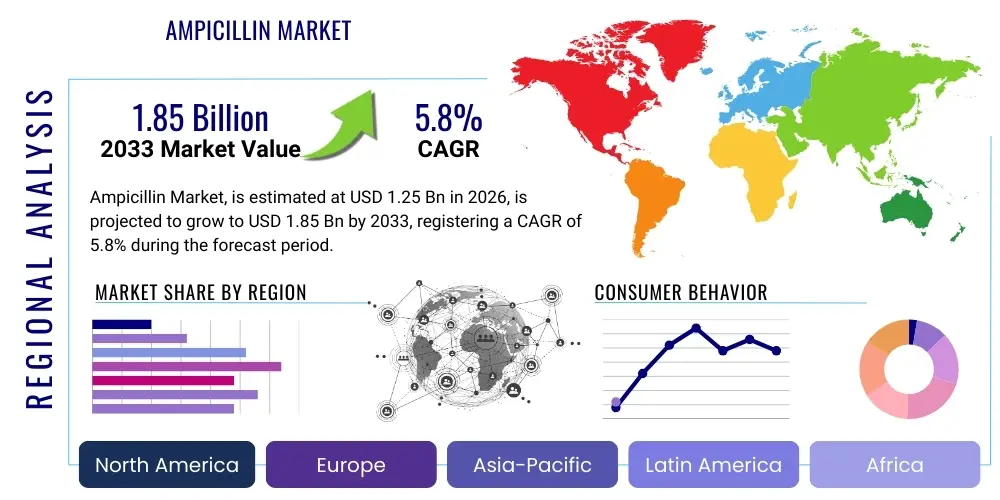

Ampicillin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436847 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ampicillin Market Size

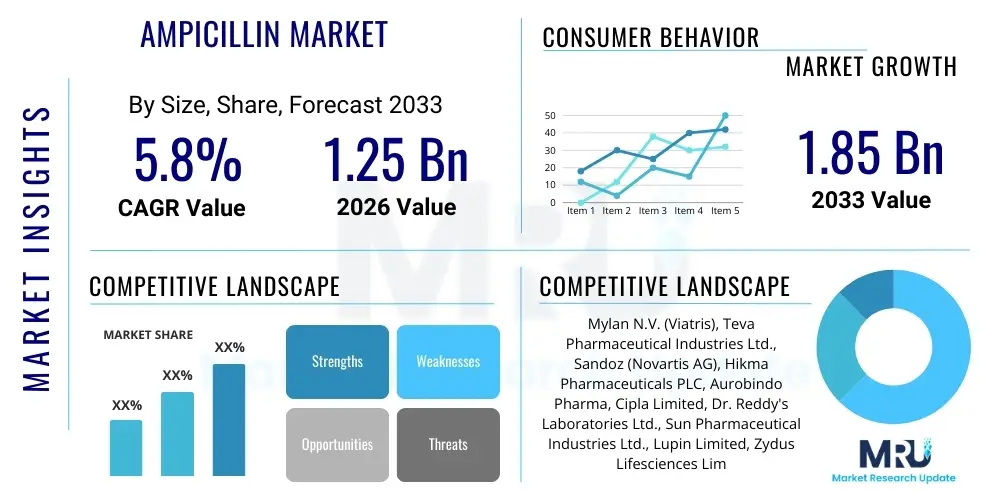

The Ampicillin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the sustained global prevalence of bacterial infections susceptible to aminopenicillins, especially in developing economies where access to essential medicines like ampicillin remains a critical public health priority.

The valuation of the ampicillin market reflects its status as a cornerstone in therapeutic regimens for conditions such as respiratory tract infections, urinary tract infections, and specific types of meningitis. Despite the continuous emergence of newer, broader-spectrum antibiotics, ampicillin maintains significant market share due to its established efficacy, favorable cost profile, and inclusion in essential medicines lists mandated by international health organizations. Furthermore, the rising geriatric population globally, which is inherently more susceptible to bacterial infections, contributes substantially to the increasing demand for effective first-line antibiotics.

Future growth projections incorporate an analysis of evolving healthcare infrastructure, particularly the investment in hospital and clinical settings across Asia Pacific and Latin America. While antibiotic resistance remains a significant constraint, the market sustains its momentum through fixed-dose combinations (FDCs) containing beta-lactamase inhibitors, such as ampicillin/sulbactam, which broaden the therapeutic utility and counteract resistance mechanisms, thereby ensuring its continued relevance in modern clinical practice and driving incremental revenue growth over the forecast horizon.

Ampicillin Market introduction

Ampicillin is a beta-lactam antibiotic belonging to the aminopenicillin class, widely utilized for treating a broad spectrum of bacterial infections. It acts by inhibiting bacterial cell wall synthesis, leading to bactericidal effects against both Gram-positive and specific Gram-negative organisms. Market growth is structurally supported by its application in treating common diseases such as otitis media, sinusitis, bronchitis, and septicemia, offering a reliable, cost-effective therapeutic solution, especially in resource-constrained environments globally. The product's stability and efficacy in various formulations, including oral capsules, suspension, and parenteral injections, ensure its broad applicability across diverse patient demographics and treatment settings.

Major applications of ampicillin span institutional and outpatient care, focusing heavily on empirical treatment regimes before specific pathogen identification, particularly in community-acquired infections. The inherent benefits of ampicillin include its proven safety profile, low production cost compared to patented third or fourth-generation antibiotics, and extensive clinical history dating back decades, which simplifies its deployment in standardized treatment protocols worldwide. This historical integration within global pharmacopeia solidifies its position as an indispensable agent in managing infectious diseases, ensuring consistent demand from governmental procurement agencies and large hospital networks.

Key driving factors accelerating the ampicillin market include the increasing global burden of infectious diseases, improvements in diagnostic capabilities leading to faster prescription rates, and substantial investment in healthcare infrastructure in emerging economies. Moreover, the strategic promotion of combination therapies like ampicillin with sulbactam, which mitigates resistance concerns stemming from beta-lactamase production, enhances its longevity and therapeutic scope. These dynamics, coupled with robust generic drug manufacturing capacities in regions like India and China, ensure steady supply and competitive pricing, fostering widespread accessibility and driving overall market volume.

Ampicillin Market Executive Summary

The Ampicillin Market is characterized by stable demand driven by the persistent global incidence of bacterial infections, counterbalanced by increasing concerns regarding antimicrobial resistance (AMR). Business trends indicate a strong reliance on generic manufacturing, with major pharmaceutical companies focusing on developing fixed-dose combinations (FDCs) to extend the drug's patent life and utility. Investment in quality control and supply chain robustness is paramount, particularly for parenteral formulations used in critical care settings. The market exhibits high fragmentation, dominated by manufacturers in Asia Pacific capitalizing on low operating costs and high-volume production, creating intense pricing pressure globally and ensuring high accessibility across diverse economic strata.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, largely due to its immense population base, high prevalence of infectious diseases, and expanding public health expenditure. North America and Europe, while mature, maintain significant market share, driven primarily by high-value combination products and stringent regulatory requirements ensuring quality supply. Emerging markets in Latin America and the Middle East and Africa (MEA) are witnessing accelerated growth, fueled by improving healthcare access and government initiatives prioritizing the availability of essential antibiotics, often sourced through large international tenders and bulk purchasing agreements.

Segmentation trends reveal that the capsule and tablet formulations dominate the market volume, preferred for outpatient treatment of mild to moderate infections. However, the injectable segment (powder for injection) holds a significant value share due to its necessity in treating severe systemic infections and hospital-acquired conditions. Furthermore, the human application segment remains overwhelmingly large compared to veterinary applications, though the latter also exhibits steady growth tied to livestock health management. Combination products featuring beta-lactamase inhibitors are experiencing faster value growth, reflecting clinical efforts to overcome prevailing resistance challenges and preserve the therapeutic relevance of the ampicillin core molecule.

AI Impact Analysis on Ampicillin Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ampicillin market primarily revolve around three core themes: optimizing manufacturing processes, enhancing surveillance for resistance patterns, and accelerating the discovery of novel synergistic drug combinations. Users frequently ask if AI can lower the already competitive manufacturing costs further or if it can help prolong the effective life of existing antibiotics like ampicillin by predicting effective treatment strategies. The consensus expectation is that AI will not fundamentally change the demand for a generic cornerstone drug but will dramatically improve the efficiency of its production, distribution logistics, and clinical deployment strategies. Specifically, AI-driven diagnostics and clinical decision support systems (CDSS) are expected to rationalize antibiotic use, thereby mitigating overuse and potentially slowing the development of resistance against common antibiotics.

AI's role in drug development, though typically focused on novel molecules, extends to existing compounds like ampicillin through computational chemistry and predictive modeling. AI algorithms can be utilized to screen for compounds that, when combined with ampicillin, offer significantly enhanced efficacy or overcome specific resistance mechanisms that current inhibitors fail to address completely. This 'repurposing' or 'enhancing' approach is crucial for maintaining the utility of older, proven antibiotics. Furthermore, in pharmaceutical manufacturing, predictive maintenance, quality control checks using machine vision, and optimized supply chain routing driven by AI can reduce wastage, minimize batch contamination risks, and ensure timely availability, particularly in complex global distribution networks.

In clinical practice, AI systems are beginning to analyze vast datasets of patient microbiological profiles and resistance test results, providing clinicians with real-time recommendations for appropriate antibiotic selection, dosing adjustments, and duration of therapy. For ampicillin, which is often used empirically, AI can more accurately predict the local probability of resistance based on current epidemiological data, thus guiding the decision of whether to use ampicillin alone or in combination. This application of AI serves as a powerful tool in antimicrobial stewardship programs, ensuring that essential drugs like ampicillin remain effective for as long as possible, optimizing patient outcomes while conserving drug longevity.

- AI optimizes large-scale generic manufacturing and predictive maintenance, reducing operational costs.

- Machine learning algorithms enhance epidemiological surveillance, tracking ampicillin resistance patterns globally.

- AI accelerates the identification of novel synergistic combinations (e.g., new beta-lactamase inhibitors) with ampicillin.

- Clinical decision support systems (CDSS) improve antibiotic prescribing practices and reduce irrational ampicillin use.

- AI models forecast demand fluctuations and optimize complex global supply chain logistics for raw materials and finished goods.

DRO & Impact Forces Of Ampicillin Market

The dynamics of the Ampicillin Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. Key drivers include the persistently high global incidence of bacterial infections, especially in densely populated emerging regions, coupled with the proven efficacy, safety, and low cost of ampicillin relative to patented alternatives. Regulatory bodies globally endorse ampicillin as an essential medicine, promoting its subsidized distribution and bulk procurement, which maintains consistent, high-volume demand. Furthermore, growing public health initiatives aimed at improving primary care access, particularly in rural and underserved areas, significantly bolster the utilization of foundational antibiotics like ampicillin.

However, significant restraints temper the market's explosive growth. The primary constraint is the widespread and accelerating issue of Antimicrobial Resistance (AMR), particularly the prevalence of beta-lactamase-producing bacteria, which renders standard ampicillin ineffective in many settings. Regulatory scrutiny concerning environmental contamination from antibiotic manufacturing wastewater also imposes compliance costs and operational restrictions on producers. Additionally, intense price competition, stemming from a highly fragmented generic market, compresses profit margins, discouraging substantial investment in formulation improvements or specialized research related to the molecule.

Opportunities for growth lie primarily in the development and marketing of fixed-dose combination products, notably ampicillin/sulbactam, which successfully overcome common resistance mechanisms and command higher prices and margins. There is a burgeoning opportunity in leveraging advanced drug delivery systems to improve patient compliance and bioavailability, such as sustained-release oral formulations. Finally, the expanding veterinary segment, driven by global demand for high-quality livestock and stringent disease control measures in agriculture, presents a secondary growth avenue for ampicillin and its derivatives, diversifying revenue streams away from purely human consumption.

Segmentation Analysis

The Ampicillin Market is extensively segmented based on formulation, application, distribution channel, and geography, allowing for precise market analysis tailored to clinical and commercial needs. Understanding these segments is crucial for stakeholders to identify key growth pockets and adapt supply chain strategies. The segmentation highlights the bifurcation between high-volume, low-margin oral products and lower-volume, higher-value parenteral products essential for acute hospital care, illustrating the diverse therapeutic roles ampicillin fulfills in the global healthcare system. This structure enables manufacturers to specialize in either bulk API production or final dosage form manufacturing and distribution.

By formulation, the market is typically divided into injectables, capsules/tablets, and oral suspensions. Injectable formulations are critical for severe infections requiring rapid, high-concentration systemic delivery, ensuring their high value share despite lower unit volume. Conversely, oral solid dosage forms (capsules and tablets) drive the majority of the unit volume, catering to outpatient treatment and representing the highest accessibility segment. Oral suspensions are vital for pediatric populations and patients with dysphagia, necessitating specific formulation expertise to ensure palatability and stability.

In terms of application, the human therapeutics segment dominates, covering a vast array of infections including respiratory, gastrointestinal, skin and soft tissue, and urinary tract infections. The veterinary segment, while smaller, is growing steadily, driven by the need for infection control in poultry, swine, and cattle farming to ensure food safety and animal welfare. Geographic segmentation reveals regional disparities in usage patterns, influenced by local resistance profiles, healthcare expenditure, and regulatory approval processes, requiring tailored marketing and distribution strategies for optimal market penetration.

- By Formulation

- Injectable (Powder for Injection)

- Oral Solid Dosage (Capsules, Tablets)

- Oral Suspension/Syrup

- By Application

- Human Therapeutics (Respiratory Tract Infections, Urinary Tract Infections, Meningitis, Septicemia, others)

- Veterinary Medicine (Livestock, Companion Animals)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies and Drug Stores

- Online Pharmacies

Value Chain Analysis For Ampicillin Market

The Ampicillin market value chain begins with upstream activities focused on the procurement and synthesis of the Active Pharmaceutical Ingredient (API). This stage involves securing raw materials, primarily 6-aminopenicillanic acid (6-APA), derived through biochemical processes. Upstream stability is critical, as fluctuations in the supply or purity of 6-APA directly impact final drug manufacturing costs and quality. Major API suppliers, primarily located in cost-effective manufacturing hubs in India and China, form the base of the chain, engaging in complex chemical synthesis and purification processes to produce high-grade ampicillin trihydrate or sodium salt required for various finished product formulations.

The midstream process involves formulation and packaging. Manufacturers convert the API into final dosage forms—injectables, capsules, or suspensions—a step requiring specialized facilities compliant with Good Manufacturing Practices (GMP). Due to ampicillin's relatively low profit margin, efficiency and large-scale operation are paramount at this stage. Direct distribution channels involve large pharmaceutical companies selling bulk finished goods directly to national health systems, large hospitals, or global procurement agencies like WHO and UNICEF, often through long-term tender contracts. These direct relationships emphasize volume and price negotiation efficiency, minimizing intermediary costs and ensuring timely supply to public health programs.

Downstream activities center on distribution, sales, and end-user access. Indirect distribution predominantly relies on wholesalers and regional distributors who manage inventory and deliver to retail pharmacies, smaller clinics, and local hospitals. These intermediaries provide essential coverage in fragmented markets, handling regulatory compliance for specific regions and managing fragmented demand. The final consumption occurs at institutional settings (hospitals, clinics) and outpatient settings (retail pharmacies), where market penetration and accessibility are key performance indicators. The efficiency of this downstream network, particularly in emerging markets, directly impacts the availability of ampicillin to the patient population, underscoring the importance of robust cold chain logistics for injectable forms.

Ampicillin Market Potential Customers

Potential customers for the Ampicillin Market are diverse, encompassing institutional buyers, direct government procurement agencies, and individual retail consumers, all seeking effective and affordable treatment for bacterial infections. The largest consumer base comprises hospitals, both private and public, which utilize ampicillin extensively in emergency rooms, general wards, and critical care units for both prophylactic use and the treatment of confirmed or suspected infections. These institutional buyers focus on bulk purchasing, reliable supply chains, and adherence to established formularies, making them high-volume, continuous customers for manufacturers of injectable ampicillin and ampicillin/sulbactam combination products.

Government agencies and non-governmental organizations (NGOs), such as national health services, international aid bodies, and military medical services, represent another critical customer segment. These entities frequently procure ampicillin through large-scale international tenders to supply essential medicines programs, especially in low- and middle-income countries. Their purchasing criteria are heavily weighted towards price, quality assurance (pre-qualification status), and the manufacturer's ability to fulfill massive, time-sensitive delivery orders. This segment drives significant market volume, emphasizing the importance of competitive pricing and global regulatory compliance for manufacturers targeting essential medicines lists.

The third major segment consists of retail pharmacies and drug stores, which serve individual consumers requiring oral formulations for community-acquired infections prescribed by general practitioners. These purchases are driven by patient access, prescription volume, and local insurance coverage. Finally, veterinary clinics and agricultural livestock managers form a distinct, specialized customer base. They purchase ampicillin formulations specifically designed for animal health, driven by factors related to livestock management protocols, disease outbreaks, and regulatory guidelines on antibiotic use in food production animals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mylan N.V. (Viatris), Teva Pharmaceutical Industries Ltd., Sandoz (Novartis AG), Hikma Pharmaceuticals PLC, Aurobindo Pharma, Cipla Limited, Dr. Reddy's Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Lupin Limited, Zydus Lifesciences Limited, Pfizer Inc., GlaxoSmithKline PLC (GSK), Merck & Co., Sanofi S.A., Bristol-Myers Squibb, Baxter International Inc., Fresenius Kabi AG, Intas Pharmaceuticals Ltd., Neon Laboratories Limited, Alkem Laboratories Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ampicillin Market Key Technology Landscape

The technology landscape surrounding the Ampicillin Market is primarily focused on optimizing manufacturing efficiency, improving drug stability, and enhancing delivery mechanisms, rather than fundamental drug discovery, given its off-patent status. A crucial technological area involves advanced API synthesis techniques, aiming to maximize purity and yield while minimizing hazardous byproducts, adhering to stricter environmental regulations imposed globally. Modern fermentation and chemical synthesis processes leverage sophisticated reactor design and continuous manufacturing principles to reduce batch variation and achieve economies of scale, essential for maintaining competitiveness in a price-sensitive generic market. Furthermore, manufacturers utilize particle size reduction technologies, such as micronization, to enhance the dissolution rate and bioavailability of oral solid dosage forms, improving therapeutic efficacy and speed of onset.

Another significant technological focus is formulation science, specifically related to improving the stability of ampicillin, particularly in suspension and injectable forms. Ampicillin is inherently sensitive to hydrolysis, necessitating careful selection of excipients and buffers. Advanced lyophilization (freeze-drying) techniques are crucial for injectable ampicillin sodium, ensuring long-term shelf stability in hospital settings and minimizing the need for complex cold chain management during distribution. For oral suspensions, microencapsulation technologies are sometimes employed to mask the bitter taste, thereby improving pediatric compliance, while ensuring the drug remains stable until reconstitution by the end-user, addressing a significant patient adherence challenge.

The most strategically important technological development involves Fixed-Dose Combination (FDC) formulation techniques. Integrating ampicillin with beta-lactamase inhibitors like sulbactam requires specialized blending and granulation technologies to ensure homogeneity and consistent dose delivery of both active ingredients. Technologies ensuring extended or sustained release for specific formulations are also being explored, aiming to reduce dosing frequency, thereby improving patient convenience and therapeutic outcomes, particularly for chronic or recurrent infections. Overall, the technological evolution is centered on refining existing processes to achieve superior quality, cost-effectiveness, and enhanced clinical performance of this foundational antibiotic.

The manufacturing process for sterile injectable ampicillin requires rigorous adherence to aseptic processing techniques. Advanced isolator technology and Restricted Access Barrier Systems (RABS) are now standard in state-of-the-art facilities to minimize human intervention and drastically reduce the risk of microbial contamination during filling and finishing operations. This high level of sterilization technology is non-negotiable for products administered intravenously, directly impacting patient safety and regulatory compliance across mature markets. Furthermore, the integration of real-time quality assurance monitoring, utilizing process analytical technology (PAT), allows manufacturers to monitor critical quality attributes throughout the production cycle, enabling proactive adjustments and ensuring that every batch meets global pharmacopeia standards without relying solely on post-production testing.

In the realm of packaging and delivery, technological advancements focus on improving usability and safety. Prefilled syringes or vials with safety mechanisms are gaining traction, especially in institutional settings, to minimize dosage errors and reduce needle-stick injuries among healthcare workers. For oral products, advanced blister packaging technologies using materials with superior moisture and oxygen barrier properties are employed to extend the shelf life of highly hygroscopic ampicillin salts. These packaging innovations are vital for distribution in tropical and subtropical regions where high humidity can rapidly degrade the product. The overall technological landscape is defined by efficiency, stability engineering, and patient-centric delivery mechanisms, safeguarding the widespread utility of ampicillin.

Regional Highlights

- Asia Pacific (APAC)

APAC represents the largest and fastest-growing market for ampicillin globally. This dominance is attributable to the region's massive and rapidly increasing population, high incidence rates of infectious diseases, and expanding healthcare coverage, particularly in China and India. These two countries are not only massive consumers of antibiotics but also serve as the world's primary manufacturing hubs for Ampicillin API and finished generic formulations, leveraging low operating costs and immense manufacturing capacity. Government policies focused on improving public health access and controlling infectious outbreaks drive substantial bulk purchasing, ensuring continuous market growth. The high prevalence of community-acquired infections, combined with moderate antibiotic resistance rates compared to Western nations (though resistance is rising), ensures ampicillin remains a heavily prescribed, cost-effective treatment option across both rural and urban health systems.

The competitive landscape in APAC is extremely intense, characterized by domestic pharmaceutical giants vying for market share through aggressive pricing strategies. While volume consumption is exceptionally high, the revenue generated per unit is generally lower than in North America or Europe. Future growth will be significantly shaped by the adoption of combination therapies (ampicillin/sulbactam) to mitigate the escalating resistance threat. Furthermore, increasing investment in private healthcare and pharmacy chains across Southeast Asian countries, such as Indonesia and Vietnam, is facilitating wider access to prescription antibiotics, further consolidating APAC’s position as the global market leader.

- North America

The North American ampicillin market is characterized by high-value sales, driven primarily by the injectable combination product segment (ampicillin/sulbactam). While usage of ampicillin alone has declined due to high local prevalence of beta-lactamase-producing organisms, the combination therapy remains a standard of care for severe hospital-acquired infections. The market is mature, with stringent regulatory oversight from the FDA, ensuring high quality standards but also higher manufacturing and compliance costs. Pricing in this region is premium compared to other geographies, reflecting the sophisticated healthcare infrastructure and complex insurance reimbursement models.

Demand in the US and Canada is stable, driven by the geriatric demographic and high consumption in large hospital systems. The strategic focus for key players is on managing complex supply chains, minimizing shortages, and providing high-quality sterile injectable products. Antibiotic stewardship programs (ASPs) are highly influential in North America, promoting rational use and precise targeting, which influences prescription patterns away from empirical monotherapy and towards more targeted combination treatments when resistance is suspected. This careful prescribing maintains the clinical relevance of ampicillin within its specific indications, supporting sustained, albeit moderate, revenue streams.

- Europe

The European market for ampicillin shows varied dynamics across its sub-regions, with usage patterns strongly influenced by national healthcare policies and local resistance profiles. Western European nations generally exhibit similar trends to North America, focusing on injectable combination products and stringent stewardship, often limiting monotherapy to specific sensitive infections. The market benefits from centralized procurement in countries like the UK and France, ensuring bulk purchasing and controlled distribution, though pricing remains significantly regulated compared to the US.

In Eastern European countries, usage rates for generic, lower-cost oral ampicillin remain high due to greater economic constraints and varying levels of regulatory control over antibiotic prescribing. The European Medicines Agency (EMA) standards drive quality requirements across the continent, necessitating compliance from all suppliers. Key drivers include stable demand from institutional settings and the ongoing need for affordable first-line antibiotics, particularly in veterinary applications where regulation surrounding antibiotic use is increasingly becoming standardized across the European Union.

- Latin America (LATAM) and Middle East & Africa (MEA)

LATAM and MEA are emerging markets exhibiting rapid growth potential due to improving healthcare expenditure, expansion of medical infrastructure, and substantial investment in addressing infectious disease burdens. In LATAM, countries like Brazil and Mexico are major consumers, relying heavily on imported generic ampicillin products. Market penetration is often hampered by logistical challenges and economic instability, but strong public health demand ensures essential supply.

In MEA, the demand is significantly influenced by government procurement for public health initiatives and increasing urbanization leading to denser populations more susceptible to rapid infection transmission. African nations, in particular, rely heavily on low-cost oral and injectable ampicillin provided through international aid and essential medicines programs. The growth trajectory is steep, constrained primarily by inconsistent regulatory environments and challenges related to efficient distribution and combating counterfeit drugs, requiring robust supply chain authentication technologies for responsible market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ampicillin Market.- Mylan N.V. (Viatris)

- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis AG)

- Hikma Pharmaceuticals PLC

- Aurobindo Pharma

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Zydus Lifesciences Limited

- Pfizer Inc.

- GlaxoSmithKline PLC (GSK)

- Merck & Co.

- Sanofi S.A.

- Bristol-Myers Squibb

- Baxter International Inc.

- Fresenius Kabi AG

- Intas Pharmaceuticals Ltd.

- Neon Laboratories Limited

- Alkem Laboratories Ltd.

Frequently Asked Questions

Analyze common user questions about the Ampicillin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the Ampicillin Market growth?

The primary factor driving the Ampicillin Market growth is the sustained high global prevalence of bacterial infections, especially in emerging economies, coupled with its status as a highly effective, low-cost, and widely available essential medicine listed by international health organizations.

How does antimicrobial resistance (AMR) impact the future of ampicillin sales?

AMR, specifically beta-lactamase production, acts as the major restraint, leading to decreased efficacy of ampicillin monotherapy. However, this restraint is mitigated by the increasing demand for fixed-dose combinations (FDCs) like ampicillin/sulbactam, which ensures the drug's continued relevance and higher market value in the combination segment.

Which geographic region dominates the Ampicillin Market?

The Asia Pacific (APAC) region dominates the Ampicillin Market both in terms of production volume and consumption, driven by high population density, high infection rates, and the presence of major generic API and finished formulation manufacturers in countries like India and China.

What is the significance of the injectable segment in the Ampicillin Market?

While the oral segment accounts for the highest volume of units sold, the injectable segment (powder for injection) holds a significant value share because it is essential for treating severe, acute infections and systemic hospital-acquired conditions, commanding premium pricing and stringent quality requirements.

How is AI influencing the manufacturing of generic antibiotics like ampicillin?

AI is influencing ampicillin manufacturing by optimizing large-scale production processes, enabling predictive maintenance to reduce downtime, improving quality control via machine vision, and streamlining complex global supply chains to ensure cost-efficiency and timely delivery.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager