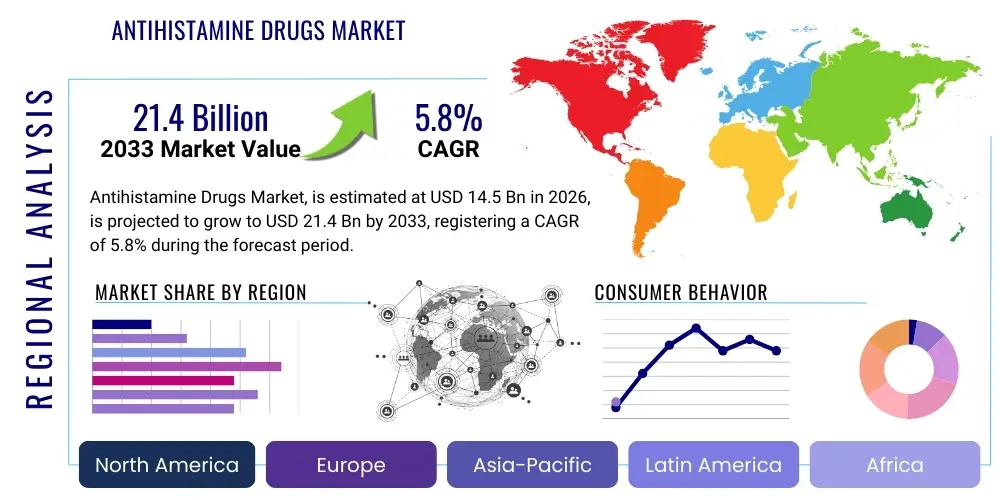

Antihistamine Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438867 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Antihistamine Drugs Market Size

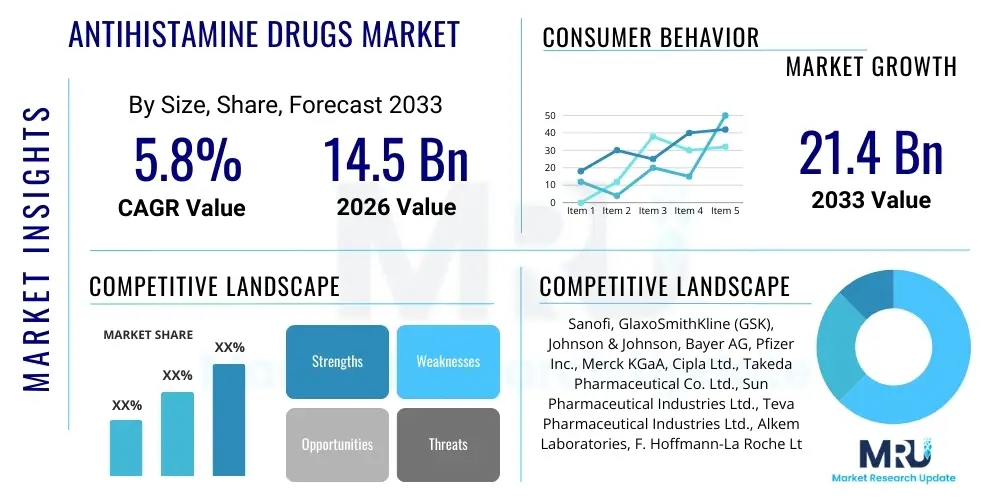

The Antihistamine Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 21.4 Billion by the end of the forecast period in 2033.

Antihistamine Drugs Market introduction

The Antihistamine Drugs Market encompasses the global sales of pharmaceutical agents designed to counteract the effects of histamine, a chemical mediator released during allergic reactions. These drugs are fundamentally categorized into first-generation (sedating) and second/third-generation (non-sedating) compounds, addressing conditions ranging from seasonal allergies (rhinitis), chronic urticaria, allergic conjunctivitis, to insect stings. The core product description involves molecules that act as H1 receptor antagonists, blocking histamine binding and thus mitigating symptoms like itching, sneezing, and inflammation. The rising prevalence of allergies globally, driven by factors such as climate change, increased pollution, and changes in lifestyle, stands as a primary structural driver for market expansion.

Major applications of antihistamines are broad, primarily focused on symptomatic relief. They are critical in managing acute and chronic allergic manifestations, offering significant benefits to patient quality of life by controlling disruptive symptoms that impact daily activities and sleep. Furthermore, certain first-generation antihistamines retain utility in non-allergic applications, such as motion sickness prophylaxis and as sleep aids due to their sedative properties. The market benefits substantially from high accessibility, with many key medications having shifted from prescription-only status to Over-The-Counter (OTC) availability, significantly boosting consumer access and immediate purchase decisions. This shift has established robust revenue streams for pharmaceutical manufacturers.

Driving factors for sustained market growth include continuous advancements in drug formulations, particularly the development of safer, faster-acting, and longer-lasting third-generation drugs with minimal central nervous system side effects. Increased consumer awareness regarding allergy management, coupled with favorable reimbursement policies in developed economies and increasing healthcare expenditure in emerging markets, further stimulate demand. The introduction of combination therapies, such as antihistamines paired with decongestants or corticosteroids, provides enhanced therapeutic efficacy, thereby expanding the potential patient pool and clinical utility of these pharmacological agents.

Antihistamine Drugs Market Executive Summary

The Antihistamine Drugs Market demonstrates robust growth, largely fueled by the escalating incidence of allergic disorders worldwide and the transition of effective second-generation drugs to OTC status, democratizing access. Business trends indicate a strong focus on strategic mergers and acquisitions among major players aiming to consolidate market share and enhance distribution networks, particularly in fast-growing regions like Asia Pacific. Furthermore, there is significant investment in research and development aimed at developing novel therapeutic mechanisms, including mast cell stabilizers and targeted immunotherapy, which may eventually complement or partially substitute traditional antihistamines, signaling a shift toward preventative rather than solely symptomatic treatment.

Regional trends reveal North America maintaining market dominance, characterized by high healthcare spending, established regulatory frameworks, and high patient awareness. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, increasing pollution levels contributing to respiratory allergies, and the expansion of generic drug manufacturing capabilities, making treatments more affordable and accessible to larger populations. European markets show stable, mature growth, driven by an aging population susceptible to chronic conditions and well-defined public healthcare systems ensuring consistent demand for allergy medication.

Segment trends highlight the dominance of the second-generation segment (e.g., Cetirizine, Loratadine, Fexofenadine) due to their improved efficacy and favorable safety profile compared to first-generation sedating agents. By route of administration, the oral segment (tablets, syrups) remains the largest, preferred for convenience and systemic relief. However, topical formulations, including nasal sprays and eye drops, are witnessing accelerated growth, driven by patient preference for localized and immediate symptom relief for conditions like allergic rhinitis and conjunctivitis. The OTC segment, benefiting from regulatory deregulation, is expanding significantly faster than the prescription segment, fundamentally reshaping retail pharmacy dynamics and consumer purchasing behavior.

AI Impact Analysis on Antihistamine Drugs Market

Common user questions regarding AI's influence often center on its role in drug discovery acceleration, personalized allergy treatment protocols, and optimizing supply chain logistics for OTC medications. Users are keen to understand if AI can accurately predict allergy outbreaks based on environmental data (pollen counts, air quality), thereby improving preventative healthcare measures and the proactive distribution of antihistamine supplies. Furthermore, significant interest exists in how Artificial Intelligence can sift through vast clinical trial data to identify potential new therapeutic targets or repurpose existing antihistamine molecules for non-traditional uses, accelerating the time-to-market for novel formulations. Concerns revolve around data privacy when integrating personalized patient health records with AI diagnostic tools and the regulatory complexities involved in validating AI-derived treatment recommendations, particularly concerning dosing and drug interaction warnings for vulnerable populations.

- AI algorithms can analyze patient genetic profiles and environmental exposure data to recommend personalized antihistamine regimens, optimizing dosage and type (first, second, or third generation).

- Machine learning models enhance pharmacovigilance by rapidly identifying potential adverse drug reactions (ADRs) associated with specific antihistamine compounds post-market release.

- AI assists in predicting seasonal allergy severity and duration, enabling pharmaceutical companies and retailers to optimize inventory management and regional distribution of high-demand products.

- Generative AI accelerates the initial stages of drug discovery, designing novel compounds with higher selectivity for histamine receptors (H1, H2, H3, H4) and improved pharmacokinetic profiles.

- AI-powered diagnostic tools improve the accuracy and speed of identifying specific allergic triggers, leading to more precise, rather than generalized, antihistamine recommendations.

DRO & Impact Forces Of Antihistamine Drugs Market

The market dynamics are governed by a complex interplay of drivers, restraints, and opportunities, culminating in defining the impact forces. Key drivers include the persistently high prevalence and rising global incidence of allergic conditions such as hay fever and asthma, coupled with significant growth in the geriatric population, which often requires medication management. The transition of several blockbuster drugs from prescription status to Over-The-Counter accessibility substantially broadens the consumer base and facilitates easier self-medication. However, restraints such as patent expiration leading to intense generic competition compress profit margins, especially for older, highly effective formulations. Furthermore, regulatory scrutiny regarding drug safety, particularly the potential for cardiovascular side effects associated with certain antihistamine classes, imposes constraints on development and market entry. The emergence of alternative therapies, including immunotherapy and complementary medicine, also poses a competitive threat to conventional pharmacological treatments. Opportunities are evident in the development of fixed-dose combination products targeting multiple symptoms simultaneously and the expansion into high-growth, underserved emerging markets where diagnostic capabilities and access to advanced medication are improving.

The primary driving force remains the increasing urbanization and industrialization across developing nations, which correlate strongly with deteriorating air quality and higher exposure to allergens and pollutants, directly increasing the global patient pool requiring antihistamine intervention. This demographic shift provides a long-term, stable growth trajectory. Restraining forces are dominated by the financial pressure exerted by genericization. As key patents expire, branded manufacturers face steep price erosion, forcing them to pivot towards innovation in specialized drug delivery systems or the development of novel molecular entities (NMEs) to maintain high profitability. The impact force of regulatory changes, particularly those relating to ingredient restrictions or labeling requirements (e.g., mandatory warnings regarding sedation), necessitates continuous adaptation in manufacturing and marketing strategies.

A crucial opportunity lies in leveraging personalized medicine approaches, potentially guided by AI, to tailor antihistamine therapy based on patient biomarkers, improving efficacy while minimizing side effects. This shift aligns with broader trends in healthcare toward precision treatment. Furthermore, the rising awareness of the negative impact of untreated allergic rhinitis on productivity and quality of life encourages proactive seeking of medical intervention, sustaining consumer demand across all economic strata. The synthesis of these forces indicates that while the market is mature in terms of product categories, growth will be primarily driven by volume increases in emerging regions and value increases through innovative formulations in established regions.

Segmentation Analysis

The Antihistamine Drugs Market is comprehensively segmented based on various critical parameters, including drug class, route of administration, indication, and distribution channel, providing granular insights into consumer preference and therapeutic efficacy. Drug class segmentation distinguishes between the older, sedating first-generation antihistamines and the newer, non-sedating second and third generations, with the latter commanding the largest market share due to superior safety profiles and less interference with daily activities. Route of administration determines convenience and speed of onset, dividing the market into oral (tablets, capsules, syrups), nasal (sprays), and ocular (drops) formulations. Analyzing these segments helps stakeholders tailor their product portfolios to specific patient needs, such as localized relief for allergic conjunctivitis versus systemic relief for chronic urticaria.

- By Drug Class:

- First-Generation Antihistamines (Sedating)

- Second-Generation Antihistamines (Non-Sedating)

- Third-Generation Antihistamines (Advanced Non-Sedating)

- By Route of Administration:

- Oral

- Nasal

- Ocular

- Injectable

- By Indication:

- Allergic Rhinitis (Seasonal and Perennial)

- Allergic Conjunctivitis

- Urticaria (Hives)

- Angioedema

- Others (Dermatitis, Motion Sickness)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By Prescription Status:

- Over-The-Counter (OTC) Drugs

- Prescription Drugs

Value Chain Analysis For Antihistamine Drugs Market

The value chain for the Antihistamine Drugs Market begins with upstream activities focused on the sourcing and synthesis of Active Pharmaceutical Ingredients (APIs). This phase involves high-level research and development by specialized chemical manufacturers and pharmaceutical companies to ensure the purity and bioavailability of core molecules like Cetirizine or Loratadine. The quality control at this stage is paramount, as regulatory agencies impose stringent standards on API production. Major pharmaceutical companies often rely on a network of Contract Manufacturing Organizations (CMOs) in regions like India and China for cost-effective bulk synthesis, introducing complexity in supply chain management and geopolitical risk assessment.

The midstream involves drug formulation, packaging, and regulatory approval. After the API is synthesized, it is formulated into final dosage forms (tablets, solutions, sprays). This stage demands advanced manufacturing technology, particularly for controlled-release formulations or complex nasal delivery systems. Downstream activities encompass the distribution and marketing of the final product. The distribution channel is heavily bifurcated: prescription drugs flow through specialized hospital and clinic networks, while the high-volume OTC drugs move through massive retail pharmacy chains, hypermarkets, and increasingly, e-commerce platforms. The dominance of the OTC segment necessitates extensive marketing campaigns directly targeting consumers (DTC advertising) to drive brand recognition and immediate purchase.

The primary distribution method for OTC antihistamines is indirect, leveraging wholesalers and large retail pharmacy conglomerates to ensure nationwide coverage and shelf availability. Direct distribution, although less common for high-volume OTC products, is often employed for highly specialized or newly launched prescription antihistamines where controlled inventory management and direct engagement with key opinion leaders (KOLs) and prescribing physicians are crucial. The efficacy of the indirect channel is essential for market penetration, requiring robust logistical networks capable of managing rapid replenishment cycles, especially during peak allergy seasons.

Antihistamine Drugs Market Potential Customers

Potential customers for the Antihistamine Drugs Market are fundamentally diverse, encompassing individuals suffering from acute, seasonal, or chronic allergic conditions globally. The largest segment of end-users includes individuals diagnosed with Allergic Rhinitis, commonly known as hay fever, which requires recurrent or continuous medication intake, particularly during spring and fall seasons. These consumers are typically seeking non-sedating, fast-acting oral formulations that offer 24-hour relief to minimize disruption to work or school activities. Another significant customer group comprises patients with Chronic Idiopathic Urticaria (CIU), who require long-term, often high-dose, second or third-generation antihistamines for maintenance therapy.

Furthermore, pediatric patients represent a crucial customer segment, driving demand for specialized formulations such as palatable liquid syrups and orally disintegrating tablets (ODTs) designed for easier administration. These younger patients often suffer from food allergies, allergic dermatitis, and seasonal allergies, necessitating parental or guardian involvement in medication choice. Healthcare providers, including general practitioners, allergists, immunologists, and pediatricians, act as influential buyers, determining the volume and type of prescription antihistamines consumed within the formal healthcare setting.

The increasing accessibility of OTC antihistamines has created a vast consumer base consisting of health-conscious individuals who self-diagnose mild to moderate symptoms and prefer convenience over consultation. These customers prioritize brand trust, fast relief, and competitive pricing, typically purchasing through retail pharmacies and large supermarket chains. Hospitals and emergency departments also constitute significant buyers, stocking injectable antihistamines (e.g., Diphenhydramine) for acute, severe allergic reactions, such as anaphylaxis, underscoring the critical, life-saving application of these drugs in institutional settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 21.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi, GlaxoSmithKline (GSK), Johnson & Johnson, Bayer AG, Pfizer Inc., Merck KGaA, Cipla Ltd., Takeda Pharmaceutical Co. Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Alkem Laboratories, F. Hoffmann-La Roche Ltd., Zydus Cadila, Perrigo Company plc, Prestige Consumer Healthcare Inc., Mylan (Viatris), Novartis AG, Bristol Myers Squibb, Aurobindo Pharma, Boehringer Ingelheim |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antihistamine Drugs Market Key Technology Landscape

The technological landscape of the Antihistamine Drugs Market is defined by continuous innovation in molecular design and sophisticated drug delivery systems aimed at improving patient compliance and therapeutic outcomes. A primary focus is on chiral switching technology, which involves isolating the active enantiomer of a racemic mixture to enhance efficacy and reduce unwanted side effects, exemplified by the development of Levocetirizine from Cetirizine. This precision chemistry maximizes the therapeutic index. Furthermore, advancements in sustained-release and controlled-release technologies are crucial for developing once-daily formulations, maintaining consistent plasma drug levels, and reducing the need for multiple doses, which is a major factor in improving patient adherence for chronic conditions like perennial allergic rhinitis.

Drug delivery technologies are undergoing rapid transformation, particularly concerning non-oral routes. Innovations in nasal spray technology focus on improving the mucosal absorption of antihistamines to provide rapid local relief while minimizing systemic exposure. This includes developing micro-encapsulation and suspension technologies to ensure uniform drug dispersion and prolonged residence time in the nasal passages. Similarly, in ocular solutions, advanced formulation techniques are employed to stabilize active ingredients and improve retention time on the eye surface, which is essential for managing allergic conjunctivitis effectively and reducing the frequency of application.

Looking ahead, the integration of digital health and wearable technology is beginning to influence the market. These technologies allow for real-time monitoring of environmental allergens and patient symptoms, leading to 'just-in-time' medication usage advice. This is coupled with ongoing research into next-generation H4 receptor antagonists, which are implicated in immune modulation and inflammation, offering the potential for antihistamines to move beyond mere symptom relief and address the underlying immune response. These technological shifts are driving value creation, especially in the premium branded segment, differentiating products from ubiquitous generic alternatives.

Regional Highlights

- North America: This region holds the largest market share due to high consumer awareness, favorable reimbursement policies, and the presence of major pharmaceutical headquarters. The United States specifically drives demand, characterized by high rates of allergic rhinitis and robust OTC distribution channels. Innovation adoption is rapid, supporting the uptake of premium, third-generation non-sedating antihistamines and combination products.

- Europe: Europe is a mature market exhibiting stable growth. Countries such as Germany, the UK, and France show consistent demand, supported by well-established healthcare infrastructure and high pollution levels in urban centers. Regulatory harmonization within the EU facilitates market entry for novel drugs, though pricing pressures from generic manufacturers are significant, particularly in Western Europe.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, increasing air pollution, and rising disposable incomes that improve healthcare accessibility. Population giants like China and India present enormous untapped potential, with increasing chronic respiratory allergies pushing market demand. The market here is cost-sensitive, favoring locally produced generics, but branded medicines are gaining traction among the growing middle class.

- Latin America (LATAM): Growth in LATAM is moderate but steady, spurred by improvements in healthcare access and rising awareness of allergic conditions. Brazil and Mexico are key markets, often characterized by a mixed distribution system involving both public health purchasing and private pharmacy sales. Economic volatility, however, remains a constraining factor on per capita pharmaceutical spending.

- Middle East and Africa (MEA): This region is characterized by fragmented growth. Countries in the Gulf Cooperation Council (GCC) show high per capita spending and a preference for branded, imported drugs. Conversely, market penetration is slower in many parts of Africa due to logistical challenges and lower average healthcare budgets. Respiratory allergies, exacerbated by high levels of sand dust and specific regional allergens, ensure underlying demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antihistamine Drugs Market.- Sanofi

- GlaxoSmithKline (GSK)

- Johnson & Johnson

- Bayer AG

- Pfizer Inc.

- Merck KGaA

- Cipla Ltd.

- Takeda Pharmaceutical Company Limited

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Alkem Laboratories

- F. Hoffmann-La Roche Ltd.

- Zydus Cadila

- Perrigo Company plc

- Prestige Consumer Healthcare Inc.

- Mylan (now Viatris)

- Novartis AG

- Bristol Myers Squibb

- Aurobindo Pharma

- Boehringer Ingelheim

Frequently Asked Questions

Analyze common user questions about the Antihistamine Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between first-generation and second/third-generation antihistamines?

First-generation antihistamines, such as Diphenhydramine, readily cross the blood-brain barrier, resulting in sedative side effects. Second and third-generation drugs (e.g., Cetirizine, Fexofenadine, Levocetirizine) are highly selective for peripheral H1 receptors and generally non-sedating, making them preferred for daily allergy management due to improved safety and compliance profiles.

Which factors are primarily driving the growth of the Over-The-Counter (OTC) antihistamine segment?

The primary drivers include the regulatory shift of key second-generation drugs to OTC status, providing consumers with easy, prescription-free access. This is further fueled by increasing health literacy, the convenience of self-medication, and aggressive consumer-targeted marketing campaigns by major pharmaceutical companies promoting brand loyalty.

How significant is the impact of generic drugs on the Antihistamine Drugs Market?

The impact is highly significant. Generic versions of blockbuster antihistamines (like Loratadine and Cetirizine) have led to severe price erosion, especially in developed markets, acting as a major restraint on revenue growth for branded manufacturers. This drives branded companies to invest heavily in novel, patent-protected third-generation formulations and combination products.

What role does climate change play in the demand for antihistamine drugs?

Climate change contributes significantly to increased demand by extending and intensifying pollen seasons globally, leading to higher concentrations of airborne allergens. This prolonged exposure results in more severe and frequent allergic rhinitis episodes, requiring extended periods of antihistamine usage across a larger segment of the population.

What are the key emerging opportunities related to drug delivery technology in this market?

Emerging opportunities focus on developing advanced drug delivery systems, particularly sustained-release oral formulations for 24-hour efficacy, and highly efficient localized delivery systems like micro-pump nasal sprays and preservative-free ocular drops, enhancing both patient compliance and targeted therapeutic action while minimizing systemic exposure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager