Anti-Hair Loss Essence Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434340 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Anti-Hair Loss Essence Market Size

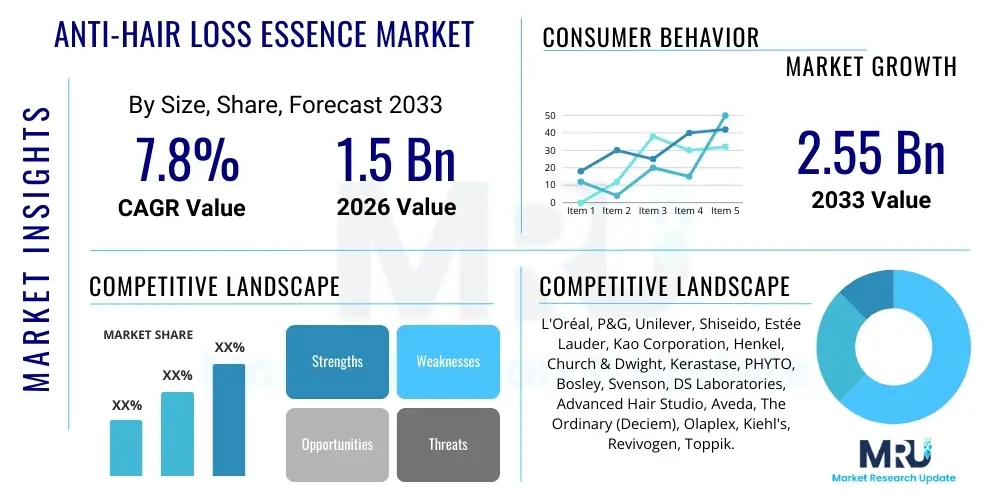

The Anti-Hair Loss Essence Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Anti-Hair Loss Essence Market introduction

The Anti-Hair Loss Essence Market encompasses sophisticated cosmetic and therapeutic formulations specifically designed to prevent or mitigate hair thinning and loss by addressing underlying scalp health and follicular vitality. These products, often delivered as lightweight, non-greasy liquids, serums, or tonics, concentrate highly active ingredients directly onto the scalp. Unlike traditional shampoos or conditioners, essences are formulated for prolonged contact with the skin barrier and hair follicles, maximizing the penetration and efficacy of compounds such as minoxidil, natural peptides, stem cell extracts, and proprietary botanical mixtures. The primary function of these essences is to prolong the anagen (growth) phase of the hair cycle, minimize the telogen (resting/shedding) phase, and improve overall blood circulation to the scalp, thereby nourishing dormant or miniaturized follicles.

The product description highlights essences as a critical element in daily hair care routines for individuals experiencing early stages of alopecia, stress-induced shedding, or pattern baldness. Major applications span clinical dermatological treatment adjuncts, preventative cosmetic measures, and post-procedural care following hair transplants or micro-needling treatments. The benefits of using anti-hair loss essences are significant, including improved hair density, reduced breakage, enhanced scalp moisture balance, and a noticeable thickening of existing hair strands. Furthermore, modern formulations often prioritize consumer experience, featuring clean labels, pleasant textures, and targeted delivery systems, moving beyond medicinal odors traditionally associated with hair loss treatments.

Driving factors propelling this market include a globally aging population more susceptible to age-related hair thinning, a significant increase in lifestyle-related stress contributing to telogen effluvium, and enhanced consumer awareness regarding hair health maintenance. Social media trends and increased visibility of male and female pattern baldness treatments have normalized the use of prophylactic and therapeutic hair care products. Moreover, continuous innovation in biotechnology, specifically the development of highly effective plant-based stem cell derivatives and personalized peptide cocktails, is offering consumers novel, clinically-backed solutions that circumvent some of the side effects historically associated with chemical treatments like finasteride, further fueling market expansion and penetration across various demographic segments globally.

Anti-Hair Loss Essence Market Executive Summary

The Anti-Hair Loss Essence Market is characterized by robust growth driven by shifting consumer attitudes towards preventative wellness and the rapid globalization of premium cosmetic brands. Key business trends indicate a strong move toward e-commerce and direct-to-consumer (DTC) models, allowing niche biotechnology companies to compete effectively with established pharmaceutical and cosmetic giants. Investment focus is increasingly centered on clinical efficacy verification and transparent ingredient sourcing, necessitated by consumer demand for accountability and performance. Furthermore, strategic mergers and acquisitions are common as large players seek to integrate specialized ingredient technologies and proprietary delivery systems, ensuring a diverse and scientifically credible product portfolio capable of addressing varied etiological causes of hair loss, ranging from hormonal imbalances to environmental factors.

Regional trends reveal Asia Pacific (APAC) as the largest and fastest-growing market, primarily due to high population density, rising disposable incomes in emerging economies like China and India, and a deep-rooted cultural emphasis on aesthetic appearance and hair health. North America and Europe maintain a leading position in research and development and premium segment sales, capitalizing on strong consumer spending on high-end dermatological and cosmeceutical products. Segmentation trends highlight the dominance of the women’s segment in terms of value, driven by significant spending on specialized products, while the natural and herbal ingredient category is experiencing the most rapid growth rate, responding to the global clean beauty movement and concerns regarding chemical exposure. The distribution landscape is evolving rapidly, with professional salons and specialty aesthetic clinics becoming key channels for expert advice and higher-priced essence recommendations.

In essence, the market outlook is overwhelmingly positive, underpinned by demographic shifts and technological advancements. Success in this competitive landscape is contingent upon effective brand storytelling that connects scientific claims with consumer emotional needs, robust clinical testing, and adaptive supply chain management capable of handling sensitive, biotech-derived ingredients. The convergence of dermatology, biotechnology, and personalized medicine is creating complex yet highly rewarding opportunities, positioning anti-hair loss essences as a dynamic sector within the broader global functional beauty and personal care industry. Companies that leverage data analytics to understand consumer genomics and lifestyle patterns will be best positioned to capture market share through hyper-personalized product offerings.

AI Impact Analysis on Anti-Hair Loss Essence Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the historically trial-and-error approach to hair loss treatment, particularly regarding personalized diagnostics and the speed of new ingredient discovery. Common questions revolve around AI’s ability to analyze complex factors like genetics, lifestyle data, and scalp microbiome composition to recommend the most effective essence formulation for an individual, minimizing treatment costs and maximizing efficacy. Consumers also express interest in AI-powered tools for tracking progress, such as mobile apps that use computer vision to measure hair density changes over time. Additionally, researchers focus on AI's role in accelerating the identification and validation of novel, safe, and highly effective compounds, especially synthetic peptides or growth factors, significantly reducing the time and expense involved in preclinical testing. The key themes summarized from user inquiries underscore the expectation that AI will deliver personalization, optimize product development, and enhance consumer engagement through measurable results, transforming the market from generic solutions to precision treatments.

- AI-Driven Personalization: Using machine learning algorithms to analyze individual genomic data, hormonal profiles, and lifestyle factors to customize anti-hair loss essence formulations, ensuring maximum compatibility and efficacy for specific alopecia types.

- Accelerated Ingredient Discovery: Leveraging AI and high-throughput screening to rapidly sift through vast chemical libraries, predicting the biological activity and safety profile of novel compounds (e.g., small molecules, botanical extracts) capable of stimulating hair growth or inhibiting hair loss pathways.

- Supply Chain Optimization: Utilizing predictive analytics to forecast demand fluctuations across diverse regional markets and optimize inventory management for highly perishable or temperature-sensitive biotech ingredients used in premium essences, reducing waste and ensuring product freshness.

- Enhanced Diagnostic Tools: Implementing computer vision and deep learning models in smartphone applications or handheld devices for non-invasive, objective measurement of scalp health, follicular density, and hair shaft diameter, providing consumers with real-time feedback on treatment effectiveness.

- Virtual Consultation and Recommendation: AI-powered chatbots and virtual assistants providing 24/7 customer support, offering initial assessment of hair loss concerns, and recommending specific essence products based on user-provided symptoms and preferences, thereby streamlining the consumer journey.

- Clinical Trial Acceleration: Employing AI to analyze complex biological data from preclinical studies, identifying suitable candidates for clinical trials faster, and minimizing the time required to bring new, scientifically validated anti-hair loss products to market, enhancing competitive speed.

DRO & Impact Forces Of Anti-Hair Loss Essence Market

The Anti-Hair Loss Essence Market is heavily influenced by a confluence of psychological, demographic, and technological factors that shape its growth trajectory. The primary drivers include the escalating global prevalence of hair loss conditions, significantly influenced by chronic stress, poor diet, and environmental pollution. Secondly, the increasing consumer acceptance of functional cosmetic products—those offering both aesthetic and therapeutic benefits—has broadened the market base beyond traditional sufferers to include individuals focused on preventative aging and wellness. Opportunities in this market are vast, centering on the development of highly specialized, non-invasive treatments, particularly those integrating biotechnology such as growth factors and exosomes derived from stem cell research, which promise superior efficacy with fewer side effects. Furthermore, the burgeoning male grooming segment, which increasingly seeks discrete, high-performance daily treatment options, presents a substantial avenue for market expansion and premium product pricing.

However, the market faces considerable restraints that temper accelerated growth. Chief among these is the pervasive consumer skepticism regarding the efficacy claims of cosmetic anti-hair loss products, often stemming from historically disappointing results or the lack of rigorous clinical data backing over-the-counter formulations. Regulatory hurdles, particularly in regions like the European Union where cosmetic ingredient claims are strictly monitored, impose high costs and complexities on market entry and product marketing. The long duration required for consumers to observe tangible results from topical essences (often 3 to 6 months) often leads to low compliance rates and premature discontinuation, impacting perceived product performance and repeat purchasing cycles. This requires manufacturers to invest heavily not just in product efficacy but also in consumer education and sophisticated compliance tracking mechanisms.

Impact forces currently shaping the competitive environment include the critical role of dermatologist and trichologist endorsements, which lend essential credibility to new product launches in a saturated market. The rise of clean beauty and sustainability mandates that companies reformulate products to remove controversial chemicals, favoring natural, ethically sourced, and often more expensive ingredients, which impacts production costs and consumer pricing. Simultaneously, rapid advancements in delivery systems, such as nano-encapsulation and liposomal technology, are critical determinants of competitive success, as improved bioavailability directly correlates with enhanced clinical outcomes. Companies mastering these impact forces—efficacy through technology, credibility through endorsement, and alignment with consumer ethical concerns—are poised to dominate the next phase of market evolution.

Segmentation Analysis

The Anti-Hair Loss Essence Market segmentation is crucial for understanding target consumer behavior and strategic market positioning. The market is broadly categorized based on Product Type (Natural/Herbal vs. Synthetic/Chemical), Ingredient, Distribution Channel, and End-User (Men vs. Women). This diversified segmentation allows manufacturers to tailor their marketing and R&D efforts precisely, addressing specific consumer needs—from those seeking potent pharmaceutical-grade compounds like Minoxidil to consumers preferring gentle, plant-based solutions. The Ingredient segment is particularly dynamic, reflecting the continuous introduction of advanced bio-active molecules, moving beyond traditional vitamins and minerals to embrace advanced peptides and stem cell derivatives, catering to consumers who prioritize innovative science and rapid results.

- By Product Type:

- Natural/Herbal Essences

- Synthetic/Chemical Essences

- By Ingredient:

- Minoxidil

- Stem Cell Technology Extracts

- Essential Oils (e.g., Rosemary, Peppermint)

- Peptides/Proteins (e.g., Copper Peptides, Keratin)

- Vitamins and Nutrients (e.g., Biotin, Niacinamide)

- By Distribution Channel:

- Online Retail (E-commerce, Brand Websites)

- Offline Retail

- Pharmacies and Drug Stores

- Specialty Stores (e.g., Sephora, Ulta)

- Supermarkets and Hypermarkets

- Professional Salons and Clinics

- By End-User:

- Men

- Women

Value Chain Analysis For Anti-Hair Loss Essence Market

The value chain for anti-hair loss essences is complex, starting with highly specialized upstream activities involving the sourcing and synthesis of potent active ingredients. Upstream analysis focuses heavily on biotechnology firms, specialized chemical suppliers, and cultivators of high-purity botanical extracts. For synthetic compounds like Minoxidil or high-performance peptides, the process requires stringent quality control and Good Manufacturing Practices (GMP) certification to ensure stability and concentration. For natural ingredients, sustainable sourcing and sophisticated extraction technologies (such as supercritical CO2 extraction) are paramount to yield concentrated and bioavailable essential components. The high cost and intellectual property associated with proprietary biotech ingredients significantly influence the final product pricing and differentiation, making raw material sourcing a critical competitive advantage.

Midstream activities involve formulation, manufacturing, and packaging. Essence formulation is a delicate process requiring expertise to ensure the stability of active ingredients, particularly growth factors and peptides, which are often sensitive to temperature and light. Manufacturing involves aseptic filling and specialized packaging—often utilizing dark glass bottles or airless pump dispensers—to maintain product integrity and efficacy throughout the shelf life. Downstream analysis focuses on the distribution network. The essential nature of these products means distribution channels are varied: Direct and indirect sales methods are both heavily utilized. Direct distribution, primarily through e-commerce and brand-owned websites, allows for greater control over brand messaging, customer data acquisition, and maintaining product freshness, particularly crucial for highly active, sensitive formulations.

Indirect distribution encompasses retail channels where expert advice is valued. Pharmacies and professional salons act as gatekeepers, relying on expert recommendations to push premium products, while supermarkets cater to mass-market and lower-cost options. The effectiveness of the value chain is determined by the speed of innovation (getting new biotech ingredients from lab to shelf), adherence to global cosmetic regulations (especially concerning claim substantiation), and efficient cold chain logistics for sensitive components. Mastery of the entire value chain, from securing exclusive ingredient licenses upstream to strategic placement in high-trust clinical environments downstream, is essential for securing long-term market dominance and building consumer trust in efficacy claims.

Anti-Hair Loss Essence Market Potential Customers

Potential customers for anti-hair loss essences are diverse, encompassing both therapeutic users seeking solutions for diagnosed conditions and prophylactic users focused on maintaining hair density as a part of their wellness routine. The primary End-Users/Buyers fall into two major demographic groups: men and women experiencing pattern hair loss (Androgenetic Alopecia), stress-related shedding (Telogen Effluvium), or age-related hair thinning. Men, often seeking potent, clinically validated ingredients like Minoxidil, form a significant consumer base, driven by the desire for non-invasive alternatives to surgical interventions. Women, who frequently experience hair loss due to hormonal fluctuations, pregnancy, or nutrient deficiencies, prioritize gentle, hormone-free, and natural formulations that also address scalp sensitivity and overall hair quality, leading them to prefer peptide-based or botanical essences.

Beyond traditional consumers, the market targets specialized buyers in high-income demographics seeking advanced cosmeceutical solutions. This segment includes individuals undergoing post-transplant care, where essences are recommended by clinicians to support graft survival and accelerate recovery. Younger consumers, specifically millennials and Gen Z, represent a growing segment focusing on prevention, incorporating essences into multi-step daily routines long before noticeable thinning occurs. These preventative buyers are highly influenced by social media and seek products endorsed by dermatologists or influencers, prioritizing ingredient transparency and clean beauty labels over pharmaceutical heritage.

A crucial buyer segment also resides within professional channels, including dermatologists, trichologists, and high-end salon professionals. These entities purchase essences in bulk or recommend specific lines to their clients, acting as trusted intermediaries whose endorsements drive sales of premium, higher-concentration formulations. For these professional buyers, product stability, clinical trial results, and the brand’s professional support and education programs are primary purchasing criteria. Ultimately, the potential customer base is expanding, shifting from reactive treatment of severe hair loss to proactive, routine scalp maintenance across all age and gender demographics, necessitating a broad range of products from clinical strength to gentle, daily preventative care options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal, P&G, Unilever, Shiseido, Estée Lauder, Kao Corporation, Henkel, Church & Dwight, Kerastase, PHYTO, Bosley, Svenson, DS Laboratories, Advanced Hair Studio, Aveda, The Ordinary (Deciem), Olaplex, Kiehl's, Revivogen, Toppik. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anti-Hair Loss Essence Market Key Technology Landscape

The Anti-Hair Loss Essence Market is driven by sophisticated advancements in biotechnology and material science, focusing primarily on maximizing ingredient bioavailability and targeting specific cellular pathways responsible for hair follicle miniaturization. One of the most significant technological developments is the use of micro-encapsulation and liposomal delivery systems. These technologies encapsulate active ingredients, such as peptides or growth factors, within protective lipid vesicles. This not only shields the sensitive molecules from degradation by light or oxidation but also facilitates deeper penetration through the stratum corneum and into the hair follicle bulb, ensuring that a therapeutic concentration of the compound reaches the target site. This enhanced delivery efficacy directly translates into superior clinical results compared to traditional topical applications, serving as a critical differentiator for premium product lines.

Another pivotal technological area involves research into plant stem cell technology and exosome therapy. Plant stem cell extracts are utilized for their ability to promote cell proliferation and survival, mimicking the regenerative signals necessary for sustained hair growth. More recently, the focus has shifted towards utilizing exosomes—small extracellular vesicles released by stem cells—which carry growth factors and signaling molecules that directly communicate with dormant hair follicles, encouraging them to re-enter the anagen phase. This represents a frontier technology moving beyond conventional chemical stimulation to biological regeneration, offering solutions for more advanced stages of alopecia and paving the way for highly concentrated clinical-grade essences. Companies investing heavily in proprietary exosome isolation and purification methods gain a substantial competitive edge in the high-value segment.

Furthermore, digital technologies are integrating seamlessly into the product ecosystem. The development of smart applicators and devices utilizing micro-needling or gentle electric pulses (microcurrent technology) enhances the penetration of the essence into the scalp while simultaneously stimulating blood flow. These devices are often paired with tracking software that monitors usage compliance and tracks physical changes in hair density, leveraging AI and cloud connectivity. This convergence of biochemical innovation (the essence) and physical/digital delivery enhancement (the applicator) creates an end-to-end solution that addresses the chronic issue of efficacy and consumer adherence, fundamentally redefining the market for high-performance anti-hair loss treatments and solidifying the link between technology and measurable outcomes.

Regional Highlights

The global Anti-Hair Loss Essence Market exhibits significant regional disparities in consumer behavior, regulatory frameworks, and market saturation, making regional strategy paramount for global manufacturers. North America, particularly the United States, represents a highly sophisticated and mature market, characterized by high consumer spending, early adoption of advanced clinical treatments, and a strong presence of R&D facilities. This region is a leader in the segment driven by Minoxidil and peptide-based solutions, and is rapidly embracing personalized medicine and high-end cosmeceuticals, often recommended directly by dermatologists. The regulatory environment is rigorous but permits strong scientific claims if supported by robust data.

Europe mirrors North America in its demand for premium, scientifically-backed products, but is distinctive due to its stringent regulatory landscape, particularly the European Union's cosmetic regulations (REACH), which emphasize ingredient safety, transparency, and severely restrict misleading efficacy claims. This pushes manufacturers towards 'Clean Beauty' formulations, favoring natural extracts, certified organic components, and highly scrutinized biotech ingredients, ensuring European markets lead in the ethical sourcing and sustainable packaging segments of the essence market. Germany, France, and the UK are primary hubs for innovation and consumption within the region.

Asia Pacific (APAC) is the engine of global market expansion, driven by countries like China, Japan, South Korea, and India. This region is characterized by a massive population, increasing urbanization, rising stress levels, and a cultural emphasis on aesthetic perfection, making preventative hair care a priority from a young age. South Korea and Japan lead in cosmetic technology, introducing highly innovative delivery systems and proprietary fermentation-derived ingredients. China, fueled by a booming middle class and rapid e-commerce penetration, presents the largest opportunity for market volume growth, often integrating traditional Asian medicinal herbs (TCM) with modern cosmetic science in its essence formulations. Latin America and the Middle East & Africa (MEA) are emerging markets showing accelerated growth, largely dependent on imports of established Western or Asian brands and benefiting from rising awareness and increasing access to modern retail channels.

- North America (USA, Canada): Dominant in personalized medicine adoption and clinical-grade formulations; strong market for prescription and high-end over-the-counter options; focus on R&D and digital health integration.

- Europe (UK, Germany, France): Strict regulatory environment favoring clean beauty and sustainable sourcing; high demand for natural and clinically tested botanical extracts; emphasis on dermatological endorsement.

- Asia Pacific (China, Japan, South Korea, India): Highest growth potential and largest market volume; driven by cultural importance of hair and rapid acceptance of biotech and traditional medicinal ingredient blends; strong e-commerce distribution networks.

- Latin America (Brazil, Mexico): Emerging market with significant potential; influenced by global trends and high demand for cosmetic enhancement products; price sensitivity is higher compared to developed regions.

- Middle East & Africa (MEA): Growing interest in luxury hair care products due to rising disposable income in GCC countries; focus on treating issues related to hard water and environmental stress; market reliant on imported premium brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anti-Hair Loss Essence Market.- L'Oréal S.A.

- The Procter & Gamble Company (P&G)

- Unilever PLC

- Shiseido Company, Limited

- The Estée Lauder Companies Inc.

- Kao Corporation

- Henkel AG & Co. KGaA

- Church & Dwight Co., Inc.

- Kerastase (L'Oréal Group)

- PHYTO (Ales Groupe)

- Bosley Inc.

- Svenson Hair Center

- DS Laboratories

- Advanced Hair Studio

- Aveda Corporation (Estée Lauder Group)

- The Ordinary (Deciem/Estée Lauder Group)

- Olaplex Holdings, Inc.

- Kiehl's Since 1851 (L'Oréal Group)

- Revivogen

- Toppik (Church & Dwight)

Frequently Asked Questions

Analyze common user questions about the Anti-Hair Loss Essence market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a hair loss essence and a traditional hair tonic or serum?

An anti-hair loss essence is typically a highly concentrated, fast-absorbing liquid formulation designed specifically for deep scalp penetration, delivering active pharmaceutical ingredients (like Minoxidil) or advanced biotech compounds (like peptides and stem cell extracts) directly to the hair follicle bulb. Traditional tonics or serums are often focused more on superficial hair shaft conditioning or hydration rather than follicular stimulation and preventing miniaturization, making the essence superior for therapeutic action.

How long does it take for anti-hair loss essences to show measurable results?

Measurable results from anti-hair loss essences usually require consistent daily application over a minimum period of three to six months. Hair growth cycles are lengthy, with the anagen phase lasting years. Users must adhere strictly to the usage protocols to allow the active ingredients sufficient time to prolong the growth phase, reduce shedding, and visibly increase hair density. Initial signs typically include reduced hair fall before significant new growth is observed.

Are natural or herbal anti-hair loss essences as effective as synthetic, chemically based products?

The efficacy depends entirely on the formulation and concentration. While synthetic ingredients like Minoxidil have established clinical validation, advanced natural essences, utilizing proprietary botanical extracts (e.g., saw palmetto, rosemary oil, specific plant stem cells) and validated through clinical trials, are increasingly proving highly effective. Natural products are often preferred by consumers seeking minimal side effects and aligning with clean beauty standards, but independent validation of ingredient purity and concentration is crucial for performance assessment.

What role does the scalp microbiome play in the effectiveness of hair loss essences?

The scalp microbiome is increasingly recognized as critical, as dysbiosis (imbalance of bacteria and fungi) can lead to inflammation, irritation, and follicular damage, exacerbating hair loss. Modern anti-hair loss essences often incorporate prebiotics, probiotics, or postbiotics specifically to restore a healthy scalp environment, thereby creating optimal conditions for hair follicle function and allowing the primary active ingredients to perform better and maximize therapeutic efficacy.

How is AI impacting the customization and development of anti-hair loss essence products?

AI is fundamentally transforming product development by analyzing complex biological data (genomics, proteomics) to identify novel active molecules faster than traditional methods. For customization, AI analyzes individual user data—including lifestyle, environmental exposure, and high-resolution scalp imagery—to recommend or formulate hyper-personalized essence compositions, ensuring the consumer receives a targeted treatment that addresses their specific etiological cause of hair loss, thereby enhancing product performance and consumer trust significantly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager