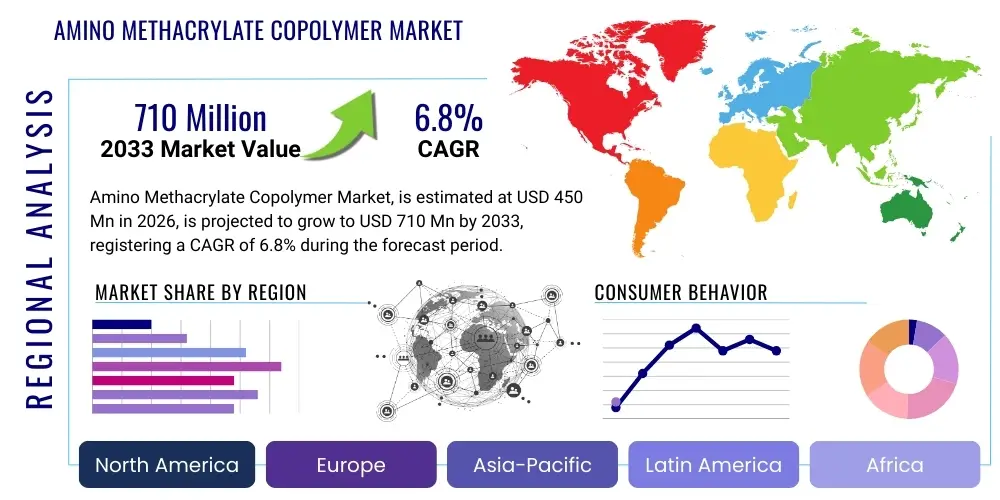

Amino Methacrylate Copolymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436757 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Amino Methacrylate Copolymer Market Size

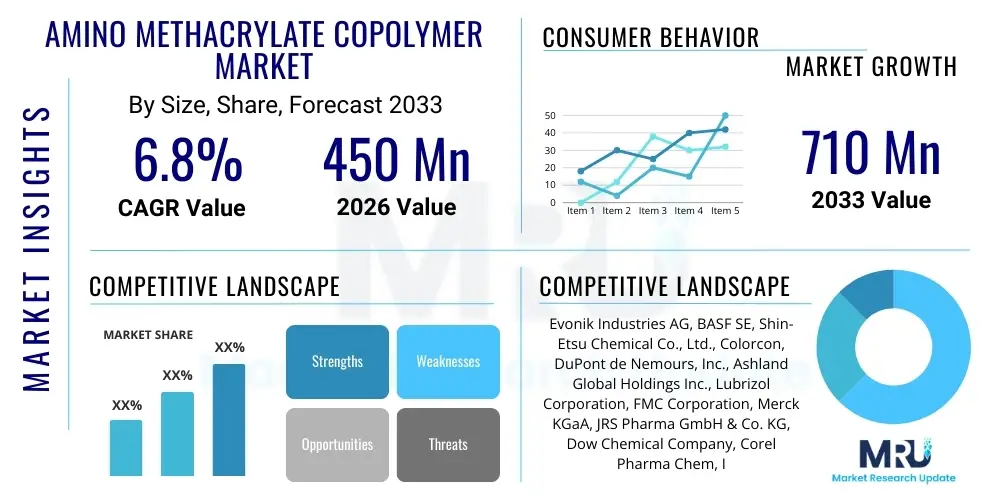

The Amino Methacrylate Copolymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing demand for advanced drug delivery systems, particularly in the pharmaceutical industry where these copolymers serve as critical excipients for enteric coatings and controlled-release formulations. The necessity for improved patient compliance and enhanced bioavailability of complex drug molecules mandates the use of specialized coating materials, positioning amino methacrylate copolymers as indispensable components in modern drug manufacturing.

Amino Methacrylate Copolymer Market introduction

Amino Methacrylate Copolymers (AMCs) are synthetic polymers derived from methacrylic acid esters, characterized by their pH-dependent solubility and permeability profiles. These properties make them highly valued pharmaceutical excipients, predominantly used for functional film coatings on solid dosage forms such as tablets and capsules. Functionally, AMCs enable targeted drug release, ensuring that sensitive active pharmaceutical ingredients (APIs) are protected from the acidic environment of the stomach (enteric release) or released gradually over an extended period (sustained release). The market landscape is defined by continuous innovation in polymer grades and applications, addressing complex pharmacological challenges.

The primary applications of AMCs span across pharmaceuticals, nutraceuticals, and specialized industrial coatings. In pharmaceuticals, they are essential for creating coatings that are insoluble in gastric fluids but dissolve rapidly in intestinal fluids, crucial for drugs that cause gastric irritation or are degraded by low pH. Beyond enteric protection, their use in matrix systems facilitates controlled and pulsed drug delivery, optimizing therapeutic efficacy. The driving factors behind market expansion include stringent regulatory demands for quality drug formulations, the rising prevalence of chronic diseases requiring sustained medication, and significant investment in research and development aimed at novel drug delivery techniques.

The core benefit of utilizing AMCs lies in their versatility and reliable performance as functional coatings. They offer superior film properties, including high elasticity, excellent adhesion, and low permeability to moisture, contributing significantly to the stability and shelf life of the final dosage form. Furthermore, the development of aqueous dispersion forms of these copolymers has streamlined the coating process for manufacturers, moving away from solvent-based systems and promoting environmental sustainability and safety within production facilities. This shift towards aqueous-based systems is a major technological impetus shaping the current market trajectory.

Amino Methacrylate Copolymer Market Executive Summary

The Amino Methacrylate Copolymer Market is experiencing sustained growth, driven fundamentally by the pharmaceutical sector’s pivot towards complex and high-value drug formulations. Key business trends indicate increasing consolidation among core polymer manufacturers, coupled with strategic partnerships aimed at securing raw material supply chains and expanding regional distribution capabilities, particularly within high-growth regions like Asia Pacific. The focus on developing advanced polymer grades optimized for challenging APIs, such as biologics and highly potent compounds, represents a critical strategic imperative for market leaders. Furthermore, the rising adoption of continuous manufacturing processes in pharmaceuticals necessitates functional excipients like AMCs that are compatible with rapid, high-throughput coating technologies, thereby accelerating market demand.

Regionally, North America and Europe maintain dominance due to established pharmaceutical industries, strict regulatory frameworks promoting quality excipient use, and significant R&D spending on innovative drug delivery platforms. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is attributed to the burgeoning generics market, substantial investments in local drug manufacturing infrastructure, and the expanding presence of Contract Development and Manufacturing Organizations (CDMOs) focused on formulation services. Countries like China and India are emerging as major consumption hubs, benefiting from improved healthcare access and a large patient base requiring controlled-release medications.

Segment trends highlight the dominance of the cationic grade (Eudragit E type equivalent) and anionic grade (Eudragit L and S type equivalents) segments, dictated by specific functional requirements—pH-independent immediate release versus pH-dependent enteric protection, respectively. The application segment sees robust growth in controlled-release oral solids, driven by the shift from immediate-release to modified-release drugs to improve dosing frequency and minimize side effects. Nutraceutical applications, focusing on the protection of sensitive vitamins and probiotics, are also witnessing significant expansion, providing market diversification away from solely pharmaceutical demand.

AI Impact Analysis on Amino Methacrylate Copolymer Market

User queries regarding AI's influence on the Amino Methacrylate Copolymer market center primarily on optimization, R&D acceleration, and quality assurance. Common themes include how AI can expedite the formulation process, predicting the stability and dissolution profile of polymer-coated dosage forms, and streamlining the highly regulated excipient supply chain. Users are keen to understand if machine learning algorithms can reduce the time and cost associated with selecting the optimal AMC grade and concentration for a novel drug, moving formulation from empirical experimentation to predictive modeling. There is also significant interest in using AI-driven predictive maintenance and sensor technology within manufacturing to ensure consistent coating quality and thickness, minimizing batch-to-batch variability, which is critical for highly regulated pharmaceutical excipients.

- AI accelerates drug formulation by predicting optimal polymer ratios and coating parameters, drastically reducing experimental iterations.

- Machine learning algorithms enhance quality control by analyzing spectroscopic data in real-time to monitor coating consistency and ensure compliance.

- Predictive modeling aids in optimizing supply chain logistics and inventory management for raw materials and finished AMC products, reducing lead times.

- AI-driven text mining supports regulatory compliance documentation and accelerates the approval process by efficiently extracting and analyzing excipient data.

- Computational chemistry, leveraged by AI, assists in designing novel methacrylate copolymer structures with tailored release profiles.

DRO & Impact Forces Of Amino Methacrylate Copolymer Market

The Amino Methacrylate Copolymer market is shaped by a confluence of driving factors, restrictive regulatory hurdles, and emerging technological opportunities, which collectively exert powerful forces upon market dynamics. A primary driver is the accelerating shift towards advanced modified-release dosage forms across the pharmaceutical industry, aiming to enhance drug efficacy, improve patient compliance through reduced dosing frequency, and minimize adverse effects associated with peak plasma concentrations. Furthermore, the patent expiration of blockbuster drugs and the subsequent influx of complex generic formulations reliant on specialized excipients like AMCs continue to spur demand. Regulatory support for high-quality, non-toxic pharmaceutical excipients also provides a robust foundation for market growth, ensuring that manufacturers maintain strict quality standards, thereby validating the premium positioning of established AMC grades.

However, the market faces significant restraints. The highly stringent regulatory approval process for novel excipients presents a substantial barrier to entry and slows down the commercialization of new polymer grades. Pharmaceutical companies are inherently risk-averse regarding changes to approved formulations, preferring established, registered excipients, which can limit the adoption rate of innovations in the copolymer space. Fluctuations in the prices and availability of key petrochemical raw materials, such as methacrylic acid and related monomers, introduce cost volatility and supply chain complexities for manufacturers. Additionally, the need for specialized equipment and technical expertise for successful aqueous coating operations can restrain adoption, particularly in emerging markets where capital investment might be limited.

Opportunities for market growth are abundant, particularly in expanding application scope beyond traditional pharmaceuticals. The rapid growth of the nutraceutical and dietary supplement industries, requiring protective coatings for sensitive ingredients like probiotics, enzymes, and specialized vitamins, opens up new revenue streams. Moreover, the development of personalized medicine and 3D-printed pharmaceuticals necessitates highly specific, tailored polymer matrices, offering fertile ground for specialized AMC derivatives. The rising demand for sustained-release formulations in veterinary medicine also represents an untapped area for market expansion. Impact forces stemming from innovation and regulation significantly influence market trajectory, pushing manufacturers towards developing multifunctional copolymers that can address multiple formulation challenges simultaneously, thereby optimizing production efficiency and formulation complexity.

Segmentation Analysis

The Amino Methacrylate Copolymer market is highly segmented based on functional properties, application, and form, reflecting the diverse requirements of the pharmaceutical and allied industries. Segmentation by type typically categorizes copolymers based on their dissolution characteristics—cationic, anionic, and neutral—which dictate their suitability for immediate, enteric, or sustained release. The application segmentation clearly delineates the market into pharmaceutical coatings, taste masking agents, binders, and nutraceutical applications, with pharmaceutical coatings dominating the market share due to critical use in oral solid dosage forms. Furthermore, the market is differentiated by form, specifically aqueous dispersions versus organic solution/powder forms, driven by the industry's sustained shift toward safer, more environmentally friendly aqueous coating systems, which offer operational advantages and reduced solvent handling risks.

- By Type:

- Cationic Copolymers (e.g., pH-independent release)

- Anionic Copolymers (e.g., Enteric coating, pH > 5.5)

- Neutral Copolymers (e.g., Sustain release, matrix formation)

- By Form:

- Aqueous Dispersions

- Organic Solutions/Powders

- By Application:

- Pharmaceutical Coatings (Enteric, Sustained, Immediate Release)

- Taste Masking Agents

- Binding and Matrix Systems

- Nutraceuticals (Probiotic Protection)

- Industrial/Specialty Coatings

- By End User:

- Pharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Nutraceutical Manufacturers

- Academia and Research Institutions

Value Chain Analysis For Amino Methacrylate Copolymer Market

The value chain for the Amino Methacrylate Copolymer market is intricate and heavily dependent on specialized chemical synthesis and stringent quality control. The upstream segment involves the procurement and processing of fundamental petrochemical derivatives, primarily methacrylic acid, alkyl acrylates, and functional monomers like aminoalkyl methacrylates. These raw materials are highly specialized commodities whose purity and consistent supply are critical determinants of the final copolymer quality. Leading specialty chemical manufacturers handle the polymerization process, which requires precise reaction conditions and advanced technology to produce the various functional grades of AMCs (e.g., cationic, anionic) in compliance with Pharmacopeial standards (USP/EP/JP). This upstream process is capital-intensive and subject to strict chemical regulatory oversight.

The midstream phase focuses on compounding, formulation, and commercialization of the excipients, often converting synthesized polymers into commercially viable forms such as aqueous dispersions, powders, or granular products. This phase includes extensive quality testing and regulatory documentation (e.g., Drug Master Files – DMFs). The distribution channel relies heavily on specialized chemical distributors who possess expertise in handling highly regulated pharmaceutical excipients and maintaining the necessary logistical documentation. Direct distribution occurs when major excipient manufacturers supply large pharmaceutical companies directly under long-term contracts, ensuring traceability and supply security. Indirect channels involve regional distributors who service smaller formulation labs and generic manufacturers across diverse geographic regions, offering technical support and localized inventory.

The downstream analysis centers on the end-user applications, primarily pharmaceutical and nutraceutical manufacturing. End-users incorporate AMCs into their solid dosage forms (tablets, pellets, capsules) using sophisticated coating equipment. The performance of the copolymer directly impacts the therapeutic outcome and regulatory approval of the final drug product, making technical support and formulation guidance from the AMC supplier highly valuable. The close interaction between the AMC manufacturer and the end-user formulation scientist is crucial, establishing a strong feedback loop for optimizing product application and addressing formulation challenges. This downstream utilization drives demand for specific polymer characteristics, such as low viscosity and reliable film formation.

Amino Methacrylate Copolymer Market Potential Customers

The primary customers for Amino Methacrylate Copolymers are organizations involved in the development and manufacturing of oral solid dosage forms that require specialized functional coatings or matrices. This customer base includes multinational pharmaceutical corporations, which utilize AMCs extensively for developing branded, modified-release drugs, addressing challenges like acid sensitivity, local irritation, and compliance. Additionally, generic drug manufacturers constitute a rapidly growing segment of buyers, as they often rely on established, approved excipients to replicate the release profiles of originator drugs during bioequivalence studies. Contract Development and Manufacturing Organizations (CDMOs) are also crucial customers, purchasing large volumes of AMCs for formulating client drugs on a contract basis, offering formulation expertise and specialized coating services to the broader industry.

A significant expansion area involves nutraceutical and dietary supplement companies. These manufacturers increasingly require high-performance coating materials to protect sensitive ingredients, such as probiotics and enzymes, from degradation in the stomach, ensuring they reach the intended site of action in the intestines. This demand segment prioritizes excipients that are Generally Recognized As Safe (GRAS) or hold similar regulatory acceptance. Research institutions and academic laboratories also constitute a small but technically influential segment, using AMCs in early-stage research for novel drug delivery systems, microencapsulation, and tissue engineering applications, influencing future product development trends.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evonik Industries AG, BASF SE, Shin-Etsu Chemical Co., Ltd., Colorcon, DuPont de Nemours, Inc., Ashland Global Holdings Inc., Lubrizol Corporation, FMC Corporation, Merck KGaA, JRS Pharma GmbH & Co. KG, Dow Chemical Company, Corel Pharma Chem, Ideal Cures Pvt. Ltd., Roquette Frères, Kerry Group plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amino Methacrylate Copolymer Market Key Technology Landscape

The technology landscape governing the Amino Methacrylate Copolymer market is centered on advanced polymerization techniques, formulation science, and specialized coating technology. In the manufacturing phase, techniques like emulsion polymerization are predominantly utilized to produce high-molecular-weight copolymers with controlled properties. The key technological advancement lies in the transition from organic solvent-based systems to aqueous dispersion technology. Aqueous dispersions, such as those relying on proprietary emulsification and stabilization techniques, offer superior safety, environmental compatibility, and ease of processing for end-users. Manufacturers are continually investing in stabilizing these aqueous systems to ensure long shelf life and consistent film formation properties without the need for high levels of plasticizers, which can otherwise compromise drug stability.

On the application side, significant technology involves sophisticated coating equipment, including fluid bed coating, pan coating, and continuous coating systems. The success of using AMCs, particularly for complex sustained-release profiles, hinges on the precise control of the coating thickness and uniformity, often monitored using Process Analytical Technology (PAT) tools like near-infrared (NIR) spectroscopy. Furthermore, research is focusing on developing multifunctional copolymers—polymers that inherently combine film-forming properties with plasticizing capabilities or enhanced moisture barrier function—to simplify formulation requirements and reduce the total number of excipients required in a drug product. This drives innovation toward co-processed excipient systems.

Novel technologies also include the use of nanotechnology to create fine particle size dispersions, which improves the flowability and film smoothness, essential for high-quality aesthetic pharmaceutical coatings. Furthermore, the integration of 3D printing technology in drug manufacturing is pushing demand for specialized thermoplastic AMC grades suitable for extrusion and hot melt processes, offering unparalleled customization of dosage geometry and release kinetics. These technological advancements ensure that AMCs remain at the forefront of pharmaceutical formulation science, supporting the development of next-generation drug products with highly optimized therapeutic profiles.

Regional Highlights

- North America: This region dominates the market share, driven by a highly mature pharmaceutical industry, high regulatory standards (FDA compliance), and substantial R&D expenditure focused on complex controlled-release and high-potency drug formulations. The large presence of biotechnology and specialty pharma companies ensures continuous demand for high-quality, specialty excipients. The rapid adoption of continuous manufacturing processes further solidifies North America's leadership position.

- Europe: Europe is a major consumer, supported by stringent quality regulations enforced by the European Medicines Agency (EMA) and a strong generics manufacturing base in countries like Germany, Ireland, and Switzerland. Emphasis on environmentally friendly manufacturing drives strong demand for aqueous AMC dispersions. Innovation often focuses on developing novel co-processing technologies and polymer blends to enhance product stability and bioavailability.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the massive expansion of the generics and biosimilars manufacturing sectors, especially in India and China. Increasing disposable incomes, improving healthcare access, and significant government investment in pharmaceutical infrastructure are key accelerators. The region serves both local needs and acts as a major hub for global contract manufacturing, translating into soaring demand for reliable excipients like AMCs.

- Latin America (LATAM): Growth in LATAM is steady, characterized by increasing foreign investment in local pharmaceutical manufacturing facilities, particularly in Brazil and Mexico. The market growth is focused on replacing older, less efficient coating materials with modern AMCs to meet evolving international quality standards and serve local populations requiring cost-effective generic drugs.

- Middle East and Africa (MEA): This region is an emerging market, driven by governmental initiatives aimed at localizing drug production (e.g., Saudi Arabia, UAE). Demand is highly concentrated in establishing robust pharmaceutical formulation capabilities, often relying on imported, high-quality excipients from established European and North American suppliers to ensure product quality and regulatory acceptance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amino Methacrylate Copolymer Market.- Evonik Industries AG

- BASF SE

- Shin-Etsu Chemical Co., Ltd.

- Colorcon

- DuPont de Nemours, Inc.

- Ashland Global Holdings Inc.

- Lubrizol Corporation

- FMC Corporation

- Merck KGaA

- JRS Pharma GmbH & Co. KG

- Dow Chemical Company

- Corel Pharma Chem

- Ideal Cures Pvt. Ltd.

- Roquette Frères

- Kerry Group plc

- Wacker Chemie AG

- Mitsubishi Chemical Holdings

- Kao Corporation

- ISP Corporation (Ashland)

- Qingdao Cima Science Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Amino Methacrylate Copolymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Amino Methacrylate Copolymers in pharmaceuticals?

The primary function is to serve as functional pharmaceutical excipients, predominantly used for enteric coating and sustained-release matrices in oral solid dosage forms (tablets and capsules). They ensure targeted drug delivery by controlling the rate and location of API release within the gastrointestinal tract, crucial for improving drug efficacy and stability.

Which grades of Amino Methacrylate Copolymers are most utilized in the market?

The most utilized grades are the cationic copolymers (for immediate or pH-independent release/taste masking) and the anionic copolymers (for enteric protection, dissolving above specific pH levels, typically pH 5.5 or 7.0), fulfilling the core needs of modified drug release systems.

How is the shift towards aqueous dispersions impacting the market?

The shift towards aqueous dispersions is positively impacting the market by offering safer, more sustainable, and easier-to-handle coating systems compared to traditional organic solvent-based methods. This transition improves operational efficiency, reduces environmental impact, and enhances worker safety in pharmaceutical manufacturing facilities globally.

What are the main regional growth drivers for Amino Methacrylate Copolymers?

The main drivers include robust R&D spending and established regulatory compliance in North America and Europe, coupled with the rapid expansion of generic drug manufacturing and increasing healthcare infrastructure investment across the Asia Pacific region, which is the fastest-growing market.

What role does 3D printing technology play in the demand for these copolymers?

3D printing technology increases demand for specialized, highly consistent thermoplastic grades of AMCs suitable for fabrication via extrusion methods. This allows for the creation of customized, complex dosage forms with highly precise and reproducible drug release kinetics required for personalized medicine applications.

The Amino Methacrylate Copolymer market is characterized by intense specialization, where product efficacy is tied directly to stringent regulatory compliance and advanced material science. Ongoing technological developments in polymer synthesis are focused on achieving tighter control over molecular weight distribution and functional group placement, enhancing the performance and predictability of the resulting excipient. Furthermore, compliance with global pharmacopeial standards (USP, EP, JP) is non-negotiable, requiring manufacturers to maintain impeccable quality assurance systems, which acts as a key barrier to entry for smaller players. The complexity inherent in formulating controlled-release systems ensures that AMCs, owing to their reliable pH-dependent properties, will maintain their premium status within the excipient landscape. The integration of advanced analytical tools, such as rheometers and thermal analyzers, throughout the manufacturing process is crucial for characterizing these polymers and ensuring batch consistency, thereby supporting the high-stakes requirements of the pharmaceutical industry. This emphasis on quality and technological precision reinforces the market’s stable, high-value growth trajectory.

The pharmaceutical segment continues to innovate, exploring co-processing techniques involving AMCs and other excipients (like cellulose derivatives or starches) to achieve novel drug release profiles, such as pulsatile release or multi-layered coatings. This formulation complexity necessitates close collaboration between excipient suppliers and drug developers. The increasing global focus on improving drug stability, particularly for moisture-sensitive APIs, drives demand for AMC grades with superior moisture barrier properties. Beyond technical performance, sustainability is emerging as a critical competitive factor. Manufacturers are exploring bio-based or biodegradable methacrylate monomers to address growing environmental concerns, though maintaining pharmaceutical-grade purity and performance remains the primary challenge. The market is thus balancing high technical performance with increasing regulatory and environmental pressures.

Market segmentation based on the physical form—aqueous dispersions versus powders—is crucial for understanding operational preferences. Aqueous dispersions, while challenging to stabilize and handle, are favored by large, modern facilities prioritizing solvent-free operations. Powders, on the other hand, offer advantages in stability and ease of shipping, appealing to manufacturers in developing regions or those using specialized non-aqueous coating techniques. The future growth of the market hinges significantly on the ability of manufacturers to optimize aqueous dispersion technology further, making it compatible with high-speed coating lines while minimizing defects such as tackiness or cracking during application. This technical evolution ensures the continued relevance and expansion of the Amino Methacrylate Copolymer market across diverse manufacturing environments globally, guaranteeing high-quality, reproducible drug coatings for global health needs.

The competitive landscape of the Amino Methacrylate Copolymer market is dominated by a few key global players, primarily specialty chemical and excipient manufacturers who possess extensive intellectual property, regulatory expertise, and established relationships with major pharmaceutical firms. These market leaders invest heavily in applied research to develop new polymer functionalities, often providing proprietary technical services and formulation support to their clients, thereby building strong customer loyalty and creating high switching costs. Mid-tier companies often focus on producing generic or specialty variants, targeting regional markets or specific niche applications, such as nutraceutical coatings or veterinary medicine. Pricing strategy is highly differentiated, reflecting the regulatory burden, quality certifications, and technical support bundled with the product, with premium pricing often associated with established DMF-registered grades used in blockbuster drugs.

Strategic mergers and acquisitions are common, serving as mechanisms for market leaders to consolidate technological capabilities, secure specialized monomer supply, and gain rapid access to new geographic markets, particularly in fast-growing APAC countries. For instance, the acquisition of smaller, innovative polymer technology firms can enhance the product portfolio with novel sustained-release solutions. Key competitive differentiators include purity (low residual monomer content), consistency in batch manufacturing, comprehensive regulatory documentation (DMFs/ASMFs), and the stability profile of the final aqueous dispersion product. Furthermore, the ability to rapidly assist pharmaceutical clients in solving complex formulation issues is a major competitive advantage, positioning the supplier as a strategic partner rather than just a material provider.

The influence of raw material suppliers is considerable, as the consistency of base monomers directly impacts the polymerization outcome. Any volatility in the supply or pricing of methacrylic acid derivatives can exert margin pressure on AMC manufacturers, necessitating strong supply chain management and forward purchasing strategies. The industry is also witnessing increased scrutiny regarding the environmental footprint of polymer production, leading to competitive efforts in process optimization to minimize solvent usage and waste generation. Overall, competition centers not only on product quality but also on regulatory preparedness, technical service delivery, and supply chain resilience, ensuring the reliable provisioning of these critical functional excipients to the global drug manufacturing industry.

The market outlook remains strongly positive, underpinned by unstoppable demographic trends, notably the aging global population and the resulting rise in chronic illnesses such as diabetes, cardiovascular diseases, and cancer. Treating these conditions often requires long-term medication with controlled-release characteristics, which directly drives the adoption of AMCs. The pharmaceutical industry's focus on developing complex small-molecule drugs and increasingly stabilizing biological drugs in oral forms further necessitates advanced excipient technology. Economic factors, including increased per capita spending on healthcare in emerging economies, are expanding the patient base accessing coated medications, ensuring sustained volumetric growth for the market.

However, the threat of substitution, while currently low, remains a long-term consideration. Researchers are constantly exploring alternative functional polymers, such as high-molecular-weight cellulose derivatives or novel synthetic co-polymers, which could potentially offer comparable or superior release characteristics at a lower cost or with easier regulatory acceptance. Nevertheless, the decades of proven safety data and widespread regulatory acceptance of existing AMC grades (like those pioneered under brand names such as Eudragit) provide a substantial defensive moat against immediate displacement. Any successful substitute would require equally extensive toxicological and clinical data, a process that is both expensive and time-consuming.

Future opportunities are heavily tied to innovation in targeted delivery. Beyond the traditional enteric coating, AMCs are being modified chemically to target specific regions of the colon or to respond to specific biological triggers (e.g., enzymes present in diseased states). This high level of functional specificity ensures that the market for specialized, high-performance AMC grades will continue to command premium pricing and experience above-average growth rates. Furthermore, expanding penetration into the veterinary pharmaceutical sector, which is increasingly adopting human-grade excipients for improved animal health outcomes, represents a lucrative, yet less saturated, market avenue. The continuous evolution of drug delivery technology guarantees the Amino Methacrylate Copolymer market a critical and growing role in global pharmaceutical manufacturing.

The regulatory framework surrounding the use of Amino Methacrylate Copolymers is rigorous and contributes significantly to market stabilization and quality assurance. Global regulatory bodies, including the FDA in the United States, the EMA in Europe, and the MHLW in Japan, require comprehensive documentation (such as Drug Master Files or DMFs) detailing the chemical composition, manufacturing process, quality control testing, and stability of the excipient. This high level of scrutiny ensures the safety and consistency of the polymers used in human and animal medicine. Changes in formulation require extensive revalidation, creating high barriers to switching suppliers, thereby favoring established market leaders with a long history of regulatory approvals.

Manufacturers must consistently demonstrate compliance with Good Manufacturing Practices (GMP) specifically tailored for excipient production. This includes traceability, batch consistency, and low impurity profiles, especially concerning residual monomers or heavy metals. The International Pharmaceutical Excipients Council (IPEC) plays an important role in setting industry best practices and guidelines for quality assessment, which manufacturers adopt to harmonize their standards globally. Any regulatory action, such as a material safety warning or a quality recall, can severely damage a supplier's reputation and lead to rapid market share loss, highlighting the paramount importance of continuous quality control.

Looking forward, regulatory agencies are focusing increasingly on assessing the functionality of excipients within the final dosage form, rather than just basic material properties. This requires AMC manufacturers to provide more in-depth data on how their specific grades interact with APIs and process parameters (e.g., coating speed, temperature, curing time). The ongoing harmonization of global pharmacopeial standards aims to streamline international commerce but simultaneously demands higher levels of testing uniformity from all excipient suppliers, forcing continual investment in analytical capabilities and specialized regulatory affairs teams to navigate the complex landscape efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager