Amorphous Polyolefin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435672 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Amorphous Polyolefin Market Size

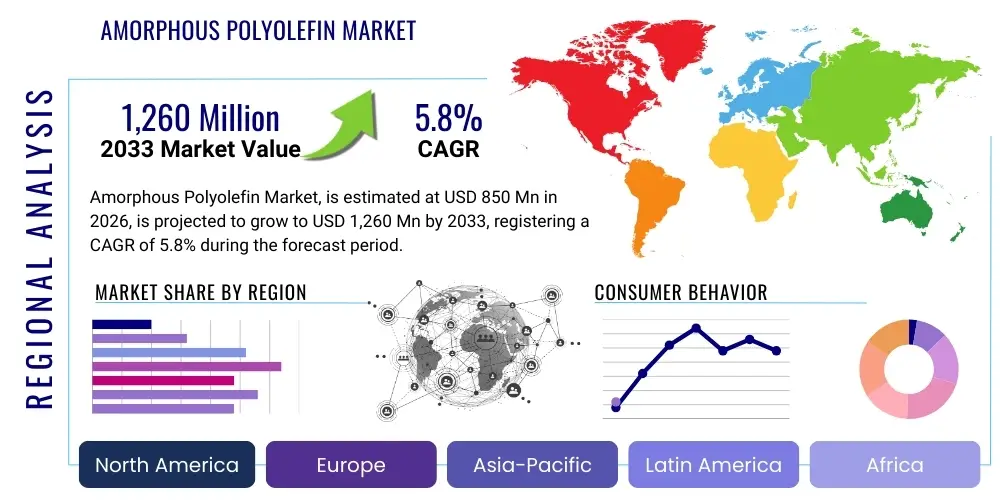

The Amorphous Polyolefin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,260 million by the end of the forecast period in 2033.

Amorphous Polyolefin Market introduction

Amorphous Polyolefin (APO) is a type of synthetic polymer derived from the polymerization of alpha-olefins, primarily propylene, ethylene, and butene, characterized by its non-crystalline structure. This unique molecular architecture grants APO materials distinct properties, such as low viscosity, high thermal stability, and excellent adhesion to various substrates, making them indispensable components across multiple industrial sectors. Unlike semi-crystalline polyolefins, the amorphous nature of APO results in lower softening points and superior flexibility, which are crucial attributes for applications requiring high-performance bonding solutions. The utility of APO is fundamentally linked to its role as a key ingredient in hot-melt adhesives (HMAs) and sealants, where it enhances tack, reduces processing temperature, and improves overall structural integrity of bonded materials.

The product description of APO centers on its versatility as a hydrocarbon resin modifier and base polymer. Key benefits include superior moisture resistance, excellent chemical compatibility with waxes and other polymers, and the ability to formulate pressure-sensitive and non-pressure-sensitive adhesives. Major applications span packaging, where APO-based HMAs ensure fast setting times and strong case and carton sealing; the hygiene industry (nonwovens), demanding flexible and non-toxic bonding for diapers and feminine care products; and construction, utilized in roofing membranes and sealants due to its weathering resistance. These polymers offer a cost-effective alternative to competitive adhesive technologies while delivering comparable or superior performance in specific application niches, driving widespread adoption across mature and emerging economies.

Driving factors for this market expansion are multifaceted, anchored predominantly by the rapid growth in the flexible packaging industry, particularly within Asia Pacific, and the increasing global demand for disposable hygiene products. Furthermore, stringent environmental regulations are slowly favoring solvent-free adhesive systems like HMAs, where APO plays a vital structural role. Technological advancements in polymerization processes, leading to tailored APO grades with enhanced thermal and cohesive strength, are continually broadening the material’s application scope into demanding sectors such as automotive assembly and specialized electronics encapsulation. The continuous shift towards automation in manufacturing processes necessitates faster, more reliable bonding, positioning APO as a crucial enabling material for modern industrial production.

Amorphous Polyolefin Market Executive Summary

The global Amorphous Polyolefin market is poised for robust expansion, driven primarily by favorable business trends in consumer goods packaging and personal hygiene sectors, particularly in fast-developing regions. Business trends indicate a strong market shift towards sustainable and high-efficiency hot-melt adhesives (HMAs). Manufacturers are focusing on developing APO grades with higher purity and improved thermal profiles to cater to specialized applications like automotive interior bonding and solar panel lamination. Strategic investments are centered on expanding production capacities in key manufacturing hubs, coupled with a focus on backward integration to secure stable access to olefin feedstocks. This emphasis on process optimization and product customization is fueling competitive dynamics and fostering innovation in end-use formulation.

Regionally, the Asia Pacific (APAC) continues to assert dominance, characterized by rapid industrialization, burgeoning e-commerce leading to increased packaging demand, and a massive consumer base driving the nonwovens sector. North America and Europe, while mature, exhibit steady growth fueled by the replacement of traditional adhesives with high-performance APO-based HMAs in construction and durable goods. Regional trends also show increasing regulatory pressure in Europe regarding polymer migration in food contact materials, pushing APO suppliers to certify compliance and improve product traceability. The Middle East and Africa (MEA) and Latin America represent emerging opportunities, mainly driven by infrastructure development and the increasing adoption of modern packaging technologies, though market penetration remains constrained by logistics and pricing volatility in certain sub-regions.

Segmentation trends highlight the Propylene-based APO segment maintaining the largest market share due to its cost-effectiveness and widespread use in standard HMA formulations. However, the Ethylene-based APO segment is anticipated to witness the highest growth rate, driven by its superior performance characteristics in high-temperature applications and advanced packaging. Application-wise, Hot-Melt Adhesives remain the largest segment, but the Polymer Modification segment is gaining traction, leveraging APO's ability to improve the impact resistance and flexibility of base polymers like polyethylene and polypropylene. The End-User analysis confirms the Packaging industry as the primary consumer, followed closely by the fast-expanding Hygiene (nonwovens) industry, signaling resilient demand despite potential economic fluctuations.

AI Impact Analysis on Amorphous Polyolefin Market

User queries regarding the impact of Artificial Intelligence (AI) on the Amorphous Polyolefin market frequently revolve around themes of process optimization, predictive maintenance, and novel material discovery. Users seek to understand how AI can reduce the variability inherent in polymerization reactions, which directly influences the quality and consistency of APO products, such as melt viscosity and cohesive strength. Key concerns often focus on the capital investment required for implementing sophisticated AI-driven systems versus the achievable return on investment in a historically low-margin commodity chemical sector. Expectations center on AI's ability to accelerate the development of specialized APO grades tailored for advanced applications, such as high-adhesion formulations for sustainable packaging materials or enhanced thermal resistance for automotive adhesives. Ultimately, users anticipate AI will drive operational efficiency, minimize feedstock waste, and enable quicker scaling of new product development cycles, thereby sustaining competitive advantage.

- AI-driven optimization of polymerization reactor conditions, leading to consistent molecular weight distribution and enhanced product quality (e.g., specific softening points).

- Implementation of predictive maintenance models for large-scale production assets, minimizing unplanned downtime and reducing maintenance costs associated with continuous operation.

- AI-assisted formulation development, allowing researchers to rapidly screen thousands of potential APO blends with additives for specific HMA performance criteria (tack, heat resistance, peel strength).

- Optimization of supply chain logistics and inventory management using machine learning algorithms to forecast volatile raw material (olefin monomer) pricing and demand fluctuations.

- Enhanced quality control systems utilizing computer vision and machine learning for real-time defect detection during APO pelletizing and packaging processes.

- Simulation of long-term adhesive performance and aging characteristics under various environmental stresses, accelerating product validation cycles for end-user industries like automotive and construction.

DRO & Impact Forces Of Amorphous Polyolefin Market

The Amorphous Polyolefin market dynamics are shaped by a complex interplay of internal growth drivers and external market constraints, balanced by significant emerging opportunities that define its long-term trajectory. The primary driving force is the exceptional performance profile of APO-based hot-melt adhesives, which offer high-speed bonding and thermal stability crucial for automated manufacturing lines in packaging and disposable hygiene. However, the market faces a substantial restraint concerning the price volatility of primary feedstocks, namely propylene, ethylene, and butene monomers, which are derived from crude oil and natural gas, tying APO profitability directly to global energy market fluctuations. The core opportunity lies in the shift towards sustainable adhesive solutions and the integration of APO into advanced materials engineering, specifically in composite manufacturing and high-demand applications requiring durable, solvent-free bonding.

Drivers are strongly influenced by favorable regulatory trends promoting solvent-free and low Volatile Organic Compound (VOC) adhesive systems, positioning APO-based HMAs as an environmentally compliant choice across North America and Europe. The continued expansion of e-commerce necessitates high volumes of corrugated packaging, further cementing the demand for fast-setting APO adhesives used in carton sealing and tray forming. Restraints extend beyond raw material costs to include intense competition from alternative adhesive types, such as Ethyl Vinyl Acetate (EVA) and Styrene Isoprene Styrene (SIS), particularly in price-sensitive, low-performance applications where APO’s specialized properties may be over-specified. Furthermore, the specialized handling and equipment required for high-volume HMA application can act as a minor barrier to entry for smaller manufacturers in developing regions.

Impact forces currently prioritize technological differentiation and geographic market expansion. The high impact force of technological advancement is evident in the push toward metallocene catalysis, which allows for finer control over the molecular structure of APO, resulting in tailored performance grades with higher heat resistance or enhanced cohesion, thereby opening avenues into durable goods manufacturing. The opportunity landscape is further broadened by emerging applications in solar energy, utilizing APO films for module lamination where long-term durability and moisture protection are paramount. Strategic alignment with key downstream users, particularly major players in the nonwovens and high-speed packaging machinery sectors, is essential for capitalizing on these growth vectors and mitigating the risk associated with commodity pricing pressures, ensuring sustained market relevance.

Segmentation Analysis

The Amorphous Polyolefin market segmentation provides critical insights into the diverse end-user requirements and the technical specifications driving demand for specific APO types. Segmentation is primarily conducted based on Type (the olefin monomer base), Application (the function served by the APO), and End-User Industry (the ultimate consumer sector). The Type segmentation reveals the dominance of Propylene-based APO due to its cost-efficiency and versatility, while other segments address specialized needs requiring different thermal and adhesive properties. The highly detailed application breakdown confirms that the market is intrinsically linked to the performance of hot-melt adhesives, which consume the vast majority of produced APO, though secondary uses such as polymer modification are gaining momentum.

- By Type:

- Propylene-based Amorphous Polyolefin (APAO)

- Ethylene-based Amorphous Polyolefin

- Butene-based Amorphous Polyolefin

- Copolymer/Terpolymer APO

- By Application:

- Hot-Melt Adhesives (HMA)

- Sealants

- Polymer Modification

- Coatings and Lamination

- Roofing and Waterproofing

- By End-User Industry:

- Packaging

- Hygiene (Nonwovens)

- Automotive

- Construction

- Electrical & Electronics

- Footwear and Textile

Value Chain Analysis For Amorphous Polyolefin Market

The Amorphous Polyolefin value chain commences with the upstream extraction and refining of crude oil and natural gas, which yield the primary olefin monomers—propylene, ethylene, and butene—supplied by major petrochemical companies. Manufacturing APO involves specialized polymerization processes, often utilizing Ziegler-Natta or metallocene catalysts, performed by dedicated chemical producers. The efficiency and scale of this upstream supply heavily dictate the manufacturing costs of the final APO product. Midstream activities involve the conversion of these monomers into APO pellets or flakes, focusing on achieving precise molecular weights and crystallinity standards required by downstream formulators. Key activities at this stage include quality control, product grading, and initial packaging, ensuring the bulk chemical can be safely and efficiently transported to subsequent stages.

Downstream analysis focuses on the formulating and compounding stage, where APO is blended with tackifiers, waxes, oils, and antioxidants to create specialized hot-melt adhesives, sealants, or polymer blends. These adhesive formulators, often large chemical conglomerates or specialized HMA manufacturers, tailor products for specific end-user application equipment and performance requirements (e.g., high-temperature resistance for automotive parts, or fast-setting for high-speed packaging lines). The distribution channel for APO is bifurcated: direct distribution is common for large-volume contracts between APO producers and major HMA formulators, ensuring technical support and supply consistency. Indirect distribution utilizes regional chemical distributors and specialized agents, particularly for smaller volumes or to service geographically dispersed end-users, offering localized inventory and shorter lead times. This hybrid distribution model ensures broad market penetration.

The final consumption stage is highly dependent on the performance of the adhesive systems delivered. End-users in the packaging, hygiene, and construction sectors purchase the formulated HMA sticks, pellets, or bulk tanks. The quality of the APO directly impacts the adhesion strength, temperature stability, and shelf life of these final products. The entire value chain is characterized by a high degree of technical collaboration, particularly between APO producers and adhesive formulators, to co-develop products that meet increasingly stringent performance specifications and environmental standards. Optimization of this chain involves securing stable raw material contracts (upstream) and maintaining strong technical partnerships with high-volume converters (downstream) to sustain market competitive advantage and reliability.

Amorphous Polyolefin Market Potential Customers

The primary customers for Amorphous Polyolefin are highly concentrated in the industrial and consumer goods manufacturing sectors, defined by their large-scale requirements for high-performance, solvent-free bonding solutions. These customers are typically major adhesive and sealant compounders who integrate bulk APO into their proprietary formulations for distribution to consumer product manufacturers. Key end-user industries include the packaging sector, where rapid case and carton sealing adhesives are essential for e-commerce and fast-moving consumer goods (FMCG). Another crucial customer segment is the hygiene industry, comprising manufacturers of disposable nonwoven products like diapers, adult incontinence products, and feminine hygiene items, who require flexible, non-toxic, and dermatologically safe adhesives that perform well under varying moisture conditions.

Beyond these primary markets, significant potential customers exist in the automotive and construction industries. Automotive manufacturers utilize APO in specialized HMAs for interior trim lamination, headliner assembly, and noise damping, valuing its vibration resistance and thermal stability under extreme temperature fluctuations. Construction customers, including roofing material manufacturers and general contractors, rely on APO-based sealants and waterproofing membranes for their durability, UV resistance, and excellent adhesion to diverse building materials such as concrete, metal, and wood. Potential buyers are continually seeking APO grades that offer lower application temperatures to reduce energy costs and minimize thermal damage to substrates, driving demand for specialized, high-flow APO copolymers.

The secondary customer base includes specialized polymer modifiers and plastic compounders who use APO to enhance the physical properties of thermoplastics, particularly to improve impact strength and flow characteristics in injection molding applications. Direct buyers of APO are generally high-volume users requiring technical specifications tailored to their unique processing equipment and regulatory compliance needs. The buying decision is heavily influenced by factors such as long-term supply stability, product consistency (critical for automated high-speed lines), and competitive pricing relative to alternative polymer modifiers like EVA or SBS elastomers. Long-term supplier relationships, often secured through performance testing and technical service agreements, are characteristic of this market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1,260 million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, REXtac LLC, Evonik Industries AG, Lotte Chemical Corporation, LyondellBasell Industries N.V., Wacker Chemie AG, ExxonMobil Chemical Company, Hanwha TotalEnergies Petrochemical Co., Ltd., Chevron Phillips Chemical Company LLC, DOW Inc., Mitsui Chemicals, Inc., Versalis S.p.A. (Eni), SK Global Chemical Co., Ltd., ARLANXEO, Henkel AG & Co. KGaA, Bostik (Arkema Group), SIBUR Holding, Sinopec, Formosa Plastics Corporation, PolyMirae. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amorphous Polyolefin Market Key Technology Landscape

The technological landscape for the Amorphous Polyolefin market is primarily defined by advanced polymerization techniques designed to achieve precise control over molecular structure, critical for tailoring the material's adhesive and thermal properties. Traditional APO production largely relied on Ziegler-Natta catalysis, which remains prevalent for commodity-grade propylene-based APO (APAO). However, a significant technological shift involves the increasing adoption of metallocene catalyst technology. Metallocene catalysts offer superior control over tacticity and stereoregularity, allowing manufacturers to synthesize APO with narrower molecular weight distributions and highly uniform amorphous characteristics. This results in enhanced performance attributes such as reduced melt viscosity for easier processing, improved cohesion, and greater thermal stability, enabling APO to penetrate higher-specification applications like durable electronics and high-end automotive bonding.

Further technological advancements focus on post-polymerization processing and formulation optimization. Manufacturers are investing in compounding technology to efficiently integrate performance additives, including specialized tackifiers, waxes, and stabilizers, into the APO matrix. This ensures the final HMA compound meets specific requirements such as increased open time, faster set time, or improved resistance to plasticizer migration. Innovation in formulation is crucial for addressing the diverse needs of the nonwovens sector, where the adhesive must be soft, non-staining, and invisible on the finished product. Process technologies like continuous flow reactors and advanced process control systems (often augmented by AI, as noted earlier) are being implemented to improve yield, reduce energy consumption, and ensure batch-to-batch consistency, which is paramount for high-volume chemical supply.

A key area of future technological development involves bio-based and sustainable APO precursors. Although challenging due to cost and technical scalability, research is ongoing to utilize bio-derived olefins, aligning with global trends favoring renewable materials. Furthermore, specialized manufacturing techniques are being deployed to produce low-molecular-weight APO grades that act as high-performance resin modifiers, enhancing the flow and impact properties of other polymers. The underlying theme across the technological landscape is the transition from commodity-focused production to high-value, tailored polymer engineering, necessitating continuous investment in catalyst research and advanced process automation to maintain technological competitive edge in a dynamic industrial environment.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market and is forecasted to maintain the highest growth rate, driven by expansive manufacturing bases in China, India, and Southeast Asian nations. The region's rapidly growing population and increasing urbanization fuel colossal demand for disposable hygiene products (diapers, wipes), which are major consumers of APO-based HMAs. Furthermore, APAC serves as the global manufacturing hub for electronics and packaging, underpinning high-volume consumption. Government initiatives supporting infrastructure development, particularly in construction and transportation, also bolster the demand for sealants and high-performance adhesives. The competitive environment is characterized by intense price sensitivity, leading to a strong focus on large-scale, cost-efficient production, making it a critical region for global APO suppliers.

- North America: North America represents a mature, high-value market focused on performance and regulatory compliance. Growth here is steady, largely stemming from the continuous modernization of packaging lines and robust demand in the automotive sector for lightweighting solutions that utilize high-strength adhesives. The emphasis on high-quality roofing and construction materials, necessitating durable and weather-resistant sealants, provides consistent demand. The region exhibits high adoption rates of specialized APO grades, particularly metallocene-catalyzed polymers, due to stringent quality control requirements and a willingness to invest in premium adhesive solutions that enhance product durability and sustainability profiles.

- Europe: The European market is heavily influenced by strict sustainability regulations and circular economy initiatives, driving demand for APO in recyclable packaging solutions and low-VOC adhesives. While the hygiene market is mature, innovation focuses on ultra-thin and premium product designs, requiring highly specific APO formulations. The automotive industry, centered in Germany and France, demands advanced APO for interior bonding and noise reduction applications, requiring suppliers to meet stringent thermal and fire safety standards. Economic growth is moderate, favoring established suppliers with robust technical service capabilities and localized manufacturing footprints to ensure compliance with REACH regulations and evolving material directives.

- Latin America (LATAM): LATAM is an emerging market characterized by fluctuating economic stability but strong demographic growth. Brazil and Mexico are the primary consumption centers, with market expansion tied directly to the growth of organized retail, leading to increased demand for FMCG packaging. Infrastructure projects and increasing penetration of modern hygiene products in middle-income households are key drivers. Market entry strategies often focus on competitive pricing and leveraging established distribution networks to overcome logistical challenges inherent in the region. The construction sector’s reliance on imported materials can, however, introduce currency and tariff-related risks for APO suppliers.

- Middle East and Africa (MEA): The MEA region is developing rapidly, primarily fueled by massive infrastructure investments in the GCC countries and the growth of consumer bases in South Africa and Nigeria. Demand for APO is significant in large construction projects (sealants, insulation) and the expansion of local packaging and converting industries. However, the market is highly reliant on imports, making it sensitive to global shipping costs and geopolitical stability. Long-term potential is high due to ongoing diversification efforts away from oil economies, leading to localized manufacturing growth, presenting opportunities for APO producers willing to establish regional distribution partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amorphous Polyolefin Market.- Eastman Chemical Company

- REXtac LLC

- Evonik Industries AG

- Lotte Chemical Corporation

- LyondellBasell Industries N.V.

- Wacker Chemie AG

- ExxonMobil Chemical Company

- Hanwha TotalEnergies Petrochemical Co., Ltd.

- Chevron Phillips Chemical Company LLC

- DOW Inc.

- Mitsui Chemicals, Inc.

- Versalis S.p.A. (Eni)

- SK Global Chemical Co., Ltd.

- ARLANXEO

- Henkel AG & Co. KGaA

- Bostik (Arkema Group)

- SIBUR Holding

- Sinopec

- Formosa Plastics Corporation

- PolyMirae

Frequently Asked Questions

Analyze common user questions about the Amorphous Polyolefin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Amorphous Polyolefin (APO) in hot-melt adhesives (HMAs)?

APO serves as a base polymer or modifier in HMAs, providing crucial properties such as excellent adhesion, low melt viscosity for high-speed application, and good thermal stability. It enhances the bond strength and flexibility of the adhesive across various substrates, particularly in packaging and nonwoven hygiene products.

How does the Propylene-based APO (APAO) segment compare to Ethylene-based APO?

Propylene-based APO (APAO) is the largest segment due to its versatility and cost-effectiveness in standard HMA formulations. Ethylene-based APO, conversely, offers superior cohesive strength and thermal resistance, making it preferred for demanding applications such as specialized automotive parts and high-temperature sealants, albeit at a typically higher cost structure.

Which geographical region is the largest consumer of Amorphous Polyolefin?

The Asia Pacific (APAC) region is the largest consumer of APO, driven primarily by massive industrial growth, particularly in the packaging industry due to e-commerce expansion, and the rapidly increasing demand for disposable hygiene products in countries like China and India.

What are the main drivers of market growth for Amorphous Polyolefin?

Key drivers include the global shift toward high-speed, automated packaging lines requiring fast-setting adhesives, the robust growth of the nonwoven hygiene products sector, and the regulatory push favoring solvent-free, low-VOC adhesive systems in automotive and construction industries.

What impact does raw material price volatility have on the Amorphous Polyolefin market?

The market faces significant restraint from the price volatility of olefin monomers (propylene and ethylene), which are petrochemical derivatives. Fluctuations in crude oil and natural gas prices directly impact the production cost of APO, influencing profit margins for manufacturers and affecting end-user pricing stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager