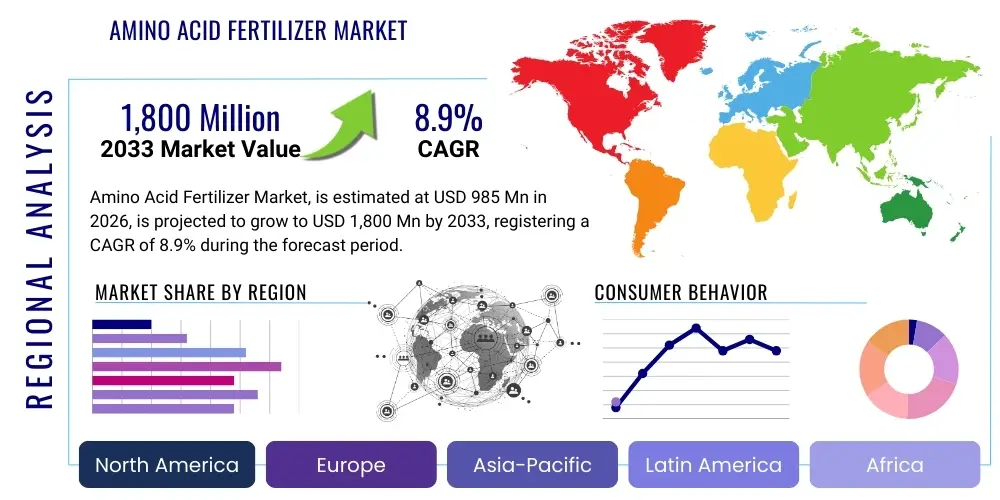

Amino Acid Fertilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437477 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Amino Acid Fertilizer Market Size

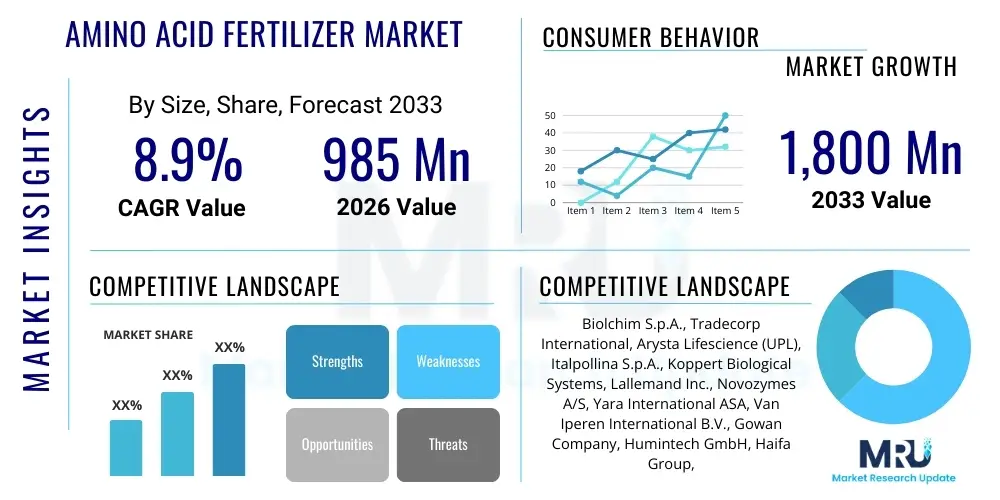

The Amino Acid Fertilizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 985 million in 2026 and is projected to reach USD 1,800 million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global necessity for sustainable agricultural practices, coupled with increasing farmer awareness regarding the yield-enhancing and stress-mitigating properties inherent in biostimulant inputs. The adoption rate is accelerating across high-value crop cultivation in developed economies and staple food production in emerging regions.

Amino Acid Fertilizer Market introduction

Amino acid fertilizers represent a sophisticated class of organic compounds used in agriculture, derived primarily through the hydrolysis of natural protein sources such as soybean meal, animal hides, or keratin. These products function not only as sources of readily available nitrogen but, more importantly, as crucial biostimulants that significantly enhance plant physiological processes. They directly influence nutrient assimilation, boost photosynthetic efficiency, and improve the plant's natural defense mechanisms against abiotic stresses like drought, salinity, and extreme temperatures. The rising popularity stems from their capacity to improve soil health and increase crop quality without the environmental drawbacks associated with conventional synthetic fertilizers.

The major applications of amino acid fertilizers span diverse agricultural domains, including high-tech greenhouse operations, large-scale commercial farming of cereals and cash crops, and the burgeoning organic farming sector. They are particularly utilized for high-value crops such as fruits, vegetables, and ornamentals where quality parameters like sweetness, color, and shelf life are critical. Their dual function—acting as a mild nitrogen source and a powerful biostimulant—positions them uniquely in the input landscape, supporting optimal plant growth phases, especially during critical developmental stages like flowering and fruit setting. Farmers are increasingly adopting these products due to the documented improvements in fertilizer use efficiency (FUE), which translates into better economic returns.

Key driving factors propelling the market include stringent environmental regulations limiting the use of synthetic nitrogen fertilizers, which often lead to nutrient runoff and water pollution. Conversely, amino acid fertilizers offer an environmentally benign alternative that aligns perfectly with global sustainability goals, including the European Green Deal and similar initiatives worldwide. Furthermore, advances in protein hydrolysis technology have made the production process more efficient and scalable, lowering manufacturing costs and expanding product accessibility. The continued focus on optimizing food quality and ensuring climate resilience in agriculture will further cement the market trajectory during the forecast period.

Amino Acid Fertilizer Market Executive Summary

The Amino Acid Fertilizer Market demonstrates vigorous growth, underpinned by fundamental business trends emphasizing biological solutions and circular economy principles. Major producers are focusing on backward integration to secure raw material supply, often utilizing food industry waste streams to produce high-quality, plant-based hydrolysates. Strategic market expansion is visible through increased merger and acquisition activities, particularly by large conventional fertilizer companies seeking to diversify their portfolio into the biostimulant category. This ensures robust distribution channels capable of delivering specialized liquid and dry formulations to diverse farming communities globally, focusing heavily on precision application techniques that maximize efficacy.

From a regional perspective, Asia Pacific (APAC) stands out as the primary growth engine, fueled by the massive agricultural land base in countries like India and China, coupled with rising government support for organic inputs and the implementation of modern irrigation systems like drip and fertigation. North America and Europe, while mature markets, exhibit high adoption rates due to strict regulatory environments favoring sustainable inputs and advanced agricultural practices. Segment trends indicate a strong preference for liquid formulations, which facilitate easier handling, precise dosing, and efficient application through existing irrigation and spraying equipment. The fruit and vegetable segment remains the largest consumer, valuing the role of amino acids in improving crop aesthetics and nutritional density.

Overall, the market is characterized by a shift towards specialized, crop-specific formulations. Key stakeholders are investing heavily in R&D to identify specific amino acid profiles best suited for particular crops or stress conditions, moving beyond generic protein hydrolysates. The convergence of conventional nutrient management with biostimulant functionality defines the competitive landscape. This strategic alignment ensures that amino acid fertilizers are increasingly seen not just as premium additives but as essential components of modern, resilient crop nutrition programs aimed at enhancing farm profitability and ecological integrity simultaneously, justifying the high market valuation projected by 2033.

AI Impact Analysis on Amino Acid Fertilizer Market

Common user questions regarding AI's impact revolve around optimizing application rates, predicting crop nutritional deficiencies that amino acids can address, and automating supply chain logistics for highly specialized biological inputs. Users frequently ask if AI can accurately determine the optimal timing for foliar application based on localized weather patterns and specific plant stress indicators. Furthermore, significant interest lies in how machine learning algorithms can analyze complex soil and leaf nutrient data (derived from sensors or drone imagery) to recommend precise, variable rate application maps for amino acid fertilizers, ensuring zero waste and maximum biological effect. The overarching theme is the integration of predictive intelligence to move from generalized dosing recommendations to hyper-personalized, real-time nutrient management strategies, maximizing the cost-effectiveness of these premium inputs.

The deployment of Artificial Intelligence is revolutionizing the commercialization and usage of amino acid fertilizers by enabling unprecedented levels of precision. AI-powered platforms can process vast datasets—including climate forecasts, soil microbiome composition, historical yield data, and real-time plant physiological status—to generate optimized dosing protocols. This capability moves the industry toward genuine precision agriculture, ensuring that the high cost of amino acid fertilizers is justified by quantifiable improvements in yield and quality. Furthermore, AI tools are critical in R&D, helping researchers rapidly screen protein hydrolysate compositions to identify novel biostimulant pathways and create superior, highly efficacious commercial products faster than traditional methods. This integration transforms amino acid fertilizer use from a generalized practice into a data-driven, outcome-focused nutritional strategy.

- AI-driven Predictive Analytics: Used for forecasting optimal application timing based on expected abiotic stress (heat waves, sudden cold snaps), thereby maximizing the stress-mitigating benefits of amino acids.

- Precision Dosing Recommendations: Machine learning analyzes drone imagery and sensor data to create Variable Rate Technology (VRT) maps, minimizing fertilizer overuse and increasing profitability.

- Supply Chain Optimization: AI algorithms manage inventory and logistics for perishable or batch-specific biological products, ensuring fresh and effective delivery to regional hubs.

- Automated Formulation Development: AI speeds up the discovery of superior amino acid profiles and synergistic blends with micronutrients through high-throughput screening simulations.

- Real-time Deficiency Diagnostics: Integrating image recognition to detect early signs of nutrient stress or damage, prompting immediate and targeted amino acid intervention.

DRO & Impact Forces Of Amino Acid Fertilizer Market

The market dynamics are defined by a strong convergence of driving forces (Drivers) centered on sustainability and performance, countered by inherent challenges (Restraints) related to cost and standardization, while ample scope exists for market expansion (Opportunities). The fundamental impact force propelling the market is the global shift toward ecological intensification—producing more food sustainably while reducing environmental footprints. This paradigm strongly favors biostimulants over traditional synthetic inputs, making the amino acid fertilizer segment highly attractive to agricultural stakeholders aiming for both high productivity and compliance with green standards. Market players must navigate the complexity of diverse regulatory standards across continents while capitalizing on the technological advancements making these products more efficient and accessible.

Key market drivers include the documented efficacy of amino acid products in enhancing crop tolerance to increasingly volatile climate conditions, such as prolonged droughts or salinity intrusion, which are critical global agricultural challenges. Furthermore, the rising consumer demand for organically grown and residue-free produce directly incentivizes farmers to adopt inputs like amino acids that comply with stringent organic certifications. However, these benefits are moderated by significant restraints, primarily the high production cost compared to commodity fertilizers like urea or Ammonium Nitrate, making widespread adoption challenging for budget-sensitive staple crop farmers. Additionally, the variability in product composition, dependent on the source material and hydrolysis method, sometimes leads to inconsistent field results, posing a challenge for standardization and farmer trust.

Opportunities for market penetration are vast, particularly in developing economies where agricultural productivity needs immediate enhancement and where government subsidies are beginning to shift toward sustainable inputs. Developing customized formulations targeting specific regional crops (e.g., rice in Asia, corn in the Americas) and utilizing advanced technologies like micro-encapsulation for slow-release functionalities represent crucial avenues for growth. The core impact force is the demonstrated efficacy in improving nutrient uptake efficiency. This force ensures that, despite the higher price point, the superior return on investment—through enhanced yields, better quality, and reduced environmental impact—will continue to fuel demand across sophisticated and forward-looking agricultural enterprises globally.

Segmentation Analysis

The Amino Acid Fertilizer Market is segmented based on several critical factors, including the physical form of the product, the biological source of the raw material, the intended application method, and the target crop type. Analyzing these segments provides vital insights into consumer preferences and technological trends. The segmentation helps manufacturers tailor their production processes and marketing strategies, focusing on high-growth areas such as liquid formulations applied via fertigation and products derived from sustainable, plant-based sources. Understanding these segment dynamics is essential for strategic planning, allowing companies to allocate resources efficiently towards regions and product types that exhibit the highest potential for adoption and profitability within the biostimulant space.

- Form:

- Liquid Amino Acid Fertilizer

- Dry (Powder/Granular) Amino Acid Fertilizer

- Source:

- Plant-Based Amino Acid Fertilizer (e.g., Soy, Corn, Sugar Beet)

- Animal-Based Amino Acid Fertilizer (e.g., Keratin, Hide, Feather Meal)

- Application Method:

- Foliar Application

- Soil Application (Drenching)

- Fertigation

- Crop Type:

- Cereals & Grains (Wheat, Rice, Corn)

- Fruits & Vegetables

- Oilseeds & Pulses

- Turf & Ornamentals

- Other Crops (e.g., Cotton, Sugarcane)

Value Chain Analysis For Amino Acid Fertilizer Market

The value chain for amino acid fertilizers begins with the Upstream Analysis, focusing on the sourcing and processing of raw materials. This typically involves securing protein-rich waste streams from the food and agriculture industries, such as animal byproducts (for animal-based fertilizers) or agricultural waste like soybean hulls and corn gluten (for plant-based fertilizers). Key processes involve enzymatic or chemical hydrolysis to break down complex proteins into bioavailable free amino acids and peptides. Efficiency and purity in this initial phase are paramount, as the quality of the final fertilizer product is heavily dependent on the stability and composition of the hydrolysate.

Midstream activities encompass formulation, manufacturing, and quality control. Manufacturers refine the crude hydrolysate into specialized commercial products, often mixing the amino acids with micronutrients, humic acids, or other biostimulants to create synergistic effects. They produce both concentrated liquid formulations, favored for ease of use in modern irrigation systems, and dry, water-soluble powders, valued for their reduced logistical cost and extended shelf life. Strict quality checks, including heavy metal testing and microbial screening, are crucial to ensure the product meets both organic certification standards and basic safety regulations required for agricultural inputs globally.

The Downstream Analysis involves the distribution channel, which is complex due to the specialized nature of the product. Distribution often occurs through a hybrid model: direct sales to large corporate farms and plantations, and indirect sales through a network of specialized agricultural distributors, agro-dealers, and retailer cooperatives. The role of technical consultants and agronomists is vital in this channel, as amino acid fertilizers require technical expertise for optimal application timing and dosage. E-commerce platforms are also gaining traction, particularly for smaller farms and specialty crop producers, enabling streamlined access to detailed product information and customized ordering. The end-users—farmers and growers—value products supported by robust field trial data and personalized agronomic advice.

Amino Acid Fertilizer Market Potential Customers

The primary customers in the Amino Acid Fertilizer Market are commercial agricultural operations seeking to enhance crop quality and resilience while adhering to environmental sustainability mandates. This includes large-scale conventional farmers who recognize the supplementary benefits of biostimulants in boosting the efficiency of traditional NPK fertilizers. They use amino acids primarily to mitigate abiotic stress effects, such as those caused by pesticide application or environmental fluctuations, ensuring stable yield outcomes across vast fields of cereals and cash crops.

Another rapidly growing segment of potential customers is the certified Organic Farming sector and specialty crop growers. These producers are inherently restricted from using most synthetic inputs, making natural biostimulants, especially certified plant-based amino acid fertilizers, indispensable tools for maintaining vigor, improving fruit size, and enhancing overall market value. Greenhouse and protected cultivation operators represent a particularly high-value customer base, utilizing precise fertigation systems that perfectly suit liquid amino acid applications, maximizing nutrient delivery in controlled environments for high-demand produce like tomatoes, peppers, and leafy greens.

Furthermore, turf and ornamental professionals, including golf course managers and landscaping companies, represent niche but significant buyers, using amino acids to improve the aesthetic quality, root development, and stress recovery of high-maintenance turfgrass. Finally, academic and corporate research institutions frequently purchase high-purity amino acid formulations for advanced studies focused on plant physiology, biostimulation mechanisms, and developing the next generation of climate-resilient crop varieties, positioning them as influential, indirect customers shaping future market demand and innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 985 Million |

| Market Forecast in 2033 | USD 1,800 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Biolchim S.p.A., Tradecorp International, Arysta Lifescience (UPL), Italpollina S.p.A., Koppert Biological Systems, Lallemand Inc., Novozymes A/S, Yara International ASA, Van Iperen International B.V., Gowan Company, Humintech GmbH, Haifa Group, Cytozyme Laboratories, Inc., Bioiberica S.A.U., Valagro S.p.A., Nutri-Tech Solutions (NTS), Placke GmbH, Green Has Italia S.p.A., Futureco Bioscience, Manutec Pty Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amino Acid Fertilizer Market Key Technology Landscape

The technological landscape of the amino acid fertilizer market is rapidly advancing, moving beyond simple acid or alkaline hydrolysis to sophisticated bioprocessing techniques. Enzymatic hydrolysis is the dominant cutting-edge technology, offering precise control over the breakdown of proteins, which results in a higher concentration of free L-amino acids and short-chain peptides. These specific molecules are more readily absorbed and metabolized by plants compared to the mixed compositions resulting from chemical hydrolysis. This technological shift directly addresses the need for consistent product quality and maximized biological activity, enabling manufacturers to guarantee specific performance metrics to high-value customers.

Furthermore, formulation technologies are crucial for product stability and delivery effectiveness. Key innovations include micro-encapsulation and nanotechnology, which are utilized to protect amino acids from degradation (e.g., UV exposure) and control their release rate into the soil or plant tissue. Encapsulation techniques are especially valuable for soil application, ensuring that the fertilizer delivers nutrition over an extended period, improving nutrient efficiency and reducing the frequency of application. Advances in chelation technology, where amino acids are used as natural chelating agents for essential micronutrients (like iron, zinc, and manganese), also represent a significant technological milestone. This enhances the solubility and bioavailability of these minerals, facilitating their rapid uptake by the plant root system or foliage.

Finally, the integration of high-throughput screening and analytical chemistry is becoming standardized. Companies utilize advanced chromatographic techniques (e.g., HPLC) and mass spectrometry to accurately map the amino acid profile of their products. This detailed analysis allows producers to validate claims about the biostimulant activity of their formulations and tailor products for specific plant needs, such as high glycine-betaine content for drought resistance or specific ratios of glutamic acid and aspartic acid for metabolic energy enhancement. This commitment to transparency and precise composition analysis is fundamental to building trust in the premium amino acid fertilizer segment.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Amino Acid Fertilizer Market, reflecting variations in regulatory environments, farming scales, and climate challenges.

- Asia Pacific (APAC): This region dominates the market in terms of volume consumption due to vast agricultural land, particularly in China and India. Growth is accelerated by government policies promoting soil health, the rapid adoption of modern irrigation (fertigation) systems, and the region's intense vulnerability to climate-induced stresses, making amino acid biostimulants essential for maintaining stable crop yields in staples like rice and wheat.

- Europe: Europe represents a high-value, maturity market characterized by stringent regulations (e.g., the EU Fertilizer Products Regulation) that favor biostimulants. The strong focus on organic farming and the reduction of chemical nitrogen inputs under the European Green Deal drive premium pricing and high technological adoption of specialized, certified organic amino acid formulations.

- North America: Driven by large-scale commercial farming and advanced precision agriculture practices, North America shows rapid adoption, especially in high-value horticulture and specialty crops (fruits, nuts, leafy greens). Farmers here prioritize products offering measurable ROI and enhanced stress tolerance, utilizing precise foliar and fertigation applications guided by data analytics.

- Latin America (LATAM): This region is emerging rapidly, particularly Brazil and Argentina, fueled by the expansion of large commodity crops (soybean, sugarcane) and significant investment in sustainable agricultural inputs. The demand here is often focused on improving fertilizer use efficiency in tropical and subtropical climates where nutrient leaching is a major concern.

- Middle East and Africa (MEA): Growth in MEA is primarily motivated by the acute need for salinity and drought tolerance solutions in arid environments. Amino acid fertilizers are highly valued for their role in mitigating salt stress and enhancing water use efficiency (WUE) in irrigated agriculture across the Gulf nations and key African agricultural zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amino Acid Fertilizer Market.- Biolchim S.p.A.

- Tradecorp International

- Arysta Lifescience (UPL)

- Italpollina S.p.A.

- Koppert Biological Systems

- Lallemand Inc.

- Novozymes A/S

- Yara International ASA

- Van Iperen International B.V.

- Gowan Company

- Humintech GmbH

- Haifa Group

- Cytozyme Laboratories, Inc.

- Bioiberica S.A.U.

- Valagro S.p.A.

- Nutri-Tech Solutions (NTS)

- Placke GmbH

- Green Has Italia S.p.A.

- Futureco Bioscience

- Manutec Pty Ltd.

Frequently Asked Questions

Analyze common user questions about the Amino Acid Fertilizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using amino acid fertilizers over conventional fertilizers?

Amino acid fertilizers function as both a nutrient source (nitrogen) and a biostimulant. Their primary benefit is enhancing nutrient uptake efficiency, improving plant tolerance to abiotic stresses (drought, heat, salinity), boosting photosynthesis, and ultimately improving crop quality and yield consistency. They offer a sustainable, low-environmental-impact alternative to synthetic inputs.

Which source segment, plant-based or animal-based, is dominating the Amino Acid Fertilizer Market?

The plant-based amino acid fertilizer segment is exhibiting faster growth and increasingly commanding a larger market share. This dominance is driven by the growing demand for organic and vegan-certified inputs, ethical considerations, and the consistent purity of hydrolysates derived from vegetable sources like soy and corn.

How does the application method impact the effectiveness of amino acid fertilizers?

The application method, particularly foliar spraying and fertigation, significantly impacts effectiveness. Foliar application ensures rapid absorption and immediate stress relief, ideal during critical growth stages. Fertigation allows for precise, continuous delivery through irrigation systems, optimizing root development and overall nutrient assimilation in the soil.

What major challenges restrict the widespread adoption of amino acid fertilizers?

The main challenges restricting adoption are the comparatively high initial cost relative to commodity synthetic fertilizers, which affects price-sensitive staple crop producers. Additionally, ensuring product consistency and standardization across different manufacturers and source materials remains a regulatory and consumer confidence hurdle.

How is technology, specifically enzymatic hydrolysis, transforming the production of these fertilizers?

Enzymatic hydrolysis represents a technological advancement that uses specific enzymes to break down proteins, yielding a higher concentration of free L-amino acids and short-chain peptides. This process ensures superior purity, controlled composition, and enhanced biological efficacy compared to traditional chemical hydrolysis methods, leading to higher-performance products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager