American Whiskey Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431463 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

American Whiskey Market Size

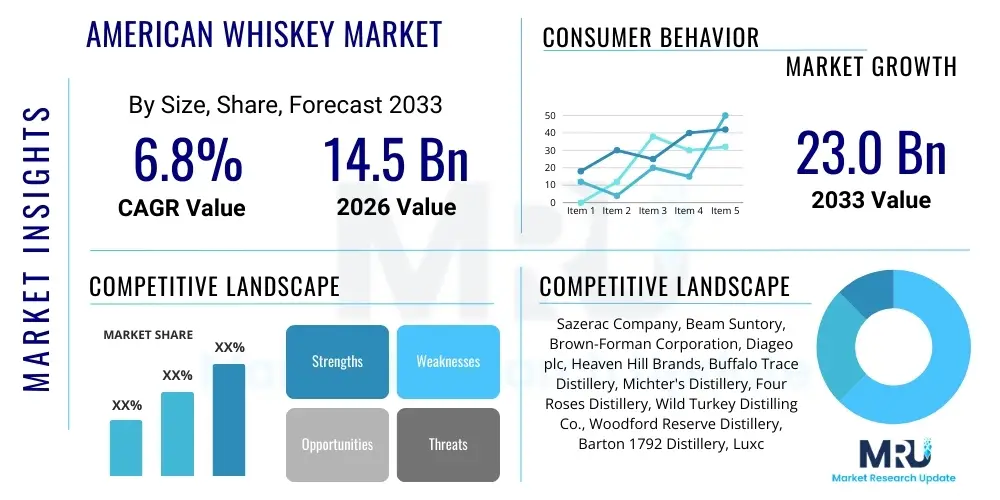

The American Whiskey Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $23.0 Billion by the end of the forecast period in 2033.

American Whiskey Market introduction

The American Whiskey market encompasses a diverse and rapidly expanding segment of the global spirits industry, primarily defined by products such as Bourbon, Rye, Tennessee Whiskey, and blended American whiskies. These products must adhere to stringent federal regulations regarding mash bills, aging processes (typically in new charred oak barrels for Bourbon and Tennessee Whiskey), and alcoholic strength. The fundamental appeal of American whiskey lies in its unique flavor profile, which often features notes of vanilla, caramel, oak char, and spice, distinguishing it significantly from Scotch or Irish whiskies. This segment has witnessed robust premiumization, driven by consumer demand for high-end, aged, and single-barrel expressions, positioning it as a cornerstone of luxury beverage consumption globally.

Major applications of American whiskey include neat consumption, on the rocks, and as a primary component in classic and contemporary cocktails, such as the Old Fashioned, Manhattan, and Whiskey Sour. The geographical indication and the heritage associated with Kentucky and Tennessee are powerful marketing tools that contribute significantly to brand storytelling and consumer engagement. Key benefits driving market adoption include the versatility of the spirit, its historical significance, and the perceived status associated with premium brands. Furthermore, the rising popularity of mixology culture and the expansion of craft distilleries offering unique and small-batch products are continually diversifying the consumer base, moving beyond traditional demographics.

The primary driving factors sustaining market growth include surging export demand, particularly across Asian Pacific and European markets, reflecting the increasing global appreciation for American craftsmanship. Domestically, innovation in barrel finishes, flavor experimentation (e.g., flavored whiskies), and targeted marketing efforts towards younger consumers have bolstered sales. Economic stability in key consumer markets, coupled with effective lobbying for favorable trade policies, further supports volume and value growth across the forecast period.

American Whiskey Market Executive Summary

The American Whiskey market is currently characterized by significant premiumization trends, where high-end and super-premium segments are outpacing volume growth in standard and value categories. This shift is fueling higher average selling prices (ASPs) and improving margins for major distilleries. Business trends indicate a focus on vertical integration, with producers investing heavily in sustainable sourcing, advanced distillation techniques, and sophisticated bottling operations to meet complex global standards. Strategic mergers and acquisitions are common, as larger entities seek to integrate successful craft brands and expand their portfolio diversity, particularly in the rapidly evolving Rye whiskey segment. E-commerce and direct-to-consumer (DTC) channels are proving transformative, allowing brands to bypass traditional distribution hurdles and foster direct relationships with dedicated enthusiasts, thereby enhancing brand loyalty and accelerating market penetration.

Regionally, North America remains the primary consumption hub, though the fastest growth rates are observed in the Asia Pacific (APAC) region, driven by rising disposable incomes in emerging economies like China and India, and the increasing westernization of consumer preferences. Europe, particularly the UK and Germany, continues to serve as a critical export market, although it remains sensitive to geopolitical trade regulations and tariffs. Within the segments, Bourbon maintains market dominance by volume, benefiting from its broad appeal and regulatory consistency. However, Rye whiskey is experiencing exceptional growth, fueled by its assertive flavor profile and its crucial role in modern cocktail culture, appealing strongly to professional bartenders and discerning consumers.

Overall, the market trajectory is robust, underpinned by effective brand legacy marketing and consistent product quality. Despite potential headwinds from rising material costs (especially oak and grains) and inflationary pressures impacting consumer spending power, the market demonstrates resilience due to the inelastic nature of demand for super-premium spirits. The focus on flavor innovation, sustainable production practices, and exploiting digital marketing channels will define competitive success over the projection period, ensuring sustained momentum across key product categories like Tennessee whiskey and traditional Kentucky Bourbon.

AI Impact Analysis on American Whiskey Market

User queries regarding the impact of Artificial Intelligence (AI) on the American Whiskey market predominantly center on improving efficiency, predicting consumer preferences, and optimizing supply chain logistics. Consumers and industry stakeholders are keenly interested in how AI can enhance the consistency and quality of distillation through predictive analytics, particularly concerning barrel aging and blending processes. Key themes include the use of machine learning to analyze complex sensory data, optimize fermentation protocols, and forecast global demand fluctuations to prevent stockouts or overproduction of long-aged products. Concerns often revolve around the potential standardization of flavor profiles and the risk of AI reducing the artisanal nature and human element inherent in traditional whiskey making. Expectations focus heavily on AI’s ability to drive personalization in marketing and customer experience, using data derived from digital interactions to suggest tailored products or virtual tasting experiences.

- AI-driven optimization of fermentation and distillation parameters for enhanced quality control and consistency.

- Predictive analytics leveraging market trends, social media sentiment, and economic indicators to forecast demand for specific SKUs.

- Machine learning algorithms used in barrel management, predicting ideal aging periods, and optimizing blending ratios based on chemical composition and flavor profiles.

- Automated inventory management and supply chain logistics, minimizing waste and ensuring timely distribution of high-demand aged expressions.

- Enhanced consumer personalization through data analysis, leading to targeted marketing campaigns and development of niche whiskey products.

- Use of AI in robotic bottling and quality inspection, increasing production throughput and reducing human error on assembly lines.

DRO & Impact Forces Of American Whiskey Market

The American Whiskey market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form significant impact forces shaping its future trajectory. A primary driver is the accelerating trend of premiumization and the resulting consumer willingness to pay higher prices for older and unique whiskey expressions, bolstering overall market value. Coupled with this is the robust growth in international exports, fueled by successful trade negotiations and increasing recognition of American whiskey’s quality in emerging Asian and Latin American markets. The rise of craft distilleries, offering innovation and locally sourced ingredients, further drives consumer engagement and market fragmentation, presenting diverse choices beyond the major players. These factors generate a strong positive impact, ensuring sustained demand even amidst economic fluctuations.

However, significant restraints temper this growth. The long aging process required for premium Bourbon and Rye (often 4 to 12 years or more) necessitates substantial upfront capital investment and ties up resources, creating inherent supply elasticity constraints that make it difficult to quickly respond to sudden demand spikes. Additionally, volatility in global commodity prices for grains (corn, rye, barley) and the specialized American white oak used for barrels can impact production costs substantially. Regulatory challenges, including fluctuating international tariffs and complex taxation structures across different jurisdictions, pose external hurdles that can significantly impact profitability and market access for smaller producers. Environmental concerns regarding water usage and waste disposal also mandate costly sustainable practices.

The major opportunities lie in exploiting digital transformation through e-commerce and virtual reality experiences, providing direct sales channels and innovative customer interaction points. Moreover, expanding into emerging spirit categories, such as experimental finished whiskies or specific regional styles currently underrepresented, offers significant potential for differentiation. The strongest impact force on the market is currently globalization and the associated shift towards aspirational luxury spending, which inherently favors high-quality, heritage products like American whiskey. Strategic leveraging of distillery tourism and experiential marketing also presents a lucrative opportunity to cement brand loyalty and attract international visitors.

Segmentation Analysis

The American Whiskey market segmentation provides a granular view of consumer preferences and operational focus across different product types, quality grades, distribution channels, and geographical regions. Understanding these segments is crucial for manufacturers to tailor production, marketing, and pricing strategies effectively. Key segmentations revolve around the spirit's designation—Bourbon, Rye, Tennessee, and others—which dictates specific production rules and flavor profiles. Further divisions based on price point (premium, super-premium, value) reveal where the most significant value growth is occurring, generally highlighting the accelerated growth of the high-end category driven by affluent consumers seeking exclusivity and age statements.

- Product Type:

- Bourbon Whiskey

- Rye Whiskey

- Tennessee Whiskey

- Blended American Whiskey

- Other American Whiskeys (e.g., Corn Whiskey, Wheat Whiskey)

- Quality Grade/Price Point:

- Value

- Standard

- Premium

- Super-Premium and Ultra-Premium

- Distribution Channel:

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Retail Stores, Liquor Shops, Supermarkets)

- E-commerce/Online Sales

- Packaging Type:

- Bottles

- Cans/Ready-to-Drink (RTD) Formats

Value Chain Analysis For American Whiskey Market

The value chain for American Whiskey begins with upstream activities focused on raw material sourcing, predominantly corn, rye, barley, and specialized white oak for barrel production. Upstream analysis involves managing relationships with grain farmers and coopers, ensuring sustainable sourcing, quality control over mash bill ingredients, and effective transportation logistics to the distillery. The procurement phase is highly strategic, as the quality and provenance of the grain and the specification of the new charred oak barrels fundamentally dictate the final product’s character. Price volatility in these raw materials, especially oak, which must be perfectly seasoned and crafted, represents a significant cost driver at this stage.

Midstream processes center on distillation, maturation, and blending. Distillation involves mashing, fermentation, and controlled heating, which are capital-intensive processes requiring specialized equipment and skilled labor. Maturation—the long aging process in barrels—is the most time-consuming and capital-intensive phase, demanding extensive warehousing and accurate climate control to minimize the 'angel's share' (evaporation loss). Master Distillers and Master Blenders execute the critical final stage, ensuring consistency and achieving the desired flavor profile before bottling. Efficiency improvements here, often through automation and sensory technology, are key to maintaining competitiveness and scaling premium output.

Downstream analysis focuses on distribution and sales. The distribution channel is often complex due to the three-tier system in the United States (producer to distributor to retailer), which introduces regulatory layers and limits direct control over pricing and shelf placement. Direct and indirect channels both play vital roles. Indirect channels (Off-Trade and On-Trade) rely heavily on established distribution partnerships for broad market reach. Direct channels, including distillery gift shops and licensed e-commerce platforms, offer higher margins and direct consumer engagement. Marketing and branding, emphasizing heritage, quality, and craftsmanship, are pivotal downstream activities that determine brand perception and final consumer purchase decisions, supported by increasing investment in digital marketing and AEO strategies.

American Whiskey Market Potential Customers

The potential customers for the American Whiskey market are highly segmented but primarily include discerning consumers with higher disposable incomes who prioritize quality, age statements, and brand authenticity. The core demographic consists of affluent millennials and Gen X professionals who are actively engaged in cocktail culture and seek out limited edition or single-barrel releases for collecting or immediate consumption. These buyers often possess a high degree of product knowledge, actively utilizing digital resources and specialized whiskey communities to inform their purchasing decisions.

Beyond the primary consumer base, the market targets institutional buyers such as premium bars, high-end restaurants, and luxury hotels (the On-Trade segment), where American whiskey forms the foundation of classic and modern beverage menus. Global travel retail (duty-free) also constitutes a crucial end-user segment, capitalizing on international travelers seeking exclusive or travel-specific packaging. Emerging markets, particularly in Asia, represent a significant growth area where new consumers are increasingly adopting Western premium spirit consumption patterns as a status symbol.

Lastly, specialized collectors and investors form a distinct, high-value customer group. These individuals acquire rare, highly aged, or unique bottlings not just for consumption but as tangible assets, treating certain whiskey releases as investment commodities. This segment drives up the average price of ultra-premium expressions and fuels the secondary market, underscoring the intrinsic value placed on scarcity and heritage within the American Whiskey category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $23.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sazerac Company, Beam Suntory, Brown-Forman Corporation, Diageo plc, Heaven Hill Brands, Buffalo Trace Distillery, Michter's Distillery, Four Roses Distillery, Wild Turkey Distilling Co., Woodford Reserve Distillery, Barton 1792 Distillery, Luxco Inc., MGP Ingredients, Castle & Key Distillery, Bardstown Bourbon Company, Willett Distillery, Old Forester Distillery, Maker's Mark Distillery, High West Distillery, Garrison Brothers Distillery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

American Whiskey Market Key Technology Landscape

The modern American Whiskey market is increasingly adopting sophisticated technologies to ensure consistency, improve efficiency, and enhance consumer experiences, moving beyond traditional artisanal methods. One critical area is the implementation of advanced sensory analysis equipment, such as gas chromatography-mass spectrometry (GC-MS) and near-infrared (NIR) spectroscopy. These technologies provide precise, real-time data on the chemical composition of the distillate and the aging whiskey, allowing blenders to monitor esterification, oxidation, and the extraction of desirable compounds from the oak barrel. This analytical precision significantly reduces the reliance on manual tasting until the final blending stages, ensuring that every batch meets stringent quality standards, which is vital for maintaining brand equity across globally distributed products.

Furthermore, the integration of automation and data analytics platforms is transforming upstream and midstream operations. Fully automated mashing and fermentation tanks, controlled by programmable logic controllers (PLCs) and integrated with cloud-based data tracking systems, optimize yield and energy consumption. For the crucial aging process, distilleries are utilizing environmental monitoring systems employing IoT sensors within warehouses. These systems track temperature, humidity, and barometric pressure fluctuations, providing large datasets that, when analyzed using AI and machine learning, help predict the optimal barrel placement and aging duration, thereby maximizing flavor development and reducing the variability associated with barrel-to-barrel differences. This technological convergence ensures both consistency and efficiency in a process traditionally dependent entirely on time and environment.

In the downstream segment, technology focuses heavily on consumer engagement and supply chain integrity. Blockchain technology is emerging as a critical tool for ensuring authenticity and combating counterfeiting, particularly for highly valuable, limited-edition releases. By logging the production and movement of each bottle on an immutable ledger, consumers can verify provenance instantly. Additionally, augmented reality (AR) and virtual reality (VR) technologies are being deployed in marketing and experiential tourism, offering virtual distillery tours, interactive tasting notes accessible via smartphone apps, and immersive storytelling that connects consumers directly with the brand's heritage, enhancing digital engagement and driving AEO performance across search engines.

Regional Highlights

The American Whiskey market exhibits distinct growth patterns and consumption behaviors across key global regions. North America, dominated by the United States, serves as the spiritual and operational hub, accounting for the largest share of both production and consumption value. The U.S. market is characterized by mature consumer bases, strong premiumization trends, and rapid adoption of craft and specialized Rye whiskey expressions. The robust hospitality sector and a deeply ingrained cocktail culture ensure continuous high domestic demand. Canada also shows strong consumption, primarily for well-established Bourbon brands.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, driven by expanding middle-class populations, Western cultural assimilation, and rising appreciation for high-end spirits as luxury items. Countries like China, Japan, and Australia are key consumption hotspots, with Japan showing a particular interest in high-quality, aged whiskies due to its own sophisticated whisky culture. Demand in APAC is heavily influenced by gifting traditions and social status associated with premium imported brands.

Europe remains a vital export destination, particularly for Bourbon, with the UK, Germany, and France serving as major entry points. European consumers are discerning and responsive to marketing emphasizing tradition and quality, though the market remains sensitive to geopolitical trade tariffs and import duties. Latin America and the Middle East & Africa (MEA) represent smaller but rapidly emerging markets, where younger consumers are increasingly experimenting with international spirit categories, presenting long-term growth opportunities, especially for mid-range and flavored American whiskies.

- North America: Market maturity, strong domestic production base, high penetration of super-premium Bourbon and rising craft Rye popularity.

- Asia Pacific (APAC): Highest expected growth rate, driven by expanding luxury consumption in China and status-driven gifting in key urban centers.

- Europe: Critical export market, characterized by mature discerning consumers and reliance on favorable trade relations with the U.S.

- Latin America: Emerging market with increasing disposable income leading to higher demand for imported spirits, particularly standard and premium Bourbon.

- Middle East and Africa (MEA): Niche market focused on high-end, exclusive expressions driven by travel retail and luxury consumption in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the American Whiskey Market.- Sazerac Company

- Beam Suntory

- Brown-Forman Corporation

- Diageo plc

- Heaven Hill Brands

- Buffalo Trace Distillery

- Michter's Distillery

- Four Roses Distillery

- Wild Turkey Distilling Co.

- Woodford Reserve Distillery

- Barton 1792 Distillery

- Luxco Inc.

- MGP Ingredients

- Castle & Key Distillery

- Bardstown Bourbon Company

- Willett Distillery

- Old Forester Distillery

- Maker's Mark Distillery

- High West Distillery

- Garrison Brothers Distillery

Frequently Asked Questions

Analyze common user questions about the American Whiskey market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the premiumization trend in American Whiskey?

The premiumization trend is primarily driven by consumer willingness to invest in unique, aged, and high-quality expressions, viewing super-premium whiskey as a status symbol and an experiential luxury good. This shift is supported by effective brand storytelling focusing on heritage and limited availability.

How is Rye Whiskey impacting the overall American Whiskey market growth?

Rye whiskey is experiencing significant market acceleration due to its bold flavor profile, which is highly favored by bartenders and cocktail enthusiasts. Its rising popularity among younger, experimental consumers contributes disproportionately to the market's value growth and diversification.

Which geographical region is showing the fastest growth rate for American Whiskey exports?

The Asia Pacific (APAC) region is currently exhibiting the fastest growth rate for American Whiskey exports. This expansion is powered by rising middle-class disposable incomes, increased acceptance of Western luxury goods, and evolving cocktail culture in major economies like China and India.

What technological advancement is crucial for maintaining American Whiskey quality and consistency?

Advanced sensory analysis technologies, such as gas chromatography and NIR spectroscopy, are crucial. They provide precise chemical data throughout the distillation and aging processes, allowing blenders to ensure strict quality consistency and optimize flavor profiles across large-scale production runs.

What major restraint faces American Whiskey producers in meeting global demand?

The most significant restraint is the mandated long aging process (especially for Bourbon), which ties up capital and creates inherent supply inelasticity. It is impossible to rapidly scale production of aged whiskey to meet sudden, unexpected spikes in demand, leading to occasional shortages in super-premium categories.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager