Ammonium Hydrogen Fluoride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434394 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Ammonium Hydrogen Fluoride Market Size

The Ammonium Hydrogen Fluoride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 815 Million by the end of the forecast period in 2033.

Ammonium Hydrogen Fluoride Market introduction

Ammonium Hydrogen Fluoride (AHF), also chemically known as ammonium bifluoride ($\text{NH}_4\text{HF}_2$), is a crucial inorganic chemical widely utilized across several high-tech and industrial sectors due to its potent acidic and fluorinating properties. It typically exists as a white crystalline solid, highly soluble in water, and possesses strong corrosive characteristics, necessitating careful handling and application. Its primary function leverages its ability to selectively etch glass, silicon, and other materials, making it indispensable in modern manufacturing processes. The chemical acts as a critical intermediate in various complex synthetic pathways and plays a pivotal role in maintaining high-purity surfaces in sensitive environments.

The product's versatility extends to major applications including glass processing, metal treatment, and specialized chemical synthesis. In the glass industry, AHF is the preferred etchant for frosted glass, intricate ornamentation, and the preparation of bulbs and optical components. Its application in metallurgy involves the removal of scale and the preparation of metal surfaces for subsequent protective coatings or manufacturing steps. The increasing demand for electronic-grade AHF, characterized by ultra-low impurity levels, directly correlates with the relentless expansion of the global semiconductor and electronics industries, where it is vital for cleaning silicon wafers and etching circuit patterns with high precision.

Key benefits driving the market include AHF's effectiveness as a cleaning agent, its role in improving product quality in glass manufacturing, and its efficacy in complex chemical reactions. Furthermore, the material serves as an efficient fluxing agent in brazing and soldering operations. Market growth is primarily driven by the escalating demand from the electronics sector, particularly the fabrication of advanced semiconductors and flat panel displays. Secondary driving factors include robust growth in the construction industry requiring specialized glass products and increasing global focus on high-purity chemical processing, which sustains demand for technical and electronic grades of AHF.

Ammonium Hydrogen Fluoride Market Executive Summary

The Ammonium Hydrogen Fluoride market is experiencing significant upward trajectory, primarily propelled by burgeoning demands within the electronics and semiconductor manufacturing sectors. The business trend leans heavily towards specialization, with manufacturers investing substantially in technologies required to produce Electronic Grade (EL Grade) AHF, which commands a higher price point due to stringent purity requirements (parts per billion levels). Strategic alliances focusing on secure, long-term supply chains are becoming commonplace, addressing volatility in raw material sourcing—specifically hydrofluoric acid. Furthermore, sustainability initiatives are influencing processing methodologies, driving innovation towards cleaner production techniques and safer handling practices, although the corrosive nature of the product remains a core operational challenge.

Regional dynamics highlight Asia Pacific (APAC) as the dominant and fastest-growing region, overwhelmingly due to the concentration of global electronics manufacturing hubs in countries like China, South Korea, Taiwan, and Japan. This region dictates global pricing and supply chain stability for high-purity AHF. North America and Europe maintain substantial market shares driven by mature industrial applications, including aerospace metallurgy and established chemical production facilities, though growth rates are comparatively slower, focusing more on regulatory compliance and specialized high-value applications. Emerging economies within Latin America and MEA are showing potential, spurred by infrastructural development and nascent local glass manufacturing capabilities, requiring increased volumes of technical grade AHF.

Segment trends reveal a pronounced shift in favor of the Electronic Grade segment by value, despite Technical Grade maintaining dominance by volume in traditional industrial cleaning and glass frosting applications. The Application segment is witnessing rapid expansion in Semiconductor Manufacturing, dwarfing growth rates in traditional industrial cleaning applications. Manufacturers are strategically diversifying their product portfolios, moving up the value chain by offering customized solutions tailored to specific semiconductor fabrication steps, such as wet etching processes for advanced memory chips and microprocessors. This segmentation divergence underscores the market's evolution from a commodity chemical base to a highly specialized, performance-driven input material.

AI Impact Analysis on Ammonium Hydrogen Fluoride Market

User inquiries regarding the impact of AI on the Ammonium Hydrogen Fluoride (AHF) market primarily revolve around three key themes: optimization of chemical production processes, advancements in semiconductor manufacturing that drive AHF demand, and intelligent supply chain management. Users frequently ask how AI can enhance the purity control in AHF synthesis, considering the extreme sensitivity of Electronic Grade AHF used in chip fabrication. There is also significant curiosity about how AI-driven predictive maintenance and quality control systems in semiconductor fabs will affect the specific volume and grade requirements for etching chemicals like AHF. The collective expectation is that AI will not replace the chemical itself, but rather radically optimize the efficiency, safety, and precision of its production and application, especially in high-stakes environments like wafer cleaning.

The direct impact of AI implementation lies in streamlining and optimizing the highly complex synthesis and purification stages of AHF manufacturing. AI algorithms can process vast amounts of sensor data in real-time to precisely control temperature, pressure, and concentration ratios, ensuring minimal impurity introduction and maximizing yield of ultra-high purity grades required by major semiconductor foundries. This level of optimization minimizes waste and energy consumption, addressing operational costs and environmental concerns simultaneously. Furthermore, AI-powered predictive analytics can forecast demand fluctuations across different application sectors (e.g., shifts in consumer electronics cycles), enabling AHF producers to adjust inventory and production schedules proactively, thereby stabilizing supply and mitigating price volatility.

In the end-user market, particularly semiconductor fabrication, AI integration accelerates process development, testing, and error detection in etching and cleaning processes. Sophisticated machine learning models can simulate etching outcomes using AHF, allowing engineers to fine-tune concentrations and exposure times digitally before running expensive physical trials. This enhanced precision reduces material usage and significantly improves the uniformity and quality of the etched features, which is critical for miniaturization in chips. Consequently, while AI increases the efficiency of AHF utilization, the overall increase in semiconductor production complexity and volume ensures a consistently growing, albeit more stringently controlled, demand for high-purity Ammonium Hydrogen Fluoride.

- AI-driven optimization enhances purity control and yield in Electronic Grade AHF production.

- Predictive maintenance systems utilize AI to ensure optimal efficiency and safety in AHF handling facilities.

- Machine Learning models simulate etching processes, reducing material waste and optimizing AHF concentration usage in semiconductor manufacturing.

- AI-powered demand forecasting stabilizes AHF supply chains in response to volatile consumer electronics production cycles.

- Robotics and automation, often AI-guided, improve worker safety by minimizing direct exposure to corrosive AHF.

DRO & Impact Forces Of Ammonium Hydrogen Fluoride Market

The Ammonium Hydrogen Fluoride market is subject to a complex interplay of driving forces, inherent constraints, and strategic opportunities that collectively shape its growth trajectory. The fundamental market driver is the exponential expansion of the global electronics industry, particularly the demand for advanced semiconductors, microchips, and flat panel displays (FPDs), all of which rely on high-purity AHF for critical wet processing steps. Simultaneously, restraints center predominantly on the severe environmental and health hazards associated with AHF, specifically its high toxicity and extreme corrosiveness, leading to stringent regulatory frameworks globally. Opportunities emerge from innovation in specialized applications, such as the development of solar photovoltaic (PV) technology and specialized metallurgical processes requiring fluorinated compounds, alongside geographical expansion into emerging industrial economies.

Key drivers include the technological advancements demanding finer etching resolutions (Moore's Law), necessitating higher purity AHF, and sustained demand from traditional applications like industrial water treatment and glass manufacturing in emerging markets. Conversely, market restraints are formidable. The capital expenditure required for compliance with increasingly strict environmental regulations (like REACH in Europe) and occupational safety standards significantly increases operational costs for manufacturers. Furthermore, the reliance on hydrofluoric acid (HF) as the primary raw material ties the AHF market directly to HF supply stability and pricing volatility, posing a significant logistical and economic constraint. The public perception and regulatory scrutiny regarding highly toxic chemicals also impede market entry and expansion in various geographies.

Impact forces such as substitution risk remain moderate; while some alternative etching chemistries exist, few offer the cost-effectiveness and precision of AHF for silicon and glass. Regulatory impact is high, often dictating process changes and driving R&D towards closed-loop systems and safer handling technologies. The competitive landscape is characterized by intense focus on purity specifications rather than just volume, making technological superiority a key competitive advantage. Opportunities are ripe in developing regions where industrialization is accelerating, requiring basic technical grade AHF, and in niche markets such as specialized battery component manufacturing where fluorine chemistry is critical. Navigating the regulatory landscape while leveraging the electronics boom dictates the success of market participants.

- Drivers:

- Exponential growth in global semiconductor and electronics manufacturing demanding ultra-high purity electronic-grade AHF.

- Sustained global infrastructure development driving demand for specialized glass products and metal cleaning applications.

- Increasing application of fluorine chemistry in niche areas such as solar panel manufacturing and specialized battery components.

- Restraints:

- High toxicity and corrosiveness of Ammonium Hydrogen Fluoride necessitating stringent environmental, health, and safety (EHS) compliance.

- Volatile pricing and restricted supply chains for hydrofluoric acid (HF), the primary raw material.

- High capital investment required for dedicated handling and waste disposal infrastructure.

- Opportunities:

- Development of safer, encapsulated forms or delivery systems for AHF, reducing handling risks.

- Expansion of manufacturing facilities in high-growth Asia Pacific regions to meet localized electronics demand.

- Innovation in recycling and regeneration technologies for spent AHF solutions, addressing waste reduction goals.

Segmentation Analysis

The Ammonium Hydrogen Fluoride market is comprehensively segmented based on Grade, Application, and End-Use Industry, providing a nuanced view of demand drivers and growth pockets. The classification by Grade is paramount, differentiating between Technical Grade, used in high-volume industrial tasks like general glass frosting and scale removal, and the highly specialized Electronic Grade (EL Grade), which serves the stringent demands of the semiconductor industry. This segregation reflects a stark difference in pricing, manufacturing complexity, and end-user requirements, with Electronic Grade driving market value growth globally.

Analysis by Application reveals that Industrial Cleaning and Glass Etching remain significant volume consumers, relying predominantly on Technical Grade AHF. However, the Semiconductor Manufacturing application segment is the undisputed leader in terms of market revenue growth due to the high cost associated with ultra-pure materials and the massive scale of global chip fabrication. The requirements for AHF in chemical synthesis, such as the production of fluorinated salts and organic fluorine compounds, offer stable, albeit slower, growth. Segmentation by End-Use Industry further clarifies these dynamics, placing Electronics & Semiconductors far ahead of Construction (glass manufacturing) and Metallurgy in terms of future market valuation potential.

Strategic segmentation allows market players to focus their research and development efforts and allocate resources effectively. Companies specializing in high-purity production often target Electronic Grade applications in APAC, while those focusing on volume production cater to the Construction and General Industrial sectors across various geographies. Understanding the granular differences in quality demands—from the few parts per million impurity tolerance in Technical Grade to the stringent parts per billion requirements in Electronic Grade—is crucial for successful market positioning and maintaining competitive advantage in this specialized chemical domain.

- By Grade:

- Technical Grade

- Electronic Grade (High Purity)

- By Application:

- Industrial Cleaning (Boiler Descaling, Water Treatment)

- Glass Etching and Frosting

- Metal Surface Treatment and Pickling

- Chemical Synthesis and Manufacturing

- Semiconductor Manufacturing (Wafer Cleaning and Etching)

- By End-Use Industry:

- Electronics and Semiconductors

- Construction (Architectural and Automotive Glass)

- Metallurgy and Metal Processing

- Chemical Processing

- Others (Pharmaceuticals, Oil & Gas)

Value Chain Analysis For Ammonium Hydrogen Fluoride Market

The value chain of the Ammonium Hydrogen Fluoride market begins with the extraction and processing of fluorospar (fluorspar), which is the primary source of fluorine. This upstream segment is characterized by high capital intensity and geographical concentration, mainly in China, Mexico, and South Africa. Fluorspar is then reacted with sulfuric acid to produce Hydrofluoric Acid (HF), the key immediate precursor chemical. The volatility in fluorspar mining and HF production significantly impacts the cost and stability of AHF manufacturing. Manufacturers must secure reliable, high-volume supply contracts for HF to maintain stable AHF output, especially for electronic grade applications where impurities in the precursor are highly detrimental to final product quality.

The midstream process involves the synthesis of AHF from ammonia and HF, followed by rigorous purification steps. For Electronic Grade AHF, purification is the most value-adding and technically complex step, requiring advanced crystallization, filtration, and trace metal analysis technologies to achieve parts per billion purity levels. The choice between direct and indirect distribution channels is critical at this stage. Direct distribution, often involving specialized chemical logistics providers, is utilized for high-volume, sensitive Electronic Grade shipments directly to major semiconductor fabrication plants (fabs) or large contract manufacturers, ensuring strict quality control during transit.

Downstream analysis focuses on the end-use industries, where AHF is integrated into complex manufacturing processes. Direct buyers, such as major semiconductor companies (e.g., TSMC, Samsung), exert substantial purchasing power and demand tight specifications and Just-In-Time (JIT) delivery. Indirect channels involve distributors or regional chemical resellers supplying smaller industrial glass manufacturers or local metal treatment facilities. The value capture moves downstream as the chemical becomes embedded in high-value products like microchips and specialized optical glass, where the quality of the AHF directly influences the performance and defect rates of the final product. Strong technical support and safe handling training are essential services provided throughout the distribution network, particularly in the handling of this corrosive material.

Ammonium Hydrogen Fluoride Market Potential Customers

The primary potential customers for Ammonium Hydrogen Fluoride span highly diversified industrial and technological sectors, with demand segmented sharply by the required purity level. High-value customers are predominantly large, multinational semiconductor fabrication plants (Foundries) and integrated device manufacturers (IDMs) located primarily across Asia. These customers purchase Electronic Grade AHF for critical functions such as silicon wafer cleaning, pre-diffusion cleaning, and specialized etching of oxide layers. Their purchasing decisions are driven almost exclusively by purity specifications, stability of supply, and compliance with stringent quality certifications rather than simply cost optimization.

Secondary, high-volume customers include large-scale glass manufacturers specializing in architectural, automotive, and specialty optical glass production. These companies utilize Technical Grade AHF for glass frosting, etching intricate patterns, and chemical polishing applications. The construction boom and increasing architectural focus on frosted or decorative glass panels drive demand in this segment. Furthermore, chemical and metallurgical facilities represent consistent buyers, using AHF for specific chemical synthesis reactions, metal pickling (removing oxide scale from ferrous and non-ferrous metals), and as a fluxing agent in brazing operations. These traditional industrial buyers prioritize reliable supply, competitive pricing, and efficient logistics for bulk purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Solvay S.A., LANXESS AG, Morita Chemical Industries Co., Ltd., Stella Chemifa Corporation, Kanto Chemical Co., Inc., Central Glass Co., Ltd., Shaowu Fluorochemical Co., Ltd., Jiangxi Hongxing Chemical Co., Ltd., Derivados del Flúor (DF), Buss ChemTech AG, Yongjing Chemical Co., Ltd., Nantong Hexing Chemical Co., Ltd., Hangzhou Dayangchem Co. Ltd., Shandong Dongyue Group, Alfa Aesar (Thermo Fisher Scientific), Merck KGaA, Avantor, Inc., Wego Chemical Group, Gelest, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ammonium Hydrogen Fluoride Market Key Technology Landscape

The technological landscape for Ammonium Hydrogen Fluoride manufacturing is dominated by advancements in purification and handling systems, particularly concerning the production of Electronic Grade materials. The core manufacturing process, involving the reaction of ammonia and hydrofluoric acid, is relatively standardized, but the subsequent purification steps define technological superiority. Key technologies focus on achieving ultra-low levels of metallic and non-metallic impurities (e.g., iron, sodium, chloride) which are detrimental to semiconductor yields. Techniques such as proprietary multi-stage crystallization, advanced filtration utilizing specialized membranes, and ion-exchange processes are crucial for reaching parts per billion purity required by leading chipmakers.

A secondary, but increasingly important, technological focus is on enhancing safety and environmental compliance during production and delivery. This involves implementing sophisticated closed-loop handling systems, automated monitoring for leak detection, and developing advanced methods for neutralizing and recycling spent AHF solutions. Innovations in packaging and transport, such as specialized high-density polyethylene (HDPE) containers with integrated safety features, are essential for ensuring the stable and safe transit of this highly corrosive substance. Continuous monitoring systems utilizing real-time sensors and data analytics are becoming standard practice to ensure both product quality consistency and adherence to strict regulatory mandates throughout the supply chain.

Furthermore, technology development is also directed toward alternative production methodologies that might reduce reliance on high-cost, high-toxicity hydrofluoric acid precursors, although current viability remains challenging. The application side sees technology improvements in precision dispensing systems for semiconductor fabs, ensuring highly accurate control over etching rates and uniformity. These integrated systems often employ advanced process control (APC) software to manage the reaction kinetics between AHF and silicon/oxide layers, maximizing the efficiency of the chemical and minimizing defects, thereby driving the need for AHF suppliers to maintain extremely tight batch-to-batch consistency.

Regional Highlights

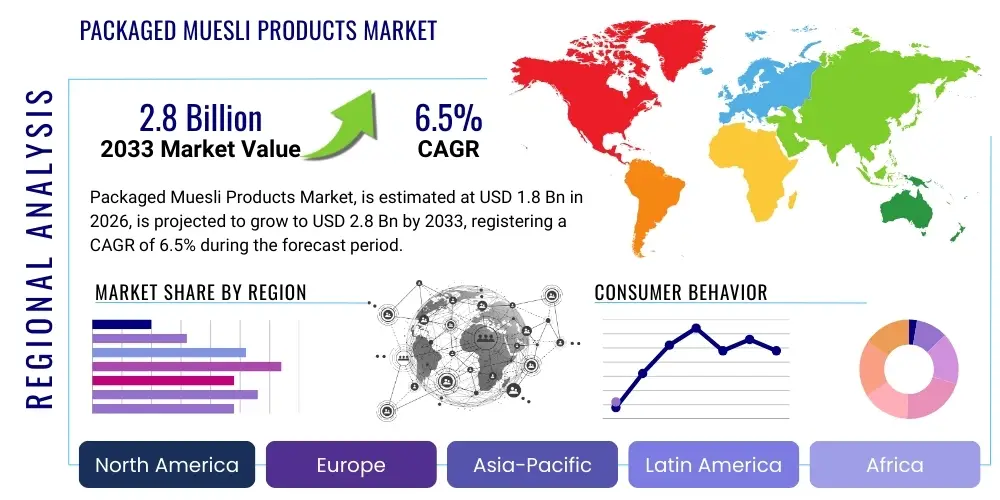

The Ammonium Hydrogen Fluoride market exhibits distinct regional dynamics, dictated primarily by the geographical distribution of major end-use industries, particularly electronics manufacturing. Asia Pacific (APAC) dominates the global market both in terms of consumption volume and production capacity. This region, encompassing major manufacturing powerhouses like China, South Korea, Taiwan, and Japan, serves as the global epicenter for semiconductor fabrication, flat panel display production, and high-volume glass manufacturing. The relentless expansion of these industries ensures APAC's leading market position and its status as the fastest-growing region, often setting global price points and purity standards for electronic-grade AHF. Regional manufacturers benefit from favorable governmental support for the chemical industry and proximity to the largest customer base.

North America and Europe represent mature markets characterized by stringent regulatory environments and a focus on specialized, high-value applications. North American demand is steady, driven by niche applications in aerospace metallurgy, specialized glass for medical or defense uses, and a robust, though smaller, domestic semiconductor industry. European market stability is rooted in strong chemical synthesis capabilities and significant consumption within the industrial cleaning and high-quality construction glass sectors. However, regulatory burdens, particularly under the REACH framework, tend to restrain rapid expansion, favoring incremental growth focused on compliance and product specialization rather than volume maximization.

The Middle East and Africa (MEA) and Latin America (LATAM) currently hold smaller market shares but are poised for moderate growth, primarily fueled by infrastructural investment and industrial diversification. Growth in LATAM is linked to expanding construction activities, necessitating higher demand for frosted and specialty glass, thus consuming technical-grade AHF. In MEA, demand is often tied to large-scale petrochemical projects and burgeoning localized industrial maintenance requirements, utilizing AHF for specialized descaling and cleaning operations. Future growth in these emerging regions will depend significantly on the successful establishment of local manufacturing hubs that require sophisticated chemical inputs.

- Asia Pacific (APAC): Dominates the global market, driven by massive investments in semiconductor fabrication, FPD manufacturing, and electronics assembly in countries including China, Taiwan, South Korea, and Japan. It is the primary consumer of Electronic Grade AHF.

- North America: A stable market characterized by mature industrial applications, strong environmental regulations, and consistent demand from specialized sectors like aerospace and advanced metallurgy.

- Europe: Growth is primarily compliance-driven, focusing on high-quality industrial chemicals and specialized glass production; stringent EHS standards (REACH) influence production costs and market strategy.

- Latin America (LATAM): Moderate growth potential tied to construction booms, increasing urbanization, and expanding glass manufacturing industries demanding Technical Grade AHF.

- Middle East and Africa (MEA): Emerging market primarily driven by infrastructure development, petrochemical maintenance, and localized chemical processing needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ammonium Hydrogen Fluoride Market.- Honeywell International Inc.

- Solvay S.A.

- LANXESS AG

- Morita Chemical Industries Co., Ltd.

- Stella Chemifa Corporation

- Kanto Chemical Co., Inc.

- Central Glass Co., Ltd.

- Shaowu Fluorochemical Co., Ltd.

- Jiangxi Hongxing Chemical Co., Ltd.

- Derivados del Flúor (DF)

- Buss ChemTech AG

- Yongjing Chemical Co., Ltd.

- Nantong Hexing Chemical Co., Ltd.

- Hangzhou Dayangchem Co. Ltd.

- Shandong Dongyue Group

- Alfa Aesar (Thermo Fisher Scientific)

- Merck KGaA

- Avantor, Inc.

- Wego Chemical Group

- Gelest, Inc.

Frequently Asked Questions

Analyze common user questions about the Ammonium Hydrogen Fluoride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Ammonium Hydrogen Fluoride market?

The primary driving force is the rapid expansion and technological advancement within the global semiconductor and electronics manufacturing industries, which rely on ultra-high purity Electronic Grade AHF for precision wafer cleaning and etching processes.

How is Electronic Grade Ammonium Hydrogen Fluoride different from Technical Grade?

Electronic Grade AHF is manufactured with exceptionally stringent purity controls, achieving impurity levels in the parts per billion range. Technical Grade AHF, used for general industrial cleaning and glass frosting, has a higher tolerance for impurities, usually measured in parts per million.

Which geographical region dominates the consumption of Ammonium Hydrogen Fluoride?

Asia Pacific (APAC) dominates the consumption of AHF due to the concentration of global semiconductor fabrication plants (fabs), flat panel display production, and high-volume consumer electronics manufacturing in countries such as China, South Korea, and Taiwan.

What are the major regulatory challenges facing AHF manufacturers?

Major regulatory challenges stem from the high toxicity and corrosiveness of AHF, leading to extremely strict Environmental, Health, and Safety (EHS) regulations globally, including high compliance costs associated with handling, storage, and waste disposal procedures.

What is the main raw material used in the production of Ammonium Hydrogen Fluoride?

The main precursor chemical used in the synthesis of Ammonium Hydrogen Fluoride is Hydrofluoric Acid (HF). The stability and pricing of HF are critical factors influencing the operational costs and supply chain dynamics of AHF production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager