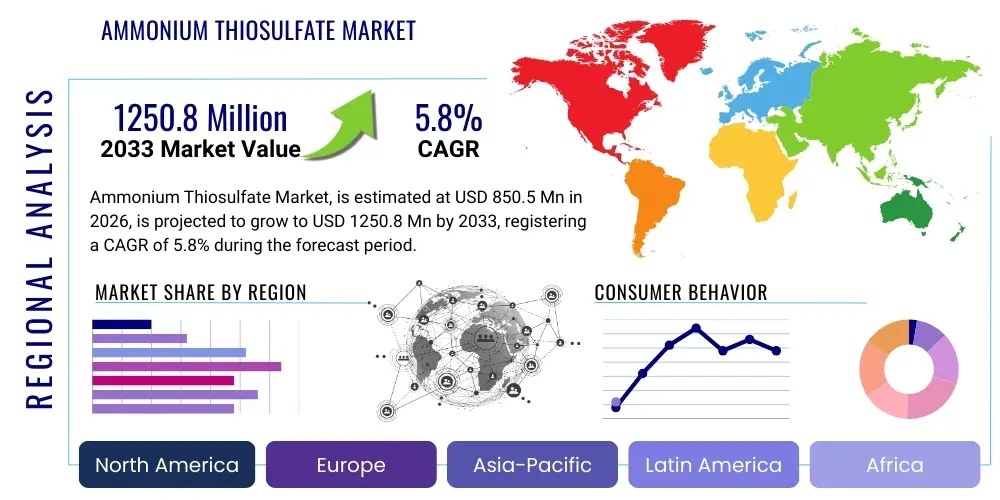

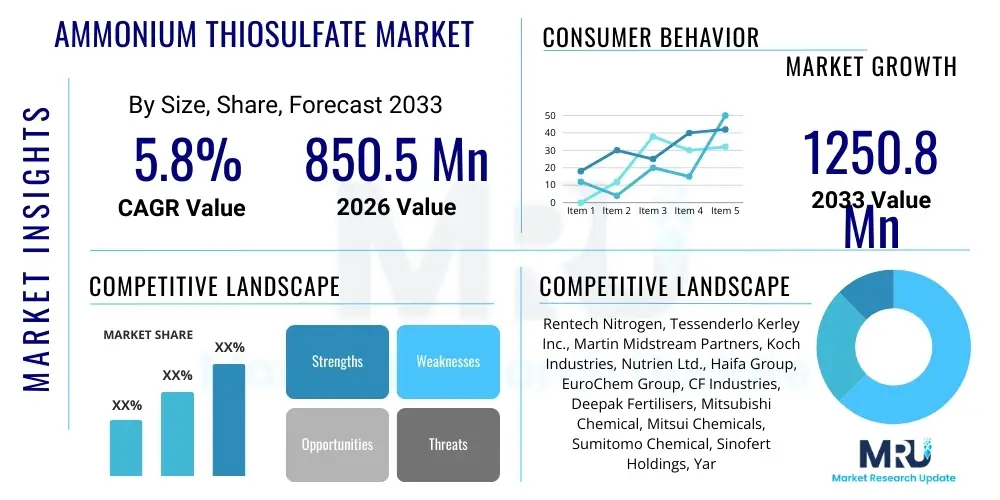

Ammonium Thiosulfate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433567 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ammonium Thiosulfate Market Size

The Ammonium Thiosulfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033. The steady expansion of the market is primarily driven by the increasing global emphasis on enhancing agricultural yield and improving nutrient use efficiency, particularly in regions facing sulfur-deficient soils. Ammonium Thiosulfate (ATS) is recognized globally as an efficient source of nitrogen and sulfur, essential macronutrients that are crucial for robust crop development, leading to sustained demand across major agricultural economies.

Ammonium Thiosulfate Market introduction

Ammonium Thiosulfate (ATS) is an inorganic chemical compound with the formula (NH4)2S2O3. It is predominantly used as a high-efficiency liquid fertilizer, providing readily available sulfur and slow-release nitrogen, making it invaluable for optimizing crop nutrient absorption and combating sulfur deficiencies prevalent in intensely farmed lands. Beyond agriculture, ATS serves critical roles in industrial sectors, including metal leaching (especially for gold and silver as a less toxic alternative to cyanide), wastewater treatment as a dechlorinating agent, and traditional photographic fixing processes due to its ability to dissolve silver halides. The primary agricultural application stems from its capacity to stabilize nitrogen in the soil, reducing leaching and volatilization losses, thereby offering significant economic and environmental benefits compared to conventional fertilizer inputs.

The market trajectory is significantly influenced by global agricultural dynamics, including the increasing population leading to higher food demand, and the widespread adoption of precision farming techniques that favor highly soluble liquid fertilizers like ATS. Its dual-nutrient supply mechanism—delivering both sulfur, necessary for protein synthesis and enzyme activity, and nitrogen, the fundamental building block of chlorophyll—positions ATS as a premium fertilizer product. Furthermore, the push towards sustainable agriculture mandates the efficient use of resources, compelling farmers and large agricultural corporations to incorporate advanced nutrient management strategies where ATS plays a central role. The transition from solid granular fertilizers to liquid formulations, driven by ease of application and blending capabilities, further underpins the product's demand across established and emerging agricultural regions.

Key drivers propelling this market include the global recognition of widespread sulfur deficiency in major food-producing regions, the rise in commodity prices necessitating optimized input costs, and technological advancements in liquid fertilizer production and application. ATS offers immediate crop response and long-term soil health benefits. Its superior compatibility with other liquid nitrogen fertilizers, such as Urea Ammonium Nitrate (UAN) solutions, allows for customized nutrient prescriptions, enhancing its appeal to modern farming operations seeking maximum efficiency. The industrial applications, though smaller in volume compared to agriculture, provide a stabilizing baseline for demand, especially in the mineral processing and water treatment sectors where specific chemical properties of ATS are indispensable.

Ammonium Thiosulfate Market Executive Summary

The Ammonium Thiosulfate market is characterized by robust growth anchored in the agricultural sector, particularly driven by the necessity for sulfur supplementation and enhanced nitrogen use efficiency in large-scale farming. Current business trends indicate a significant shift towards liquid fertilizer formulations, favoring major producers with established global supply chain networks capable of handling and distributing bulk liquid chemical products efficiently. Geographically, North America, particularly the U.S. corn belt, remains the largest consumer due to highly mechanized agriculture and prevalent sulfur deficiency issues. However, the Asia Pacific region, led by China and India, is emerging as the fastest-growing market, driven by intense cropping practices, rising farm incomes, and government support for high-efficiency fertilizers, rapidly increasing the regional market share and influencing pricing dynamics globally.

Segment trends reveal that the fertilizer application segment overwhelmingly dominates the market volume, primarily utilizing technical- grade liquid ATS. Within this segment, the application via irrigation systems (fertigation) and direct soil injection is seeing accelerated adoption, minimizing waste and maximizing nutrient placement accuracy. The industrial application segment, while smaller, is witnessing specialized growth in the hydrometallurgy sector, where the use of ATS as a non-toxic gold leaching agent offers a significant regulatory and environmental advantage over traditional cyanidation processes. This diversification, albeit marginal, provides market resilience against volatility in agricultural commodity prices.

Overall, the market structure is moderately consolidated, with major players controlling the production of raw materials (ammonia and sulfur) and possessing advanced formulation capabilities. Strategic expansions, focused on vertical integration and capacity additions in high-demand regions like Southeast Asia, are key business strategies observed. Future projections suggest that the development of specialized, low-salt-index ATS formulations and the increasing incorporation of microbial enhancers with ATS will define innovation. Furthermore, the market must navigate regulatory challenges concerning nitrogen runoff and water quality, pushing manufacturers to invest in solutions that maximize the stability and minimize the environmental footprint of their products, ensuring long-term sustainable growth and maintaining stakeholder trust across the value chain.

AI Impact Analysis on Ammonium Thiosulfate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ammonium Thiosulfate (ATS) market commonly center on three core themes: optimization of fertilizer application through precision agriculture, efficiency gains in chemical manufacturing processes, and improvement of supply chain logistics. Users are keen to understand how AI-driven predictive analytics can tailor ATS application rates based on real-time soil data, drone imagery, and weather forecasting, moving beyond static prescription maps to variable rate technology (VRT) that maximizes yield while minimizing input cost and environmental leaching. Furthermore, there is significant user interest in how machine learning algorithms can optimize complex chemical synthesis processes—particularly sulfur recovery and ammonia conversion—to reduce energy consumption, ensure batch consistency, and enhance production safety, addressing the high operational costs associated with large-scale chemical manufacturing.

The core expectation is that AI will transform ATS from a standard commodity chemical into a highly targeted input within digital farming ecosystems. AI tools, such as sophisticated market forecasting models, are already beginning to influence raw material procurement (sulfur and ammonia), helping manufacturers hedge against price volatility and manage inventory more effectively across complex, global distribution networks. This predictive capability translates into better inventory management for liquid storage and distribution terminals, reducing the risk of product degradation or logistical bottlenecks during peak planting seasons. The implementation of AI-powered quality control systems in production facilities ensures that the purity and consistency of technical-grade and pharmaceutical-grade ATS meet stringent industry specifications, thereby enhancing brand reputation and reducing waste associated with off-spec production batches.

Consequently, the integration of AI is not just about incremental efficiency; it represents a fundamental strategic shift. For ATS manufacturers, AI provides the leverage to develop customized product blends and dosage recommendations that are site-specific, offering value-added services rather than just selling bulk chemicals. This move towards 'Fertilizer-as-a-Service' models, underpinned by robust data analytics, changes the competitive landscape, favoring companies that can integrate chemical expertise with advanced digital capabilities. AI’s role in automating robotic application systems and integrating sensor data in precision sprayers further ensures that the stability and effectiveness of liquid ATS formulations are optimally maintained during field application, promising higher returns for agricultural end-users.

- Optimization of variable rate technology (VRT) for ATS application based on machine learning models of soil moisture, nutrient levels, and yield history.

- AI-driven predictive maintenance in chemical synthesis plants, reducing unplanned downtime and improving overall asset utilization for ATS production.

- Enhanced supply chain visibility and demand forecasting using AI algorithms to manage global distribution and buffer raw material price fluctuations.

- Automated quality control and real-time process optimization during the formulation of high-concentration liquid ATS products, ensuring purity and stability.

- Development of AI-powered diagnostic tools for farmers to identify sulfur deficiencies rapidly, directly boosting the demand for ATS solutions.

- Robotics integration for automated fertilizer blending and packaging operations, increasing throughput and minimizing human error in handling liquid chemicals.

DRO & Impact Forces Of Ammonium Thiosulfate Market

The dynamics of the Ammonium Thiosulfate (ATS) market are fundamentally shaped by a confluence of accelerating drivers and persistent restraints, creating lucrative opportunities balanced by significant industry impact forces. The primary market driver is the undeniable global imperative to address widespread sulfur deficiency in agricultural soils, exacerbated by decades of high-yield farming that depletes soil nutrient reserves faster than they can be replenished. ATS provides sulfur in the highly available thiosulfate form, combined with nitrogen, making it an economically effective solution for maximizing crop productivity and protein content. This structural demand is further amplified by the shift towards high-efficiency liquid fertilizers, which are favored for their superior handling, ease of blending with other macronutrients, and suitability for advanced application techniques such as fertigation and subsurface drip irrigation, offering minimized nutrient loss and better environmental stewardship.

Conversely, the market faces significant restraints, principally related to the volatility of key raw material costs, namely ammonia and elemental sulfur, both of which are heavily influenced by the global energy and petrochemical sectors. Fluctuations in natural gas prices, a major input for ammonia production, directly translate into cost pressures for ATS manufacturers, often limiting margin expansion and complicating long-term pricing strategies. Additionally, increasing environmental scrutiny and regulatory measures focusing on nitrogen pollution, particularly nitrate leaching into groundwater and nitrous oxide emissions, present a substantial constraint. Although ATS offers superior nitrogen stabilization compared to urea or nitrate fertilizers, the industry must continuously invest in research and development to demonstrate and validate its environmental advantages to mitigate potential regulatory backlash or restrictions on nitrogen usage globally, demanding robust data to support claims of reduced environmental impact.

Opportunities for market growth are abundant, particularly in expanding the adoption of ATS into emerging agricultural economies in Asia, Latin America, and Africa, where farming practices are rapidly modernizing and the need for micronutrient and macronutrient supplementation is acute. The development of high-purity ATS grades is also opening up niche opportunities in the pharmaceutical, food processing, and specialized electronics industries, diversifying the revenue streams away from the often volatile agricultural commodity cycles. The increasing sophistication of hydrometallurgy, specifically the environmentally conscious extraction of precious metals, provides a substantial long-term opportunity as companies seek viable, non-cyanide leaching alternatives. These market forces collectively necessitate agility from major players, requiring strategic investments in sustainable sourcing, production efficiency, and differentiated product formulations to sustain competitive advantage in a demanding global fertilizer market.

Segmentation Analysis

The Ammonium Thiosulfate (ATS) market is comprehensively segmented primarily based on Application, Grade, and Form, allowing for a detailed understanding of diverse end-user requirements and market dynamics across various sectors. The Application segment serves as the most critical determinant of market volume, dominated by the fertilizer sector which uses ATS to supply essential sulfur and nitrogen to crops. This segment accounts for the vast majority of global consumption, reflecting its indispensable role in modern crop nutrient management and yield maximization strategies. The secondary applications, including industrial chemicals (wastewater treatment, dechlorination), photography (fixers), and pharmaceuticals (as a reagent or sulfur source), though smaller, require specialized, often higher-purity grades, demonstrating the versatility and chemical utility of ATS across non-agricultural domains. Understanding these distinct application requirements is crucial for manufacturers in tailoring production processes and optimizing distribution channels.

Segmentation by Grade differentiates between the standard Technical Grade, which forms the bulk of the agricultural and industrial chemical market, and the stringent Pharmaceutical Grade. Technical Grade ATS is typically produced in large volumes and sold based on concentration and purity suitable for bulk application in fields or heavy industrial use. Pharmaceutical Grade, conversely, demands meticulous quality control, exceptionally low impurity levels, and compliance with stringent pharmacological standards, commanding a significant price premium due to the required complexity in manufacturing and certification. The third key segmentation focuses on Form, dividing the market into Liquid and Solid (or crystalline) ATS. Liquid ATS is the overwhelmingly dominant form globally, favored for its ease of storage, handling, precise metering in irrigation systems, and seamless compatibility with liquid nitrogen solutions, facilitating the rapid and efficient implementation of integrated nutrient plans in large-scale commercial farming operations, thereby driving infrastructural investment towards liquid handling facilities.

The intricate segmentation analysis provides critical insights for market participants regarding pricing strategies, regional focus, and product portfolio development. For example, solid ATS, although less common, is sometimes preferred in certain regions due to logistical constraints or specific blending requirements for granular fertilizer mixtures, offering a strategic niche. The interplay between the segment variables—such as liquid Technical Grade ATS dominating North American agriculture, contrasted with potential future demand for high-purity solid ATS in specialized pharmaceutical applications in Europe—informs tailored business development strategies. Overall market growth hinges on the sustained expansion of the liquid fertilizer segment in agriculture, coupled with the slow but steady adoption of ATS in environmentally sound industrial processes, necessitating continuous innovation in formulation and delivery mechanisms across all delineated segments.

- Application

- Fertilizers (Agricultural Use)

- Industrial Chemicals (Water Treatment, Dechlorination, Metal Leaching)

- Photography (Fixing Solutions)

- Pharmaceuticals

- Grade

- Technical Grade

- Pharmaceutical Grade

- Form

- Liquid (Aqueous Solution)

- Solid (Crystalline Powder)

Value Chain Analysis For Ammonium Thiosulfate Market

The value chain for the Ammonium Thiosulfate (ATS) market begins with the upstream sourcing of two primary raw materials: ammonia (derived from natural gas via the Haber-Bosch process) and sulfur compounds (often sulfur dioxide or elemental sulfur recovered from oil and gas refining). The competitive advantage at this initial stage is often determined by access to cost-effective natural gas resources and proximity to large-scale ammonia and sulfur processing facilities, heavily influencing the final production cost of ATS. Manufacturing involves the reaction of sulfur dioxide with ammonia in the presence of water, requiring significant capital investment in reaction vessels, scrubbing systems, and purification technology, especially for producers aiming for the high-concentration liquid formulation favored by the market. Vertical integration—where major fertilizer companies produce their own ammonia—is a key strategy to mitigate supply risk and control operational expenditures within this capital-intensive phase of the value chain, ensuring stable inputs and reliable production outputs.

The midstream component focuses on formulation, blending, storage, and specialized transportation. Since the vast majority of ATS is distributed as a liquid solution (typically 12-0-0-26S), efficient handling requires specialized storage tanks, heated railway cars, or dedicated tanker truck fleets to manage crystallization risks, particularly in colder climates. The distribution channel is bifurcated into direct and indirect routes. Direct sales are common for large fertilizer blenders, major agricultural co-operatives, and large industrial end-users who purchase in bulk quantities directly from the manufacturer. These direct relationships facilitate customized product specifications and long-term contracts, providing revenue stability for the producers. Indirect channels involve regional distributors, specialized chemical traders, and agricultural retail outlets who manage smaller volume sales and provide localized logistical support, particularly in highly fragmented markets or regions with less developed bulk liquid infrastructure, acting as essential intermediaries to reach the vast network of smaller farmers and specialized industrial consumers.

Downstream analysis centers on the diverse end-user applications. In agriculture, downstream users include large commercial farms, regional blending facilities, and custom applicators who integrate ATS into complex nutrient programs alongside other liquid fertilizers like UAN and phosphates. The efficiency and value proposition of ATS are realized at this stage through optimized crop yield and enhanced nitrogen retention. In industrial applications, downstream users are primarily water treatment plants, mining operations (seeking environmentally safer leaching agents), and specialized chemical processors. The profitability in the downstream is increasingly dependent on technical support and advisory services provided by manufacturers or distributors, helping end-users correctly incorporate ATS into their specific systems, maximizing its effectiveness. The trend towards precision agriculture further strengthens the role of the distributor or manufacturer in providing sophisticated guidance on dosage and timing, cementing their position as value-added partners rather than mere commodity suppliers in a dynamic and technologically evolving market environment.

Ammonium Thiosulfate Market Potential Customers

The primary and most significant customer segment for Ammonium Thiosulfate (ATS) comprises the large-scale commercial farming entities and the extensive network of agricultural co-operatives globally. These customers, operating across major commodity crop sectors such as corn, wheat, cotton, and specialty crops, rely heavily on high-efficiency liquid fertilizers to sustain intensive cultivation practices and maximize return on investment per acre. Their demand is driven by the need to replenish sulfur—an essential secondary macronutrient that is frequently deficient—and to leverage ATS’s unique nitrogen stabilizing properties, which minimize volatilization and leaching losses, especially when used in conjunction with high-nitrogen liquid applications. These key buyers typically purchase technical-grade ATS in bulk quantities through long-term contracts, demanding consistent purity and reliable logistical support, often incorporating the solution directly into custom-blended nutrient prescriptions via sophisticated liquid handling and application systems, making them highly price-sensitive but volume-loyal customers.

A secondary, yet rapidly growing, customer base includes fertilizer blenders and independent distributors who act as intermediaries, customizing ATS solutions for localized markets and smaller agricultural operations. These blending facilities purchase base ATS solutions and combine them with micronutrients, potassium, or phosphorus sources to create tailored formulations suited to specific regional soil types and crop requirements. Their role is critical in reaching fragmented markets that lack the infrastructure or scale for direct bulk purchase from major manufacturers. Furthermore, the industrial sector represents a diverse set of specialized customers; this includes municipalities and large industrial facilities utilizing ATS for wastewater treatment (as a dependable dechlorinating agent) and the mining industry, particularly companies involved in gold and silver extraction, seeking greener lixiviants to replace highly toxic traditional chemicals like cyanide. This industrial customer base values consistent purity, regulatory compliance, and reliable supply for continuous process operations.

Finally, a niche but high-value customer segment exists in the pharmaceutical and photographic industries. Pharmaceutical customers require exceptionally high-purity, often solid crystalline ATS, utilized as a raw material or reagent in specific chemical synthesis processes, demanding stringent quality documentation and compliance with Good Manufacturing Practices (GMP). Similarly, professional photographic labs, though diminished in volume due to digital transitions, still rely on ATS for traditional film processing as a fixing agent to dissolve unexposed silver halides, requiring specific specifications tailored for chemical stability in darkroom environments. These highly specialized end-users are less sensitive to bulk price fluctuations but require meticulous quality control, specialized packaging, and adherence to strict regulatory standards, presenting an opportunity for manufacturers capable of producing premium, certified grades of Ammonium Thiosulfate.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rentech Nitrogen, Tessenderlo Kerley, Nutrien, Kuga, K+S, Martin Midstream Partners, Koch Industries, EuroChem, Shandong Leide Chemical, Shaanxi Xinghua Chemistry, Hebei Jinguang Chemical, Hubei Xingfa Chemicals Group, Lianyungang Jindun Chemical, Haifa Group, ICL Group, Yara International, CF Industries, OCP Group, Indian Farmers Fertiliser Cooperative (IFFCO), Sinofert. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ammonium Thiosulfate Market Key Technology Landscape

The manufacturing and application of Ammonium Thiosulfate (ATS) are underpinned by several critical technologies focused on process efficiency, product purity, and formulation stability. In the manufacturing phase, the core technological focus revolves around efficient sulfur recovery and management, often integrated directly with large-scale ammonia production facilities to capture cost synergies and environmental benefits. Advanced process control systems, leveraging sensors and continuous monitoring, are essential for ensuring the precise reaction conditions necessary for the synthesis of high-concentration, stable liquid ATS solution. Modern production utilizes sophisticated scrubbing towers and gas absorption techniques to react sulfur dioxide (or related sulfur sources) with aqueous ammonia, optimizing yield and minimizing undesirable byproducts. The capability to consistently produce low-salt-index formulations is a key technical differentiator, addressing concerns related to phytotoxicity and ensuring compatibility with sensitive drip irrigation systems prevalent in precision agriculture.

On the formulation and application front, significant technological advancements are centered on enhancing the stability and delivery of liquid ATS. Specialized formulation technologies involve incorporating stabilizers and anti-crystallization agents to maintain the product's liquid state during storage and transportation, particularly in variable temperature conditions, thereby ensuring operational reliability for end-users. Furthermore, the compatibility of ATS with other macronutrient and micronutrient liquid blends (e.g., UAN) is continuously improved through advanced blending technologies that ensure homogeneous mixing and long-term suspension of all components without precipitation. The integration of these advanced liquid formulations with Variable Rate Technology (VRT) equipment, which utilizes GPS mapping and sensor data to adjust application rates in real-time, represents the cutting-edge of downstream application technology, guaranteeing optimal nutrient placement and maximizing the economic value derived from every gallon of ATS applied.

The transition into specialized markets also mandates specific technological improvements. For instance, the production of Pharmaceutical Grade ATS requires ultra-filtration and multiple recrystallization steps to remove heavy metals and trace impurities, demanding high-level cleanroom environments and validated purification technologies far exceeding the requirements for technical grade fertilizer. Similarly, in the burgeoning hydrometallurgy sector, research is focused on developing catalyst-assisted ATS leaching systems and specialized recovery processes that optimize metal dissolution rates while ensuring the environmental integrity of the spent leaching solution. These technological advancements, from efficient synthesis reactors to intelligent application tools, are vital for maintaining the competitive edge of ATS against alternative sulfur and nitrogen sources, securing its position as a high-performance chemical in both agricultural and industrial domains, and ensuring the product meets increasingly stringent global standards for safety and environmental performance.

Regional Highlights

Regional consumption patterns for Ammonium Thiosulfate are highly heterogeneous, dictated primarily by agricultural intensity, soil composition, and the prevalence of sulfur deficiency, alongside industrial activities and regulatory frameworks concerning fertilizer application. North America, specifically the United States, represents the most mature and significant market for ATS globally, owing to its vast acreage dedicated to corn, soybean, and wheat production, crops that exhibit high responsiveness to sulfur and nitrogen stabilization. The region’s advanced infrastructure for handling bulk liquid fertilizers and the widespread adoption of precision agriculture techniques, which favor liquid formulations for Variable Rate Application (VRA), cement its market leadership. The high historical rates of nitrogen application have led to widespread sulfur depletion, reinforcing the necessity of routine ATS supplementation, positioning the region as a critical demand driver and a benchmark for market innovation and logistics efficiency.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period, driven by the sheer volume of agricultural land, increasing population pressure, and rapid modernization of farming practices in countries such as China, India, and Southeast Asian nations. Governments in this region are increasingly promoting the use of high-efficiency fertilizers to address the dual challenges of food security and environmental pollution from nutrient runoff. The shift from traditional granular fertilizers to liquid formats, although infrastructure development is still ongoing, is accelerating demand for readily available sulfur sources like ATS. Furthermore, the robust industrial sectors in APAC, particularly in chemical manufacturing and wastewater treatment, contribute significantly to non-agricultural consumption, providing market stability and diversification beyond the cyclical agricultural sector, fostering localized production and strengthening regional supply chains.

Europe constitutes a substantial, yet mature, market for ATS, characterized by strict environmental regulations, particularly the Nitrates Directive, which favors fertilizers that minimize nitrogen losses. ATS is strategically positioned here due to its superior nitrogen stabilizing properties, making it an acceptable and favored option for sustainable farming practices and compliance with regulatory mandates. Demand in Central and Eastern Europe is growing as farming practices intensify and soil health concerns become prominent. Meanwhile, Latin America (LATAM) presents a strong potential growth opportunity, especially in large agricultural economies like Brazil and Argentina, where expanding soybean and sugar cane cultivation requires substantial sulfur inputs. The Middle East and Africa (MEA) remain smaller markets, constrained by limited agricultural land and underdeveloped liquid fertilizer infrastructure, but significant investments in resource efficiency and large-scale farming projects, particularly in Saudi Arabia and Egypt, suggest future market potential, relying on imports and specialized applications in arid and semi-arid cropping systems.

- North America: Dominant market share due to large-scale corn and soybean cultivation, high adoption of liquid fertilizers, and entrenched infrastructure for bulk liquid handling and VRT application.

- Asia Pacific (APAC): Fastest-growing region, driven by intensive agriculture, increasing food demand, governmental support for efficient fertilizer use, and expanding industrial sectors in China and India.

- Europe: Stable demand, emphasizing environmentally compliant fertilizers; strict regulations favor ATS for its nitrogen stabilization properties, supporting sustainable intensification efforts across the continent.

- Latin America (LATAM): High growth potential fueled by expanding cash crop acreage (soybeans, sugarcane) and the need for sulfur supplementation in major farming regions like the Pampas and Cerrado biomes.

- Middle East and Africa (MEA): Emerging market with niche opportunities in specific high-value crops and specialized industrial uses, largely dependent on infrastructure investment and import logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ammonium Thiosulfate Market.- Rentech Nitrogen

- Tessenderlo Kerley

- Nutrien

- Kuga

- K+S

- Martin Midstream Partners

- Koch Industries

- EuroChem

- Shandong Leide Chemical

- Shaanxi Xinghua Chemistry

- Hebei Jinguang Chemical

- Hubei Xingfa Chemicals Group

- Lianyungang Jindun Chemical

- Haifa Group

- ICL Group

- Yara International

- CF Industries

- OCP Group

- Indian Farmers Fertiliser Cooperative (IFFCO)

- Sinofert

Frequently Asked Questions

Analyze common user questions about the Ammonium Thiosulfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ammonium Thiosulfate (ATS) and what are its primary uses?

Ammonium Thiosulfate (ATS) is a clear liquid chemical compound (NH4)2S2O3 used primarily as a highly effective, dual-nutrient liquid fertilizer. It supplies readily available sulfur (S) and slow-release nitrogen (N). Key secondary uses include metal leaching (hydrometallurgy), photographic fixing, and wastewater dechlorination, capitalizing on its strong reducing properties.

How does ATS enhance nitrogen use efficiency in agriculture?

ATS enhances nitrogen use efficiency by acting as a temporary nitrification inhibitor. The thiosulfate component delays the conversion of ammonium (a stable form of nitrogen) to nitrate (a form susceptible to leaching and denitrification), keeping nitrogen in the root zone longer for plant uptake and significantly reducing environmental losses.

Which regions drive the highest demand for Ammonium Thiosulfate?

North America, particularly the United States, is the largest current consumer due to intensive, mechanized farming practices and high prevalence of sulfur-deficient soils. The Asia Pacific region, however, is projected to be the fastest-growing market, driven by rapid agricultural modernization in nations like China and India.

What are the main alternatives to ATS in fertilizer applications?

Alternatives providing sulfur include Ammonium Sulfate, Gypsum (Calcium Sulfate), and elemental sulfur, while alternatives for nitrogen stabilization include urease and nitrification inhibitors blended with urea (e.g., UAN solutions). ATS is often preferred for its liquid form, dual-nutrient composition, and compatibility with diverse blending requirements.

What are the key technical challenges in the production and distribution of liquid ATS?

Key technical challenges include managing the high volatility and cost of raw materials (ammonia and sulfur), ensuring product stability and preventing crystallization during cold storage and transit, and maintaining the consistency of low-salt-index formulations to prevent crop damage when used in sensitive irrigation systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ammonium Thiosulfate Market Size Report By Type (Ammonium Thiosulfate Solid, Ammonium Thiosulfate Liquid), By Application (Grain Fertilizer, Cash Crop Fertilizer, Other Agricultural Applications, Industrial Applications), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Liquid Ammonium Thiosulfate Market Statistics 2025 Analysis By Application (Corn Fertilizer, Grain Fertilizer, Cash Crop Fertilizer), By Type (60% ATS), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager