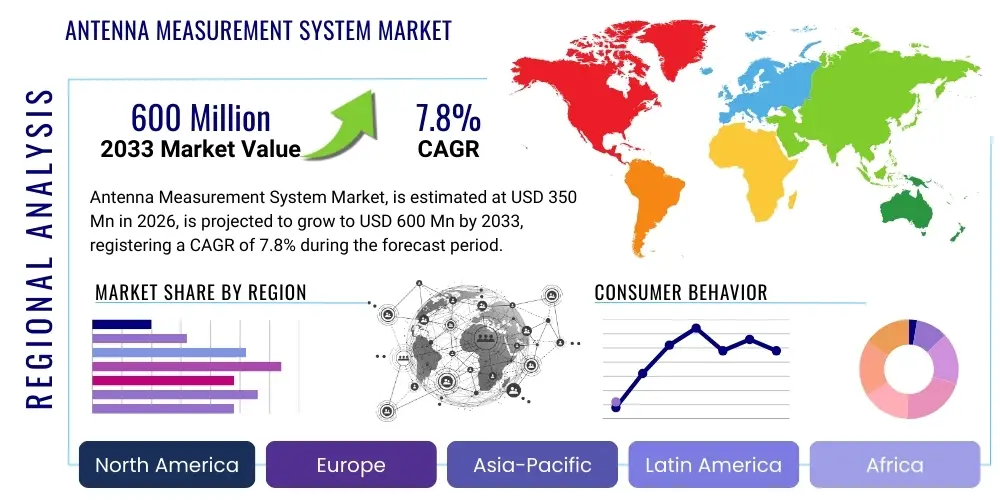

Antenna Measurement System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437427 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Antenna Measurement System Market Size

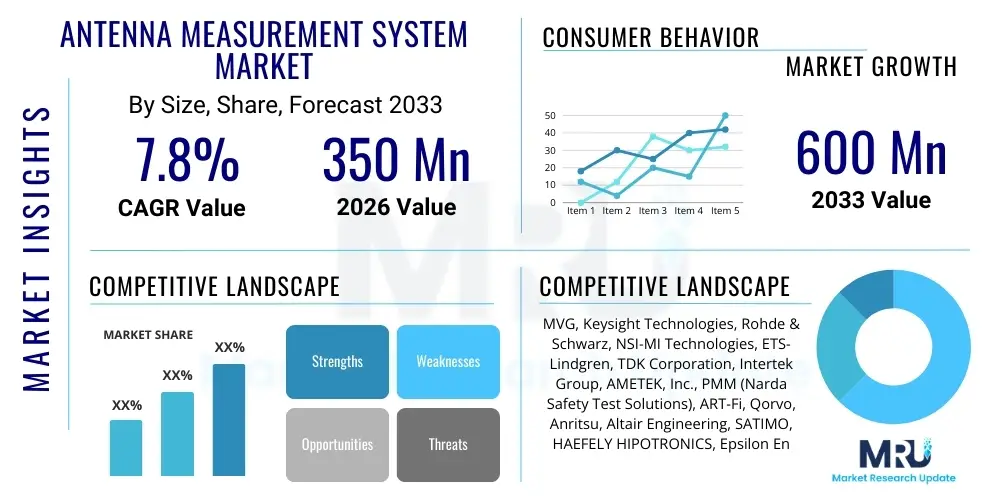

The Antenna Measurement System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $600 Million USD by the end of the forecast period in 2033.

Antenna Measurement System Market introduction

The Antenna Measurement System (AMS) market encompasses specialized equipment and software utilized for characterizing the performance metrics of antennas across various frequency spectra. These systems are crucial for ensuring the quality, efficiency, and regulatory compliance of communication and radar devices. AMS solutions provide essential data points such as gain, radiation patterns, efficiency, polarization purity, and input impedance, which are vital for the successful deployment of wireless technologies. The fundamental requirement for accurate antenna testing stems from the increasing complexity of modern antennas, particularly those employing massive MIMO (Multiple Input Multiple Multiple Output) or beamforming techniques necessary for advanced wireless standards like 5G and emerging 6G networks. The core product offering spans compact range systems, near-field scanners, far-field systems, and associated electromagnetic simulation software packages.

Major applications of antenna measurement systems are highly diversified, extending across the defense sector, telecommunications infrastructure development, consumer electronics manufacturing (smartphones, IoT devices), and the burgeoning automotive industry, particularly for autonomous vehicle radar and V2X (Vehicle-to-Everything) communications. The primary benefit derived from deploying sophisticated AMS solutions is the acceleration of product development cycles and the reduction of costly design iterations. High-precision measurement capabilities allow engineers to validate theoretical performance models against real-world parameters early in the development phase, ensuring optimal device performance before mass production. This validation is critical in competitive markets where timely deployment and guaranteed signal integrity are paramount for market success and technological superiority.

The market is predominantly driven by significant global investment in next-generation wireless infrastructure, particularly the ongoing deployment of high-frequency millimeter-wave (mmWave) 5G technology, which necessitates extremely precise and high-throughput measurement capabilities. Furthermore, the relentless miniaturization of electronic components, coupled with the increasing complexity of integrated antennas (AiP - Antenna in Package) and phased arrays, mandates advanced testing environments such as specialized anechoic chambers and planar near-field scanners. The proliferation of Low Earth Orbit (LEO) satellite constellations and sophisticated radar systems for defense and surveillance further bolsters demand for robust, high-performance antenna testing solutions capable of handling wide bandwidths and complex beam steering requirements.

Antenna Measurement System Market Executive Summary

The Antenna Measurement System (AMS) market exhibits robust growth driven primarily by structural shifts in global telecommunications and defense spending. Business trends highlight a strong industry pivot towards solutions supporting high-frequency testing, particularly above 28 GHz, essential for mmWave 5G deployment and advanced satellite communication systems. Key market players are focusing on integrating automated measurement procedures, advanced robotic positioning systems, and sophisticated post-processing algorithms to enhance measurement speed and accuracy. The competitive landscape is characterized by strategic partnerships between AMS providers and semiconductor manufacturers to offer integrated testing environments for Antenna-in-Package (AiP) and System-in-Package (SiP) solutions, addressing the challenges posed by component integration and size reduction.

Regional trends indicate North America maintaining market leadership due to substantial defense budgets allocated to radar and electronic warfare systems, alongside pioneering research and development activities in 6G technologies. Asia Pacific (APAC), however, is poised for the fastest growth, propelled by massive investments in 5G infrastructure rollout across countries like China, South Korea, and Japan, coupled with a rapidly expanding consumer electronics manufacturing base. Europe demonstrates steady growth, driven by stringent regulatory standards (e.g., CE marking) and robust automotive sector demand for sophisticated radar sensor testing (e.g., 77 GHz). Regional investment priorities emphasize portable, faster, and more versatile testing setups to handle diverse testing requirements efficiently.

Segmentation trends reveal Near-Field Systems dominating the market by value, favored for their ability to accurately test large or complex antennas within relatively smaller physical spaces, making them ideal for high-volume telecommunication base station antenna testing and satellite array validation. The frequency range segment above 18 GHz is experiencing the highest CAGR, directly correlated with the necessity to test high-band 5G and increasingly complex military radar systems operating in the Ku, K, and Ka bands. Application-wise, the Telecommunications and Aerospace & Defense sectors remain the primary revenue generators, though the Automotive segment is emerging rapidly as vehicles become equipped with numerous radar, LiDAR, and communication antennas requiring comprehensive end-of-line and R&D testing procedures.

AI Impact Analysis on Antenna Measurement System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Antenna Measurement System (AMS) market frequently center on themes of enhanced measurement throughput, autonomous calibration capabilities, and the potential for AI-driven design optimization. Users often question how AI can expedite the lengthy measurement processes, particularly for complex massive MIMO arrays where the number of test states is prohibitive. A prevalent concern is the integration of machine learning (ML) models into existing hardware platforms and the reliability of AI algorithms in detecting subtle performance anomalies or manufacturing defects that traditional software might overlook. Key expectations revolve around using AI for predictive maintenance of AMS components, intelligent data processing to filter noise and bias, and, crucially, leveraging generative AI to accelerate the antenna design phase, minimizing physical prototype iteration cycles.

The application of AI in AMS is transitioning from theoretical concepts to practical implementation, focusing heavily on enhancing data interpretation and operational efficiency. ML algorithms are being deployed to analyze vast datasets generated by scanning systems, identifying optimal measurement parameters and compensating for systematic errors induced by the test environment or probe imperfections. This optimization leads to reduced measurement time and improved accuracy without requiring physical adjustments to the system setup. Furthermore, AI is critical in classifying radiation patterns and automatically comparing measured performance against simulation models, providing instant feedback loops for design refinement. This capability significantly elevates the utility of AMS by turning raw data into actionable engineering intelligence.

In the near future, AI and Deep Learning (DL) are expected to drive the development of "smart" measurement systems capable of autonomous operation and self-correction. These systems will utilize reinforcement learning to optimize the trajectory of the robotic positioning system based on real-time data analysis, ensuring maximum efficiency while minimizing setup errors. Moreover, the integration of AI-powered anomaly detection tools will revolutionize quality control by instantly flagging antennas exhibiting subtle deviations from expected performance envelopes, which is particularly vital for high-reliability applications in aerospace and medical device testing. The convergence of AI with simulation tools also facilitates a tighter integration between virtual prototyping and physical testing, accelerating the entire product lifecycle.

- AI-driven optimization of measurement pathways and robotic movements, reducing test duration by up to 30%.

- Machine learning algorithms for predictive error correction and autonomous system calibration, enhancing data fidelity.

- Deep Learning models utilized for real-time anomaly detection in radiation patterns and performance characteristics.

- AI facilitates rapid analysis and classification of complex massive MIMO and beamforming data structures.

- Integration of generative AI tools to accelerate antenna design iteration, reducing reliance on extensive physical prototyping before AMS validation.

DRO & Impact Forces Of Antenna Measurement System Market

The Antenna Measurement System (AMS) market dynamic is shaped by a powerful confluence of drivers and restraints, framed by significant market opportunities and underlying impactful forces. A primary driver is the global, multi-billion dollar investment in 5G and forthcoming 6G network deployment, which mandates rigorous testing of high-frequency components (mmWave) and complex antenna architectures like massive MIMO arrays. This requirement pushes manufacturers towards advanced, high-precision near-field and compact range systems. Simultaneously, the accelerating adoption of electric vehicles and autonomous driving technologies fuels the demand for AMS capable of testing crucial automotive radar systems (77 GHz and above) under various environmental conditions. However, the market faces restraints, primarily concerning the prohibitively high initial cost of establishing and maintaining certified anechoic chamber environments and advanced multi-probe systems, creating significant barriers to entry for smaller firms or academic institutions. Furthermore, the scarcity of highly skilled engineers specialized in high-frequency measurement techniques and post-processing limits rapid adoption in some emerging regions, complicating technology diffusion.

Significant opportunities reside in the burgeoning satellite communication sector, particularly the deployment of large LEO and MEO constellations by companies like SpaceX and Amazon, necessitating extensive ground-based testing of satellite payloads and user terminals. This sector requires high-throughput testing solutions that can rapidly characterize thousands of array elements. Another key opportunity lies in the development of customized, portable, and desktop-sized AMS solutions suitable for R&D labs and small-scale manufacturing facilities focused on IoT and wearable devices. These smaller, more flexible systems address the need for cost-effective, localized testing capabilities. The market impact forces primarily stem from technological obsolescence; rapid advancements in wireless standards constantly necessitate the replacement or significant upgrade of existing measurement infrastructure to remain compliant with new frequency bands and complexity requirements. This continuous upgrade cycle ensures sustained demand, especially for software-defined measurement instruments.

The intensifying geopolitical competition in space and defense technology significantly influences the market, driving demand for AMS capable of testing advanced electronic warfare, surveillance, and next-generation radar systems with extremely stringent performance requirements. The shift from traditional far-field testing to sophisticated near-field measurement techniques (planar, cylindrical, spherical) represents a major structural impact force, dictated by the need to handle physically large antennas and complex beamforming arrays efficiently within confined spaces. Restraints related to complexity are also critical; as frequencies increase (towards sub-THz), maintaining measurement accuracy becomes exponentially difficult due to cable losses, calibration complexities, and environmental susceptibility, demanding continuous innovation in probe design and software compensation algorithms. Successfully navigating these forces requires manufacturers to focus on modular, scalable, and software-centric solutions that can adapt quickly to evolving standards and minimize the total cost of ownership for end-users.

Segmentation Analysis

The Antenna Measurement System market is comprehensively segmented based on the system type, the operational frequency range, the end-use application, and the system components. This multifaceted segmentation provides a clear view of where capital expenditure is concentrated and which technological solutions are driving growth across different industrial verticals. The differentiation by system type (Near-Field, Far-Field, Compact Range) is critical as it defines the physical scope, accuracy level, and initial investment required for the testing facility, directly influencing suitability for specific antenna sizes and measurement requirements. The increasing focus on higher frequencies, particularly those above 18 GHz, reflects the transition to advanced communication standards (5G mmWave) and sophisticated radar applications, serving as a primary indicator of market maturity and technological advancement.

The application segmentation is crucial for understanding market demand drivers, with Aerospace & Defense and Telecommunications historically dominating revenue generation due to the need for mission-critical, high-reliability antenna performance testing. However, the rapid expansion of the Automotive segment, fueled by radar and V2X communication proliferation, is emerging as the fastest-growing application area, demanding specialized measurement systems that can perform complex scenarios like corner radar testing. Furthermore, segmentation by component—which includes measurement chambers (anechoic chambers), positioning systems, measurement instruments (VNAs, spectrum analyzers), and specialized software—helps in identifying revenue streams for hardware manufacturers versus software and service providers, noting a trend towards integrated solutions where software intellectual property provides significant competitive differentiation and recurring revenue.

- By System Type: Near-Field Systems (Planar, Cylindrical, Spherical), Far-Field Systems (Outdoor Ranges, Indoor Anechoic Chambers), Compact Range Systems.

- By Component: Anechoic Chambers, Positioning Systems (Rotators, Turntables, Scanners), Measurement Instruments (Vector Network Analyzers, Spectrum Analyzers), Measurement Software and Probes.

- By Frequency Range: Up to 1 GHz, 1 GHz to 18 GHz, Above 18 GHz (including mmWave).

- By Application: Aerospace & Defense, Telecommunications (Base Stations, Handsets), Automotive (Radar, V2X), Consumer Electronics (IoT, Wearables), Research & Academic.

Value Chain Analysis For Antenna Measurement System Market

The value chain of the Antenna Measurement System (AMS) market begins with the upstream suppliers responsible for high-precision components. This segment includes manufacturers of specialized raw materials for RF absorbing materials (used in anechoic chambers), precision mechanical components for robotic positioning systems (e.g., highly accurate stepper motors and encoders), and core RF instrumentation providers supplying Vector Network Analyzers (VNAs) and spectrum analyzers. The quality and availability of these high-fidelity inputs directly impact the final system performance, establishing a strong dependence on global supply chain robustness for sensitive electronic and mechanical parts. Key strategic relationships in this phase focus on securing reliable sources for specialized RF components capable of handling high frequencies with minimal loss, ensuring the accuracy required by next-generation testing standards.

The middle segment of the value chain is dominated by AMS Integrators and Original Equipment Manufacturers (OEMs), such as MVG, Keysight, and Rohde & Schwarz. These companies specialize in system design, assembly, calibration, and the development of proprietary measurement software. They acquire components upstream and integrate them into coherent, calibrated measurement solutions (near-field systems, compact ranges). The core value addition here is the intellectual property embedded in the measurement algorithms, data processing capabilities, and the highly accurate synchronization of the physical positioning system with the RF instruments. OEMs often provide significant post-sale support, including chamber recalibration, software updates, and maintenance services, which represent substantial recurring revenue streams.

Downstream analysis focuses on the distribution channels and end-users. Distribution is typically direct for large, complex systems (such as massive anechoic chambers or satellite testing facilities) due to the necessity of professional installation, calibration, and customized integration tailored to the client's specific testing volume and antenna size requirements. For smaller, more standardized components or portable systems, indirect channels involving specialized technical distributors or sales representatives might be used. The ultimate buyers—the end-users—are primarily R&D departments, quality assurance labs in manufacturing facilities (Telecommunication and Automotive), and government defense organizations. The effectiveness of the distribution hinges on providing comprehensive technical consultation and after-sales service, as AMS solutions represent major capital expenditure that requires long-term operational support and expertise.

Antenna Measurement System Market Potential Customers

The primary customers for Antenna Measurement Systems are entities that design, manufacture, or rigorously test wireless communication and radar apparatus, often operating under strict regulatory or performance specifications. In the Telecommunications sector, major base station equipment vendors (e.g., Ericsson, Nokia, Huawei) and high-volume handset manufacturers require sophisticated near-field systems for testing massive MIMO arrays and integrated antennas in consumer devices. These customers prioritize high throughput, automation, and the ability to test complex beamforming performance rapidly. Government defense agencies and aerospace contractors constitute another foundational customer base, requiring highly accurate compact ranges and specialized far-field facilities for testing military radar, electronic warfare antennas, and satellite communication payloads, where failure is not an option and precision verification is mandatory.

A rapidly expanding customer base is found within the Automotive industry, driven by the shift towards autonomous and connected vehicles. Automotive OEMs and Tier 1 suppliers purchase AMS solutions specifically tailored for high-frequency radar testing (e.g., 77 GHz collision avoidance systems) and V2X communication antennas. These systems often require specialized environments that simulate road conditions or temperature variations. Academic and commercial research institutions are also perennial customers, utilizing flexible, state-of-the-art AMS platforms to conduct fundamental research into new antenna materials, novel architectures (metamaterials), and emerging wireless standards (6G). Their purchasing decisions are often influenced by system flexibility and the ability to interface with diverse measurement hardware and proprietary simulation tools.

Furthermore, the growing ecosystem of IoT (Internet of Things) and medical device manufacturers represents an increasing pool of potential customers. Although often requiring smaller, more cost-effective benchtop or compact AMS solutions, these companies require systems to validate the performance of miniature, integrated antennas essential for wearable health monitors, smart home devices, and asset trackers. The purchasing criteria for this segment emphasize ease of use, cost-effectiveness, and certification compliance (e.g., FCC, CE). Ultimately, any company whose core product relies on reliable wireless connectivity—from consumer drones to large industrial machinery using wireless sensing—is a potential customer for antenna measurement and verification services or systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $600 Million USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MVG, Keysight Technologies, Rohde & Schwarz, NSI-MI Technologies, ETS-Lindgren, TDK Corporation, Intertek Group, AMETEK, Inc., PMM (Narda Safety Test Solutions), ART-Fi, Qorvo, Anritsu, Altair Engineering, SATIMO, HAEFELY HIPOTRONICS, Epsilon Engineering, Sierra Nevada Corporation, Airbus Defence and Space, Boeing (Testing Solutions Division), Microwave Vision Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antenna Measurement System Market Key Technology Landscape

The technological landscape of the Antenna Measurement System (AMS) market is characterized by a persistent drive towards higher precision, wider bandwidth coverage, and increased measurement speed, primarily necessitated by the demands of 5G mmWave and satellite communications. A crucial technological shift is the widespread adoption of Near-Field (NF) measurement techniques, specifically planar and spherical NF scanning, which allows for the accurate characterization of large antennas and phased arrays (such as massive MIMO) within a shielded anechoic environment. Advanced probe arrays, often incorporating specialized broadband feeds, are essential to capture the complex electromagnetic fields accurately. Furthermore, sophisticated numerical transformation algorithms (NF-to-FF transformation) are required to convert the measured near-field data into far-field radiation patterns with high computational efficiency and minimal numerical error, often leveraging powerful GPU acceleration.

Another pivotal technological development involves the integration of high-performance Vector Network Analyzers (VNAs) and specialized RF instrumentation capable of ultra-wideband measurements, extending into the sub-THz frequencies (100 GHz and beyond) for future 6G research and advanced defense applications. System manufacturers are increasingly developing modular and software-defined instrumentation platforms that offer enhanced flexibility, allowing users to adapt measurement configurations quickly to handle varying frequency requirements and complex modulation schemes. This software-centric approach facilitates remote operation, automated calibration routines, and seamless integration with electromagnetic simulation tools (like FEKO or CST), creating a comprehensive digital twin environment for antenna performance prediction and verification.

The deployment of highly accurate, multi-axis robotic positioning systems (gantry systems and precision turntables) constitutes a significant technological pillar. These systems must ensure extremely low mechanical tolerance errors (often in the micrometer range) and rapid movement synchronization to minimize measurement time while maintaining repeatability across thousands of data points, particularly critical for large satellite antennas. Furthermore, the refinement of Anechoic Chamber technology—including the development of advanced pyramidal and multi-layer carbon-loaded foam absorbers for improved reflectivity suppression at high frequencies—remains fundamental to providing pristine, controlled measurement environments. Future developments are focused on hybrid systems combining the advantages of compact ranges and near-field scanning, alongside the aforementioned integration of AI for smarter, predictive measurement protocols.

Regional Highlights

Regional dynamics play a significant role in shaping the Antenna Measurement System (AMS) market, reflecting varied levels of technological investment, regulatory frameworks, and sector dominance. North America, encompassing the US and Canada, traditionally holds the largest market share. This dominance is underpinned by robust government spending on sophisticated Aerospace and Defense programs, particularly those related to next-generation radar, electronic warfare systems, and space-based assets. The region also hosts major telecommunication technology innovators and is at the forefront of 6G research, ensuring continuous demand for advanced, high-frequency testing infrastructure. The presence of key AMS market leaders and rigorous quality standards further solidifies its position as a high-value market.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid expansion is fundamentally driven by the enormous scale of 5G network rollout in countries like China, India, and Japan, necessitating vast quantities of base station and user equipment antenna testing. Furthermore, APAC serves as the global manufacturing hub for consumer electronics, fueling high demand for automated, high-throughput AMS solutions suitable for mass production quality control of smartphones, IoT devices, and automotive components. Government initiatives supporting local semiconductor and telecommunications development, combined with increasingly complex domestic defense modernization programs, contribute substantially to regional market acceleration.

Europe demonstrates steady and mature growth, primarily supported by high technical standards and demand from the established Automotive and industrial sectors. European manufacturers are leaders in high-frequency radar sensors for autonomous driving, requiring specialized, customized AMS solutions. Additionally, the region benefits from strong collaborative R&D efforts involving universities and industry focusing on future wireless technologies and standardized testing procedures. The Middle East and Africa (MEA) and Latin America (LATAM) currently represent smaller market shares but are exhibiting promising growth, driven by localized 5G expansion projects, satellite ground station upgrades, and increasing domestic defense procurement, leading to gradual investment in foundational AMS infrastructure.

- North America (NA): Market leader driven by high defense expenditure, extensive 6G research, and mature telecommunication infrastructure development. Key focus on high-frequency, high-reliability military and satellite testing.

- Asia Pacific (APAC): Fastest-growing region, powered by large-scale 5G infrastructure deployment, dominance in consumer electronics manufacturing, and increasing regional investment in automotive radar testing facilities.

- Europe (EU): Steady growth fueled by stringent regulatory requirements, leadership in automotive radar technology (77 GHz), and continuous investment in academic and industrial R&D facilities.

- Middle East & Africa (MEA): Emerging market characterized by initial 5G rollout phases and increasing procurement of advanced communication and surveillance systems for defense applications.

- Latin America (LATAM): Developing market with gradual adoption driven by localized telecom expansion and modernization efforts, often seeking cost-effective and scalable AMS solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antenna Measurement System Market.- MVG (Microwave Vision Group)

- Keysight Technologies

- Rohde & Schwarz

- NSI-MI Technologies

- ETS-Lindgren

- TDK Corporation

- Intertek Group

- AMETEK, Inc.

- PMM (Narda Safety Test Solutions)

- ART-Fi

- Qorvo

- Anritsu

- Altair Engineering

- SATIMO

- HAEFELY HIPOTRONICS

- Epsilon Engineering

- Sierra Nevada Corporation

- Airbus Defence and Space (Testing Solutions)

- Boeing (Testing Solutions Division)

- Aethercomm

Frequently Asked Questions

Analyze common user questions about the Antenna Measurement System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical challenge in measuring 5G mmWave antennas?

The primary technical challenge is maintaining high measurement accuracy and repeatability at frequencies above 24 GHz. This requires extremely precise mechanical positioning systems, specialized probes that minimize signal loss, and advanced calibration routines to mitigate environmental factors and cable reflections inherent to high-frequency electromagnetic testing.

Why are Near-Field (NF) systems preferred over Far-Field (FF) systems for modern antenna testing?

Near-Field systems are preferred because they allow for the accurate measurement of electrically large antennas (like massive MIMO arrays) within a relatively small, indoor anechoic environment. They avoid the atmospheric effects and significant physical space requirements associated with traditional outdoor Far-Field ranges, offering better throughput and repeatability for complex array testing.

How is AI specifically enhancing the efficiency of Antenna Measurement Systems?

AI enhances efficiency by optimizing measurement protocols, using Machine Learning to predict and correct systematic errors during data acquisition, and rapidly processing vast amounts of complex data (e.g., beam steering characteristics) to reduce post-processing time and accelerate the iterative antenna design and validation cycle.

Which industry application is driving the highest growth in demand for AMS solutions?

While Telecommunications remains the largest segment by revenue, the Automotive industry, particularly the demand for testing high-frequency (77 GHz) radar sensors used in Advanced Driver Assistance Systems (ADAS) and autonomous vehicles, is currently exhibiting the highest Compound Annual Growth Rate (CAGR) in the AMS market.

What role do Vector Network Analyzers (VNAs) play in the overall antenna measurement system setup?

VNAs serve as the core measurement instrument, providing the fundamental capability to generate and measure RF signals across a wide frequency spectrum. They are crucial for assessing critical antenna parameters such as return loss, insertion loss, and characterizing the scattering parameters necessary to calculate radiation patterns and impedance matching, often operating up to 100 GHz or higher in modern systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager