Analog Timer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432024 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Analog Timer Market Size

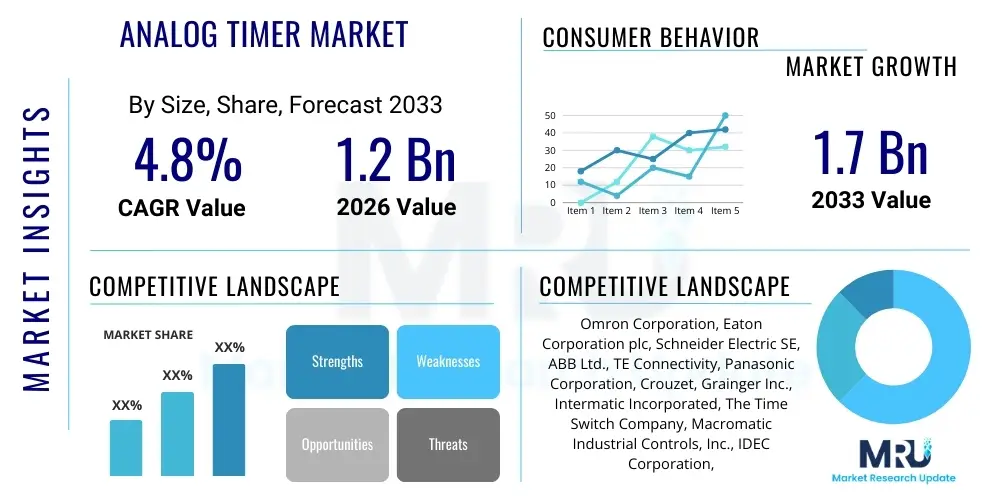

The Analog Timer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.7 Billion by the end of the forecast period in 2033. This steady growth trajectory is primarily driven by the consistent demand for reliable, cost-effective, and robust timing solutions in legacy industrial infrastructure and specific niche applications where simplicity and resilience to environmental factors outweigh the need for complex digital integration. While digital counterparts dominate high-end process control, analog timers maintain significant market share due to their ease of installation, maintenance, and exceptional durability, particularly in sectors such as HVAC, lighting control, and older manufacturing facilities requiring simple, repeatable time-delayed operations.

The stability of the analog timer market reflects its critical role in maintenance, repair, and overhaul (MRO) activities. Many industrial and commercial systems, installed decades ago, rely exclusively on analog timing mechanisms. When these components fail, immediate replacement requires compatible analog units, sustaining a strong, non-discretionary replacement market. Furthermore, the low cost of ownership and high operational reliability in electrically noisy environments make analog timers the preferred choice for applications where sophisticated programming is unnecessary. This inherent resilience against electromagnetic interference (EMI) is a major differentiating factor, ensuring their longevity in environments where digital systems might struggle with signal integrity.

Analog Timer Market introduction

The Analog Timer Market encompasses devices that utilize electromechanical, pneumatic, or basic electronic circuitry to provide time-delay functions, interval timing, or cyclical control without requiring complex digital processors or programming interfaces. These devices are fundamentally characterized by their mechanical setting methods, often featuring a knob, dial, or tactile adjustment mechanism, offering highly intuitive operation. Key products include electromechanical time switches, thermal timers, motor-driven timers, and pneumatic time-delay relays. They are essential components in automation systems, ensuring sequential operation of machinery, controlled energy usage, and safety interlocks across various industries. The primary benefits of analog timers include their inherent simplicity, high reliability, resistance to extreme temperatures and electrical noise, and long service life, making them foundational components in reliable control circuits.

Major applications of analog timers span the industrial, commercial, and residential sectors. In industry, they are critical for motor starting sequences (star-delta transitions), process heating control, and conveyor belt timing. Commercial applications frequently involve HVAC system sequencing, lighting control for optimizing energy consumption, and security system delays. Residential use, while increasingly migrating toward smart digital devices, still involves analog timers in appliances, pool pumps, and basic outdoor lighting schedules where set-it-and-forget-it functionality is valued. The driving factors sustaining this market include the growing demand for basic industrial automation in emerging economies, the consistent requirement for MRO replacements in developed markets, and the preference for rugged, non-software dependent control mechanisms in harsh operating environments.

The market also witnesses innovation focused on integrating analog reliability with enhanced features, such as improved timing accuracy and wider voltage range tolerance, without compromising the fundamental simplicity of the design. These timers serve as crucial building blocks in ensuring operational continuity, particularly in mission-critical, low-complexity control tasks. The ongoing expansion of manufacturing facilities globally, coupled with stringent safety standards requiring dependable interlocking mechanisms, continues to fuel the steady, albeit mature, growth of the analog timer segment.

Analog Timer Market Executive Summary

The Analog Timer Market Executive Summary highlights a mature market characterized by robust replacement demand and niche expansion into specialized industrial applications. Current business trends indicate a stabilization of market size following previous pressures from digital encroachment. Manufacturers are focusing on differentiating their offerings through improved precision, enhanced mechanical durability, and the introduction of hybrid analog-digital models that combine the tactile simplicity of analog setting with the extended functionality and accuracy of digital circuitry. The market remains highly competitive, driven by cost efficiency and long-term product reliability. Geographically, Asia Pacific (APAC) dominates the market due to accelerated industrialization and vast manufacturing infrastructure, generating strong demand for cost-effective timing controls, while North America and Europe primarily focus on MRO activities and high-specification replacements adhering to stringent regional standards.

Segment trends reveal that electromechanical timers still command the largest share, valued for their proven track record and straightforward design. However, there is a noticeable rise in solid-state analog timers which offer improved timing accuracy and reduced mechanical wear, bridging the performance gap towards purely digital solutions while retaining analog input simplicity. The end-user analysis shows that the industrial sector, particularly machine tools, process control, and material handling, remains the largest consumer base, prioritizing resilience and operational longevity. The construction and infrastructure sectors also contribute significantly, relying on these devices for phased electrical installations and safety sequence control. Strategic growth opportunities reside in offering ruggedized timers certified for hazardous or extremely high/low-temperature environments, catering to the specialized requirements of the oil & gas and chemical processing industries.

Overall, the market is structurally sound, supported by infrastructural inertia and the continuing need for reliable, maintenance-friendly control components. While digital transformation is pervasive, analog timers serve an essential function in the lower tiers of the automation pyramid, ensuring that foundational operations are executed reliably, regardless of complex network dependencies. Key stakeholders are prioritizing supply chain resilience and expanding distribution channels to effectively serve the geographically dispersed MRO demand base, guaranteeing component availability across various operational lifecycles of industrial equipment.

AI Impact Analysis on Analog Timer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Analog Timer Market primarily revolve around whether AI-driven predictive maintenance systems and the rise of smart factories will render these simple electromechanical devices obsolete. Users frequently question how low-cost, non-networked timers can coexist in an IoT-enabled environment and if they will eventually be entirely replaced by intelligent, programmable logic controllers (PLCs) or embedded digital systems communicating with central AI platforms. The core concern centers on the perceived lack of data generation and connectivity inherent in analog devices, suggesting they cannot contribute to the massive datasets required for effective AI-based process optimization or anomaly detection. Expectations, however, are shifting towards recognizing niche roles for analog timers, particularly where instantaneous, non-volatile control is required, or where the simple "dumb" reliability is considered an operational advantage over complex, software-dependent solutions, mitigating cybersecurity risks associated with networked control points. This analysis reveals a consensus that while AI drives complexity upwards, foundational reliability still necessitates simple, robust components.

AI's primary influence is indirect, forcing manufacturers to enhance the peripheral performance of analog timers rather than directly digitizing the core timing mechanism. For instance, in an AI-optimized production line, while the overall sequence is managed digitally, the final stage actuators or safety interlocks might still be controlled by analog timers for guaranteed robustness. AI algorithms, optimizing production schedules and energy usage, might dictate precisely when an analog timer is activated or deactivated, but the timer itself executes the command flawlessly based on its physical properties. Furthermore, AI-driven diagnostics in complex machinery might identify a failing analog timer far sooner than traditional methods, paradoxically increasing the demand for reliable, high-quality analog replacements, thereby streamlining the MRO supply chain based on predictive failure rates analyzed by AI models.

- AI drives integration of digital interfaces with rugged analog cores (Hybrid Timers).

- Predictive maintenance systems, powered by AI, forecast analog timer failure, boosting MRO efficiency and replacement volume.

- Analog timers maintain critical roles in safety interlocks where software failures or network latency cannot be tolerated, serving as reliable physical backups.

- Lack of connectivity is viewed as a security advantage in isolated control loops within highly networked smart factories.

- AI optimizes large-scale production schedules, increasing the overall utilization rate of equipment, thus raising the demand for durable, long-life analog components.

- AI analysis helps rationalize inventory management for analog components, ensuring timely supply for geographically dispersed assets.

DRO & Impact Forces Of Analog Timer Market

The dynamics of the Analog Timer Market are shaped by a classic interplay between durability and technological obsolescence. Drivers (D) include the persistent demand for reliable, high-tolerance components in electrically noisy industrial environments, the substantial volume of non-discretionary MRO replacement demand, and the intrinsic cost-effectiveness compared to programmable controllers for basic functions. Restraints (R) are dominated by the rapid advancement and proliferation of highly accurate digital timers and PLCs, which offer enhanced connectivity, remote diagnostics, and programming flexibility, pushing analog solutions out of new, complex automation projects. Furthermore, a perceived lack of standardization across manufacturers can complicate integration efforts in highly modern systems. Opportunities (O) emerge from developing niche, highly ruggedized timers for extreme environments (e.g., aerospace, heavy machinery), and the creation of hybrid products that offer simplified analog setting paired with digital accuracy and limited network communication capabilities. The impact forces acting upon the market determine the competitive intensity and profitability, reflecting buyer power in MRO segments and the threat posed by sophisticated digital substitutes.

Detailed Analysis of Drivers: Analog timers are celebrated for their simplicity of operation, requiring minimal training and possessing high tolerance for voltage fluctuations and harsh physical conditions like vibration and temperature extremes, making them ideal for legacy industrial settings and developing market applications. Their design ensures that they are not susceptible to software bugs, operating system updates, or cybersecurity threats, providing a level of robustness that digital systems often cannot match without significant cost investment. The vast installed base of industrial machinery globally necessitates a consistent supply of compatible analog replacements, sustaining market revenue primarily through the aftermarket. Moreover, in many basic control loops, the functionality provided by a simple analog timer is entirely sufficient, making the investment in complex digital controls economically unjustified, thus cementing the market position of the analog solution based purely on superior value proposition for specific tasks.

Detailed Analysis of Restraints: The primary restraint is the overwhelming market shift towards Industry 4.0, where connectivity and data acquisition are paramount. Analog timers lack the capability for remote monitoring, real-time data logging, and seamless integration into Supervisory Control and Data Acquisition (SCADA) or Manufacturing Execution Systems (MES). This absence of digital communication severely limits their utility in optimizing modern, data-driven production environments. Furthermore, digital timers offer superior timing accuracy (often measured in milliseconds versus the seconds/minutes of deviation possible in some electromechanical models) and greater flexibility in sequencing complex operations, which is increasingly required in high-precision manufacturing. The skills gap in maintaining legacy analog equipment versus standardized digital platforms also contributes to the preference for new digital installations.

Detailed Analysis of Opportunities: The specialization of analog timers represents the most fertile ground for future growth. Developing products specifically certified for hazardous locations (Class 1, Division 2 environments) or those with enhanced resistance to corrosive chemicals opens lucrative avenues in the oil & gas and specialty chemical processing sectors. Furthermore, the push for energy efficiency in buildings provides opportunities for specialized analog time switches integrated into simple, highly durable systems for decentralized HVAC and lighting management, particularly in older commercial buildings undergoing minimal retrofitting. Strategic alliances with original equipment manufacturers (OEMs) specializing in machinery destined for rugged environments, where system simplicity translates directly into reduced downtime risk, are also key avenues for expansion. The focus should be on "smart simplicity"—improving durability and reliability without adding unnecessary digital complexity.

Impact Forces (Based on Porter's Five Forces Model): The bargaining power of buyers is moderately high, especially in the MRO segment, where buyers are often price-sensitive and focused on immediate replacement availability. However, in niche industrial segments requiring specialized certifications, buyer power decreases due to the limited number of qualified suppliers. The bargaining power of suppliers is low to moderate, as the core components (relays, motors, springs) are standardized commodities, though proprietary manufacturing techniques for achieving high accuracy can increase supplier leverage. The threat of new entrants is low due to established supplier relationships and the necessity for specific industrial certifications, alongside the mature nature of the technology which offers slim margins for disruptive entry. The threat of substitutes (digital timers, PLCs) is high and constitutes the most significant competitive force, continually eroding the market share of analog devices in new installations. Finally, competitive rivalry among existing competitors is intense, focused primarily on price, durability specifications, warranty periods, and global distribution capabilities, particularly in the high-volume replacement market.

Segmentation Analysis

The Analog Timer Market is comprehensively segmented based on the mechanism of operation (Type), the specific purpose or function (Function), the duration they are designed to manage (Range), and the ultimate application environment (End-User). Segmentation allows for targeted marketing and product development, addressing the unique needs of different industrial and commercial applications. The market structure reflects the technological diversity within the analog category, ranging from simple electromechanical devices to more sophisticated solid-state components that mimic analog behavior. Understanding these segments is crucial for manufacturers to allocate resources effectively and capitalize on areas of resilient demand, such as specialized industrial control or high-volume MRO requirements where simplicity and durability are paramount selection criteria.

- By Type:

- Electromechanical Timers (Motor-driven, Cam timers)

- Pneumatic Timers (Air-damped mechanisms)

- Thermal Timers (Bimetallic strips)

- Solid-State Analog Timers (Using RC circuits or dedicated chips to emulate analog behavior)

- By Function:

- Delay-on Timers

- Delay-off Timers

- Interval Timers (One-shot timers)

- Cycle Timers (Repeat cycle timers)

- Time Switch/Schedule Timers (24-hour, 7-day)

- By Range:

- Short Interval (Seconds to Minutes)

- Medium Interval (Minutes to Hours)

- Long Interval (Hours to Days/Weeks)

- By End-User Industry:

- Industrial Manufacturing (Machine Tools, Process Control, Robotics)

- HVAC Systems (Compressor sequencing, Ventilation control)

- Lighting and Energy Management

- Commercial Appliances and Equipment (Ovens, Laundromats)

- Infrastructure and Construction (Traffic lights, Pump control)

Value Chain Analysis For Analog Timer Market

The value chain for the Analog Timer Market begins with the upstream sourcing of raw materials and precision components, followed by manufacturing and assembly, culminating in distribution channels that deliver the final product to diverse end-users. Upstream activities involve procuring standardized components such as small synchronous motors (for electromechanical timers), springs, high-grade plastic enclosures, specialized timing resistors and capacitors (for solid-state variants), and switching relays. Quality control and precision engineering at this stage are vital, as the durability and timing accuracy of the final product depend heavily on component quality. Manufacturers often rely on specialized suppliers for highly accurate timing components to maintain competitive edge. The manufacturing process is highly mechanized but still requires significant quality checks, especially for calibrating the time scale and ensuring the longevity of mechanical wear parts.

The downstream segment focuses heavily on effective market penetration, primarily targeting the original equipment manufacturer (OEM) market and the massive MRO (Maintenance, Repair, and Overhaul) sector. Distribution channels are varied, including direct sales to large OEMs (who integrate timers into larger machines), indirect sales through industrial electrical distributors (serving MRO needs and small-to-medium enterprises), and specialized engineering wholesalers. The MRO channel is particularly critical; end-users rely on prompt availability of replacement parts, making robust inventory management and decentralized warehousing key elements for success in the aftermarket. Direct engagement with system integrators and electrical contractors is also important, as they often specify the brand and type of timer during retrofitting or new installation projects.

The efficiency of the distribution channel is directly correlated with market responsiveness. Companies must ensure their most popular models are readily available on distributor shelves globally, as MRO purchases are typically urgent. Indirect sales through global electrical supply chains, such as those operated by major industrial automation distributors, account for the majority of the transactional volume. The transition of some purchasing towards e-commerce platforms also influences the downstream, requiring manufacturers to provide comprehensive digital product information, technical specifications, and cross-reference guides to support online procurement decisions, although the core of industrial purchasing remains tethered to established relationships with trusted distributors.

Analog Timer Market Potential Customers

The primary consumers of analog timers are highly diverse, spanning sectors that prioritize operational resilience, cost-effectiveness, and simplicity over complex data connectivity. End-users fall broadly into three categories: large industrial OEMs, MRO professionals maintaining existing infrastructure, and commercial enterprises requiring basic scheduling control. Industrial manufacturing customers, especially those in food and beverage processing, chemical manufacturing, and heavy machinery, frequently purchase high-tolerance electromechanical timers for sequence control and motor protection, valuing their resistance to wash-down environments and high vibration. These customers require reliable components that can operate continuously for years with minimal intervention, making durability the main purchase criterion.

Another major customer segment involves the Building Automation and Commercial Infrastructure sector, particularly HVAC and lighting control specialists. Analog time switches are routinely specified for controlling boilers, chiller cycling, and outdoor lighting schedules in older buildings or new, non-smart installations where the upfront cost of digital systems is prohibitive. Residential and light commercial customers, often purchasing through retail or local electrical wholesalers, utilize basic analog timers for pool pumps, water heaters, and security light systems, favoring their simple "turn-the-dial" programming over digital interfaces. Furthermore, utilities and power distribution companies use specialized, ruggedized analog timers for control panel applications where electromagnetic protection and guaranteed isolation are critical safety features, representing a specialized, high-margin customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omron Corporation, Eaton Corporation plc, Schneider Electric SE, ABB Ltd., TE Connectivity, Panasonic Corporation, Crouzet, Grainger Inc., Intermatic Incorporated, The Time Switch Company, Macromatic Industrial Controls, Inc., IDEC Corporation, Dwyer Instruments, Inc., AMF Harley, Tork, Finder S.p.A., Carlo Gavazzi Holding AG, Honeywell International Inc., Rockwell Automation Inc., Siemens AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Analog Timer Market Key Technology Landscape

The core technology underpinning the Analog Timer Market remains the precise electromechanical system, though modern innovations focus on enhancing accuracy, longevity, and robustness. Electromechanical timers rely on miniature synchronous motors and gear trains to translate electrical input into a mechanical movement that trips a switch after a predetermined delay. Technological advancements here concentrate on improving the resilience of the gear materials (often using advanced polymers or precision metals) and optimizing motor efficiency to reduce power consumption and heat generation. The critical technology differentiator is the mechanical clutch or escapement mechanism, which must be calibrated meticulously to ensure repeatable timing cycles, often requiring specialized manufacturing processes to achieve high tolerances crucial for industrial control applications. For time switches, the technology revolves around robust spring mechanisms and precise dial indicators, emphasizing manual override capabilities and non-volatile operation.

In the solid-state analog segment, the technology landscape shifts towards leveraging passive components—primarily resistors and capacitors (RC circuits)—to define the time constant. While these circuits are inherently digital in their final output switching (often using thyristors or transistors), they are considered "analog" in their input and control mechanism, offering superior precision and durability compared to purely mechanical solutions because they eliminate moving parts subject to wear and tear. Key technological research in this area focuses on developing specialized integrated circuits (ICs) that provide highly linear and temperature-stable charging/discharging characteristics, minimizing drift and ensuring consistent timing performance across fluctuating operational temperatures. This solid-state approach allows for a blend of analog functionality (simple dialing) with nearly digital accuracy, positioning these products as effective substitutes for mechanical timers in moderate to harsh environments.

A significant trend involves the development of hybrid analog timers, which strategically utilize digital microcontrollers only for improved precision and enhanced user interface (e.g., LED indicators for status or fine-tuning calibration) while maintaining the fundamental analog or electromechanical core for robustness and setting simplicity. This technological convergence aims to capture the benefits of both worlds: the reliability and tactile feedback of analog controls combined with the improved accuracy and extended functionality (e.g., dual timing ranges or instant reset) offered by digital components. Furthermore, the push for miniaturization and compliance with international standards (such as IEC and UL) requires innovative packaging and terminal designs that facilitate quick, secure installation while maintaining high insulation and protection ratings (IP ratings) against dust and moisture, ensuring that the foundational technologies are effectively packaged for demanding industrial deployment environments globally.

The continuous focus on technological improvement within the analog timer sphere is driven by the need to withstand increasing voltage transients and electromagnetic interference (EMI) prevalent in modern industrial environments, particularly those containing variable frequency drives (VFDs) and heavy machinery. Manufacturers invest heavily in transient voltage suppressors and enhanced filtering technologies integrated into the timer circuitry to guarantee operational stability. The technology of synchronization, particularly in motor-driven timers, also sees ongoing refinements to ensure the timer maintains highly accurate rate synchronization with the power supply frequency (50/60 Hz), which is paramount for long-term scheduling accuracy. Advanced material science is also applied to improve the contact materials of the internal switching relays, extending their electrical and mechanical life cycles, thereby reinforcing the core value proposition of analog timers: unparalleled long-term durability and reliability in repetitive operations. The persistence of these mature yet optimized technologies ensures the analog timer remains a viable and preferred solution for simple, robust timing functions.

For electromechanical timers, the implementation of precision stepper motors instead of traditional synchronous motors is an advancement aimed at reducing wear and increasing torque accuracy, allowing for more precise movement of the timing dial or cam mechanism. This shift addresses one of the historical weaknesses of analog mechanisms—the mechanical tolerance stacking error—by applying modern motor control techniques. Furthermore, the enclosures are being designed using specialized, flame-retardant, and UV-resistant polymers (such as high-grade polycarbonates and ABS blends), which are crucial for applications in outdoor settings or highly regulated environments like petrochemical plants where material stability under heat and corrosive agents is non-negotiable. This material technology evolution ensures that the external shell matches the internal robustness of the timing mechanism, providing comprehensive product integrity. The integration of patented dampening systems, particularly in pneumatic timers, continues to be refined to allow for highly consistent performance despite ambient pressure and temperature fluctuations, showcasing continuous, albeit subtle, technological evolution in even the oldest timing modalities. The consistent application of quality standards, such as ISO 9001 certification in the manufacturing process, underpins the technological trust placed in these components globally.

The importance of tactile feedback and physical simplicity drives the technological requirement for highly ergonomic design in the setting mechanism. The technological challenge is to provide a smooth, precise adjustment dial that is both resistant to accidental movement (drift) and easy to operate manually, often requiring specialized detent or clutch designs. Manufacturers use sophisticated testing equipment, including highly accelerated life testing (HALT) and highly accelerated stress screening (HASS), to validate the mechanical endurance of the setting mechanisms and internal components, far exceeding the expected operational lifespan. This rigorous testing regime, enabled by modern data analysis and material science, ensures that even the simplest analog timers meet or surpass the performance benchmarks required by safety-critical industrial applications, reinforcing their role as a low-tech component with high-tech assurance. The focus remains on perfecting the mechanical-electrical interface, ensuring that the switch contacts handle specified electrical loads reliably over millions of cycles, which is achieved through specific alloy compositions (e.g., silver cadmium oxide contacts) and optimized contact geometries to minimize arcing and welding.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand patterns and manufacturing landscape of the Analog Timer Market. Asia Pacific (APAC) currently stands as the largest and fastest-growing market, primarily fueled by massive industrial expansion, particularly in China, India, and Southeast Asian nations. These countries prioritize cost-effective and rugged automation solutions for rapidly deployed manufacturing facilities, where analog timers fit perfectly into the requirement for foundational control elements. APAC is also a major manufacturing hub for analog timers, benefitting from lower production costs and proximity to raw material supplies, leading to intense price competition and high production volumes catering to both domestic consumption and global export.

North America and Europe represent mature markets characterized by steady, predictable demand, largely driven by MRO activities. In North America, the focus is on maintaining vast legacy industrial and commercial infrastructure, requiring high-quality, long-life replacement timers that comply strictly with UL and CSA safety standards. Europe demonstrates a similar demand pattern, with an added emphasis on highly specified, certified components adhering to CE marking and region-specific regulatory frameworks. European demand often leans toward products offering superior longevity and precision for integration into high-value machinery, such as specialized machine tools and advanced processing equipment, where downtime is prohibitively expensive. Replacement cycles in these regions are long, but the high quality and reliability expectations keep average selling prices robust compared to volume markets.

Latin America and the Middle East & Africa (MEA) exhibit emerging market characteristics. Demand in Latin America is tied to infrastructural development, mining operations, and agriculture, sectors that value the robustness of analog timers in challenging, often remote environments where digital support infrastructure is limited. The MEA region, particularly driven by oil & gas, construction, and utility projects, requires highly durable, often explosion-proof or specialized environment-rated analog timers. Growth in these regions is volatile but promises significant long-term expansion as industrialization accelerates, necessitating localized distribution and specialized product offerings tailored to extreme climatic conditions and regional technical specifications.

- Asia Pacific (APAC): Dominates market size due to rapid industrialization, large manufacturing base, and strong adoption of cost-effective automation solutions. Focus on high-volume production and export.

- North America: Driven by MRO demand, strict adherence to UL/CSA standards, and requirements for highly reliable timers in HVAC and commercial systems. Focus on quality replacements and inventory stocking by major distributors.

- Europe: Characterized by stable replacement demand, stringent regulatory compliance (CE marking), and preference for high-precision, long-life timers integrated into premium industrial machinery.

- Latin America: Emerging market growth linked to infrastructure, mining, and remote operational needs; demand focuses on robust, simple-to-maintain electromechanical solutions.

- Middle East & Africa (MEA): Growth centered on oil & gas, construction, and utilities; high demand for ruggedized, high-temperature tolerant analog timers meeting international hazardous area classifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Analog Timer Market.- Omron Corporation

- Eaton Corporation plc

- Schneider Electric SE

- ABB Ltd.

- TE Connectivity

- Panasonic Corporation

- Crouzet

- Grainger Inc.

- Intermatic Incorporated

- The Time Switch Company

- Macromatic Industrial Controls, Inc.

- IDEC Corporation

- Dwyer Instruments, Inc.

- AMF Harley

- Tork

- Finder S.p.A.

- Carlo Gavazzi Holding AG

- Honeywell International Inc.

- Rockwell Automation Inc.

- Siemens AG

- Legrand S.A.

- Tele Controls

- Delta Dore

- GE Industrial Solutions

Frequently Asked Questions

Analyze common user questions about the Analog Timer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the continued demand for analog timers in modern industry?

The continued demand is primarily driven by the replacement market (MRO) for the vast installed base of existing industrial machinery and the requirement for highly durable, EMI-resistant, and cost-effective timing solutions in basic control loops where digital complexity is unnecessary. Analog timers offer operational simplicity and superior resilience in harsh electrical environments.

How do analog timers compare to digital timers in terms of cost and reliability?

Analog timers typically offer a lower initial purchase cost and a higher level of non-software dependent reliability, especially regarding resistance to electrical noise and voltage fluctuations. Digital timers, while more expensive, offer superior timing accuracy, programmability, and integration capabilities, making analog timers the preferred choice where simplicity and long-term mechanical robustness are prioritized over high precision connectivity.

Which end-user segment utilizes the largest volume of analog timers globally?

The Industrial Manufacturing sector, encompassing machine tools, process control, and material handling systems, represents the largest consuming segment. These industries require reliable, hard-wired timing devices for essential sequence control, motor start protection, and safety interlocks, contributing significantly to both OEM and MRO sales volumes.

Are electromechanical timers becoming completely obsolete due to solid-state and digital alternatives?

No, electromechanical timers are not becoming obsolete. While their market share in new, complex installations is declining, they maintain a stable and essential presence in the MRO market. They are also preferred for applications demanding high switching current capacity and guaranteed physical isolation of contacts, ensuring their critical role in many legacy and rugged industrial systems persists.

What technological advancements are analog timer manufacturers focusing on currently?

Manufacturers are focusing on developing hybrid analog-digital models that combine the robust core of analog mechanisms with improved precision and limited digital features. Key areas of advancement include enhancing mechanical durability, improving timing stability across temperature variations, miniaturization, and securing higher IP ratings for deployment in extreme industrial and outdoor environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Analog Timer Market Size Report By Type (DIN Rail Mount, Panel Mount, Plug-in Mount), By Application (Industrial Devices, Lighting System, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Analog Timer Market Statistics 2025 Analysis By Application (Industrial Devices, Lighting System), By Type (DIN Rail Mount, Panel Mount, Plug-in Mount), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager