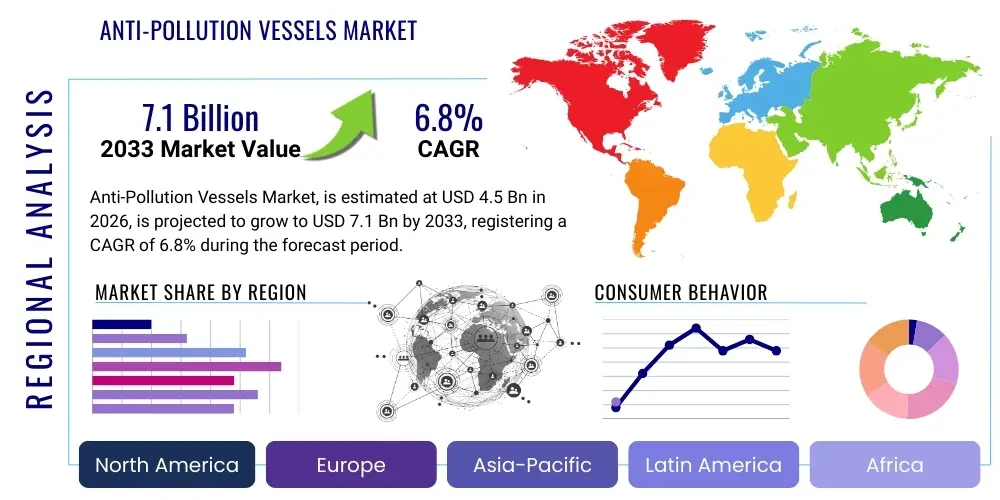

Anti-Pollution Vessels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436976 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Anti-Pollution Vessels Market Size

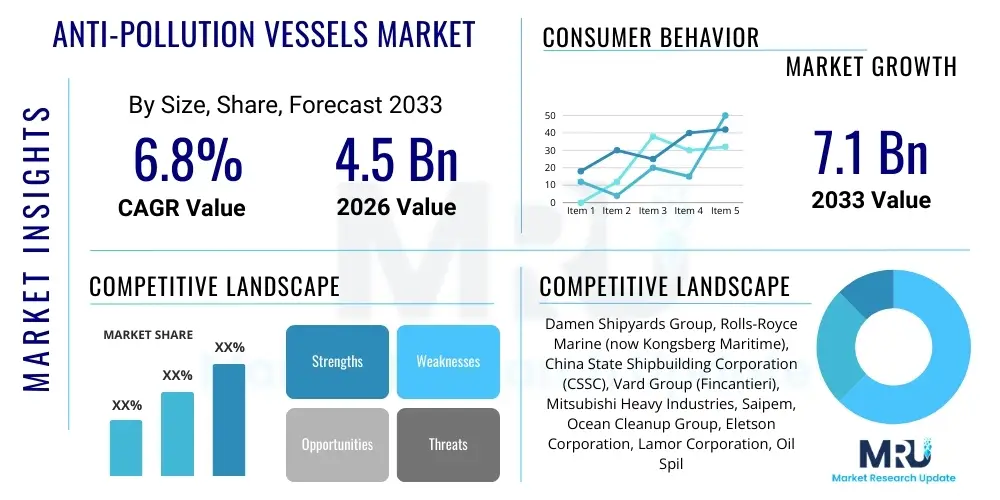

The Anti-Pollution Vessels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Anti-Pollution Vessels Market introduction

The Anti-Pollution Vessels Market encompasses specialized marine assets designed primarily for preventing, mitigating, and remediating environmental damage caused by maritime activities, predominantly focusing on oil spills, chemical discharge, and marine debris collection. These vessels are critical components of global maritime safety and environmental protection infrastructure, mandated by stringent international regulations such as the International Convention for the Prevention of Pollution from Ships (MARPOL). Products in this sector range from highly sophisticated oil spill recovery vessels (OSRV), chemical containment barges, and mechanical skimming ships, to smaller, highly maneuverable waste collection boats utilized in coastal and inland waterways. The technological focus is increasingly shifting towards enhanced recovery efficiency, autonomous operations, and the integration of advanced sensors for real-time monitoring and detection of pollution sources, ensuring rapid response capabilities across various marine environments.

Major applications of anti-pollution vessels include emergency response operations following accidental discharge events, routine preventative maintenance in high-traffic shipping lanes and offshore exploration areas, and systematic cleanup of accumulated marine plastic and non-biodegradable waste in vulnerable ecosystems. The benefits derived from deploying these specialized assets are significant, encompassing the preservation of marine biodiversity, protection of coastal economies dependent on fisheries and tourism, and compliance with international environmental standards, thereby avoiding substantial financial penalties and reputational damage for maritime operators and governments. Furthermore, modern anti-pollution vessels are increasingly being utilized for monitoring activities, leveraging sophisticated sonar and remote sensing technologies to track illegal dumping and effluent discharge, moving beyond purely reactive cleanup towards proactive environmental enforcement.

Key driving factors accelerating the market growth include the escalating volume of global maritime trade and offshore energy exploration, which inherently increases the risk profile for pollution events. Simultaneously, heightened public awareness regarding climate change and marine ecosystem degradation, coupled with governmental pressure to enforce stricter environmental compliance (e.g., IMO 2020 low-sulfur fuel mandates impacting vessel design and cleanup methodologies), fuel demand for superior anti-pollution solutions. The continuous evolution of environmental legislation, particularly in environmentally sensitive regions like the Arctic and major chokepoints, necessitates sustained investment in advanced, purpose-built vessels capable of operating effectively under challenging climatic conditions, solidifying the market's trajectory toward technological innovation and fleet modernization.

Anti-Pollution Vessels Market Executive Summary

The Anti-Pollution Vessels Market is characterized by robust growth driven primarily by escalating regulatory enforcement and technological advancements aimed at enhancing rapid response capabilities to marine pollution events. Business trends indicate a marked shift towards the procurement of multi-functional vessels capable of handling diverse pollution types—from heavy crude oil spills to microplastic collection and hazardous chemical neutralization. Key industry players are focusing on modular designs that allow rapid reconfiguration of cleanup systems and prioritizing investments in training and simulation platforms to ensure operational readiness. Furthermore, consolidation among smaller specialist providers and larger shipbuilding conglomerates is streamlining supply chains, while public-private partnerships are emerging as a favored model for financing and deploying high-cost emergency response fleets globally, particularly in areas lacking dedicated governmental resources.

Regional trends reveal significant investment surges in the Asia Pacific (APAC) region, largely fueled by the rapid expansion of naval and commercial ports, extensive coastal development projects, and increased offshore oil and gas production in the South China Sea and Indian Ocean. North America and Europe, while possessing mature fleets, demonstrate leadership in adopting high-specification technology, including unmanned surface vessels (USVs) and advanced aerial surveillance integration, focusing heavily on preventive monitoring and ballast water treatment compliance enforcement. The Middle East and Africa (MEA), situated along critical global oil transit routes, maintain a high demand for large-scale, heavy-duty oil spill recovery vessels due to the strategic importance of protecting vital energy infrastructure and ensuring unimpeded trade flow through key maritime passages.

Segment trends highlight the dominance of the oil spill recovery segment due to the catastrophic environmental and economic consequences associated with large-scale spills, mandating substantial regulatory preparedness. However, the fastest-growing segment is projected to be marine debris and plastics collection, driven by widespread governmental initiatives and global commitments to address the ubiquitous issue of ocean plastic waste. Technology segmentation emphasizes the increasing demand for advanced separation and recovery systems, such as oleophilic skimmers and specialized adsorbent materials integrated into vessel operations. Furthermore, the operational segment is seeing a clear preference for vessels capable of operating in shallow coastal waters (coastal response) where environmental damage is most acute and recovery logistics are often complex, demanding high maneuverability and draft optimization.

AI Impact Analysis on Anti-Pollution Vessels Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Anti-Pollution Vessels Market frequently center on its potential to revolutionize response times, improve situational awareness during spills, and automate the challenging process of marine debris detection and collection. Key themes observed include concerns about the reliability of autonomous cleanup systems in dynamic ocean environments, the integration costs associated with deploying sophisticated machine learning algorithms on existing vessel fleets, and the ethical implications of using predictive AI models to enforce maritime environmental regulations. Users anticipate that AI will fundamentally transform vessel deployment strategies by enabling highly accurate trajectory modeling of pollution plumes and optimizing the allocation of recovery resources, thereby minimizing environmental dispersion and maximizing cleanup efficiency, moving the industry toward a data-driven, preemptive operational model.

The application of AI and Machine Learning (ML) is moving the anti-pollution sector from reactive cleanup to predictive monitoring. AI systems are currently being developed and implemented to analyze complex data streams from satellite imagery, drone surveillance, and onboard sensor arrays to instantaneously identify the type, volume, and spread of pollutants, such as oil films or chemical plumes. This instantaneous processing capabilities significantly shorten the decision-making cycle for command centers, allowing for the immediate dispatch of the appropriate vessel type and optimization of its recovery path (skimming trajectories). Furthermore, ML algorithms are being trained on historical spill data, oceanographic conditions, and vessel performance metrics to develop highly accurate predictive models that forecast pollution movement, enabling strategic prepositioning of assets before a spill reaches sensitive coastal areas, thereby maximizing overall operational effectiveness and resource utilization.

- AI-Enhanced Spill Trajectory Modeling: Utilizes machine learning to fuse meteorological, oceanographic, and satellite data, providing high-fidelity predictions of pollution movement for optimal vessel routing.

- Autonomous Navigation and Optimized Skimming: AI powers Unmanned Surface Vessels (USVs) for automated navigation and optimizes the engagement angle and speed of skimming equipment to maximize oil recovery yield.

- Real-Time Debris Classification: Vision-based AI systems mounted on vessels identify, classify, and map marine plastic and large debris fields, distinguishing pollutants from natural objects, leading to targeted cleanup operations.

- Predictive Maintenance for Vessel Systems: Machine learning algorithms monitor engine and recovery system performance, forecasting potential equipment failures to ensure high reliability during critical emergency deployments.

- Regulatory Compliance Monitoring: AI analyzes vast ship movement data against regulatory boundaries and discharge permits, flagging anomalies that indicate potential or actual pollution incidents for enforcement action.

DRO & Impact Forces Of Anti-Pollution Vessels Market

The Anti-Pollution Vessels Market is primarily driven by rigorous international maritime regulations, notably the MARPOL Convention and various regional directives, which necessitate mandatory preparedness and response capabilities for maritime organizations and national governments. Restraints, conversely, include the high capital expenditure required for acquiring and maintaining technologically advanced vessels, coupled with operational complexities such as securing trained personnel and the difficulty of effective cleanup in severe weather conditions or remote, ice-covered areas. Opportunities lie in the burgeoning market for marine debris collection technologies and the integration of autonomy and renewable energy sources into vessel design, addressing both operational efficiency and long-term sustainability. These internal market dynamics are powerfully impacted by external forces, including volatile crude oil prices affecting offshore exploration activities and, critically, the increasing societal pressure and media scrutiny following high-profile environmental disasters, demanding immediate and substantial improvements in global response infrastructure.

The driving forces are multi-faceted, stemming from both governmental mandates and commercial necessity. The continuous expansion of global shipping lanes, especially through sensitive areas like the Arctic and the Suez Canal, increases the inherent risk of large-scale environmental incidents, forcing governments to expand their fleet capacity and technological sophistication. Economic incentives also play a role; robust anti-pollution capabilities minimize downtime and regulatory fines following incidents, representing a compelling business case for private operators in the salvage and emergency response sectors. Furthermore, the push towards digitalization in maritime operations is allowing for the seamless integration of vessel tracking, weather forecasting, and pollution modeling software, substantially improving the effectiveness of deployed anti-pollution assets and fostering continuous technological iteration within the market.

Key restraints impose significant limitations on market expansion, particularly in developing nations. The capital intensity of procuring advanced vessels, which often incorporate specialized machinery like sophisticated dynamic positioning systems and heavy-duty onboard processing units, presents a major barrier to entry. Operational costs, specifically the maintenance of complex equipment and the high cost of fuel consumption during protracted recovery operations, further constrain budget allocations. Opportunities, however, are abundant, particularly in the domain of preventative technology, such such as advanced ballast water management systems and exhaust gas cleaning systems (scrubbers) integrated directly into conventional commercial vessels, reducing the need for specialized cleanup vessels. Moreover, the global focus on mitigating plastic pollution opens up an entirely new market segment for innovative surface collectors, processing vessels, and drone-based monitoring systems that fall under the broader umbrella of anti-pollution assets.

Segmentation Analysis

The Anti-Pollution Vessels Market is fundamentally segmented based on the type of pollutant addressed, the operational environment, and the recovery technology utilized. This structure allows for granular analysis of demand patterns driven by specific regional regulatory needs and the characteristic threats prevalent in different oceanographic areas. The core segmentation relies heavily on distinguishing between oil spill response, chemical spill containment, and marine debris collection, reflecting the diverse functional requirements of the vessels. The design of these specialized ships is highly correlated with their operational intent, ranging from high-speed, open-ocean interceptors designed for rapid deployment, to robust barges engineered for sustained skimming operations in contaminated ports or complex coastal marshlands. Understanding these segments is vital for shipbuilding companies and response organizations to allocate capital effectively and ensure technological specifications meet real-world operational challenges.

Further granularity in segmentation is provided by the type of recovery mechanism employed, such as mechanical skimming (e.g., weir, belt, brush skimmers), in-situ burning capabilities, and chemical dispersant application systems. The regulatory landscape often dictates the acceptable method of pollution management, influencing procurement choices. For instance, mechanical recovery vessels are preferred in jurisdictions where chemical dispersant use is strictly regulated or prohibited near coastal areas. Furthermore, the operational environment segmentation (Coastal/Shallow Water vs. Offshore/Deep Water) recognizes that vessel characteristics like draft, speed, storage capacity, and sea-keeping capability must be specifically tailored to the intended zone of operation, addressing varied wave heights, salinity levels, and logistical demands associated with the geographical location of the pollution event. The emergence of smaller, highly modular vessels also caters to the growing need for rapid deployment and flexibility in enclosed waterways.

- By Vessel Type:

- Oil Spill Recovery Vessels (OSRV)

- Marine Debris Collection Vessels (Plastics and Garbage)

- Chemical Spill Response Vessels

- Multi-Purpose Pollution Control Barges

- Firefighting and Rescue Vessels with Pollution Control Capabilities

- By Operation Environment:

- Offshore (Deep Water)

- Coastal and Shallow Water

- Inland Waterways and Ports

- By Technology Used:

- Mechanical Skimming Systems (Weir, Brush, Disc)

- Adsorbent/Sorbent Material Application Systems

- Dispersant Application Systems

- Onboard Oil-Water Separation and Storage

- Marine Waste Processing and Compaction Systems

- By End-User:

- Government and Coastal Authorities (Navy, Coast Guard)

- Oil and Gas Exploration Companies (Internal Response Fleets)

- Private Maritime Services (Salvage and Environmental Response Contractors)

- Port and Harbor Management Authorities

Value Chain Analysis For Anti-Pollution Vessels Market

The value chain for the Anti-Pollution Vessels Market begins with upstream activities focused on the sophisticated design, material sourcing, and system integration required for specialized shipbuilding. This stage involves naval architects, marine engineers, and specialized equipment manufacturers providing high-performance components such as dynamic positioning systems, specialized corrosion-resistant materials, and certified pollution containment booms and skimmers. Critical inputs include high-reliability engines, advanced navigation equipment, and, increasingly, integration with autonomous control software platforms. The upstream segment is heavily influenced by classification societies and rigorous regulatory bodies, ensuring that all components and vessel designs adhere to stringent international safety and environmental standards (e.g., IMO Tiers and MARPOL compliance), requiring significant R&D investment from component suppliers to meet evolving performance criteria.

Midstream activities center on the actual construction and assembly of the vessels, predominantly carried out by specialized shipyards globally. These facilities manage the complex logistics of integrating proprietary anti-pollution equipment—such as dedicated oil collection tanks, integrated incinerators for recovered materials, and deployment systems for dispersants—into the hull structure. Quality control, certification, and sea trials are paramount at this stage, often involving collaboration between the shipbuilder, the end-user (e.g., Coast Guard or oil major), and classification societies like Lloyd's Register or DNV. Distribution channels for these high-value assets are typically direct, involving negotiated contracts between the shipyard or a prime systems integrator and the governmental authority or large private entity purchasing the vessel. The indirect channel occasionally involves specialized brokers or defense contractors managing complex international procurement tenders, particularly for multi-national fleets or foreign aid acquisitions.

Downstream activities focus on the deployment, operation, and maintenance (O&M) of the vessels. Direct users include national coastal authorities, major oil companies maintaining mandatory response capabilities, and specialized private environmental response contractors. O&M services, which represent a significant long-term revenue stream, encompass routine servicing of complex hydraulic and mechanical skimming systems, sensor calibration, regulatory compliance audits, and periodic dry-docking and overhaul. Given the emergency nature of their deployment, maintaining a high state of readiness is crucial, driving consistent demand for spare parts, crew training (often provided by the original equipment manufacturers), and system upgrades to incorporate newer technologies, ensuring the vessels can effectively meet unforeseen environmental challenges throughout their operational lifespan.

Anti-Pollution Vessels Market Potential Customers

The primary customers for anti-pollution vessels are state-level entities responsible for national maritime security and environmental protection. This includes national Coast Guards, Navies tasked with littoral defense, port authorities managing localized spills, and environmental protection agencies requiring specialized assets for monitoring and enforcement. These governmental bodies drive demand for high-specification, multi-role vessels that combine robust response capabilities (e.g., heavy-duty oil recovery) with long-endurance patrol functions. Procurement decisions are heavily influenced by national emergency response plans, regional cooperative agreements (like the Bonn Agreement in Europe), and budgetary allocations dedicated to infrastructure modernization and disaster preparedness, often favoring proven technologies and comprehensive through-life support contracts from suppliers.

A secondary, yet highly influential, customer segment consists of major multinational oil and gas exploration and production companies. Under international regulations and lease agreements, these companies are mandated to demonstrate immediate and adequate pollution response capacity for their offshore drilling and transport operations. These end-users typically invest in dedicated, high-capacity OSRVs or contract specialized private maritime service providers who operate proprietary anti-pollution fleets. The demand from this segment is cyclical, correlating with trends in offshore capital expenditure and geopolitical stability, but remains non-negotiable due to the potentially catastrophic liabilities associated with major oil spills. Their requirements often focus on rapid deployment, extreme sea-keeping ability, and compliance with specific regional regulatory standards in areas of operation, such as the Gulf of Mexico or the North Sea.

The third significant category includes commercial port and harbor management authorities, independent environmental salvage and response contractors, and operators of large chemical and bulk transport fleets. Port authorities need smaller, highly maneuverable vessels designed for confined spaces, focusing on debris collection, minor oil leakage cleanup, and containment booming within sheltered waters. Independent contractors purchase or lease specialized vessels to offer services to smaller shipping companies or regional governments lacking dedicated resources, often prioritizing modular designs for varied tasks. As the global focus shifts towards marine plastic reduction, environmental NGOs and waste management firms are also emerging as niche buyers, seeking smaller, innovative collection boats for localized coastal cleanup efforts, further diversifying the customer base beyond traditional maritime defense and energy sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Damen Shipyards Group, Rolls-Royce Marine (now Kongsberg Maritime), China State Shipbuilding Corporation (CSSC), Vard Group (Fincantieri), Mitsubishi Heavy Industries, Saipem, Ocean Cleanup Group, Eletson Corporation, Lamor Corporation, Oil Spill Response Limited (OSRL), T&T Marine Salvage, Marine Spill Response Corporation (MSRC), HYDRA Group, Desmi A/S, Vigor Industrial, Eastern Shipbuilding Group, Bollinger Shipyards, BAE Systems, ST Engineering Marine, Austal Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anti-Pollution Vessels Market Key Technology Landscape

The technological landscape of the Anti-Pollution Vessels Market is rapidly evolving, moving away from traditional containment and recovery methods towards high-efficiency, environmentally integrated solutions. A critical technological trend involves the optimization of mechanical recovery systems, particularly advanced skimmers, which now incorporate adaptive brush or weir technologies that adjust automatically to varying oil viscosity, thickness, and wave conditions, thereby maximizing the oil-to-water recovery ratio. Furthermore, the mandatory implementation of ballast water treatment systems (BWTS) under IMO regulations, while often integrated into conventional shipping, is influencing the design of dedicated anti-pollution vessels, which require sophisticated onboard separation and filtration capabilities to manage the wastewater generated during cleanup operations without causing secondary contamination. The focus is on modular, containerized systems that allow rapid installation and removal, enhancing the vessel's versatility across different mission profiles.

The integration of digital technologies represents another significant shift. Modern anti-pollution vessels increasingly rely on sophisticated Sensor Fusion platforms that combine data from multiple sources, including Lidar, thermal imaging, high-resolution radar, and real-time laboratory analysis equipment, to precisely map the pollution area and guide recovery operations. This technology is essential for addressing pollutants invisible to the naked eye or distributed across vast areas. Furthermore, Unmanned Surface Vessels (USVs) and drone technology are becoming standard assets, used for perimeter monitoring, chemical sensing, and initial dispersant application, acting as force multipliers for the larger manned vessels. These autonomous systems improve operational safety by handling tasks in highly contaminated or hazardous zones, simultaneously providing persistent surveillance capabilities critical for effective response documentation.

Future technological developments are centering on sustainable operations and alternative energy sources. There is growing research into vessels powered by hybrid or fully electric propulsion systems to minimize the vessels’ own carbon footprint during long patrols and standby periods. Specifically targeting marine debris, technologies like large-scale passive collection barriers and dedicated onboard processing plants for sorting, compacting, and potentially recycling recovered plastics are transforming the marine waste segment. The overarching technological goal is to enhance the efficacy of recovery in harsh environments, minimize the reliance on chemical dispersants, and ensure that the vessels themselves operate at the highest environmental compliance standards, aligning the cleanup fleet with broader global sustainability objectives and regulatory expectations.

Regional Highlights

The demand profile for Anti-Pollution Vessels varies significantly across major regions, driven by differences in regulatory stringency, volume of maritime traffic, and local environmental vulnerabilities. North America and Europe possess highly mature markets characterized by strict regulatory frameworks (e.g., OPA 90 in the US, EU Directives) and robust public-sector investments in dedicated Coast Guard and national reserve fleets. Procurement in these regions focuses on technological superiority, advanced sensor integration, and compliance with increasingly demanding emission standards for new vessels. Europe, in particular, demonstrates high demand for vessels equipped with sophisticated ballast water management and exhaust gas scrubber technology, reflecting its commitment to comprehensive environmental compliance across all maritime assets.

Asia Pacific (APAC) is projected to be the fastest-growing market, driven by exponential growth in commercial shipping, rapid expansion of port infrastructure, and aggressive development of offshore oil and gas fields, particularly around Southeast Asia and Australia. Governments in this region are actively modernizing their response fleets to manage heightened risk, leading to significant tender opportunities for high-capacity OSRVs and coastal patrol vessels. The Middle East and Africa (MEA) market maintains steady demand, primarily focused on safeguarding vital oil export terminals and high-volume tanker routes (e.g., Strait of Hormuz, Bab el-Mandeb). Investment here is heavily skewed towards large, heavy-duty vessels capable of managing high-viscosity crude oil spills, ensuring the continuity of global energy supply chains and the protection of strategically critical coastal infrastructure.

- North America: Driven by OPA 90 mandates; High adoption of USVs and aerial surveillance integration; Focus on deepwater and arctic preparedness.

- Europe: Regulatory leadership through EU Directives and regional cooperation (Bonn Agreement); Strong market for vessels integrating advanced ballast water treatment and low-emission propulsion systems.

- Asia Pacific (APAC): Rapid fleet expansion due to infrastructure boom; Significant governmental investment in localized marine debris collection capabilities; High growth potential in China, India, and ASEAN nations.

- Middle East and Africa (MEA): Critical demand centered on protecting oil transport routes and production facilities; Preference for large, robust oil recovery vessels capable of managing catastrophic spills.

- Latin America: Growing regulatory pressure in emerging oil and gas regions (e.g., Brazil, Guyana); Increasing focus on fleet modernization and securing international aid for response technology acquisition.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anti-Pollution Vessels Market.- Damen Shipyards Group

- Rolls-Royce Marine (now Kongsberg Maritime)

- China State Shipbuilding Corporation (CSSC)

- Vard Group (Fincantieri)

- Mitsubishi Heavy Industries

- Saipem

- Ocean Cleanup Group

- Eletson Corporation

- Lamor Corporation

- Oil Spill Response Limited (OSRL)

- T&T Marine Salvage

- Marine Spill Response Corporation (MSRC)

- HYDRA Group

- Desmi A/S

- Vigor Industrial

- Eastern Shipbuilding Group

- Bollinger Shipyards

- BAE Systems

- ST Engineering Marine

- Austal Limited

Frequently Asked Questions

Analyze common user questions about the Anti-Pollution Vessels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Anti-Pollution Vessels?

The primary factor driving market demand is the stringent enforcement of international maritime regulations, primarily the MARPOL convention, which mandates that flag states and vessel operators maintain sufficient preparedness and capability for immediate pollution response to minimize environmental damage and financial liabilities.

How is technological innovation affecting oil spill recovery efficiency?

Technological innovation is enhancing recovery efficiency through the deployment of AI-powered autonomous surface vessels (USVs) for rapid detection, high-fidelity sensor fusion for plume modeling, and adaptive mechanical skimming systems that maximize the ratio of recovered oil to water, particularly in challenging sea states.

Which geographical region is showing the highest growth potential in this market?

The Asia Pacific (APAC) region exhibits the highest growth potential, driven by significant increases in commercial shipping traffic, expanding port infrastructure development, and a strong governmental push to modernize fleets to address both oil spills and escalating marine plastic pollution.

What are the main segments within the Anti-Pollution Vessels Market?

The main market segments are categorized by vessel type (Oil Spill Recovery, Marine Debris Collection, Chemical Response), operational environment (Offshore, Coastal/Shallow Water), and key end-users (Government/Coast Guard, Oil & Gas Operators, Private Contractors).

What restraints are currently challenging the market expansion?

The most significant restraints include the exceptionally high capital expenditure required for the acquisition of technologically sophisticated, certified anti-pollution vessels and the persistent operational challenge of recruiting and retaining specialized, highly trained personnel required for effective emergency response deployment and maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager