Animal Pharmaceutical Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434268 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Animal Pharmaceutical Market Size

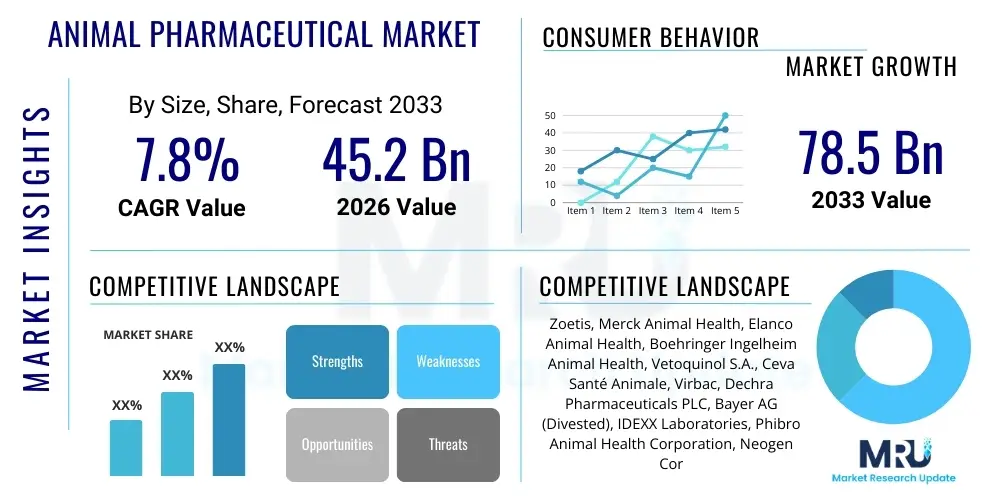

The Animal Pharmaceutical Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 78.5 Billion by the end of the forecast period in 2033.

Animal Pharmaceutical Market introduction

The Animal Pharmaceutical Market encompasses the development, manufacturing, and distribution of veterinary medicines, vaccines, medicated feed additives, and other health products designed to maintain the health and productivity of both companion animals and livestock. This sector is critical for global food security, public health protection through the control of zoonotic diseases, and the overall well-being of pets, which are increasingly viewed as family members. Key products include parasiticides, anti-infectives, pain management drugs, and specialized biologicals. The industry is characterized by rigorous regulatory frameworks, complex R&D cycles focused on target species specificity, and significant investment in biotechnology to address emerging microbial resistance and new viral threats.

Major applications of these pharmaceuticals span therapeutic interventions, preventative healthcare (vaccination), and enhanced animal production efficiency. In the therapeutic domain, drugs treat bacterial, viral, and parasitic infections, ensuring the animal’s quality of life and preventing widespread outbreaks. Preventative applications, particularly the widespread use of vaccines for diseases like FMD (Foot-and-Mouth Disease) and Canine Parvovirus, form the backbone of modern veterinary practice. Furthermore, the market is heavily influenced by the high global demand for protein, which necessitates efficient livestock management using medicated feed and performance enhancers, though the latter faces increasing regulatory scrutiny in developed economies.

The primary driving factors propelling the market expansion include the increasing global pet population, the growing awareness among owners about veterinary healthcare, rising disposable incomes in developing economies leading to higher spending on pets, and the necessity to manage large-scale livestock operations efficiently. Furthermore, government initiatives aimed at preventing zoonotic disease transmission, coupled with technological advancements in diagnostics and drug delivery systems, are fueling innovation. The shift toward precision livestock farming and personalized medicine for companion animals also presents substantial growth opportunities, demanding sophisticated pharmaceutical solutions tailored to individual animal health profiles.

- Product Description: The market includes anti-infectives, parasiticides (endectocides, ectoparasiticides), vaccines (live, attenuated, subunit), medicated feed additives, and specialty therapeutic drugs (e.g., oncology, cardiology).

- Major Applications: Disease prevention (vaccination), therapeutic treatment of acute and chronic diseases, pain management, and enhancement of production parameters (growth promotion, reproductive health).

- Benefits: Improved animal welfare, reduced incidence of zoonotic diseases (e.g., rabies, avian influenza), enhanced livestock productivity, ensuring a stable and safe global food supply, and extending the lifespan of companion animals.

- Driving Factors: Increasing adoption rates of companion animals, rising disposable income, intensification of livestock farming practices, higher prevalence of zoonotic and chronic animal diseases, and continuous regulatory focus on food safety standards.

Animal Pharmaceutical Market Executive Summary

The Animal Pharmaceutical Market demonstrates robust growth driven primarily by structural shifts in global food consumption patterns and the humanization of pets in Western and Asian societies. Business trends indicate a strong focus on mergers and acquisitions among major industry players seeking to consolidate market share, diversify product portfolios across both livestock and companion animal segments, and gain access to advanced R&D pipelines, particularly in biologics and innovative vaccine technology. There is a discernible commercial movement towards preventative medicine over therapeutic intervention, leading to elevated demand for complex vaccines and advanced parasitic control measures. Furthermore, companies are leveraging digital technologies and data analytics to improve veterinary diagnostic capabilities, which subsequently drives targeted pharmaceutical consumption.

Regionally, North America and Europe maintain dominance, characterized by high pet ownership per capita, mature regulatory environments, and substantial consumer willingness to spend on premium veterinary care, often supported by growing pet insurance penetration. However, the Asia Pacific region is poised for the fastest expansion, fueled by massive industrialization of swine and poultry farming in countries like China and India, coupled with rapid urbanization that increases pet adoption rates among the emerging middle class. Latin America also presents significant opportunities, particularly in cattle health management, essential for its extensive beef export markets. Regional strategies are adapting to different disease profiles; for instance, African swine fever management drives R&D in Asia, while bovine respiratory disease remains central in the Americas.

In terms of segmentation, biologicals (vaccines) represent the fastest-growing product segment, reflecting the global imperative for disease prevention and minimizing antibiotic usage due to antimicrobial resistance (AMR) concerns. The companion animal segment is expanding faster than the livestock segment in value, largely due to high-cost specialty drugs and chronic disease management therapies. The livestock segment, however, dominates volume, with a focus on cost-effective, broad-spectrum parasiticides and feed additives. The industry is currently prioritizing the development of alternatives to traditional antibiotics, focusing on prebiotics, probiotics, and phages, thereby mitigating risks associated with regulatory pushback against indiscriminate antibiotic use in production animals.

- Business Trends: Increased cross-segment M&A activity, strategic shift towards non-antibiotic treatments, heightened investment in novel drug delivery systems (e.g., long-acting injectables), and expansion of direct-to-consumer services via veterinary clinics.

- Regional Trends: Rapid market expansion in APAC driven by industrial livestock farming and rising pet adoption; established, high-value markets in North America and Europe focused on premium pet health products; growing regulatory harmonization efforts globally.

- Segments Trends: Accelerated growth in the companion animal segment, led by demand for specialty drugs (e.g., oncology, dermatology). Dominance of biologics (vaccines) as a strategic preventative measure. Decline in conventional antibiotic growth due to AMR concerns, offset by increased demand for parasiticides.

AI Impact Analysis on Animal Pharmaceutical Market

Analysis of common user questions reveals strong interest concerning how Artificial Intelligence (AI) and machine learning (ML) are transforming drug discovery, optimizing clinical trials, and enhancing veterinary diagnostics, thereby directly influencing the animal pharmaceutical landscape. Key themes revolve around AI's capability to accelerate the identification of novel drug targets specific to animal pathogens, the efficiency gains in reducing the time-to-market for new treatments, and the ethical implications of using predictive modeling for herd health management. Users frequently inquire about the integration of AI in precision livestock farming (PLF) to manage disease outbreaks proactively and the role of AI-powered diagnostics in enabling tailored medicine for companion animals, reflecting high expectations for reduced costs and improved treatment efficacy.

AI is fundamentally restructuring the R&D pipeline in animal pharmaceuticals. By leveraging vast datasets of genomic information, clinical trial results, and epidemiological patterns, AI algorithms can predict compound efficacy and toxicity in specific animal species with far greater accuracy than traditional methods. This capability reduces the reliance on expensive and time-consuming wet-lab experiments and accelerates the path to regulatory approval. Furthermore, AI facilitates the rapid analysis of field data relating to disease surveillance, allowing pharmaceutical companies to quickly identify emerging resistance patterns or novel pathogens, ensuring their product development stays relevant to immediate veterinary needs.

Operationally, AI enhances market efficiency and distribution. In livestock management, predictive maintenance models utilizing AI analyze sensor data from farms to forecast disease risk, enabling veterinarians and producers to administer prophylactic treatments precisely when and where they are needed, minimizing waste and maximizing herd health. For companion animals, AI supports sophisticated diagnostic tools that process medical images and laboratory results, leading to faster, more accurate diagnoses and the personalized selection of pharmaceuticals, shifting the veterinary practice towards highly individualized care models. This adoption ensures that the animal pharmaceutical supply chain is optimized for rapid response and customized product delivery based on real-time health data.

- Drug Discovery Acceleration: AI algorithms analyze complex biological data (genomics, proteomics) to identify and validate new molecular targets for veterinary drugs, significantly shortening the preclinical research phase.

- Optimized Clinical Trials: ML models predict animal response, helping select optimal trial populations and dosage regimes, thereby reducing the number of animals required and decreasing overall trial duration and cost.

- Precision Medicine Implementation: AI-powered diagnostics analyze patient data (e.g., imaging, bloodwork) to recommend highly tailored pharmaceutical interventions for companion animals, improving treatment success rates.

- Antimicrobial Resistance (AMR) Management: AI tracks and predicts the evolution of bacterial resistance, guiding the development of new anti-infectives and helping veterinarians optimize stewardship practices.

- Disease Outbreak Prediction: Integration of AI with real-time farm monitoring systems in livestock identifies environmental or behavioral anomalies indicating early disease onset, enabling proactive, targeted pharmaceutical intervention (Precision Livestock Farming).

DRO & Impact Forces Of Animal Pharmaceutical Market

The Animal Pharmaceutical Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities. Key drivers include the exponential increase in pet ownership globally, coupled with the emotional attachment and high willingness of owners to spend on advanced pet healthcare, often mirroring human healthcare standards. Simultaneously, the persistent global demand for animal protein, necessitating high productivity and minimal losses in industrialized farming systems, mandates the continuous use of prophylactic and therapeutic pharmaceuticals. The rising prevalence of zoonotic diseases, posing threats to both animal and human populations, further compels substantial investment in vaccine R&D and pharmaceutical interventions, supported by governmental public health initiatives.

Restraints primarily revolve around stringent and often divergent regulatory approval processes across various jurisdictions, which significantly lengthen the time and increase the cost required to bring new animal drugs to market. The pervasive global concern regarding Antimicrobial Resistance (AMR) acts as a powerful restraint, leading to strict limitations or outright bans on the use of growth-promoting antibiotics, forcing companies to undertake expensive development of non-antibiotic alternatives. Furthermore, issues related to drug adherence in large livestock populations, the complexity of developing species-specific dosage forms, and the high initial cost of novel biologicals can impede market penetration in cost-sensitive regions.

Opportunities are concentrated in the burgeoning field of veterinary biologics, including sophisticated vaccines and monoclonal antibodies, offering highly targeted treatments with reduced side effects. The transition towards digital veterinary platforms and telemedicine opens new avenues for pharmaceutical distribution and compliance monitoring. Moreover, focusing on neglected tropical animal diseases and developing specialized pharmaceuticals for aquaculture and exotic animal health represent untapped market niches. The increasing consumer demand for organic and antibiotic-free meat, paradoxically, drives the need for high-efficacy preventative pharmaceuticals to maintain animal health without traditional chemical interventions, creating a strong market for prebiotics, probiotics, and nutritional supplements. These forces collectively shape the market's trajectory toward innovation, precision, and sustainability.

- Drivers (D):

- Rising global pet adoption and increased humanization of companion animals, leading to greater demand for advanced veterinary care.

- Intensification and globalization of livestock production to meet soaring protein demand.

- Increased incidence and awareness of zoonotic and foodborne diseases, driving public health spending on animal vaccines and parasiticides.

- Technological advancements in drug delivery systems and diagnostics (e.g., point-of-care testing).

- Restraints (R):

- Stringent regulatory requirements and high capital expenditure for R&D and clinical trials.

- Global pressure to reduce and eventually phase out the use of antibiotics in food-producing animals due to Antimicrobial Resistance (AMR).

- Lack of harmonized international standards for veterinary drug registration.

- Price sensitivity in certain livestock segments, particularly in emerging markets.

- Opportunities (O):

- Development of innovative biologicals, including recombinant vaccines, gene therapies, and monoclonal antibodies.

- Expansion into emerging markets (APAC, LATAM) with rapidly professionalizing farming sectors.

- Focus on specialized segments such as aquaculture, companion animal oncology, and chronic disease management.

- Integration of digital health platforms and telemedicine to improve adherence and efficacy monitoring.

- Impact Forces:

- Regulatory scrutiny (high impact, accelerating shift away from antibiotics).

- Technological innovation (high impact, enabling biologics and precision medicine).

- Consumer preferences (moderate to high impact, driving demand for premium pet care and antibiotic-free meat).

Segmentation Analysis

The Animal Pharmaceutical Market is comprehensively segmented based on product type, animal type, route of administration, and distribution channel, providing a nuanced view of market dynamics and specialized needs. Product segmentation reflects the diversity of veterinary interventions, ranging from complex biologicals that confer immunity to small molecule therapeutic drugs addressing specific ailments. Animal type segmentation highlights the structural difference between high-value companion animal care (driven by discretionary spending) and high-volume livestock management (driven by economic efficiency and food safety). Analyzing these segments helps stakeholders target specific disease burdens, regulatory environments, and consumer behaviors effectively across different geographic markets.

The product type segment comprising parasiticides and vaccines holds the largest share, underscoring the universal need for preventative care against common infectious agents and parasites in both pets and farm animals. The biologicals segment, specifically vaccines, is projected to register the fastest growth due to mounting regulatory pressure to limit antibiotic use, necessitating highly effective preventative solutions. Segmentation by animal type clearly indicates the rising influence of the companion animal segment, which, despite lower volume compared to livestock, commands premium pricing for chronic disease management drugs, specialized nutraceuticals, and innovative pain relief solutions, reflecting the trend of pet humanization globally. This granular analysis is crucial for strategic R&D alignment and commercial investment planning.

- By Product Type:

- Drugs:

- Anti-infectives (Antibiotics, Antifungals, Antivirals)

- Parasiticides (Endectocides, Ectoparasiticides, Anthelmintics)

- Anti-inflammatories and Analgesics (NSAIDs, Opioids)

- Hormones

- Other Pharmaceuticals (e.g., Cardiovascular, Oncology, Dermatology)

- Vaccines/Biologicals:

- Live Attenuated Vaccines

- Inactivated Vaccines

- Recombinant Vaccines

- Toxoid Vaccines

- Medicated Feed Additives:

- Nutritional Feed Additives

- Medicinal Feed Additives (probiotics, prebiotics, growth enhancers)

- Drugs:

- By Animal Type:

- Companion Animals:

- Dogs

- Cats

- Horses

- Other Companion Animals

- Livestock Animals:

- Cattle

- Poultry

- Swine

- Sheep and Goats

- Aquaculture

- Companion Animals:

- By Route of Administration:

- Oral

- Parenteral (Injectable)

- Topical

- By Distribution Channel:

- Veterinary Clinics and Hospitals

- Veterinary Pharmacies

- Retail Channels (Online and Offline)

- Feed Manufacturers

Value Chain Analysis For Animal Pharmaceutical Market

The value chain of the Animal Pharmaceutical Market commences with rigorous upstream activities, dominated by R&D and active pharmaceutical ingredient (API) manufacturing. The upstream segment involves biopharmaceutical research aimed at identifying specific antigens for vaccine development or novel small molecules effective against veterinary pathogens. Key upstream players include specialized chemical manufacturers, API producers, and biotechnology companies that supply the core ingredients. High costs are typically incurred in this stage due to the stringent requirements for safety and efficacy across diverse animal species and the extended timelines necessary for regulatory testing, particularly in the development of complex biological products like recombinant vaccines.

The midstream section of the value chain involves the formulation, manufacturing, and quality control of the final dosage forms. Large integrated animal health companies often manage their own manufacturing facilities, ensuring compliance with Good Manufacturing Practices (GMP) and maintaining cold chain integrity for sensitive products like vaccines. Manufacturing complexity stems from the need to produce large volumes efficiently for livestock markets while ensuring high-precision, palatable formulations for companion animal use. Efficiency in this stage directly impacts the competitiveness of the final product, especially in cost-sensitive markets where medicated feed additives are widely used.

Downstream activities center on distribution and sales, primarily leveraging veterinary clinics, specialized pharmacies, and, for livestock, direct sales through feed manufacturers and large commercial farm groups. Direct distribution is crucial for controlled substances and vaccines requiring specific handling. The role of veterinarians is pivotal, acting not only as prescribers but often as the primary distribution channel for companion animal products, influencing owner decisions based on diagnostic results and treatment protocols. The rise of e-commerce is transforming the downstream market, particularly for non-prescription parasiticides and nutraceuticals, demanding robust supply chain logistics and verified compliance systems to ensure product authenticity and correct usage.

Animal Pharmaceutical Market Potential Customers

Potential customers for animal pharmaceuticals are broadly categorized into two major groups: the professional veterinary care sector, which serves companion animals, and the large-scale agricultural sector, which manages livestock. The companion animal market's primary customers are pet owners who purchase drugs through veterinary clinics or specialized online pharmacies, focusing heavily on preventative care (vaccines, flea/tick control) and chronic disease management (pain relief, specialty therapeutics). These customers are typically motivated by emotional attachment and are less price-sensitive than the livestock sector, driving demand for premium, innovative, and easily administered products.

In the livestock segment, the key customers are commercial producers, integrated farming operations (e.g., large poultry and swine integrators), and aquaculture farms. These customers are highly sensitive to cost-benefit analysis and disease management protocols, purchasing pharmaceuticals, vaccines, and medicated feed additives in large volumes directly or through authorized distributors. Their purchasing decisions are primarily driven by economic factors: minimizing disease losses, maximizing feed conversion rates, and ensuring compliance with national and international food safety standards, particularly concerning antibiotic withdrawal periods and residue limits. Therefore, the focus here is on mass application, efficacy, and ease of incorporation into existing production systems.

An increasingly important customer group includes government bodies and non-governmental organizations (NGOs) involved in public health and animal disease control programs. These entities are major purchasers of vaccines (e.g., rabies, FMD, avian influenza) for mandatory vaccination drives aimed at preventing zoonotic spread and maintaining national herd health status, often involving procurement through large tenders and centralized distribution networks. Furthermore, veterinarians themselves, as the technical specifiers and influencers, represent a crucial B2B customer interface, directly impacting the final end-user consumption patterns across both segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 78.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis, Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Vetoquinol S.A., Ceva Santé Animale, Virbac, Dechra Pharmaceuticals PLC, Bayer AG (Divested), IDEXX Laboratories, Phibro Animal Health Corporation, Neogen Corporation, Heska Corporation, Indian Immunologicals Ltd., Biogenesis Bago, HIPRA, Kyoritsu Seiyaku, China Animal Husbandry Industry Co., Ltd., Zydus Animal Health and Vaccines, Eco Animal Health Group plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Animal Pharmaceutical Market Key Technology Landscape

The Animal Pharmaceutical Market is undergoing significant technological evolution, primarily driven by advancements in biotechnology and digital integration. A central element is the shift from conventional vaccines to sophisticated biological products, including recombinant vaccines, subunit vaccines, and the application of monoclonal antibodies (mAbs). Recombinant DNA technology allows for the production of highly specific, safe, and effective vaccines that minimize the risk of reversion to virulence, addressing historical safety concerns associated with live attenuated versions. Monoclonal antibodies are emerging as powerful therapeutic agents, especially for companion animal oncology and chronic conditions like canine dermatitis, offering targeted intervention with fewer systemic side effects.

Another crucial technological area is the development of novel drug delivery systems. The market is increasingly adopting long-acting injectables, which significantly improve compliance in both pets and livestock by reducing the frequency of administration, thereby lowering handling stress and labor costs. Implantable drug delivery devices and transdermal patches are also gaining traction, particularly for pain management and hormonal treatments in companion animals. Furthermore, nanotechnology is being explored to enhance drug bioavailability, reduce toxicity, and facilitate targeted drug release directly to the site of infection or pathology, improving overall treatment efficacy while minimizing environmental impact.

Digital technologies and data analytics form the third pillar of the modern technological landscape. The integration of sensors, IoT devices, and telemedicine platforms allows for continuous, real-time health monitoring of animals, generating vast datasets that fuel predictive diagnostics and precision dosing strategies. Pharmacogenomics, utilizing genetic profiling to predict an animal’s response to specific drugs, is particularly impactful in companion animal medicine, ensuring optimal pharmaceutical selection and minimizing adverse drug reactions. This confluence of biotechnology and digital tools enables the industry to transition towards a personalized, preventative, and data-driven approach to animal healthcare.

Regional Highlights

- North America (NA): North America maintains the largest market share, characterized by high disposable incomes, extensive pet humanization trends, and advanced veterinary infrastructure. The U.S. and Canada show a high willingness to spend on premium and specialty veterinary drugs, particularly for chronic diseases (diabetes, arthritis, cancer) in dogs and cats. The region is a key innovation hub for biologics and digital veterinary health solutions. Regulatory approvals, particularly by the FDA's Center for Veterinary Medicine (CVM), set global standards.

- Europe: Western Europe is a mature market driven by strict animal welfare regulations and robust demand for high-quality animal protein, favoring preventative healthcare products. Key growth drivers include the mandatory transition away from conventional antibiotics (especially through EU legislation) and high rates of pet insurance penetration. Eastern Europe presents opportunities due to the modernization and consolidation of its livestock sector.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by the rapid industrialization of livestock farming (swine, poultry, aquaculture) in China, India, and Southeast Asia, driven by enormous population demand for protein. Rising middle-class populations in urban centers are simultaneously boosting the pet adoption rate and increasing expenditure on pet healthcare, creating dual growth drivers. The region grapples with major endemic diseases (e.g., African Swine Fever, various poultry diseases) which necessitate massive vaccine and anti-infective consumption.

- Latin America (LATAM): LATAM is dominated by the demand for pharmaceuticals tailored to bovine health, given the region's massive beef production and export markets (Brazil, Argentina). Market expansion is driven by the professionalization of large farms and the need for efficacious parasiticides and reproductive health management products. Political and economic stability fluctuations occasionally affect market access and pricing structures.

- Middle East and Africa (MEA): This region offers specialized opportunities focused on poultry and ruminant health, addressing unique climatic challenges and specific regional pathogens. Government initiatives to enhance food security and manage transboundary animal diseases are the primary market drivers. Growth is constrained by lower disposable incomes and less developed veterinary infrastructure compared to Western markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Pharmaceutical Market.- Zoetis

- Merck Animal Health

- Elanco Animal Health

- Boehringer Ingelheim Animal Health

- Vetoquinol S.A.

- Ceva Santé Animale

- Virbac

- Dechra Pharmaceuticals PLC

- Bayer AG (Divested Portfolio now largely with Elanco/Merck)

- IDEXX Laboratories

- Phibro Animal Health Corporation

- Neogen Corporation

- Heska Corporation

- Indian Immunologicals Ltd.

- Biogenesis Bago

- HIPRA

- Kyoritsu Seiyaku

- China Animal Husbandry Industry Co., Ltd.

- Zydus Animal Health and Vaccines

- Eco Animal Health Group plc.

Frequently Asked Questions

Analyze common user questions about the Animal Pharmaceutical market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Animal Pharmaceutical Market?

The primary driver is the increasing humanization and subsequent growth of the companion animal population globally, coupled with a higher willingness among owners to spend on premium, advanced veterinary medical treatments, particularly specialty drugs for chronic conditions.

How is the concern over Antimicrobial Resistance (AMR) affecting the market?

AMR concerns are fundamentally restructuring the market by accelerating the decline in the use of growth-promoting antibiotics in livestock and simultaneously driving massive investment into the development and commercialization of preventative biologicals, such as advanced vaccines and non-antibiotic alternatives like probiotics.

Which product segment is expected to show the fastest growth rate?

The Biologicals segment, primarily comprising vaccines and monoclonal antibodies, is projected to exhibit the fastest growth. This acceleration is due to the strategic industry shift towards proactive disease prevention and highly targeted therapeutic interventions across both companion and production animals.

What role does Artificial Intelligence (AI) play in the Animal Pharmaceutical industry?

AI is utilized to significantly enhance efficiency in drug discovery by identifying novel targets, optimizing the design and execution of clinical trials, and supporting advanced veterinary diagnostic tools to facilitate precision medicine and real-time disease outbreak prediction in livestock farming.

Which region currently holds the largest market share and why?

North America holds the largest market share due to its established regulatory framework, high level of technological innovation, high per capita expenditure on pet healthcare, and the pervasive trend of viewing pets as integral family members, encouraging the adoption of expensive specialty treatments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager