the most rapid migration due to advancements in minimally invasive techniques and anesthesia. Gastroenterology and Ophthalmology remain high-volume, established segments.

What are the key technological challenges facing ASCs today?

Key technological challenges include the high capital cost of adopting advanced technologies like robotics and integrated navigation systems, ensuring seamless data interoperability between the ASC’s EHR and external health systems, and maintaining robust cybersecurity standards for patient data in decentralized settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager