Amphibious ATVs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432071 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Amphibious ATVs Market Size

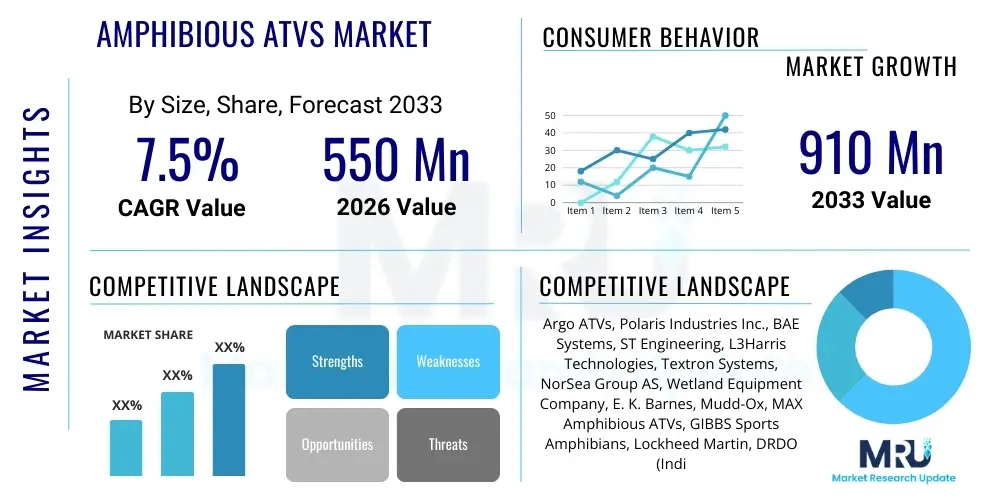

The Amphibious ATVs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $550 Million USD in 2026 and is projected to reach $910 Million USD by the end of the forecast period in 2033.

Amphibious ATVs Market introduction

The Amphibious All-Terrain Vehicles (ATVs) Market encompasses specialized vehicles designed for seamless operation across diverse terrains, including solid ground, swamps, snow, and bodies of water. These versatile machines typically utilize a sealed hull and skid steering, often featuring continuous tracks or large, low-pressure tires for propulsion on land and in water. The primary applications span crucial sectors such as military defense, complex search and rescue operations, infrastructure maintenance in remote regions, and increasingly, high-end recreational activities like hunting and fishing in inaccessible areas. Their unique capability to transition between land and water without external modification positions them as indispensable assets where conventional vehicles fail, particularly in disaster response and exploration.

The core benefit driving market adoption is the unparalleled operational flexibility and enhanced safety provided in hostile or unstable environments. Amphibious ATVs reduce the logistical complexity associated with multi-terrain missions, enabling first responders and defense personnel to bypass damaged infrastructure or natural barriers efficiently. Furthermore, advancements in engine efficiency, payload capacity, and navigational aids have significantly broadened their utility beyond traditional military usage, making them attractive for commercial applications like surveying, pipeline inspection, and mining exploration in marshlands and coastal zones. The rugged design and relative ease of maintenance, compared to specialized watercraft or tracked earthmovers, further cement their value proposition in remote deployments.

Driving factors fueling the market growth include escalating global focus on disaster preparedness and response capabilities, necessitated by rising instances of extreme weather events and flooding worldwide. Governments and humanitarian agencies are actively investing in robust, reliable, and swift mobilization assets, positioning amphibious ATVs as key components of modern disaster management fleets. Additionally, defense modernization programs in several key regions are emphasizing multi-domain capabilities, increasing the demand for tactical, armored amphibious vehicles. The growing interest in rugged off-road recreation, particularly in North America and Europe, also contributes substantially to the consumer segment, seeking high-performance vehicles capable of tackling challenging wilderness excursions.

Amphibious ATVs Market Executive Summary

The Amphibious ATVs market is undergoing rapid evolution, driven by converging demands from the defense sector for enhanced tactical mobility and the civil sector for resilient disaster response mechanisms. Key business trends indicate a strong move toward electrification and hybrid propulsion systems to meet stringent environmental regulations and offer quieter operation, a crucial advantage in surveillance and recreational use. Manufacturers are also focusing on modular vehicle design, allowing for rapid customization for specific missions, ranging from heavy payload transport to advanced medical evacuation. Strategic alliances between niche ATV manufacturers and global defense contractors are becoming common, aimed at integrating sophisticated communication and sensor technologies into the vehicle platform. The competitive landscape remains highly specialized, though established defense companies are increasingly acquiring smaller innovators to capture technological expertise.

Regionally, North America maintains market dominance, primarily due to high adoption rates in the recreational segment and significant defense spending on advanced tactical vehicles. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, propelled by massive governmental investments in infrastructural development in regions susceptible to monsoons and coastal flooding, notably in India, China, and Southeast Asia. Europe's market growth is stable, supported by stringent environmental safety regulations requiring specialized equipment for wetland conservation management and offshore maintenance operations. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, driven by resource exploration activities in remote, often waterlogged or desert-adjacent areas.

Segment trends reveal that the 8x8 drive configuration continues to hold the largest market share due to superior stability, payload capacity, and performance across the widest range of difficult terrains. Within applications, the defense and security segment remains the most dominant and technologically advanced, often serving as the incubator for innovations later adopted by the civil market. However, the search and rescue (SAR) and commercial utility segments are experiencing disproportionately high growth, reflecting the immediate necessity for swift and effective deployment following natural calamities or in remote construction projects. The future trajectory suggests increased digitalization, with integrated GPS, remote diagnostics, and telematics becoming standard features across all vehicle classes, enhancing operational efficiency and proactive maintenance scheduling.

AI Impact Analysis on Amphibious ATVs Market

Common user questions regarding AI in the Amphibious ATVs market generally revolve around the feasibility and safety of autonomous operation across diverse fluid environments, the reliability of AI-driven predictive maintenance in remote conditions, and the potential for enhanced situational awareness through machine learning algorithms. Users are particularly concerned with how AI can manage the complex transition phases between land and water, predict structural integrity issues arising from water damage and corrosion, and optimize route planning to avoid unexpected obstacles both submerged and visible. The consensus expectation is that AI will initially be implemented to augment human operators through advanced decision support systems and sophisticated sensor fusion, rather than achieving complete Level 5 autonomy, addressing critical themes of safety, efficiency, and system reliability in mission-critical applications.

- AI integration enables sophisticated autonomous navigation and obstacle avoidance, particularly crucial for underwater or low-visibility operations.

- Predictive maintenance algorithms analyze sensor data (vibration, thermal, fluid dynamics) to forecast mechanical failures, significantly extending operational lifespan and reducing downtime.

- Machine learning enhances mission planning by optimizing amphibious routes based on real-time environmental data (water current, tidal changes, land stability).

- AI-powered sensor fusion improves situational awareness for operators, combining radar, sonar, LIDAR, and thermal imaging into a single, comprehensive operational view.

- Autonomous fleet coordination utilizes AI to manage synchronized movements of multiple ATVs in large-scale rescue or military formations, maximizing efficiency.

- Deep learning models facilitate the rapid classification and identification of threats or victims during search and rescue missions across varied landscapes.

- AI assists in payload management and dynamic stability control, adjusting power delivery and suspension parameters instantly during high-speed transitions between water and land.

DRO & Impact Forces Of Amphibious ATVs Market

The Amphibious ATVs Market is strongly influenced by several systemic forces. Key drivers include increasing defense modernization initiatives requiring multi-domain operational capacity, coupled with the rising global incidence of natural disasters necessitating rapid response vehicles capable of operating in flooded or inaccessible areas. Restraints primarily involve the high initial procurement costs associated with these highly specialized, complex machines and ongoing maintenance requirements, which can deter smaller commercial entities or local governments. Opportunities lie significantly in developing lightweight, electric-powered models for noise-sensitive applications and expanding penetration into niche commercial sectors such as specialized agriculture, environmental monitoring, and renewable energy infrastructure maintenance. The primary impact force remains governmental policy and defense budget allocation, which dictates the scale and speed of adoption, particularly for high-specification, high-cost armored variants, thereby shaping technological advancements and market size.

Segmentation Analysis

The Amphibious ATVs market is comprehensively segmented based on various technical specifications and end-use applications, providing clarity on operational trends and market demand patterns. Primary segmentation includes the vehicle's drive type, defining its operational stability and capacity; the specific application or end-user sector, highlighting key demand centers like defense versus recreation; the type of terrain most frequently navigated, influencing material selection and specialized features; and the propulsion mechanism utilized for water travel, impacting speed and efficiency. This detailed breakdown aids manufacturers in tailoring vehicle specifications to precise customer requirements and helps investors understand the areas of highest growth potential, particularly the rising demand for mid-range utility vehicles suitable for both SAR and utility tasks.

- By Drive Type

- 8x8

- 6x6

- 4x4

- Others (Tracked/Hybrid)

- By Application

- Defense and Security

- Search and Rescue (SAR)

- Recreational

- Commercial Utility (Oil & Gas, Mining, Agriculture)

- By Terrain

- Water

- Swamp/Marshland

- Snow/Ice

- Desert/Sand

- By Propulsion Type

- Skid Steering (Tire/Track Tread)

- Propeller Driven

- Jet Propulsion

Value Chain Analysis For Amphibious ATVs Market

The value chain for the Amphibious ATVs market initiates with the upstream analysis, focusing heavily on specialized raw material sourcing and component manufacturing. This stage is crucial due to the stringent requirements for corrosion resistance, lightweight structural integrity, and high durability imposed by the multi-terrain operating environment. Key components include specialized marine-grade aluminum or composite materials for the hull, high-performance engines (often customized diesel or robust gasoline variants), advanced transmission systems capable of driving both wheels/tracks and aquatic propulsion mechanisms, and sophisticated sensor packages for navigation. Manufacturers often face logistical challenges in securing proprietary components like sealed bearing systems and custom-engineered tires, requiring strong, long-term relationships with Tier 1 component suppliers who can guarantee military-grade specifications and consistent quality control.

The core manufacturing and assembly stage involves high-precision engineering, where complex integration of land-based automotive technologies and marine propulsion systems occurs. Due to the low-volume, high-specification nature of the product, manufacturing is often less automated than mass-market automotive production. Downstream analysis encompasses the complex distribution and aftermarket support structure. For defense and SAR applications, distribution is typically direct through government tenders and specialized contract sales, requiring comprehensive logistical support, training, and long-term maintenance contracts. Conversely, recreational and light commercial ATVs utilize indirect distribution through established dealer networks and specialty off-road equipment retailers, who must possess specific technical expertise regarding amphibious operation and necessary regulatory compliance.

Effective management of the distribution channel, encompassing both direct sales for governmental contracts and indirect channels for civilian use, is critical for market penetration and sustaining customer satisfaction. Direct sales require expert technical consultation and extensive post-sales technical support to ensure compliance with mission requirements. Indirect channels rely on robust dealership training and inventory management to showcase the vehicle’s dual capabilities effectively. Furthermore, the provision of timely aftermarket services, including spare parts availability for remote locations and specialized repair services to address potential water damage or hull integrity issues, forms a critical competitive differentiator, directly influencing total cost of ownership and long-term customer loyalty within this highly demanding niche market.

Amphibious ATVs Market Potential Customers

The potential customer base for Amphibious ATVs is highly diverse, categorized primarily by their need for mobility in challenging, transitional environments. The largest and most demanding segment comprises government defense and military organizations globally, which require these vehicles for reconnaissance, rapid troop deployment, perimeter patrolling, and tactical support in coastal, riverine, or marshy terrains. These customers prioritize armored protection, high payload capacity, stealth features, and seamless integration with existing command and control infrastructure. Furthermore, national and regional emergency services, including fire departments, coast guards, and federal emergency management agencies, represent critical end-users, requiring durable vehicles capable of accessing disaster zones cut off by flooding or debris, prioritizing speed, reliable communication systems, and high visibility features for rescue operations.

Beyond the defense and safety sectors, the commercial utility segment is rapidly expanding its adoption of amphibious ATVs. Industries such as oil and gas, particularly for maintaining pipelines and drilling infrastructure in inaccessible wetlands and swamps, rely on these vehicles to transport personnel and specialized tools efficiently without damaging fragile ecosystems. Similarly, the mining and exploration sectors utilize these vehicles for geological surveying and accessing remote mineral deposits often located in challenging landscapes. These commercial buyers prioritize low operating costs, high fuel efficiency, ease of maintenance, and the ability to operate continuously for long shifts, often favoring simpler, high-durability 6x6 or 8x8 configurations optimized for heavy lifting rather than high speed.

Finally, the recreational and individual consumer market forms a significant, high-growth segment, particularly in regions like North America and Northern Europe where robust outdoor cultures thrive. Enthusiasts utilize these ATVs for hunting, fishing, extreme off-roading, and accessing secluded cabins or wilderness retreats that are otherwise unreachable by standard vehicles. This demographic values personalized customization, aesthetic appeal, ease of transportability, and superior performance characteristics in extreme conditions, often driving demand for lightweight, powerful, and aesthetically advanced models. Manufacturers are increasingly catering to this sector by offering user-friendly controls, integrated entertainment systems, and a wide array of aftermarket accessories, thereby broadening the market appeal beyond strictly industrial or defense applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million USD |

| Market Forecast in 2033 | $910 Million USD |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Argo ATVs, Polaris Industries Inc., BAE Systems, ST Engineering, L3Harris Technologies, Textron Systems, NorSea Group AS, Wetland Equipment Company, E. K. Barnes, Mudd-Ox, MAX Amphibious ATVs, GIBBS Sports Amphibians, Lockheed Martin, DRDO (India), General Dynamics Land Systems, Hovertechnics, Marsh Buggies Inc., Advanced Integrated Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amphibious ATVs Market Key Technology Landscape

The technological evolution within the Amphibious ATVs market is rapidly shifting toward enhancing operational efficiency, minimizing environmental impact, and improving survivability across diverse terrains. A fundamental technological focus is on material science, specifically the utilization of lightweight, high-strength composite materials and marine-grade alloys in hull construction. This allows for reduced overall vehicle weight, significantly improving buoyancy and maximizing payload capacity without compromising structural integrity or corrosion resistance. Furthermore, advanced engine technology, particularly the deployment of compact, high-torque diesel and gasoline engines compliant with Tier 4 emission standards, is crucial. The emerging trend of hybrid and full-electric powertrains is gaining momentum, offering reduced acoustic signatures vital for military surveillance and enhanced operational range stability through optimized energy management systems.

Another critical area of development involves sophisticated propulsion and transition systems designed to manage the shift between land and water seamlessly. Many modern amphibious vehicles are moving beyond reliance solely on tire tread for water propulsion, integrating dedicated marine systems such as jet pumps or retractable propellers, significantly boosting on-water speed and maneuverability. Simultaneously, advanced suspension and track systems are being developed to distribute weight optimally across soft terrains like snow and mud, often employing hydro-pneumatic suspension to allow for rapid ground clearance adjustments. This technological refinement ensures maximum traction and prevents the vehicle from becoming mired, a common operational failure point in challenging marsh environments, ultimately broadening the vehicle's versatility across varied missions.

Furthermore, the integration of advanced digital technologies, aligning with the concept of the connected vehicle, is profoundly shaping the market. This includes the incorporation of sensor fusion technology—combining data from GPS, inertial measurement units (IMUs), multi-spectral cameras, and sonar—to provide comprehensive 360-degree situational awareness, particularly essential for navigating murky water or zero-visibility conditions. Telematics and remote diagnostics capabilities allow operators to monitor vehicle health and location in real-time, crucial for fleet management in large-scale rescue operations. Looking forward, the adoption of drive-by-wire controls and increasing levels of semi-autonomous operation, powered by AI algorithms for route optimization and hazard detection, are expected to become standard features in high-end, military-grade amphibious platforms, dramatically reducing operator fatigue and improving mission success rates.

Regional Highlights

- North America: This region holds the largest market share, driven significantly by the robust recreational vehicle market and substantial defense procurement contracts. The vast wilderness areas, coupled with a high disposable income and strong cultural affinity for outdoor activities, fuel demand for high-performance civilian ATVs. Military modernization efforts, particularly within the US Army and Marine Corps, emphasize rapid mobility in littoral and riverine environments, ensuring sustained investment in advanced 8x8 and armored amphibious platforms.

- Asia Pacific (APAC): Expected to be the fastest-growing market, primarily due to intense infrastructural development activities near coastlines and river deltas, particularly in China, India, and Indonesia. High susceptibility to monsoons, coastal flooding, and tsunamis necessitates significant government investment in SAR and disaster relief fleets, offering vast opportunities for commercial utility and emergency response vehicle suppliers.

- Europe: Characterized by stable growth, the European market is focused on specialized applications such as environmental conservation management in wetlands, maintenance of offshore wind farms, and precise governmental requirements for border security operations. Regulatory focus on low emissions and quiet operation favors the increasing adoption of electric and hybrid amphibious solutions across the continent.

- Latin America: Market growth is emergent, fueled by natural resource extraction activities (oil, gas, and mining) in complex environments like the Amazon basin and dense marshlands. Procurement is highly localized, often driven by the specific needs of large, privately-owned resource companies requiring specialized transport to bypass difficult jungle or water obstacles, alongside governmental needs for flood response.

- Middle East and Africa (MEA): This region shows potential, driven primarily by ongoing defense spending on border surveillance equipment and the need for utility transport in oil exploration zones, which often involve difficult transitions between arid landscapes and coastal swamps. The unique combination of desert and littoral environments requires highly specialized vehicles capable of handling extreme temperatures and varied density terrains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amphibious ATVs Market.- Argo ATVs (A Division of ODG)

- Polaris Industries Inc.

- BAE Systems

- ST Engineering

- L3Harris Technologies

- Textron Systems

- NorSea Group AS

- Wetland Equipment Company

- E. K. Barnes

- Mudd-Ox

- MAX Amphibious ATVs

- GIBBS Sports Amphibians

- Lockheed Martin

- DRDO (India)

- General Dynamics Land Systems

- Hovertechnics

- Marsh Buggies Inc.

- Advanced Integrated Technologies

- Hagglunds (A BAE Systems subsidiary)

- Tinger LLC

Frequently Asked Questions

Analyze common user questions about the Amphibious ATVs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Amphibious ATVs Market?

The market is primarily driven by escalating global investments in disaster preparedness and response infrastructure, coupled with continuous modernization of military and defense fleets requiring multi-domain mobility capabilities, particularly in flood-prone and inaccessible coastal regions.

Which drive type configuration dominates the Amphibious ATVs segment?

The 8x8 drive type configuration typically dominates the market. It offers the best combination of stability, payload capacity, and operational performance across the most challenging and varied terrains, making it preferred for both military and heavy commercial utility applications.

What are the main technological innovations impacting Amphibious ATVs?

Key technological innovations include the integration of hybrid and electric propulsion systems for quiet operation and reduced emissions, the use of advanced lightweight composite materials for enhanced buoyancy, and sophisticated sensor fusion systems that enable semi-autonomous navigation and superior situational awareness.

How do high maintenance costs affect market adoption?

High maintenance costs, primarily associated with required corrosion control, specialized parts, and complex system integration, act as a restraint, particularly for smaller commercial entities and individual recreational buyers, influencing their Total Cost of Ownership (TCO) calculation.

Which geographical region exhibits the highest projected growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest projected growth rate, driven by extensive government investment in coastal defense, disaster mitigation infrastructure, and large-scale industrial activities across its numerous river deltas and flood-vulnerable zones.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager