Ammonium Polyphosphate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433792 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ammonium Polyphosphate Market Size

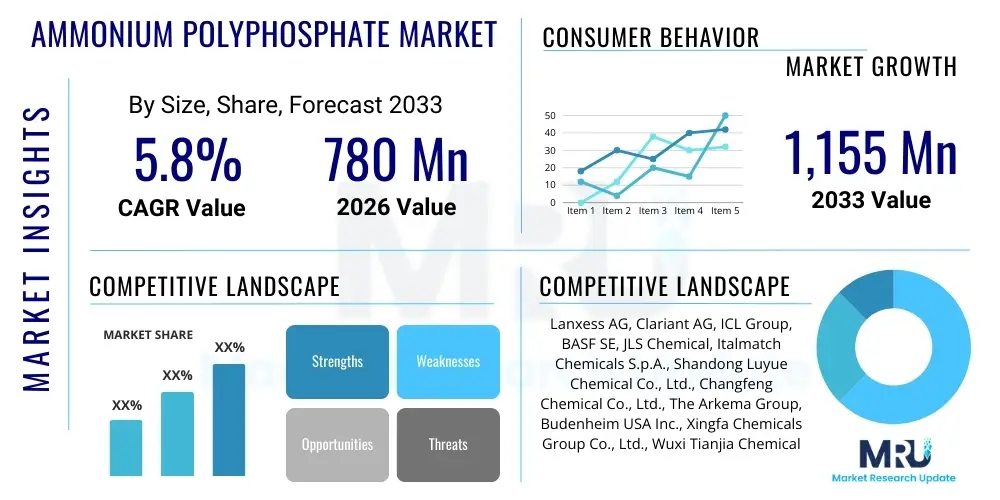

The Ammonium Polyphosphate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% (CAGR) between 2026 and 2033. The market is estimated at USD 780 Million in 2026 and is projected to reach USD 1,155 Million by the end of the forecast period in 2033.

Ammonium Polyphosphate Market introduction

Ammonium Polyphosphate (APP) is an inorganic compound primarily utilized as a highly effective, non-halogenated flame retardant and a crucial component in high-grade fertilizers. Chemically, it is a polymer derived from the reaction between phosphoric acid and ammonia, resulting in chains of varying lengths. The structure provides an excellent source of phosphorus and nitrogen, which are essential nutrients, or, in flame retardant applications, act synergistically to form a protective char layer when exposed to heat. This dual utility across the construction, transportation, and agriculture sectors positions APP as a strategically important chemical commodity, driving consistent demand globally.

The product is commercially available in two primary grades: APP Grade I (low polymerization degree, less soluble, used mainly in fertilizers) and APP Grade II (high polymerization degree, high thermal stability, widely preferred for intumescent flame retardant systems). Major applications include coatings, plastics (especially polyolefins and engineering thermoplastics), textiles, and the manufacturing of specialty nitrogen-phosphorus compound fertilizers. The fundamental benefit of APP as a flame retardant lies in its non-halogenated nature, addressing growing environmental and safety concerns regarding toxic smoke and corrosive gases released by traditional halogenated alternatives during combustion. Regulatory mandates enforcing stringent fire safety standards across developed economies further amplify the adoption rates of APP-based fire protection solutions.

Driving factors for the Ammonium Polyphosphate market include the booming construction industry, particularly in the Asia Pacific region, which necessitates superior passive fire protection materials for residential and commercial structures. Furthermore, the increasing penetration of intumescent coatings in the steel structure protection segment and the rising demand for high-performance specialty fertilizers that offer slow-release nutrients contribute significantly to market expansion. The ongoing global shift toward sustainable and eco-friendly chemical manufacturing practices also strongly favors non-toxic additives like APP over traditional materials, cementing its role as a cornerstone ingredient in safety and agricultural applications.

Ammonium Polyphosphate Market Executive Summary

The Ammonium Polyphosphate (APP) market demonstrates robust growth, primarily fueled by stringent global fire safety regulations and the sustained expansion of the construction and agricultural sectors. Key business trends indicate a strong move toward high-grade APP II variants, which command premium pricing due to their superior performance in intumescent systems, driving overall market value. Manufacturers are focusing on technological advancements, specifically microencapsulation techniques, to enhance the water resistance and dispersion properties of APP, thereby broadening its applicability in moisture-sensitive materials like wood composites and specialized coatings. Strategic capacity expansions, particularly in Asia, are observed as companies seek to capitalize on regional manufacturing hubs and reduced logistical costs, leading to intensified competition.

Regionally, Asia Pacific (APAC) stands out as the dominant and fastest-growing market, attributing its rise to rapid urbanization, massive infrastructure projects (e.g., in China and India), and the establishment of large-scale polymer and textile manufacturing facilities that necessitate effective flame retardancy. North America and Europe, characterized by mature markets, exhibit stable demand driven strictly by regulatory compliance (such as REACH in Europe and specialized building codes in the US), focusing heavily on sustainable, non-halogenated alternatives. The Middle East and Africa (MEA) are emerging as high-potential regions, linked to heavy investment in petrochemical and construction industries, requiring robust flame retardant solutions for both structural integrity and operational safety.

In terms of segment trends, the application segment is clearly tilting towards the 'Paints and Coatings' sector, primarily due to the mandated use of intumescent coatings for steel framework protection in modern commercial buildings. Within the product type segment, the higher degree of polymerization (APP II) is witnessing faster value growth compared to the lower degree (APP I), reflecting the industry's premiumization efforts toward advanced fire safety. The fertilizer segment, while stable, is increasingly adopting slow-release, encapsulated APP formulations to improve nutrient efficiency and minimize environmental runoff, aligning with global agricultural sustainability goals.

AI Impact Analysis on Ammonium Polyphosphate Market

User inquiries regarding AI's impact on the Ammonium Polyphosphate market commonly center on predictive formulation capabilities, supply chain resilience, and the optimization of manufacturing yields. Key themes reveal user expectations that AI/Machine Learning (ML) will significantly reduce R&D cycles required to develop new synergistic flame retardant blends, optimize the polymerization process to achieve precise APP chain lengths, and accurately model the thermal performance of APP in various end-use matrices (plastics, textiles, coatings). Concerns also include the integration cost of AI systems into legacy chemical production plants and the ability of AI to ensure regulatory compliance across diverse international fire safety standards while simultaneously enhancing environmental performance. Overall, the market anticipates AI will transition APP manufacturing toward predictive quality control and highly customized application solutions, moving away from generalized formulation approaches.

- AI optimizes raw material feed rates (ammonia and phosphoric acid) to maximize APP yield and control polymerization degree.

- Machine learning algorithms predict the optimal concentration of APP needed in specific polymer matrices (e.g., PP, PE) to meet required UL94 fire ratings.

- Predictive maintenance models for reactors and crystallizers minimize downtime, enhancing the overall efficiency and consistency of APP production.

- AI-driven supply chain management forecasts demand fluctuations in construction and agriculture sectors, optimizing inventory and reducing logistical costs.

- AI facilitates the rapid discovery of novel synergistic additives (e.g., metal salts or boron compounds) that enhance the charring effectiveness of APP.

- Generative AI tools assist in simulating the thermal degradation and intumescent behavior of APP coatings under various fire scenarios, accelerating product testing.

DRO & Impact Forces Of Ammonium Polyphosphate Market

The Ammonium Polyphosphate (APP) market is predominantly driven by escalating global fire safety regulations and the sustained growth of the construction and polymer industries, necessitating non-halogenated, high-performance flame retardants. However, the market faces significant restraints, primarily stemming from the inherent challenge of low water solubility in certain APP grades, which limits their use in aqueous systems and certain coating applications. Furthermore, fluctuations in the prices of key raw materials, namely phosphoric acid and ammonia, introduce volatility to the production cost structure. Opportunities lie in the strategic development of microencapsulated APP (to improve water resistance and dispersion) and the penetration of high-growth niche applications, such as specialized insulation foams and advanced composite materials for aerospace and automotive sectors, where superior thermal performance is mandatory. These internal dynamics—the push for safety (Driver) versus solubility issues and raw material cost variability (Restraints)—are modulated by external impact forces like environmental policy shifts (favoring non-halogenated products) and rapid technological adoption in emerging economies (Opportunity), collectively shaping the market trajectory toward sustainable, high-performance solutions.

Segmentation Analysis

The Ammonium Polyphosphate market is comprehensively segmented based on product type, application, and end-use industry, providing granular insights into demand patterns and growth drivers. The division by product type—APP I (low polymerization degree, often used as fertilizer) and APP II (high polymerization degree, preferred for flame retardants)—is critical as it defines performance characteristics, thermal stability, and ultimate market pricing. Application segmentation highlights the compound's dual role, separating the highly regulated flame retardant uses (coatings, plastics, textiles) from its high-volume application in agriculture. Analyzing these segments helps stakeholders tailor their product offerings and strategic investments toward the fastest-growing and highest-value market niches, particularly those driven by stringent fire safety compliance in industrial and construction end-users.

- By Product Type:

- APP I (Low Degree of Polymerization)

- APP II (High Degree of Polymerization)

- By Application:

- Flame Retardants

- Intumescent Coatings

- Plastics and Polymers

- Textiles and Fabrics

- Wood and Cellulose Products

- Fertilizers (NPK Formulations, Specialty Fertilizers)

- By End-Use Industry:

- Construction

- Automotive and Transportation

- Electrical and Electronics

- Agriculture

- Textile and Furniture

Value Chain Analysis For Ammonium Polyphosphate Market

The value chain for the Ammonium Polyphosphate market begins with the upstream sourcing of key raw materials: purified phosphoric acid and ammonia. These commodities are typically supplied by large chemical and petrochemical companies, and their price volatility significantly impacts the profitability of APP manufacturers. Manufacturing involves complex chemical processes, including the polymerization and granulation of the final product, often requiring specialized, pressure-resistant reactors to ensure the precise degree of polymerization required for high-grade APP II. Upstream analysis focuses on securing long-term supply contracts for phosphorus inputs and optimizing energy consumption during the polymerization stage, which is a major cost driver.

The midstream comprises the core APP manufacturers who focus on product refinement, including particle size control, surface treatment (e.g., microencapsulation to improve moisture resistance), and blending to create specific grades suitable for various applications. Distribution channels are highly fragmented, relying on specialized chemical distributors who possess technical expertise regarding flame retardant integration into polymer and coating systems. Direct sales are common for high-volume fertilizer applications to major agricultural cooperatives, while indirect channels via local chemical distributors are prevalent for small to medium-sized flame retardant end-users, ensuring localized inventory and technical support.

Downstream analysis centers on the integration of APP into final products across key end-use industries. For the construction sector, APP is channeled into intumescent paint formulators and drywall manufacturers. In the polymer sector, masterbatch producers blend APP with resins before supplying them to automotive or electronics manufacturers. The effectiveness of APP is highly dependent on formulation expertise at this downstream stage; therefore, technical collaboration between APP producers and end-product manufacturers is crucial. The efficiency of this value chain, from raw material conversion to specialized application, dictates market competitiveness, with integrated players capable of controlling phosphorus sourcing holding a significant cost advantage.

Ammonium Polyphosphate Market Potential Customers

Potential customers and end-users of Ammonium Polyphosphate span multiple critical industrial sectors due to its dual functionality as a premium fertilizer ingredient and a leading non-halogenated flame retardant. In the flame retardant segment, primary buyers include formulators of intumescent coatings, who require APP Grade II to protect structural steel, wood, and other cellulosic materials in high-risk environments. This group heavily comprises large international paint and coatings manufacturers serving the infrastructure and commercial building markets. Another key customer group is thermoplastic manufacturers, specifically producers of polypropylene (PP) and polyethylene (PE) masterbatches, utilized in automotive components, electrical casings, and consumer goods, demanding APP for compliance with strict UL and fire rating standards.

A second major category of buyers is the agricultural sector, where large fertilizer cooperatives and bulk blenders purchase APP Grade I for inclusion in high-analysis NPK (Nitrogen-Phosphorus-Potassium) fertilizers. These customers prioritize APP for its high nutrient content and its contribution to specialized, often slow-release, nutrient formulations aimed at maximizing crop yield and minimizing environmental impact. Furthermore, textile and nonwoven fabric manufacturers represent a niche but growing customer base, utilizing APP-based treatments to render products like upholstery, curtains, and technical fabrics fire-resistant, catering to stringent safety standards in public transportation and residential furnishings.

In essence, the end-user base is highly diversified, ranging from global chemical giants who integrate APP into complex fire safety systems to regional agricultural supply houses focused on efficient crop nutrition. The decision criteria for these buyers vary significantly: flame retardant customers prioritize thermal stability, particle size, and regulatory compliance, while agricultural customers focus on nutrient concentration, solubility, and cost-effectiveness. Consequently, APP producers must maintain specialized sales teams and distribution networks tailored to the distinct technical requirements of these diverse potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 780 Million |

| Market Forecast in 2033 | USD 1,155 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess AG, Clariant AG, ICL Group, BASF SE, JLS Chemical, Italmatch Chemicals S.p.A., Shandong Luyue Chemical Co., Ltd., Changfeng Chemical Co., Ltd., The Arkema Group, Budenheim USA Inc., Xingfa Chemicals Group Co., Ltd., Wuxi Tianjia Chemical Co., Ltd., Sanwa Chemical Industry Co., Ltd., Pittsfield Plastics Engineering, Sinochem Group, Shandong Hongxing Chemical Co., Ltd., Jiangsu Yoke Technology Co., Ltd., Hebei Jinhao Chemical Co., Ltd., Merck KGaA, Akzo Nobel N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ammonium Polyphosphate Market Key Technology Landscape

The technology landscape in the Ammonium Polyphosphate market is characterized by ongoing innovation aimed at enhancing product performance, overcoming inherent limitations like solubility, and optimizing manufacturing efficiency. One of the most significant advancements is Microencapsulation Technology. This process involves coating the APP particles with a thin, water-insoluble layer of resin (such as melamine-formaldehyde or siloxane polymers). The primary objective of microencapsulation is to drastically improve the water resistance of APP, making it suitable for water-borne coatings and polymer systems where untreated APP would leach out or degrade rapidly, thereby expanding its usage in high-moisture applications like outdoor paints and marine coatings. This treatment also improves dispersion in polymer matrices and reduces dust formation during handling, addressing industrial hygiene concerns.

Another crucial technological focus is on developing Synergistic Flame Retardant Systems. APP rarely acts alone in modern formulations; its effectiveness is significantly boosted when combined with co-additives, or synergists. Current R&D is concentrated on identifying and synthesizing novel synergists, such as specific metal oxides (e.g., zinc borate), nitrogen compounds (e.g., melamine derivatives), or carbon-source compounds. These combinations work by optimizing the charring process, enhancing the thermal insulation properties of the char layer, and sometimes acting as gas phase inhibitors. The goal is to achieve higher V-0 or VTM ratings (UL standards) at lower total loading levels, which preserves the mechanical properties of the base polymer, a critical requirement in automotive and electronics end-uses.

Furthermore, advancements in Continuous Process Manufacturing and crystallization control are improving the consistency and purity of APP production. Traditional batch processes can lead to inconsistencies in the degree of polymerization (n-value), impacting the thermal stability of the final product. New continuous processing technologies, often incorporating advanced sensors and automated process control systems (sometimes leveraged by AI/ML), ensure tighter control over reaction parameters. This results in highly uniform APP II products with defined chain lengths, guaranteeing superior performance for demanding applications like structural fire protection and high-performance composites. These manufacturing upgrades are essential for high-volume producers to maintain cost competitiveness while meeting rigorous quality specifications.

Regional Highlights

The global Ammonium Polyphosphate (APP) market exhibits diverse growth dynamics across major regions, driven primarily by localized regulatory environments, industrial production scales, and agricultural demands. Asia Pacific (APAC) holds the largest market share and is anticipated to witness the highest growth rate during the forecast period. This dominance is directly linked to the rapid expansion of the construction sector in China, India, and Southeast Asian nations, coupled with massive investments in polymer, electronics, and textile manufacturing, all of which require non-halogenated flame retardants to comply with new building and manufacturing standards. Furthermore, the extensive agricultural sector in APAC drives significant consumption of APP Grade I for fertilizer production.

- Asia Pacific (APAC): Dominates the market due to high construction activity, large-scale electronics manufacturing, and significant fertilizer consumption, making it the primary hub for both production and demand.

- North America: Characterized by stringent fire safety codes (e.g., NFPA standards) in building and transportation, leading to high-value demand for premium APP Grade II in intumescent coatings and engineering plastics.

- Europe: Growth is mandated by regulatory pressures, particularly REACH, favoring non-halogenated alternatives, sustaining strong demand in the automotive, insulation, and furniture sectors, with a focus on sustainable chemical sourcing.

- Latin America (LATAM): Exhibits moderate growth, primarily driven by infrastructure development in Brazil and Mexico and the large-scale agricultural sector’s need for efficient phosphorus fertilizers.

- Middle East and Africa (MEA): Emerging market spurred by major petrochemical investments and large construction projects (Saudi Arabia, UAE), creating a demand base for fire protection solutions in industrial and commercial assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ammonium Polyphosphate Market.- Lanxess AG

- Clariant AG

- ICL Group

- BASF SE

- JLS Chemical

- Italmatch Chemicals S.p.A.

- Shandong Luyue Chemical Co., Ltd.

- Changfeng Chemical Co., Ltd.

- The Arkema Group

- Budenheim USA Inc.

- Xingfa Chemicals Group Co., Ltd.

- Wuxi Tianjia Chemical Co., Ltd.

- Sanwa Chemical Industry Co., Ltd.

- Pittsfield Plastics Engineering

- Sinochem Group

- Shandong Hongxing Chemical Co., Ltd.

- Jiangsu Yoke Technology Co., Ltd.

- Hebei Jinhao Chemical Co., Ltd.

- Merck KGaA

- Akzo Nobel N.V.

Frequently Asked Questions

Analyze common user questions about the Ammonium Polyphosphate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary grades of Ammonium Polyphosphate and how do they differ in application?

The two primary grades are APP Grade I (low polymerization degree, generally used in specialty fertilizers due to higher water solubility) and APP Grade II (high polymerization degree, preferred for high-performance flame retardant systems like intumescent coatings due to better thermal stability and lower solubility).

Why is Ammonium Polyphosphate considered a key sustainable flame retardant choice?

APP is non-halogenated, meaning it does not release highly toxic or corrosive halogen acids and dense smoke during combustion, addressing critical environmental, health, and fire safety concerns associated with traditional halogenated flame retardants.

Which end-use industry drives the highest demand for Ammonium Polyphosphate Grade II?

The Construction industry drives the highest demand for APP Grade II, primarily through its use in intumescent coatings designed to provide passive fire protection for structural steel and other critical building materials.

What technological advancements are addressing the solubility limitations of APP?

Microencapsulation technology is the leading solution, involving coating APP particles with polymers like melamine-formaldehyde or siloxanes. This enhances water resistance and improves dispersion, allowing APP to be used effectively in water-based systems and polymers.

How does raw material price volatility affect the Ammonium Polyphosphate market?

The cost of APP production is highly sensitive to the global market price of key upstream raw materials, specifically purified phosphoric acid and ammonia. Price fluctuations directly impact the operating margins of APP manufacturers and influence final product pricing across both the flame retardant and fertilizer segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager