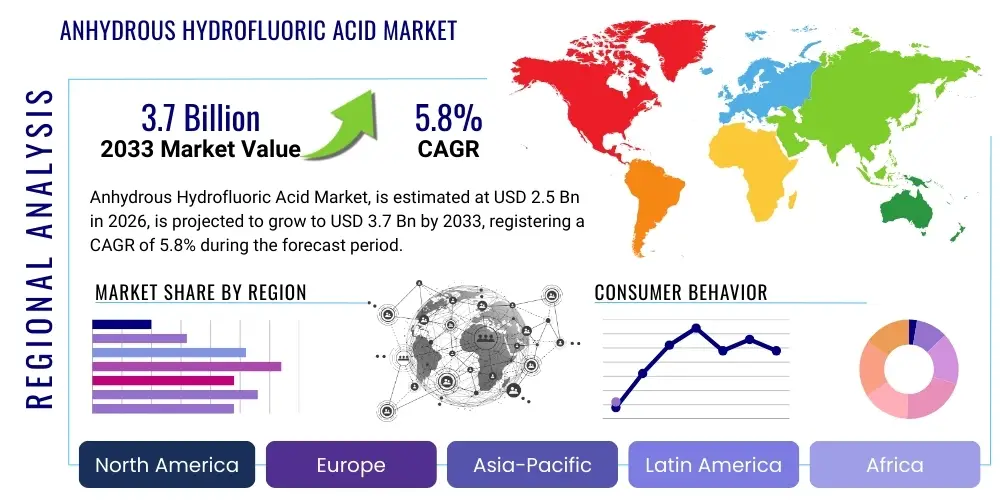

Anhydrous Hydrofluoric Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435286 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Anhydrous Hydrofluoric Acid Market Size

The Anhydrous Hydrofluoric Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.7 Billion by the end of the forecast period in 2033.

Anhydrous Hydrofluoric Acid Market introduction

Anhydrous Hydrofluoric Acid (AHF), a colorless liquid or gas, is a critical foundational chemical intermediary essential for a vast range of industrial processes. It is typically produced by the reaction of fluorspar (calcium fluoride) with sulfuric acid, yielding highly concentrated hydrogen fluoride. AHF serves as a cornerstone in the manufacturing of fluorine-containing chemicals, which are indispensable across modern industries, including refrigerants, aluminum smelting, electronics, and pharmaceuticals. Due to its highly corrosive and hazardous nature, the production, handling, and transportation of AHF are subject to stringent global environmental and safety regulations, significantly impacting market dynamics and technological investments.

The primary application driving market expansion is the synthesis of fluorocarbons, which include refrigerants, blowing agents, and specialized polymers like PTFE. While the phase-down of older, high-Global Warming Potential (GWP) hydrofluorocarbons (HFCs) under international agreements like the Kigali Amendment presents complex challenges, it simultaneously necessitates the development and increased production of next-generation, low-GWP alternatives, all of which require AHF in their production pathway. Furthermore, AHF is vital in the aluminum production process for creating synthetic cryolite, a critical electrolyte, linking the market growth directly to global infrastructural development and automotive demand.

Key benefits of AHF stem from its unique chemical properties, particularly its potent reactivity and utility in synthesizing fluorinated compounds with exceptional thermal stability and chemical resistance. Driving factors for the market include the accelerating demand for high-performance fluoropolymers in electric vehicle (EV) batteries and solar panels, the resurgence of the semiconductor industry requiring AHF for etching and cleaning processes, and sustained growth in the pharmaceutical and agrochemical sectors where fluorinated molecules are increasingly crucial for enhancing drug efficacy and stability. The market's resilience is tied to its fundamental role as a precursor chemical, making it irreplaceable in numerous high-value supply chains.

Anhydrous Hydrofluoric Acid Market Executive Summary

The Anhydrous Hydrofluoric Acid market is characterized by constrained supply chains originating from concentrated fluorspar deposits, stringent regulatory frameworks governing production and handling, and robust demand from technologically advanced end-user sectors. Business trends indicate a strategic focus among major producers on backward integration into fluorspar mining to secure raw material supply and mitigate price volatility. Furthermore, there is increasing investment in advanced safety and purification technologies to meet the high purity requirements of the electronics and pharmaceutical industries. The competitive landscape is moderately consolidated, with key players emphasizing geographical expansion, particularly in high-growth Asia Pacific markets, and pursuing sustainable manufacturing practices to gain regulatory compliance advantages.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in both consumption and production of AHF, primarily driven by China's dominant position in fluorocarbon manufacturing, aluminum smelting, and the burgeoning electronics assembly sector. North America and Europe maintain stable, mature markets focused on high-purity applications, particularly specialized chemicals and aerospace materials, and are heavily influenced by environmental policies pushing the transition towards low-GWP refrigerants. This transition mandates continuous R&D efforts and capital expenditure in processing facilities capable of handling complex feedstocks, ensuring regional market stability despite regulatory pressures.

Segment trends demonstrate strong growth in the fluorocarbons segment, despite regulatory hurdles, owing to the necessary shift towards HFOs (hydrofluoroolefins). The specialty chemicals and electronics segment, driven by the expanding global need for advanced semiconductor etching agents and fluorinated polymers used in lithium-ion battery components, is witnessing the highest purity demands and corresponding price premiums. The essential nature of AHF in these rapidly evolving technological fields ensures sustained premium pricing for ultra-high purity grades. Overall, market stability is highly correlated with global economic health, particularly investment in infrastructure, consumer electronics manufacturing, and the decarbonization movement necessitating advanced battery technologies.

AI Impact Analysis on Anhydrous Hydrofluoric Acid Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Anhydrous Hydrofluoric Acid market primarily center on safety enhancements, predictive process optimization, and efficiency improvements in production, which is inherently energy-intensive and hazardous. Users seek clarity on how AI can minimize operational risks associated with AHF handling and storage, given its extreme corrosive properties. Key themes emerging from these questions involve optimizing the synthesis reaction parameters to maximize yield from fluctuating fluorspar quality, predicting equipment failure in harsh environments to prevent catastrophic incidents, and streamlining complex global logistics for this restricted chemical commodity. Expectations are high that AI will lead to cleaner, safer, and more economically viable production pathways, crucial for justifying expansion investments under tight regulatory scrutiny.

The application of predictive maintenance algorithms, powered by AI, represents a significant operational shift. Sensors deployed in reaction vessels, piping, and storage tanks can collect data on temperature, pressure, and material stress. ML models analyze these continuous data streams to identify subtle deviations indicative of potential leaks, corrosion, or equipment degradation long before conventional monitoring systems flag an issue. This preemptive capability not only drastically enhances worker safety and environmental protection—critical concerns for AHF operations—but also minimizes expensive, unscheduled downtime, thereby improving overall plant capacity utilization and economic efficiency.

Furthermore, AI-driven process optimization is being implemented in the highly complex chemical synthesis of AHF. ML models can rapidly analyze the varying quality characteristics of raw fluorspar input, adjusting parameters such as sulfuric acid concentration, temperature profiles, and reaction residence time in real-time to maintain optimal yield and purity levels. This is especially vital for producing the ultra-high purity AHF required by the semiconductor industry, where impurities measured in parts per billion can lead to product defects. AI and advanced analytics are also utilized to model complex supply chain risks, optimizing inventory levels of fluorspar and managing the intricate distribution logistics required for AHF transport across international borders under strict security protocols.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast corrosion rates and equipment failure in AHF production and storage infrastructure, drastically improving safety and uptime.

- Process Optimization and Yield Maximization: Machine Learning models fine-tune reaction parameters (temperature, flow rates) in real-time based on fluctuating raw material quality (fluorspar), increasing AHF purity and yield.

- Supply Chain and Logistics Modeling: AI optimizes complex, highly regulated distribution routes and inventory management for this hazardous chemical, reducing transit risks and associated costs.

- Safety Protocol Automation: AI systems monitor worker compliance with rigorous safety procedures within high-risk AHF areas, providing immediate alerts for non-compliance and enhancing overall site security.

- Material Science Research Acceleration: AI aids in screening potential alternative feedstocks or developing more robust, corrosion-resistant materials for use in AHF handling equipment.

DRO & Impact Forces Of Anhydrous Hydrofluoric Acid Market

The dynamics of the Anhydrous Hydrofluoric Acid market are governed by a critical tension between robust industrial demand (Drivers) and severe regulatory and safety limitations (Restraints), punctuated by transformative application potential (Opportunities). The primary drivers include the burgeoning global demand for specialized fluorinated products, notably low-GWP refrigerants (HFOs) and high-performance lithium-ion batteries utilized in electric vehicles and grid storage systems, both of which require AHF as a fundamental building block. Furthermore, relentless growth in the semiconductor fabrication sector, particularly in Asia, continuously boosts the need for ultra-high purity AHF for etching and cleaning applications, commanding premium pricing. These demand sectors ensure a stable and growing market trajectory for the foreseeable future, despite upstream constraints.

Conversely, the market faces profound restraints primarily stemming from the inherent hazards of AHF. Its extreme corrosivity and toxicity necessitate enormous capital investment in specialized, high-integrity production facilities and transportation infrastructure, coupled with high operational costs related to safety protocols, waste disposal, and regulatory compliance. Moreover, the environmental regulations, particularly those concerning the phase-down of older fluorocarbons and the scrutiny placed on mining fluorspar—the primary feedstock—limit new market entrants and place financial burdens on established players. Geopolitical risks associated with fluorspar supply, largely concentrated in a few regions, also represent a significant supply chain restraint, contributing to raw material price volatility.

Opportunities in the market center on technological innovation and market diversification. The sustained push for green technology presents an opportunity for producers specializing in high-purity AHF derivatives essential for advanced battery electrolytes (LiPF6 production) and next-generation fuel cell technology components. Another key opportunity lies in developing environmentally friendlier production methods that reduce energy consumption and minimize hazardous waste generation, potentially leveraging non-fluorspar based feedstocks or highly efficient recycling technologies. The impact forces acting on this market include intense regulatory oversight from bodies like the EPA and REACH, technological shifts in end-user industries (e.g., transition away from conventional refrigeration systems), and global trade policies affecting raw material movement.

Segmentation Analysis

The Anhydrous Hydrofluoric Acid market is primarily segmented based on its Purity Grade, which dictates its application suitability and pricing structure, and by end-use application, reflecting the diverse industrial sectors relying on this core chemical. Purity grades range from technical grade, suitable for bulk chemical production, to ultra-high purity (UHP) grades, essential for highly sensitive electronics and pharmaceuticals. The end-use segmentation is crucial as it demonstrates the market's dependence on cyclical industries like aluminum and stable, high-growth sectors such as semiconductors and advanced materials. Understanding these segments is key to analyzing differential pricing strategies and regional consumption patterns, given the strict requirements for handling, transport, and storage vary significantly by purity level.

- By Purity Grade:

- Technical Grade Anhydrous Hydrofluoric Acid (AHF)

- High Purity Grade Anhydrous Hydrofluoric Acid (AHF)

- Ultra-High Purity Grade Anhydrous Hydrofluoric Acid (AHF)

- By Application:

- Fluorocarbon Production (Refrigerants, Blowing Agents, Propellants)

- Fluorinated Derivatives (Specialty Chemicals, Polymers, Elastomers)

- Aluminum Smelting (Production of Synthetic Cryolite)

- Uranium Processing

- Pharmaceutical and Agrochemicals (Synthesis of fluorinated compounds)

- Semiconductors and Electronics (Etching and cleaning processes)

- Others (Metal pickling, petroleum catalysts)

Value Chain Analysis For Anhydrous Hydrofluoric Acid Market

The value chain for the Anhydrous Hydrofluoric Acid market is characterized by high integration and specialized processing stages, starting with the mining of fluorspar (calcium fluoride), the primary raw material. The upstream analysis focuses heavily on the geographical concentration and quality of fluorspar reserves, particularly acid-grade fluorspar (containing over 97% CaF2), which is essential for AHF production. Securing reliable and high-quality fluorspar supply is a major bottleneck, leading many large AHF producers to engage in backward integration through ownership or long-term contracts with fluorspar mines, particularly in China, Mexico, and South Africa. Raw material costs constitute a significant portion of the final AHF price, and processing involves highly energy-intensive and capital-intensive acidulation reactions under strictly controlled safety conditions.

The midstream of the value chain involves the synthesis and purification of AHF. Technical grade AHF is often directly utilized by large, integrated chemical companies for in-house conversion into downstream fluorocarbons and specialty chemical intermediates. For high-purity and ultra-high purity applications, additional and rigorous purification steps, such as distillation and filtering, are mandatory to remove trace impurities, making this phase complex and costly. This midstream stage is dominated by a few large global chemical manufacturers with the technical expertise and capacity to handle the hazardous substance efficiently and safely.

Downstream analysis involves the distribution channels and end-user consumption. AHF is transported primarily in specialized, dedicated steel tank cars or cylinders under high pressure, adhering to strict international hazardous materials regulations, making the logistics expensive and complex. Distribution is highly controlled, often involving direct sales contracts from the manufacturer to major industrial end-users (e.g., aluminum smelters, large refrigerant producers). Indirect distribution through third-party specialized chemical distributors is limited primarily to smaller-volume, high-purity grades required by pharmaceutical or specialty electronics firms. The final consumption is driven by the production of essential derivatives, including HFCs, HFOs, PTFE, and various fluoro-monomers, linking the market’s health directly to the success of these end-product industries.

Anhydrous Hydrofluoric Acid Market Potential Customers

The primary customers for Anhydrous Hydrofluoric Acid are large industrial entities that rely on fluorine chemistry for their production processes. The largest consumer base comprises manufacturers engaged in fluorocarbon synthesis, including major chemical and petrochemical companies producing refrigerants, aerosol propellants, and insulation blowing agents. These buyers are highly sensitive to AHF purity and price fluctuations, as AHF is a primary precursor for their high-volume, commodity chemical outputs. The global regulatory shift towards low-GWP substances means these customers are continuously investing in new technologies, ensuring sustained, albeit evolving, demand for AHF.

Another major segment of buyers includes primary aluminum producers. These integrated companies use AHF to manufacture synthetic cryolite (Na3AlF6) and aluminum fluoride (AlF3), essential components used as fluxes and electrolytes in the Hall–Héroult process for aluminum smelting. The demand from this segment is cyclical, closely tied to global commodity prices for aluminum and infrastructural spending. These buyers typically require technical grade AHF in very large, consistent volumes, often supplied via dedicated, long-term contracts to ensure supply continuity for their 24/7 smelting operations.

The fastest-growing, though smaller volume, customer segment consists of specialized chemical manufacturers, pharmaceutical companies, and semiconductor fabricators. These customers require ultra-high purity AHF (often electronic grade) for processes such as advanced drug synthesis, agrochemical formulation, and silicon wafer etching and cleaning. For these users, purity is paramount, often demanding AHF with impurities measured in parts per billion. Due to the high value derived from these end products (e.g., microchips, patented drugs), these buyers are less price-sensitive and focus instead on stringent quality assurance, reliable supply, and technical support from AHF suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Chemours Company, Solvay S.A., Shandong Dongyue Chemical Co., Ltd., Sanmei Group, Gujarat Fluorochemicals Limited (GFL), Halocarbon Products Corporation, Xingfa Group, Arkema Group, Daikin Industries, Ltd., Jiangsu Sopo Chemical Co., Ltd., China National Chemical Corporation (ChemChina), Air Liquide, Kanto Denka Kogyo Co., Ltd., Central Glass Co., Ltd., Lanxess AG, Morita Chemical Industries Co., Ltd., Stella Chemifa Corporation, Mexichem (Orbia), Pelchem SOC Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anhydrous Hydrofluoric Acid Market Key Technology Landscape

The predominant technological approach for AHF production remains the acidulation of acid-grade fluorspar with concentrated sulfuric acid in rotary kilns, a mature but energy-intensive and complex process. Current technological innovation in this landscape is not focused on fundamentally altering the core chemical reaction, but rather on refining upstream raw material preparation, optimizing reactor design for thermal efficiency and yield, and, most crucially, enhancing downstream purification processes. The trend is moving towards closed-loop systems and advanced scrubbing technologies to capture and neutralize fluorine-containing off-gases, mitigating environmental impact and ensuring compliance with tightening emission standards globally. Advanced sensing and control systems are key to managing the highly corrosive environment and maintaining operational safety.

A critical segment of technological advancement is dedicated to achieving Ultra-High Purity (UHP) AHF, essential for the booming semiconductor industry (e-grade). Production of e-grade AHF requires multiple stages of distillation and specialized filtration using inert materials to remove trace metallic ions and organic contaminants to levels undetectable by standard methods. Companies are investing heavily in proprietary purification technologies and dedicated, contamination-free handling systems to meet the increasingly strict purity requirements driven by the shift to smaller node fabrication processes (e.g., 5nm and below). This specialized purification technology allows suppliers to command significant price premiums over technical- grade AHF.

Furthermore, attention is being given to developing technologies for the safe and efficient management of byproduct gypsum (calcium sulfate) and the exploration of alternative feedstocks, such as hexafluorosilicic acid (HFS), a byproduct of phosphate fertilizer production. While HFS conversion to AHF is technically viable, it presents its own complex separation and purification challenges. The long-term technological landscape is also being shaped by advancements in AHF storage and transport, focusing on developing new, highly corrosion-resistant alloys and composite materials for containers, ensuring maximum integrity and public safety during transit and minimizing leakage risk which is paramount for this hazardous chemical.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC, led primarily by China, constitutes the largest market both in terms of production capacity and consumption. This dominance is driven by China's extensive manufacturing base for fluorocarbons, the huge capacity dedicated to aluminum smelting, and the proliferation of electronics and semiconductor fabrication plants across South Korea, Taiwan, and Japan. The region is the main engine of global demand growth, absorbing significant volumes for battery electrolytes and next-generation refrigerants.

- North America Maturity and High-Value Focus: North America is a mature market characterized by stable demand and a strong focus on high-value applications, particularly in aerospace, specialty polymers (PTFE), and high-grade intermediates for the pharmaceutical sector. Demand is increasingly driven by stringent environmental regulations promoting the shift towards newer, non-ozone depleting, low-GWP HFO refrigerants, requiring local AHF production capacity to service this transition.

- Europe's Regulatory Influence: The European market is heavily influenced by the REACH regulation and the F-Gas regulation, leading to a steady, managed reduction in older HFC consumption. European demand is stable for specialty chemical synthesis, technical grades for aluminum and steel, and high-purity inputs for advanced materials. Innovation here is geared towards sustainable production and high-efficiency purification technologies, essential for maintaining competitiveness amidst high operating costs and environmental scrutiny.

- Latin America and MEA Emerging Growth: Latin America shows moderate growth linked to regional industrial expansion, particularly in Brazil and Mexico, focusing on basic chemical production and regional refrigeration needs. The Middle East and Africa (MEA) region, while smaller, presents opportunities linked to expanding petrochemical operations and localized aluminum production, although complex logistics and safety requirements often limit local AHF production, necessitating significant imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anhydrous Hydrofluoric Acid Market.- Honeywell International Inc.

- Chemours Company

- Solvay S.A.

- Shandong Dongyue Chemical Co., Ltd.

- Sanmei Group

- Gujarat Fluorochemicals Limited (GFL)

- Halocarbon Products Corporation

- Xingfa Group

- Arkema Group

- Daikin Industries, Ltd.

- Jiangsu Sopo Chemical Co., Ltd.

- China National Chemical Corporation (ChemChina)

- Air Liquide

- Kanto Denka Kogyo Co., Ltd.

- Central Glass Co., Ltd.

- Lanxess AG

- Morita Chemical Industries Co., Ltd.

- Stella Chemifa Corporation

- Mexichem (Orbia)

- Pelchem SOC Ltd.

Frequently Asked Questions

Analyze common user questions about the Anhydrous Hydrofluoric Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Anhydrous Hydrofluoric Acid (AHF) primarily used for?

AHF is primarily used as a precursor chemical in the manufacturing of fluorocarbons (refrigerants, blowing agents), specialized fluoropolymers (PTFE), essential chemicals for aluminum production (synthetic cryolite), and ultra-high purity etching agents for the semiconductor industry.

How does the global regulatory environment, like the Kigali Amendment, affect AHF demand?

The Kigali Amendment mandates the phase-down of high-GWP HFCs, necessitating a global shift towards newer, low-GWP alternatives (HFOs). Since AHF is critical for synthesizing these new HFOs, the regulation, paradoxically, ensures sustained and evolving demand for high-purity AHF.

Which region dominates the production and consumption of Anhydrous Hydrofluoric Acid?

The Asia Pacific (APAC) region, driven overwhelmingly by manufacturing capacities in China, is the leading market for both the production and consumption of AHF due to its massive fluorochemical, aluminum, and electronics industries.

What is the main raw material constraint affecting the AHF market supply chain?

The primary constraint is the consistent availability and quality of acid-grade fluorspar (calcium fluoride). Supply is geographically concentrated, and fluctuations in mining output or geopolitical controls significantly impact the stability and pricing of AHF production.

What is the difference between technical grade and ultra-high purity (UHP) AHF?

Technical grade AHF is used for high-volume chemical synthesis (e.g., fluorocarbons, aluminum). UHP AHF, also known as electronic grade, undergoes extensive purification to remove trace impurities measured in parts per billion, making it essential for highly sensitive semiconductor etching and cleaning processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager