Animal Feed Phytase Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434374 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Animal Feed Phytase Market Size

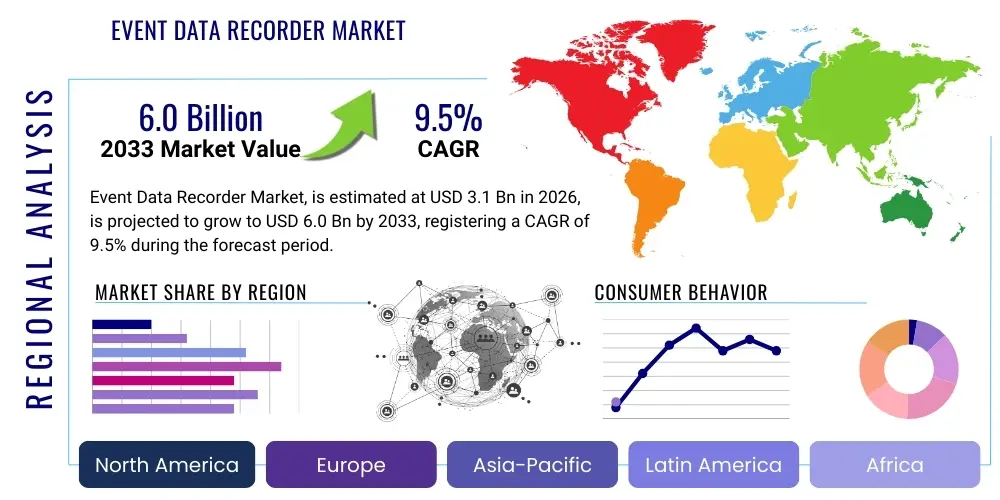

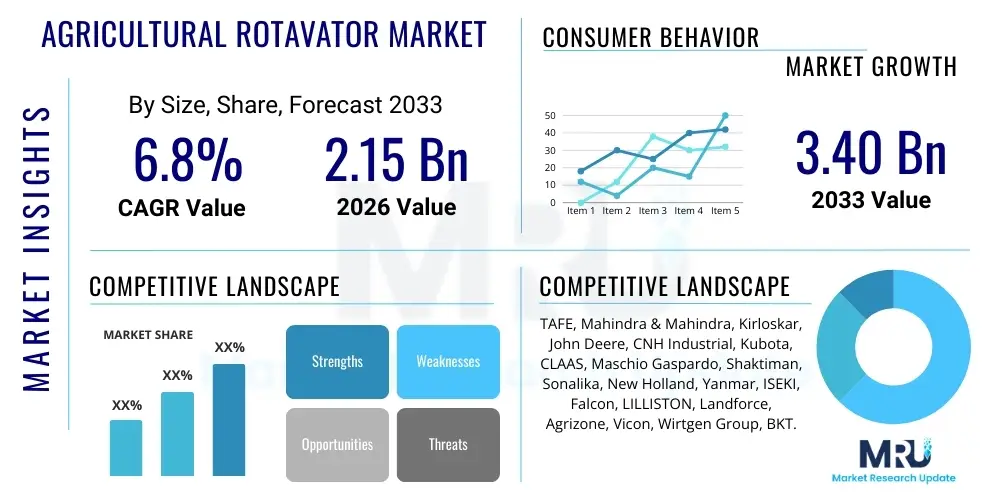

The Animal Feed Phytase Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033.

Animal Feed Phytase Market introduction

Phytase is a specific class of phosphatase enzymes that catalyze the hydrolysis of phytic acid (myo-inositol hexakisphosphate), a principal storage form of phosphorus in many plant materials, into inositol and a series of less-phosphorylated phosphate intermediates. As monogastric animals like poultry and swine lack sufficient endogenous phytase activity to efficiently break down phytic acid, its presence in feed significantly reduces the bioavailability of phosphorus and essential minerals, leading to nutritional deficiencies and the excessive environmental excretion of inorganic phosphorus. The application of microbial phytase in animal feed addresses these nutritional challenges directly by liberating phytate-bound phosphorus, dramatically improving mineral absorption, and reducing the requirement for expensive, finite, inorganic phosphate supplements.

The primary applications of exogenous phytase enzymes are concentrated within the intensive livestock farming sectors, predominantly poultry (broilers, layers, turkeys) and swine production. Utilization in aquaculture, particularly in species fed plant-based diets, is rapidly accelerating, driven by sustainability goals and the need to optimize feed efficiency. The integration of phytase not only serves the core function of enhancing phosphorus utilization—resulting in healthier animals, improved growth rates, and better bone integrity—but also delivers substantial economic benefits to producers by lowering overall feed costs. Furthermore, phytase inclusion minimizes the anti-nutritional effects of phytic acid, which typically chelates proteins and other micronutrients, thereby improving the digestibility and absorption of the entire feed matrix, contributing to a more sustainable and cost-effective production cycle.

Market expansion is fundamentally driven by the escalating global demand for animal protein, particularly in developing economies, coupled with increasingly stringent environmental regulations targeting phosphorus run-off from agricultural waste. These regulatory pressures, especially evident in regions like the European Union and specific states in North America, mandate reductions in nutrient excretion, positioning phytase as an indispensable component for environmentally compliant feed formulation. Technological advancements leading to the commercialization of highly thermostable and acid-stable phytase variants further accelerate adoption, ensuring that the enzyme remains highly active throughout the complex process of feed pelleting and digestion. These driving factors solidify phytase's status as a critical efficiency and sustainability enhancer in modern animal agriculture.

Animal Feed Phytase Market Executive Summary

The Animal Feed Phytase Market is characterized by robust growth, propelled by concurrent demands for greater feed efficiency and reduced environmental footprint in global livestock production. Key business trends indicate intensified mergers and acquisitions activity among major biotechnology and animal nutrition companies focused on consolidating intellectual property related to next-generation enzyme technologies, such as novel thermostable variants with superior pH profiles. Strategic partnerships between enzyme manufacturers and large-scale integrated livestock producers are becoming common, aimed at ensuring stable supply chains and facilitating application-specific dosage optimization. Furthermore, the market is experiencing significant pricing pressures, especially in high-volume regions like Asia Pacific, where localized production of phytase enzymes is leading to cost competitiveness, though premium pricing is maintained for specialized, high-performance products offering superior efficacy and handling characteristics.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, largely attributable to the massive scale of poultry and swine industries in China, India, and Southeast Asian nations, alongside the rapid modernization of feed milling infrastructure. Europe demonstrates high maturity and stability, driven strictly by the European Union’s comprehensive environmental directives, which have mandated phosphorus reduction strategies for decades, positioning phytase as a standard inclusion in virtually all monogastric feed formulations. North America also presents a strong, technologically advanced market, where adoption is motivated by cost savings derived from replacing expensive inorganic phosphate sources and optimizing performance metrics. Emerging markets in Latin America and the Middle East & Africa are demonstrating nascent but significant growth, fueled by increasing per capita meat consumption and the professionalization of local livestock sectors, though implementation challenges related to consistent feed quality and regulatory enforcement remain.

In terms of segmentation, the poultry segment remains the largest end-use application due to the sheer volume of broiler production globally and the substantial benefits phytase provides in terms of feed conversion ratio (FCR) improvement. However, the aquaculture segment is witnessing the highest relative growth rate, spurred by the global shift towards sustainable fish and shrimp farming that increasingly relies on plant-based proteins, making phytate detoxification essential. From a product type perspective, 6-phytase variants derived predominantly from bacterial sources (e.g., E. coli) are gaining traction over traditional 3-phytase, owing to their generally higher efficiency, superior thermostability, and broader pH activity range within the animal gut, resulting in more consistent and complete phosphorus release. This continuous technological refinement in enzyme types is a central theme driving segment trends and overall market value proposition.

AI Impact Analysis on Animal Feed Phytase Market

Common user questions regarding AI’s influence on the Animal Feed Phytase market generally revolve around the optimization potential in enzyme production, dosage calculation, and integration into precision livestock farming systems. Users frequently inquire about how AI models can predict the precise activity of phytase under various on-farm conditions, how machine learning can accelerate the discovery and modification of novel, hyper-efficient enzyme strains, and what role prescriptive analytics plays in optimizing feed formulation in real-time. Key concerns often focus on the required data infrastructure for effective AI implementation and the integration challenges with existing legacy feed mill software. The underlying theme is the expectation that AI and associated data analytics tools will transition phytase application from generalized inclusion to highly precise, predictive deployment, maximizing both nutritional benefit and economic return for producers while further reinforcing environmental compliance standards.

The integration of Artificial Intelligence represents a significant paradigm shift in the utilization and efficacy of animal feed enzymes, particularly phytase. At the formulation level, AI-driven algorithms are being developed to utilize complex datasets—including raw material composition variability, animal genetic strain, environmental temperature, and specific digestive tract pH profiles—to calculate the exact required inclusion rate of phytase, moving beyond traditional matrix values. This precision nutrition approach minimizes enzyme over-dosing, which reduces cost, and ensures maximum biological effectiveness, thereby improving the consistency of phosphorus release and overall animal performance. This capability transforms phytase from a static additive into a dynamically managed ingredient whose use is tailored to minute variations in feed batches and livestock requirements.

Furthermore, AI is poised to revolutionize the enzyme R&D pipeline. Machine learning is being applied to analyze massive genomic and proteomic datasets to identify and engineer novel microbial strains capable of producing phytase with enhanced attributes, such as extreme thermostability, broader acid resistance, and higher specific activity. AI-guided enzyme design accelerates the lead optimization process, drastically cutting down the time and cost associated with laboratory screening of enzyme variants. In manufacturing, predictive maintenance algorithms and real-time quality control systems, leveraging AI, ensure optimal fermentation conditions, enhancing yield and consistency of industrial phytase production, thereby ensuring a reliable supply of high-quality enzyme products to meet the escalating global demand.

- AI-driven optimization of phytase inclusion rates in precision feed formulation.

- Machine learning acceleration in the discovery and engineering of superior thermostable phytase variants.

- Predictive modeling of phytase efficacy based on real-time raw material variability and environmental factors.

- Automation and quality control enhancements in large-scale microbial fermentation processes using AI.

- Integration of AI systems with existing feed management software for prescriptive dosage analytics.

- Reduced reliance on static nutrient matrix values through dynamic, data-informed phytase deployment.

DRO & Impact Forces Of Animal Feed Phytase Market

The dynamics of the Animal Feed Phytase market are governed by a strong confluence of drivers related to sustainability, economics, and regulatory frameworks, which are countered by specific technical and market-entry restraints. The primary driving force is the global imperative to minimize environmental pollution, particularly the phosphorus content in agricultural runoff, driven by comprehensive government mandates and consumer demands for sustainable meat production practices. Economically, the capability of phytase to replace expensive inorganic dicalcium phosphate (DCP) and mono-calcium phosphate (MCP) serves as a powerful incentive for adoption by feed manufacturers seeking to optimize costs in volatile commodity markets. These forces combine to create significant momentum, transforming phytase from a mere performance enhancer into a necessary, foundational component of modern feed formulation designed for both efficiency and environmental compliance.

However, the market faces inherent restraints that temper its explosive growth potential. A significant technical challenge involves the thermal lability of certain phytase strains, where high-temperature pelleting processes can lead to enzyme denaturation and efficacy loss, necessitating the use of more expensive, specialized thermostable variants or post-pelleting application methods. Furthermore, the regulatory environment surrounding the approval of genetically modified (GM) microbes used in enzyme production or the introduction of novel enzyme classes can be protracted and costly, acting as a barrier to innovation and market entry, particularly in regions with conservative regulatory bodies. The high initial capital investment required for establishing large-scale industrial fermentation facilities also limits the competitive landscape, maintaining market control primarily within the hands of a few established biotechnology giants, thereby slowing competitive pricing pressures.

Despite these challenges, substantial opportunities exist, principally revolving around technological advancements and market diversification. The relentless pursuit of developing phytases with higher intrinsic thermostability (often through directed evolution or protein engineering) and improved gastric stability offers significant future potential, enabling more robust and consistent application. Furthermore, the expansion of phytase use beyond traditional poultry and swine—specifically targeting the burgeoning aquaculture sector, which requires sustainable solutions for plant-based feed—presents a high-growth niche. Developing comprehensive enzyme cocktails, where phytase is combined synergistically with other feed enzymes (like carbohydrases and proteases) to maximize overall nutrient utilization, also represents a promising avenue for adding value and enhancing adoption rates across the diverse global feed industry.

Segmentation Analysis

The Animal Feed Phytase Market is comprehensively segmented based on its source of origin, the physical form in which it is supplied, the specific type of enzyme activity, and the end-user animal application. This multi-faceted segmentation allows for targeted product development and market positioning tailored to meet the specific physiological and industrial requirements of different livestock sectors. The source segmentation, dividing the market primarily into Fungi, Bacteria, and Yeast, reflects the varied production methods and enzyme characteristics, where bacterial phytase (often derived from E. coli) currently dominates due to its superior efficiency and thermostability attributes essential for commercial feed production. The critical application segmentation highlights the volume dependency on monogastric animals, although high growth rates in aquaculture are redefining future market distribution.

The segmentation by form—Liquid versus Dry (powder/granulated)—is dictated largely by the stage of feed manufacturing and the need for heat stability. Dry forms are overwhelmingly preferred for conventional mash and pelleted feed where the product must withstand intense heat during conditioning and pelletizing. Conversely, liquid forms are increasingly adopted for post-pelleting application (PPA), particularly utilized by highly integrated feed mills that require precise, low-dosage inclusion and wish to avoid the potential performance loss associated with heat exposure. The choice of form is thus a crucial decision point influenced by the capital expenditure capability of the feed mill and the specific quality control standards in place.

Segmentation by enzyme type—predominantly 3-Phytase and 6-Phytase—reflects distinct mechanisms of action relating to the initial cleavage point on the phytic acid molecule. While both are effective, 6-Phytase is generally considered superior due to its more extensive and rapid degradation of phytate across the broader pH range found in the animal's digestive tract, leading to a more complete release of phosphorus and associated minerals. This differentiation is vital for producers aiming for maximal 'superdosing' effects, where high enzyme concentrations are used not only to release phosphorus but also to fully eliminate the anti-nutritional effects of phytate. Understanding these segment variations is essential for manufacturers to align their R&D and commercial strategies with evolving end-user demands for performance and stability.

- By Source:

- Fungi (e.g., Aspergillus spp.)

- Bacteria (e.g., E. coli, Bacillus spp.)

- Yeast

- By Application:

- Poultry (Broilers, Layers, Turkeys)

- Swine (Pigs, Sows)

- Aquaculture (Fish, Shrimp)

- Ruminants (Cattle, Sheep)

- By Form:

- Dry (Powder/Granular)

- Liquid

- By Type:

- 3-Phytase

- 6-Phytase

Value Chain Analysis For Animal Feed Phytase Market

The value chain for the Animal Feed Phytase market is complex, beginning with highly specialized upstream activities involving microbial strain development and industrial fermentation, leading through rigorous manufacturing processes, and concluding with sophisticated downstream distribution to global feed manufacturers. Upstream activities are dominated by specialized biotechnology and enzyme engineering firms that invest heavily in R&D to identify and genetically modify high-yielding and resilient microbial strains. Key raw materials for fermentation include specialized media components such as carbon sources (glucose/sucrose), nitrogen sources, and specific minerals, sourced primarily from agricultural and chemical industries. Success at this stage relies heavily on intellectual property protection and proprietary fermentation techniques that maximize enzyme yield and ensure the desired product characteristics, such as thermostability and pH resilience.

The mid-stream manufacturing process involves large-scale industrial fermentation, followed by complex recovery, purification, and formulation steps. Recovery often involves centrifugation, filtration, and ultrafiltration to isolate the enzyme from the fermentation broth. Formulation is critical, as it determines the final product form (liquid or dry) and includes processes like spray drying, granulation, or encapsulation, ensuring the enzyme’s activity remains intact and stable for transport, storage, and feed processing. Quality control checks at this stage are stringent, verifying enzyme potency, purity, and microbial safety, as phytase products are regulated feed additives requiring specific certifications for market entry.

The downstream segment involves highly structured distribution channels necessary to move temperature-sensitive products globally to end-users. Distribution is often segmented into direct sales to large, integrated feed mill operators and indirect sales through specialized distributors and local agents who manage smaller regional accounts. Large global enzyme manufacturers frequently utilize their own global sales forces (direct channel) to handle major accounts (like multinational poultry integrators), providing technical support and dosage optimization consulting alongside product sales. The indirect channel relies on established animal health and nutrition distributors who provide the necessary logistical support, localized inventory, and crucial technical liaison services to smaller regional feed mills, ensuring broad market penetration and timely delivery of the product.

Animal Feed Phytase Market Potential Customers

The primary consumers and end-users of animal feed phytase are globally diversified but largely concentrated within the industrial animal production sector, specifically entities involved in feed manufacturing and vertically integrated livestock operations. Major feed compounders, such as Cargill, New Hope Group, and CP Group, represent massive volume buyers, incorporating phytase as a standard inclusion in their specialized diets for swine and poultry. These customers prioritize supply reliability, consistency of enzyme activity, high thermostability, and the ability to demonstrate quantifiable economic returns on investment (ROI) derived from reduced mineral supplementation costs and improved Feed Conversion Ratios (FCRs). They require advanced technical support for matrix value optimization and auditing compliance with international feed safety standards.

Vertically integrated producers, often referred to as integrators (e.g., large poultry or pork companies that manage breeding, feed milling, and processing), constitute another crucial customer segment. Because these operations control the entire production chain, they are highly motivated to adopt technologies, like phytase, that simultaneously enhance performance metrics and address internal sustainability goals regarding nutrient excretion management. For integrators, the decision to use a specific phytase product often rests on its proven effectiveness across different stages of growth and its compatibility with various feed ingredients sourced internally. They seek partnerships with phytase suppliers that offer customized enzyme blends and comprehensive diagnostic services to ensure optimal gut health and nutrient absorption throughout the lifecycle of the animal.

A rapidly expanding customer base includes aquaculture feed manufacturers, particularly those servicing the salmon, shrimp, and tilapia industries, as well as smaller, independent regional feed mills and commercial farming operations that buy directly or through specialized regional distributors. Aquaculture producers are driven by the urgent need to replace unsustainable fish meal with plant proteins, making effective phytate breakdown essential for sustainable growth and welfare. For smaller regional mills and large commercial farms, ease of application, clear documentation regarding dosage, and competitive pricing are significant factors. These varied end-user groups collectively form the demand backbone of the phytase market, requiring a spectrum of products ranging from high-performance, premium enzymes for integrated operations to cost-effective, standard solutions for commodity feed producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, DuPont de Nemours Inc. (Danisco Animal Nutrition), DSM Nutritional Products, AB Enzymes (Associated British Foods), Novozymes A/S, Kemin Industries, Novus International, Adisseo (Blue Star Adisseo Co., Ltd.), Alltech, VTR Bio-Tech Co., Ltd., Huvepharma, Jinan Tiantianxiang (TTX), Beijing Challenge Biochemical Co., Ltd., Zhejiang Ebecan Biotechnology Co., Ltd., Sunhy Group, Norel S.A., Shenzhen Leveking Bio-Engineering Co., Ltd., Advanced Enzyme Technologies, Chr. Hansen Holding A/S, Bio-Cat. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Animal Feed Phytase Market Key Technology Landscape

The technological landscape of the Animal Feed Phytase market is dynamically driven by advancements in microbial strain engineering, high-throughput screening, and formulation science, all aimed at creating enzymes that are more robust, efficient, and cost-effective. The foundational technology remains industrial submerged fermentation, utilizing genetically optimized strains of bacteria (predominantly E. coli or Bacillus) or fungi (like Aspergillus). Modern fermentation techniques focus on optimizing bioreactor conditions, media composition, and process control to maximize volumetric productivity, ensuring high yield and lowering the manufacturing cost per unit of enzyme activity. Significant recent progress involves utilizing synthetic biology and CRISPR-Cas systems to precision-edit microbial genomes, leading to the development of 'super-producing' strains that can significantly outpace traditional wild-type or chemically mutated counterparts in enzyme output.

A primary technical hurdle that dictates product superiority is thermostability—the ability of the enzyme to maintain its tertiary structure and activity despite the high temperatures (up to 95°C) encountered during the feed pelleting process. Key technological responses include directed evolution and rational protein design, where researchers modify the enzyme’s amino acid sequence to introduce stabilizing bonds and regions that resist heat denaturation. Furthermore, formulation advancements such as encapsulation technology, involving coating the enzyme particles with specialized materials, provide a physical barrier against heat and moisture. These encapsulation techniques, often involving lipids, starches, or specialized polymers, ensure the enzyme remains fully potent until it reaches the animal's gut, thereby maximizing its biological availability and consistency of performance across different feed types.

Beyond heat resistance, the optimization of the enzyme’s activity profile across the acidic conditions of the stomach and the more neutral pH of the small intestine is critical. The move from older 3-phytase to highly efficient 6-phytase variants reflects a technological push toward enzymes with a broader and more resilient pH operational range, ensuring comprehensive phytate hydrolysis throughout the entire digestive tract. Furthermore, the development of integrated enzyme delivery systems, combining phytase with other synergistic enzymes (like non-starch polysaccharide (NSP) enzymes and proteases), represents an emerging technological trend. This holistic approach leverages enzyme synergy to achieve maximal nutrient digestibility, moving the focus from simply mineral release to total feed utilization, further enhancing the economic and sustainability benefits derived from enzyme inclusion.

Regional Highlights

Regional dynamics play a crucial role in shaping the Animal Feed Phytase market, influenced by varying regulatory pressures, livestock population densities, and technological adoption rates. Asia Pacific (APAC) represents the largest and fastest-growing market globally, driven by the massive scale of swine and poultry production, particularly in China and Southeast Asia. Regulatory environments are becoming increasingly strict concerning environmental impact, mirroring western standards, which accelerates phytase adoption. Furthermore, the localized development of competitive phytase strains in countries like China and India is impacting global pricing structures and increasing accessibility for regional feed mills.

Europe holds a highly mature market, characterized by near-universal adoption of phytase, primarily due to the European Union's pioneering legislation regarding nutrient management, notably the Nitrates Directive and the limitation on phosphorus excretion. This region is driven by premium, high-efficacy phytase products and continuous innovation focused on super-dosing strategies and multi-enzyme applications. The strong regulatory framework ensures sustained demand, prioritizing environmental stewardship alongside animal performance. Technological adoption of post-pelleting application (PPA) systems is higher in Europe due to advanced feed milling infrastructure.

North America is a substantial market where phytase inclusion is driven primarily by economic efficiency—replacing costly inorganic phosphate sources—and secondarily by regional environmental legislation (e.g., concentrated animal feeding operation regulations). The market is highly competitive, dominated by major global players who focus on providing highly concentrated, superior thermostable products suitable for the high-speed feed milling operations prevalent in the US and Canada. Latin America, particularly Brazil and Mexico, offers high growth potential, characterized by rapidly modernizing livestock industries and increasing meat exports, which necessitate improved feed efficiency and adherence to international sustainability standards.

- Asia Pacific (APAC): Market leader by volume; driven by China's immense livestock sector and accelerating environmental compliance efforts; strong regional competition in enzyme manufacturing.

- Europe: Highly mature market; adoption mandated by strict EU environmental regulations concerning phosphorus excretion; focus on premium, high-thermostability products and super-dosing strategies.

- North America: Driven by economic incentive (inorganic phosphate replacement) and sophisticated feed milling technology; strong focus on thermostable 6-phytase variants.

- Latin America (LATAM): Significant growth potential driven by expanding beef, poultry, and swine exports, necessitating optimized feed efficiency and sustainable inputs, particularly in Brazil and Argentina.

- Middle East & Africa (MEA): Emerging market; growth tied to increasing domestic demand for poultry products and initial investments in modern, professional feed mills requiring nutrient optimization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Feed Phytase Market.- BASF SE

- DuPont de Nemours Inc. (Danisco Animal Nutrition)

- DSM Nutritional Products

- AB Enzymes (Associated British Foods)

- Novozymes A/S

- Kemin Industries

- Novus International

- Adisseo (Blue Star Adisseo Co., Ltd.)

- Alltech

- VTR Bio-Tech Co., Ltd.

- Huvepharma

- Jinan Tiantianxiang (TTX)

- Beijing Challenge Biochemical Co., Ltd.

- Zhejiang Ebecan Biotechnology Co., Ltd.

- Sunhy Group

- Norel S.A.

- Shenzhen Leveking Bio-Engineering Co., Ltd.

- Advanced Enzyme Technologies

- Chr. Hansen Holding A/S

- Bio-Cat

Frequently Asked Questions

Analyze common user questions about the Animal Feed Phytase market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of phytase in animal feed?

The primary function of phytase is to break down phytic acid (phytate), the main storage form of phosphorus in plants, thereby liberating digestible inorganic phosphorus for monogastric animals like poultry and swine, which lack the necessary endogenous enzymes to perform this breakdown effectively.

How do thermostable phytase variants benefit feed manufacturers?

Thermostable phytase variants are critical because they maintain enzyme activity and efficacy even when exposed to the high temperatures (pelleting heat) inherent in commercial feed manufacturing processes, ensuring consistent enzyme potency and reliable nutrient release when consumed by the animal.

Which segment accounts for the largest application share in the Animal Feed Phytase Market?

The poultry segment, encompassing broiler and layer production, accounts for the largest application share in the Animal Feed Phytase Market globally due to the vast scale of production and the significant economic and nutritional benefits phytase provides in poultry diets.

What is the main driver of market growth in the Asia Pacific region?

The main driver of market growth in the Asia Pacific region is the burgeoning scale of the livestock industry, particularly in China and India, coupled with increasing governmental and environmental pressure to reduce phosphorus excretion and optimize feed resource utilization efficiency.

What is the difference between 3-Phytase and 6-Phytase?

The difference lies in the initial point of hydrolysis on the phytic acid molecule; 6-Phytase (often derived from E. coli) is generally preferred in the industry due to its superior efficiency, faster action, and broader activity across the varying pH levels encountered throughout the animal's digestive tract, leading to better phosphorus release.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager