Amorphous Alloy Transformer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438393 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Amorphous Alloy Transformer Market Size

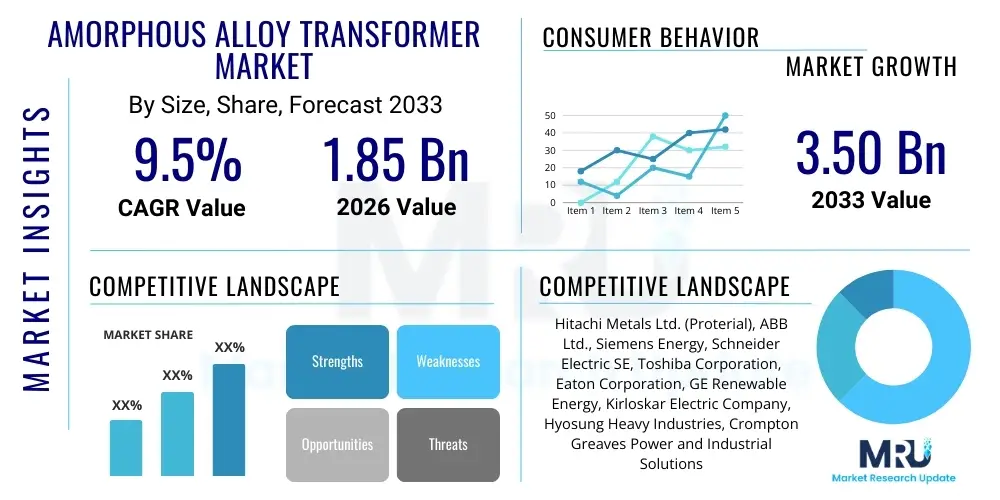

The Amorphous Alloy Transformer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.50 Billion by the end of the forecast period in 2033.

Amorphous Alloy Transformer Market introduction

The Amorphous Alloy Transformer Market encompasses devices utilizing metallic glass cores instead of traditional grain-oriented silicon steel cores. These amorphous metal alloys, typically composed of iron, boron, silicon, and carbon, possess a unique non-crystalline atomic structure, resulting in significantly lower magnetic core losses, particularly eddy current and hysteresis losses, when compared to conventional materials. This superior energy efficiency, especially under no-load conditions, positions amorphous alloy transformers (AATs) as a crucial technology in global efforts toward energy conservation and grid modernization. AATs are primarily deployed in electrical distribution networks, fulfilling the critical function of stepping down high voltage electricity to usable levels while minimizing power wastage.

Major applications for amorphous alloy transformers span across utility distribution grids, industrial manufacturing facilities, commercial buildings, and renewable energy integration points such as solar and wind farms. Their high efficiency translates directly into reduced operational costs and a smaller carbon footprint, aligning perfectly with stringent governmental energy efficiency regulations mandated globally, particularly in developed and rapidly developing economies. The foundational benefit driving market adoption is the reduction in total cost of ownership (TCO) over the lifetime of the transformer, even though the initial procurement cost might be marginally higher than silicon steel alternatives. This long-term economic viability is a significant driver, alongside the increasing focus on constructing smarter, more resilient, and sustainable power infrastructure.

Key driving factors propelling the growth of this market include governmental subsidies and incentives promoting energy-efficient distribution equipment, the rapid expansion and upgrading of aging electrical grids worldwide, and the burgeoning demand for reliable electricity supply in developing nations undergoing rapid urbanization and industrialization. Furthermore, the integration of distributed generation sources and microgrids necessitates highly efficient and reliable transformers capable of handling complex power flows, a requirement optimally met by AAT technology. The consistent push towards meeting climate change targets and enhancing grid reliability ensures a robust demand trajectory for amorphous alloy solutions throughout the forecast period.

Amorphous Alloy Transformer Market Executive Summary

The Amorphous Alloy Transformer Market is undergoing substantial growth, fundamentally driven by global regulatory pressures focusing on grid efficiency and energy loss reduction. Business trends indicate a shift towards modular and smart transformer designs, integrating monitoring and diagnostic capabilities with the inherent efficiency of amorphous cores. Major manufacturers are investing heavily in improving amorphous ribbon production yield and reducing manufacturing complexities to lower overall unit costs, thereby making AATs more competitive against traditional silicon steel transformers. Regional expansion is particularly pronounced in the Asia Pacific, where massive infrastructure investments in countries like China and India are creating unparalleled opportunities for distribution transformer deployment. Conversely, mature markets in North America and Europe focus more on replacement cycles and mandatory adherence to high-efficiency standards (e.g., DOE standards in the US and Ecodesign directives in the EU), which favor AAT adoption.

Segment trends highlight the dominance of the distribution transformer segment, attributed to its direct linkage with utility infrastructure upgrades and residential/commercial consumption points. Within the power rating segmentation, medium-sized transformers (above 100 kVA up to 1000 kVA) demonstrate the highest adoption rates, reflecting their typical use in substations serving localized population clusters. Material science advancements are also influencing segment dynamics, with ongoing research into next-generation amorphous alloys that offer enhanced magnetic properties and thermal stability. The competitive landscape remains moderately fragmented, characterized by global energy conglomerates, specialized transformer manufacturers, and niche amorphous metal suppliers collaborating to optimize the supply chain.

In summary, the market exhibits robust momentum supported by favorable policy environments globally. While high initial material costs historically posed a restraint, technological improvements and economies of scale are progressively mitigating this barrier. The future trajectory is marked by increasing integration of AATs into smart grid architectures, positioning them as foundational components for efficient power delivery. Strategic partnerships aimed at localized manufacturing and supply chain resilience, especially concerning raw material sourcing (iron, boron), are key competitive differentiators influencing market share and profitability across all major geographical segments.

AI Impact Analysis on Amorphous Alloy Transformer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Amorphous Alloy Transformer Market primarily revolve around three core themes: predictive maintenance, design optimization, and smart grid integration. Users are keen to understand how AI algorithms can leverage the inherent efficiency of AATs within complex power systems. Key concerns often address whether AI can accurately predict core loss degradation or potential failures in AATs, thereby extending their operational lifespan and maximizing return on investment. Furthermore, there is significant interest in how machine learning can accelerate the complex material composition optimization process for amorphous alloys, refining the balance between magnetic properties, mechanical stability, and cost of production.

The convergence of AI with AAT technology is fundamentally transforming operational efficiency and design methodologies. AI-powered diagnostic systems analyze real-time operational data—such as temperature fluctuations, load profiles, and harmonic distortions—to establish highly accurate predictive maintenance schedules, minimizing unscheduled downtime which is crucial for utilities. In the design phase, AI algorithms simulate billions of permutations of core structure and winding configurations, rapidly identifying optimal designs that maximize energy efficiency while adhering to strict weight and size constraints, a process far exceeding traditional finite element analysis capabilities. This capability significantly shortens the product development cycle for highly specialized AATs.

Moreover, within the context of smart grids, AI acts as the control layer utilizing AATs as high-efficiency nodes. Machine learning models determine optimal voltage regulation points and dynamically adjust load balancing across the distribution network, ensuring the AATs operate consistently at peak efficiency, especially in scenarios involving variable renewable energy inputs. This intelligent management not only maximizes the energy saving potential of the amorphous core but also enhances overall grid resilience and power quality, directly addressing consumer and utility expectations for reliable, high-quality electricity delivery.

- AI optimizes predictive maintenance schedules for AATs based on real-time operational parameters (temperature, load cycles).

- Machine learning accelerates the R&D process for amorphous alloy composition and core geometric design optimization.

- AI-driven smart grid systems use AATs as key components for dynamic voltage optimization and efficient load management.

- Automated monitoring of core losses detects subtle deviations, ensuring prolonged operational efficiency and compliance with energy standards.

- AI enhances manufacturing quality control by analyzing spectroscopic data of amorphous ribbons during production, minimizing material defects.

DRO & Impact Forces Of Amorphous Alloy Transformer Market

The market for Amorphous Alloy Transformers is primarily driven by stringent global energy efficiency regulations and the inherent need for utilities to minimize non-technical power losses within their vast distribution networks. Governmental mandates across Asia Pacific, Europe, and North America compelling the replacement of conventional, less efficient silicon steel core transformers with high-efficiency alternatives like AATs constitute the principal external force. The rising cost of energy and the growing focus on sustainability amplify the economic rationale for adopting AATs, as their superior energy saving capability translates directly into lower operating expenditures (OPEX) over the lifecycle of the unit. Furthermore, the expansion of electricity infrastructure into rural and remote areas, particularly in emerging economies, necessitates robust and efficient distribution transformers, thereby creating a substantial demand base.

However, significant restraints impede faster market penetration. The foremost challenge is the higher initial procurement cost of AATs compared to conventional transformers, stemming from the specialized manufacturing processes required for amorphous metal ribbons and the relatively higher cost of raw materials (especially specific metal alloys). Additionally, certain physical and mechanical properties, such as the inherent hardness and brittleness of amorphous alloys, complicate the manufacturing and handling processes, requiring specialized winding and core assembly techniques. Another crucial restraint is the limited global manufacturing capacity for high-quality amorphous metal ribbon, which is currently dominated by a few key players, leading to supply chain constraints and price volatility, particularly during periods of high demand.

Opportunities for market expansion are abundant, particularly through technological innovations and emerging market penetration. The increasing integration of renewable energy sources (solar, wind) necessitates distribution transformers capable of handling bi-directional power flow and high harmonic content efficiently, a segment where AATs excel due to their low core losses under varying load conditions. Developing specialized, compact AATs for niche applications such as electric vehicle charging infrastructure and data center power distribution presents a lucrative avenue. The market can also capitalize on the growing emphasis on "Total Cost of Ownership" (TCO) assessments, actively educating end-users about the substantial long-term savings accrued from reduced energy consumption, thereby justifying the higher upfront investment. The overall impact forces are predominantly positive, with efficiency demands and technological advancement overriding initial cost restraints, projecting sustained growth.

Segmentation Analysis

The Amorphous Alloy Transformer market is comprehensively segmented based on its application, type of cooling, power rating, and geographical deployment, providing a multifaceted view of market dynamics and adoption patterns. Segmentation by application clearly distinguishes between utility distribution transformers, industrial usage, and commercial deployment, with the utility sector historically commanding the largest market share due to the widespread need for grid infrastructure upgrades. Segmentation by cooling type, such as oil-immersed versus dry-type transformers, reflects regional preferences and safety standards, with dry-type preferred in indoor or densely populated urban settings. Understanding these segments is crucial for manufacturers to tailor their production, marketing, and distribution strategies effectively to meet specific regional and industry requirements while aligning with diverse regulatory environments concerning energy efficiency and power delivery reliability.

- By Application:

- Utility

- Industrial

- Commercial & Residential

- By Phase:

- Single-Phase

- Three-Phase

- By Power Rating:

- Less than 100 kVA

- 101 kVA – 1,000 kVA

- Above 1,000 kVA

- By Cooling Type:

- Oil-Immersed

- Dry-Type

- By End-User:

- Power Generation

- Transmission & Distribution

- Infrastructure (Railways, Ports)

- Manufacturing & Process Industry

Value Chain Analysis For Amorphous Alloy Transformer Market

The value chain for the Amorphous Alloy Transformer Market initiates with the specialized upstream process of manufacturing amorphous metal alloys. This stage is highly centralized, involving the rapid solidification of molten metal (iron, silicon, boron) into thin, continuous ribbons, a process that determines the core magnetic properties and overall efficiency of the final transformer. Key players in this upstream segment are typically specialized material science companies or integrated transformer manufacturers with proprietary ribbon production technology. The quality and consistent supply of these ribbons are critical bottlenecks affecting downstream production capacity and cost structures. Sourcing raw materials (iron ore, ferroalloys, boron) for the preparation of the metallic glass precedes the ribbon fabrication phase, highlighting the initial dependence on global commodity markets and strategic raw material security.

The midstream component involves the complex manufacturing and assembly of the transformer units. This includes core preparation (cutting and stacking/winding the amorphous ribbons), winding the copper or aluminum coils, tank fabrication, insulation, and final assembly and testing. Due to the brittle nature of amorphous ribbons, handling and core assembly require specialized, automated equipment and precise quality control, differentiating AAT production from conventional transformer manufacturing. Distribution channels subsequently move the finished products to the end-users. Direct distribution is common for large-scale utility procurement contracts and customized industrial projects, involving close collaboration between the manufacturer and the utility company or EPC contractor. This allows for tailored specifications and post-installation services.

Indirect distribution involves sales through third-party distributors, wholesalers, and electrical equipment retailers, primarily serving smaller commercial and residential projects. The downstream phase involves installation, commissioning, and subsequent maintenance and servicing. Given the long operational lifespan of AATs (typically 30+ years), after-sales service, including monitoring and diagnostic support, represents a significant value addition segment. Overall, the value chain is characterized by high technical expertise at the upstream (material science) and midstream (manufacturing) levels, emphasizing the importance of integrated capabilities or strong, reliable partnerships between material producers and transformer assemblers.

Amorphous Alloy Transformer Market Potential Customers

The primary end-users and buyers of amorphous alloy transformers are organizations deeply invested in reliable electricity distribution and efficiency mandates. The most significant customer segment comprises Electric Utilities and Power Distribution Companies, which require high-efficiency transformers for their transmission and distribution (T&D) networks, serving residential, commercial, and light industrial loads. These customers prioritize long-term efficiency, reliability, and compliance with national efficiency standards (e.g., EU Ecodesign, Indian BEE standards, US DOE minimum standards). Their procurement is typically characterized by large volume contracts, long-term operational guarantees, and rigorous technical specifications.

The second major group includes Industrial Manufacturers and Process Industries (such as automotive, chemicals, metals, and textiles). These facilities require robust, efficient transformers to handle heavy and often fluctuating industrial loads. For these customers, minimizing internal energy consumption and reducing peak demand charges are critical financial considerations, making the superior efficiency of AATs highly attractive. Furthermore, any facility integrating renewable energy sources or considering microgrid solutions often opts for AATs due to their performance benefits under variable load conditions and commitment to corporate sustainability goals.

Finally, the Commercial and Infrastructure sectors represent burgeoning customer segments. Large commercial complexes, data centers, hospitals, educational institutions, and public infrastructure projects (like metro systems and railway electrification) are increasingly mandating AATs to meet high safety standards (especially dry-type AATs for indoor use) and achieve stringent building energy efficiency certifications (like LEED). The inherent reliability and low lifecycle costs appeal directly to asset owners and developers who view electricity consumption as a major operational expense, ensuring that AATs remain a preferred choice for new construction and large-scale modernization projects across diverse urban environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.50 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals Ltd. (Proterial), ABB Ltd., Siemens Energy, Schneider Electric SE, Toshiba Corporation, Eaton Corporation, GE Renewable Energy, Kirloskar Electric Company, Hyosung Heavy Industries, Crompton Greaves Power and Industrial Solutions Limited, Wilson Power Solutions, Jinan Xuhua Electrical Equipment Co. Ltd., Shandong Xinchenfa Electric Co. Ltd., Shanghai Huaming Power Equipment Co. Ltd., CREAT Group, Zhejiang Farady Powertech Co. Ltd., Efacec Power Solutions, TBEA Co. Ltd., Voltamp Transformers Ltd., EMCO Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amorphous Alloy Transformer Market Key Technology Landscape

The core technology underpinning the Amorphous Alloy Transformer market is the rapid solidification process used to produce metallic glass ribbons. This involves cooling molten metal alloys, predominantly iron-based with additives like boron and silicon, at extremely high rates (around a million degrees Celsius per second) via a single-roller melt-spinning technique. This ultra-rapid cooling bypasses crystallization, resulting in a non-crystalline, glassy atomic structure. This unique structure eliminates grain boundaries, which are the primary sources of energy dissipation (hysteresis loss) in traditional crystalline silicon steel. Technological advancement in this area focuses on optimizing the alloy composition for enhanced magnetic saturation and reduced coercivity while improving ribbon consistency and width for easier manufacturing integration.

Beyond material science, significant technological developments are centered on core assembly and thermal management. The inherent brittleness of the amorphous ribbons necessitates sophisticated, highly automated manufacturing techniques, often involving specialized winding machines and precise handling to prevent micro-cracks. Innovations in core geometry, such as wound cores versus stacked laminations (though stacked cores are less common for amorphous materials), aim to maximize the effective magnetic cross-section while minimizing waste. Furthermore, advanced insulation materials and improved cooling duct designs are being implemented, particularly in dry-type AATs, to manage heat efficiently and enhance the overall operational temperature profile and longevity of the transformer, ensuring performance reliability under heavy load conditions.

Digital integration and smart features represent another critical technological frontier. Modern AATs are increasingly equipped with advanced monitoring systems utilizing embedded sensors for temperature, vibration, and partial discharge detection. These components, often coupled with communication modules (IoT integration), allow for real-time performance tracking and condition monitoring, forming the backbone of smart grid applications. This technological convergence enables precise load management, predictive diagnostics, and remote operational control, enhancing the economic benefits of the high-efficiency amorphous core by maximizing uptime and optimizing electricity flow across the entire distribution network.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region in the Amorphous Alloy Transformer Market. This growth is fueled by massive governmental investment in electrical infrastructure expansion, especially in China, India, and Southeast Asian nations undergoing rapid urbanization and industrialization. Countries like India have aggressive energy efficiency programs (e.g., mandatory use of star-rated transformers) that strongly favor AAT adoption. The region is also a key manufacturing hub for both the amorphous metal ribbons and the finished transformers, leading to competitive pricing and robust supply chain dynamics.

- North America: The North American market is driven primarily by replacement demand and strict regulatory compliance. The US Department of Energy (DOE) minimum efficiency standards mandate high performance for new distribution transformers, making AATs a preferred choice for utilities upgrading aging infrastructure. Emphasis here is placed on grid resilience, smart grid deployment, and integrating decentralized renewable energy sources, where the low-loss characteristics of amorphous cores are highly valued. Canada also exhibits steady demand due linked to grid modernization efforts and environmental commitments.

- Europe: The European market growth is robust, largely attributable to the EU’s Ecodesign Directive, which sets very high efficiency standards for transformers placed into service. This regulatory environment effectively accelerates the phasing out of standard distribution transformers in favor of high-efficiency models, including AATs. Western Europe focuses predominantly on replacing older units and integrating transformers into complex urban distribution networks and renewable energy projects. Germany, France, and the UK are key markets driven by sustainability goals and sophisticated grid management requirements.

- Latin America: This region presents significant long-term potential, though adoption rates are varied. Market growth is spurred by the need to expand electricity access and reduce T&D losses, which are historically high in many South American countries. Governments in Brazil and Mexico are cautiously promoting energy efficiency in their utility sectors. The region's development is often dependent on public funding for large-scale grid projects, making stable economic conditions critical for sustaining AAT market expansion.

- Middle East and Africa (MEA): Growth in the MEA region is fragmented but significant, driven by large infrastructure projects in the Gulf Cooperation Council (GCC) countries aimed at diversifying economies and supporting rapid construction of smart cities and industrial zones. High temperatures necessitate high-quality, reliable cooling systems, often favoring advanced oil-immersed AAT designs. In Africa, the market is nascent but supported by initiatives to improve electrification rates and minimize system-wide energy losses across underdeveloped grids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amorphous Alloy Transformer Market.- Hitachi Metals Ltd. (now Proterial Ltd.)

- ABB Ltd.

- Siemens Energy AG

- Schneider Electric SE

- Toshiba Corporation

- Eaton Corporation plc

- GE Renewable Energy

- Kirloskar Electric Company Ltd.

- Hyosung Heavy Industries

- Crompton Greaves Power and Industrial Solutions Limited (CG Power)

- Wilson Power Solutions

- Jinan Xuhua Electrical Equipment Co. Ltd.

- Shandong Xinchenfa Electric Co. Ltd.

- Shanghai Huaming Power Equipment Co. Ltd.

- CREAT Group Co. Ltd.

- Zhejiang Farady Powertech Co. Ltd.

- Efacec Power Solutions, SGPS, S.A.

- TBEA Co. Ltd.

- Voltamp Transformers Ltd.

- EMCO Limited

Frequently Asked Questions

Analyze common user questions about the Amorphous Alloy Transformer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of amorphous alloy transformers over silicon steel transformers?

The primary advantage of Amorphous Alloy Transformers (AATs) is significantly lower no-load core losses (up to 70% less) due to the non-crystalline atomic structure of the amorphous metal core. This superior energy efficiency leads to substantial long-term operational cost savings and reduced environmental impact, especially in distribution networks where transformers remain energized constantly.

Are amorphous alloy transformers more expensive initially?

Yes, Amorphous Alloy Transformers typically have a higher initial procurement cost compared to traditional grain-oriented silicon steel transformers. This premium is attributed to the specialized manufacturing process required for producing amorphous metal ribbons and the high cost of raw materials. However, the higher upfront cost is generally recovered quickly through energy savings over the transformer's lifespan (Total Cost of Ownership optimization).

Where are amorphous alloy transformers most commonly used?

Amorphous Alloy Transformers are most commonly used in utility distribution networks, primarily in secondary substations and pole-mounted applications, serving residential and commercial loads. They are also increasingly adopted in industrial facilities and integrated into renewable energy systems like solar farms where minimizing T&D losses and ensuring reliable power quality are critical operational objectives.

How do global energy efficiency regulations affect the demand for AATs?

Global energy efficiency regulations, such as the EU Ecodesign Directive and US DOE standards, are the primary market drivers for AATs. These mandates enforce high minimum energy performance requirements for new and replacement transformers, effectively excluding many conventional models and accelerating the adoption of highly efficient technologies like amorphous alloy cores to meet mandatory regulatory compliance.

What is the future outlook for the amorphous alloy transformer market regarding smart grids?

The future outlook is highly positive. AATs are considered foundational components of smart grids due to their efficiency and reliability. Their integration with advanced sensor technology and AI-driven monitoring systems enables dynamic optimization of power flow, voltage regulation, and predictive maintenance, enhancing overall grid resilience and maximizing the financial and environmental benefits of energy conservation efforts across modern power infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager