Animal Feed Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436346 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Animal Feed Ingredients Market Size

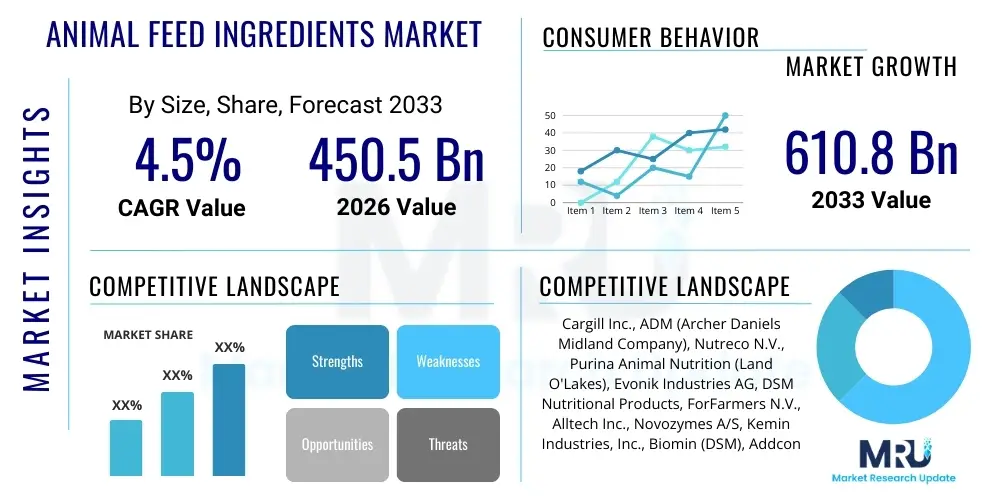

The Animal Feed Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 610.8 Billion by the end of the forecast period in 2033.

Animal Feed Ingredients Market introduction

The Animal Feed Ingredients Market encompasses all raw materials and additives utilized in the formulation of compounded feeds designed to meet the nutritional requirements of livestock, poultry, aquaculture, and companion animals. These ingredients are critical for enhancing animal health, maximizing productivity, ensuring food safety, and ultimately, supporting the global meat and dairy supply chain. Core products include protein sources (soybean meal, fish meal, specialized amino acids), energy sources (corn, barley), minerals, vitamins, and an increasingly important category of feed additives such as prebiotics, probiotics, enzymes, and phytogenics, which improve digestion and nutrient absorption. The complexity of feed formulation demands high-quality, traceable, and often specialized ingredients tailored to specific animal stages and production goals.

The primary applications of these ingredients span across commercial animal husbandry, including intensive farming operations focused on producing swine, beef, poultry (broilers and layers), and dairy products. A significant application segment is dedicated to aquaculture, where specialized pellets requiring unique binding and nutrient profiles are essential for fish and shrimp health. The benefits derived from high-quality feed ingredients are profound; they include optimized Feed Conversion Ratio (FCR), reduced environmental impact through lower nutrient excretion, and improved animal welfare through disease prevention and immune system support. Furthermore, modern feed formulation addresses consumer demands for antibiotic-free and sustainably produced animal proteins, driving innovation in ingredient technology.

Key driving factors propelling the growth of this market include the relentless growth in global population and disposable incomes, leading to increased per capita consumption of meat, milk, and eggs, particularly in emerging economies across Asia Pacific and Latin America. Additionally, the industrialization of livestock farming mandates the use of scientifically formulated feeds to ensure consistent performance and efficiency across large flocks and herds. Regulatory pressures promoting sustainable farming practices and the necessity to reduce antimicrobial usage are also significantly boosting the demand for functional feed additives that support gut health and immunity naturally. This environment fosters continuous research and development into novel, sustainable protein sources and precision nutrition solutions.

Animal Feed Ingredients Market Executive Summary

The Animal Feed Ingredients Market is experiencing robust expansion, primarily fueled by shifting global dietary patterns favoring protein-rich foods and the increasing focus on sustainable and efficient livestock production. Business trends highlight a strong move towards diversification of protein sources, with significant investments directed toward insect proteins, single-cell proteins (SCPs), and algae-based ingredients to mitigate reliance on traditional, volatile commodities like soy and fish meal. Furthermore, consolidation among major global ingredient suppliers and increased strategic partnerships between ingredient manufacturers and large-scale integrated farming operations are reshaping the competitive landscape. Regulatory compliance, particularly concerning traceability and non-GMO mandates in certain regions, is now a crucial factor determining market access and operational strategies, pushing manufacturers to invest heavily in supply chain transparency and quality assurance technologies.

Regionally, the Asia Pacific (APAC) market stands out as the primary growth engine, driven by massive domestic consumption, rapid urbanization, and the continuous modernization of agricultural practices in countries like China, India, and Vietnam. While North America and Europe remain mature markets characterized by stringent quality standards and a high uptake of premium functional additives (e.g., enzymes, probiotics), APAC’s scale and trajectory offer unparalleled opportunities for volume growth. Restraints in APAC, however, often revolve around infrastructure limitations and price sensitivity. In contrast, Latin America is demonstrating accelerated growth due to its status as a major global exporter of beef and poultry, requiring high-performance, cost-effective feed ingredients to maintain global competitiveness, while the Middle East and Africa (MEA) focus remains on enhancing domestic food security through specialized feed for poultry and aquaculture.

Segment trends reveal that the Additives segment, particularly focused on health and performance enhancement, is outpacing the growth of the basic macronutrient segments (Energy and Protein). Within additives, phytogenics and acidifiers are experiencing heightened adoption as substitutes for antibiotics and growth promoters, driven by legislative mandates and consumer preferences in developed markets. Among the different animal types, the aquaculture segment is projected to register the fastest growth due to the accelerating global demand for farmed fish and the unique nutritional requirements that necessitates high-density, specialized ingredients. The poultry segment, being the largest consumer of prepared feed globally, continues to drive demand for essential amino acids and enzyme supplements to optimize feed efficiency and address environmental concerns related to nitrogen and phosphorus excretion.

AI Impact Analysis on Animal Feed Ingredients Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Animal Feed Ingredients Market generally center on three key areas: optimizing ingredient formulation for maximum cost-efficiency and nutritional value; enhancing supply chain resilience, transparency, and traceability from raw material sourcing to feed mill; and predicting animal health outcomes and disease outbreaks to allow for proactive nutritional intervention. Users are highly interested in how AI algorithms can process vast datasets—including weather patterns, commodity prices, animal performance metrics, and ingredient variability—to create dynamic, real-time adjustments to feed recipes. Concerns often relate to the initial investment required for sophisticated sensor technology and data infrastructure necessary to implement these AI solutions effectively, and the need for skilled personnel to interpret complex data models for practical application at the farm level.

The integration of AI is transforming traditional feed manufacturing from static recipe management to dynamic, precision nutrition systems. AI-driven systems leverage machine learning to analyze the variability inherent in raw materials—such as protein content fluctuations in soybean batches or mycotoxin levels in stored grains—allowing feed mills to adjust inclusion rates instantly and consistently hit target nutrient profiles while minimizing over-formulation costs. This level of optimization significantly reduces operational expenditure and improves the reliability of the finished feed product. Furthermore, predictive modeling, utilizing AI trained on genetic, environmental, and dietary data, enables livestock managers to anticipate production dips or health issues weeks in advance, facilitating timely nutritional changes or the precise application of functional feed additives like immune boosters or specialized amino acids.

AI also plays a critical role in enhancing the sustainability and quality control aspects of the feed ingredient supply chain. Through advanced image recognition and sensor fusion technology, AI models can rapidly and accurately detect contaminants, adulteration, or physical quality defects in incoming raw materials, improving food safety margins substantially beyond conventional lab testing intervals. In terms of sustainability, AI optimizes logistics and inventory management, minimizing spoilage and waste. More strategically, AI algorithms are being employed in the discovery and validation of novel, alternative feed ingredients, accelerating the assessment of nutritional efficacy, digestibility, and scalability of sustainable options like cultured meat proteins or novel microbial biomass, thereby speeding up the transition away from resource-intensive traditional ingredients.

- AI optimizes feed formulation in real-time based on ingredient variability, market prices, and desired animal performance targets.

- Predictive analytics driven by AI models anticipate animal health risks, enabling proactive inclusion of essential functional ingredients and reducing disease incidence.

- Machine learning enhances supply chain traceability and quality assurance by rapidly identifying and flagging contaminants or adulteration in raw materials.

- AI-enabled sensor technology monitors storage conditions, minimizing ingredient spoilage and operational waste across feed processing facilities.

- Accelerated discovery and validation of sustainable, novel protein sources (e.g., insect meal, SCP) using AI to model nutritional profiles and scalability.

DRO & Impact Forces Of Animal Feed Ingredients Market

The Animal Feed Ingredients Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces that dictate market evolution and strategic direction. A primary driver is the necessity for optimizing protein production efficiency globally, driven by sustained population growth and urbanization, which necessitates feed ingredients that deliver exceptional Feed Conversion Ratios (FCRs) and improved animal health outcomes. This is closely followed by the global regulatory shift away from antibiotic growth promoters (AGPs), which creates massive demand for functional alternatives such as prebiotics, organic acids, and specialty enzymes. However, the market is restrained by the high volatility and unpredictable pricing of major commodity ingredients (like corn and soy), which significantly impacts the cost structure of feed producers and limits investment predictability. Furthermore, regulatory hurdles and complex approval processes for novel feed additives in diverse jurisdictions often slow down product commercialization and market penetration.

Opportunities in this sector are highly concentrated around technological innovation and sustainability initiatives. The most compelling opportunities lie in the development and commercialization of sustainable and resilient alternative protein sources, including insect-based meals, algae, and single-cell proteins, which offer environmentally friendly profiles and reduce dependence on conventional aquaculture and agricultural inputs. Another significant avenue is the widespread adoption of precision nutrition technologies, enabled by digitalization and AI, which allows feed ingredients to be dosed and formulated with unprecedented accuracy based on real-time animal needs and micro-environmental data, thereby maximizing return on ingredient investment. This move towards customized nutrition rather than generalized diets represents a paradigm shift that offers superior performance and reduced waste.

The combined impact forces emphasize a sustained upward pressure on ingredient quality and functional capabilities. The market is being forced to prioritize solutions that simultaneously address economic efficiency (lower FCR), environmental sustainability (reduced waste and lower resource use), and food safety (clean label and antibiotic-free production). Suppliers who can effectively manage commodity price risks while simultaneously delivering technologically advanced, proven functional ingredients will command market leadership. These forces necessitate significant R&D spending, robust supply chain risk management, and strategic sourcing strategies focused not only on cost but increasingly on sustainability certifications and ingredient origin transparency, shaping the long-term competitive dynamics of the industry.

Segmentation Analysis

The Animal Feed Ingredients Market is comprehensively segmented based on the type of ingredient, the form of the feed, the type of animal livestock, and various geographical regions. Understanding these segmentations provides critical insight into the varying nutritional priorities and market dynamics specific to different production systems globally. The segmentation by ingredient type, which includes Energy, Protein, Additives, and others, is essential as it reflects the primary function of the component in the animal's diet, with the Protein segment traditionally holding the largest share due to its foundational role in muscle growth and maintenance, although the Additives segment is rapidly gaining ground due to performance and health mandates. Segmentation by livestock type, encompassing Poultry, Swine, Ruminants, Aquaculture, and Pet Food, defines the specific nutritional formulation requirements, where poultry and aquaculture demand sophisticated additive packages due to intensive farming conditions and high growth rate objectives.

The classification based on the form of the feed, such as pellets, mash, crumbles, and liquids, is vital for logistics, nutrient stability, and optimal delivery to the specific animal species; for instance, aquaculture relies heavily on stable pellet forms, while poultry often utilizes mash or crumbles. The differentiation between compound feed (ready-to-use mixtures) and raw materials (individual commodities) highlights the different customer bases, catering to large feed mills versus smaller, integrated farms that mix their own rations. Analyzing these granular segments helps stakeholders identify high-growth niches, particularly in the functional additives space (e.g., specific enzyme types for monogastrics) and geographically, where local raw material availability and regulatory standards heavily influence preferred ingredient choices. This multi-dimensional segmentation approach allows for targeted market entry strategies and specialized product development.

- By Ingredient Type:

- Protein Meals (Soybean Meal, Fish Meal, Meat & Bone Meal, Plant Proteins)

- Energy Sources (Corn, Wheat, Barley, Sorghum)

- Feed Additives

- Vitamins and Minerals

- Amino Acids (Lysine, Methionine, Threonine)

- Enzymes (Phytase, Amylase, Protease)

- Probiotics and Prebiotics

- Acidifiers

- Antioxidants

- Pigments and Colorants

- Fats and Oils

- By Form:

- Dry Feed Ingredients

- Liquid Feed Ingredients

- By Livestock:

- Poultry (Broiler, Layer)

- Swine

- Ruminants (Cattle, Dairy Cows, Sheep, Goats)

- Aquaculture (Fish, Shrimp)

- Pet Food

- By Source:

- Plant-Based

- Animal-Based

- Synthetic

Value Chain Analysis For Animal Feed Ingredients Market

The value chain for the Animal Feed Ingredients Market is a complex and highly integrated structure, beginning with the upstream sourcing of foundational raw materials and extending through sophisticated processing and delivery to end-users. The upstream analysis focuses on primary commodity producers—large-scale farming operations and aquaculture fisheries responsible for generating grains (corn, wheat), oilseeds (soybean, rapeseed), and animal protein by-products. This stage is highly susceptible to weather volatility, geopolitical risks affecting trade routes, and commodity market speculation, necessitating strong hedging and strategic purchasing capabilities by processors. Specialized upstream manufacturers are also involved in the bio-fermentation processes required for producing key synthetic ingredients like essential amino acids and specific enzymes, which require significant capital investment and adherence to stringent quality controls.

Midstream activities involve the crucial transformation steps: processing raw agricultural materials into digestible and concentrated feed ingredients. This includes oilseed crushing and extraction (producing soybean meal), rendering of animal by-products, and the formulation and blending of micronutrients and additives. Feed ingredient manufacturers are responsible for ensuring consistency, safety (e.g., mycotoxin control), and nutritional efficacy. This stage also involves extensive R&D to develop novel ingredients and optimize bioavailability. The distribution channel is multifaceted, relying on bulk logistics (rail, sea freight) for large volume commodities and specialized cold-chain logistics for sensitive additives like probiotics. Direct distribution often occurs from major feed compounders to large, integrated farms, while indirect channels utilize regional distributors, agents, and local cooperatives to reach smaller, independent producers.

Downstream analysis centers on the customers—the commercial feed mills that blend the ingredients into finished feeds, and the livestock producers themselves. These end-users demand rigorous quality specifications, reliable delivery, and increasingly, technical support regarding feed formulation and animal performance monitoring. The trend towards vertical integration means that large producers often bypass independent feed mills, creating internal demand for raw ingredients. Indirectly, the value chain is also influenced significantly by regulatory bodies that set standards for ingredient inclusion, safety, and traceability (e.g., FDA, EFSA). The overall profitability of the chain depends heavily on managing the gap between fluctuating raw material costs (upstream) and relatively stable finished feed prices (downstream), positioning advanced ingredient processing and functional additives as critical value-added differentiators.

Animal Feed Ingredients Market Potential Customers

The primary consumers and end-users of the Animal Feed Ingredients Market are fundamentally the commercial animal production industries across various segments, requiring constant, high-volume supply of nutritional inputs to sustain intensive operations. The largest segment of potential customers includes integrated poultry and swine producers, who often operate massive, modern farming complexes and rely entirely on scientifically formulated diets to achieve stringent growth targets, health metrics, and meet processing deadlines. These customers prioritize ingredients that offer superior Feed Conversion Ratios (FCR), enhanced disease resistance, and reliable quality consistency across global supply points. Their buying decisions are highly influenced by technical performance data, cost-in-use metrics, and regulatory compliance assurances, making them premium targets for specialized additives like enzymes and amino acids.

A rapidly expanding segment of potential customers is the global aquaculture sector, encompassing farms dedicated to finfish (salmon, tilapia, carp) and crustaceans (shrimp). Aquaculture requires unique ingredient specifications, particularly high-quality, sustainable marine or terrestrial proteins and binders that ensure pellet stability in water without excessive nutrient leaching. The drive for sustainability means these customers are keenly interested in novel ingredients such as insect meal and algal proteins that substitute traditional fishmeal, offering significant growth opportunities for specialized manufacturers. Furthermore, dairy and beef cattle operations, particularly in regions focused on high-yield production, constitute a major customer group for bulk ingredients like specialty forages, energy sources, and ruminant-specific additives like buffers and rumen-protected nutrients designed to maximize milk or meat yield.

Finally, the companion animal food industry represents a stable and increasingly premium customer base. Manufacturers of high-end pet food, particularly those focusing on 'human-grade' or functional ingredients (grain-free, specialized protein sources, probiotics for gut health), purchase high-specification raw materials, including specialized protein hydrolysates, fiber sources, and targeted functional ingredients. While the volume purchased by this sector is lower than livestock, the margins are generally higher due to the premium nature and regulatory requirements surrounding pet nutrition. Distribution channels often need to be tailored to meet the varying scale and technical demands of these distinct customer groups, ranging from bulk shipments to mills to specialized deliveries for niche pet food formulators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 610.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., ADM (Archer Daniels Midland Company), Nutreco N.V., Purina Animal Nutrition (Land O'Lakes), Evonik Industries AG, DSM Nutritional Products, ForFarmers N.V., Alltech Inc., Novozymes A/S, Kemin Industries, Inc., Biomin (DSM), Addcon GmbH, Associated British Foods (ABF), BASF SE, Lallemand Inc., CP Group, De Heus Animal Nutrition, Phibro Animal Health Corporation, Novus International Inc., Bluestar Adisseo Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Animal Feed Ingredients Market Key Technology Landscape

The Animal Feed Ingredients market is characterized by a rapid evolution in manufacturing and application technologies aimed at improving ingredient efficacy, sustainability, and production scalability. One of the most significant technological advancements lies in the field of industrial biotechnology, particularly fermentation technology, which is crucial for the large-scale, cost-effective production of high-value additives such as essential amino acids (e.g., lysine, methionine), vitamins, and specialized enzymes (like phytase and xylanase). Modern fermentation processes utilize engineered microorganisms and optimize bioreactor conditions to maximize yield and purity, allowing manufacturers to offer ingredients with consistent quality independent of agricultural volatility. This shift from synthetic chemical production or extraction to bio-based manufacturing aligns strongly with global sustainability trends and the demand for natural and clean-label ingredients, pushing companies to invest heavily in expanding their biological manufacturing footprints globally.

Another pivotal technological landscape involves precision nutrition and digitalization tools, which transform how ingredients are formulated and delivered. Advanced sensor technology, including near-infrared (NIR) spectroscopy, is now routinely used at feed mills to instantly analyze the nutrient profile of incoming raw materials, facilitating real-time formulation adjustments rather than relying on delayed lab analysis. Coupled with sophisticated feed formulation software, which utilizes AI and complex linear programming models, producers can tailor diets precisely to the genetic potential, life stage, and environmental conditions of the animal, minimizing nutrient waste and maximizing ingredient utilization. These digital tools enable "smart feeding" practices, moving the industry towards highly customized and sustainable feeding regimes, particularly in integrated livestock operations.

Furthermore, significant technological breakthroughs are occurring in the development and processing of alternative protein sources, driven by the need to replace resource-intensive fishmeal and soy. This includes the high-tech rearing and processing of insect larvae (such as Black Soldier Fly) using waste streams as feedstock, creating circular economy solutions. Processing technologies for these novel proteins focus on maximizing digestibility and nutrient bioavailability while ensuring safety and regulatory approval, often involving complex thermal treatments or enzymatic hydrolysis. Similarly, the advancement in microalgae and single-cell protein production relies on controlled photobioreactor systems, which are technologically demanding but offer highly consistent, nutrient-dense protein sources independent of arable land. These technological leaps are crucial for mitigating the future supply chain risks associated with traditional protein commodities.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global animal feed ingredients market both in terms of volume and growth trajectory, fueled by rapidly expanding livestock and aquaculture sectors, particularly in China, India, and Southeast Asian nations. The region’s growth is underpinned by substantial dietary shifts towards increased per capita meat and seafood consumption, alongside the rapid transition from traditional backyard farming to large-scale, industrialized commercial operations. This industrialization necessitates high volumes of formulated feed and advanced additives to manage efficiency and prevent disease outbreaks in dense farm environments. Demand is particularly strong for essential amino acids and gut health additives as producers strive for superior FCRs under stringent operational conditions. Challenges remain regarding fragmented supply chains and varying regulatory landscapes across different nations, requiring tailored market strategies focused on cost-efficiency and quality assurance.

- North America: North America is characterized as a mature, technologically advanced market focused heavily on precision nutrition, sustainability, and animal welfare standards. The market here drives demand for premium, scientifically backed feed additives, including sophisticated enzymes, specialized functional proteins, and advanced feed supplements for reducing methane emissions in ruminants. Strict regulatory oversight, particularly regarding antibiotic use and feed safety (e.g., FSMA regulations), ensures high barriers to entry and favors established manufacturers capable of providing comprehensive traceability and quality documentation. The region leads in the adoption of AI-driven feed formulation and supply chain optimization technologies, emphasizing efficiency improvements and minimizing environmental footprints, especially in large dairy and poultry sectors.

- Europe: Europe is a global leader in legislative changes driving the adoption of functional feed ingredients, primarily due to the complete ban on antibiotic growth promoters (AGPs) and stringent environmental policies. This has created a vibrant and robust market for antibiotic alternatives such as probiotics, prebiotics, acidifiers, and phytogenics. The focus on sustainability, coupled with consumer preference for ethically raised and locally sourced animal products, pushes demand towards certified sustainable ingredients, novel proteins (like insect meal), and ingredients that enhance animal welfare. The market growth is stable, driven by continuous innovation and regulatory support for solutions that decrease the environmental impact of livestock farming, particularly concerning nitrogen and phosphorus excretion.

- Latin America (LATAM): LATAM serves as a critical global hub for meat production and export, making its feed ingredient market highly cost-competitive and volume-driven. Brazil and Argentina are massive producers of soybeans and corn, providing a significant advantage in raw material sourcing. Market growth is robust, particularly in the poultry and beef sectors, requiring consistent, high-quality energy and protein sources to maintain export competitiveness. While price sensitivity is higher than in Europe or North America, there is increasing adoption of performance-enhancing additives to meet the quality and efficiency standards required for international trade. The region also shows promising growth in aquaculture, particularly in countries like Chile and Ecuador, driving demand for specialized fish feed inputs.

- Middle East and Africa (MEA): MEA is a highly strategic market driven primarily by the need for enhanced domestic food security and mitigating reliance on imports, particularly in Gulf Cooperation Council (GCC) countries. Given the arid climate and limited domestic agricultural output, the region relies heavily on imported feed ingredients. Poultry and aquaculture are key growth segments, supported by significant government investments to establish large, modern farms. Demand focuses on ingredients that perform well under high heat stress conditions and solutions that address local challenges, such as specialized mycotoxin binders. The market size is smaller but offers high potential due to continuous government backing and rapid infrastructure development aimed at self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Feed Ingredients Market.- Cargill Inc.

- ADM (Archer Daniels Midland Company)

- Nutreco N.V.

- Evonik Industries AG

- DSM Nutritional Products

- Kemin Industries, Inc.

- Alltech Inc.

- Novozymes A/S

- ForFarmers N.V.

- Associated British Foods (ABF)

- BASF SE

- Lallemand Inc.

- CP Group

- De Heus Animal Nutrition

- Phibro Animal Health Corporation

- Novus International Inc.

- Bluestar Adisseo Co.

- DuPont de Nemours, Inc.

- Zinpro Corporation

- Global Bio-Chem Technology Group Company Limited

Frequently Asked Questions

Analyze common user questions about the Animal Feed Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Animal Feed Ingredients Market?

The primary driver is the accelerating global demand for animal protein (meat, dairy, eggs) driven by population growth and rising disposable incomes in emerging economies, necessitating more efficient and productive livestock feeding systems.

How is the phasing out of antibiotic growth promoters (AGPs) influencing ingredient demand?

The regulatory removal of AGPs is significantly boosting the demand for specialized functional feed additives, including probiotics, prebiotics, organic acids, and phytogenics, which support gut health and immunity as natural alternatives.

What are the most significant restraints affecting market profitability?

The major restraints include high volatility and unpredictable pricing of key commodity raw materials (e.g., soybean meal, corn), coupled with increasing complexity in global trade regulations and supply chain disruptions.

Which animal segment utilizes the highest volume of prepared feed ingredients globally?

The poultry segment, encompassing both broiler and layer production, consumes the highest volume of formulated feed ingredients worldwide due to the intensive nature of poultry farming and the need for high-performance diets.

What role does technology play in ensuring the safety and quality of feed ingredients?

Technology, particularly AI-driven quality control and NIR spectroscopy, enables real-time analysis of raw material nutrient profiles and contaminant detection, significantly enhancing ingredient safety, formulation accuracy, and supply chain transparency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager