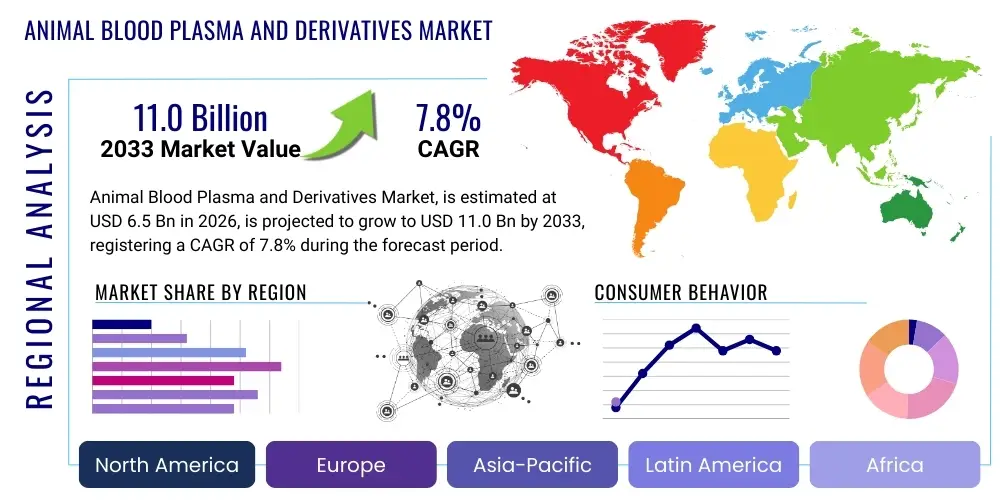

Animal Blood Plasma and Derivatives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437813 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Animal Blood Plasma and Derivatives Market Size

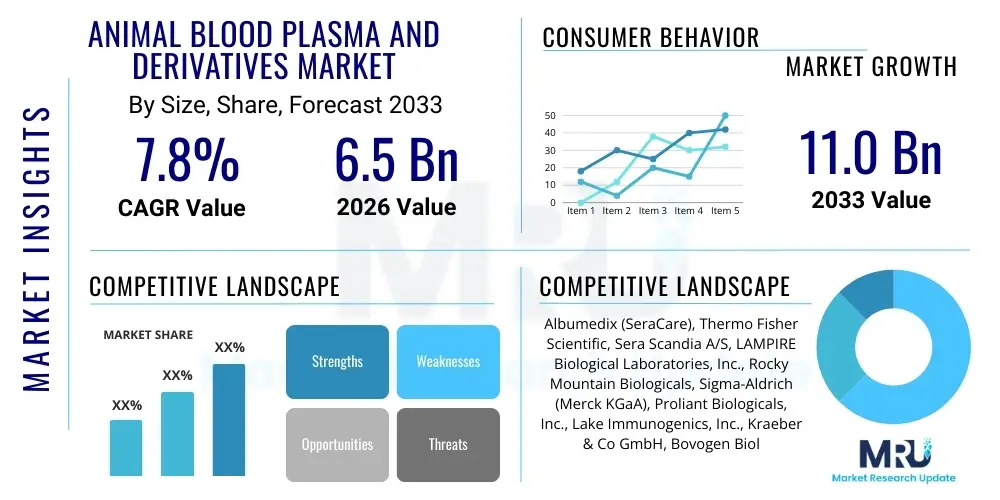

The Animal Blood Plasma and Derivatives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for high-quality animal-derived proteins utilized across veterinary medicine, animal nutrition, and biopharmaceutical research applications. Increased adoption of specialized derivatives, such as purified immunoglobulins and serum albumin, for critical therapeutic and diagnostic procedures in companion and production animals contributes significantly to this projected valuation increase.

Animal Blood Plasma and Derivatives Market introduction

The Animal Blood Plasma and Derivatives Market encompasses the collection, processing, and distribution of plasma and plasma-derived products sourced from various animal species, primarily bovine, porcine, ovine, and equine sources. These derivatives, which include concentrated proteins such as albumin, fibrinogen, thrombin, and specialized immunoglobulins, are essential ingredients in a broad spectrum of industries. The market's stability is rooted in the irreplaceable biological functionality these components provide, acting as growth factors, natural immune boosters, volume expanders, and crucial components in cell culture media, which supports the burgeoning biotechnology sector.

The core products are indispensable across major applications, ranging from therapeutic veterinary medicine—where plasma transfusions treat shock and severe infections—to advanced diagnostic kits and biomedical research, particularly in the cultivation of delicate cell lines and vaccine production. Furthermore, a major driving force is the nutritional sector, where spray-dried animal plasma (SDAP) is widely incorporated into early-stage animal feed formulations, especially for piglets, to enhance growth rates, improve gut health, and reduce reliance on antimicrobial agents. This nutritional application is critical in regions with intensive livestock farming, where optimizing animal health efficiency is a paramount economic concern.

Key benefits derived from these specialized materials include superior biological compatibility, high concentration of natural growth factors, and the provision of passive immunity in young animals. The market growth is principally driven by surging global companion animal ownership, increased awareness and expenditure on sophisticated veterinary healthcare, and the ongoing push by the livestock industry to find sustainable, highly effective nutritional supplements that comply with global restrictions on antibiotic use. Regulatory shifts demanding higher standards of animal health and food safety further cement the market's long-term growth trajectory, despite inherent complexities related to sourcing logistics and pathogen risk mitigation.

Animal Blood Plasma and Derivatives Market Executive Summary

The Animal Blood Plasma and Derivatives Market demonstrates robust upward mobility, characterized by significant business trends focusing on vertical integration among collectors and processors to ensure supply chain integrity and standardization of product purity. Regional trends indicate that North America and Europe continue to dominate the market due to established veterinary infrastructure, high expenditure on pet care, and rigorous biopharmaceutical R&D activities, while the Asia Pacific region is emerging as the fastest-growing market, propelled by rapid expansion in its swine and poultry industries and increasing adoption of modern farming practices that utilize plasma-based feed additives extensively. Segment trends highlight that the application segment is shifting towards high-value pharmaceutical and diagnostic uses, moving beyond traditional bulk nutritional applications, with immunoglobulins and serum albumin witnessing the steepest rise in demand due to their critical roles in immunological assays and specialized therapeutic treatments for both livestock and companion animals.

AI Impact Analysis on Animal Blood Plasma and Derivatives Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Animal Blood Plasma and Derivatives Market primarily focus on optimization across three key areas: supply chain robustness, enhancement of product safety through advanced screening, and process efficiency in large-scale fractionation. Users are specifically concerned with how AI can mitigate the inherent risks associated with biological sourcing, such as identifying potential contamination early and predicting localized disease outbreaks that could severely disrupt supply. Key themes emerging from these analyses center on AI's ability to introduce predictive maintenance for complex processing equipment, optimize the timing and location of plasma collection efforts based on animal population health data, and apply sophisticated algorithms to analyze spectroscopic and biomarker data for automated quality control, ensuring the final derivative products meet stringent regulatory standards for purity and safety. The expectation is that AI will drastically reduce batch variability and elevate biosecurity protocols across the entire value chain.

The implementation of machine learning models is revolutionizing the upstream segment of the market by enabling predictive health monitoring of donor animal populations. By integrating data streams from farm management systems, veterinary records, and real-time environmental sensors, AI can forecast potential health risks, such as Bovine Viral Diarrhea (BVD) or Porcine Epidemic Diarrhea (PED), allowing processors to proactively adjust sourcing strategies or implement enhanced pre-screening protocols. This predictive capability minimizes the risk of accepting contaminated plasma lots, which is critical given the severe financial and operational consequences of batch failure in biological manufacturing. Furthermore, AI-driven insights are crucial for optimizing inventory management, balancing the volatile supply chain with consistent, high demand from veterinary pharmaceutical manufacturers.

In the downstream processing phases, AI algorithms are applied to complex chromatography and ultrafiltration steps, optimizing parameters for maximal yield and purity of specific protein fractions, such as IgG or serum albumin. Traditional fractionation processes often rely on standardized, fixed protocols, but AI allows for real-time adjustments based on the unique characteristics of each plasma batch, thereby increasing recovery rates and reducing processing waste. This level of optimization is crucial in maintaining cost-competitiveness in a market characterized by high operational expenditures. Ultimately, AI is positioned not merely as an efficiency tool, but as a core technology for ensuring the pharmaceutical-grade quality and safety required for modern advanced veterinary and human-adjacent applications.

- AI-driven predictive modeling optimizes donor animal health monitoring, forecasting potential pathogen risks (e.g., PRRS, BVD).

- Machine learning enhances plasma quality control by analyzing biomarker patterns for automated contamination detection during screening.

- AI algorithms optimize fractionation and purification parameters (chromatography, filtration) to maximize protein yield and consistency.

- Predictive supply chain analytics improve inventory management and logistics, minimizing wastage due to short shelf life or regional supply disruptions.

- Advanced image recognition assists in automating visual inspection during processing, ensuring derivative physical quality and integrity.

DRO & Impact Forces Of Animal Blood Plasma and Derivatives Market

The dynamics of the Animal Blood Plasma and Derivatives Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting significant Impact Forces. Major drivers include the global expansion of livestock populations, heightened consumer demand for antibiotic-free meat, which boosts the requirement for plasma-derived feed alternatives (SDAP), and the technological advancements in veterinary medicine demanding specialized biological therapies. Conversely, the market is restrained primarily by extremely strict and varied international regulatory guidelines governing the sourcing, processing, and cross-border movement of animal-derived biological materials, coupled with high operational costs associated with maintaining pathogen-free environments and the public perception challenges related to animal welfare practices. Opportunities exist in the continuous development of novel fractionation methods, the diversification of sourcing species (beyond bovine and porcine), and the rising utilization of these derivatives in advanced cell culture media for human biologicals production.

One of the most significant impact forces is the growing prevalence of livestock and companion animal diseases, which simultaneously increases the demand for therapeutic and diagnostic products derived from plasma and heightens the scrutiny over plasma safety and screening procedures. For example, sudden outbreaks of diseases like African Swine Fever (ASF) or highly pathogenic Avian Influenza can simultaneously increase the need for diagnostic kits (requiring plasma components) and severely restrict the available pool of safe donor animals, creating immense supply-side pressure. This sensitivity to epidemiological factors makes the market inherently volatile but also reinforces the necessity for robust, high-quality derivative production, driving investment in advanced pathogen reduction technologies (PRT).

The regulatory environment, particularly mandates from bodies like the European Medicines Agency (EMA) and the U.S. FDA Center for Veterinary Medicine (CVM), acts as a dual-edged force. While stringent regulations ensure product quality and safety, thereby boosting end-user confidence, they also impose high barriers to entry and significantly increase compliance costs, particularly for small and medium-sized enterprises. The ongoing transition toward sustainable and welfare-focused animal farming practices also presents an impact force; while it addresses public concerns, it necessitates more localized and specialized sourcing networks, moving away from mass collection models and influencing the logistics and cost structure of the plasma supply chain significantly. Ultimately, the future success of market participants hinges on their ability to navigate these regulatory complexities while maintaining competitive operational efficiency through technological adoption.

Segmentation Analysis

The Animal Blood Plasma and Derivatives Market is meticulously segmented based on the source animal, the type of derivative product, and its final application, reflecting the specialized needs of the veterinary, nutritional, and pharmaceutical industries. Analysis of these segments is crucial for understanding specific growth pockets, with porcine and bovine sources dominating the raw material inputs due to their vast populations in commercial farming, while key derivative products like albumin and immunoglobulins represent the highest value capture points. The application segment reveals a polarization between high-volume, cost-sensitive nutritional feed uses and low-volume, high-value therapeutic and diagnostic applications, each driven by distinct market dynamics and regulatory requirements. Strategic focus areas include expanding the utility of bovine serum albumin (BSA) in cell culture media, essential for vaccine and biopharmaceutical manufacturing, and increasing the purity of porcine immunoglobulins for inclusion in specialty animal feed to boost early life immune function.

- By Source Animal:

- Bovine (Cattle)

- Porcine (Swine)

- Ovine (Sheep)

- Equine (Horses)

- Others (e.g., Poultry, Caprine)

- By Product Type:

- Serum Albumin (BSA, PSA)

- Immunoglobulins (IgG, IgA, IgM)

- Fibrinogen and Fibrin Derivatives

- Thrombin

- Transferrin

- Others (e.g., Growth Factors, Lipoproteins)

- By Application:

- Animal Nutrition/Feed Additives (Spray-Dried Plasma)

- Pharmaceutical/Therapeutics (Wound healing, Volume expanders, Vaccines)

- Diagnostics and Research (Culture Media, Reagents, Assays)

- By End-User:

- Veterinary Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Animal Feed Manufacturers

- Research and Academic Institutions

Value Chain Analysis For Animal Blood Plasma and Derivatives Market

The value chain for animal blood plasma and derivatives is inherently complex, starting with the upstream sourcing and collection, moving through highly specialized midstream processing, and culminating in diverse downstream distribution channels tailored for specific end-user industries. The upstream segment involves the ethical and regulated sourcing of blood from slaughterhouses or dedicated plasma collection facilities, which requires strict adherence to animal welfare standards and thorough pre-screening for viral and bacterial pathogens. Establishing secure, traceable, and geographically dispersed collection networks is paramount in minimizing supply disruption risks, especially given the episodic nature of livestock processing and the strict regional controls over blood collection practices. Regulatory compliance at this stage dictates the eligibility and quality of the raw material entering the chain.

The core midstream activity is fractionation, where whole plasma is meticulously separated into its valuable protein components using sophisticated processes such as centrifugation, cold ethanol precipitation (Cohn method variant), and advanced chromatography techniques. This transformation step significantly adds value by purifying bulk plasma into pharmaceutical-grade components like highly concentrated albumin or therapeutic immunoglobulins. Investment in technology, including advanced sterile filtration and pathogen inactivation methods (e.g., solvent/detergent treatment), is critical at this stage to ensure product safety and regulatory acceptance. Processors often rely on highly automated systems and specialized facility designs to maintain the requisite sterility and traceability required for biological materials.

Downstream, the finished derivatives are channeled through distinct distribution pathways. Bulk products, such as spray-dried plasma (SDAP) for animal feed, typically move through indirect channels involving large agricultural distributors and feed millers. Conversely, high-purity pharmaceutical-grade products, like specialized culture media components or injectables, often utilize direct distribution or highly specialized third-party logistics providers who can manage cold chain requirements and stringent quality assurance protocols, ensuring product integrity until it reaches biotechnology labs, research institutes, or veterinary clinics. This dual distribution model reflects the bifurcated nature of the market, serving both the high-volume commodity sector and the specialized high-value biopharmaceutical niche.

Animal Blood Plasma and Derivatives Market Potential Customers

The potential customer base for animal blood plasma and derivatives is highly diversified, spanning multiple industries that rely on these biological materials for therapeutic, nutritional, and research applications. Primary customers include large-scale animal feed manufacturers who are heavy users of spray-dried plasma as a functional protein source for early-weaned livestock, particularly swine and poultry, aiming to improve feed conversion ratios and overall survivability. Another crucial segment comprises veterinary hospitals and specialized animal clinics that utilize whole plasma or purified immunoglobulins for emergency transfusions, treating immune deficiencies, and providing critical care post-surgery, where rapid biological intervention is necessary to save animal lives and support recovery.

Furthermore, the biopharmaceutical and diagnostics industries represent the high-value segment of the customer base. Pharmaceutical companies rely on specific plasma components, most notably Bovine Serum Albumin (BSA), as an essential stabilizer, transport protein, and inert component in the formulation of human and animal vaccines, culture media for bioproduction, and therapeutic antibodies. Research institutions and diagnostic kit manufacturers also constitute significant customers, needing high-purity reagents like thrombin and specific transferrins for complex in-vitro assays, cell culture optimization, and the development of new testing methodologies for infectious diseases in both humans and animals. These customers prioritize purity, consistency, and regulatory documentation above all else.

The purchasing decisions of these diverse end-users are driven by different factors: feed manufacturers prioritize cost-effectiveness and volume availability, while pharmaceutical customers focus intensely on compliance documentation, pathogen safety data, and the consistency of the protein fraction purity. The growing global focus on developing personalized veterinary medicine and advanced regenerative therapies is expanding the need for ultra-high-purity, often customized, plasma fractions, creating a niche market for specialized small-batch processors who cater to academic research and early-stage biotech companies requiring materials with specific biological activity profiles, thereby diversifying the customer landscape beyond large industrial buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albumedix (SeraCare), Thermo Fisher Scientific, Sera Scandia A/S, LAMPIRE Biological Laboratories, Inc., Rocky Mountain Biologicals, Sigma-Aldrich (Merck KGaA), Proliant Biologicals, Inc., Lake Immunogenics, Inc., Kraeber & Co GmbH, Bovogen Biologicals Pty Ltd, PALL Corporation, Biovet Pvt. Ltd., Shenzhen Hepalink Pharmaceutical Co., Ltd., CSL Behring, and Vaxxinova. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Animal Blood Plasma and Derivatives Market Key Technology Landscape

The technology landscape for the Animal Blood Plasma and Derivatives Market is highly focused on enhancing product purity, ensuring pathogen safety, and optimizing high-throughput fractionation processes to meet pharmaceutical standards. Core technology remains based on cold ethanol precipitation (a modified Cohn process) for initial bulk separation, but modern manufacturing relies heavily on advanced chromatographic techniques—specifically ion-exchange, affinity, and size exclusion chromatography—to achieve ultra-high purity levels required for therapeutic and diagnostic grade proteins like specialized immunoglobulins or purified transferrin. These chromatographic systems are increasingly automated and designed for continuous processing, leading to higher efficiency, reduced labor costs, and superior batch consistency compared to traditional methods. Furthermore, the integration of single-use technologies (SUTs) in bioreactors and purification systems is gaining traction, minimizing the risk of cross-contamination between batches and streamlining facility cleanroom operations, which is critical in a biosecurity-sensitive industry.

A non-negotiable technological requirement across the market is the implementation of robust Pathogen Reduction Technologies (PRT) and viral inactivation steps, vital for meeting global regulatory standards for product safety. Standard methods include solvent/detergent treatment, low pH incubation, and specialized nanofiltration steps capable of removing small viral contaminants without compromising the biological activity of the therapeutic protein. Continuous innovation in PRT aims to develop broad-spectrum inactivation methods that are non-toxic, highly effective against enveloped and non-enveloped viruses, and adaptable to various plasma fractions. The market actively invests in advanced filtration membranes and monitoring systems that can provide validated assurance of viral clearance, a mandatory prerequisite for any product destined for sensitive applications like cell culture media used in human vaccine production.

Beyond separation and safety, preservation and stability technologies are crucial. Lyophilization (freeze-drying) remains the primary method for extending the shelf life of high-value derivatives, allowing for global distribution without reliance on complex cold chain logistics, especially vital for products shipped to remote research facilities or veterinary practices. Advances in excipient formulation are supporting the development of more stable liquid plasma products that can withstand higher temperatures or prolonged storage, thereby simplifying handling for end-users. The future technological direction is heavily influenced by the adoption of sophisticated spectroscopic analysis (e.g., Raman and near-infrared spectroscopy) coupled with AI for real-time quality assurance, enabling immediate compositional verification and purity checks during manufacturing, moving away from time-consuming, post-production laboratory testing.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by high expenditure on companion animal healthcare, advanced veterinary diagnostics, and a robust biotechnology sector that uses animal derivatives extensively in research and cell culture. The U.S. and Canada benefit from sophisticated regulatory frameworks (FDA/USDA) that mandate high standards for biological product quality, fostering a concentration of leading plasma processing companies and R&D activities. The demand here is skewed toward high-purity, therapeutic-grade products like specific monoclonal antibodies derived from animal plasma, and specialized bovine serum albumin for pharmaceutical applications.

- Europe: Characterized by stringent food safety and animal welfare regulations (EMA, EFSA), Europe maintains a strong market presence, particularly in the production of high-quality feed-grade plasma alternatives due to strict limits on antibiotic use in livestock. Sourcing regulations, particularly concerning bovine material (due to historical BSE concerns), are exceptionally strict, often necessitating importation of specialized fractions. Market growth is stable, driven by an aging and highly affluent pet population requiring advanced veterinary care, including plasma-based therapeutics.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate globally, fueled by massive, rapidly expanding livestock industries (especially swine and aquaculture in China, India, and Southeast Asia) and modernization of farming techniques. The intense demand for spray-dried plasma (SDAP) as a nutritional supplement to boost early animal health and reduce feed conversion ratios is the primary driver. While regulatory enforcement can vary, increasing international trade pressures are compelling local manufacturers to adopt global quality standards, leading to substantial investment in new processing facilities and technology transfer from Western firms.

- Latin America: This region serves as a crucial sourcing hub, particularly for bovine plasma, due to large cattle populations in countries like Brazil and Argentina. The market is primarily export-oriented, supplying raw plasma or bulk derivatives to processors in North America and Europe. Domestic demand is growing, especially in veterinary medicine, but the core function remains the large-scale, cost-effective supply of raw materials, making the market highly sensitive to global commodity prices and logistics efficiency.

- Middle East and Africa (MEA): This region is an emerging market, driven largely by growing investments in modernized poultry and livestock farming to ensure regional food security. The demand for derivatives, particularly feed-grade products, is steadily rising. However, market size is currently limited by less developed veterinary infrastructure and reliance on imported finished products, though local manufacturing capabilities are beginning to expand in countries like South Africa and the UAE, focused initially on local veterinary needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Blood Plasma and Derivatives Market.- Albumedix (SeraCare Life Sciences)

- Thermo Fisher Scientific Inc.

- Sera Scandia A/S

- LAMPIRE Biological Laboratories, Inc.

- Rocky Mountain Biologicals, Inc.

- Sigma-Aldrich (Merck KGaA)

- Proliant Biologicals, Inc.

- Lake Immunogenics, Inc.

- Kraeber & Co GmbH

- Bovogen Biologicals Pty Ltd

- PALL Corporation

- Biovet Pvt. Ltd.

- Shenzhen Hepalink Pharmaceutical Co., Ltd.

- CSL Behring

- Vaxxinova

- Bio-Rad Laboratories, Inc.

- Cytiva (a Danaher company)

- Lorne Laboratories Ltd.

- RayBiotech, Inc.

- Atlanta Biologicals, Inc.

Frequently Asked Questions

Analyze common user questions about the Animal Blood Plasma and Derivatives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Animal Blood Plasma and Derivatives Market?

The market is primarily driven by the escalating demand for antibiotic-free feed alternatives, particularly spray-dried animal plasma (SDAP) for livestock, combined with rising global expenditure on advanced companion animal veterinary care and diagnostics, which require high-purity immunoglobulins and serum albumin.

How do regulatory restraints impact the sourcing and distribution of animal plasma?

Regulatory bodies impose stringent requirements on sourcing (animal health, welfare) and processing (pathogen inactivation), creating high barriers to entry and operational costs. These regulations often limit cross-border transport and necessitate complex traceability systems, particularly for bovine and porcine derivatives.

Which animal source segment holds the largest share and why?

The Porcine (Swine) segment currently holds a significant share, mainly because of the high volume demand for porcine plasma derivatives used in the animal nutrition industry, where spray-dried porcine plasma is widely utilized globally as a key feed additive for neonatal piglets.

What technological innovations are crucial for market expansion?

Crucial technological advancements include highly efficient chromatographic separation techniques for purifying specific proteins, and robust Pathogen Reduction Technologies (PRT) like nanofiltration and solvent/detergent methods, which are essential for meeting the safety standards required for pharmaceutical and therapeutic applications.

How is AI expected to transform the animal plasma industry?

AI is set to transform the industry by enhancing supply chain resilience through predictive modeling of disease outbreaks, optimizing complex fractionation processes in real-time to increase yield and purity, and automating quality control checks during plasma screening to improve overall biosecurity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager