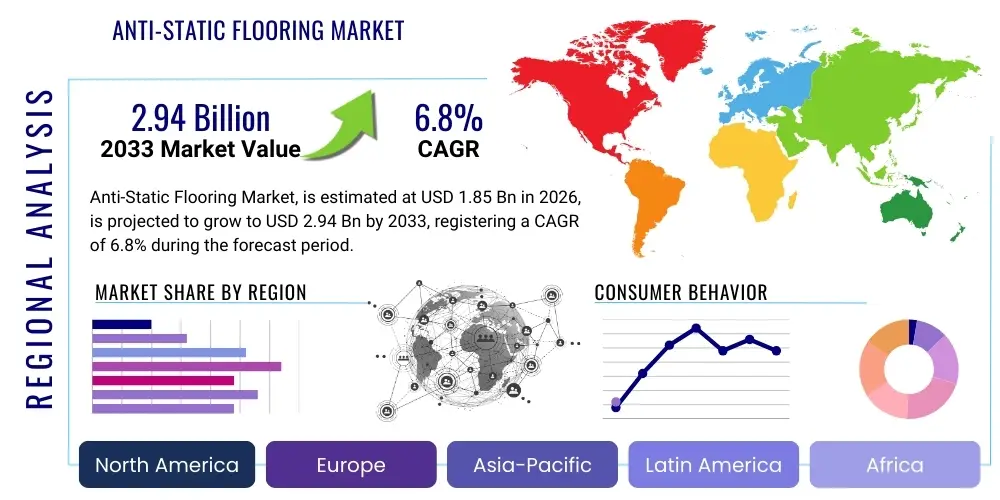

Anti-Static Flooring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437261 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Anti-Static Flooring Market Size

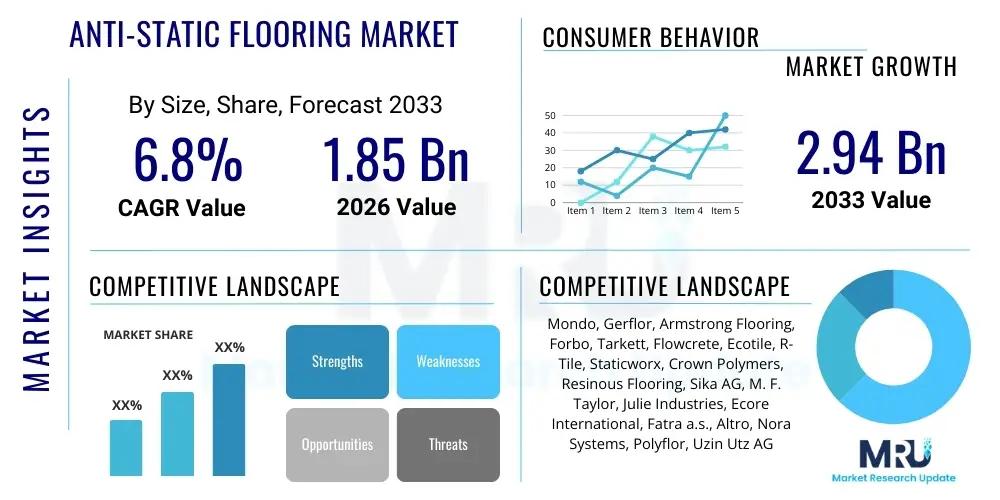

The Anti-Static Flooring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.94 Billion by the end of the forecast period in 2033.

Anti-Static Flooring Market introduction

Anti-static flooring, often referred to as Electrostatic Discharge (ESD) flooring, is specifically engineered to control, mitigate, and safely dissipate static electricity generated by personnel and equipment within sensitive environments. This specialized flooring prevents the accumulation of static charge, which, if uncontrolled, can lead to severe damage to microelectronic components, create fire hazards in combustible atmospheres, and disrupt critical operations. Products include conductive, static-dissipative, and insulated flooring materials such as vinyl tiles, epoxy coatings, and rubber sheeting, tailored to different resistance requirements.

Major applications of anti-static flooring span high-technology sectors, including data centers, cleanrooms, server rooms, electronics manufacturing facilities (semiconductors, PCBs), and healthcare operating theaters where sensitive monitoring equipment is used. The primary benefit of these floors is safeguarding expensive, mission-critical electronic devices and ensuring operational uptime. Furthermore, in environments dealing with volatile organic compounds (VOCs) or explosive dusts, anti-static floors are vital for personnel safety by preventing static sparks that could trigger combustion or explosions. The functional integrity and reliability of these specialized environments heavily depend on effective ESD protection provided by the flooring system.

Key driving factors accelerating market growth include the exponential global expansion of cloud computing infrastructure, necessitating continuous construction of large-scale data centers globally. Additionally, the tightening of international regulatory standards (such as ANSI/ESD S20.20) mandates robust static control protocols in electronics assembly and handling areas. The increasing complexity and miniaturization of electronic components make them exponentially more susceptible to static damage, compelling manufacturers across various industries, particularly aerospace and automotive electronics, to upgrade their facility flooring to meet stringent static dissipative requirements.

Anti-Static Flooring Market Executive Summary

The Anti-Static Flooring Market is characterized by robust growth, primarily propelled by the unrelenting expansion of the digital economy and the corresponding surge in data center construction across all major geographies. Business trends indicate a shift towards highly durable, low-maintenance epoxy and polyurethane systems over traditional tile formats, particularly in large industrial settings where seamless, highly chemical-resistant surfaces are preferred. Technological advancements are focusing on integrating better aesthetic qualities and sustainable material compositions without compromising the critical ESD performance parameters. Strategic investments are flowing into research and development aimed at developing advanced hybrid materials that offer superior static dissipation characteristics coupled with enhanced wear resistance, catering to high-traffic environments like logistics hubs handling sensitive electronic goods.

Regionally, the Asia Pacific (APAC) region is experiencing the fastest expansion, driven by massive foreign direct investment in manufacturing capabilities, particularly in China, South Korea, and Taiwan, which dominate the global semiconductor and electronics production landscape. North America and Europe remain mature markets but exhibit steady demand fueled by stringent safety regulations in healthcare facilities and continuous modernization cycles within existing data centers and pharmaceutical manufacturing plants. The Middle East and Africa (MEA), while smaller, are showing emerging potential as Gulf nations diversify their economies, invest heavily in smart city infrastructure, and establish regional cloud data hubs, demanding high-specification anti-static installations.

Segment trends reveal that the Application segment dominated by data centers and electronics manufacturing continues to hold the largest market share, emphasizing the criticality of ESD control in these core industries. Within the Product segment, epoxy-based coatings are gaining significant traction due to their cost-effectiveness for large areas, seamless application, and excellent chemical resistance, making them highly suitable for cleanrooms and heavy-duty manufacturing environments. Conversely, modular vinyl tiles maintain relevance in renovation projects or areas requiring flexibility and rapid installation. The market is increasingly competitive, with leading players focusing on expanding their certified contractor networks and offering comprehensive, integrated flooring systems that include grounding points and monitoring capabilities to maximize value proposition for end-users seeking reliable, turnkey solutions.

AI Impact Analysis on Anti-Static Flooring Market

Users commonly inquire about how Artificial Intelligence and advanced data analytics are affecting the maintenance, performance monitoring, and material development lifecycle of anti-static flooring systems. Key concerns revolve around the integration of smart sensors within the flooring structure to monitor resistance levels in real-time and predict potential points of failure before regulatory limits are breached. Users are keen to understand if AI can optimize facility maintenance schedules by correlating operational data, traffic patterns, and environmental variables (such as humidity and temperature) to recommend precise cleaning and renewal protocols, thereby extending the useful life of the critical flooring infrastructure. Additionally, interest lies in how AI-driven simulation and material science research can accelerate the development of next-generation flooring composites with inherently superior and more stable ESD characteristics, moving beyond conventional material limitations. The central expectation is that AI will transform anti-static flooring from a passive safeguard into an active, intelligent component of the facility's overall static control ecosystem.

The integration of AI into the anti-static flooring domain is primarily focused on enhancing reliability and reducing operational risk. Current manual testing and spot-check methodologies for verifying surface resistance are time-consuming and prone to human error. AI facilitates the deployment of IoT sensors embedded within the flooring structure or peripheral monitoring devices that continuously feed resistance, temperature, and wear data into a central analytical platform. Machine learning algorithms process this extensive dataset to identify subtle deviations from optimal ESD standards, providing facility managers with predictive warnings about areas requiring immediate attention or maintenance, thereby ensuring continuous compliance and preventing costly equipment damage caused by intermittent static events.

Furthermore, AI is instrumental in refining supply chain logistics and installation quality control. By analyzing vast datasets related to installation conditions, curing times, and material batch variations, AI models can predict potential performance discrepancies immediately following installation, reducing the risk of premature failure. This analytical capability helps manufacturers refine installation guidelines and optimize product formulations for specific regional climate challenges. Ultimately, the adoption of AI-enabled monitoring systems elevates the perception of anti-static flooring from a simple construction material to a highly specialized, self-monitoring asset crucial for high-reliability environments like advanced semiconductor fabrication plants and hyperscale data centers, driving demand for premium, smart-enabled products.

- AI enables Predictive Maintenance by analyzing real-time resistance data from embedded sensors to forecast material degradation and schedule timely resurfacing or repair, maximizing uptime.

- It optimizes Material Science Development by simulating molecular compositions and stress tolerances, accelerating the creation of novel conductive polymers with improved stability and longevity.

- AI enhances Installation Quality Control by processing environmental factors (humidity, temperature) during curing to ensure optimal chemical bonds and adherence to specified ESD limits across large surface areas.

- Smart Facility Integration allows anti-static floors to communicate their status directly with Building Management Systems (BMS), contributing to a holistic, automated static control environment.

- AI facilitates Compliance Reporting by automatically generating detailed, auditable records of resistance tests and performance logs, significantly simplifying regulatory adherence for critical facilities.

DRO & Impact Forces Of Anti-Static Flooring Market

The dynamics of the Anti-Static Flooring Market are shaped by a complex interplay of positive growth drivers, necessary limiting factors, and substantial future opportunities. The core driver is the imperative for protecting microelectronic components, which are becoming increasingly sensitive to minute static discharges as manufacturing tolerances shrink. This is directly correlated with the global surge in data consumption and digital transformation initiatives, necessitating continuous investment in new data centers, server farms, and specialized cleanroom environments, all of which require mandatory static control measures. Regulatory frameworks, particularly in highly sensitive sectors like defense, aerospace, and pharmaceuticals, are becoming more rigorous, demanding certified and reliably monitored ESD flooring solutions, thus acting as a consistent market stimulant. These regulatory mandates force existing facilities to upgrade and new facilities to incorporate high-grade systems from the outset.

Conversely, the market faces notable restraints, primarily the significantly higher initial installation costs associated with specialized anti-static materials and preparation compared to conventional industrial flooring. The installation process itself is complex, requiring highly specialized labor and strict adherence to environmental controls (like specific temperature and humidity ranges during curing), which can add to project timelines and overall expense. Furthermore, the performance of anti-static flooring is highly sensitive to routine maintenance protocols; incorrect cleaning agents or improper maintenance procedures can compromise the conductive pathway, leading to compliance failures. This reliance on rigorous, often costly, maintenance regimes acts as a deterrent, particularly for smaller facilities or those with tight operational budgets. Technical constraints, such as the potential for localized resistance variability over time, also require ongoing vigilance and investment in monitoring equipment.

Significant opportunities exist in emerging economies where industrialization and technology adoption are accelerating, particularly in Southeast Asia and Latin America, which are rapidly developing their electronics manufacturing and pharmaceutical sectors. There is a burgeoning opportunity in the development of modular, temporary ESD flooring solutions for short-term projects or leased facilities, offering flexibility without compromising compliance. Innovation in sustainable materials, such as bio-based conductive polymers, presents a major green opportunity, aligning with corporate sustainability goals. The increasing demand for integrated monitoring systems (IoT-enabled floors) that provide real-time performance data represents a high-value opportunity, moving the industry toward 'smart' ESD protective infrastructure. Finally, the rapid adoption of electric vehicles (EVs) and the construction of massive gigafactories for battery production, which often handle sensitive electronic control units and combustible materials, opens up a new, high-growth application vertical for heavy-duty anti-static floor systems.

Impact Forces: The market impact forces are categorized by the intensity of competitive rivalry, the potential threat of new entrants, the bargaining power of suppliers, the bargaining power of buyers, and the threat of substitute products. Competitive rivalry is high, driven by the presence of large, established chemical and flooring manufacturers offering diverse product lines (epoxy, vinyl, rubber). The threat of new entrants is moderate; while proprietary material science is a barrier, new players can enter by specializing in niche application methods or advanced monitoring technologies. Buyer power is substantial, particularly large institutional buyers (hyperscale data centers, global semiconductor fabs) who demand stringent specifications, certifications, and volume discounts. Supplier power is moderate, influenced by the specialized nature of key raw materials like carbon black, conductive polymers, and specific resin systems. The threat of substitutes is low, as conventional flooring cannot provide the mandated ESD protection; however, highly specialized conductive paints or portable grounding mats serve as minor, localized alternatives but not overall replacements.

Segmentation Analysis

The Anti-Static Flooring Market segmentation provides a granular view of the industry structure based on product type, material composition, application area, and ultimate end-use sector. Understanding these segments is crucial for market participants to tailor their strategies and product offerings to specific operational requirements and regulatory environments. The market is primarily segmented by the form factor of the flooring (e.g., rigid tiles versus seamless coatings) and the base material used (e.g., resilient vinyl versus robust epoxy). The stringent technical requirements of certain applications, such as cleanrooms requiring seamless, non-shedding surfaces, heavily influence material choice. Conversely, environments prioritizing speed of installation and modularity often opt for tile formats.

The segmentation by material reveals a clear trade-off between cost, durability, and resistance stability. Vinyl flooring, particularly in tile and sheet form, remains popular due to its balanced cost and performance characteristics, offering moderate static dissipation capabilities suitable for commercial electronics assembly. However, materials like epoxy and polyurethane are increasingly dominant in high-performance industrial and pharmaceutical settings where chemical resistance, wear resistance, and a fully seamless, grounded surface are paramount. Rubber flooring, known for its extreme durability and comfort, holds a niche in certain high-traffic, specialized manufacturing environments and control rooms.

Application-based segmentation highlights the primary revenue drivers, with data centers and electronics manufacturing dominating due to their inherent sensitivity to static electricity and continuous investment cycles. The healthcare segment, including operating rooms and imaging suites, represents a stable and growing demand sector driven by the need to protect sophisticated medical electronics and ensure patient safety. Further, specialized manufacturing segments, such as automotive electronics and aerospace components assembly, represent high-growth niches where static control is indispensable for component quality and functional integrity.

- By Product Type:

- Tiles (Vinyl, Rubber, Ceramic)

- Sheets (Vinyl, Rubber)

- Coatings (Epoxy, Polyurethane)

- By Material:

- Vinyl (Homogeneous, Heterogeneous)

- Epoxy

- Polyurethane

- Rubber

- Others (e.g., Conductive Carpets, Terrazzo)

- By Application:

- Data Centers and Server Rooms

- Electronics Manufacturing and Assembly (Semiconductors, PCB)

- Healthcare Facilities (Operating Theaters, X-ray Rooms)

- Industrial and Manufacturing (Pharmaceutical, Chemical Processing)

- Control Rooms and Communication Facilities

- Aerospace and Defense

- By End-Use Sector:

- Industrial

- Commercial

- Institutional

Value Chain Analysis For Anti-Static Flooring Market

The value chain for the Anti-Static Flooring Market begins with upstream activities involving the sourcing and processing of specialized raw materials. This includes the manufacturing of base polymers (PVC, epoxy resins, polyurethane components), conductive additives (carbon fibers, carbon black, graphite, or specialized metallic fillers), and various pigments and stabilizers. The quality and consistency of these raw materials are absolutely critical, as they directly dictate the final ESD performance characteristics, durability, and life cycle of the finished product. Suppliers of these high-grade chemicals and additives hold moderate bargaining power, especially for proprietary conductive agents necessary to meet ultra-low resistance specifications required by organizations like semiconductor fabricators. Efficiency in this upstream segment focuses on reducing material costs while maintaining stringent quality control, minimizing batch-to-batch variation in conductivity.

The central manufacturing stage involves formulating the flooring material—whether compounding vinyl for tiles/sheets or mixing chemical components for high-performance coatings. This stage includes complex processes like calendering, pressure molding, and specialized chemical reaction engineering. After manufacturing, the products enter the distribution channel, which is a mix of direct and indirect sales strategies. Direct channels are typically utilized for large, highly specialized projects, such as major data center builds or large pharmaceutical expansions, where manufacturers collaborate closely with architects, engineers, and large, certified installation contractors to ensure end-to-end performance guarantee and certification. This direct engagement ensures technical accuracy and compliance with complex specifications.

Indirect channels involve distribution through a network of specialized flooring distributors and authorized regional dealers who manage inventory and facilitate smaller projects, renovations, and general industrial installations. Downstream analysis focuses on the end-user (buyers) and the specialized installation services. Anti-static flooring installation is highly technical, requiring certified applicators who understand substrate preparation, grounding protocols, and specific curing requirements. The final service delivery often includes post-installation monitoring and maintenance contracts. This downstream segment is highly critical; even a high-quality product can fail if installed incorrectly, making the certified contractor network a crucial component of the value proposition. Demand for certified, turnkey solutions is increasing as end-users seek to minimize risk and consolidate responsibility.

Anti-Static Flooring Market Potential Customers

Potential customers for anti-static flooring are organizations whose core operations rely heavily on static-sensitive electronics, high-precision instrumentation, or the handling of flammable materials. The largest buyer segment encompasses large-scale technology firms, including hyperscale cloud providers (e.g., Google, Amazon, Microsoft) and colocation data center operators, who continuously expand and retrofit their facilities. These customers prioritize long-term durability, consistent resistance performance, and comprehensive warranties, often favoring seamless epoxy or specialized vinyl sheets capable of handling heavy rolling loads and continuous foot traffic. Procurement decisions are highly technical, driven by stringent compliance with ANSI/ESD S20.20 standards and internal risk mitigation protocols.

Another major customer group is the electronics manufacturing industry, ranging from semiconductor fabrication plants (fabs) to consumer electronics assembly facilities. These buyers demand ultra-high cleanliness (cleanroom compatibility) along with reliable static dissipation. They typically require highly chemical-resistant, non-shedding, seamless coatings to minimize particle contamination, often preferring specialized polyurethane or advanced epoxy systems. Healthcare organizations represent a stable customer base, particularly hospitals, surgical centers, and pharmaceutical research labs. Their buying criteria include not only ESD control for sensitive equipment but also antimicrobial properties and ease of sterilization, leading them to favor high-grade, sealed vinyl or rubber flooring.

Beyond these core sectors, industrial end-users, such as automotive component manufacturers (especially for EV battery management systems), petrochemical processing facilities, and military/defense contractors, constitute vital potential customers. These buyers require flooring capable of resisting heavy impact, chemical spills, and extreme temperature fluctuations while maintaining ground path integrity. The continuous evolution of technology and tightening safety regulations across all these sectors ensure sustained, high-value demand for certified anti-static flooring solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.94 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mondo, Gerflor, Armstrong Flooring, Forbo, Tarkett, Flowcrete, Ecotile, R-Tile, Staticworx, Crown Polymers, Resinous Flooring, Sika AG, M. F. Taylor, Julie Industries, Ecore International, Fatra a.s., Altro, Nora Systems, Polyflor, Uzin Utz AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anti-Static Flooring Market Key Technology Landscape

The technological landscape of the Anti-Static Flooring Market is focused on enhancing three critical areas: conductivity longevity, material sustainability, and installation efficiency. Traditional technologies rely heavily on incorporating conductive elements such as carbon black or metallic fibers into a polymeric matrix (vinyl, epoxy). Current advancements, however, are exploring specialized polymers and intrinsically conductive polymers (ICPs) that offer molecular-level conductivity, potentially eliminating the need for high concentrations of fillers, which can compromise the material's structural integrity or aesthetic appeal. Furthermore, the development of sophisticated static dissipative coatings that can be applied over existing substrates is gaining traction, providing a cost-effective alternative for facility upgrades and renovations without extensive structural downtime.

A major technological frontier involves the integration of smart technology. This includes developing flooring systems embedded with micro-sensors and wireless transmitters (IoT capabilities) to enable continuous, real-time monitoring of surface resistance, temperature, and humidity. This shift from periodic manual testing to continuous automated surveillance ensures proactive compliance and drastically reduces the risk of undetected ESD failures. These smart floors require minimal wiring and robust encapsulation of the electronics to withstand heavy traffic and chemical exposure, pushing material science boundaries. Manufacturers are also heavily investing in proprietary grounding systems and specialized adhesives designed specifically to maintain consistent low-resistance pathways even under fluctuating environmental conditions, addressing a key historical performance challenge.

In terms of installation methodology, there is a push towards fast-cure, low-VOC (Volatile Organic Compound) epoxy and polyurethane systems to minimize environmental impact and reduce facility downtime. Modular systems, such as interlocking ESD tiles made from recycled materials, are also leveraging advanced molding and locking mechanisms that guarantee continuous electrical contact between tiles without the need for traditional adhesives or welding. This focus on modularity and rapid application is especially important in high-demand, quick-build sectors like temporary cleanrooms or expansion phases of data centers. Overall, the technology is moving towards fully integrated, intelligent, and environmentally responsible systems that offer verifiable, long-term ESD performance and facilitate seamless integration with modern facility management systems.

Regional Highlights

- North America: North America represents a mature and technologically advanced market segment, characterized by high demand originating from the concentration of hyperscale data centers, large pharmaceutical manufacturing, and the defense/aerospace industries. The region maintains stringent compliance standards, particularly driven by bodies like ANSI/ESD and OSHA, compelling facilities to utilize premium, certified anti-static solutions. The United States accounts for the dominant share, fueled by continuous expansion in cloud infrastructure and the reshoring of specialized manufacturing. Growth here is primarily driven by replacement cycles, facility modernization, and the adoption of cutting-edge IoT-enabled flooring systems, focusing on operational efficiency and risk mitigation. This market segment exhibits a preference for high-performance epoxy coatings and robust vinyl sheeting that offer long lifespan and seamless integration with complex facility architectures.

- Europe: The European market demonstrates steady growth, driven by robust industrial sectors, particularly automotive electronics, advanced manufacturing (Industry 4.0), and a strong presence of pharmaceutical research and production. Germany, the UK, and France are key contributors, mandated by high worker safety standards and environmental regulations (REACH). European demand favors sustainable and aesthetically pleasing solutions, leading to higher adoption rates for ESD rubber flooring (known for comfort and sustainability) and low-VOC epoxy systems. Expansion in Eastern Europe, particularly in manufacturing hubs, offers additional growth avenues, though installation complexity and cost sensitivity can be higher than in Western Europe.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, commanding the largest market share due to its central role in global electronics manufacturing. Countries like China, South Korea, Taiwan, and Vietnam are hubs for semiconductor production, PCB assembly, and consumer electronics, generating enormous demand for specialized anti-static flooring in cleanrooms and assembly lines. Government policies supporting local manufacturing and massive foreign investment in data center infrastructure further accelerate market expansion. The high volume of facility construction often leads to strong competition and a focus on cost-effective, high-performance vinyl sheets and epoxy coatings. India is an emerging powerhouse, with rapidly growing IT infrastructure and pharmaceutical sectors driving demand for local and imported ESD products.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in industrializing nations such as Brazil and Mexico, particularly driven by automotive manufacturing (electronic components) and nascent data center development. While overall market penetration remains lower than in APAC or North America, increasing regulatory awareness and the establishment of local electronics assembly plants are steadily boosting demand for reliable, cost-effective anti-static solutions, often favoring readily available vinyl tile and sheet formats.

- Middle East and Africa (MEA): The MEA region is developing rapidly, primarily fueled by Gulf Cooperation Council (GCC) countries investing heavily in digital infrastructure, smart cities, and economic diversification away from oil. Large-scale data center projects in the UAE and Saudi Arabia are major consumers of high-specification anti-static coatings. Growth is highly project-dependent, but the region shows strong potential for premium product adoption, especially systems certified for harsh environmental conditions (high heat and dust).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anti-Static Flooring Market.- Mondo S.p.A.

- Gerflor SAS

- Armstrong Flooring, Inc.

- Forbo Group

- Tarkett S.A.

- Flowcrete (Part of Tremco CPG)

- Ecotile Flooring Ltd.

- R-Tile International

- Staticworx, Inc.

- Crown Polymers, Corp.

- Resinous Flooring International

- Sika AG

- M. F. Taylor, Inc.

- Julie Industries, Inc.

- Ecore International

- Fatra a.s.

- Altro Group

- Nora Systems GmbH (Part of Interface Inc.)

- Polyflor Ltd.

- Uzin Utz AG

Frequently Asked Questions

Analyze common user questions about the Anti-Static Flooring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary distinction between conductive and static dissipative flooring?

The distinction lies in their electrical resistance range. Conductive flooring exhibits a very low resistance (typically 1.0 x 10^4 to 1.0 x 10^6 ohms), allowing charges to dissipate extremely rapidly. It is ideal for environments handling explosives or volatile chemicals. Static dissipative flooring has a higher, safer resistance range (typically 1.0 x 10^6 to 1.0 x 10^9 ohms), ensuring a slower, controlled discharge essential for protecting sensitive electronic components like semiconductors and hard drives in data centers.

Which type of anti-static flooring is most cost-effective for large industrial applications?

Epoxy and polyurethane coatings are generally the most cost-effective solutions for covering vast industrial floor areas. While the initial material cost for high-performance epoxy can be significant, their seamless application minimizes installation joints, offering excellent chemical and abrasion resistance, resulting in a lower total cost of ownership over the long term, particularly in high-traffic manufacturing facilities and logistics hubs.

How frequently must anti-static flooring be tested to maintain compliance?

Testing frequency is mandated by industry standards (like ANSI/ESD S20.20) and internal facility risk assessments. While new installations require immediate verification, most critical environments (data centers, cleanrooms) require periodic testing, typically quarterly or semi-annually, using certified equipment (megohmmeters) to measure resistance to ground (RTG) and point-to-point (RTP), ensuring continuous safety and performance compliance across the floor surface.

What role does moisture and relative humidity play in the performance of ESD floors?

Moisture and relative humidity significantly affect ESD performance, particularly with older or lower-quality flooring systems. Low humidity can cause surface resistance to increase dramatically, potentially rendering the flooring ineffective at dissipating charge. Conversely, excessively high humidity can sometimes reduce surface resistance too much. Modern, high-performance anti-static floors are engineered to maintain stable resistance across a wider range of environmental conditions, but facility managers must still rigorously control environmental parameters (typically 40% to 60% RH) for optimal static control.

Are sustainable or green options available in the Anti-Static Flooring Market?

Yes, sustainability is a growing trend. Manufacturers offer options such as rubber flooring made from recycled content and vinyl flooring utilizing lower levels of phthalates and minimal VOC emissions. Furthermore, advanced epoxy and polyurethane systems are increasingly being formulated with low-VOC content, making them preferable for LEED-certified projects. Research is ongoing into bio-based resins and intrinsically conductive polymers (ICPs) derived from sustainable feedstocks to further enhance the environmental profile of these critical materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager