Ammonium Acryloyldimethyltaurate, VP Copolymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437538 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ammonium Acryloyldimethyltaurate, VP Copolymer Market Size

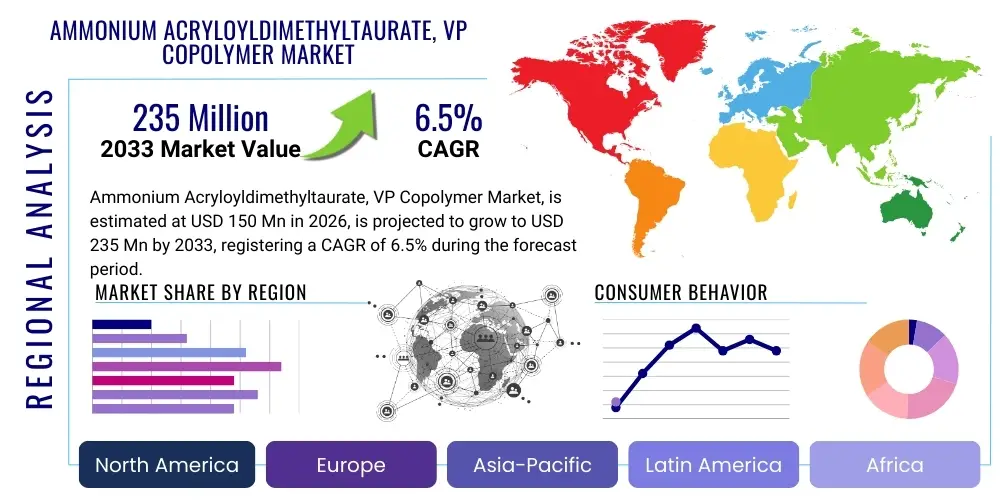

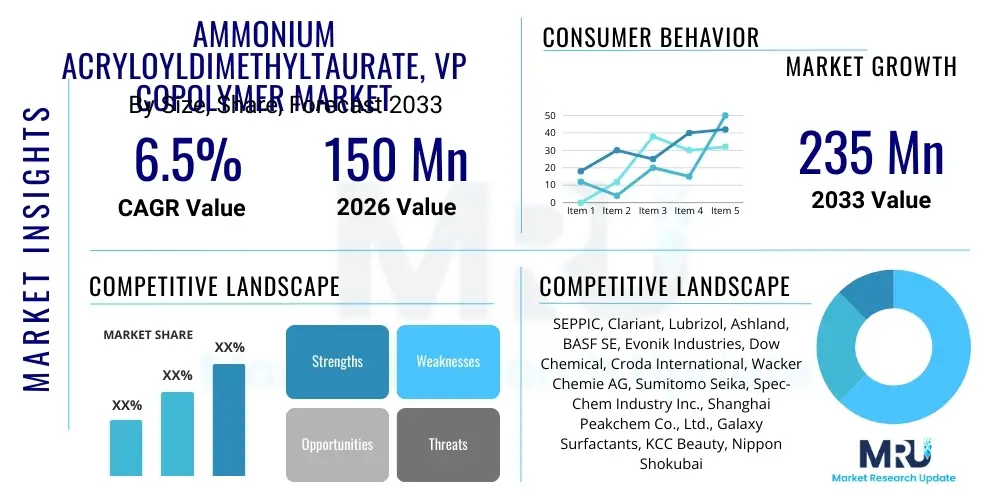

The Ammonium Acryloyldimethyltaurate, VP Copolymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 235 Million by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the escalating global demand for high-performance cosmetic and personal care ingredients that offer superior sensory profiles and formulation stability. The polymer is highly valued for its exceptional thickening efficiency across a wide pH range and its ability to create stable emulsions without the need for traditional emulsifiers, making it a critical component in modern, minimalist formulation strategies.

The market expansion is further underpinned by robust regulatory acceptance in major regions, including North America and Europe, which allows for broader application in dermatological and pharmaceutical-grade topical products. Manufacturers are increasingly prioritizing ingredient stability and ease of processing, characteristics inherent to Ammonium Acryloyldimethyltaurate, VP Copolymer. Furthermore, the rising consumer preference for lightweight, non-tacky textures in sunscreens and specialized skin treatments drives demand for polymers that can deliver excellent aesthetics and feel, ensuring sustained market valuation increases throughout the forecast period.

Ammonium Acryloyldimethyltaurate, VP Copolymer Market introduction

Ammonium Acryloyldimethyltaurate, VP Copolymer is a synthetic polymer recognized primarily as an advanced rheology modifier and stabilizer in the cosmetic and personal care industry. It belongs to the class of inverse emulsion polymers and functions effectively as a thickener, suspending agent, and emulsion stabilizer, even in the presence of challenging ingredients like high levels of oils or electrolytes. Its chemical structure, derived from the polymerization of ammonium acryloyldimethyltaurate and vinylpyrrolidone monomers, imparts excellent shear-thinning behavior, which translates to desirable application properties—such as easy spreading and rapid absorption—in end products like facial creams, serums, liquid foundations, and high-SPF sunscreens.

Major applications of this copolymer span across skin care, hair care, and color cosmetics. In skin care, it provides desirable texture and consistency to anti-aging creams, moisturizers, and gels, offering a pleasant, non-sticky sensory experience. In sunscreens, it plays a vital role in stabilizing oil-in-water emulsions and ensuring the uniform dispersion of UV filters, critical for maintaining efficacy. The synergistic thickening and stabilizing capabilities allow formulators to reduce reliance on complex, multi-component systems, streamlining manufacturing processes and reducing overall formulation costs while enhancing product quality and shelf life. This versatility makes it an indispensable ingredient in modern product development.

The market is primarily driven by the continuous innovation within the personal care sector, where the focus remains on developing multifunctional products that cater to sensitive skin and specific consumer needs, such as water resistance or non-comedogenicity. The inherent stability of Ammonium Acryloyldimethyltaurate, VP Copolymer against temperature fluctuations and pH variations provides significant benefits for global distribution and long-term product integrity. As consumer awareness regarding ingredient performance increases, the demand for scientifically proven rheology modifiers that deliver consistent results and superior sensory attributes ensures its sustained market growth.

Ammonium Acryloyldimethyltaurate, VP Copolymer Market Executive Summary

The Ammonium Acryloyldimethyltaurate, VP Copolymer Market is experiencing robust growth fueled by several converging business trends, most notably the shift towards simplified, efficient, and aesthetically pleasing cosmetic formulations. Key market participants are focusing on expanding production capacity and optimizing polymerization processes to meet the escalating demand from Asian markets, particularly China and India, where consumption of high-end skin and sun care products is accelerating. Strategic collaborations between raw material suppliers and major cosmetic houses are crucial for co-developing customized grades of the copolymer tailored for specific application segments, such as electrolyte-tolerant thickening systems required for active ingredient formulations. Pricing stability, coupled with consistent quality supply, remains a competitive differentiator among leading global manufacturers.

Regionally, the market dynamics are characterized by mature demand in North America and Europe, driven by stringent quality standards and a preference for premium, multifunctional ingredients, while the Asia Pacific region exhibits the highest growth potential due to rapid urbanization, increasing disposable incomes, and the burgeoning local cosmetic manufacturing base. European regulations concerning microplastics and sustainable sourcing are subtly influencing product development, pushing R&D towards grades that minimize environmental impact while maintaining core performance characteristics. The North American market is focused on innovation in highly specialized applications, such such as medical dermatological formulations and performance-driven sports sunscreens, where the copolymer’s water-resistant properties are highly valued.

Segment trends reveal that the skin care application category dominates the market share, largely due to its extensive use in moisturizers, facial masks, and anti-aging treatments. Within the formulation type segment, the water-based and gel formulations show accelerated uptake, leveraging the copolymer’s ability to create crystal-clear, non-tacky gels with excellent suspension capabilities. Furthermore, the growth rate is particularly strong in the specialty grades sub-segment, which includes high-viscosity or highly electrolyte-tolerant versions of the copolymer, catering to advanced cosmetic chemistry needs. These specialized segments command premium pricing and represent critical areas for future investment and differentiation among producers.

AI Impact Analysis on Ammonium Acryloyldimethyltaurate, VP Copolymer Market

Common user questions regarding AI's influence in this market often revolve around how artificial intelligence can optimize formulation stability, predict ingredient interactions, and accelerate the discovery of novel rheology modifiers. Users are concerned about whether AI can truly replace experienced formulators in balancing complex sensory attributes and viscosity requirements. The analysis reveals that the primary expectations center on AI’s capability to analyze vast databases of chemical structures and experimental stability data to rapidly screen potential copolymer blends and processing parameters. Key themes include leveraging machine learning for predictive modeling of ingredient compatibility, optimizing batch synthesis for reduced variance, and improving supply chain resilience by anticipating demand fluctuations in cosmetic manufacturing. Users also seek clarity on AI's role in ensuring compliance with evolving regulatory standards related to material safety and environmental impact.

AI is fundamentally transforming the research and development pipeline for advanced rheology modifiers like Ammonium Acryloyldimethyltaurate, VP Copolymer by drastically reducing the time required for optimization. Machine learning algorithms can process data from thousands of historical formulation trials, identifying complex, non-linear correlations between copolymer concentration, pH, electrolyte presence, and final product stability and texture. This allows formulators to move away from tedious trial-and-error methodologies towards data-driven predictive modeling, leading to faster time-to-market for new cosmetic products. Specifically, AI assists in tailoring the copolymer’s molecular weight distribution and branching structure during synthesis to achieve precise rheological profiles demanded by specialized applications, such as high-shear processing or aerosol formulations.

Beyond R&D, AI’s greatest impact is anticipated in smart manufacturing and quality control. In the production of the copolymer, AI-driven sensors and control systems monitor reaction kinetics in real-time, adjusting temperature and monomer addition rates to ensure highly consistent batch quality and minimize waste. For downstream users (cosmetic manufacturers), AI tools integrated into formulation software can predict the shelf life and long-term stability of a product containing Ammonium Acryloyldimethyltaurate, VP Copolymer under various storage conditions, mitigating the risk of product failure. Furthermore, natural language processing and computer vision are being utilized to quickly analyze market feedback and social media trends, identifying consumer preferences for specific textures and rapidly informing the necessary adjustments to ingredient specifications and concentration levels.

- AI-driven predictive modeling accelerates the optimization of copolymer concentration and viscosity profile in new formulations.

- Machine learning algorithms enhance quality control during polymerization, ensuring batch-to-batch consistency and purity.

- Supply chain resilience is improved through AI forecasting of ingredient demand fluctuations from global cosmetic manufacturers.

- AI aids in rapid regulatory screening by comparing product compositions against regional chemical safety databases.

- Computational chemistry simulations predict interaction behavior between the copolymer and high-concentration active ingredients or electrolytes.

DRO & Impact Forces Of Ammonium Acryloyldimethyltaurate, VP Copolymer Market

The market for Ammonium Acryloyldimethyltaurate, VP Copolymer is shaped by significant drivers, offset by specific restraints, while abundant opportunities define its future trajectory, collectively establishing a compelling set of impact forces. The primary driver is the accelerating consumer preference for aesthetically superior and multifunctional personal care products, which heavily rely on the copolymer’s ability to deliver light, non-tacky textures and superior emulsion stability, especially in complex sunscreen and serum formulations. Simultaneously, the growing demand from emerging economies, particularly in the APAC region, driven by expanding middle classes and increased hygiene awareness, provides a robust fundamental growth platform. These market dynamics are bolstered by regulatory recognition of the copolymer’s safety profile, allowing its widespread adoption.

However, the market faces notable restraints, chiefly the price volatility of key raw materials, including the vinylpyrrolidone monomer, which can impact manufacturing costs and final product pricing. Furthermore, the increasing consumer and regulatory scrutiny regarding synthetic polymers in favor of natural or bio-derived ingredients poses a long-term challenge, necessitating manufacturers to invest heavily in demonstrating the superior performance and favorable toxicological profile of the synthetic compound. The complexity of establishing global standardized specifications for various grades of the copolymer also acts as a subtle barrier to entry and cross-regional trade, requiring extensive documentation and testing for different jurisdictions.

The key opportunities lie in the further penetration of specialty markets such as clinical dermatological products, wound care, and pharmaceutical excipients, where the high tolerance to salts and active ingredients is paramount. Developing specialized, high-solid-content grades that offer enhanced sustainability or biodegradable characteristics presents a lucrative avenue for market expansion and differentiation. The impact forces are characterized by moderate supply-side elasticity due to the specialized manufacturing process, coupled with high demand-side inelasticity, particularly from major cosmetic brands that rely on its unique performance. This dynamic creates a stable, albeit competitive, environment where innovation in process efficiency and product purity determines market leadership.

Segmentation Analysis

The Ammonium Acryloyldimethyltaurate, VP Copolymer market is comprehensively segmented primarily by Type (based on molecular weight or specific functionalization), by Application (categorized by the end-use product), and by Geographic Region. This segmentation allows for precise analysis of market trends, identifying high-growth pockets, and understanding the differentiated requirements of various end-user industries. The segmentation by application is particularly critical, reflecting the dominance of the skin care sector which utilizes the polymer for its texture modification and emulsification properties across a vast array of consumer products. Understanding the specific regional demand patterns—such as the high demand for sun care ingredients in tropical and highly regulated markets—further refines the strategic outlook for manufacturers and distributors within this specialized chemical sector.

Segmentation by Type often reflects the technical versatility of the polymer, distinguishing between high-molecular weight grades used for high-viscosity applications and low-molecular weight grades optimized for film-forming properties or specific electrolyte tolerance. Manufacturers frequently market their products based on these functional attributes, allowing cosmetic formulators to select the precise ingredient needed to achieve a desired sensory profile, ranging from thick, luxurious creams to light, quickly absorbed serums. This granularity in product offering ensures that the copolymer remains relevant across the broad spectrum of premium, mass-market, and niche cosmetic formulations, supporting its fundamental market position against competing rheology modifiers such as carbomers and cellulosic thickeners.

Geographic segmentation is essential for grasping the divergent regulatory environments and consumer behavior influencing market adoption. Asia Pacific is defined by rapid growth in domestic manufacturing and high consumer acceptance of innovative cosmetic ingredients, whereas North America and Europe prioritize robust supply chain verification and compliance with strict safety standards. The sustained growth across all segments highlights the ingredient's perceived value as a high-performance stabilizer. Strategic market penetration requires customizing marketing efforts and technical support based on the specific needs derived from these key segmentation parameters.

- By Type:

- Standard Grade

- High Viscosity Grade

- Electrolyte Tolerant Grade

- Fast Hydrating Grade

- By Application:

- Skin Care (Creams, Lotions, Serums)

- Sun Care (Sunscreens, After-sun Products)

- Hair Care (Shampoos, Conditioners, Styling Gels)

- Color Cosmetics (Liquid Foundations, BB/CC Creams)

- Personal Hygiene (Body Washes, Hand Sanitizers)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Ammonium Acryloyldimethyltaurate, VP Copolymer Market

The value chain for Ammonium Acryloyldimethyltaurate, VP Copolymer begins with the upstream procurement of essential raw materials, primarily the monomers Ammonium Acryloyldimethyltaurate and Vinylpyrrolidone, along with initiators and solvents necessary for the polymerization process. The upstream segment is characterized by high capital intensity and reliance on the petrochemical industry for sourcing basic chemical building blocks. Manufacturers of the copolymer often have specialized, proprietary polymerization techniques (e.g., inverse emulsion polymerization) that confer unique rheological properties to the final polymer powder or dispersion. Efficiency in upstream sourcing and process optimization is paramount as it directly impacts the cost structure and purity of the resulting rheology modifier.

The midstream phase involves the synthesis and refinement of the copolymer. Key activities include precise control over reaction conditions to manage molecular weight and particle size distribution, followed by separation, drying, and micronization of the final product into marketable forms. Direct distribution channels involve selling large volumes of the copolymer directly to major multinational cosmetic manufacturers who have centralized procurement and formulation centers. Indirect channels, which are particularly prevalent in fragmented markets like Asia Pacific and Latin America, rely on specialized chemical distributors. These distributors provide value-added services such as local warehousing, small-batch packaging, technical support, and navigating complex regional chemical registration requirements, bridging the gap between large-scale producers and numerous smaller cosmetic and pharmaceutical companies.

The downstream analysis focuses on the end-users: cosmetic, personal care, and pharmaceutical product formulators. These buyers incorporate the copolymer for stabilization and texture enhancement. The ultimate success of the copolymer is dictated by its performance in the final consumer product, measured by sensory attributes, shelf stability, and application efficacy. Feedback from downstream users regarding handling, dispersion, and compatibility with challenging active ingredients drives innovation back up the chain, particularly in developing faster-dispersing or higher electrolyte-tolerant grades. The complexity of the global cosmetic distribution network necessitates a highly responsive and technically proficient distribution channel to ensure timely delivery and maintain product quality across diverse geographies.

Ammonium Acryloyldimethyltaurate, VP Copolymer Market Potential Customers

Potential customers for Ammonium Acryloyldimethyltaurate, VP Copolymer are primarily concentrated within the global personal care and specialty chemicals industries. The largest segment of end-users consists of multinational cosmetic conglomerates that manufacture high volumes of skin care, sun care, and hair styling products. These major buyers prioritize consistent quality, global supply security, and highly specialized technical support to ensure their diverse product lines maintain superior stability and sensory appeal across different markets. Their purchasing decisions are heavily influenced by the polymer's ability to simplify emulsion processes, enhance product aesthetics, and comply with varied international regulatory standards, making them high-value customers who often negotiate long-term supply contracts.

Another significant customer base includes medium to large-sized private label cosmetic manufacturers and niche brands specializing in high-performance or professional-grade products. These buyers are often focused on innovation and differentiation, requiring specialized grades of the copolymer that enable unique textures, such as water-break gels or highly stable serums containing high concentrations of challenging actives like Vitamin C or AHAs. For these customers, the primary value proposition of the copolymer is its versatility and robustness in complex formulations, allowing them to rapidly launch innovative products that command premium pricing, focusing less on scale and more on technical performance and sensory experience delivered to the consumer.

Furthermore, the pharmaceutical and medical dermatological sectors represent a growing segment of potential customers. These industries utilize the copolymer as a functional excipient in topical drugs, such as medicated creams and ointments, where rheology control is essential for accurate dosing, smooth application, and enhanced drug delivery efficacy. For this highly regulated segment, the emphasis is placed on cGMP compliance, extensive safety documentation, and stability testing, often necessitating pharmaceutical-grade versions of the polymer. The expanding use in specialized areas like wound care gels and transdermal patches underscores the technical versatility and biocompatibility of Ammonium Acryloyldimethyltaurate, VP Copolymer beyond traditional consumer cosmetics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 235 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SEPPIC, Clariant, Lubrizol, Ashland, BASF SE, Evonik Industries, Dow Chemical, Croda International, Wacker Chemie AG, Sumitomo Seika, Spec-Chem Industry Inc., Shanghai Peakchem Co., Ltd., Galaxy Surfactants, KCC Beauty, Nippon Shokubai |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ammonium Acryloyldimethyltaurate, VP Copolymer Market Key Technology Landscape

The key technology landscape underpinning the Ammonium Acryloyldimethyltaurate, VP Copolymer market is centered around advanced polymerization techniques, specifically inverse emulsion polymerization, which allows manufacturers to control the molecular architecture and particle morphology with high precision. This technology is critical because it directly influences the copolymer’s performance attributes, such as thickening efficiency, ease of dispersion (quick-break properties), and tolerance to solvents or electrolytes. Recent technological advancements focus on achieving higher solid content in the inverse emulsion phase to reduce transportation costs and environmental impact, while also developing grades that are easier to incorporate into cold-process cosmetic formulations, reducing the energy footprint for end-users. Continuous innovation in reactor design and mixing technology is necessary to ensure uniform particle size and minimal residual monomer levels, meeting increasingly strict purity standards.

Furthermore, proprietary post-polymerization processing technologies, such as micro-grinding and surface treatment, play a vital role in enhancing the powder form of the copolymer. These techniques improve dispersibility and hydration kinetics, allowing formulators to achieve consistent viscosity profiles quickly and reliably without extensive heating or high-shear mixing. The incorporation of advanced analytical tools, including Gel Permeation Chromatography (GPC) for molecular weight profiling and Rheometers for precise viscosity measurements, ensures rigorous quality control. These technologies enable manufacturers to maintain tight specifications for parameters like solution clarity and shear stability, which are essential for applications ranging from clear styling gels to high-SPF, water-resistant sunscreens.

The most forward-looking technology trend involves green chemistry and sustainable production methodologies. Although the copolymer is synthetic, manufacturers are increasingly exploring biocatalysis and solvent-free polymerization techniques to reduce the environmental impact associated with chemical synthesis. Research into functionalized copolymer derivatives, achieved through advanced grafting or cross-linking techniques, aims to create multi-functional ingredients that provide thickening, stabilization, and specific biological benefits, such as controlled release of active ingredients. Adopting Industry 4.0 principles, including sensor integration and process automation, is becoming standard practice to optimize yields, reduce batch variation, and ensure cost-effective production in a highly competitive global market.

Regional Highlights

The global Ammonium Acryloyldimethyltaurate, VP Copolymer market exhibits pronounced regional variations in demand, driven by differing regulatory environments, consumer trends, and local manufacturing capabilities. North America and Europe currently represent the largest consumer base, characterized by a mature market with high demand for premium and specialized personal care products. In these regions, the copolymer is primarily utilized in sophisticated anti-aging serums, clinically-tested dermatological preparations, and high-SPF sunscreens, where consumers are willing to pay a premium for enhanced sensory attributes and verified stability. Regulatory compliance with REACH in Europe and stringent FDA guidelines in the U.S. necessitates that suppliers maintain exceptional documentation and product purity, reinforcing the leadership of established global chemical companies in these areas.

The Asia Pacific (APAC) region, however, is projected to be the fastest-growing market during the forecast period. This acceleration is attributed to the burgeoning cosmetics industries in China, South Korea, and India, coupled with rising disposable incomes and rapid westernization of beauty standards. APAC manufacturers increasingly seek high-performance rheology modifiers to improve the quality of domestic skin care, particularly lightweight moisturizers and essence products popular in the region. The strong emphasis on sun care in Southeast Asia also drives demand for the copolymer due to its excellent stabilizing properties in high-oil-phase emulsions. Localized production and strong regional distribution networks are becoming critical success factors in navigating the diverse consumer preferences across the region.

Latin America and the Middle East & Africa (MEA) represent emerging markets with substantial untapped potential. Latin America, particularly Brazil and Mexico, exhibits strong consumption of hair care and body care products, creating steady demand for functional ingredients. MEA shows concentrated growth in Gulf Cooperation Council (GCC) countries, driven by high per capita spending on luxury cosmetic products. While these regions may experience greater price sensitivity compared to North America or Europe, the ongoing establishment of local manufacturing facilities and the entry of international cosmetic brands provide significant opportunities for the copolymer market to expand its footprint and accelerate volume growth.

- Asia Pacific (APAC): Highest growth rate, driven by Chinese and Indian cosmetic manufacturing expansion and high demand for sun care and specialized skin care formulations.

- North America: Market stability and high penetration in premium anti-aging and medical dermatological segments, supported by robust regulatory adherence.

- Europe: Focus on sustainable and compliant synthetic ingredients; strong usage in high-end cosmetic gels and stabilizers, adhering strictly to European Union regulations.

- Latin America: Growing market driven by hair care and body care consumption, with increasing adoption of globally standardized formulations.

- Middle East & Africa (MEA): Rising demand in GCC countries fueled by high disposable incomes and a shift toward imported or regionally manufactured luxury cosmetics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ammonium Acryloyldimethyltaurate, VP Copolymer Market.- SEPPIC

- Clariant

- Lubrizol

- Ashland

- BASF SE

- Evonik Industries

- Dow Chemical

- Croda International

- Wacker Chemie AG

- Sumitomo Seika

- Spec-Chem Industry Inc.

- Shanghai Peakchem Co., Ltd.

- Galaxy Surfactants

- KCC Beauty

- Nippon Shokubai

- AkzoNobel (Nouryon)

- Momentive Performance Materials

- Polymer Solutions Group (PSG)

- Guangzhou Tinci Materials Technology Co., Ltd.

- DSM Nutritional Products

Frequently Asked Questions

Analyze common user questions about the Ammonium Acryloyldimethyltaurate, VP Copolymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Ammonium Acryloyldimethyltaurate, VP Copolymer in cosmetic formulations?

The primary function is to act as a highly efficient synthetic rheology modifier, stabilizer, and emulsifier in cosmetic products. It excels at thickening formulations, maintaining stability across wide pH ranges, and providing desirable sensory attributes such as a non-sticky, light texture, particularly crucial for high-performance serums and sunscreens.

How does the polymer contribute to the stability of challenging cosmetic formulations?

It provides exceptional stability by forming a highly structured network within the aqueous phase, effectively suspending insoluble particles and stabilizing oil-in-water emulsions, even in the presence of high concentrations of electrolytes, salts, or ethanol, which typically destabilize conventional thickeners.

Which application segment shows the fastest growth rate for this copolymer?

The skin care application segment, particularly high-end facial serums, moisturizers, and gels, is currently the largest consumer and exhibits the fastest absolute growth, driven by the need for superior texture and compatibility with demanding active ingredients in anti-aging and specialized treatment products.

Are there sustainable or bio-based alternatives competing with this synthetic copolymer?

Yes, competition exists primarily from natural thickeners like xanthan gum and modified starches, and other synthetic polymers like carbomers. However, Ammonium Acryloyldimethyltaurate, VP Copolymer maintains a competitive edge due to its superior electrolyte tolerance, clarity in gel formation, and performance consistency, prompting R&D into more environmentally friendly synthetic processes.

What are the key technological advancements driving production efficiency for this material?

Key advancements include enhanced inverse emulsion polymerization techniques for better particle control, development of fast-dispersing powdered grades for easier cold-process formulation, and the integration of AI and Industry 4.0 automation to ensure ultra-high batch consistency and minimize residual monomer levels, thereby improving safety and purity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager