Antacid Tablet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433053 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Antacid Tablet Market Size

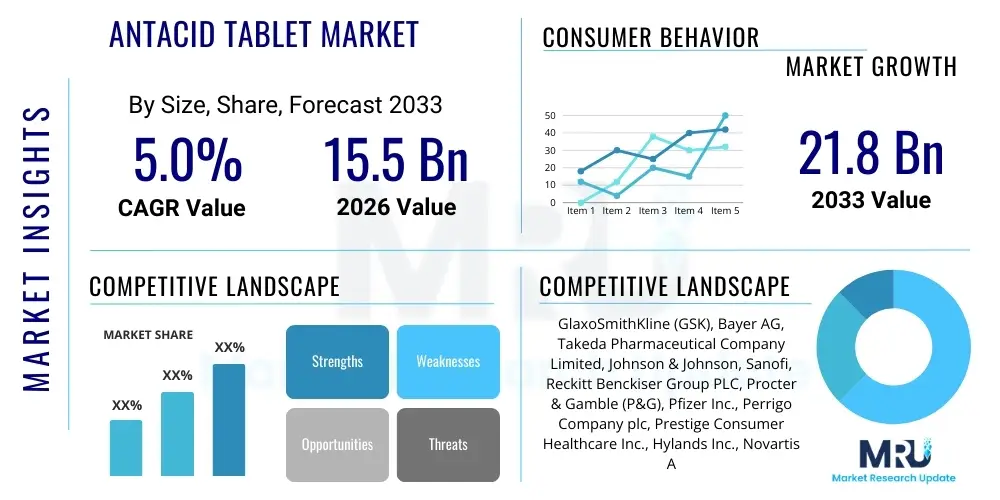

The Antacid Tablet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.0% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 21.8 Billion by the end of the forecast period in 2033.

Antacid Tablet Market introduction

The Antacid Tablet Market encompasses the global sales and distribution of over-the-counter (OTC) and prescription medications formulated in tablet form designed to neutralize stomach acid, thereby providing relief from symptoms associated with heartburn, indigestion, and acid reflux (Gastroesophageal Reflux Disease or GERD). These products are critical components of consumer healthcare, driven primarily by lifestyle factors such as poor dietary habits, increased consumption of processed foods, high stress levels, and rising prevalence of obesity and related gastrointestinal disorders globally. Key ingredients commonly utilized include calcium carbonate, aluminum hydroxide, and magnesium hydroxide, often employed singularly or in combination to optimize efficacy and minimize side effects like constipation or diarrhea.

Major applications of antacid tablets revolve around symptomatic relief for dyspepsia and heartburn. They serve as primary, easily accessible solutions for consumers experiencing acute episodes of acid imbalance. Furthermore, they are often recommended as adjunct therapy alongside prescription medications like Proton Pump Inhibitors (PPIs) or H2 blockers, particularly for breakthrough symptoms. The convenience offered by tablet formulations, including chewable and dissolvable options, significantly enhances user compliance and accessibility across various demographic groups. The shift towards self-medication and proactive management of minor digestive issues further reinforces the demand for these OTC products.

Driving factors stimulating market expansion include the aging global population, which is more susceptible to digestive ailments, and the increasing disposable income in emerging economies, facilitating greater access to OTC healthcare products. Additionally, aggressive marketing and educational campaigns emphasizing the correlation between diet and acid reflux symptoms are raising consumer awareness. The continuous introduction of novel formulations, such as flavored chewable tablets and effervescent options that offer quicker onset of action and improved palatability, contributes substantially to sustained market growth, making antacid tablets a cornerstone of non-prescription gastrointestinal relief.

Antacid Tablet Market Executive Summary

The Antacid Tablet Market exhibits robust business trends characterized by intense competition among global pharmaceutical giants and regional players, focusing heavily on brand loyalty and rapid product innovation, particularly in formulation delivery. Strategic mergers and acquisitions are common as companies seek to consolidate market share and acquire specialized technology, especially related to synergistic ingredients or improved absorption rates. A notable trend is the push toward natural and 'clean label' antacids, responding to growing consumer skepticism regarding synthetic additives, which requires R&D investment in naturally derived buffering agents. Furthermore, the expansion of e-commerce distribution channels is transforming consumer access, enabling rapid market penetration for niche and specialized antacid products, thereby bypassing traditional retail limitations.

Regionally, North America and Europe maintain dominance, attributed to high healthcare expenditure, established OTC regulatory frameworks, and high prevalence of obesity and stress-related disorders. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial population growth, rapid urbanization leading to lifestyle changes conducive to digestive issues, and improving economic conditions increasing consumer willingness to purchase OTC remedies. Key markets like China and India are seeing significant infrastructural improvements in retail pharmacy networks, coupled with increasing adoption of westernized dietary habits, which strongly supports market expansion in these areas. Regulatory harmonization efforts across trade blocs also facilitate easier product importation and standardization.

Segment trends highlight the sustained popularity of Calcium Carbonate antacids due to their cost-effectiveness and rapid action, although combination antacids (e.g., combining magnesium and aluminum salts) are gaining traction by offering a balanced side-effect profile. In terms of formulation, chewable tablets remain the largest segment, prized for their portability and ease of administration without water, making them ideal for on-the-go consumption. However, effervescent tablets are experiencing high growth, driven by consumer preference for rapid dispersal and quicker relief. The distribution segment is witnessing a pronounced shift towards online pharmacies, which offer discretion, competitive pricing, and convenience, fundamentally altering consumer purchasing patterns for routine healthcare items.

AI Impact Analysis on Antacid Tablet Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Antacid Tablet Market primarily focus on optimizing product efficacy, personalizing consumer recommendations, and streamlining supply chain logistics. Common concerns involve whether AI can accurately predict individual responses to different antacid formulations based on genetic or biometric data, and how quickly AI can analyze large-scale post-market surveillance data to detect rare adverse events or efficacy gaps. Users also frequently ask about the role of machine learning in synthesizing novel, highly effective active ingredients and optimizing tablet coating or dissolution rates. The overarching expectation is that AI will move the market beyond simple symptomatic relief towards predictive, personalized digestive health management, particularly through integrating wearable device data related to sleep, stress, and eating habits to trigger timely antacid intake or dietary adjustments.

AI's influence is already evident in several operational areas, particularly in pharmacovigilance and consumer engagement. AI-powered sentiment analysis tools monitor social media and online reviews, providing real-time feedback to manufacturers about product effectiveness, taste profiles, and perceived side effects, allowing for rapid formulation tweaks or targeted marketing campaigns. Furthermore, AI algorithms are being deployed in supply chain forecasting, predicting regional spikes in demand correlating with seasonal changes or public health alerts (e.g., holiday seasons known for overeating), thereby optimizing inventory levels and reducing stock-outs at retail points. This data-driven approach enhances operational efficiency and ensures consistent product availability.

Looking ahead, the most transformative impact of AI is anticipated in clinical decision support and personalized medicine. AI could analyze a patient's electronic health record (EHR), coupled with microbiome data and lifestyle inputs, to recommend the precise type and dosage of antacid (or alternative treatment) that minimizes side effects and maximizes relief efficacy. This shift from one-size-fits-all treatments to hyper-personalized recommendations will redefine how consumers interact with OTC digestive aids, potentially integrating antacid use within broader digital health ecosystems and chronic disease management platforms. This integration raises the bar for formulation precision and requires high-fidelity data input throughout the R&D and post-market phases.

- AI optimizes supply chain forecasting by analyzing historical sales, weather patterns, and localized dietary trends, ensuring optimal inventory distribution.

- Machine learning algorithms accelerate R&D by simulating the chemical interaction of new buffering agents and excipients, predicting stability and dissolution profiles.

- AI-driven consumer chatbots and virtual assistants provide personalized dosage recommendations and identify potential drug interactions, enhancing user safety.

- Real-time sentiment analysis monitors consumer feedback across digital platforms, aiding in rapid quality control and identifying unmet needs related to taste and side effects.

- Predictive analytics supports targeted marketing campaigns, identifying consumer cohorts most likely to experience acid reflux based on demographic and behavioral data.

DRO & Impact Forces Of Antacid Tablet Market

The Antacid Tablet Market dynamics are shaped by powerful Drivers, inherent Restraints, and transformative Opportunities, culminating in significant Impact Forces that dictate strategic priorities. The primary Drivers revolve around accelerating lifestyle diseases, including GERD and chronic dyspepsia, directly linked to modern diets rich in fats, spices, and processed foods, coupled with increased stress levels. Furthermore, the ease of OTC availability and low cost compared to prescription alternatives significantly boosts consumer adoption. These drivers exert a constant upward pressure on demand, particularly in densely populated urban centers across the globe. Manufacturers continuously leverage these drivers by launching larger package sizes and multi-buy promotions.

Conversely, the market faces significant Restraints, most notably the strong competition from alternative treatments, particularly highly effective Proton Pump Inhibitors (PPIs) and H2-Receptor Antagonists (H2 blockers), which offer long-lasting relief, often overshadowing the short-term symptomatic action of traditional antacids. Public concerns regarding the long-term safety and potential mineral interaction issues (e.g., concerns about calcium antacids causing kidney stones or magnesium antacids causing electrolyte imbalance in vulnerable populations) also temper growth. Additionally, stringent regulatory requirements for labeling and claims related to therapeutic effectiveness require continuous clinical substantiation, raising compliance costs for manufacturers, particularly small-to-mid-sized enterprises.

Opportunities for market expansion are abundant, centered on product innovation targeting specific consumer needs, such as formulations for pregnant women, pediatric populations, or patients with underlying comorbidities like diabetes. Developing combination products that include anti-gas agents (like simethicone) or mucosal protectants presents a substantial opportunity for differentiation and premium pricing. Furthermore, expanding distribution networks into underdeveloped rural areas in emerging markets, utilizing mobile pharmacies and localized retail partnerships, promises untapped revenue streams. The rising trend of preventive healthcare also offers opportunities for marketing antacids not just as relief measures but as tools for immediate gut health maintenance.

These Drivers, Restraints, and Opportunities coalesce into distinct Impact Forces. The rapid urbanization across Asia and Latin America represents a profound Impact Force, creating millions of new potential users annually who adopt high-risk diets. Counteracting this is the regulatory scrutiny over long-term antacid consumption, forcing companies to invest heavily in consumer education campaigns emphasizing proper dosage and consultation. The most critical Impact Force remains the continuous battle for market share against prescription-strength alternatives, which mandates that antacid tablets maintain competitive pricing and exceptional availability across all retail formats to secure consumer preference at the point of need.

Segmentation Analysis

The Antacid Tablet Market is comprehensively segmented based on Type of active ingredient, Formulation delivery method, and primary Distribution Channel. This segmentation is crucial for understanding specific consumer preferences, regional demand patterns, and identifying niche areas for product development. Type segmentation distinguishes products based on their chemical composition, which directly influences the speed of onset, duration of relief, and potential side-effect profile (e.g., constipating vs. laxative effects). The formulation analysis examines consumer preference for convenience and palatability, with chewable tablets dominating volume due to their ease of consumption, contrasting with the growing demand for rapid action through effervescent formats. Analyzing these segments allows market participants to tailor their marketing and operational strategies precisely to high-growth areas.

The dominance of Calcium Carbonate within the Type segment is attributable to its efficacy, low cost, and ability to double as a dietary calcium supplement, particularly appealing to certain demographic groups. However, combination antacids, which strategically blend ingredients like Aluminum and Magnesium to achieve a more neutral side-effect profile, are gaining substantial market penetration, especially in the premium category. Understanding the Distribution Channel breakdown is vital, as the pivot towards e-commerce signifies a major shift in consumer buying behavior, necessitating strong digital marketing and efficient last-mile logistics. While traditional retail pharmacies still hold the largest share, the rapid expansion of online platforms demands significant operational adaptation from key players to maintain relevance and accessibility in the evolving purchasing landscape.

- Type

- Calcium Carbonate Antacids: Known for rapid action and high acid neutralizing capacity (ANC).

- Aluminum Hydroxide Antacids: Often used to manage hyperphosphatemia; known potential for constipation.

- Magnesium Hydroxide Antacids: Known for rapid action; often utilized for its mild laxative effect.

- Combination Antacids: Blending Aluminum and Magnesium salts to balance side effects.

- Others (Sodium Bicarbonate, Alginates): Niche applications and specialized rapid-relief formats.

- Formulation

- Chewable Tablets: Largest segment due to portability and convenience (no water needed).

- Effervescent Tablets: Fastest-growing segment due to perceived quicker absorption and action.

- Dissolvable/Orally Disintegrating Tablets (ODTs): Targeting consumers preferring alternative textures.

- Distribution Channel

- Retail Pharmacies: Traditional and dominant channel, benefiting from professional recommendation.

- Hospital Pharmacies: Sales associated with inpatient care and post-discharge recommendations.

- E-commerce/Online Pharmacies: High growth channel driven by convenience and competitive pricing.

Value Chain Analysis For Antacid Tablet Market

The Antacid Tablet Market value chain begins with the Upstream Analysis, which focuses on the sourcing of key active pharmaceutical ingredients (APIs) such as calcium carbonate, magnesium hydroxide, and aluminum salts, along with excipients like binding agents, flavorings, and coatings. Quality control at this stage is paramount, as the purity and grade of mineral salts directly influence the final product’s acid-neutralizing capacity (ANC) and safety profile. Key suppliers often operate globally, leading to intense competition based on bulk pricing and consistent quality assurance protocols. Manufacturers often maintain long-term contracts with these suppliers to mitigate supply chain volatility and ensure raw material security, especially for high-volume, low-cost APIs.

The core manufacturing process involves formulation, granulation, compression, and coating, requiring specialized equipment and adherence to Good Manufacturing Practices (GMP). Subsequent Downstream Analysis focuses on distribution and sales. The distribution channel is bifurcated into Direct and Indirect models. Direct sales typically involve large manufacturers supplying major pharmacy chains or national hospital systems through their dedicated logistics arms. The Indirect model relies heavily on wholesale distributors, aggregators, and third-party logistics (3PL) providers to manage inventory, warehousing, and transportation to smaller independent pharmacies, convenience stores, and increasingly, specialized e-commerce fulfillment centers. This network complexity necessitates robust tracking and cold chain capabilities, although antacids generally require ambient storage.

The final stage of the value chain involves market access and consumer uptake, heavily influenced by regulatory approvals, effective shelf placement, and targeted marketing. Direct marketing (DTC) campaigns play a vital role in building brand recognition and prompting consumers to choose specific brands when purchasing OTC. E-commerce platforms, functioning as an indirect channel, are increasingly streamlined, utilizing direct-to-consumer delivery models and leveraging review systems to influence purchasing decisions, effectively bypassing traditional retail advisory roles. The efficiency of this channel segment is directly tied to the ability of the supply chain to react quickly to fluctuating online demand and promotional cycles.

Antacid Tablet Market Potential Customers

The Antacid Tablet Market caters to a broad demographic spectrum, primarily comprising individuals experiencing occasional or chronic symptoms related to gastric acidity, heartburn, and dyspepsia. The core potential customers, or end-users, are adults aged 35 and above, as the incidence of GERD and associated digestive discomfort tends to increase with age, often exacerbated by underlying health conditions and polypharmacy. These buyers seek immediate, effective, and convenient relief, prioritizing products with a proven track record and palatable taste profiles, particularly for chewable formulations. They are generally health-conscious consumers who opt for self-medication for minor ailments before seeking professional medical intervention, making them highly responsive to OTC marketing and availability.

A significant secondary customer segment includes patients managing specific lifestyle or temporary conditions. This includes pregnant women, who frequently suffer from hormonally induced acid reflux, seeking antacids specifically approved for use during pregnancy (often calcium-based). It also encompasses individuals with poor dietary habits, high stress occupations, or those consuming large amounts of coffee, alcohol, or spicy food. These customers require products that fit seamlessly into their high-paced lifestyles, favoring quick-acting effervescent or highly portable chewable options. Purchase decisions are often made impulsively at the point of need (e.g., at convenience stores or supermarket checkouts).

Institutional buyers represent another important segment, including hospitals, clinics, and long-term care facilities, where antacid tablets are administered as standard protocol for managing inpatient digestive discomfort and preventing stress ulcers. These professional buyers prioritize bulk purchasing, cost-efficiency, and established safety profiles. Furthermore, the growing segment of customers using prescription medications (like NSAIDs or certain blood pressure drugs) that can cause gastrointestinal side effects often use antacid tablets as a necessary prophylactic measure or supplementary treatment. Targeting these different customer groups requires differentiated product packaging, dosage formats, and specific messaging emphasizing safety and effectiveness for their unique physiological needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 21.8 Billion |

| Growth Rate | 5.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GlaxoSmithKline (GSK), Bayer AG, Takeda Pharmaceutical Company Limited, Johnson & Johnson, Sanofi, Reckitt Benckiser Group PLC, Procter & Gamble (P&G), Pfizer Inc., Perrigo Company plc, Prestige Consumer Healthcare Inc., Hylands Inc., Novartis AG, Boehringer Ingelheim International GmbH, Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Zydus Cadila, Abbott Laboratories, Alvogen, Sandoz (Novartis), Church & Dwight Co., Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antacid Tablet Market Key Technology Landscape

The technology landscape for the Antacid Tablet Market is focused less on radical API invention and more on sophisticated formulation science and optimized delivery systems to enhance efficacy, speed of action, and patient compliance. A critical area of technological advancement involves microencapsulation and nanotechnology utilized to stabilize sensitive ingredients and ensure precise release profiles. For example, applying advanced coating technologies can mask the chalky taste often associated with mineral salts, thereby improving palatability, particularly for chewable forms, which significantly impacts consumer acceptance. Furthermore, novel tablet compression techniques allow for multi-layer tablets that separate incompatible ingredients or provide staggered release capabilities, ensuring both immediate relief and sustained action.

Another pivotal technological area is the development of rapid dissolution technologies for effervescent and orally disintegrating tablets (ODTs). Achieving rapid and complete dissolution requires precise blending of organic acids (like citric acid or tartaric acid) and carbonate or bicarbonate salts, optimized through sophisticated blending machinery and moisture-controlled environments to maintain stability. The goal is to minimize the latency period between consumption and the onset of acid neutralization. This technical optimization is crucial for addressing the consumer demand for immediate symptom relief, providing a significant competitive advantage over slower-acting standard tablets. Advanced analytical instrumentation, such as Dissolution Testing Apparatus and texture analyzers, are used constantly to ensure batch-to-batch consistency and performance standards.

Beyond the product itself, digital technology plays an increasing role in the market infrastructure. Advanced packaging technologies, including child-resistant and senior-friendly blister packs, improve safety and ease of use. Additionally, manufacturers are leveraging predictive analytics and Internet of Things (IoT) sensors within their production facilities to monitor temperature, humidity, and pressure in real-time, optimizing manufacturing yield and reducing contamination risks. The integration of QR codes and serialization technology on packaging is also crucial for traceability, combating counterfeiting, and ensuring regulatory compliance across complex global distribution channels, reinforcing the integrity of the supply chain from plant to consumer.

Regional Highlights

The Antacid Tablet Market exhibits distinct regional consumption patterns and growth trajectories shaped by dietary habits, healthcare infrastructure, and socioeconomic factors. North America remains the dominant revenue generator, characterized by high consumer awareness, widespread acceptance of self-medication, high disposable incomes, and diets heavily contributing to acid reflux issues. The region benefits from established regulatory pathways for OTC products and a dense network of major retail pharmacy chains, facilitating easy access to a vast array of proprietary and generic antacid brands.

Europe constitutes the second-largest market, displaying high consumption rates, particularly in Western economies like Germany, the UK, and France. Market maturity here dictates that growth is largely driven by product differentiation, such as specialized natural formulations and combination therapies, rather than sheer volume expansion. Furthermore, strong regulatory bodies in Europe enforce strict quality and labeling standards, which fosters consumer trust but also presents hurdles for product market entry.

Asia Pacific (APAC) is unequivocally the fastest-growing market globally. This exponential growth is underpinned by massive population bases, rapid urbanization leading to increased consumption of spicy, fatty, and processed foods, and improving economic indicators that translate into higher healthcare spending capacity. Countries such as China, India, and Southeast Asian nations are investing heavily in modernizing their pharmaceutical distribution networks, providing vast opportunities for global manufacturers to expand their market footprint beyond traditional metropolitan areas and capture emerging middle-class demand.

Latin America (LATAM) and the Middle East & Africa (MEA) represent nascent but promising markets. Growth in these regions is heavily reliant on improving healthcare access and establishing robust regulatory frameworks. LATAM’s growth is spurred by increased health consciousness and a growing middle class, while the MEA region sees demand rise primarily in urban centers and oil-rich nations with higher expatriate populations accustomed to Western OTC self-care practices. However, these regions often face challenges related to product affordability and complex import tariffs, which temper overall market expansion.

- North America: Market leader driven by high prevalence of GERD, mature OTC segment, and strong consumer spending power. Key focus on advanced chewable formulations and digital health integration.

- Europe: Stable growth achieved through formulation innovation, especially in effervescent tablets, strict quality standards, and emphasis on pharmacist recommendations.

- Asia Pacific (APAC): Highest growth region propelled by dietary shifts, urbanization, large consumer base (China and India), and infrastructural improvements in distribution.

- Latin America: Emerging market driven by improving economic conditions and increased consumer spending on health and wellness. Focus on accessible pricing strategies.

- Middle East and Africa (MEA): Growth concentrated in urban areas; market expansion relies on healthcare infrastructure development and addressing affordability challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antacid Tablet Market.- GlaxoSmithKline (GSK)

- Bayer AG

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson

- Sanofi

- Reckitt Benckiser Group PLC

- Procter & Gamble (P&G)

- Pfizer Inc.

- Perrigo Company plc

- Prestige Consumer Healthcare Inc.

- Hylands Inc.

- Novartis AG

- Boehringer Ingelheim International GmbH

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Zydus Cadila

- Abbott Laboratories

- Alvogen

- Sandoz (Novartis)

- Church & Dwight Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Antacid Tablet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Antacid Tablet Market through 2033?

The Antacid Tablet Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.0% between 2026 and 2033, driven primarily by increasing prevalence of lifestyle-related digestive disorders and enhanced product accessibility via e-commerce platforms globally. This steady growth trajectory is supported by continuous formulation improvements aimed at rapid action and improved palatability.

Which type of antacid ingredient holds the largest market share globally?

Calcium Carbonate antacids currently hold the largest market share due to their high acid-neutralizing capacity, cost-effectiveness, and ancillary benefit as a dietary calcium supplement. However, combination antacids, which utilize balanced blends of ingredients like Aluminum and Magnesium to minimize typical side effects such as constipation or diarrhea, are rapidly gaining consumer preference in premium segments.

How is the rise of e-commerce affecting the distribution of antacid tablets?

E-commerce is significantly disrupting traditional distribution channels by offering greater convenience, comparative pricing, and discretion, especially for routine purchases. This channel is experiencing the fastest growth, necessitating that key market players invest heavily in digital marketing, streamlined logistics, and strong online presence to maintain market accessibility and capture the digitally native consumer base.

What are the primary factors restraining the long-term growth of the antacid tablet segment?

The primary restraints include intense competition from more potent, longer-acting alternatives like prescription and OTC Proton Pump Inhibitors (PPIs) and H2 blockers. Additionally, increasing consumer scrutiny regarding the long-term safety and potential systemic side effects associated with mineral-based antacids, combined with stringent regulatory requirements for therapeutic claims, limit aggressive market expansion.

Which geographic region is expected to demonstrate the highest growth in the Antacid Tablet Market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate during the forecast period. This acceleration is attributed to rapid urbanization, significant shifts towards Westernized diets that trigger acid reflux, expanding healthcare infrastructure, and the growing disposable income of middle-class populations in densely populated countries like China and India, making OTC products widely accessible.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager