Anemia and Vitamin Test Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432067 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Anemia and Vitamin Test Market Size

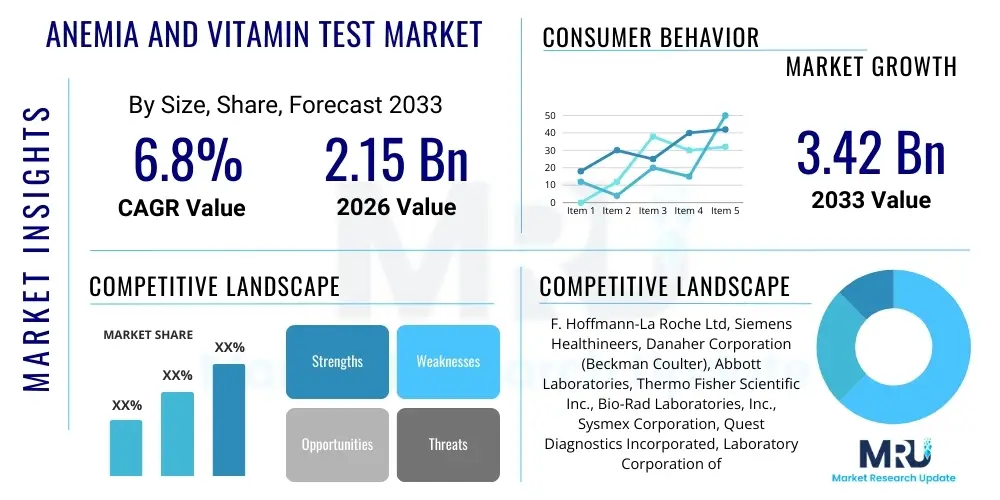

The Anemia and Vitamin Test Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.15 billion in 2026 and is projected to reach USD 3.42 billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global prevalence of nutritional deficiencies, particularly Vitamin D, Vitamin B12, and iron deficiency, alongside robust technological advancements in automated diagnostic platforms and point-of-care (PoC) testing solutions which enhance accessibility and speed of results.

The substantial market expansion is intrinsically linked to rising awareness among both patients and healthcare providers regarding the critical role of timely screening and diagnosis in preventing severe health complications associated with untreated deficiencies. As healthcare systems globally pivot toward proactive and preventive medicine models, the demand for comprehensive diagnostic panels, which simultaneously assess hematological parameters indicative of anemia (such as complete blood count or CBC) and key vitamin levels, is intensifying. Furthermore, the aging global population, which is more susceptible to malabsorption and chronic diseases necessitating frequent monitoring, contributes significantly to sustained market valuation increases.

Geographic market variations highlight different growth accelerators; developed regions lead in advanced testing adoption due to established healthcare infrastructure and high reimbursement rates, while emerging economies exhibit faster growth rates driven by concerted public health initiatives aimed at tackling widespread malnutrition and establishing decentralized diagnostic capabilities, particularly through public-private partnerships focused on improving access to essential micronutrient testing.

Anemia and Vitamin Test Market introduction

The Anemia and Vitamin Test Market encompasses the diagnostic products and services utilized for the quantitative measurement of blood components related to hematological status, specifically focusing on the identification and classification of various types of anemia (e.g., iron-deficiency anemia, megaloblastic anemia, and anemia of chronic disease) and the assessment of key vitamin levels, primarily B12, folate, and Vitamin D. These tests are essential tools in clinical practice, ranging from routine wellness checks and prenatal screening to specialized diagnostics for patients suffering from chronic malabsorption syndromes, autoimmune disorders, and chemotherapy side effects. Key products include automated hematology analyzers, immunoassay systems, mass spectrometry instruments, and associated reagents and consumables, all designed to deliver accurate and rapid clinical insights for effective patient management.

Major applications of these diagnostic solutions span across hospitals, clinical laboratories, reference laboratories, and point-of-care settings. The necessity for these tests is driven by the high global incidence of anemia—recognized as a significant public health issue by the World Health Organization—and the widespread prevalence of micronutrient deficiencies that often manifest subtle or non-specific symptoms, necessitating reliable laboratory confirmation. The benefits of timely testing are profound, enabling early intervention with appropriate supplementation or treatment, thereby mitigating risks such as impaired cognitive development in children, fatigue, cardiovascular stress, and severe neurological damage associated with prolonged Vitamin B12 deficiency. The tests serve as crucial monitoring tools during treatment protocols to ensure efficacy and adjust dosages.

Driving factors propelling market growth include the rising burden of chronic diseases which often induce nutritional imbalances, the expanding use of targeted therapies requiring companion diagnostics for nutritional status, and continuous innovation in testing methodologies, especially the development of miniaturized and multiplex assays that allow for simultaneous detection of multiple analytes using minimal sample volume. Furthermore, favorable regulatory environments in key markets that support the adoption of new, efficient diagnostic devices and increasing investments in laboratory automation infrastructure worldwide solidify the foundation for sustained market expansion over the forecast period.

Anemia and Vitamin Test Market Executive Summary

The Anemia and Vitamin Test Market is characterized by robust technological innovation and significant clinical relevance, positioning it for steady growth through 2033. Key business trends include the shift towards centralized, high-throughput testing systems for large reference labs and the simultaneous push for decentralized, user-friendly point-of-care devices in primary care and remote settings, addressing the diverse needs of different healthcare landscapes. Market leaders are focusing on strategic acquisitions and partnerships to expand their diagnostic panel portfolios and geographical reach, particularly targeting emerging markets where deficiency prevalence is highest. Furthermore, standardization challenges across different assay platforms for analytes like Vitamin D are driving industry efforts toward harmonization, improving result reliability and comparability across various clinical settings, thus enhancing the overall utility of these tests in evidence-based medicine.

Regional trends indicate North America maintaining its dominance due to advanced healthcare infrastructure, high awareness levels, and significant expenditure on preventive health and specialized diagnostics. However, the Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, propelled by massive government initiatives to combat malnutrition, increasing healthcare expenditure, and the rapid establishment of modern clinical laboratories. Europe remains a strong market, driven by favorable reimbursement policies for chronic disease monitoring and the early adoption of highly automated laboratory testing systems. In Latin America and MEA, market penetration is accelerating, supported by international aid programs focused on maternal and child health, demanding scalable and cost-effective testing solutions.

Segment trends reveal that the Instruments segment, particularly automated hematology analyzers and specialized mass spectrometers, holds a significant market share due to their high volume capacity and precision, crucial for reference laboratories. However, the Reagents and Kits segment is expected to show faster growth, attributed to the recurring purchase model necessary for ongoing testing and the development of highly specific, quality-controlled assays. Among applications, infectious disease diagnostics and geriatric care are increasingly demanding these tests, while End-User segmentation highlights the enduring significance of Clinical Laboratories as the primary volume consumers, although the uptake in physician office laboratories (POLs) utilizing rapid testing platforms is rapidly gaining momentum, changing the traditional diagnostic workflow dynamics.

AI Impact Analysis on Anemia and Vitamin Test Market

User queries regarding the impact of Artificial Intelligence (AI) on the Anemia and Vitamin Test Market frequently revolve around three core themes: precision, predictive diagnostics, and workflow automation. Users are keen to understand how AI-driven algorithms can enhance the accuracy of differential diagnoses, especially in cases of complex or mixed anemias that are challenging to classify based solely on basic CBC parameters. Significant user concern also focuses on the potential for AI to integrate diverse patient data—including demographics, symptoms, dietary habits, and historical lab results—to predict deficiency risks before they become clinically severe. Furthermore, clinical laboratory professionals frequently ask about AI's role in optimizing laboratory workflows, such as automated quality control checks, instrument scheduling, and interpretation assistance for high-volume vitamin D or B12 testing, aiming for cost reduction and turnaround time improvement.

AI is set to revolutionize the interpretive phase of anemia and vitamin testing by providing advanced computational support. Traditional diagnostic methods rely on established cut-offs and manual correlation of multiple test results (e.g., ferritin, transferrin saturation, MMA, homocysteine). AI algorithms, particularly machine learning models, can analyze vast datasets of anonymized patient outcomes and lab results, identifying subtle patterns and correlations that human analysts might miss. This allows for significantly more precise classification of anemia subtypes and improved identification of confounding factors, such as the overlap between iron deficiency and the anemia of chronic inflammation. This enhanced diagnostic precision reduces misdiagnosis rates and ensures patients receive the correct, targeted therapy more rapidly, minimizing ineffective treatment cycles.

Beyond interpretation, AI integration is profoundly affecting laboratory operations and public health screening programs. In high-throughput clinical laboratories, AI systems manage instrument load balancing, predict reagent needs based on testing volume forecasts, and flag samples requiring immediate attention due to critical values or questionable results derived from automated morphology analysis. At the population level, AI models, leveraging genomic and demographic data, can identify high-risk populations for specific vitamin deficiencies (e.g., Vitamin D in specific geographic locations or B12 deficiency in specific medication users), facilitating targeted screening interventions, which represents a significant shift from reactive testing to proactive, predictive public health management. This predictive capability is key to preventative healthcare and maximizing resource allocation efficiency.

- AI enhances differential diagnosis accuracy by analyzing complex hematological parameters and clinical history.

- Predictive modeling identifies populations at high risk for specific vitamin deficiencies, optimizing screening programs.

- Automation of quality control and workflow management in high-throughput laboratories improves efficiency and reduces human error.

- AI-driven image analysis assists in automated classification of blood cell morphology, supporting complex anemia diagnosis.

- Integration of laboratory results with Electronic Health Records (EHRs) using AI facilitates longitudinal patient tracking and personalized deficiency management.

DRO & Impact Forces Of Anemia and Vitamin Test Market

The Anemia and Vitamin Test Market is shaped by a potent combination of Drivers, Restraints, and Opportunities (DRO) that dictate its expansion trajectory and market dynamics. Key drivers include the high and rising global prevalence of anemia and nutritional deficiencies, exacerbated by poor dietary habits, lifestyle changes, and the increasing incidence of chronic diseases (like diabetes, CKD, and IBS) that impair nutrient absorption. Opportunities are heavily concentrated around technological advancements in non-invasive and micro-sampling techniques, coupled with the expansion into decentralized testing environments such as physician office labs and home testing kits, which promise greater patient convenience and broader diagnostic accessibility, especially in resource-limited settings. These powerful market forces are subject to regulatory hurdles and standardization issues, which act as significant restraints that impact product development cycles and market entry strategies.

The primary impact forces driving market evolution stem from policy shifts toward preventative medicine and robust clinical guidelines mandating regular monitoring of specific nutrient levels, particularly in vulnerable groups like pregnant women, neonates, and the elderly. The necessity for personalized nutrition and tailored supplementation based on precise diagnostic data is creating sustained demand. Conversely, the market faces significant restraints, notably the high capital investment required for establishing sophisticated testing laboratories and the variability in reimbursement policies across different geographies, which can impede the adoption of newer, often more expensive, diagnostic technologies. Furthermore, achieving global standardization for complex vitamin assays, particularly Vitamin D, remains a technical challenge, impacting cross-platform comparability and clinical decision-making consistency.

Market stakeholders must strategically navigate these impact forces. Drivers push for increased volume and technological refinement, encouraging investment in automation and miniaturization. Opportunities highlight untapped markets in direct-to-consumer testing and digital health integration. Successfully overcoming restraints requires substantial collaboration between manufacturers, regulatory bodies, and clinical experts to streamline approval processes and harmonize testing protocols. The overarching impact forces necessitate a pivot towards scalable, affordable, and highly accurate diagnostic solutions that can serve both high-end reference laboratories and decentralized primary care settings effectively, ensuring sustained market viability and growth in diverse global healthcare economies.

Segmentation Analysis

The Anemia and Vitamin Test Market is structurally segmented based on crucial criteria including test type, product type, application, and end-user, providing a granular view of demand distribution and technological adoption patterns across the global landscape. Segmentation by test type differentiates between anemia-specific tests (such as Complete Blood Count (CBC), Iron Studies, Reticulocyte Count, and Haptoglobin) and specific Vitamin Assays (e.g., Vitamin B12, Folate, Vitamin D, Vitamin C, and others). Product segmentation, essential for understanding vendor revenue streams, is typically divided into Instruments (Automated Analyzers, Mass Spectrometry Systems) and Reagents & Kits, the latter being the recurring revenue driver. This detailed segmentation allows stakeholders to target specific technological and clinical niches within the broader diagnostic ecosystem.

Application segmentation reflects the diverse clinical scenarios where these tests are indispensable, including general wellness and prevention, specialized diagnostics for chronic diseases, maternal and fetal health monitoring, and geriatric care. Due to the high global burden, general wellness screening and chronic disease management remain the largest application areas, demanding high-volume, reliable testing. End-user segmentation highlights the operational consumer of the products, with Clinical Laboratories retaining the largest share due to their role in processing centralized testing volume. However, the fastest growth is observed in Physician Office Laboratories (POLs) and Point-of-Care (PoC) settings, reflecting the increasing patient preference for immediate diagnostic results in non-hospital environments and the ongoing decentralization of diagnostic services, particularly enabled by robust PoC testing devices.

The dynamic interplay between these segments is crucial for market forecasting. The continuous development of multiplexed assays falls under the Reagents and Kits segment, accelerating growth across all application areas by providing cost-effective simultaneous detection. Similarly, the advancement of sophisticated, small footprint instruments caters directly to the burgeoning POL segment, expanding testing accessibility. Strategic investments are therefore focused on creating synergy between automated instrumentation capable of handling complex assays and the development of highly sensitive, stable reagents required for accurate measurement of micronutrients often present in minute concentrations, ensuring clinical utility remains high across all segments.

- By Test Type:

- Anemia Tests (CBC, Iron Studies, Transferrin, Ferritin, TIBC, Haptoglobin, Reticulocyte Count)

- Vitamin Assays (Vitamin B12, Folic Acid, Vitamin D (25-OH D), Vitamin C, Others)

- By Product:

- Instruments (Automated Hematology Analyzers, Immunoassay Systems, Mass Spectrometry Systems, PoC Devices)

- Reagents & Kits (Calibrators, Controls, Assay Kits)

- By Application:

- Chronic Disease Diagnostics (Kidney Disease, Inflammatory Bowel Disease)

- Maternal and Fetal Health

- Geriatric Care

- General Wellness and Screening

- Infectious Disease Related Diagnostics

- By End-User:

- Clinical Laboratories (Reference and Centralized Labs)

- Hospitals

- Physician Office Laboratories (POLs)

- Academic & Research Institutes

- Home Care/Direct-to-Consumer Testing

Value Chain Analysis For Anemia and Vitamin Test Market

The value chain of the Anemia and Vitamin Test Market is structured around specialized processes starting from raw material procurement to final patient diagnosis, involving stringent quality control and complex logistics. Upstream activities are centered on the sourcing and manufacturing of highly specialized raw materials, including specific antibodies, antigens, enzymes, and chemical components essential for developing immunoassay and clinical chemistry reagents. This phase requires rigorous purification and standardization to ensure diagnostic accuracy. Key upstream players include specialized chemical suppliers and biotechnology companies that provide these critical components, focusing heavily on R&D to enhance assay sensitivity and stability, particularly for micronutrients that are challenging to measure consistently in biological matrices.

Midstream involves the manufacturing and assembly of sophisticated diagnostic instruments (analyzers) and the final formulation and packaging of reagent kits. Instrument manufacturers invest significantly in automation, miniaturization, and integration of software for data management and interpretation. Distribution channels are bifurcated into direct sales models, often employed by large manufacturers for major centralized laboratories and hospital networks, and indirect distribution through regional distributors and channel partners, particularly effective for reaching smaller Physician Office Laboratories (POLs) and remote testing sites. The choice of channel depends on the complexity of the product; high-value instruments typically require direct sales with specialized technical support, while high-volume reagents are often handled via established distributor networks.

Downstream activities involve the critical processes of laboratory testing, interpretation, and reporting, which define the ultimate value delivery to the end-user (patient and clinician). Clinical laboratories, hospitals, and PoC facilities execute the tests. The final stage incorporates the crucial relationship between diagnostic results and clinical action, where results guide treatment decisions, supplementation, or further specialized testing. Effective downstream integration necessitates robust IT infrastructure for secure data transmission and interoperability with Electronic Health Records (EHRs), ensuring that the diagnostic insights translate seamlessly into improved patient outcomes and efficient healthcare management. This integrated approach maximizes the clinical utility derived from the diagnostic products.

Anemia and Vitamin Test Market Potential Customers

The primary end-users and buyers in the Anemia and Vitamin Test Market encompass a broad spectrum of healthcare entities and increasingly, consumers engaging in personalized health management. The most significant volume buyers are large centralized Clinical Laboratories and Reference Labs, which require high-throughput, automated instruments and bulk quantities of reagents to manage extensive testing volumes requested by primary care physicians, specialists, and public health screening programs. These customers prioritize operational efficiency, high precision, rapid turnaround time (TAT), and cost-per-test optimization, making them ideal targets for premium, fully automated diagnostic platforms and long-term reagent contracts.

Hospitals represent another major customer segment, encompassing both acute care and specialized clinics (such as oncology, gastroenterology, and prenatal care units). Hospitals often utilize both centralized lab services and smaller, dedicated satellite labs or PoC settings for critical care, necessitating a mix of high-end analyzers and rapid testing devices. The critical nature of hospital testing often dictates a strong preference for reliability, ease of use, and immediate result availability for urgent medical decisions. Furthermore, government public health agencies are substantial customers, particularly in developing nations, purchasing mass testing kits for large-scale nutritional surveys and intervention programs targeting maternal and child health.

The fastest-growing customer base includes Physician Office Laboratories (POLs) and the burgeoning Direct-to-Consumer (DTC) market. POLs seek compact, easy-to-operate devices that allow immediate patient consultation following diagnosis, favoring closed systems and cartridge-based assays. The DTC segment, driven by increasing health consciousness and the trend toward self-monitoring, uses at-home collection kits for tests like Vitamin D and B12, serviced primarily through specialized mail-in laboratories. This segment demands simplicity, discretion, and reliable connectivity to digital health platforms, representing a key area for future strategic focus for market vendors exploring innovative distribution and service models outside traditional clinical settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.42 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche Ltd, Siemens Healthineers, Danaher Corporation (Beckman Coulter), Abbott Laboratories, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Sysmex Corporation, Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (LabCorp), Ortho Clinical Diagnostics (QuidelOrtho), DiaSorin S.p.A., Grifols, S.A., Eiken Chemical Co., Ltd., Mindray Medical International Limited, BioMerieux SA, Eurofins Scientific, Becton, Dickinson and Company (BD), Sekisui Diagnostics, Trinity Biotech, PerkinElmer Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anemia and Vitamin Test Market Key Technology Landscape

The technology landscape of the Anemia and Vitamin Test Market is defined by the convergence of high-throughput automation and precision methodologies, seeking to improve efficiency, accuracy, and speed of diagnosis. Automated hematology analyzers, which utilize sophisticated flow cytometry and impedance technology, form the backbone of anemia diagnostics, capable of performing complete blood counts (CBCs) and differential analysis rapidly and reliably on thousands of samples per day. For the assessment of vitamins and key nutritional biomarkers (like ferritin and transferrin), Immunoassay systems (Chemiluminescence Immunoassay - CLIA and Enzyme-Linked Immunosorbent Assay - ELISA) dominate, offering high sensitivity and adaptability for both routine and specialized testing environments. These systems are continually evolving to become more compact and integrate advanced robotics for sample handling, minimizing manual intervention and maximizing throughput.

A critical technological trend driving market expansion is the increasing adoption of Liquid Chromatography-Tandem Mass Spectrometry (LC-MS/MS). While initially confined to reference laboratories due to high complexity and cost, LC-MS/MS offers superior specificity and sensitivity, especially for analytes like Vitamin D metabolites, B vitamins, and homocysteine, where matrix effects and cross-reactivity can hinder immunoassay accuracy. Efforts are now focused on streamlining LC-MS/MS workflows and developing specialized kits to make this gold standard technology more accessible to clinical laboratories. This transition is essential for enhancing the reliability of results that inform high-stakes clinical decisions, particularly in managing complex deficiency syndromes and optimizing therapeutic drug monitoring.

Furthermore, Point-of-Care (PoC) testing technology is rapidly maturing, transforming accessibility for both anemia screening and certain vitamin assessments. Microfluidics and lab-on-a-chip technologies enable the creation of compact, portable devices that require minimal sample volumes (e.g., finger-prick blood) and deliver quantitative results in minutes. These technologies are crucial for public health campaigns, remote settings, and primary care facilities where immediate results guide immediate nutritional intervention or referral. The focus of technological development here is on ensuring the accuracy of these rapid, decentralized tests meets the rigorous standards of central laboratory instruments, coupled with strong digital connectivity for immediate data recording and integration into patient records, ensuring compliance and effective follow-up care.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological uptake within the Anemia and Vitamin Test Market, reflecting differences in healthcare infrastructure, disease prevalence, and regulatory frameworks. North America, comprising the United States and Canada, leads the market primarily due to early and aggressive adoption of advanced diagnostic technologies such as mass spectrometry and high-throughput automation. High healthcare spending, favorable reimbursement policies for screening and chronic disease management, and the strong presence of major market players drive innovation and penetration in this region. The significant public awareness regarding nutritional supplements and personalized health also fuels high demand for Vitamin D and B12 testing.

Europe represents a mature market characterized by stringent regulatory environments (e.g., IVDR compliance) and well-established public healthcare systems emphasizing preventative screening. Countries like Germany, France, and the UK are major consumers, focusing on continuous quality improvement and the integration of diagnostic results into national health registries. The European market sees strong growth in sophisticated immunoassay systems and specialized diagnostics required for managing geriatric populations and patients with chronic inflammatory diseases often linked to anemia.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, driven by two key factors: the sheer volume of the population suffering from nutritional deficiencies, particularly iron deficiency anemia in women and children across India and Southeast Asia, and massive governmental and NGO investments aimed at upgrading clinical laboratory infrastructure. Economic development in countries like China and India is leading to increased disposable income and improved access to advanced private healthcare, fueling demand for modern diagnostic equipment and quality reagents to replace older testing methods, ensuring significant future market opportunities.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets experiencing strong, albeit often sporadic, growth. In LATAM, urbanization and the expansion of private clinics increase demand for automated systems. In MEA, particularly Sub-Saharan Africa, the market growth is heavily influenced by international health funding aimed at tackling widespread malnutrition, infectious diseases like malaria which cause severe anemia, and maternal health issues. This region heavily prioritizes cost-effective, durable PoC testing solutions suitable for challenging logistical environments and high-volume basic screening programs, creating specific demand niches for robust and decentralized technologies.

- North America: Dominance driven by high R&D spending, established insurance coverage for specialized diagnostics, and early adoption of gold-standard technologies like LC-MS/MS.

- Europe: High adoption rates for automated systems, focus on quality standardization (IVDR compliance), and robust public health screening programs for elderly and high-risk groups.

- Asia Pacific (APAC): Fastest growth due to high prevalence of nutritional deficiencies, rapidly improving healthcare infrastructure investment, and large-scale public health initiatives in countries like China and India.

- Latin America (LATAM): Growth fueled by expansion of private healthcare services and increasing urbanization, leading to higher demand for reliable laboratory testing infrastructure.

- Middle East and Africa (MEA): Demand concentrated on affordable PoC solutions and bulk reagent procurement, largely driven by public health programs targeting endemic nutritional deficiencies and infectious disease-related anemia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anemia and Vitamin Test Market.- F. Hoffmann-La Roche Ltd

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Sysmex Corporation

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (LabCorp)

- Ortho Clinical Diagnostics (QuidelOrtho)

- DiaSorin S.p.A.

- Grifols, S.A.

- Eiken Chemical Co., Ltd.

- Mindray Medical International Limited

- BioMerieux SA

- Eurofins Scientific

- Becton, Dickinson and Company (BD)

- Sekisui Diagnostics

- Trinity Biotech

- PerkinElmer Inc.

Frequently Asked Questions

Analyze common user questions about the Anemia and Vitamin Test market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological advancements are driving the growth of the Anemia and Vitamin Test Market?

The market growth is primarily driven by the increasing integration of high-throughput laboratory automation and the maturation of Point-of-Care (PoC) testing devices. Additionally, the adoption of highly specific methodologies like Liquid Chromatography-Tandem Mass Spectrometry (LC-MS/MS) for accurate vitamin metabolite assessment is enhancing clinical utility and result reliability.

Which key micronutrient assays are experiencing the highest demand globally?

The assays experiencing the highest global demand are Vitamin D (25-OH D), Vitamin B12, and Ferritin (as a marker for iron deficiency). These tests are critical due to the high global prevalence of these specific deficiencies and their crucial roles in bone health, neurological function, and hematopoiesis, respectively.

How is the shift towards preventative healthcare influencing the demand for these tests?

The move toward preventative healthcare significantly increases demand by encouraging routine wellness screening, particularly in high-risk groups such as the elderly, pregnant women, and patients with malabsorption syndromes. Early and proactive screening allows for timely intervention, mitigating the long-term costs and severity associated with untreated nutritional deficiencies.

Which end-user segment is forecasted to exhibit the fastest growth in testing volume?

While Clinical Reference Laboratories maintain the largest market share by volume, the Physician Office Laboratories (POLs) and the Direct-to-Consumer (DTC) segments are forecasted to exhibit the fastest growth rate. This acceleration is due to the increasing preference for decentralized testing, reduced turnaround times, and greater patient engagement in health monitoring.

What are the primary restraints affecting the Anemia and Vitamin Test Market?

Key restraints include the substantial capital investment required for high-end automated diagnostic instrumentation, the variability and often restrictive nature of reimbursement policies across different national health systems, and persistent technical challenges related to achieving global standardization and harmonization for complex vitamin assays like Vitamin D.

What role does the prevalence of chronic kidney disease play in this market?

Chronic kidney disease (CKD) is a significant driver of demand because CKD patients frequently develop anemia of chronic disease and often require rigorous monitoring of B vitamins and iron status due to impaired erythropoiesis and absorption issues. Regular diagnostic testing is essential for managing complications and guiding treatment protocols, such as erythropoiesis-stimulating agents.

How are emerging markets, particularly in APAC, impacting global market trends?

Emerging markets in APAC are driving global trends by demanding cost-effective, high-volume, and robust screening solutions. Their immense need to combat widespread nutritional deficiencies compels manufacturers to develop simpler, scalable, and affordable diagnostic platforms suitable for large-scale public health programs, influencing innovation toward accessibility.

Define the primary difference between anemia testing and vitamin assay methodologies.

Anemia testing primarily uses hematology analyzers employing impedance and flow cytometry to measure physical blood cell parameters (CBC, indices), while vitamin assays generally rely on highly sensitive chemical detection methods such as immunoassays (CLIA, ELISA) or chromatography (LC-MS/MS) to quantify specific micronutrient concentrations in the serum or plasma.

How is the implementation of AI influencing diagnostic accuracy in complex anemia cases?

AI significantly enhances diagnostic accuracy by utilizing machine learning algorithms to analyze multivariate data sets—including clinical history, demographic information, and multiple lab results—to identify subtle patterns characteristic of complex or mixed-cause anemias (e.g., distinguishing between iron deficiency and anemia of inflammation) more reliably than traditional, rule-based clinical guidelines.

What specific challenges exist in standardizing Vitamin D testing globally?

Standardization challenges in Vitamin D testing stem primarily from matrix effects (interference from other substances in blood) and the existence of multiple circulating metabolites (e.g., 25-OH D2 and 25-OH D3). Immunoassay performance can vary widely, necessitating the use of the gold standard LC-MS/MS for reference and ongoing efforts by organizations like the Vitamin D Standardization Program (VDSP) to harmonize commercial assays.

What is the relevance of transferrin saturation (TSAT) testing in the market?

Transferrin saturation (TSAT) is highly relevant as a key component of comprehensive iron studies, providing an essential measure of the body's functional iron status. It is crucial for diagnosing iron deficiency, monitoring supplementation effectiveness, and guiding decisions regarding intravenous iron therapy, especially in dialysis and chemotherapy patients.

Are there significant regulatory hurdles for new diagnostic product introduction in key markets?

Yes, significant regulatory hurdles exist, particularly in the EU with the transition to the IVD Regulation (IVDR), which requires extensive clinical evidence and documentation, prolonging the time-to-market for new diagnostic tests and instruments. Similarly, FDA approval processes in the US require rigorous validation of analytical and clinical performance.

How does the geriatric population serve as a specific driver for this market?

The rapidly expanding geriatric population is a crucial driver because older adults are inherently more susceptible to nutritional deficiencies due to age-related malabsorption, polypharmacy interactions, and chronic conditions that affect metabolism. This demographic requires routine, frequent screening for Vitamin B12, folate, and anemia monitoring, ensuring sustained high demand.

What competitive strategies are major market players employing to gain market share?

Major players are focusing on expanding their consolidated diagnostic menus (multiplexing), integrating advanced AI/software features into their analyzers for interpretive assistance, and engaging in strategic mergers and acquisitions to capture complementary technologies, particularly in the rapidly growing PoC and mass spectrometry segments, while enhancing supply chain resilience globally.

Explain the significance of homocysteine and methylmalonic acid (MMA) testing.

Homocysteine and methylmalonic acid (MMA) are essential functional biomarkers. Elevated levels of both, especially MMA, often serve as definitive indicators of functional Vitamin B12 deficiency at the cellular level, even sometimes before serum B12 levels drop critically low. These tests are vital for diagnosing early or subclinical deficiency, particularly in neurological contexts.

How has the COVID-19 pandemic structurally affected the market?

The pandemic initially led to testing volume volatility but subsequently accelerated trends toward automation and decentralization. Supply chain disruptions highlighted the need for localized manufacturing (impacting reagents), while the observed links between severe COVID-19 outcomes and Vitamin D deficiency globally amplified long-term demand for proactive nutritional testing.

What is the role of specialized software in the Anemia and Vitamin Test workflow?

Specialized software plays a critical role in data management, ensuring quality control, flagging critical test results automatically, and aiding in the complex correlation of multiple hematological and nutritional biomarkers. Advanced AI-driven software provides interpretive support to laboratory professionals, speeding up the diagnostic process and reducing potential transcription errors.

Why is the reagents and kits segment projected for faster growth than the instruments segment?

The reagents and kits segment represents a recurring revenue stream, directly tied to the continually increasing volume of tests performed worldwide. While instruments are high-value, one-time purchases, the constant necessary replenishment of calibrators, controls, and assay kits ensures that the reagents segment maintains a higher volume growth rate driven by clinical demand.

What is meant by the term "iron studies" within this market context?

"Iron studies" refer to a panel of tests used together to assess the body's iron stores and metabolism. This panel typically includes serum iron, ferritin (storage iron), total iron-binding capacity (TIBC), and transferrin saturation (TSAT), providing a comprehensive picture necessary for diagnosing the cause and severity of iron-related anemias.

How does the growing interest in personalized medicine influence diagnostic utilization?

Personalized medicine strongly influences diagnostic utilization by demanding precise, patient-specific nutritional data. Testing moves beyond simple deficiency confirmation to monitoring individual responses to tailored supplementation regimes and identifying genetic predispositions (e.g., MTHFR mutations affecting folate metabolism), requiring specialized and comprehensive diagnostic panels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager