Anaerobic Treatment Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435750 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Anaerobic Treatment Technology Market Size

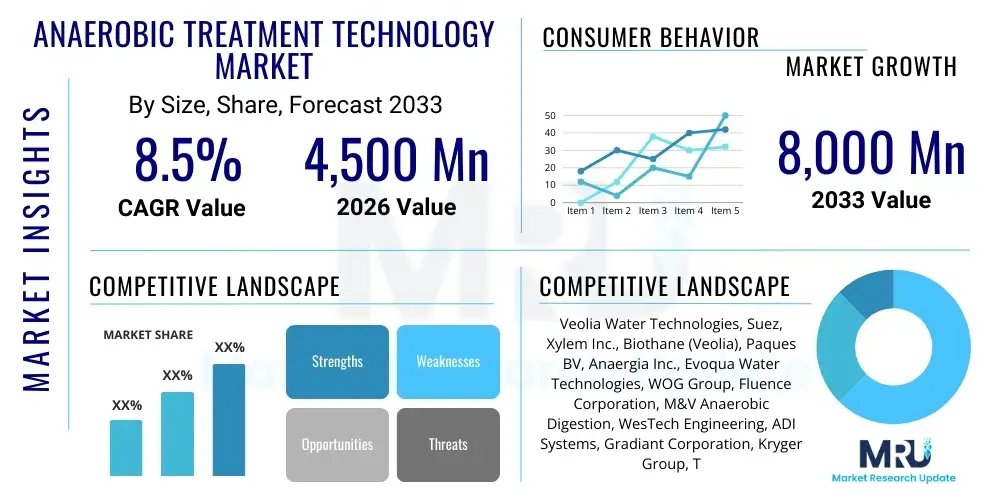

The Anaerobic Treatment Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Anaerobic Treatment Technology Market introduction

The Anaerobic Treatment Technology Market encompasses systems and processes designed to treat wastewater, sludge, and organic waste streams in the absence of oxygen, resulting in the stabilization of organic matter and the production of valuable biogas (methane). These technologies leverage diverse microbial communities housed within specialized reactors to break down complex organic pollutants into simpler compounds. The core product offering includes various reactor configurations such as Upflow Anaerobic Sludge Blanket (UASB), Expanded Granular Sludge Bed (EGSB), and Anaerobic Membrane Bioreactors (AnMBR). This market is fundamentally driven by the global imperative for sustainable water management, stricter environmental regulations concerning discharge limits, and the escalating demand for renewable energy sources derived from waste.

Major applications of anaerobic treatment span across high-strength industrial wastewater, municipal sewage treatment, and agricultural waste management. Industrial sectors like Food & Beverage (F&B), Pulp & Paper, and Chemical manufacturing generate effluent highly suited for anaerobic processes due to high Chemical Oxygen Demand (COD) concentrations. The technology offers significant benefits over conventional aerobic systems, primarily related to lower energy consumption—since aeration is not required—and the positive energy balance achieved through methane recovery. Furthermore, anaerobic processes generate substantially less excess sludge, drastically reducing sludge handling and disposal costs, which is a major operational expenditure for wastewater facilities worldwide.

Key factors driving market expansion include the increasing regulatory pressure in industrialized and developing nations to adopt circular economy principles, the rising cost of energy, and governmental incentives promoting biogas utilization. The shift towards decentralized wastewater treatment solutions, especially in geographically dispersed industrial parks, further accelerates the adoption of these compact and energy-efficient systems. Technological advancements, particularly in high-rate reactors and integration with advanced membrane filtration, are enhancing performance stability and broadening the scope of applicability for previously challenging waste streams, solidifying anaerobic treatment as a crucial element of modern sustainable infrastructure.

Anaerobic Treatment Technology Market Executive Summary

The Anaerobic Treatment Technology Market demonstrates robust growth, primarily fueled by the confluence of stringent environmental policies, increasing energy costs, and continuous technological innovation focusing on high-rate systems. Business trends indicate a strong move toward system integration, where anaerobic units are combined with aerobic or membrane processes to achieve extremely high effluent quality while maximizing biogas yield. Key players are strategically focusing on developing modular, scalable solutions tailored for small to medium enterprises (SMEs) within the industrial sector, alongside large-scale centralized municipal applications. The competitive landscape is characterized by intellectual property differentiation regarding granule formation and process automation, essential for maintaining reactor stability and efficiency under variable load conditions.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by rapid urbanization, industrialization, and significant government investment in new sanitation infrastructure, particularly in China and India. Europe maintains market leadership in terms of technological maturity and regulatory compliance, benefitting from the ambitious targets set by the European Union regarding renewable energy production and waste reduction mandates, making it a hub for advanced Anaerobic Digestion (AD) facilities. North America shows steady growth, primarily concentrated in the industrial sector, driven by industries seeking both environmental compliance and operational cost reduction through self-generated energy.

Segment trends underscore the dominance of the Industrial Wastewater Treatment application segment due to the concentrated nature and higher biogas potential of industrial effluent. Among reactor types, the Upflow Anaerobic Sludge Blanket (UASB) remains highly popular due to its operational simplicity and cost-effectiveness, especially in developing markets. However, the Expanded Granular Sludge Bed (EGSB) and Anaerobic Membrane Bioreactor (AnMBR) segments are exhibiting superior growth rates, reflecting the industry's focus on achieving higher loading rates, smaller footprints, and producing superior quality effluent necessary for water reuse schemes. The dual economic driver—waste mitigation and energy production—ensures sustained investment across all key market segments.

AI Impact Analysis on Anaerobic Treatment Technology Market

Common user questions regarding AI's impact on anaerobic treatment technology revolve around optimizing operational efficiency, predicting system failures, improving biogas yield prediction accuracy, and automating complex microbial community management. Users frequently ask: "How can AI reduce the risk of reactor souring or instability?" and "What is the return on investment for implementing AI-driven process controls?" The consensus themes are centered on transitioning from reactive maintenance to predictive process control, leveraging machine learning to interpret vast amounts of sensor data (pH, temperature, flow rates, volatile fatty acids) in real-time. This advanced data processing capability is expected to drastically improve stability, particularly when treating highly variable or toxic industrial waste streams, a traditional challenge for biological systems. Furthermore, expectations are high for AI models to accurately simulate different substrate combinations to maximize methane recovery, driving operational profitability.

- AI optimizes feed rate and mixing to maintain optimal microbial activity and stability.

- Predictive maintenance schedules are generated by AI analyzing sensor data, preventing catastrophic reactor failures.

- Machine learning algorithms enhance biogas production forecasting and quality control, maximizing energy recovery profitability.

- Advanced control systems use AI to quickly adjust pH and alkalinity, mitigating risks of acidification (souring).

- Image recognition coupled with AI monitors sludge granulation health and particle size distribution within the reactor.

- AI platforms integrate weather data and energy market prices to optimize the timing of biogas utilization or injection into the grid.

DRO & Impact Forces Of Anaerobic Treatment Technology Market

The dynamics of the Anaerobic Treatment Technology Market are shaped by powerful Drivers and opportunities related to sustainability and energy recovery, balanced against significant Restraints concerning high upfront capital costs and technical complexity. Regulatory frameworks globally are acting as major impact forces, pushing industries toward zero-liquid discharge and waste-to-energy models. The push for biogas and biomethane as substitutes for natural gas is a primary economic driver, transforming waste treatment from a cost center into a potential revenue stream, especially for large industrial producers. Conversely, the market must navigate challenges related to the sensitivity of anaerobic microbial cultures to toxic compounds and temperature fluctuations, requiring sophisticated control mechanisms which add to the overall system complexity and initial investment.

Specific market Drivers include the increasing global focus on the transition to circular economies, wherein wastewater resources are viewed as sources for energy, water, and nutrients. The high-rate capabilities of modern anaerobic systems allow for effective treatment within smaller footprints, making them attractive for urban and highly constrained industrial sites. Furthermore, ongoing research focusing on co-digestion—mixing various waste streams (e.g., municipal sludge and food waste)—is significantly enhancing biogas yield and stability, unlocking opportunities for centralized waste processing hubs. This synergy between diverse organic sources maximizes resource recovery potential and improves system economics.

However, major restraints include the perception of high initial capital expenditure (CAPEX) required for sophisticated anaerobic reactors and the operational expertise needed to manage the highly sensitive biological process, particularly the initiation and maintenance of healthy granular sludge. The opportunity landscape is robust, centered on the widespread adoption of Anaerobic Membrane Bioreactors (AnMBR) that bridge the gap between treatment quality and energy efficiency, and the development of modular, decentralized units suitable for small community or remote industrial applications. The overarching impact forces include regulatory shifts (e.g., carbon taxes, renewable energy mandates) and the fluctuating prices of natural gas, directly influencing the economic viability of biogas projects.

Segmentation Analysis

The Anaerobic Treatment Technology Market is comprehensively segmented based on technology type, application (end-user), and scale, reflecting the diversity of waste streams and treatment objectives globally. Segmentation by technology is crucial as it determines the hydraulic retention time (HRT), sludge retention time (SRT), and overall efficiency. Key reactor types range from simple, robust systems like Anaerobic Filters to advanced, high-rate technologies such as EGSB and AnMBR, each optimized for specific effluent strengths and volumes. Segmentation by application highlights the distinct requirements of municipal sewage treatment compared to various industrial waste streams, which often involve higher organic loads and unique inhibitory compounds, necessitating specialized system designs.

- Technology Type:

- Upflow Anaerobic Sludge Blanket (UASB)

- Expanded Granular Sludge Bed (EGSB)

- Anaerobic Filters (AF)

- Anaerobic Baffled Reactor (ABR)

- Anaerobic Membrane Bioreactor (AnMBR)

- Others (e.g., High-rate systems, Fluidized Bed Reactors)

- Application (End-User):

- Industrial Wastewater Treatment

- Food & Beverage (F&B)

- Pulp & Paper

- Chemical & Petrochemical

- Pharmaceutical

- Textile

- Others (e.g., Agricultural processing)

- Municipal Wastewater Treatment

- Agricultural Waste Management (Manure & Slurry)

- Industrial Wastewater Treatment

- Scale:

- Small-Scale (0–500 m³ capacity)

- Medium-Scale (500–5,000 m³ capacity)

- Large-Scale (Over 5,000 m³ capacity)

Value Chain Analysis For Anaerobic Treatment Technology Market

The value chain for Anaerobic Treatment Technology is characterized by highly specialized stages, beginning with upstream supply of materials and core components, moving through system integration and installation, and concluding with long-term operational services and downstream resource recovery. Upstream analysis involves the procurement of structural materials (steel, concrete for reactor construction), pumps, mixers, and crucial instrumentation and control (I&C) systems. Suppliers of biological additives, nutrients, and specialized seed sludge also form a critical component of the upstream ecosystem, ensuring the successful start-up and stability of the treatment facility. The quality and reliability of these upstream components directly impact the overall system lifetime and performance.

The midstream stage is dominated by specialized engineering, procurement, and construction (EPC) firms and technology licensors who design, build, and commission the reactors based on client specifications and waste characteristics. This stage requires deep expertise in hydraulics, microbiology, and process engineering. Distribution channels for the technology are predominantly direct, involving complex, tailored contracts between the technology provider/EPC firm and the end-user (municipal authority or industrial facility). Indirect channels may occasionally involve environmental consulting firms or regional distributors facilitating the sale of standardized or modular units to smaller industrial clients.

Downstream analysis focuses heavily on the outputs of the anaerobic process: treated effluent, stabilized sludge, and biogas. The monetization of biogas through purification (upgrading to biomethane), direct electricity generation, or thermal use constitutes the primary downstream revenue stream. Furthermore, the market is seeing an increasing focus on the recovery of nutrients (e.g., phosphorus, nitrogen) from the digestate, driving integration with specialized nutrient recovery technologies. Operational and maintenance services, including remote monitoring and biological process support, represent a significant and growing portion of the downstream value, ensuring the long-term efficiency and compliance of the installed base.

Anaerobic Treatment Technology Market Potential Customers

Potential customers for Anaerobic Treatment Technology are primarily large-scale entities facing significant wastewater treatment costs or regulatory obligations, coupled with a desire for energy independence and sustainable operations. The most prominent end-users are concentrated within the industrial sector, particularly those generating high-strength organic effluent. These include major companies in the food processing industry (e.g., breweries, dairies, starch producers) and the pulp and paper manufacturing sector, where wastewater contains high COD loads that are costly to treat aerobically and offer substantial biogas production potential. These industrial buyers prioritize systems that offer rapid payback through energy savings and compliance assurance.

Municipal authorities and water utilities represent another vital customer segment. While municipal sewage often has lower organic concentrations compared to industrial streams, the sheer volume, coupled with the need for sludge reduction and increasing pressure to transition treatment plants into resource recovery facilities (Water Resource Recovery Facilities), makes them significant buyers of anaerobic treatment technologies, especially high-rate digesters and co-digestion systems integrating municipal sludge with food waste. Additionally, large-scale agricultural operations, particularly concentrated animal feeding operations (CAFOs), are major buyers, utilizing these technologies to manage high volumes of manure, reduce greenhouse gas emissions, and generate renewable energy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,500 Million |

| Market Forecast in 2033 | USD 8,000 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Water Technologies, Suez, Xylem Inc., Biothane (Veolia), Paques BV, Anaergia Inc., Evoqua Water Technologies, WOG Group, Fluence Corporation, M&V Anaerobic Digestion, WesTech Engineering, ADI Systems, Gradiant Corporation, Kryger Group, Tomorrow Water, DMT Environmental Technology, Pureflow Inc., Martin GmbH, REMONDIS Aqua, GWE (Global Water Engineering) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anaerobic Treatment Technology Market Key Technology Landscape

The technology landscape for anaerobic treatment is highly dynamic, characterized by continuous innovation aimed at increasing treatment efficiency, stability, and the overall yield of high-quality biogas. Traditional technologies like the Upflow Anaerobic Sludge Blanket (UASB) remain foundational due to their reliability and cost-effectiveness for treating moderate-strength wastewater, especially in warm climates. However, the market growth is increasingly concentrated in high-rate reactor designs, such as the Expanded Granular Sludge Bed (EGSB) and the Internal Circulation (IC) reactor. These advanced systems utilize hydraulic forces to achieve superior mixing and mass transfer, supporting extremely high organic loading rates (OLR) and significantly reducing the physical footprint required for treatment plants, making them ideal for space-constrained industrial installations.

The most transformative technology in recent years is the Anaerobic Membrane Bioreactor (AnMBR). AnMBR integrates anaerobic digestion with membrane filtration (microfiltration or ultrafiltration) to completely decouple the sludge retention time (SRT) from the hydraulic retention time (HRT). This decoupling allows for the retention of slow-growing biomass, leading to exceptionally high effluent quality suitable for direct reuse, while simultaneously maintaining a high concentration of active microbes within the reactor. Although AnMBR systems typically have higher initial capital and operational costs associated with membrane maintenance, their benefits in terms of superior effluent quality and reduced sludge production are driving rapid adoption, particularly in regulated markets demanding high water reuse standards.

Beyond core reactor design, the technological landscape includes significant advancements in peripheral systems and control technologies. Specialized pretreatment steps, such as thermal hydrolysis and ultrasound, are being increasingly used to enhance the biodegradability of complex waste streams and sludge, thereby boosting biogas production. Furthermore, the integration of advanced sensors and computational fluid dynamics (CFD) modeling is optimizing reactor flow patterns and ensuring uniform temperature distribution, essential for maximizing microbial activity. The ongoing trend is towards digitization and smart reactors, where AI and machine learning are deployed to predict upsets and fine-tune operational parameters automatically, moving the technology toward autonomous operation.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth: APAC represents the largest and fastest-growing market, driven by rapid industrialization, population growth, and escalating water scarcity, particularly in China, India, and Southeast Asia. Governments in this region are heavily investing in wastewater infrastructure modernization and promoting policies that incentivize waste-to-energy projects to address severe pollution challenges. The region’s abundance of high-strength industrial effluent (e.g., palm oil, tapioca, textile manufacturing) makes it a prime candidate for anaerobic treatment.

- Europe’s Technological Leadership: Europe is characterized by strict environmental legislation (e.g., EU Water Framework Directive, renewable energy targets) and high maturity in terms of installed capacity and technology adoption. Countries like Germany, the Netherlands, and Denmark lead in implementing advanced anaerobic digestion, focusing intensely on biogas upgrading to biomethane for grid injection and vehicular fuel. High energy prices accelerate the economic viability of European waste-to-energy projects, maintaining the region's position at the forefront of AnMBR and advanced co-digestion research.

- North American Industrial Adoption: North America exhibits consistent market growth, primarily driven by the industrial sector (F&B, Pulp & Paper) seeking operational efficiencies and regulatory compliance. Adoption is characterized by a strong emphasis on economic returns through biogas utilization, often through combined heat and power (CHP) systems. The market is increasingly influenced by state-level policies and utility incentives promoting renewable natural gas (RNG) production, fueling investment in upgrading facilities.

- Latin America's Emerging Opportunities: Latin America shows significant potential, largely concentrated in Brazil, Mexico, and Chile, driven by the massive scale of agricultural processing (sugar, ethanol, meatpacking) wastewater. While infrastructure development faces financing challenges, the high organic load of industrial effluents in the region makes anaerobic treatment the most cost-effective and energy-efficient solution, favoring the deployment of robust UASB and EGSB systems.

- Middle East and Africa (MEA) Focus on Water Reuse: The MEA market, while smaller, is growing, particularly due to severe water stress requiring advanced treatment solutions for effluent reuse. The focus here is often dual: managing sludge and producing energy in water-scarce environments. Projects often involve integrated anaerobic systems designed to handle high temperatures and complex, varying organic loads characteristic of decentralized industrial facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anaerobic Treatment Technology Market.- Veolia Water Technologies

- Suez

- Paques BV

- Anaergia Inc.

- Xylem Inc.

- Evoqua Water Technologies

- GWE (Global Water Engineering)

- Biothane (A Veolia Company)

- DMT Environmental Technology

- Fluence Corporation

- WesTech Engineering

- ADI Systems

- Linde Engineering

- Grünbeck Wasseraufbereitung GmbH

- M&V Anaerobic Digestion

- Pureflow Inc.

- Tomorrow Water

- Kryger Group

- Martin GmbH

- REMONDIS Aqua

Frequently Asked Questions

Analyze common user questions about the Anaerobic Treatment Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Anaerobic Membrane Bioreactor (AnMBR) technology and why is it preferred over conventional UASB?

AnMBR is an advanced anaerobic system integrating membrane filtration to separate solid biomass from treated water. It is preferred over conventional UASB because it allows for complete retention of the active biomass (sludge), enabling higher organic loading rates, smaller reactor footprints, and producing superior quality effluent suitable for direct water reuse, though at a higher capital cost.

How does anaerobic treatment contribute to the circular economy?

Anaerobic treatment is central to the circular economy by converting waste materials (wastewater and sludge) into recoverable resources. It simultaneously produces clean effluent, reduces solid waste volumes, and generates biogas (renewable energy source), thereby closing the loop on water and energy use within industrial and municipal operations.

What are the primary factors affecting the operational stability and efficiency of an anaerobic reactor?

Operational stability is primarily affected by temperature fluctuations, rapid changes in organic loading rate (shock loads), and the presence of inhibitory substances such as heavy metals or high concentrations of volatile fatty acids (VFA). Maintaining pH within a narrow neutral range and ensuring the formation of healthy, dense granular sludge are crucial for high efficiency.

Which industry segment is the largest end-user of anaerobic treatment technology globally?

The Food and Beverage (F&B) industry segment is generally the largest industrial end-user globally. This is due to the consistently high organic content (COD) in F&B waste streams, which provides excellent potential for high biogas yield and favorable economics for investing in waste-to-energy anaerobic solutions to offset high processing energy demands.

What role does regulatory pressure play in driving market growth in the Anaerobic Treatment sector?

Regulatory pressure is a major market driver, specifically through stricter discharge limits for COD/BOD, mandates for sludge reduction, and governmental incentives/targets for renewable energy generation (biogas/biomethane). Compliance requirements force industrial and municipal entities to adopt high-efficiency, resource-recovering treatment methods like anaerobic digestion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager