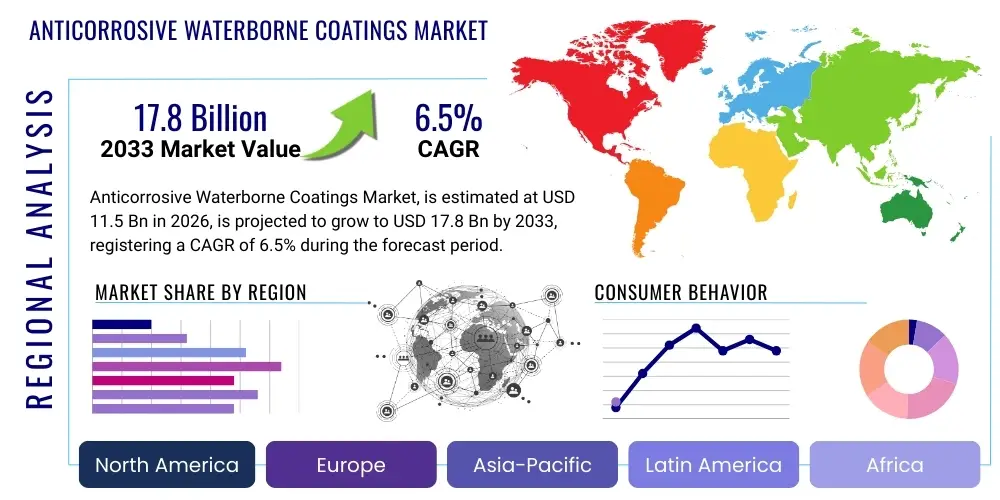

Anticorrosive Waterborne Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434433 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Anticorrosive Waterborne Coatings Market Size

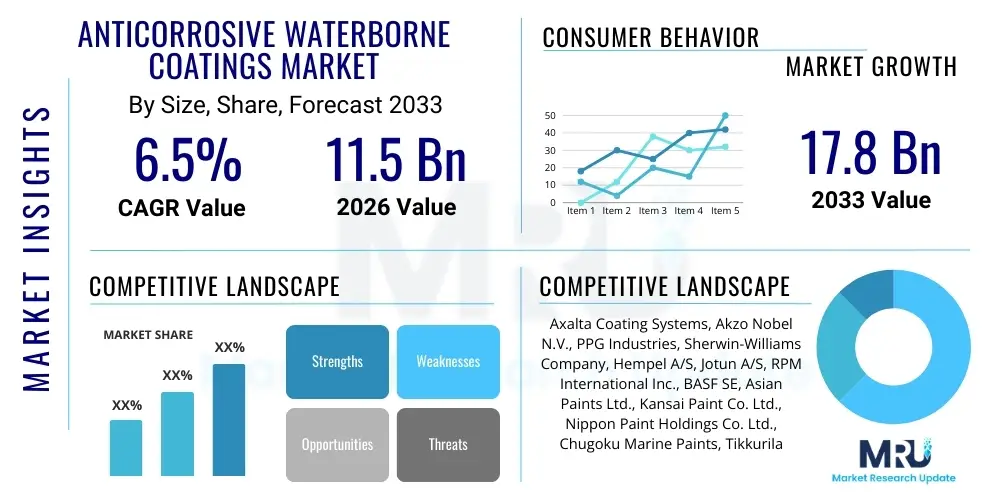

The Anticorrosive Waterborne Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

Anticorrosive Waterborne Coatings Market introduction

The Anticorrosive Waterborne Coatings Market encompasses a critical segment of the protective coatings industry, focusing on formulations that utilize water as the primary solvent or dispersion medium. These coatings are essential for protecting metallic substrates, such as steel and aluminum, from degradation caused by moisture, chemicals, and environmental factors, thereby extending the service life of assets across diverse industries. The shift towards waterborne formulations is fundamentally driven by stringent global environmental regulations, particularly those targeting Volatile Organic Compounds (VOCs), making these products a highly attractive, sustainable alternative to traditional solvent-borne systems. Key application areas include infrastructure (bridges, pipelines), marine structures, automotive components, and industrial maintenance.

Waterborne anticorrosive coatings function by establishing a robust barrier layer and often incorporating specialized anticorrosive pigments, such as zinc phosphate or newer chromate-free alternatives, which actively inhibit the electrochemical reactions leading to corrosion. Product development efforts are centered on enhancing performance characteristics, including adhesion, abrasion resistance, and long-term durability, to match or exceed the protection levels offered by solvent-based predecessors. The fundamental advantages of using waterborne systems—low odor, reduced flammability risk during application, and easier cleanup—further solidify their adoption, particularly in enclosed industrial environments and high-traffic construction zones. The market is witnessing continuous innovation in polymer chemistry, including advancements in acrylics, polyurethanes, and epoxies, specifically tailored for superior aqueous dispersion and cross-linking properties.

Major applications of these coatings are predominantly found in demanding sectors like oil and gas, where pipeline integrity is paramount, and in the marine industry, protecting vessels and offshore platforms against harsh saline environments. Furthermore, the rapid growth in global infrastructure development and the increasing need for maintenance and refurbishment of aging assets worldwide serve as primary driving factors. The rising demand for sustainable building materials and energy-efficient manufacturing processes also accelerates the market penetration of these environmentally benign coating solutions, positioning them as a cornerstone of modern industrial protection strategies globally. The long-term economic benefit derived from reduced asset corrosion and minimized recoating cycles makes waterborne anticorrosive systems an economically sound choice for asset owners.

Anticorrosive Waterborne Coatings Market Executive Summary

The global Anticorrosive Waterborne Coatings market is characterized by robust growth, primarily fueled by regulatory mandates enforcing VOC reduction and a strong industry preference for sustainable coating technologies. Business trends indicate a heightened focus on high-performance hybrid systems, integrating technologies like nanostructured materials and bio-based components to improve corrosion resistance and extend recoating cycles. Strategic mergers and acquisitions among major chemical producers and coatings specialists are aimed at consolidating technology portfolios and expanding geographical reach, particularly into rapidly industrializing regions. The automotive sector's increasing use of electrocoating (e-coating) with waterborne primers further drives demand, emphasizing uniformity and efficiency in large-scale manufacturing operations. Innovation remains critical, focusing on developing single-coat, direct-to-metal (DTM) waterborne solutions that simplify application processes and reduce total cost of ownership for end-users by minimizing labor and material steps.

Regional trends demonstrate Asia Pacific (APAC) as the fastest-growing market, driven by massive infrastructure projects in China, India, and Southeast Asian nations, coupled with expanding shipbuilding activities and rapid urbanization. High economic growth rates in developing APAC countries necessitate significant protective coating demand for new manufacturing facilities and transportation networks. North America and Europe maintain significant market shares, characterized by mature regulatory environments and high adoption rates of advanced, premium-priced waterborne systems for maintenance, repair, and overhaul (MRO) activities. European trends emphasize specific regulatory compliance, such as REACH, pushing manufacturers toward advanced, safer pigment technologies and bio-based resin alternatives. Conversely, Latin America and MEA show nascent growth potential, spurred by investments in oil and gas infrastructure and general industrial expansion, where the cost-performance balance of waterborne coatings is becoming increasingly favorable compared to traditional solvent systems.

Segmentation trends highlight the dominance of acrylic and epoxy chemistries due to their versatile application profiles and established performance records. Acrylics are favored for atmospheric exposure due to UV stability, while epoxies excel in chemical and immersion resistance. However, polyurethanes are gaining traction in applications requiring superior abrasion resistance and UV stability for heavy-duty transportation and protective finishes. In terms of application methods, spraying remains the most common technique, but there is growing sophistication in specialized application equipment tailored for viscous waterborne formulations. The general industrial segment, encompassing machinery, appliances, and fabrication, remains the largest volume consumer, though the marine and infrastructure segments are expected to exhibit the highest future growth rates, specifically targeting long-life protective systems essential for asset preservation and meeting extended performance warranties under challenging environmental conditions.

AI Impact Analysis on Anticorrosive Waterborne Coatings Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Anticorrosive Waterborne Coatings market primarily revolve around three core themes: predictive maintenance, accelerated formulation development, and supply chain efficiency. Users frequently ask: "How can AI predict coating failure before it occurs?" or "Can machine learning reduce the time required to develop a new low-VOC anticorrosive formula?" These questions highlight expectations that AI will transition the industry from reactive failure analysis to proactive protection strategies. Key concerns center on the data requirements necessary for training sophisticated AI models—specifically, the need for large, high-quality, real-world performance datasets related to various corrosive environments, substrate types, and coating compositions. Users expect AI to optimize the blend of anticorrosive pigments and binders for specific environmental challenges, fundamentally changing the R&D landscape by rapidly identifying non-obvious ingredient synergies that enhance durability.

AI's role in predictive maintenance is becoming increasingly relevant, especially for high-value assets like offshore wind turbines, marine vessels, and extensive piping systems in the oil and gas sector. AI models, utilizing sensor data from monitoring systems (e.g., humidity, temperature, localized corrosion rates, film integrity sensors), can analyze patterns indicating premature coating degradation or localized breaches in the protective layer well before visual inspection reveals a failure. This capability allows asset managers to schedule maintenance interventions precisely when needed, rather than relying on fixed-cycle maintenance programs, significantly reducing operational downtime and associated MRO costs. Furthermore, integrating AI into quality control during the manufacturing process ensures higher batch consistency and reduces material waste, addressing key concerns about the sensitivity of waterborne systems to minor variations in input materials and processing parameters, which is essential for mass-produced e-coat primers.

In the realm of formulation and R&D, AI and machine learning algorithms are accelerating the discovery of novel raw materials and optimizing complex ingredient interactions that define coating performance. By simulating millions of potential formulations based on desired performance parameters (e.g., VOC content, adhesion strength, salt spray resistance, cure kinetics), AI drastically cuts down the laboratory time and expense traditionally associated with materials science. This predictive modeling capability is critical for rapidly developing next-generation, high-performance, non-toxic anticorrosive pigments needed to replace legacy hazardous materials like zinc chromate. Ultimately, the integration of AI is expected to standardize and optimize protective coating application processes, using image recognition and data analytics to ensure optimal film thickness, uniformity, and curing parameters across industrial settings, thereby enhancing the overall reliability and longevity of waterborne anticorrosive systems and reducing application-related failures.

- AI-driven optimization of coating formulation based on predictive performance modeling and ingredient interaction analysis.

- Enhanced quality control during manufacturing, ensuring precise monitoring of dispersion stability and batch-to-batch consistency for complex waterborne systems.

- Predictive maintenance schedules for high-value assets using AI analysis of real-time coating sensor data and environmental telemetry.

- Optimization of raw material sourcing and supply chain logistics for specialized chemicals and anticorrosive pigments to mitigate supply risks.

- Development of digital twins of coated assets to simulate environmental degradation under various stress factors (temperature, humidity, chemical exposure).

DRO & Impact Forces Of Anticorrosive Waterborne Coatings Market

The market dynamics for Anticorrosive Waterborne Coatings are defined by a powerful convergence of regulatory pressure, technological advancements, and shifting end-user demands for sustainability, summarized by the key Drivers, Restraints, and Opportunities (DRO). The primary driver remains the global push towards environmental compliance, specifically the tightening regulations regarding Volatile Organic Compound (VOC) emissions in industrialized regions like North America and Europe, which effectively mandates the replacement of high-solvent-content coatings. Coupled with this is the continuous growth in infrastructure spending globally, particularly in coastal and industrial zones requiring robust, long-lasting corrosion protection for assets like bridges, utilities, and marine structures. This ensures a stable and growing demand base for high-performance waterborne systems. Furthermore, the proven technical performance advancements, bringing waterborne coatings closer to or on par with solvent-based equivalents in terms of barrier properties, chemical resistance, and longevity, further solidify their indispensable market position.

Restraints primarily revolve around the inherent technical challenges associated with waterborne systems, specifically their sensitivity to temperature and humidity during application and curing, which necessitates stringent environmental controls and higher energy usage for forced drying in certain industrial settings. Furthermore, while the cost of raw materials for standard waterborne systems is generally competitive, the specialized, high-performance anticorrosive pigments and advanced resins required for heavy-duty industrial applications can carry a premium cost. The complexity of formulation to ensure long-term shelf stability and freeze-thaw resistance of aqueous dispersions also poses logistical and storage challenges compared to solvent-based products. Performance limitations in extremely harsh chemical or high-temperature environments, although rapidly decreasing due to innovation, still present a challenge when competing against highly specialized, traditional solvent-based epoxy and polyurethane systems in niche heavy-duty applications.

Significant opportunities exist in emerging applications, especially in the renewable energy sector, including coatings for wind turbine components (onshore and offshore towers and blades) and solar panel mounting structures, which demand durable, environmentally friendly protection against atmospheric corrosion and UV degradation. The trend toward smart coatings, which incorporate self-healing or monitoring functionalities, represents a high-potential innovation avenue, leveraging the aqueous base for incorporating functional nanoparticles and microcapsules. Geographically, expansion into developing economies in Southeast Asia and Africa, coupled with strategic partnerships targeting massive government infrastructure repair projects and rapid urbanization, offers substantial potential for long-term volume growth. The ongoing development of bio-based binders and non-toxic, sustainable anticorrosive pigments also presents a clear pathway for differentiation, enabling manufacturers to capture premium pricing in environmentally conscious markets.

Segmentation Analysis

The Anticorrosive Waterborne Coatings market is comprehensively segmented based on Resin Type, Application Method, End-Use Industry, and Region, reflecting the diverse technical requirements and specific user base of protective coatings. Segmentation by resin type is critical as it dictates the coating's intrinsic performance characteristics, including chemical resistance, mechanical strength, weatherability, and application versatility. Acrylics dominate in volume due to their excellent UV resistance, fast drying times, and cost-effectiveness, making them ideal for exterior architectural and general industrial applications where moderate protection is sufficient. Epoxies, conversely, are preferred for demanding applications requiring superior adhesion, chemical resistance, and abrasion resistance, particularly in marine, oil and gas, and heavy-duty industrial settings, often used as primers or intermediate coats.

Analysis by Application Method highlights that spray application, including airless, conventional, and highly efficient electrostatic techniques, is the predominant method across all major industries due to its effectiveness in achieving rapid, uniform coverage over large or complex surfaces. However, specialized immersion and flow coating techniques, particularly E-coating (electrocoating), are vital within the automotive and appliance manufacturing sectors. E-coating ensures 100% coverage and consistent film thickness in internal and external complex cavities, showcasing the high-volume, precision requirements of these original equipment manufacturing (OEM) segments. Brush and roller application remains essential for smaller MRO projects, touch-ups, and specialized areas where spray application is impractical due to overspray concerns or confined spaces.

The End-Use Industry segmentation illustrates the heavy reliance of infrastructure (pipelines, bridges, roads) and general industry (machinery, metal fabrication) on these coatings, constituting the major volume drivers. However, the fastest growth is often observed in the specialized marine and energy sectors. These high-specification sectors demand increasingly strict performance standards and longer required warranty periods for protective systems, driving innovation towards multi-layer waterborne systems with active inhibition properties. Understanding these granular segments is essential for strategic planning, enabling manufacturers to tailor their R&D investments and marketing strategies precisely to the high-growth, high-value opportunities within the specialized protective coatings market.

- By Resin Type:

- Acrylics (Styrene Acrylics, Pure Acrylics)

- Epoxies (Waterborne Epoxy Esters, Epoxy Dispersions)

- Polyurethanes (PUs) (Polyurethane Dispersions PUDs)

- Alkyds (Water-reducible Alkyds)

- Others (Vinyls, Silicones, Hybrid Polymers)

- By Application Method:

- Spray Coating (Airless, Conventional, Electrostatic)

- Brush/Roller Coating

- Dip Coating/E-Coating (Electrocoating)

- By End-Use Industry:

- General Industrial (Machinery, Appliances, Metal Furniture)

- Automotive & Transportation (OEM and Refinish, Rail, Heavy Trucks)

- Marine (Vessels, Offshore Platforms, Port Equipment)

- Infrastructure & Construction (Bridges, Pipelines, Utilities, Water Treatment)

- Power Generation (Wind Energy Components, Oil & Gas Infrastructure)

- Aerospace

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (APAC) (China, India, Japan, South Korea)

- Latin America (LATAM) (Brazil, Argentina)

- Middle East & Africa (MEA) (Saudi Arabia, UAE, South Africa)

Value Chain Analysis For Anticorrosive Waterborne Coatings Market

The value chain for the Anticorrosive Waterborne Coatings market commences with the critical upstream suppliers of specialty raw materials, including high-performance binder resins, functional additives, and anticorrosive pigments. Upstream analysis highlights the high concentration and specialization within the chemical supply market. Key ingredients, such as specialized polymeric dispersions (acrylic PUDs, waterborne epoxies) and non-toxic corrosion inhibitors (e.g., modified zinc phosphates, organic inhibitors), are often sourced from a limited number of global chemical giants. Price volatility in petrochemical feedstocks, which form the basis for most resins, significantly impacts the overall cost structure of the finished coating product. Ensuring material traceability, quality consistency, and sustainable sourcing practices are major upstream challenges, necessitating strategic partnerships between coating manufacturers and chemical suppliers to secure high-quality inputs.

Midstream activities are centered on the manufacturing and formulation stages performed by the coatings companies. This stage is highly technologically intensive, requiring advanced mixing, dispersion, and quality control techniques to produce stable aqueous formulations that meet rigorous performance standards. The R&D process focuses heavily on optimizing the chemical interaction between water-based binders and performance additives to achieve effective flash rust inhibition, stability, and fast cure times—features historically difficult to achieve in waterborne systems. Manufacturing efficiency, batch consistency, and stringent compliance with safety and environmental regulations (e.g., maintaining low VOC thresholds) are critical differentiators in this midstream segment, driving continuous investment in sophisticated production equipment tailored for water-based products.

The downstream segment involves distribution and end-user application. Distribution channels are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) and major infrastructure project owners, and indirect sales through specialized technical distributors and agents serving the fragmented MRO (Maintenance, Repair, and Overhaul) market. The direct channel facilitates high-volume, customized solutions and intense technical support, crucial for complex projects like marine vessel coatings or automotive E-coat lines. The indirect channel relies on the distributor's localized inventory, technical training, and ability to efficiently supply smaller batches and ancillary equipment to contractors. Successful downstream market penetration heavily depends on providing robust application training and technical specifications, ensuring that applicators handle the unique curing and environmental requirements of waterborne products effectively to achieve optimal corrosion protection.

Anticorrosive Waterborne Coatings Market Potential Customers

Potential customers for Anticorrosive Waterborne Coatings span a wide array of industrial, governmental, and commercial entities that demand superior asset protection against corrosion while simultaneously adhering to strict environmental compliance mandates. The primary end-users, or direct buyers, are segmented into several high-value categories, starting with large industrial corporations such as automotive manufacturers, appliance makers, and heavy machinery producers. The automotive sector, in particular, is a foundational customer, relying almost exclusively on waterborne E-coat primers for vehicle bodies due to the requirement for uniform coverage, automated application, and minimal environmental impact in high-volume production lines. Appliance manufacturers require aesthetically durable and chemical-resistant finishes for products like refrigerators and washing machines.

The infrastructure and construction segments represent the backbone of long-term demand. Government agencies, public works departments, and private infrastructure developers are vital customers for protecting assets such as bridges, utility towers, water storage tanks, and municipal pipelines. These customers prioritize coatings with certified long-term durability (often specifying 20+ years of service life) and robust compliance with local and national environmental standards, making high-performance, multilayer waterborne systems the preferred choice for major rehabilitation projects. Furthermore, the burgeoning renewable energy sector, including operators of onshore and offshore wind farms, constitutes a specialized customer base that requires high-performance, UV-stable anticorrosive coatings for turbine components exposed to extreme weather conditions.

Lastly, high-specification segments, including the marine and the oil and gas industries, are crucial potential customers. Marine asset owners (shipyards, fleet operators) require coatings that withstand constant saltwater immersion, necessitating highly specialized waterborne epoxy-based systems for hull protection and ballast tanks. Oil and gas companies utilize these coatings for pipelines, storage facilities, and processing equipment, demanding resistance to harsh chemicals, high temperatures, and severe atmospheric corrosion. The ultimate decision-makers in these sectors often balance initial material cost against the projected lifecycle cost of the asset, ensuring that high-durability, low-maintenance waterborne coatings are increasingly favored over less environmentally sound alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axalta Coating Systems, Akzo Nobel N.V., PPG Industries, Sherwin-Williams Company, Hempel A/S, Jotun A/S, RPM International Inc., BASF SE, Asian Paints Ltd., Kansai Paint Co. Ltd., Nippon Paint Holdings Co. Ltd., Chugoku Marine Paints, Tikkurila Oyj, Sika AG, KCC Corporation, Diamond Vogel, Solvay S.A., Dow Inc., Arkema S.A., Beckers Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anticorrosive Waterborne Coatings Market Key Technology Landscape

The technological landscape of the Anticorrosive Waterborne Coatings market is characterized by intense research and development focused on achieving solvent-based performance characteristics within an aqueous medium, driven primarily by sustainability mandates. A major area of innovation is the development of advanced polymer emulsions and dispersions that enable high-solids content while maintaining low viscosity and superior film formation. This includes the engineering of specialized polyurethanes (PUDs) and modified acrylics with highly organized internal structures, enabling rapid physical drying and enhanced chemical cross-linking upon curing. These technological breakthroughs are essential to overcoming historical drawbacks such as extended drying times and vulnerability to ambient humidity, allowing waterborne coatings to penetrate heavy-duty applications previously dominated by solvent-based systems.

A second critical technological focus is the transition to safe, high-efficacy anticorrosive pigments and inhibitors. With the global regulatory crackdown on traditional heavy metals like lead and chromates, manufacturers are investing heavily in synthesizing non-toxic alternatives. This involves the use of innovative compounds such as organic phosphonates, modified calcium ion-exchange silica, and nano-zinc particles. Nanotechnology represents a powerful enabler, where functionalized nanoparticles (e.g., cerium oxide, graphene derivatives) are uniformly dispersed within the waterborne matrix to enhance barrier properties, increase adhesion strength, and provide electrochemical passivation mechanisms. The integration of these advanced materials significantly boosts the long-term corrosion resistance and overall life expectancy of the coating system under severe exposure conditions.

Furthermore, technology related to application and curing efficiency is paramount, especially for industrial throughput. Electrocoating (E-coating) technology, which relies inherently on waterborne systems, continues to advance, providing exceptional corrosion protection through highly automated processes in the automotive and appliance sectors. For field application and MRO, the development of specialized accelerating additives and dual-cure mechanisms (e.g., ambient moisture-cure combined with air dry) is minimizing mandatory curing windows and reducing application costs. This technological evolution extends beyond the coating material itself to include sophisticated analytical modeling and quality assurance systems, often leveraging digital tools to ensure optimal application parameters (temperature, humidity, film thickness) are met, thereby guaranteeing the projected anticorrosion performance in real-world environments.

Regional Highlights

The Anticorrosive Waterborne Coatings market exhibits distinct characteristics and growth trajectories across major geographical regions, influenced by localized industrial activity, economic growth rates, and regional regulatory frameworks concerning environmental protection.

- Asia Pacific (APAC): This region is positioned as the global growth engine, driven by extensive infrastructure investments, rapid urbanization, and massive manufacturing output, particularly in automotive and shipbuilding sectors in China, India, Japan, and South Korea. Regulatory bodies in these countries are increasingly adopting stricter VOC limits, albeit often lagging behind European standards, which still accelerates the demand for waterborne alternatives. The focus in APAC is on achieving a balance between competitive pricing, high-volume manufacturing efficiency, and acceptable corrosion performance for rapidly expanding transportation and industrial networks.

- North America: Characterized by mature markets and highly stringent environmental regulations (e.g., EPA and various state-level air quality rules), North America demonstrates high adoption of premium, high-performance waterborne systems for maintenance, repair, and new construction. The market is driven by sophisticated end-users in the aerospace, heavy-duty automotive, and oil and gas infrastructure sectors who prioritize lifecycle cost reduction through extended coating durability. The region is a key consumer of advanced DTM (direct-to-metal) and rapid-curing waterborne formulations designed to minimize project downtime.

- Europe: Europe represents a global leader in environmental standards, heavily influenced by directives like the Industrial Emissions Directive (IED) and REACH regulations, which effectively enforce extremely low-VOC content and non-toxic pigment usage. This regulatory environment mandates the adoption of advanced waterborne and powder coatings, positioning Europe as a key innovation hub for highly specialized aqueous chemistries, particularly in high-quality industrial MRO and protective coatings for the rapidly expanding renewable energy sector, such as offshore wind installations.

- Latin America (LATAM): Market growth is moderate but promises significant long-term potential, tied closely to recovery and expansion in the oil and gas, mining, and general construction sectors, particularly in major economies like Brazil and Mexico. The adoption rate of waterborne systems is steadily increasing, fueled by multinational company standards and local governmental pushes for greener materials in public works projects, though competitive pricing and logistical efficiency remain major determinants in material selection across the region.

- Middle East & Africa (MEA): This region is strategically important due to substantial investments in large-scale energy infrastructure, desalination plants, and maritime assets located in highly corrosive coastal environments. While challenging climatic conditions (high heat and humidity) historically favored solvent-based systems, there is a clear trend toward high-solids and specialized waterborne epoxy coatings, driven by international quality standards and the necessity of achieving maximum corrosion control in highly aggressive operating conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anticorrosive Waterborne Coatings Market.- Axalta Coating Systems

- Akzo Nobel N.V.

- PPG Industries

- Sherwin-Williams Company

- Hempel A/S

- Jotun A/S

- RPM International Inc.

- BASF SE

- Asian Paints Ltd.

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings Co. Ltd.

- Chugoku Marine Paints

- Tikkurila Oyj

- Sika AG

- KCC Corporation

- Diamond Vogel

- Solvay S.A.

- Dow Inc.

- Arkema S.A.

- Beckers Group

Frequently Asked Questions

Analyze common user questions about the Anticorrosive Waterborne Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using waterborne anticorrosive coatings over solvent-borne coatings?

The primary benefits include significantly reduced Volatile Organic Compound (VOC) emissions, lower flammability risks during application, enhanced environmental sustainability, reduced odor, and easier cleanup, aligning with stricter global regulatory requirements for protective coatings.

Which end-use industry drives the highest demand for these coatings globally?

The General Industrial segment, including the coating of machinery, appliances, and fabricated parts, currently accounts for the largest volume consumption, though the Infrastructure and Marine sectors are projected to exhibit the fastest growth rates due to critical protection needs.

Are waterborne coatings suitable for harsh marine and offshore environments?

Yes, modern waterborne epoxy and polyurethane systems are specifically formulated for harsh marine and offshore environments. Ongoing technological advancements ensure they provide barrier protection and chemical resistance comparable to traditional systems, crucial for offshore platforms and vessels.

How do regulatory changes impact the growth of the Anticorrosive Waterborne Coatings market?

Regulatory mandates, particularly those limiting VOC content (e.g., in North America and Europe), are the single largest driver of market growth. These regulations force industrial users to transition from solvent-based systems, ensuring sustained demand for compliant waterborne alternatives.

What role does nanotechnology play in enhancing waterborne anticorrosion performance?

Nanotechnology introduces materials like graphene and nano-silicates into waterborne formulations to create denser barrier films, improve mechanical properties (hardness, abrasion resistance), and incorporate smart features like self-healing mechanisms, significantly boosting long-term corrosion protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Anticorrosive Waterborne Coatings Market Size Report By Type (Epoxy Coatings, Urethane Coatings, Acrylic Coatings, Others), By Application (Marine, Oil & Gas, Infrastructure, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Anticorrosive Waterborne Coatings Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Acrylic Coatings, Urethane Coatings, Epoxy Coatings), By Application (Infrastructure, Oil & Gas, Marine), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager