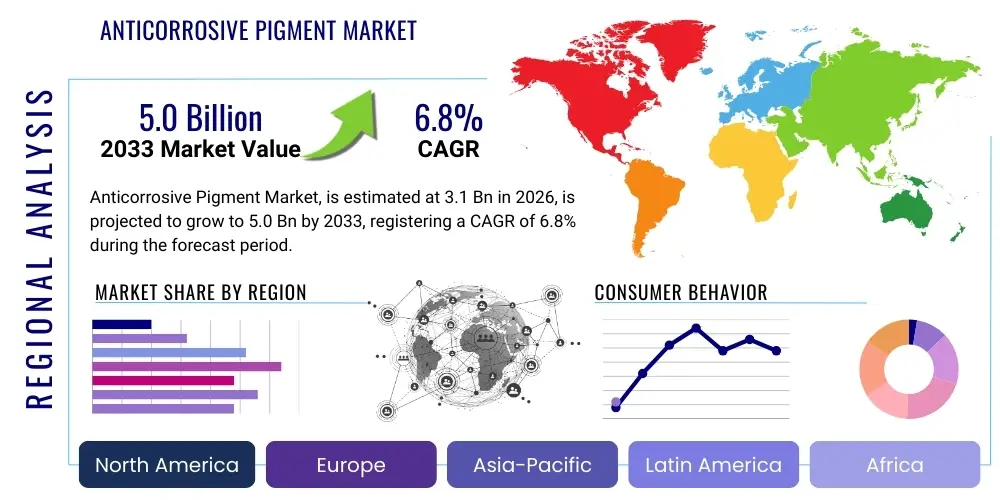

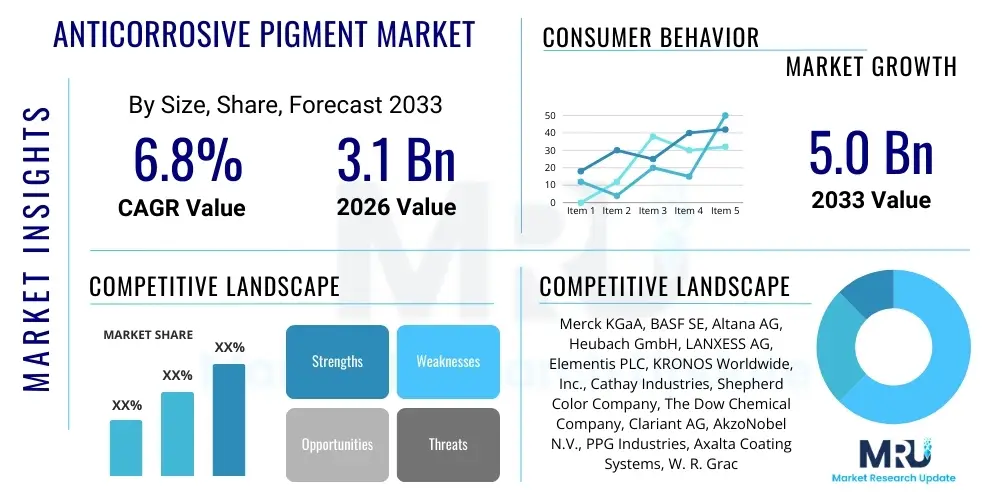

Anticorrosive Pigment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439831 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Anticorrosive Pigment Market Size

The Anticorrosive Pigment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% between 2026 and 2033. The market is estimated at USD 1.55 billion in 2026 and is projected to reach USD 2.21 billion by the end of the forecast period in 2033.

Anticorrosive Pigment Market introduction

The anticorrosive pigment market represents a vital and indispensable segment within the global specialty chemicals industry, playing a critical role in safeguarding metallic assets against the pervasive and economically detrimental forces of corrosion. These specialized chemical compounds are meticulously engineered for incorporation into protective coatings, primers, and paints, where their primary function is to inhibit or prevent electrochemical reactions that lead to the degradation and eventual failure of metal substrates. The continuous global battle against corrosion, which is estimated to cost trillions of dollars annually across industries, underscores the paramount importance and steady demand for these sophisticated protective agents. Anticorrosive pigments serve as the first line of defense, significantly extending the operational lifespan of critical infrastructure, industrial machinery, transportation assets, and countless consumer goods, thereby reducing maintenance expenditures, enhancing safety protocols, and ensuring structural integrity.

The product portfolio within the anticorrosive pigment market is highly diverse, encompassing a wide array of chemical compositions and mechanistic approaches to corrosion inhibition. Historically, heavy metal-based pigments such as zinc chromate were highly effective, but escalating environmental and health concerns have driven a significant paradigm shift towards greener, chrome-free alternatives. Modern anticorrosive pigments now include advanced zinc-based compounds like zinc phosphate, various phosphate derivatives such as aluminum tripolyphosphate, organic inhibitors, and an emerging class of novel pigments based on modified silicates, calcium sulfonates, borates, and rare earth elements. These innovative pigments operate through mechanisms such as active passivation, where a protective oxide layer is formed on the metal surface; cathodic protection, which sacrifices a more active metal; or barrier protection, physically impeding the ingress of corrosive agents like moisture and oxygen. The choice of pigment is highly dependent on the specific application, environmental exposure, desired performance characteristics, and regulatory compliance requirements.

The major applications for anticorrosive pigments span virtually every industrial sector where metallic components are exposed to corrosive environments. In the marine industry, they are indispensable for protecting ship hulls, offshore oil rigs, and port infrastructure from the relentless assault of saltwater and harsh weather. The automotive sector utilizes these pigments extensively for vehicle bodies, chassis, and undercarriage components to enhance durability and aesthetic longevity. Construction and infrastructure projects rely heavily on anticorrosive coatings containing these pigments for bridges, structural steel, pipelines, and other load-bearing metallic structures. Furthermore, industrial manufacturing, aerospace, oil and gas, and even the packaging industry leverage these pigments for critical equipment, aircraft components, refinery infrastructure, and food/beverage cans, respectively. The overarching benefits derived include prolonged asset life, substantial reductions in costly downtime and replacement cycles, improved operational safety, and significant long-term economic savings, positioning anticorrosive pigments as a cornerstone of modern industrial resilience and sustainable asset management.

Anticorrosive Pigment Market Executive Summary

The global anticorrosive pigment market is currently navigating a period of significant transformation, characterized by a complex interplay of evolving business trends, distinct regional growth patterns, and dynamic segmentation shifts. A dominant business trend is the pervasive drive towards sustainability and environmental stewardship, which is compelling manufacturers to drastically reduce or eliminate hazardous substances, particularly heavy metals like chromium, from their product formulations. This regulatory pressure, combined with increasing corporate social responsibility initiatives, is fostering an intense focus on research and development into high-performance, chrome-free, and low-VOC (Volatile Organic Compound) pigment technologies. Strategic partnerships and acquisitions aimed at consolidating market share and leveraging specialized technological expertise are also prominent, as companies seek to expand their product portfolios and geographical reach to meet diverse global demands.

From a regional perspective, the market exhibits varied maturity levels and growth trajectories. Asia Pacific stands out as the primary growth engine, propelled by unprecedented industrialization, extensive urban and rural infrastructure development projects, and robust expansion in the automotive and manufacturing sectors, particularly in burgeoning economies like China and India. North America and Europe, while representing mature markets, demonstrate a strong demand for premium, technologically advanced, and environmentally compliant anticorrosive solutions, driven by stringent regulatory frameworks, a focus on maintaining aging infrastructure, and a high level of technological sophistication in their industrial bases. Emerging markets in Latin America, the Middle East, and Africa are experiencing steady growth, largely attributed to increasing investments in oil and gas infrastructure, mining activities, and the rapid pace of construction and urbanization, all of which necessitate robust and durable corrosion protection.

Segmentation trends within the market highlight a clear shift towards more sustainable and efficient pigment types. Zinc phosphate continues to be a foundational segment due to its proven efficacy and cost-effectiveness, yet demand for advanced phosphate-based and innovative organic pigments is rapidly accelerating as industries seek superior performance coupled with enhanced environmental profiles. The coatings application segment remains the largest consumer, with marine, automotive, and general industrial coatings dictating a substantial portion of demand. Furthermore, within the end-use industries, there is a growing specialization, requiring tailored anticorrosive solutions for sectors such as aerospace, renewable energy, and specific sub-segments of construction and oil & gas. This granular demand is driving manufacturers to innovate with bespoke formulations that address the unique challenges and regulatory landscapes of each specific application and industry, ultimately shaping the future trajectory of the anticorrosive pigment market and fostering a highly competitive environment for specialized solutions.

AI Impact Analysis on Anticorrosive Pigment Market

User inquiries concerning AI's influence on the anticorrosive pigment market predominantly center on its potential to revolutionize product development, manufacturing efficiency, and predictive maintenance capabilities across the value chain. Common questions explore how AI could significantly accelerate the discovery and optimization of new, more effective, and environmentally benign pigment formulations, moving beyond traditional, time-consuming trial-and-error methodologies. Users are keenly interested in understanding AI's role in streamlining manufacturing processes, improving resource utilization, reducing waste, and enhancing quality control measures in pigment production facilities. Furthermore, there is substantial curiosity about how AI-driven analytics can elevate the application and performance monitoring of anticorrosive coatings, leading to sophisticated predictive maintenance strategies that drastically extend asset life and minimize costly downtime across diverse industrial sectors. Users widely anticipate AI to herald an era of smart coatings and data-driven material science, fundamentally transforming how corrosion protection is conceived, developed, and deployed.

- AI can significantly accelerate the research and development lifecycle for novel anticorrosive pigment formulations by leveraging advanced machine learning algorithms to analyze vast material databases, simulate molecular interactions, and predict performance characteristics with high accuracy, thereby drastically reducing development cycles and associated costs.

- The implementation of AI and machine learning in manufacturing processes can optimize various parameters such as mixing ratios, reaction temperatures, and curing times, leading to enhanced production efficiency, consistent product quality, reduced energy consumption, and minimized waste generation in pigment synthesis.

- AI-driven sensor technologies integrated into anticorrosive coatings enable real-time monitoring of coating integrity and environmental conditions, allowing for highly accurate predictive maintenance schedules that extend asset operational lifespans and prevent catastrophic failures.

- AI algorithms can analyze complex datasets related to corrosion patterns, environmental factors, and material degradation to identify optimal pigment and coating combinations for specific applications, enhancing the efficacy and longevity of protective systems and reducing premature coating failures.

- Supply chain optimization, powered by AI, can improve forecasting, raw material sourcing, inventory management, and logistics for anticorrosive pigment manufacturers, fostering greater resilience against market fluctuations and achieving significant cost savings.

- Automated quality control systems incorporating AI and machine vision can detect minute defects in pigment particle size, dispersion, or coating application with unparalleled precision and speed, ensuring superior product quality and adherence to stringent industry standards, surpassing human inspection capabilities.

DRO & Impact Forces Of Anticorrosive Pigment Market

The anticorrosive pigment market is dynamically shaped by a critical interplay of drivers, restraints, opportunities, and pervasive impact forces that collectively dictate its growth trajectory and competitive landscape. A primary driver is the intrinsic and escalating global issue of corrosion, which continues to inflict immense economic damage across industries, necessitating robust and continuous protective measures. This omnipresent need for asset preservation, coupled with relentless global infrastructure development and expansion, particularly in rapidly industrializing economies, fundamentally underpins market demand. Moreover, the increasing adoption of high-performance coatings in critical sectors such as marine, automotive, aerospace, and oil and gas, where asset failure can lead to severe safety hazards and substantial economic losses, further amplifies the demand for advanced anticorrosive pigments. Ongoing technological advancements that yield more effective, durable, and sustainable pigment solutions also serve as a potent market driver, providing superior protection and significantly extending the operational life of valuable assets.

However, the market also faces considerable restraints, prominently stemming from increasingly stringent environmental regulations worldwide concerning the use of heavy metals and volatile organic compounds (VOCs). The widespread phasing out of highly effective but toxic chromate-based pigments, due to their adverse health and environmental impacts, has compelled manufacturers to make substantial investments in research and development for equally potent yet greener alternatives. The often higher production costs associated with these innovative, eco-friendly pigments compared to conventional options can act as a significant barrier to widespread adoption, particularly in price-sensitive markets or regions with less stringent environmental enforcement. Additionally, the inherent volatility in the prices of key raw materials essential for pigment production, such as zinc, phosphorus, and various organic compounds, can directly impact manufacturing costs, profit margins, and overall market stability, presenting a perpetual challenge for industry stakeholders.

Despite these significant restraints, the anticorrosive pigment market is rich with opportunities that promise substantial growth and innovation. The burgeoning demand for chrome-free, low-VOC, and ultimately non-toxic anticorrosive solutions represents a major avenue for product innovation, market differentiation, and expansion as industries globally prioritize sustainability, worker safety, and environmental compliance. The development of next-generation smart coatings, which incorporate advanced pigments offering self-healing properties, real-time corrosion detection capabilities, or controlled release of inhibitors, presents a highly lucrative niche for future growth. Furthermore, the rapid expansion of the renewable energy sector, including vast wind turbine farms and solar power installations, creates new and specialized application areas requiring highly durable anticorrosive coatings engineered for prolonged exposure to extreme environmental conditions. Strategic collaborations and partnerships between pigment manufacturers, coating formulators, and leading end-users to co-develop tailored solutions for specific industrial challenges also present significant growth prospects, fostering a culture of continuous innovation and deeper market penetration. These impact forces collectively define the complex competitive landscape and critically shape the future trajectory of the anticorrosive pigment market, steering it towards more sustainable and technologically advanced solutions.

Segmentation Analysis

The anticorrosive pigment market undergoes a comprehensive segmentation based on several crucial parameters, offering a granular and insightful perspective into its intricate dynamics, diverse product offerings, and varied consumption patterns. This systematic categorization is essential for understanding the underlying market forces, identifying growth pockets, evaluating competitive landscapes, and tailoring strategic initiatives to meet specific end-user demands. Each segmentation criterion reveals unique aspects of the market, driven by distinct technological requirements, performance expectations, regulatory frameworks, and economic considerations. Such detailed analysis empowers market participants to refine their product development cycles, optimize their market entry strategies, and allocate resources effectively across the entire value chain, ensuring alignment with the evolving preferences and operational needs of diverse industries.

- By Type: This segment classifies anticorrosive pigments based on their fundamental chemical composition and the primary mechanism through which they inhibit corrosion. This classification is critical as different chemistries offer varying levels of protection, environmental profiles, and compatibility with coating systems.

- Zinc-based Pigments: Includes zinc phosphate, zinc dust, and zinc molybdates. These are widely used due to their dual action of barrier protection and galvanic corrosion inhibition, offering robust performance in a variety of industrial and marine coatings. Zinc phosphate, in particular, remains a staple due to its effectiveness and relatively lower toxicity compared to older chrome-based options.

- Phosphate-based Pigments (Non-Zinc): Encompasses iron phosphate, aluminum tripolyphosphate, and calcium phosphate. These pigments primarily work by forming passive layers on metal surfaces, interfering with anodic reactions. They are increasingly favored as chrome-free alternatives, providing good corrosion resistance in many applications.

- Organic Pigments: A growing category including conducting polymers like polyaniline, organic phosphonates, and various organic inhibitors. These pigments provide active corrosion protection through electrochemical interaction or barrier effects, often offering lighter weight and flexible film properties. Their eco-friendly profile makes them highly attractive for sustainable coating formulations.

- Novel/Chrome-free Pigments: This dynamic segment includes advanced alternatives developed to replace chromates entirely. Examples include modified silicates (e.g., calcium modified silica), borates, vanadates, rare earth element compounds (like cerium compounds), and calcium sulfonates. These pigments are designed to offer comparable or superior performance to traditional heavy-metal options while adhering to strict environmental regulations.

- Others: This category includes pigments primarily focused on barrier protection, such as micaceous iron oxide (MIO) and aluminum flakes, which create an impermeable physical barrier against corrosive agents. It also covers niche and specialty pigments with unique compositions for specific applications.

- By Application: This segment delineates the major end-use areas where anticorrosive pigments are incorporated into various products to impart corrosion resistance.

- Coatings (Paints & Primers): Represents the largest and most dominant application segment, spanning industrial coatings, architectural paints, marine coatings, automotive coatings, coil and can coatings, and protective primers for various substrates. The performance of the final coating system is heavily reliant on the selected pigment.

- Plastics: Used in specialized polymer composites and plastic formulations, particularly for engineering plastics, where enhanced corrosion resistance and durability are required for components exposed to harsh environments or chemicals.

- Inks: Incorporated into specialty inks for industrial marking, protective coatings on packaging, or specific printing applications where a degree of corrosion inhibition is beneficial.

- Others: Niche applications include their use in certain adhesives, sealants, lubricants, and specialized material composites where controlled corrosion protection is a key requirement.

- By End-Use Industry: This segment categorizes the market based on the primary industries that consume anticorrosive pigments for their assets and infrastructure, reflecting sector-specific demands and environmental conditions.

- Marine: Critical for protecting ships, offshore oil and gas platforms, port facilities, and other structures constantly exposed to highly corrosive saltwater environments, severe weather, and biofouling.

- Automotive: Essential for enhancing the durability and lifespan of vehicle bodies, chassis, underbody components, and other metallic parts against road salts, moisture, and environmental exposure.

- Construction & Infrastructure: Used extensively for bridges, large steel structures, pipelines, rebar in concrete, and various architectural metal components to prevent rust and ensure structural integrity.

- Industrial: Covers a broad range of applications including heavy machinery, manufacturing plant equipment, storage tanks, and various facilities exposed to aggressive industrial chemicals and environments.

- Aerospace: Crucial for protecting high-value aircraft components, spacecraft, and ground support equipment from corrosion in extreme atmospheric conditions, ensuring safety and operational reliability.

- Oil & Gas: Vital for pipelines, drilling equipment, refinery infrastructure, and storage tanks that operate in highly corrosive conditions, both onshore and offshore.

- Coil & Can: Employed in pre-coated metal sheets (coil coatings) used for appliances, roofing, and architectural panels, as well as in coatings for food and beverage cans to prevent metal-food interaction and extend shelf life.

- Others: Includes applications in areas like electrical & electronics (for component protection), agricultural equipment, defense, and specialized consumer goods.

- By Technology/Formulation of Coating: This segmentation considers the type of coating system in which the anticorrosive pigments are integrated, reflecting compatibility requirements and environmental considerations.

- Solvent-borne Coatings: Traditional coating systems offering excellent durability and performance, though increasingly subject to VOC regulations, requiring pigments compatible with organic solvents.

- Water-borne Coatings: Environmentally friendly alternatives with lower VOC emissions, gaining significant market traction. Pigments in this category must demonstrate good dispersibility and stability in aqueous systems.

- Powder Coatings: Offer superior durability, scratch resistance, and zero VOC emissions. Pigments for powder coatings require specific thermal stability and particle size distribution.

- High-Solids Coatings: Formulated to reduce solvent content and VOCs while maintaining performance, demanding pigments that are effective at higher concentrations and stable in low-solvent environments.

Value Chain Analysis For Anticorrosive Pigment Market

The value chain for the anticorrosive pigment market is a meticulously structured, multi-tiered process that begins with the foundational extraction and refinement of raw materials and culminates in the final application of sophisticated protective coatings by a diverse array of end-users. At the upstream segment of this complex chain, the primary activities involve the mining and initial processing of essential minerals such as zinc ore, phosphate rock, iron ore, and various rare earth elements. These raw materials undergo initial beneficiation and chemical conversion by specialized chemical manufacturers to produce intermediate compounds like zinc oxide, phosphoric acid, and other precursor chemicals. This foundational stage demands substantial capital investment in extraction technologies, chemical synthesis plants, and stringent quality control processes to ensure the purity, consistency, and availability of inputs. Consequently, a limited number of key raw material suppliers hold a pivotal position, influencing both the cost structures and the overall supply stability for subsequent stages of pigment production.

Positioned centrally in the midstream segment of the value chain are the anticorrosive pigment manufacturers themselves. These highly specialized companies leverage advanced chemical processes and formulation expertise to synthesize, blend, and purify various types of pigments, ensuring they precisely meet rigorous performance criteria such as corrosion inhibition efficiency, dispersibility within different coating matrices, color stability, and environmental compliance. This phase is characterized by intensive investment in research and development to innovate new pigment chemistries, particularly focusing on sustainable, chrome-free, and high-performance alternatives that can effectively address evolving market demands and regulatory pressures. Once the pigments are manufactured, they are then supplied to coating formulators, which include major paint and primer manufacturers. These formulators integrate the pigments with a complex array of resins, solvents, additives, and fillers to develop and produce the final anticorrosive coating products. This stage requires deep expertise in material science, rheology, and coating application technologies to ensure optimal protective performance, aesthetic qualities, and adherence to specific industry standards and customer specifications.

The downstream segment of the value chain encompasses the critical aspects of distribution channels and end-user application. Distribution typically occurs through a combination of direct and indirect channels. Large coating manufacturers and major industrial end-users often procure pigments or specialized coatings directly from producers, facilitating streamlined supply chains for high-volume requirements. Conversely, indirect channels involve an extensive network of distributors, agents, and wholesalers who play a crucial role in broader market penetration, logistical support, warehousing, and providing technical assistance to smaller coating manufacturers, professional applicators, and regional contractors. The ultimate stage involves the professional application of these anticorrosive coatings by specialized applicators, industrial maintenance crews, and in-house teams across a wide spectrum of end-use industries, including marine, automotive, construction, and general industrial sectors. The efficacy and quality of this application process are paramount, as they directly determine the longevity, performance, and overall cost-effectiveness of the corrosion protection system, thereby directly impacting the ultimate value delivered to the end-users and buyers of the product.

Anticorrosive Pigment Market Potential Customers

The potential customers for anticorrosive pigments are exceptionally diverse, spanning a broad spectrum of industries that are inherently reliant on robust and durable protection for their metallic assets against the incessant threat of corrosion. These end-users are predominantly organizations involved in either the manufacturing of products that require inherent corrosion resistance as a key performance attribute or those that operate extensive infrastructure, machinery, and equipment continuously exposed to aggressive corrosive environments. Key customer segments include large-scale industrial coating manufacturers, who formulate a vast array of paints and primers for various applications such as automotive original equipment manufacturers (OEMs), automotive aftermarket suppliers, marine vessel constructors, offshore platform operators, and general industrial machinery producers. These sophisticated buyers actively seek pigment solutions that offer superior and long-lasting protection, strictly adhere to an increasingly complex web of environmental and safety regulations, and contribute significantly to the overall durability and aesthetic appeal of their final coated products.

Beyond the direct coating formulators, a substantial portion of potential customers comprises direct industrial end-users. This includes critical infrastructure development and maintenance companies, especially those engaged in the construction and upkeep of bridges, vast pipeline networks for water and energy, power generation facilities, and large-scale structural steel installations. The oil and gas industry represents a particularly significant consumer, utilizing anticorrosive coatings extensively for critical assets such as pipelines, refineries, storage tanks, and offshore drilling platforms that operate under exceptionally harsh and corrosive conditions. Similarly, the aerospace sector, with its stringent safety standards and high-performance requirements, demands advanced anticorrosive solutions for aircraft components, space vehicles, and ground support equipment to ensure unparalleled reliability and extended operational lifespans. The burgeoning construction industry also represents a substantial customer base, with a continuous need for protecting structural steel, concrete reinforcements, and various other metallic components utilized in both commercial and residential building projects.

Furthermore, highly specialized market segments like the electronics industry require anticorrosive pigments for safeguarding delicate circuitry, electronic enclosures, and connectors from environmental degradation, ensuring the reliability of critical components. The packaging industry is another important customer demographic, incorporating anticorrosive pigments and coatings to ensure the integrity, safety, and extended shelf-life of metal containers for food, beverages, and other sensitive products. The dynamic and evolving landscape of these diverse industries, coupled with an increasing global emphasis on comprehensive asset integrity management, sustainability, and life-cycle cost reduction, compels these buyers to actively seek innovative, highly efficient, and environmentally compliant anticorrosive pigment solutions. Their purchasing decisions are critically influenced by a judicious balance of factors including cost-effectiveness, superior performance characteristics, regulatory compliance, the long-term benefits in terms of reduced maintenance requirements, and the extended operational lifespan of their valuable assets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.21 Billion |

| Growth Rate | 5.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PPG Industries Inc., AkzoNobel N.V., The Sherwin-Williams Company, Jotun A/S, Hempel A/S, BASF SE, Clariant AG, Elementis PLC, LANXESS AG, KRONOS Worldwide Inc., Tronox Holdings plc, The Chemours Company, DIC Corporation, Evonik Industries AG, Merck KGaA, Synthomer PLC, Michelman Inc., Ashland Global Holdings Inc., Arkema S.A., Toray Industries Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anticorrosive Pigment Market Key Technology Landscape

The anticorrosive pigment market is a dynamic arena of continuous innovation, primarily propelled by significant advancements in material science, a relentless pursuit of enhanced performance, and a critical imperative for sustainability. A pivotal area of intensive technological development is centered on the creation of high-performance chrome-free pigment technologies. Driven by increasingly stringent global environmental regulations, particularly those banning or heavily restricting hexavalent chromium compounds, research and development efforts are overwhelmingly concentrated on formulating novel inorganic and organic alternatives that can not only match but potentially surpass the effectiveness of traditional chromates without their inherent toxicity. This includes the extensive exploration and optimization of various phosphate compounds, advanced phosphonates, molybdates, vanadates, tailored silicates fortified with active inhibitors, and a growing interest in rare earth element compounds like cerium and lanthanum. These next-generation pigments are meticulously engineered to provide active corrosion inhibition through diverse mechanisms such as sophisticated passivation, robust barrier protection, or precisely controlled cathodic/anodic interference, often specifically designed for compatibility with eco-friendly coating systems such as water-borne or high-solids formulations.

Another profound technological trend that is reshaping the market involves the pioneering development of smart pigments and intelligent, self-healing coatings. Researchers are actively developing pigments capable of autonomously releasing encapsulated corrosion inhibitors in a controlled and responsive manner upon the detection of initial corrosion events or micro-damage, thereby localizing protection and significantly extending the protective lifespan of the coating. This often involves advanced microencapsulation and nanoencapsulation techniques where active corrosion inhibitors are encased within protective shells, designed to rupture and release their contents only when the coating's integrity is compromised by mechanical stress or corrosive ingress. Furthermore, the advent of nanotechnology is facilitating the creation of nanoscale pigments and additives that can dramatically enhance key properties such as barrier effectiveness, improve adhesion to substrates, and provide superior corrosion resistance at significantly lower concentrations. These engineered nanoparticles are capable of effectively blocking diffusion pathways for corrosive agents and substantially reinforcing the structural matrix of the coating, leading to more efficient, durable, and thinner protective film systems.

Beyond the intrinsic chemistry and structure of the pigments themselves, the broader technological landscape encompasses revolutionary advancements in coating formulation methodologies and highly efficient application techniques. There is a strong and sustained industry-wide emphasis on developing low-VOC (Volatile Organic Compound) and entirely VOC-free coating systems, including sophisticated water-borne, high-solids, and powder coatings. This necessitates the continuous development of novel pigments that exhibit optimal compatibility and stability within these environmentally conscious binder systems. Concurrently, advanced analytical techniques such as electrochemical impedance spectroscopy (EIS), scanning vibrating electrode techniques (SVET), and state-of-the-art surface analysis methods are becoming indispensable tools for meticulously evaluating the real-time performance of new pigment formulations. These techniques provide unparalleled insights into their intricate protective mechanisms and long-term durability under various simulated and actual environmental conditions. Moreover, the increasing integration of digitalization, automation, and AI-driven processes in both pigment manufacturing and coating production is a key technological enabler, leading to unparalleled consistency, reduced production costs, accelerated time-to-market for innovative products, and overall heightened operational efficiency, ultimately delivering superior corrosion protection solutions while rigorously addressing pressing environmental concerns and meeting the complex demands of a multitude of diverse end-use industries.

Regional Highlights

- North America: This region represents a highly mature and technologically advanced market characterized by exceptionally stringent environmental regulations and a robust, sustained demand for high-performance, eco-friendly anticorrosive solutions. Significant ongoing investments in critical infrastructure maintenance, coupled with thriving automotive and aerospace manufacturing sectors, are key drivers for the adoption of innovative chrome-free pigments and smart coating technologies. The United States and Canada are leading contributors, focusing intensely on extending the lifespan and ensuring the integrity of their extensive industrial assets and public infrastructure.

- Europe: Europe mirrors North America in its maturity and strict regulatory environment, with a pronounced emphasis on sustainability and comprehensive compliance with legislations such as REACH. This regulatory pressure has driven a rapid and widespread shift away from traditional heavy-metal-based pigments towards greener alternatives. Germany, France, the UK, and Italy stand out as significant markets, fueled by their well-established automotive, industrial machinery, and marine industries, alongside substantial governmental and private sector investments in renewable energy infrastructure, all demanding advanced and environmentally compliant corrosion protection.

- Asia Pacific (APAC): Positioned as the largest and most rapidly expanding market globally, the APAC region is propelled by unprecedented levels of industrialization, massive infrastructure development initiatives (including extensive road networks, bridges, ports, and urban expansion), and booming manufacturing sectors, particularly in economic powerhouses like China, India, Japan, and South Korea. This region presents immense and diverse opportunities for both conventional and advanced anticorrosive pigments due to its sheer scale of development, burgeoning urbanization, and increasing demand for durable, long-lasting assets across all industrial segments.

- Latin America: This region demonstrates consistent and steady growth, primarily driven by expanding oil and gas exploration and production activities, a flourishing mining sector, and ongoing urban development projects. Key markets such as Brazil, Mexico, and Argentina are experiencing increasing investments in industrial infrastructure and a growing automotive manufacturing base, all of which necessitate the implementation of effective and reliable corrosion protection solutions to safeguard assets and ensure operational continuity.

- Middle East and Africa (MEA): Growth in the MEA region is largely stimulated by substantial governmental and private sector investments in the expansive oil and gas sector, burgeoning petrochemical industries, and large-scale construction and urbanization mega-projects. The inherently harsh environmental conditions prevalent in many parts of this region, characterized by high temperatures, extreme salinity, and abrasive sand, create an exceptionally critical and urgent need for high-performance anticorrosive coatings, leading to a continuously increasing demand for specialized pigments designed for extreme durability and resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anticorrosive Pigment Market.- PPG Industries Inc.

- AkzoNobel N.V.

- The Sherwin-Williams Company

- Jotun A/S

- Hempel A/S

- BASF SE

- Clariant AG

- Elementis PLC

- LANXESS AG

- KRONOS Worldwide Inc.

- Tronox Holdings plc

- The Chemours Company

- DIC Corporation

- Evonik Industries AG

- Merck KGaA

- Synthomer PLC

- Michelman Inc.

- Ashland Global Holdings Inc.

- Arkema S.A.

- Toray Industries Inc.

Frequently Asked Questions

What are anticorrosive pigments and what is their primary function?

Anticorrosive pigments are specialized chemical compounds incorporated into protective paints and coatings to prevent or inhibit the electrochemical process of corrosion on metallic surfaces. Their primary function is to extend the lifespan of metal assets by forming passive layers, releasing active inhibitors, or providing barrier protection against corrosive elements like moisture and oxygen, thereby safeguarding infrastructure, machinery, and various metallic products from degradation.

What key factors are driving the growth of the anticorrosive pigment market?

The market's growth is predominantly driven by the pervasive and costly global issue of corrosion, which necessitates continuous asset protection across industries. Other significant drivers include substantial investments in infrastructure development, rising demand from the thriving marine and automotive sectors, and ongoing technological advancements in pigment chemistry that deliver more effective and durable protective solutions. Furthermore, a global shift towards sustainable and eco-friendly practices also fuels innovation and market expansion.

What are the primary types of anticorrosive pigments utilized in the market?

The main types include zinc-based pigments (e.g., zinc phosphate, zinc dust) known for galvanic and barrier protection, phosphate-based pigments (e.g., aluminum tripolyphosphate) offering passivation, and organic pigments (e.g., conducting polymers) providing active protection. Additionally, a rapidly growing category comprises novel chrome-free pigments such as modified silicates, calcium sulfonates, and rare earth compounds, developed as sustainable alternatives to traditional heavy-metal options.

How are environmental regulations influencing the anticorrosive pigment industry?

Environmental regulations, particularly those restricting the use of hazardous substances like hexavalent chromium (e.g., REACH directives), are profoundly influencing the market. These regulations are compelling manufacturers to pivot towards the intensive development and widespread adoption of eco-friendly, chrome-free, and low-VOC (Volatile Organic Compound) pigment alternatives. This regulatory pressure drives significant innovation and investment in sustainable chemistry to meet compliance and market demand.

Which end-use industries are the largest consumers of anticorrosive pigments?

The largest consumers are predominantly industries with extensive metallic assets exposed to harsh conditions, including marine (ships, offshore platforms), automotive (vehicle bodies, chassis), construction and infrastructure (bridges, structural steel), general industrial (machinery, plant equipment), and the oil & gas sector (pipelines, refineries). These industries rely heavily on robust corrosion protection to ensure asset longevity, enhance safety, and maintain operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager