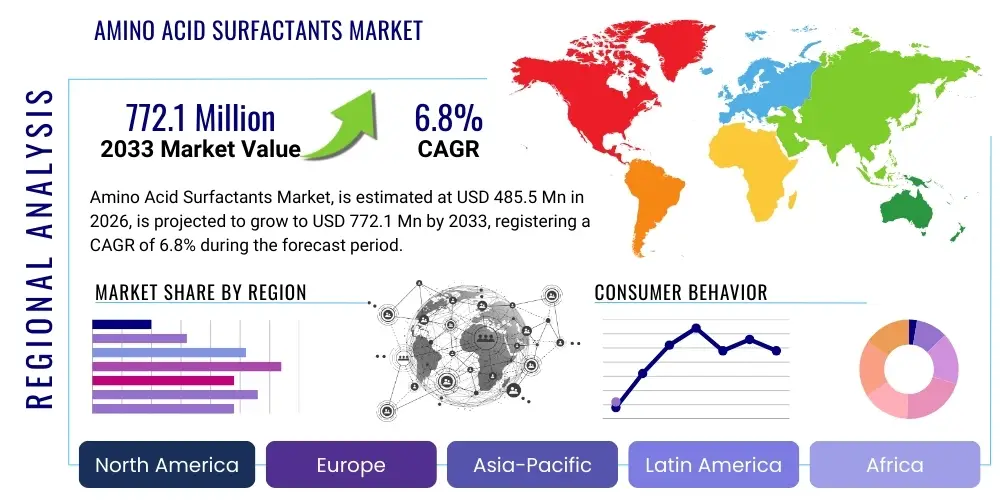

Amino Acid Surfactants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434674 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Amino Acid Surfactants Market Size

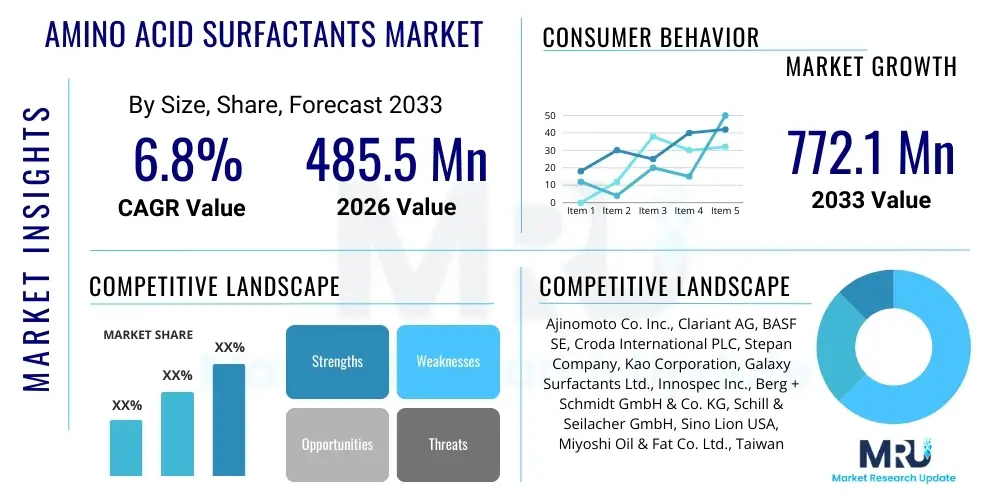

The Amino Acid Surfactants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 485.5 Million in 2026 and is projected to reach USD 772.1 Million by the end of the forecast period in 2033.

Amino Acid Surfactants Market introduction

Amino acid surfactants represent a specialized class of mild, biodegradable, and highly effective surface-active agents derived from natural sources, specifically the reaction of amino acids with fatty acids. These compounds, known for their exceptional skin and eye compatibility, low irritation potential, and moisturizing properties, are fundamentally changing the formulation landscape across the cosmetics, personal care, and pharmaceutical industries. Their inherent gentleness makes them highly desirable alternatives to conventional sulfate-based surfactants, addressing the growing consumer demand for natural, clean-label, and sustainable ingredients.

The core product portfolio includes variations such as acyl glutamates, acyl sarcosinates, acyl glycinates, and acyl alaninates, each exhibiting unique foaming, cleansing, and sensory characteristics. Glutamates, for instance, are widely prized for their creamy foam and excellent mildness, making them staples in premium facial cleansers and baby care products. Major applications span from high-end shampoos, body washes, and specialized dermatological cleansers to certain functional ingredients in the food and pharmaceutical sectors where biocompatibility is paramount. The increasing regulatory scrutiny on petrochemical derivatives further catalyzes the adoption of these bio-based alternatives.

Market growth is primarily driven by the global shift towards green chemistry and sustainability initiatives. Consumers and regulatory bodies are increasingly demanding transparent and environmentally friendly product compositions. Furthermore, the rising prevalence of sensitive skin conditions and allergies necessitates the use of milder ingredients, positioning amino acid surfactants as essential components in hypoallergenic and dermatologically tested formulations. These driving factors, coupled with continuous technological advancements improving cost-effectiveness and performance stability, solidify the market's robust expansion trajectory through the forecast period.

Amino Acid Surfactants Market Executive Summary

The Amino Acid Surfactants Market is defined by intense innovation focused on optimizing synthesis processes and expanding application versatility, reflecting significant business trends toward specialization and ingredient transparency. Major chemical manufacturers are heavily investing in capacity expansion, particularly in Asia Pacific, to meet burgeoning demand from the booming cosmetics industry in China and India. Business trends indicate a strong move away from traditional anionic surfactants towards highly specialized, functional ingredients that offer unique sensory experiences and verifiable environmental benefits, driving premiumization across several end-user segments. Supply chain resilience, particularly concerning the sourcing of renewable raw materials like specific amino acids and fatty acids, remains a critical strategic focal point for key market players.

Regionally, Asia Pacific maintains dominance, propelled by its status as a major manufacturing hub for personal care products and the large, increasingly affluent consumer base prioritizing natural beauty products. North America and Europe, while established markets, exhibit mature growth driven primarily by stringent regulatory frameworks promoting sustainable chemistry and high consumer spending on specialized, anti-aging, and sensitive skin formulations. European trends emphasize Ecocert and Cosmos certification requirements, reinforcing the demand for certified natural amino acid surfactants. Meanwhile, emerging markets in Latin America and MEA are displaying accelerated adoption rates as global cosmetic brands expand their presence and introduce localized product lines featuring milder ingredients.

Segment-wise, the Acyl Glutamates segment holds the largest market share due to its superior mildness and versatility, although Acyl Glycinates are projected to exhibit the fastest growth owing to their excellent foaming properties and cost-effectiveness in certain high-volume applications like shampoos and shower gels. The Cosmetics & Personal Care segment remains the unequivocal leader in terms of application, specifically driven by facial cleansers, baby care products, and hair care. Strategic acquisitions focused on securing proprietary synthesis technology and achieving vertical integration in the supply chain characterize the competitive landscape, ensuring that market trends align with evolving consumer preference for high-performance, bio-based ingredients.

AI Impact Analysis on Amino Acid Surfactants Market

User queries regarding the impact of Artificial Intelligence (AI) in the amino acid surfactants market primarily center on optimizing synthesis routes, predicting ingredient compatibility, and accelerating the discovery of novel bio-based structures. Common concerns revolve around whether AI can significantly lower manufacturing costs, thereby making these premium surfactants competitive with commodity chemicals, and how machine learning algorithms are utilized to screen for enhanced efficacy or reduced eco-toxicity profiles. Users are keenly interested in predictive modeling for formulation stability and the integration of AI-driven tools to manage complex, bio-based supply chains, ensuring consistent quality and sustainable sourcing of raw materials.

AI’s influence is substantial, particularly in Research and Development (R&D) and quality control processes. Machine learning algorithms are being deployed to analyze vast datasets related to molecular structures and performance metrics, allowing researchers to rapidly identify optimal fatty acid chain lengths and amino acid combinations that yield surfactants with specific desired properties, such as high foaming capacity at low concentrations or exceptional hard water tolerance. This computational acceleration of materials science reduces the traditional trial-and-error approach, significantly shortening the time-to-market for innovative, next-generation amino acid surfactants that meet stringent regulatory and consumer standards for safety and sustainability.

Furthermore, AI-powered predictive analytics are crucial in enhancing manufacturing efficiency. By modeling reactor conditions, temperature curves, and purification steps, AI minimizes waste generation and optimizes energy consumption during the complex amidation and neutralization processes used to produce these surfactants. In the supply chain, AI helps forecast demand fluctuations for key amino acid precursors and optimizes logistics, mitigating risks associated with volatile agricultural raw material markets. This enhanced efficiency ultimately improves the economic viability of amino acid surfactants, accelerating their displacement of conventional petrochemical alternatives in mainstream consumer products.

- AI-driven molecular modeling accelerates the discovery of novel, high-performance amino acid surfactant structures.

- Machine learning optimizes synthesis process parameters, reducing reaction time, energy consumption, and manufacturing costs.

- Predictive analytics enhance formulation stability screening, improving compatibility assessment with complex cosmetic matrices.

- AI deployment in quality control ensures batch-to-batch consistency and adherence to stringent mildness and purity specifications.

- Advanced forecasting tools manage supply chain volatility for bio-based raw materials, ensuring sustainable sourcing.

DRO & Impact Forces Of Amino Acid Surfactants Market

The market dynamics for amino acid surfactants are fundamentally shaped by a strong interplay of drivers emphasizing sustainability and health, counterbalanced by economic restraints related to production complexity, while opportunities lie in expanding applications beyond personal care. The primary drivers include overwhelming consumer preference for mild, natural, and biodegradable ingredients, reinforced by tightening global regulations (particularly in Europe and North America) that favor green chemistry alternatives. Restraints primarily involve the higher manufacturing costs associated with complex, multi-step synthesis and the volatility in the pricing and availability of natural, fermentation-derived amino acid precursors compared to cheaper petrochemical feedstocks. Opportunities exist in leveraging these surfactants' unique functionalities in specialized areas such as enhanced oil recovery (EOR), controlled drug delivery systems, and advanced food emulsification.

Impact forces illustrate how these drivers and restraints exert influence across the industry value chain. Regulatory impetus acts as a powerful external force, compelling major CPG companies to reformulate their product portfolios, which significantly elevates demand for amino acid surfactants. Simultaneously, the force of technological feasibility determines market penetration; ongoing research breakthroughs in enzymatic synthesis and continuous processing methods are slowly eroding the cost barrier (a major restraint), making these premium ingredients more accessible. The impact of competitive rivalry is focused on innovation, with companies seeking proprietary synthesis routes to gain a cost advantage and offer unique functional characteristics (e.g., enhanced moisturizing capabilities or specialized sensory profiles) that differentiate their products in a rapidly evolving market.

Ultimately, the market’s trajectory is dictated by the strength of consumer-led ethical purchasing decisions versus the economic feasibility of large-scale production. While the initial investment and operational complexities impose hurdles, the strong, non-negotiable consumer drive towards 'clean beauty' and sustainability provides a persistent, powerful driver that ensures sustained market expansion. Successfully navigating the raw material price volatility through long-term supply agreements and strategic vertical integration is essential for market participants looking to maximize the positive impact forces and mitigate economic restraints throughout the forecast period.

- Drivers: High consumer demand for mild, natural, and non-irritating ingredients; favorable environmental regulations promoting biodegradability; expansion of the clean beauty movement.

- Restraints: Higher production costs and complex synthesis processes compared to conventional surfactants; price volatility and limited sourcing of specific bio-based raw materials.

- Opportunity: Expansion into high-value applications like pharmaceuticals, advanced industrial degreasing, and sustainable agricultural formulations; development of cost-effective enzymatic synthesis methods.

- Impact Forces: Intense regulatory pressure favoring green alternatives; technological advancements reducing cost barriers; high substitution threat from existing, cheaper commodity chemicals; growing consumer power driving ethical sourcing.

Segmentation Analysis

The Amino Acid Surfactants Market is rigorously segmented based on product type, application, and geography, reflecting the diverse utility and regional consumption patterns of these specialized chemicals. The product type segmentation captures the chemical diversity derived from different amino acid backbones, each imparting unique functional characteristics critical for specific end-use needs. Acyl glutamates are recognized for exceptional mildness and superior skin compatibility, making them suitable for sensitive applications, whereas acyl sarcosinates are favored for their excellent foam boost and cleaning power, often used in toothpastes and shampoos. Understanding these nuanced performance profiles is crucial for manufacturers to align production capacity with specialized market demand across various industries.

Application segmentation reveals the dominance of the Cosmetics & Personal Care sector, which acts as the primary revenue generator due to the fundamental properties of amino acid surfactants being perfectly suited for skin and hair cleansing products. Within this sector, the demand is granularly spread across facial cleansers, baby care, and specialized hair formulations. However, the market is also seeing increasing penetration into adjacent high-growth areas, particularly pharmaceuticals, where their low toxicity and ability to stabilize complex formulations are highly valued in topical drug delivery systems and excipient manufacturing. Furthermore, their application in specialized industrial cleaners highlights their potential for replacing harsh, toxic cleaning agents in sensitive environments.

Geographical segmentation emphasizes the regional maturity and regulatory landscape disparities. Asia Pacific dominates due to significant manufacturing capabilities and a large consumer base focused on natural ingredients, particularly within the prestige beauty segment. North America and Europe, characterized by high disposable income and stringent chemical regulations (like REACH), drive demand for certified natural and sustainable products. The future market potential is heavily reliant on sustained innovation within these segments, focusing on improving the yield and purity of specific, high-demand surfactant types like glycinates and alaninates to achieve competitive pricing against established alternatives.

- By Type:

- Acyl Glutamates (e.g., Sodium Cocoyl Glutamate)

- Acyl Sarcosinates (e.g., Sodium Lauroyl Sarcosinate)

- Acyl Glycinates (e.g., Sodium Cocoyl Glycinate)

- Acyl Alaninates (e.g., Sodium Lauroyl Alaninate)

- Others (Taurates, Isethionates derived partly from amino acids)

- By Application:

- Cosmetics & Personal Care (Facial Cleansers, Shampoos, Body Washes, Baby Care)

- Pharmaceuticals (Topical Formulations, Excipients)

- Food & Beverages (Emulsifiers, Stabilizers)

- Industrial & Institutional Cleaners (Specialized Degreasers, Green Cleaning Solutions)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Amino Acid Surfactants Market

The value chain for amino acid surfactants begins with upstream analysis focusing intensely on raw material procurement, which is a critical differentiator for bio-based chemicals. Upstream activities involve sourcing fatty acids, typically derived from palm kernel oil, coconut oil, or other sustainable vegetable oils, and sourcing specific amino acids (such as glutamic acid, glycine, or sarcosine), often produced through fermentation processes. The efficiency and sustainability of these initial sourcing steps dictate the cost structure and the 'natural' certification status of the final surfactant. Key manufacturers must ensure robust supply agreements and, often, vertical integration into the production of amino acids to mitigate price volatility and secure consistent, high-purity inputs essential for the complex synthesis stages.

The midstream segment involves the specialized chemical synthesis, typically amidation followed by neutralization, where the amino acid moiety is reacted with the fatty acyl chloride or ester. This manufacturing stage requires high-tech, precision engineering to control reaction conditions, minimize side-product formation, and achieve the specific HLB (Hydrophilic-Lipophilic Balance) required for end-use performance. Companies possessing proprietary or optimized synthesis technologies gain a significant competitive advantage by producing higher yields and purer product forms (often sold as liquids, pastes, or powders) that meet exacting formulation standards for transparency, foam quality, and mildness. Quality control and regulatory compliance checks, ensuring adherence to certifications like COSMOS or NSF, are integral to this stage.

Downstream analysis covers distribution channels and end-user engagement. Distribution is primarily handled through specialized chemical distributors, who manage complex logistics, provide technical support to formulators, and comply with regional hazardous material shipping regulations. Direct sales channels are typically reserved for large-volume, strategic customers (Tier 1 global cosmetic brands) that require customized product specifications and long-term contracts. The final consumption is heavily concentrated in the Business-to-Business (B2B) segment, where cosmetic formulators, pharmaceutical excipient suppliers, and industrial cleaning chemical mixers purchase these surfactants based on performance, certification status, and technical data sheets detailing critical micelle concentration and irritation indices.

Amino Acid Surfactants Market Potential Customers

The primary customers and end-users of amino acid surfactants are companies operating within the personal care and cosmetics manufacturing industry, ranging from multinational corporations to niche, clean beauty startups. These buyers are specifically seeking mild, highly functional cleansing and foaming agents that can support 'sulfate-free,' 'paraben-free,' and 'natural origin' product claims, aligning with stringent consumer demands for skin and environmentally friendly products. Potential customers include major global players specializing in mass-market shampoos and body washes, as well as premium brands focusing on specialized facial care, sensitive skin products, and dermatological formulations where ingredient mildness is non-negotiable for product efficacy and safety.

Beyond the core personal care market, significant potential lies within the pharmaceutical and nutraceutical sectors. Pharmaceutical companies utilize amino acid surfactants as highly biocompatible excipients, solubilizing agents, or emulsion stabilizers in topical creams, ointments, and transdermal patches, benefiting from their low systemic toxicity and excellent compatibility with biological tissues. Nutraceutical manufacturers integrate these mild surfactants in oral formulations where ingredients must be safe for ingestion while providing emulsification or dispersion benefits, ensuring product stability and bioavailability. This segment values purity and regulatory compliance (e.g., USP standards) above raw cost.

A growing customer base is emerging in the specialized industrial and institutional (I&I) cleaning sector, particularly those focused on developing 'green' or bio-based cleaning solutions for applications such as hospital sanitation, food processing facilities, and sensitive electronics cleaning. These industrial customers are driven by occupational safety regulations and corporate sustainability mandates that necessitate replacing aggressive, petroleum-derived degreasers with biodegradable, low-VOC alternatives. The inherent low foaming yet effective cleaning capabilities of specific amino acid surfactants, coupled with their environmental profile, make them highly attractive to procurement teams prioritizing corporate social responsibility (CSR) goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485.5 Million |

| Market Forecast in 2033 | USD 772.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., Clariant AG, BASF SE, Croda International PLC, Stepan Company, Kao Corporation, Galaxy Surfactants Ltd., Innospec Inc., Berg + Schmidt GmbH & Co. KG, Schill & Seilacher GmbH, Sino Lion USA, Miyoshi Oil & Fat Co. Ltd., Taiwan Surfactant Co. Ltd., DELTA Chemicals, Zschimmer & Schwarz GmbH & Co KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amino Acid Surfactants Market Key Technology Landscape

The technological landscape of the amino acid surfactants market is characterized by intense research focused on improving synthesis efficiency and enhancing the performance profile of the resulting molecules. The current predominant technology involves the traditional amidation reaction between fatty acid derivatives and amino acids, often requiring high energy input and specialized equipment for purification. However, significant technological innovation is concentrating on green chemistry principles, specifically the transition toward enzymatic synthesis. Enzymatic processes offer lower reaction temperatures, reduced reliance on harsh organic solvents, and higher selectivity, leading to purer products and significantly decreased energy consumption, which directly aligns with sustainability goals and reduces overall operational costs in the long term.

Another crucial technological advancement involves continuous flow chemistry, replacing traditional batch processes. Continuous manufacturing allows for tighter control over reaction parameters, resulting in more consistent product quality and higher throughput, addressing the market restraint related to high manufacturing costs and scalability. Furthermore, proprietary functionalization technologies are being developed to create novel hybrid amino acid surfactants that combine the mildness characteristic with enhanced attributes, such as superior emulsification stability, improved electrolyte tolerance, or targeted conditioning properties for hair and skin. These proprietary technologies allow major players to differentiate their offerings and capture niche, high-value market segments.

Technological efforts are also heavily invested in optimizing the raw material supply chain through advanced biotechnology, particularly focusing on the fermentation of specific amino acids (like L-Glutamic Acid) from renewable feedstocks. Ensuring the sustainable and cost-effective production of these precursors is paramount. The integration of high-throughput screening and computational chemistry (as discussed in the AI analysis) forms the R&D backbone, allowing for the rapid testing and selection of surfactant derivatives with optimal critical micelle concentration (CMC) and biological compatibility, positioning technological superiority as a key competitive factor in the mature market segments.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, primarily driven by massive manufacturing capacities in China, Japan, and South Korea, which are major producers and exporters of raw materials and finished personal care products. The region benefits from a rapidly expanding middle class and strong consumer demand for natural and indigenous beauty products. Japan, in particular, has historically been at the forefront of amino acid surfactant technology, driving high-quality, specialized ingredient development. Economic growth and the high adoption rate of premium cosmetic formulations are expected to maintain APAC's leading position, though regulatory heterogeneity across countries presents unique market entry challenges.

- North America: North America represents a mature, high-value market characterized by strong regulatory compliance and high consumer purchasing power focused on 'clean beauty' and hypoallergenic claims. The U.S. drives the majority of demand, particularly within professional salon care, baby care, and specialized dermatological products. Market growth is closely tied to CPG companies reformulating their portfolios to comply with stricter ingredient transparency standards and addressing consumer skepticism towards traditional sulfate-based ingredients. Investment in biotechnological advancements for domestic, sustainable raw material sourcing is a key regional trend.

- Europe: Europe is defined by stringent environmental and chemical regulations, such as REACH and the mandate for COSMOS certification, which strongly favors the adoption of biodegradable amino acid surfactants. Western European countries, including Germany, France, and the UK, are key markets for sustainable and organic certified cosmetics. The demand here is fundamentally driven by compliance and ethical consumerism. Innovation focuses on developing highly concentrated, high-performance liquid forms to reduce packaging and transportation environmental impact, supporting the continent’s comprehensive sustainability targets.

- Latin America (LATAM): LATAM is an emerging high-growth market, characterized by increasing industrialization and rising disposable incomes, particularly in Brazil and Mexico. The market is transitioning away from reliance on low-cost ingredients towards globally aligned, quality-focused formulations. While price sensitivity remains a factor, the rapid expansion of international cosmetic brands and local efforts to develop natural, bio-diverse ingredient lines fuel the demand for amino acid surfactants, especially in the mass-market hair care and body cleansing segments.

- Middle East & Africa (MEA): The MEA market is developing, with growth concentrated in the Gulf Cooperation Council (GCC) countries due to high consumer spending on luxury and imported personal care products. The adoption rate of amino acid surfactants is accelerating as international beauty trends emphasizing gentleness and quality permeate the region. Growth is also bolstered by increased local manufacturing capabilities and rising awareness regarding the benefits of non-irritating formulations for sensitive skin types prevalent in arid climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amino Acid Surfactants Market.- Ajinomoto Co. Inc.

- Clariant AG

- BASF SE

- Croda International PLC

- Stepan Company

- Kao Corporation

- Galaxy Surfactants Ltd.

- Innospec Inc.

- Berg + Schmidt GmbH & Co. KG

- Schill & Seilacher GmbH

- Sino Lion USA

- Miyoshi Oil & Fat Co. Ltd.

- Taiwan Surfactant Co. Ltd.

- DELTA Chemicals

- Zschimmer & Schwarz GmbH & Co KG

- Akzo Nobel N.V. (now part of Nouryon)

- Evonik Industries AG

- Dow Inc.

- Lubrizol Corporation

- Colonial Chemical, Inc.

Frequently Asked Questions

Analyze common user questions about the Amino Acid Surfactants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using amino acid surfactants over traditional sulfate surfactants?

Amino acid surfactants offer significantly superior mildness, reduced irritation to the skin and eyes, excellent biodegradability, and are derived from natural, renewable sources. They maintain high cleansing efficacy while supporting 'clean label' and sustainable formulation goals, unlike harsher sulfate alternatives.

Which type of amino acid surfactant holds the largest market share by volume?

Acyl Glutamates (such as Sodium Cocoyl Glutamate) currently command the largest market share due to their exceptional mildness, rich, creamy foam structure, and versatility, making them preferred choices for premium facial cleansers and sensitive skin formulations globally.

How does the cost of amino acid surfactants compare to conventional petrochemical surfactants?

Amino acid surfactants generally have a higher production cost due to the complex, specialized synthesis processes and the sourcing of purified, often fermented, amino acid raw materials. However, technological advancements in enzymatic synthesis are gradually reducing this cost disparity.

What major regulatory factors are influencing the growth of this market?

Stringent environmental regulations, particularly in the EU (REACH) and evolving guidelines in North America, mandate increased product biodegradability and reduced toxic chemical usage. These regulations strongly favor the adoption of bio-based, mild ingredients like amino acid surfactants across cosmetics and industrial applications.

Which regional market is experiencing the fastest growth rate for amino acid surfactants?

The Asia Pacific region, driven by rapidly expanding cosmetic manufacturing hubs and a high-volume consumer market increasingly prioritizing high-quality, natural ingredients, is projected to exhibit the fastest growth rate in the amino acid surfactants market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager