Ammonium Phosphatide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433515 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Ammonium Phosphatide Market Size

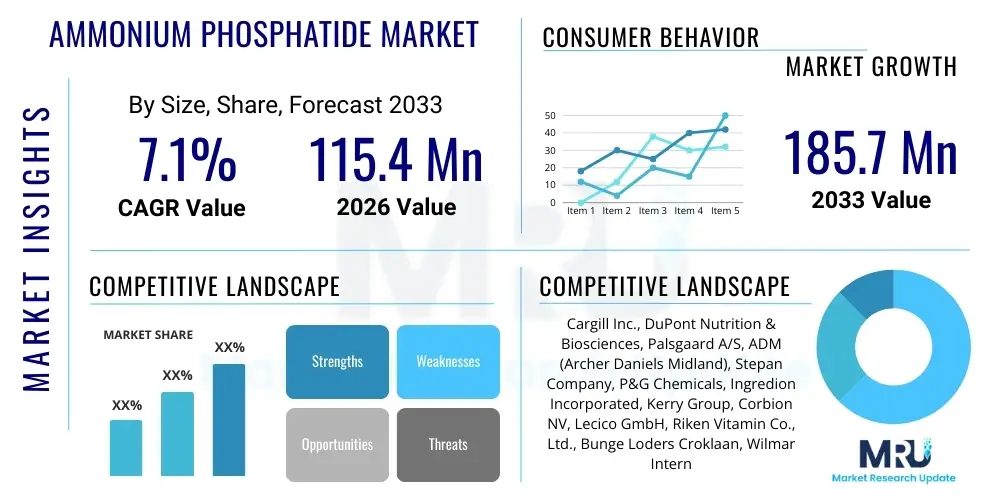

The Ammonium Phosphatide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 115.4 Million in 2026 and is projected to reach USD 185.7 Million by the end of the forecast period in 2033.

Ammonium Phosphatide Market introduction

Ammonium Phosphatide (AP), commonly designated as E442 in the European Union, is a complex food additive derived from partially hydrolyzed and re-esterified phospholipids, primarily sourced from rapeseed or soybean oil. It functions predominantly as a highly effective emulsifier, crucial for controlling the viscosity and flow properties of high-fat systems, particularly in the confectionery and bakery industries. Its primary market driver stems from its unique ability to significantly reduce the yield stress of molten chocolate mass, leading to improved molding efficiency, thinner coating layers, and reduced manufacturing costs.

The product, synthesized through a controlled chemical process, offers excellent heat stability and is valued for its non-ionic nature, allowing it to interact effectively with cocoa butter and cocoa solids. Major applications include fine chocolate manufacturing, compound coatings, icings, and various low-viscosity fat preparations. The rising global demand for premium confectionery items, coupled with the necessity for highly efficient industrial food production processes, significantly fuels the expansion of the Ammonium Phosphatide market. Furthermore, manufacturers appreciate AP for its consistent performance across varying climatic conditions, ensuring uniform product quality globally.

Key benefits of utilizing Ammonium Phosphatide include enhanced production throughput, reduced reliance on expensive cocoa butter, improved shelf-life stability, and superior textural characteristics in the final product. The market's growth is inherently linked to the economic stability of the global confectionery sector and ongoing advancements in food formulation technology aimed at reducing production complexity while maximizing consumer appeal. Regulatory approvals across major regions, recognizing AP as safe for consumption within specified limits, provide a stable foundation for market penetration and sustained growth.

Ammonium Phosphatide Market Executive Summary

The Ammonium Phosphatide (AP) market exhibits robust growth, driven primarily by technological advancements in chocolate processing and the relentless expansion of the global confectionery industry, particularly across the Asia Pacific region. Business trends highlight a pronounced shift towards high-stability, sustainable emulsifier solutions, prompting major food ingredient suppliers to invest heavily in refining synthesis processes and securing non-GMO raw material sourcing. The integration of advanced process controls is becoming critical for maintaining product consistency demanded by large-scale chocolate manufacturers, thereby influencing competitive strategies and partnership formations within the supply chain. Price volatility of competing emulsifiers and cocoa butter substitutes further positions AP as an economically attractive alternative, reinforcing its long-term market security.

Regionally, the market is spearheaded by the Asia Pacific (APAC), owing to rapid urbanization, increasing disposable incomes, and the consequent surge in demand for affordable, packaged sweets and chocolates in populous countries like China and India. Europe remains a mature market characterized by stringent quality standards and a focus on premium, sustainable ingredients, driving innovation towards high-purity AP grades. North America, while steady, shows increasing adoption in specialized baking applications and compound coatings, expanding AP’s functional scope beyond traditional chocolate applications. The interplay between regulatory environments and regional consumer preferences dictates localized growth rates and product specialization.

Segment trends reveal that the liquid form of Ammonium Phosphatide dominates the market due to its ease of handling, precise dosage, and efficient incorporation into large-batch industrial mixers. Application-wise, the chocolate and confectionery segment accounts for the vast majority of consumption, maintaining its stronghold through continuous product innovation such as low-sugar and high-protein chocolate bars. Furthermore, the functional segment relating to viscosity modification and fat stabilization is projected to witness the fastest growth, as food formulators seek multi-functional ingredients that address complexities associated with formulating modern, healthier food profiles.

AI Impact Analysis on Ammonium Phosphatide Market

Common user questions regarding AI's impact on the Ammonium Phosphatide market center on predictive quality control, optimization of chemical synthesis pathways, and enhanced supply chain resilience for raw materials like rapeseed oil derivatives. Users are primarily concerned with how AI can minimize batch-to-batch variability in AP production, ensuring strict compliance with global food safety standards (E442 purity levels). Another key theme is the potential for AI-driven logistics systems to forecast demand fluctuations in the volatile global cocoa and fat markets, allowing AP producers to proactively manage inventory and raw material procurement, thereby stabilizing production costs and improving profitability margins. Expectations include AI leading to sustainable sourcing models and advanced predictive maintenance for specialized processing equipment.

- AI-driven predictive maintenance optimizes machinery uptime in AP synthesis plants, reducing operational bottlenecks and ensuring continuous production flow.

- Machine learning algorithms enhance quality control by analyzing spectroscopic data and rheological properties, instantaneously adjusting process parameters to maintain E442 specification purity.

- AI demand forecasting improves the procurement strategy for raw materials (lecithin, glycerol, phosphoric acid), mitigating supply chain risk and minimizing inventory holding costs.

- Generative AI supports R&D efforts by simulating molecular interactions, accelerating the development of novel, highly specialized AP derivatives with enhanced functionalities for niche applications.

- Automation and robotics, guided by AI, streamline packaging and logistics, particularly in high-volume production facilities servicing the global confectionery giants.

- Data analytics platforms optimize energy consumption during the esterification and mixing stages, contributing to greener production processes and lower manufacturing overheads.

- Natural Language Processing (NLP) assists compliance teams by rapidly analyzing evolving global food safety regulations, ensuring swift adaptation of AP usage limits and labeling requirements across target markets.

DRO & Impact Forces Of Ammonium Phosphatide Market

The Ammonium Phosphatide market is propelled by key drivers such as the surging demand for affordable chocolate substitutes and compound coatings in emerging economies, alongside the inherent efficiency AP provides in high-volume industrial confectionery lines. Restraints primarily involve regulatory restrictions on emulsifier usage levels, particularly in regions with conservative food additive policies, and the potential volatility in the supply and price of primary phospholipid raw materials. Significant opportunities lie in expanding AP utilization into non-traditional applications like specialized nutritional bars and vegan dairy alternatives, leveraging its fat-stabilizing properties. These forces—market demand, regulatory constraints, and diversification potential—interact dynamically, generating specific impact forces that dictate strategic market positioning and investment decisions, requiring producers to focus intensely on cost optimization and regulatory expertise.

Drivers include the superior functionality of AP compared to traditional lecithins in reducing the plastic viscosity of chocolate, which directly translates into reduced production cycle times and better consistency. The increasing shift in global dietary patterns towards processed foods and convenient snacks necessitates high-performance emulsifiers, further embedding AP within the global food system. Conversely, the market faces headwinds from rising consumer preferences for "clean label" ingredients, often viewing complex chemical names like Ammonium Phosphatide critically, which necessitates enhanced transparency and communication regarding its safety profile. Furthermore, competition from alternative, natural emulsifiers, although currently less effective in high-fat systems, poses a long-term threat if their functionality improves through biotech advancements.

Impact forces are pronounced in three critical areas: cost efficiency, regulatory compliance, and raw material sourcing sustainability. The need for cost-effective manufacturing drives continuous innovation in synthesis processes, impacting smaller, less integrated producers. Regulatory scrutiny forces ongoing investment in toxicological and safety studies to maintain consumer confidence and existing approval status, especially in mature markets like the EU. Lastly, the industry’s push towards responsible sourcing and non-GMO certification acts as a significant differentiator, influencing purchasing decisions of multinational food corporations committed to ethical and sustainable supply chains. These combined forces mandate a highly specialized and strategically agile market approach from key stakeholders.

Segmentation Analysis

The Ammonium Phosphatide market is meticulously segmented based on key differentiators including Form, Application, and Function, reflecting the diverse requirements of the global food industry. Form segmentation separates the market into liquid and powder variants, addressing differing handling and incorporation needs of large industrial users versus smaller specialized manufacturers. The Application segment highlights the core areas of consumption, with the chocolate and confectionery sector overwhelmingly dominating due to AP’s critical role in viscosity control. Finally, Function-based segmentation focuses on the specific technical benefits derived from AP, such as viscosity reduction, fat stabilization, and crystal modification, providing granularity into specialized demand pockets within the broader food manufacturing landscape. This structured segmentation allows market players to tailor product offerings and strategic marketing efforts precisely.

- By Form:

- Liquid

- Powder/Granular

- By Application:

- Chocolate and Confectionery (Dominant Segment)

- Bakery Products (e.g., Biscuits, Wafers)

- Ice Cream and Frozen Desserts

- Compound Coatings and Fillings

- Non-Dairy and Vegan Products

- By Function:

- Viscosity Modifier (Primary Function)

- Emulsification

- Fat Stabilization

- Crystal Modification

- By Source:

- Soy-based

- Rapeseed/Canola-based (Increasingly preferred due to non-GMO status)

- Sunflower-based

Value Chain Analysis For Ammonium Phosphatide Market

The Ammonium Phosphatide value chain commences with the upstream sourcing and processing of raw materials, predominantly crude lecithin derived from soybean or rapeseed oil. This stage involves agricultural producers, oil extractors, and specialized lecithin suppliers. Key activities here focus on quality control, ensuring the purity and non-GMO status of the source materials, which significantly impacts the final AP product specifications. Manufacturers then engage in complex chemical processing, including hydrolysis, esterification with polymerized glycerol, and neutralization, which requires specialized reaction vessels and stringent process controls to synthesize the finished E442 product, representing the core value addition step in the chain.

The downstream segment involves the distribution and direct sales to end-user industries. Distribution channels are bifurcated into direct sales to large multinational confectionery corporations (such as Nestle, Mars, Hershey’s) who purchase in bulk quantities, and indirect distribution through specialized food ingredient distributors who service smaller regional manufacturers and handle complex inventory management. This distribution network requires specialized logistics for handling liquid and temperature-sensitive food additives. The final consumption occurs within the production facilities of the confectionery, bakery, and processed food sectors, where AP is integrated into fat phases to optimize rheological properties.

Maintaining efficiency throughout the value chain necessitates tight collaboration between raw material suppliers and AP manufacturers to ensure stable feedstock supply and price predictability. The complexity of the synthesis process provides a significant barrier to entry, concentrating market power among a few key players specializing in food emulsifiers. Quality assurance and adherence to international food safety regulations (e.g., EFSA, FDA) are critical at every stage, adding substantial compliance costs but ultimately ensuring the market acceptance and stability of Ammonium Phosphatide as a trusted food ingredient worldwide.

Ammonium Phosphatide Market Potential Customers

The primary customers for Ammonium Phosphatide are large-scale industrial food processors focused on fat-containing manufactured goods, overwhelmingly concentrated within the chocolate and confectionery industry. These global giants utilize AP as a high-performance, cost-effective substitute for cocoa butter, efficiently managing the viscosity of their molten chocolate mass during enrobing, molding, and coating processes. Key purchasing criteria for these customers include consistency, regulatory compliance documentation (E-number status), stability in liquid form, and competitive pricing relative to other emulsifiers like Polyglycerol Polyricinoleate (PGPR) or standard lecithin. The ability of AP suppliers to guarantee bulk, sustained delivery is paramount to securing long-term contracts with these major players.

Secondary potential customers include manufacturers of compound coatings, which are commonly used in the production of low-cost biscuits, snacks, and ice cream novelties. In this segment, AP’s role is crucial for ensuring a thin, crack-resistant coating that adheres smoothly and sets rapidly. Furthermore, the burgeoning sector of vegan and dairy-free food producers represents a high-growth customer segment. As plant-based formulations often struggle with fat separation and texture stability, AP offers unique stabilization benefits that appeal to manufacturers developing dairy-alternative creams, sauces, and specialized bakery fillings, seeking technical solutions that align with plant-based sourcing trends.

Other specialized customers include suppliers of pre-mixes and ingredient blends used in industrial baking, where AP ensures uniform fat distribution and moisture retention in high-fat doughs and batters. The demand from these diverse end-users underscores AP’s versatility, requiring suppliers to maintain varied product specifications (liquid vs. powder, concentration levels) to meet the specific technical needs of each application. Ultimately, any industrial entity requiring highly efficient, stable emulsification or viscosity modification in a fat system constitutes a potential consumer for Ammonium Phosphatide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.4 Million |

| Market Forecast in 2033 | USD 185.7 Million |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., DuPont Nutrition & Biosciences, Palsgaard A/S, ADM (Archer Daniels Midland), Stepan Company, P&G Chemicals, Ingredion Incorporated, Kerry Group, Corbion NV, Lecico GmbH, Riken Vitamin Co., Ltd., Bunge Loders Croklaan, Wilmar International, Lasenor Emul, S.L., Foodchem International Corporation, Puratos Group, Lonza Group, BASF SE, Wacker Chemie AG, Zhejiang Newland Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ammonium Phosphatide Market Key Technology Landscape

The manufacturing of Ammonium Phosphatide relies on specialized chemical engineering processes centered around the controlled esterification of phosphatides (lecithin derivatives) with ammoniated glycerol. The core technology involves optimizing reaction kinetics and temperature control during the polymerization and subsequent neutralization stages to ensure a consistent and highly functional end product (E442). Advanced reaction vessel design, featuring precision mixing and temperature management capabilities, is critical to controlling the degree of substitution and achieving the desired lipophilic-hydrophilic balance (HLB value). Current technological trends emphasize continuous flow processing over traditional batch production, enhancing throughput, reducing energy consumption, and improving batch-to-batch homogeneity, which is vital for multinational food manufacturers.

Recent technological advancements are largely focused on upstream raw material refinement and sustainable processing. This includes sophisticated membrane separation techniques to isolate high-purity lecithin fractions from crude vegetable oils, minimizing unwanted impurities that could interfere with the final AP functionality or taste profile. Furthermore, the industry is increasingly utilizing enzymatic processes or biocatalysis, seeking milder and more environmentally friendly alternatives to traditional strong acid/base catalysis in the hydrolysis stage. The goal is to align AP production with 'green chemistry' principles, reducing waste byproducts and minimizing the use of harsh chemicals, thereby addressing consumer preference for sustainably produced ingredients.

Downstream technology involves sophisticated analytical techniques, such as High-Performance Liquid Chromatography (HPLC) and advanced rheometers, used for quality assurance. These tools are indispensable for accurately measuring the concentration of active components and verifying the viscosity-reducing efficacy of each batch before shipment. Future technological investment is expected in integrating IoT sensors and real-time data monitoring systems into production lines. This allows for proactive process adjustment, leveraging predictive modeling to maintain optimal yield and purity, securing a technological edge for industry leaders focused on high-specification Ammonium Phosphatide for premium confectionery applications.

Regional Highlights

The global Ammonium Phosphatide market demonstrates significant regional variations driven by consumption patterns, regulatory landscapes, and the concentration of food processing industries. North America, characterized by its mature processed food sector and high demand for specialized compound coatings used in ice cream and confectionery bars, maintains a steady growth trajectory. The region focuses heavily on supply chain transparency and non-GMO certification, pressuring suppliers to utilize rapeseed-based AP over traditionally common soy-based variants. Despite high regulatory standards, the established infrastructure and strong consumer purchasing power ensure consistent, albeit moderate, demand.

Europe stands as a pivotal market, driven by its expansive and premium chocolate manufacturing base (e.g., Belgium, Switzerland, Germany). The European market is highly sensitive to regulatory changes concerning E-numbers (E442) and emphasizes sustainability and ethical sourcing. Manufacturers in this region often prioritize high-purity AP grades for fine chocolate applications where even minor flavor contributions are unacceptable. Strict enforcement of maximum usage levels necessitates precise dosage control and high-quality product consistency, influencing the technological sophistication of regional suppliers.

Asia Pacific (APAC) represents the fastest-growing market, fuelled by rapid urbanization, increasing disposable income, and the massive scale of domestic confectionery consumption in China and India. The demand is primarily driven by mass-market chocolate, compound coatings, and affordable packaged snacks, where AP's ability to reduce production costs and stabilize product quality is highly valued. Local manufacturers prioritize cost-effectiveness, leading to robust price competition. The developing regulatory environment in emerging APAC nations also allows for quicker market penetration compared to the stringent requirements of Western markets, attracting substantial investment from global ingredient suppliers seeking growth opportunities.

- Asia Pacific (APAC): Dominates market growth due to rising industrial production of confectionery and bakery items; characterized by strong demand for cost-effective solutions in mass-market applications.

- Europe: Mature market focused on premium chocolate, driven by strict quality standards, stringent E-number regulations, and a high focus on sustainable and ethically sourced ingredients.

- North America: Stable market with high adoption in compound coatings and specialized food applications; strong emphasis on non-GMO and clean label sourcing drives technological shifts.

- Latin America (LATAM): Emerging market showing high growth potential, linked to expanding domestic food processing industries and increasing consumer access to packaged chocolate goods.

- Middle East & Africa (MEA): Small but growing market, primarily served by imports; growth is concentrated in economically stable Gulf Cooperation Council (GCC) countries investing in domestic food manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ammonium Phosphatide Market.- Cargill Inc.

- DuPont Nutrition & Biosciences (part of IFF)

- Palsgaard A/S

- ADM (Archer Daniels Midland)

- Stepan Company

- P&G Chemicals

- Ingredion Incorporated

- Kerry Group

- Corbion NV

- Lecico GmbH

- Riken Vitamin Co., Ltd.

- Bunge Loders Croklaan

- Wilmar International

- Lasenor Emul, S.L.

- Foodchem International Corporation

- Puratos Group

- Lonza Group

- BASF SE

- Wacker Chemie AG

- Zhejiang Newland Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ammonium Phosphatide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Ammonium Phosphatide (E442) in the food industry?

Ammonium Phosphatide (E442) serves predominantly as a highly effective viscosity modifier and emulsifier in high-fat systems, particularly chocolate. Its primary role is to reduce the yield stress of molten chocolate, improving flow properties and allowing for thinner, more uniform coatings without excessive use of costly cocoa butter.

How does the use of Ammonium Phosphatide impact chocolate manufacturing costs?

AP significantly lowers manufacturing costs by allowing producers to reduce the overall fat content and, critically, substitute a portion of expensive cocoa butter with more cost-effective vegetable fats or cocoa solids. This optimization enhances production efficiency, speeds up processing times, and reduces raw material expenses per unit of finished product.

What are the key regulatory considerations for the Ammonium Phosphatide market?

Regulatory frameworks, such as those governed by the EU's EFSA and the US FDA, strictly define the maximum permissible usage levels (typically less than 1%) for Ammonium Phosphatide (E442). Manufacturers must adhere to these limits and ensure the product meets purity standards to maintain market access and consumer safety compliance globally.

Which geographical region exhibits the highest growth rate for the Ammonium Phosphatide market?

The Asia Pacific (APAC) region is projected to experience the fastest growth, driven by escalating consumer demand for packaged confectionery, rapid urbanization, and the substantial increase in large-scale industrial food production facilities across major economies like China and India.

What role does sustainability play in the sourcing of raw materials for AP?

Sustainability and ethical sourcing are major concerns. Due to consumer demand for non-GMO ingredients, the industry is increasingly shifting from soy-based lecithin towards certified non-GMO rapeseed or sunflower-based lecithin derivatives for AP synthesis. This transition ensures compliance with high-value market requirements, particularly in Europe and North America.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager