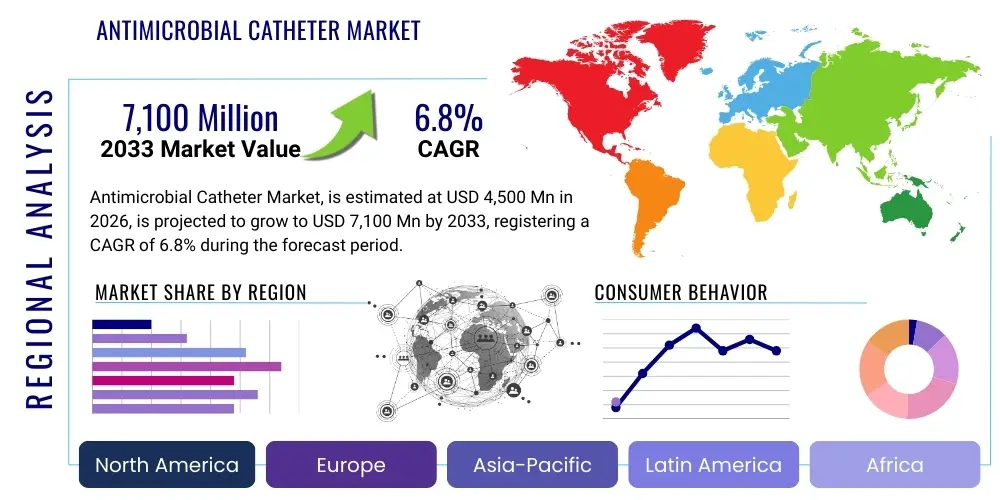

Antimicrobial Catheter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438923 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Antimicrobial Catheter Market Size

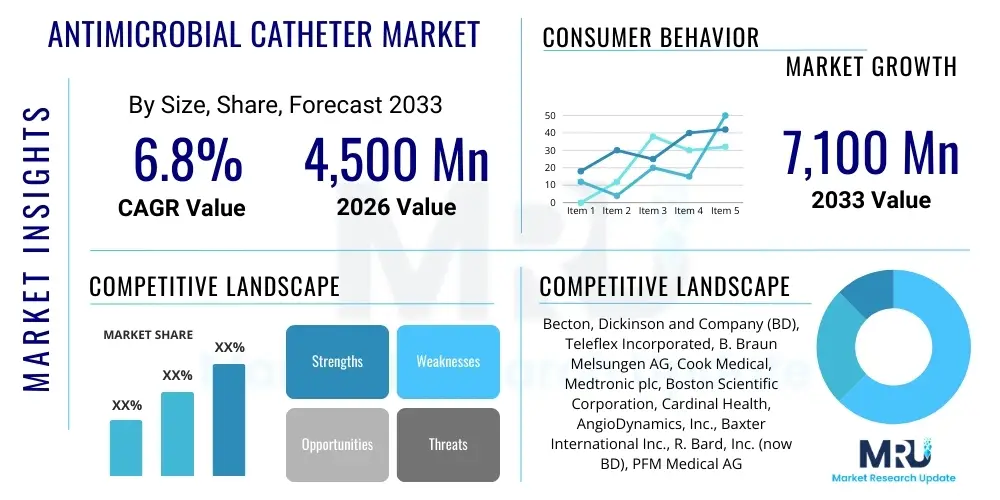

The Antimicrobial Catheter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Antimicrobial Catheter Market introduction

The Antimicrobial Catheter Market encompasses a range of medical devices designed to prevent Catheter-Associated Urinary Tract Infections (CAUTI) and Central Line-Associated Bloodstream Infections (CLABSI), which are significant sources of morbidity, mortality, and increased healthcare costs globally. These specialized catheters are typically coated or impregnated with antimicrobial agents, such as silver, chlorhexidine, or specialized antibiotics, aimed at inhibiting microbial colonization on the catheter surface both internally and externally. The primary product goal is to reduce hospital-acquired infections (HAIs) associated with prolonged catheter use, thereby improving patient outcomes and adherence to stringent clinical guidelines established by organizations like the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO).

Major applications for antimicrobial catheters span across critical care, urology, surgery, and chronic disease management, particularly in hospital settings where prolonged invasive procedures are common. Central Venous Catheters (CVCs) and Urinary Catheters are the most widely adopted segments employing antimicrobial technology, driven by high rates of associated infections. The benefits of these products include reduced infection rates, shorter hospital stays, decreased reliance on high-cost systemic antibiotics, and overall enhanced patient safety protocols. The prophylactic nature of these devices positions them as essential tools in modern infection control strategies, particularly as antimicrobial resistance (AMR) concerns rise globally.

Driving factors for this market are multi-faceted, including the increasing number of surgeries and hospitalizations, growing awareness among healthcare providers regarding infection control best practices, and favorable reimbursement policies for infection prevention measures. Furthermore, regulatory bodies in developed economies are enforcing stricter mandates regarding HAI reporting and prevention, pushing hospitals toward adopting premium infection-resistant devices. Technological advancements focusing on developing novel, broad-spectrum antimicrobial coatings and nanotechnology-based solutions are also fueling market expansion, ensuring continuous product innovation and efficacy against emerging resistant pathogens.

Antimicrobial Catheter Market Executive Summary

The Antimicrobial Catheter Market is characterized by robust growth, primarily propelled by the critical need to reduce healthcare-associated infections (HAIs) and the rising global burden of antimicrobial resistance (AMR). Business trends indicate a strong focus on strategic mergers and acquisitions among key market players to consolidate technological expertise and expand geographic footprints, particularly into emerging Asian markets. Furthermore, leading companies are investing heavily in R&D to develop non-leaching, durable antimicrobial surfaces that maintain efficacy over extended periods, moving beyond traditional silver and antibiotic coatings toward novel antiseptic agents and bacteriophage technology. The competitive landscape is also seeing an increase in collaborations between medical device manufacturers and pharmaceutical companies to create combination products that offer superior infection protection.

Regional trends highlight North America and Europe as the dominant markets, driven by sophisticated healthcare infrastructure, high awareness levels, and stringent governmental mandates concerning infection control (such as CLABSI and CAUTI reduction initiatives). However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This rapid expansion in APAC is attributed to improving healthcare access, increasing healthcare expenditure, a large patient population requiring catheterization, and the ongoing development of hospital infrastructure in countries like China, India, and South Korea. Regulatory harmonization across various regions, while slow, is expected to eventually streamline market entry for advanced antimicrobial catheter products.

Segment trends underscore the dominance of the urinary catheter segment due to the high incidence of CAUTI, which represents the most common type of HAI globally. However, the vascular catheter segment, particularly focusing on central lines, is witnessing significant technological innovation, especially in neonatal and critical care applications. In terms of antimicrobial coating, the shift is increasingly towards combination coatings (e.g., chlorhexidine and silver sulfadiazine) that offer synergistic protection against a broader spectrum of microorganisms. End-user trends show hospitals remaining the largest segment, but ambulatory surgical centers and long-term care facilities are emerging as high-growth segments demanding infection-prevention solutions for outpatient and extended care environments.

AI Impact Analysis on Antimicrobial Catheter Market

Common user questions regarding AI's impact on the Antimicrobial Catheter Market revolve around how Artificial Intelligence can enhance infection prediction, optimize coating effectiveness, and personalize catheter selection based on patient risk profiles. Users are keenly interested in AI’s role in analyzing large datasets of HAI incidence, identifying high-risk environments or procedural protocols that lead to infection, and predicting antimicrobial failure. Furthermore, there is significant inquiry into AI-driven material science, specifically how machine learning algorithms can rapidly screen and design novel coating materials or optimize drug release kinetics from existing catheter coatings to maintain efficacy without promoting resistance. The core themes coalesce around improving diagnostic accuracy, optimizing preventive strategy implementation, and fostering next-generation material innovation through computational power.

- AI algorithms can analyze patient electronic health records (EHRs) and real-time vital signs to predict the risk of catheter-associated infections (CAIs) hours or days before clinical manifestation.

- Machine learning is utilized in the R&D phase to model and predict the efficacy, durability, and leaching profiles of new antimicrobial coating formulations, significantly accelerating material discovery.

- AI-powered surveillance systems monitor catheter placement, maintenance, and removal protocols in hospitals, providing immediate feedback to staff to ensure adherence to best practices and reduce human error.

- Computational models simulate microbial biofilm formation on catheter surfaces, allowing manufacturers to stress-test coating effectiveness under various physiological conditions virtually.

- Natural Language Processing (NLP) is applied to unstructured clinical notes and adverse event reports to rapidly identify emerging patterns of antibiotic resistance related to specific catheter types or brands.

- AI assists in inventory management by forecasting demand for specific antimicrobial catheter types based on seasonal infection trends and hospital surgical schedules, optimizing supply chains.

DRO & Impact Forces Of Antimicrobial Catheter Market

The Antimicrobial Catheter Market is principally driven by stringent regulatory pressures aimed at curbing healthcare-associated infections (HAIs), the rising prevalence of chronic diseases necessitating frequent catheterization, and increasing patient safety awareness globally. However, the market faces significant restraints, primarily stemming from the high cost associated with advanced antimicrobial products compared to standard catheters, which often limits adoption in budget-constrained settings. Furthermore, the persistent and evolving threat of antimicrobial resistance (AMR) raises concerns about the long-term efficacy of current coating technologies, demanding continuous and expensive innovation. Opportunities lie in developing next-generation non-antibiotic antimicrobial coatings, such as those leveraging advanced polymers or nanotechnology, and expanding market penetration into underserved outpatient and home-care settings.

Drivers include the high economic and clinical burden of HAIs, which mandates the use of prophylactic devices, especially Central Line-Associated Bloodstream Infections (CLABSI) and Catheter-Associated Urinary Tract Infections (CAUTI). Government policies and payor reimbursement mandates strongly favor preventative measures, providing a stable financial incentive for healthcare facilities to adopt premium infection control products. Restraints are centered on the potential for leaching of antimicrobial agents into the patient's bloodstream, causing systemic toxicity, and the inherent risk of promoting antibiotic resistance if coatings are misused or improperly formulated. Moreover, challenges related to standardization and regulatory approval for novel antimicrobial agents can slow down product commercialization.

Impact forces are heavily weighted toward regulatory shifts and technological breakthroughs. A major impact force is the widespread integration of infection prevention protocols into standard hospital practice worldwide, moving antimicrobial catheters from specialized products to standard-of-care in high-risk procedures. The growing geriatric population, often requiring chronic indwelling devices, further solidifies market demand. Opportunities also include geographic expansion into high-growth emerging economies where infrastructure investment is accelerating. The market’s trajectory will be significantly shaped by successful R&D efforts to create sustainable, resistance-proof antimicrobial solutions that overcome the cost barriers currently limiting broader global adoption.

Segmentation Analysis

The Antimicrobial Catheter Market segmentation provides a granular view of product usage across various clinical settings and technological platforms. The market is primarily divided based on the type of product (e.g., cardiovascular, urological), the coating material utilized (defining the infection prevention mechanism), the specific application (e.g., dialysis, general surgery), and the end-user environment. Analyzing these segments helps stakeholders understand areas of high demand, technological focus, and regional preferences, informing strategic marketing and product development decisions. The urinary catheter segment remains the largest volume consumer, while the central venous catheter segment drives technological value due to the critical nature of its application and the severity of associated infections.

Coating technology is a crucial differentiator, with silver alloy coatings historically dominating due to their broad-spectrum efficacy and proven safety record. However, antibiotic-impregnated catheters (such as those using minocycline and rifampin) are prevalent in critical care settings for their potent initial activity against key pathogens. Newer segments are focusing on heparin-coated and polymer-based antiseptic barriers, aiming for long-term protection without relying on traditional antibiotics, aligning with global efforts to minimize antibiotic overuse and mitigate resistance development. The end-user classification reflects the shift in healthcare delivery, noting increased demand from specialized clinics and diagnostic centers beyond traditional inpatient hospital care.

- By Product Type:

- Central Venous Catheters (CVCs)

- Peripherally Inserted Central Catheters (PICCs)

- Urinary Catheters (Foley, Intermittent)

- Dialysis Catheters

- General Surgery Catheters

- By Material/Coating Type:

- Silver Alloy Coatings

- Antibiotic-Impregnated Catheters (e.g., Minocycline/Rifampin, Gentamicin)

- Chlorhexidine/Silver Sulfadiazine (CSS) Coatings

- Non-leaching Antiseptic Coatings

- By Application:

- Cardiology

- Urology

- Oncology

- Gastroenterology

- Dialysis

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics

- Long-Term Care Facilities

Value Chain Analysis For Antimicrobial Catheter Market

The value chain for the Antimicrobial Catheter Market begins with raw material suppliers, focusing heavily on specialized medical-grade polymers (like silicone, polyurethane) and the complex sourcing of antimicrobial agents (silver compounds, pharmaceutical antibiotics, or novel antiseptic chemicals). The upstream phase involves rigorous quality control and material science research to ensure compatibility, biocompatibility, and optimal drug/agent release kinetics. Key challenges in this phase include securing high-purity materials that meet stringent regulatory standards (FDA, CE Mark) and managing the volatile pricing of specialized antimicrobial inputs, which directly influences production costs and final product pricing strategies across different market tiers.

The midstream process, involving manufacturing and coating application, is highly capital-intensive, requiring specialized extrusion, molding, and proprietary surface modification technologies to uniformly and safely impregnate or coat the catheter substrate. This phase is dominated by large medical device manufacturers with the necessary infrastructure for sterilization, packaging, and regulatory compliance validation. Distribution channels form the critical link to the downstream market, relying on a mix of direct sales forces for large hospital systems and specialized medical distributors for smaller clinics and international markets. Due to the high-stakes nature of these medical devices, direct channels are often preferred to ensure precise inventory management, staff training, and rapid response to product issues.

Downstream analysis focuses on end-users, primarily hospitals and surgical centers, where purchasing decisions are driven by clinical efficacy data, total cost of ownership (including reduced HAI costs), and adherence to institutional infection control protocols. Indirect distribution through Group Purchasing Organizations (GPOs) plays a major role, negotiating bulk contracts for standardized products. The entire value chain is heavily influenced by post-market surveillance and continuous feedback loops from clinicians to R&D teams, essential for iterative product improvements and addressing potential resistance issues, thereby sustaining product relevance in a rapidly evolving clinical environment.

Antimicrobial Catheter Market Potential Customers

The primary and largest segment of potential customers for antimicrobial catheters consists of acute care hospitals, particularly those with high-volume intensive care units (ICUs), surgical wards, and neonatal units. These environments inherently utilize central venous, urinary, and arterial catheters extensively, leading to a high baseline risk of catheter-associated infections. Hospital procurement departments, clinical infection control teams, and interventional physicians (urologists, cardiologists, intensivists) are the key decision-makers, prioritizing products with robust clinical evidence supporting infection reduction and cost-effectiveness analysis demonstrating lower total treatment costs compared to managing an HAI.

Secondary potential customers include Ambulatory Surgical Centers (ASCs) and specialized outpatient clinics that perform procedures requiring temporary catheter placement, though their volume requirements differ significantly from large tertiary hospitals. The demand here is growing rapidly as more complex procedures shift to outpatient settings, increasing the need for preventative infection control measures in non-hospital environments. Additionally, long-term care facilities and home healthcare providers represent an emerging customer base, particularly for chronic patients requiring long-term indwelling urinary or peritoneal catheters, where the risk of long-term colonization and infection is persistent.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,500 Million |

| Market Forecast in 2033 | USD 7,100 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton, Dickinson and Company (BD), Teleflex Incorporated, B. Braun Melsungen AG, Cook Medical, Medtronic plc, Boston Scientific Corporation, Cardinal Health, AngioDynamics, Inc., Baxter International Inc., R. Bard, Inc. (now BD), PFM Medical AG, Smiths Medical, Vygon S.A., Getinge AB, 3M Company, Johnson & Johnson, Stryker Corporation, Terumo Corporation, Argos Medical, Teleflex Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antimicrobial Catheter Market Key Technology Landscape

The technology landscape of the Antimicrobial Catheter Market is rapidly shifting towards proactive, non-leaching surface modifications to minimize the risk of developing microbial resistance while ensuring long-term efficacy. Traditional technologies relied heavily on eluting agents, such as silver ions or antibiotics (Minocycline/Rifampin), which are effective in the short term but risk leaching out and contributing to resistance over prolonged use. The current focus is on developing advanced polymeric materials that possess inherent antimicrobial properties or are capable of sustained, controlled release over weeks rather than days. This includes surface modification techniques like plasma treatment or covalent immobilization of antimicrobial peptides (AMPs) or bacteriostatic polymers directly onto the catheter substrate, ensuring the agent remains fixed while inhibiting microbial adhesion and growth.

A significant technological push involves nanotechnology, utilizing nanoparticles of silver or other broad-spectrum agents embedded within the catheter matrix to provide a sustained, high-surface-area protective barrier. Furthermore, novel approaches are exploring hybrid coatings, combining antithrombogenic properties (such as heparin or specialized polymers) with antimicrobial function to simultaneously address the dual threats of infection and clotting, both common complications of indwelling catheters. The regulatory environment strongly influences technological choices; devices utilizing non-antibiotic agents are gaining favor due to simplified approval pathways compared to antibiotic-impregnated devices, which face stricter scrutiny regarding resistance development.

The integration of sensing technology also represents a future trend, where smart catheters incorporate biosensors capable of detecting early signs of biofilm formation or localized infection indicators (like pH changes or specific bacterial enzymes). This convergence of material science, nanotechnology, and diagnostic capabilities aims to create self-monitoring catheters that inform clinicians before a full-blown infection develops. This technological evolution underscores the market's commitment to moving beyond simple microbial killing to comprehensive, preventative, and predictive infection management tailored for long-term clinical usage.

Regional Highlights

- North America: This region holds the largest market share, driven by highly established healthcare systems, rigorous infection control mandates (CDC, CMS), and significant healthcare spending. The U.S. market is characterized by rapid adoption of premium-priced, advanced antimicrobial technologies, especially in Central Venous Catheters (CVCs), largely due to strong reimbursement incentives tied to CLABSI prevention programs. High awareness of antibiotic resistance among clinicians further fuels demand for non-antibiotic coatings.

- Europe: The European market is mature, with a strong emphasis on evidence-based medicine and standardized clinical guidelines, particularly within the UK, Germany, and France. Adoption is high, supported by the European Centre for Disease Prevention and Control (ECDC) initiatives to reduce HAIs. However, pricing pressures and varied procurement policies across member states present a challenging yet stable environment for market penetration.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive infrastructure development in countries like China and India, increasing healthcare accessibility, and a large patient base requiring dialysis and complex surgical interventions. While cost sensitivity remains a factor, rising healthcare expenditure and growing adoption of Western standards of infection control are accelerating the shift from standard to antimicrobial catheters.

- Latin America (LATAM): Growth in LATAM is moderate, influenced by inconsistent healthcare expenditure and infrastructure quality. Market adoption is concentrated in private healthcare sectors and major urban centers in countries like Brazil and Mexico. The rising prevalence of chronic conditions, particularly diabetes and cardiovascular diseases, necessitates increased catheter usage, driving underlying demand.

- Middle East and Africa (MEA): This region is characterized by steady growth, driven primarily by government investments in advanced medical infrastructure, particularly in the Gulf Cooperation Council (GCC) states. The high prevalence of infections and focus on establishing world-class specialty care facilities are key market stimuli, leading to increasing import and adoption of globally recognized antimicrobial catheter products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antimicrobial Catheter Market.- Becton, Dickinson and Company (BD)

- Teleflex Incorporated

- B. Braun Melsungen AG

- Cook Medical

- Medtronic plc

- Boston Scientific Corporation

- Cardinal Health

- AngioDynamics, Inc.

- Baxter International Inc.

- R. Bard, Inc. (now part of BD)

- PFM Medical AG

- Smiths Medical

- Vygon S.A.

- Getinge AB

- 3M Company

- Johnson & Johnson

- Stryker Corporation

- Terumo Corporation

- Argos Medical

Frequently Asked Questions

Analyze common user questions about the Antimicrobial Catheter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of antimicrobial catheters in healthcare?

The primary function is to prevent Hospital-Acquired Infections (HAIs), specifically Catheter-Associated Urinary Tract Infections (CAUTI) and Central Line-Associated Bloodstream Infections (CLABSI), by inhibiting microbial colonization on the catheter surface using specialized coatings like silver, chlorhexidine, or antibiotics.

Which type of antimicrobial coating is currently showing the most promise against resistance?

Non-antibiotic coatings, including those utilizing advanced polymers, antimicrobial peptides (AMPs), and nanotechnology-embedded silver or metal alloys, are demonstrating significant promise as they offer broad-spectrum protection without directly contributing to traditional antibiotic resistance.

How does the cost of antimicrobial catheters affect market adoption?

Antimicrobial catheters generally have a higher upfront cost than standard catheters, restraining adoption in budget-sensitive regions. However, this is increasingly offset by the long-term cost savings associated with preventing expensive HAI treatments and associated extended hospital stays.

Which geographic region currently dominates the Antimicrobial Catheter Market?

North America currently dominates the market share due to its stringent regulatory environment, advanced healthcare infrastructure, high awareness regarding infection control mandates, and significant investment in preventative medical technologies.

What are the main segments driving technological innovation in this market?

The Central Venous Catheter (CVC) segment is the primary driver of technological innovation, focusing on developing combination anti-infective and anti-thrombogenic coatings crucial for minimizing severe bloodstream infections in critical care settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager