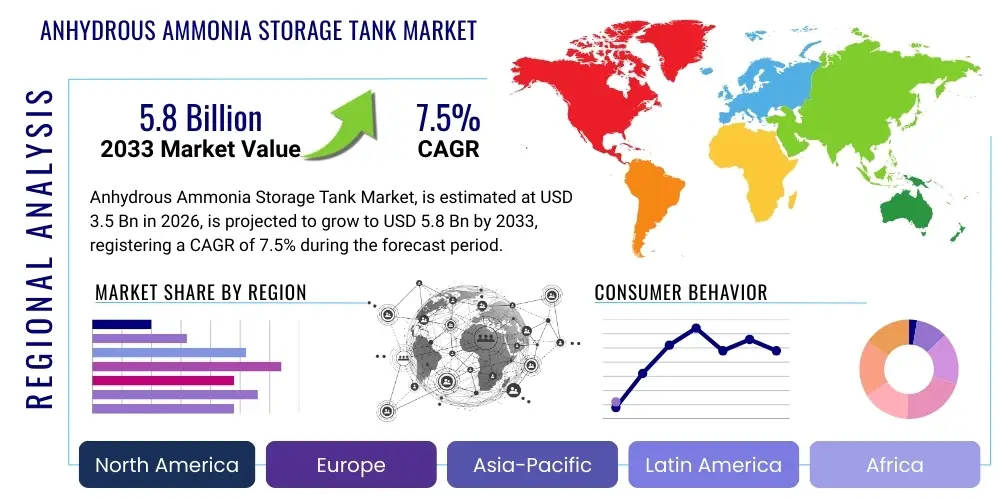

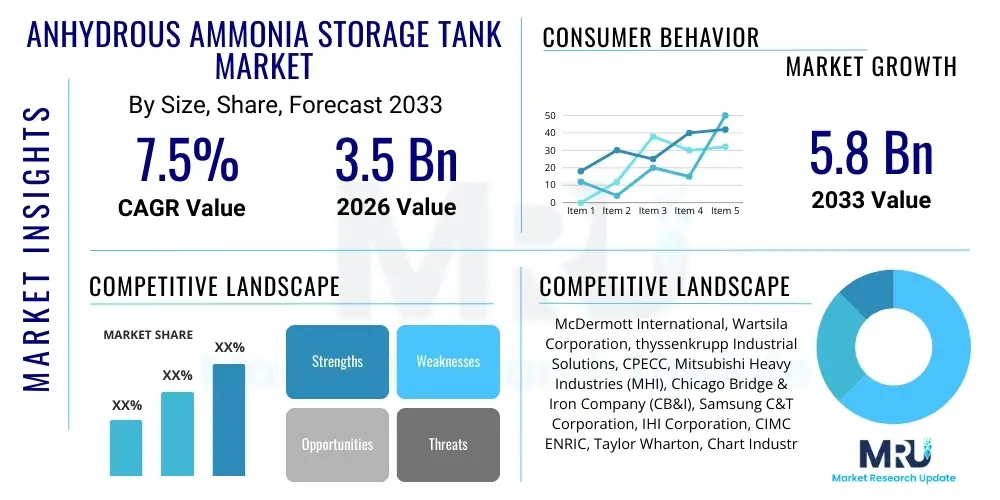

Anhydrous Ammonia Storage Tank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436277 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Anhydrous Ammonia Storage Tank Market Size

The Anhydrous Ammonia Storage Tank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033.

Anhydrous Ammonia Storage Tank Market introduction

Anhydrous ammonia (NH3) is a critical industrial chemical and commodity, primarily utilized globally as a base material for nitrogen fertilizers, essential for maintaining food security through enhanced crop yields. The Anhydrous Ammonia Storage Tank market provides the specialized containment solutions necessary to safely store this hazardous substance, which is highly toxic and corrosive, typically requiring storage either under high pressure at ambient temperatures or, more commonly for large volumes, in a fully refrigerated state near its boiling point of -33°C (-28°F). The product scope includes various tank types, such as spherical, cylindrical, and horizontal bullet tanks, built to rigorous international standards (e.g., ASME, API 620) using materials like carbon steel, often incorporating advanced insulation and specialized inner linings to ensure structural integrity and prevent leakage. These tanks are foundational infrastructure for the entire ammonia value chain, bridging production facilities, transport systems, and final end-users.

The market's robust trajectory is fundamentally driven by sustained global demand for agricultural chemicals. As the world population continues to expand and arable land diminishes, the necessity for high-efficiency fertilizers remains paramount, directly translating into increased production and subsequent storage requirements for ammonia. Beyond agriculture, ammonia’s role as an industrial refrigerant and a nascent fuel source is increasingly important. Its emergence as an effective hydrogen carrier, particularly in the context of global decarbonization efforts focusing on blue and green ammonia, has opened entirely new high-growth application sectors, demanding investment in novel and massive storage solutions at renewable energy hubs and maritime bunkering ports. The inherent benefits of proper storage—ensuring safety, maintaining supply chain continuity, and facilitating large-scale trade—underscore the vital nature of this specialized infrastructure sector.

Key driving factors include governmental initiatives promoting fertilizer self-sufficiency, significant investments in new ammonia production plants, particularly those leveraging natural gas feedstocks (blue ammonia), and accelerating pilot projects focused on converting renewable electricity into green ammonia. The inherent risks associated with NH3 storage necessitate continuous technological advancement in safety features, monitoring systems, and construction quality, thereby supporting premium pricing for high-specification storage tanks. The market ecosystem is characterized by complex engineering requirements, stringent regulatory oversight, and long project life cycles, favoring experienced EPC contractors and specialized tank fabricators capable of meeting demanding technical and safety specifications globally.

Anhydrous Ammonia Storage Tank Market Executive Summary

The Anhydrous Ammonia Storage Tank market is experiencing transformative growth, shifting from being solely reliant on agricultural demand to integrating complex energy storage and transportation requirements. Business trends highlight a strong emphasis on automation in tank fabrication and the integration of sophisticated non-destructive testing (NDT) techniques to ensure the longevity and regulatory compliance of storage assets. Significant capital expenditure is being channeled into the construction of mega-ammonia complexes, often strategically located near major natural gas sources or abundant renewable energy supplies, necessitating the deployment of ultra-large, fully refrigerated flat-bottom storage tanks, often exceeding 50,000 metric tons in capacity. This trend underscores a market increasingly focused on efficiency of scale and optimized logistics for global trade, particularly within the burgeoning hydrogen economy framework. Manufacturers are focusing on modular construction techniques to mitigate risks associated with on-site construction in remote locations and to speed up project execution timelines, addressing the pressure from rapidly expanding chemical and fertilizer production cycles.

Regionally, the Asia Pacific (APAC) sector maintains its dominance, primarily fueled by the agricultural powerhouses of India and China, alongside significant new petrochemical investments across Southeast Asia. However, the Middle East and North Africa (MENA) region is emerging as the fastest-growing market segment, driven by large-scale blue and green ammonia export projects leveraging low-cost natural gas reserves and high solar energy potential. These regions are attracting substantial foreign direct investment (FDI) into infrastructure development, specifically for export terminals and bunkering facilities. North America and Europe, while mature markets, are experiencing modernization cycles, focusing on replacing older, less efficient pressurized tanks with safer, larger capacity refrigerated vessels, often in compliance with stricter environmental and safety standards related to process safety management (PSM) and risk mitigation.

Segmentation trends reveal that the fully refrigerated tank segment is projected to achieve the highest CAGR, propelled by cross-border trade and the need to store immense quantities of ammonia efficiently at cryogenic temperatures. In terms of capacity, the ultra-large segment (over 30,000 MT) is experiencing rapid growth, reflecting the move towards global trade optimization and economies of scale in production. Furthermore, the End-User segment is diversifying, with Chemical and Fertilizer Manufacturers remaining the core consumers, but the Energy & Utility sector, driven by ammonia as a marine fuel and power generation feedstock, is quickly gaining market share. This diversification necessitates varying tank specifications, including those designed for high-purity ammonia used in advanced energy applications, signaling a shift in manufacturing focus toward material handling and purity maintenance alongside traditional safety considerations.

AI Impact Analysis on Anhydrous Ammonia Storage Tank Market

User queries regarding the impact of Artificial Intelligence (AI) on the Anhydrous Ammonia Storage Tank market frequently revolve around enhanced safety, predictive maintenance capabilities, and optimization of operational efficiency. Users are keenly interested in how AI can move beyond traditional, time-based inspection regimes to truly condition-based monitoring, anticipating failures before they occur. Key themes include the use of machine learning (ML) models to analyze vast datasets collected from sensors regarding temperature, pressure, corrosion rates, and seismic activity, providing real-time risk assessment and improving the fidelity of non-destructive examination results. There is strong expectation that AI will drastically reduce catastrophic risks inherent in NH3 storage by identifying subtle anomalies indicative of potential material degradation or containment failure, moving the industry closer to zero-incident operation. Users are also concerned with how AI can optimize the logistical flow of ammonia, particularly at large port terminals, managing inventory levels and predicting ideal shipping schedules based on market fluctuations and weather patterns.

The immediate influence of AI technology is observable in two primary areas: structural integrity management and process optimization. In integrity management, ML algorithms process input from acoustic emission sensors, ultrasonic testing devices, and robotic inspection units to create digital twins of the storage tanks. These digital models allow operators to simulate stress factors, predict remaining useful life (RUL), and prioritize maintenance schedules based on real-world asset condition rather than generic timelines. This shift maximizes operational uptime and minimizes the cost of premature or unnecessary maintenance activities. The application of sophisticated data analytics is enabling tank operators to precisely monitor corrosion under insulation (CUI) risks, a notorious problem in cryogenic and low-temperature storage, far more effectively than periodic manual inspections.

Furthermore, AI is instrumental in optimizing the storage and handling processes themselves. Advanced control systems powered by AI are used to manage the complex chilling and recirculation cycles required for fully refrigerated tanks, minimizing energy consumption and preventing pressure fluctuations that could compromise safety. By analyzing historical demand patterns, seasonal temperature variations, and supply chain constraints, AI-driven inventory management systems ensure optimal storage capacity utilization, especially at large production facilities and key distribution hubs. This enhanced level of operational intelligence not only improves economic returns but also contributes significantly to environmental compliance by minimizing waste and potential emissions associated with storage incidents.

- AI enables predictive maintenance by analyzing sensor data (pressure, temperature, acoustic emissions) to forecast material fatigue and corrosion risk.

- Machine learning algorithms optimize refrigeration and recirculation cycles in cryogenic tanks, leading to significant energy consumption reductions.

- Digital twin technology, fueled by AI, provides real-time simulation and structural integrity monitoring for complex storage infrastructure.

- AI-driven computer vision systems enhance safety inspections by analyzing video feeds for anomalies, leaks, or security breaches around tank farms.

- Advanced analytics improve supply chain efficiency and inventory forecasting at large export terminals, optimizing logistics and throughput.

DRO & Impact Forces Of Anhydrous Ammonia Storage Tank Market

The Anhydrous Ammonia Storage Tank market is shaped by a confluence of powerful drivers, stringent restraints, and transformative opportunities, all contributing to a complex set of impact forces that dictate investment and operational strategies. The primary driver remains the fundamental need for nitrogen fertilizers to sustain global agricultural productivity, necessitating continuous expansion of ammonia production capacity worldwide. Parallel to this, the burgeoning interest in ammonia as a key element in the global energy transition—specifically as a safe and efficient carrier for hydrogen (blue and green ammonia)—is acting as a massive accelerator for large-scale storage projects, particularly focused on export infrastructure and maritime bunkering. Technological advancements in construction materials, welding techniques, and leak detection systems, coupled with stricter regulatory mandates from bodies like OSHA and regional environmental agencies, also push the market forward by compelling investment in newer, safer tank designs, thereby impacting the replacement cycle positively.

Conversely, the market faces significant restraints, chief among them the extremely high capital investment required for constructing specialized, large-capacity storage tanks, especially those designed to handle the cryogenic conditions of fully refrigerated ammonia. The inherent hazards associated with anhydrous ammonia—its toxicity and potential for catastrophic failure—translate into complex and time-consuming regulatory approval processes and elevated operational risk insurance premiums, which can deter smaller players. Furthermore, the volatility in the price of natural gas, which is the primary feedstock for conventional ammonia production, introduces financial uncertainty, potentially slowing down long-term investment decisions for new storage facilities. Public opposition and NIMBY (Not In My Backyard) sentiment related to the construction of large hazardous chemical storage facilities near populated areas also represents a non-trivial challenge that requires extensive public relations and advanced safety protocols to overcome.

The foremost opportunity lies in the rapid development of the green ammonia sector, which requires entirely new supply chain infrastructure globally, distinct from traditional fertilizer routes. This shift mandates investment in storage tanks integrated with renewable energy hubs, particularly in regions with high solar and wind potential. Another significant opportunity stems from the digitalization of assets; implementing sophisticated Industrial Internet of Things (IIoT) sensors, combined with AI-driven analytics, allows tank owners to move towards truly predictive maintenance models, dramatically improving safety and asset utilization rates. The increasing trend of retrofitting existing LNG (Liquefied Natural Gas) infrastructure or repurposing aging tanks to handle ammonia, while challenging, presents a cost-effective pathway for market entry in specific geographical areas. These interconnected forces—driven by decarbonization mandates and fundamental agricultural needs—ensure sustained, high-value investment in the market, favoring firms capable of delivering high-quality, fully engineered, and compliant storage solutions.

Segmentation Analysis

The Anhydrous Ammonia Storage Tank market is segmented based on critical design parameters and end-user applications, reflecting the diverse requirements of the agricultural, chemical, and emerging energy sectors. Segmentation by storage type is crucial, distinguishing between fully refrigerated, semi-refrigerated, and pressurized tanks. Fully refrigerated tanks, which store NH3 at atmospheric pressure and -33°C, dominate the large-scale segment due to their economic advantages in high-volume, long-term storage and export logistics. Segmentation by capacity dictates the complexity of the project, ranging from small agricultural tanks used on farms to immense industrial tanks (over 50,000 MT) found at port terminals and mega-production sites. Material segmentation focuses primarily on various grades of carbon and specialized low-temperature alloy steels, chosen based on the required operating temperature and design pressure, emphasizing strict adherence to material integrity standards like API 620.

The segmentation across end-user industries provides insight into demand characteristics. While the Fertilizer and Chemical Manufacturing sector remains the foundational consumer, driving demand for process-integrated storage, the Energy and Utilities sector is emerging as a high-growth segment. This includes tanks supporting power generation utilizing ammonia, and, more notably, storage dedicated to marine fuel bunkering and global hydrogen transport infrastructure. The technical specifications, safety tolerances, and required throughput vary dramatically between these end-user segments; for instance, fertilizer storage prioritizes high volume and operational simplicity, whereas energy-related storage often requires higher purity maintenance and faster turnaround times for bunkering operations. This diversification ensures market stability across various economic cycles.

Geographically, the market is broadly segmented into five main regions, reflecting distinct regulatory environments, feedstock availability, and demand patterns. Asia Pacific leads due to its expansive agricultural base and rapid industrialization, driving both fertilizer and petrochemical demands. However, the future growth narrative is heavily influenced by large-scale strategic projects in the Middle East and Africa (MENA) related to hydrogen and ammonia export, positioning this region for accelerated expansion in the high-capacity, fully refrigerated segment. Understanding these segment dynamics is essential for market participants to tailor their offerings, whether focusing on standardized pressurized tanks for North American agriculture or bespoke cryogenic giants for Asian export hubs.

- By Storage Type:

- Fully Refrigerated Tanks (FRT)

- Semi-Refrigerated Tanks

- Pressurized Tanks

- By Capacity:

- Less than 5,000 Metric Tons (MT)

- 5,000 MT to 30,000 MT

- More than 30,000 MT (Ultra-Large)

- By Material:

- Carbon Steel

- Low-Temperature Carbon Steel/Alloys

- By End-User:

- Fertilizer Manufacturers

- Chemical and Pharmaceutical Industries

- Oil and Gas Sector

- Energy and Utilities (Hydrogen Carrier/Bunkering)

Value Chain Analysis For Anhydrous Ammonia Storage Tank Market

The value chain for the Anhydrous Ammonia Storage Tank market commences with the upstream sourcing of high-grade raw materials, primarily carbon steel plates and specialized alloys required for low-temperature service. Given the stringent performance and safety requirements, tank fabricators rely heavily on certified suppliers capable of delivering materials meeting exacting standards such as ASME and API. The complexity of the manufacturing phase involves specialized processes including hot rolling, advanced welding techniques, non-destructive testing (NDT), and specialized coatings application (e.g., zinc silicate or epoxy linings). The high cost and strict quality control associated with these raw materials, particularly the thick-walled steel required for large vessels, represent a critical component of the total project expenditure and necessitate robust supply chain management to ensure timely delivery and certification compliance.

The midstream of the value chain is dominated by specialized Engineering, Procurement, and Construction (EPC) contractors who manage the complex design, fabrication, and installation processes. Due to the massive size and unique technical specifications of fully refrigerated tanks, fabrication is often modularized in controlled environments before being shipped to the site for final assembly, often utilizing highly specialized heavy lifting and welding operations. Certification and regulatory adherence are crucial steps managed at this stage, involving third-party inspectors and government regulatory bodies (e.g., environmental and process safety agencies). Distribution channels are highly specialized and often direct, with EPC firms contracting directly with the end-users—large fertilizer producers or state-owned energy entities—rather than relying on broad distribution networks. The market sees minimal indirect distribution due to the highly customized and high-value nature of the asset.

Downstream, the installed storage tanks become central to the operations of the end-user. For fertilizer manufacturers, the tank ensures continuous feedstock supply to the urea and compound fertilizer production units. For energy companies, especially those involved in blue/green ammonia, the tanks function as essential nodes for global trade and bunkering operations. Maintenance and integrity management services form a critical long-term component of the downstream value chain, with specialized service providers offering periodic NDT inspections, insulation repair, corrosion control, and eventual decommissioning. The trend towards long-term service contracts and digital monitoring ensures ongoing revenue streams for the service segments, linking the entire value chain back to the original equipment manufacturers (OEMs) who often provide proprietary maintenance solutions based on their tank designs.

Anhydrous Ammonia Storage Tank Market Potential Customers

The core customer base for Anhydrous Ammonia Storage Tanks spans several industrial verticals, characterized by their need for large-scale, safe containment of NH3 as either a feedstock or a functional carrier. Historically, the largest and most consistent buyers have been multinational and regional Fertilizer Manufacturers, including major players like Yara International, CF Industries, and state-owned enterprises in China and India. These customers require robust, high-capacity storage integrated within large-scale production complexes to manage seasonal inventory fluctuations, ensuring uninterrupted supply for global agricultural demand. Their procurement decisions are heavily influenced by tank lifetime cost, safety records, and adherence to severe design codes, given the inherent risks involved in storing highly toxic materials necessary for their core business operations.

A rapidly expanding segment of potential customers includes Energy Companies and Utility Providers involved in the transition to cleaner fuels. This includes major oil and gas companies diversifying into hydrogen infrastructure, independent power producers exploring ammonia co-firing, and companies developing dedicated ammonia bunkering hubs at major shipping ports. These customers are driven by regulatory mandates and global decarbonization targets, necessitating specialized storage designed for high-purity ammonia used in fuel cells or marine engines. Their procurement strategy often focuses on integration capabilities with hydrogen production units (electrolyzers or steam methane reformers with carbon capture) and rapid loading/unloading capabilities required for efficient logistics in global shipping.

Additionally, Chemical and Petrochemical Processors constitute a steady market segment, utilizing ammonia in the production of various industrial chemicals, including nitric acid, ammonium nitrates, and specialized resins. Finally, governments and state-owned entities, particularly those managing strategic national reserves of fertilizer or planning major infrastructure projects for export terminals (such as those being developed in Australia, Saudi Arabia, and the UAE for green ammonia exports), represent high-value, large-volume potential customers. These large infrastructure projects often require customized, bespoke storage solutions and long-term service agreements, providing substantial opportunities for highly specialized EPC contractors and fabricators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McDermott International, Wartsila Corporation, thyssenkrupp Industrial Solutions, CPECC, Mitsubishi Heavy Industries (MHI), Chicago Bridge & Iron Company (CB&I), Samsung C&T Corporation, IHI Corporation, CIMC ENRIC, Taylor Wharton, Chart Industries, VEC Fabrication, Pfaudler, General Tank, Trinity Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anhydrous Ammonia Storage Tank Market Key Technology Landscape

The technological landscape of the Anhydrous Ammonia Storage Tank market is continuously evolving, driven by the dual mandates of enhancing safety and improving operational efficiency, particularly in the high-capacity, fully refrigerated segment. A core technological focus involves advanced metallurgy and welding techniques. Storage tanks must withstand extreme temperature gradients and potential hydrogen embrittlement if ammonia is used in a cyclic energy storage context. Therefore, advancements in low-temperature carbon steel alloys and specialized post-weld heat treatments (PWHT) are critical to ensure the structural integrity of the vessels throughout their intended operational lifespan. Additionally, the adoption of narrow gap welding and orbital welding systems reduces fabrication time while ensuring weld quality that minimizes defect rates, a crucial factor given the sheer thickness of the steel plates used in mega-tanks.

Digitalization and monitoring technologies represent another pivotal area of innovation. The integration of the Industrial Internet of Things (IIoT) sensors—monitoring parameters such as acoustic emissions, cryogenic temperature stratification, liquid level, and corrosion potential—provides operators with granular, real-time data on tank health. This sensor data is often processed by advanced control systems utilizing digital twin technology, which creates a virtual replica of the physical asset. The digital twin allows for dynamic simulation of operational scenarios and stress testing, enabling highly accurate predictive maintenance and risk modeling, thus minimizing the probability of catastrophic failures associated with aging infrastructure or unforeseen material stresses. This move toward integrated digital asset management is fundamentally reshaping the operational expenditure model for tank farm owners.

Furthermore, technology focused on enhanced corrosion control and containment is essential. Ammonia, particularly in the presence of moisture, is highly corrosive to certain materials. Technological advancements include specialized internal coatings, such as high-build epoxy or zinc silicates, designed to resist chemical attack and mechanical abrasion. For the critical issue of containment, the industry is increasingly adopting double-integrity containment solutions, typically employing a full secondary concrete wall or earthen berm around the primary containment vessel. Newer designs are favoring "full containment" tanks, where the outer concrete shell is designed to safely contain the entire contents of the inner steel tank should a breach occur, providing the highest level of safety assurance and regulatory compliance in high-risk environments.

Regional Highlights

The global Anhydrous Ammonia Storage Tank market exhibits significant regional heterogeneity, dictated by agricultural intensity, chemical industry maturity, and strategic involvement in the emerging hydrogen economy. Asia Pacific (APAC) stands as the largest market, driven primarily by India and China, which are the world's leading consumers and producers of nitrogen fertilizers. The rapid expansion of petrochemical complexes and increasing regional trade necessitate high-volume storage infrastructure. Investment in APAC is focused on both domestic agricultural supply chains (smaller, pressurized tanks for local use) and large, fully refrigerated terminals at key ports to facilitate imported ammonia and regional trade flows, making it a highly active market for new construction and capacity expansion projects.

The Middle East and Africa (MEA) region is rapidly emerging as the principal growth engine for the ultra-large capacity segment. This accelerated growth is fundamentally linked to vast, state-backed initiatives in Saudi Arabia, the UAE, and Qatar aimed at leveraging low-cost natural gas (for blue ammonia) and abundant solar/wind resources (for green ammonia) to become global exporters of clean hydrogen carriers. The storage demand here is highly concentrated in large-scale export terminals requiring bespoke, dual-integrity, fully refrigerated tanks typically exceeding 50,000 MT capacity. The strategic positioning of MEA as a logistical hub between Asia and Europe further enhances the region's importance for long-term storage investments necessary for global ammonia trade routes.

North America and Europe represent mature markets characterized by stringent regulatory environments and a focus on infrastructure modernization and replacement. In North America, demand is stable, driven by the large domestic agricultural industry and, increasingly, by the integration of ammonia storage into oil and gas facilities. European demand is driven by the EU's ambitious Green Deal, catalyzing investments in green ammonia production and storage, particularly for industrial decarbonization and as a marine fuel. The market activity in these regions focuses less on high-volume greenfield construction (outside of dedicated hydrogen projects) and more on safety upgrades, retrofitting existing assets with advanced monitoring systems, and adhering to rigorous standards like Seveso III in Europe and PSM (Process Safety Management) standards in the US.

- Asia Pacific (APAC): Dominates the market due to massive fertilizer consumption in China and India, coupled with rapid chemical industry growth and infrastructure development in Southeast Asia.

- Middle East & Africa (MEA): Fastest-growing region, powered by mega-projects focused on blue and green ammonia export, requiring ultra-large, fully refrigerated storage terminals.

- North America: Stable demand driven by agriculture and replacement cycles; strong emphasis on safety compliance (PSM) and pressurized storage used in domestic distribution.

- Europe: Focuses on regulatory-driven modernization and strategic investments in green ammonia storage to meet decarbonization and industrial fuel switching targets.

- Latin America: Growing due to agricultural expansion (especially Brazil and Argentina), driving need for imported ammonia storage and related infrastructure at coastal ports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anhydrous Ammonia Storage Tank Market.- McDermott International

- Wartsila Corporation

- thyssenkrupp Industrial Solutions

- CPECC (China Petroleum Engineering & Construction Corp.)

- Mitsubishi Heavy Industries (MHI)

- Chicago Bridge & Iron Company (CB&I - now part of McDermott)

- Samsung C&T Corporation

- IHI Corporation

- CIMC ENRIC

- Taylor Wharton

- Chart Industries

- VEC Fabrication

- Pfaudler

- General Tank

- Trinity Industries

- Wison Engineering

- Toyo Engineering Corporation

- Saipem S.p.A.

- Daelim Industrial Co., Ltd.

- SNC-Lavalin Group Inc.

Frequently Asked Questions

Analyze common user questions about the Anhydrous Ammonia Storage Tank market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the Anhydrous Ammonia Storage Tank market growth?

The market is primarily driven by sustained global demand for nitrogen fertilizers in the agricultural sector, coupled with the rapid emergence of ammonia as a critical clean energy carrier (blue and green ammonia) for global hydrogen transportation and decarbonization efforts.

What is the most common storage method for large volumes of anhydrous ammonia?

The preferred method for large-scale, industrial storage is the fully refrigerated tank (FRT), which maintains ammonia at atmospheric pressure and a cryogenic temperature of -33°C (-28°F). This method is essential for cost-effective global trade and logistics at port terminals.

Which geographical region dominates the demand for Anhydrous Ammonia Storage Tanks?

The Asia Pacific (APAC) region currently holds the largest market share due to its massive agricultural base and continuous expansion of petrochemical and fertilizer production facilities in countries like China and India.

How is AI impacting the safety and operation of ammonia storage facilities?

AI is significantly improving safety through predictive maintenance, utilizing machine learning to analyze sensor data for early detection of material fatigue and corrosion, enabling operators to move toward condition-based inspection regimes and reducing the risk of containment failure.

What types of containment systems are required for modern ammonia storage tanks?

Modern high-capacity ammonia storage facilities increasingly require double-integrity solutions, often utilizing full containment tanks where a specialized concrete outer wall is designed to contain the entire contents of the inner steel tank in case of a primary breach, meeting stringent safety standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager