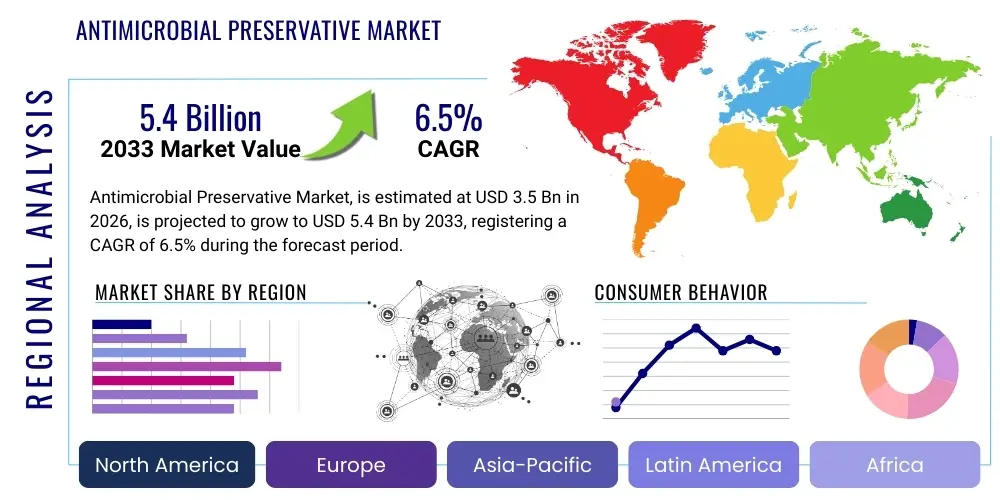

Antimicrobial Preservative Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438249 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Antimicrobial Preservative Market Size

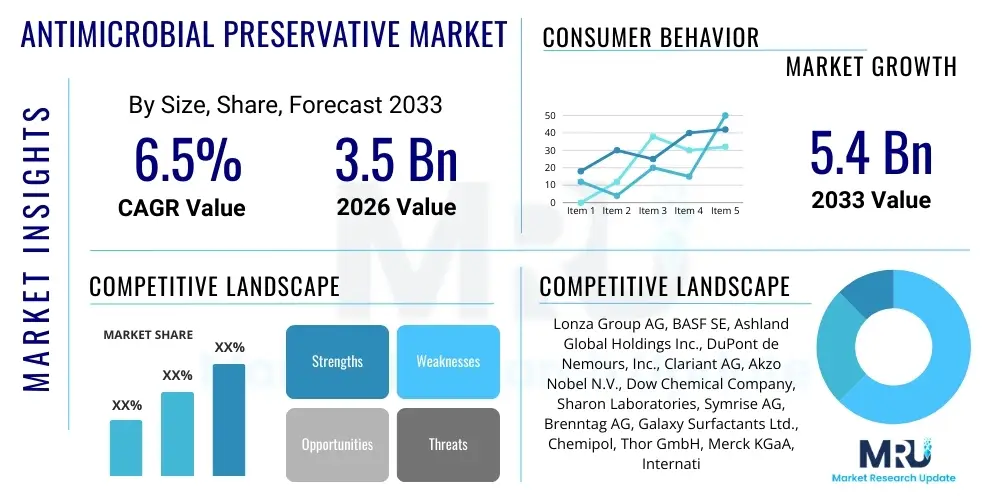

The Antimicrobial Preservative Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Antimicrobial Preservative Market introduction

The Antimicrobial Preservative Market encompasses a critical segment within the specialty chemicals industry, dedicated to ensuring the safety, efficacy, and extended shelf life of various consumer and industrial products. These substances are integrated into formulations across diverse sectors, including food and beverage, pharmaceuticals, personal care and cosmetics, and paints and coatings, primarily to inhibit the proliferation of undesirable microorganisms such as bacteria, yeast, and mold. The fundamental purpose of these preservatives is twofold: preventing product spoilage which maintains aesthetic quality and functional integrity, and crucially, safeguarding consumer health by mitigating the risk of microbial contamination that could lead to infections or illnesses.

Antimicrobial preservatives, often categorized as synthetic (like parabens, formaldehydes, and isothiazolinones) or natural (such as essential oils, organic acids, and certain peptides), function by disrupting microbial cell membranes, interfering with enzymatic pathways, or inhibiting DNA replication. The recent shift in market dynamics is strongly favoring naturally derived and 'clean label' preservative systems due to heightened consumer awareness regarding synthetic chemical exposure and stringent regulatory oversight in regions like the European Union and North America. This transition demands significant research and development investment in novel compounds that offer broad-spectrum protection without the associated safety concerns of traditional alternatives.

The major applications driving the sustained growth of this market include the global expansion of packaged food consumption, especially ready-to-eat meals, and the increasing demand for high-quality, long-lasting cosmetic formulations. Benefits derived from effective antimicrobial preservation include reduced product waste, enhanced consumer confidence in product safety, and adherence to complex international storage and transport regulations. Key driving factors involve stricter food safety standards implemented by governmental bodies worldwide and the general trend of product globalization, which necessitates longer transit and shelf-life durations, making stable and potent preservation systems indispensable for modern supply chains.

Antimicrobial Preservative Market Executive Summary

The Antimicrobial Preservative Market is characterized by robust resilience fueled by mandatory regulatory requirements and continuous innovation focused on safety and sustainability. Current business trends indicate a definitive movement away from traditional, highly regulated synthetic compounds toward sophisticated, natural, and multi-functional preservation systems. Companies are increasingly investing in proprietary blends and encapsulation technologies to enhance efficacy and reduce the necessary concentration of active ingredients, thereby mitigating regulatory scrutiny and addressing consumer demand for minimized chemical load. Mergers and acquisitions are common as larger chemical entities seek to acquire specialized expertise in bio-based and clean-label ingredients, consolidating market power and accelerating the pace of portfolio diversification in response to evolving consumer preferences.

Regionally, the market presents a dichotomy. Mature markets such as North America and Europe are dominated by innovation and adherence to stringent ‘free-from’ lists (e.g., paraben-free, formaldehyde-free), focusing on premium, high-value natural ingredients and specialized preservatives for pharmaceutical use. Conversely, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, primarily driven by rapid urbanization, burgeoning middle-class consumer spending on packaged goods and cosmetics, and less stringent, though rapidly evolving, local regulatory frameworks. The increasing penetration of international personal care brands in countries like China and India further accelerates the demand for globally compliant preservation solutions, making APAC a critical hub for future market expansion.

Segment trends reveal that the Food & Beverage sector remains the largest application segment, demanding high volumes of cost-effective preservatives, particularly organic acids like sorbates and benzoates. However, the fastest-growing segment is the Cosmetics and Personal Care industry, which prioritizes performance and consumer perception, showing strong adoption of alternative preservatives, multifunctional ingredients, and hurdle technology approaches where several mild preservation methods are combined. The Type segment confirms the strong transition: while synthetic preservatives still hold significant market share due to cost-effectiveness, the natural/bio-based preservatives segment is expanding at an accelerated pace, capturing premium pricing and addressing long-term sustainability goals across all major end-use industries.

AI Impact Analysis on Antimicrobial Preservative Market

Common user questions regarding AI's influence in the Antimicrobial Preservative Market center around themes of prediction, personalization, safety assurance, and speed-to-market. Users frequently inquire about how Artificial Intelligence can accelerate the discovery of novel preservative molecules, particularly bio-based alternatives, and how AI-driven predictive modeling can evaluate the potential toxicity and long-term stability of new compounds before costly laboratory synthesis. Key concerns also revolve around AI’s ability to manage the overwhelming complexity of global regulatory databases, ensuring formulations remain compliant across various jurisdictions. Essentially, users expect AI to significantly compress the R&D cycle, enhance formulation efficacy by optimizing synergistic blends, and provide a higher degree of safety assurance regarding microbial challenges and potential human health impacts, thereby transforming preservation science from reactive testing to proactive design.

The deployment of AI and machine learning (ML) models is revolutionizing the development and application of antimicrobial preservatives. By analyzing vast datasets encompassing chemical structures, microbial resistance patterns, efficacy testing results, and toxicological profiles, AI algorithms can identify novel chemical motifs or natural extracts with high preservative potential at an unprecedented speed. This data-driven approach significantly reduces the reliance on traditional, iterative screening processes, which are time-consuming and expensive. Furthermore, AI tools are invaluable in formulating complex product matrices, predicting how preservative efficacy might change based on pH, temperature, or the presence of other ingredients, enabling formulators to achieve optimal protection with minimum preservative load, aligning perfectly with 'clean label' requirements.

Beyond discovery and formulation, AI plays a crucial role in regulatory intelligence and quality control. ML systems can continuously monitor global regulatory changes (e.g., updates to Annex V of the EU Cosmetics Regulation or FDA guidelines) and automatically flag potential compliance risks for existing product portfolios or new developments. In manufacturing, AI-powered image recognition and sensing technologies are being integrated into production lines to monitor microbial contamination in real-time, providing immediate feedback loops that drastically enhance quality assurance and reduce costly batch rejections due to spoilage, fundamentally improving supply chain integrity from raw material sourcing to final packaging.

- Accelerated discovery of novel preservative candidates using predictive toxicology and efficacy modeling.

- Optimization of complex preservative blends (hurdle technology) to maximize protection while minimizing concentration.

- Real-time monitoring and detection of microbial contamination during manufacturing via AI-powered sensors.

- Automated compliance checks against dynamic global regulatory databases (AEO/GEO optimization).

- Predictive analysis of long-term product stability and shelf-life extension under various environmental stressors.

DRO & Impact Forces Of Antimicrobial Preservative Market

The dynamics of the Antimicrobial Preservative Market are shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively define the Impact Forces influencing market growth trajectory. The primary driver is the escalating global focus on food safety and pharmaceutical integrity, mandated by stringent governmental regulations and international standards bodies. Consumers’ heightened awareness regarding product lifespan and safety against pathogenic microorganisms necessitates the inclusion of highly effective preservation systems across all product categories. Simultaneously, urbanization and changing lifestyles, which increase reliance on processed, packaged, and convenience foods, demand longer shelf lives and robust microbial protection, continuously fueling the demand for these ingredients. This mandatory requirement for safety compliance acts as a fundamental growth accelerator.

Conversely, the market faces considerable Restraints, notably public perception and regulatory pressure against synthetic preservatives, particularly parabens, formaldehyde releasers, and specific isothiazolinones, due to perceived health risks such as endocrine disruption or sensitization. This negative consumer sentiment forces manufacturers into costly reformulation efforts and drives up raw material costs as they seek acceptable, often more expensive, natural alternatives. Furthermore, the constant evolution of microbial resistance necessitates ongoing R&D investment, creating a challenge for established preservatives which may require higher concentrations or combination strategies, potentially compounding toxicity concerns and regulatory hurdles. The technical difficulty in achieving broad-spectrum efficacy using natural ingredients while maintaining cost competitiveness and formulation compatibility remains a critical constraint.

The key Opportunities lie in the innovation surrounding bio-based and clean-label preservatives, including compounds derived from fermentation, plant extracts, and marine sources, which address both efficacy and consumer preference for natural ingredients. The growing demand for 'free-from' and 'green' products opens significant premium market segments. Additionally, technological advances in delivery systems, such as nano-encapsulation, allow for targeted release and enhanced stability of preservatives, maximizing their effectiveness at lower concentrations and overcoming common formulation compatibility issues. Geographically, untapped markets in developing economies undergoing rapid modernization present substantial growth potential for both basic and advanced preservation technologies, particularly within the expanding middle-class consumer base seeking safe and reliable imported or locally produced consumer goods.

Segmentation Analysis

The Antimicrobial Preservative Market is comprehensively segmented based on Type, Application, and Function, providing a granular view of market dynamics and adoption trends. Segmentation by Type distinguishes between Synthetic and Natural preservatives, highlighting the ongoing shift in formulation preference towards bio-based solutions despite the cost-effectiveness and proven efficacy of conventional synthetic ingredients. The application segmentation, which includes Food & Beverage, Cosmetics & Personal Care, Pharmaceuticals, and others (like paints and industrial products), clarifies which end-use industries are driving volume versus value growth. Functional segmentation further details how these substances work, separating them into categories such as anti-bacterial, anti-fungal, and broad-spectrum agents, reflecting the specific microbial threats manufacturers must address in different product matrices.

- By Type:

- Synthetic Preservatives (e.g., Parabens, Formaldehyde Releasers, Benzoates, Sorbates, Isothiazolinones, Phenoxyethanol)

- Natural Preservatives (e.g., Essential Oils, Rosemary Extract, Natamycin, Nisin, Organic Acids, Fermentation Products)

- By Application:

- Food & Beverage (e.g., Dairy, Bakery, Meat, Beverages, Ready-to-Eat Meals)

- Cosmetics & Personal Care (e.g., Skin Care, Hair Care, Toiletries, Color Cosmetics)

- Pharmaceuticals (e.g., Injectables, Oral Liquids, Topical Medications)

- Others (e.g., Paints & Coatings, Adhesives, Detergents, Water Treatment)

- By Function:

- Anti-Bacterial Agents

- Anti-Fungal Agents (Anti-Yeast and Anti-Mold)

- Broad-Spectrum Antimicrobials

Value Chain Analysis For Antimicrobial Preservative Market

The value chain for the Antimicrobial Preservative Market begins with the upstream sourcing of foundational raw materials, which vary significantly based on the preservative type. For synthetic preservatives, this involves petrochemical derivatives and commodity chemicals, requiring stable access to basic chemical feedstock. For natural preservatives, the complexity lies in sourcing high-quality, sustainable botanical extracts, bio-fermentation products, or microbial cultures, which demands specialized agricultural and biotechnological expertise and often involves volatile pricing and quality control challenges related to purity and concentration of the active compounds. Robust research and development activities form a critical input at this stage, focusing on novel synthesis pathways and biological engineering techniques to produce efficient and compliant ingredients that meet increasing market safety demands.

The core manufacturing and processing stage involves complex chemical synthesis, blending, purification, and, increasingly, advanced functionalization processes like micro- and nano-encapsulation to improve ingredient performance and stability within the final product matrix. Quality assurance and regulatory compliance testing are paramount at this stage, ensuring the preservatives meet specific pharmacopeial standards or food-grade criteria before being distributed. Midstream, the market is highly fragmented, featuring large multinational chemical producers alongside specialized, agile providers focusing solely on niche bio-based solutions. Competition centers on production efficiency, intellectual property protection for proprietary blends, and achieving scale necessary for cost-effective supply to high-volume end-users.

Downstream analysis focuses on the distribution channels and end-user integration. Distribution is typically B2B, relying on specialized chemical distributors and agents who manage complex inventory and regulatory documentation, particularly for cross-border shipments. Direct sales are common for large volume transactions involving major pharmaceutical or consumer packaged goods (CPG) conglomerates, where technical support and custom formulation assistance are integral to the sale. The end-users (manufacturers of cosmetics, food, or pharmaceuticals) integrate these preservatives into their final product formulations. Key success factors at this final stage include the supplier's ability to provide high technical reliability, consistency in supply, and robust regulatory dossiers that ease the product registration process for the final manufacturer in various global markets.

Antimicrobial Preservative Market Potential Customers

Potential customers, or end-users, of antimicrobial preservatives span several large, regulatory-heavy industries, each possessing distinct purchasing criteria and technical requirements. The largest segment comprises manufacturers in the Food & Beverage industry, ranging from large multinational food conglomerates specializing in processed snacks, ready meals, and packaged beverages, to local bakeries and dairy producers. These customers prioritize cost-effectiveness, broad efficacy against common food spoilage organisms (mold and yeast), minimal sensory impact (taste and odor), and adherence to food additive regulations like FDA Generally Recognized as Safe (GRAS) status or equivalent international standards. Their primary motive is preventing product recall and extending shelf life to support extensive supply chains.

The second major customer group includes Cosmetics and Personal Care manufacturers, from luxury cosmetic brands to mass-market producers of shampoos and lotions. For this segment, the focus has shifted dramatically toward 'free-from' claims, driving demand for natural, non-irritating, and multifunctional alternatives, often at a premium price point. These customers require preservatives that are stable in complex emulsion systems, compatible with sophisticated active ingredients, and that minimize skin sensitization risk, thereby adhering to strict consumer safety standards, particularly in the European and North American markets. Technical support regarding formulation stability and consumer perception management is highly valued by these buyers.

The third critical customer base is the Pharmaceutical industry, encompassing manufacturers of sterile injectables, oral suspensions, and topical drug products. This sector imposes the most stringent quality and documentation requirements, necessitating preservatives that meet pharmacopeial monographs (USP, EP, JP) and exhibit proven compatibility with the active pharmaceutical ingredients (APIs). These buyers prioritize absolute efficacy against specific pathogens relevant to healthcare-associated infections, unparalleled purity, comprehensive regulatory documentation (Drug Master Files or DMFs), and assured consistency in supply, often overlooking cost-efficiency in favor of safety and regulatory compliance essential for life-saving and essential medicines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group AG, BASF SE, Ashland Global Holdings Inc., DuPont de Nemours, Inc., Clariant AG, Akzo Nobel N.V., Dow Chemical Company, Sharon Laboratories, Symrise AG, Brenntag AG, Galaxy Surfactants Ltd., Chemipol, Thor GmbH, Merck KGaA, International Flavors & Fragrances (IFF), LANXESS AG, Kemin Industries, Cargill, Incorporated, Tate & Lyle PLC, Wacker Chemie AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antimicrobial Preservative Market Key Technology Landscape

The technological landscape of the Antimicrobial Preservative Market is rapidly evolving, moving beyond the simple application of bulk chemicals to incorporate sophisticated delivery and formulation science. A pivotal technological shift involves the utilization of 'Hurdle Technology,' which is not a single product but a strategy combining multiple mild preservation methods (hurdles) such as low pH, reduced water activity, mild thermal treatment, and the application of low-concentration preservatives. This synergistic approach maximizes microbial stability while minimizing reliance on high concentrations of any single, potentially controversial, preservative, aligning perfectly with consumer demand for fewer synthetic ingredients and cleaner labels. This technology requires advanced formulation understanding and predictive modeling to balance the hurdles effectively within a given product matrix, demanding high-level expertise from ingredient suppliers.

Another dominant technology driving innovation is micro- and nano-encapsulation. This technique involves coating the active preservative molecules within a microscopic protective shell (often lipid or polymer-based), offering several crucial advantages. Encapsulation protects the preservative from degradation within the formulation (e.g., from light or high pH environments), allows for controlled or targeted release over the product's lifespan, and significantly improves compatibility with sensitive ingredients that might otherwise be inhibited by the preservative. Furthermore, encapsulation often masks unpleasant odors or tastes associated with certain potent natural preservatives, making them viable for a broader range of applications, particularly in the flavor-sensitive food and beverage sector. This focus on maximizing efficacy through targeted delivery represents a major area of competitive differentiation.

The third major technological focus is the advancement in green chemistry and biotechnology for the production of novel bio-based preservatives. This includes high-throughput screening of microbial metabolites, such as bacteriocins (like Nisin) or anti-fungal peptides, derived through fermentation. Modern biotechnology utilizes genetic engineering to optimize microbial strains for higher yield and purity of these natural antimicrobial compounds. Complementary to this is the use of high-tech extraction processes (e.g., supercritical fluid extraction) for plant-derived antimicrobials, ensuring maximum potency and purity while adhering to environmentally sustainable production protocols. The integration of high-throughput screening (HTS) and AI-driven data analysis is essential in rapidly assessing the efficacy, non-toxicity, and stability of these newly discovered bio-preservative candidates, accelerating their commercialization timeline and offering sustainable alternatives to synthetic staples.

Regional Highlights

The global Antimicrobial Preservative Market displays significant regional variances driven by local regulatory climates, consumer preferences, and industrial growth rates. North America, representing a substantial portion of the market, is characterized by its mature pharmaceutical and personal care industries. Demand here is strongly influenced by strict FDA regulations regarding pharmaceutical sterility and a highly vocal consumer base demanding ‘free-from’ formulations (e.g., paraben-free, sulfate-free). This region is a major early adopter of advanced natural preservatives and encapsulation technologies, placing a premium on scientific validation and safety dossiers. The large processed food industry also creates steady demand for high-volume, regulated preservatives.

Europe holds a unique position, defined by the stringent implementation of regulations such as REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and the EU Cosmetics Regulation (Annex V). These regulatory frameworks have necessitated continuous reformulation and the substitution of many traditional synthetic preservatives, propelling Europe to the forefront of the natural and multifunctional preservative movement. The European consumer is highly sensitive to environmental and toxicity claims, creating robust demand for certified organic and sustainable ingredients, validated by certifications like Ecocert. This market focuses heavily on innovation that ensures high efficacy under lower concentration limits enforced by regulation.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid economic development, industrialization, and explosive growth in the consumer packaged goods (CPG) sector across countries like China, India, and Southeast Asia. The expanding middle class is driving massive consumption of processed foods and Western-style cosmetic products, requiring reliable preservation systems to support large-scale manufacturing and complex distribution logistics. While local regulations are becoming stricter, the sheer volume of production and relatively lower average product cost often leads to a higher utilization rate of cost-effective synthetic preservatives, although the shift toward natural alternatives is gaining significant momentum in premium urban markets.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets characterized by strong growth in domestic manufacturing and increasing integration into global supply chains. In LATAM, regulatory harmonization efforts (e.g., Mercosur) influence market dynamics, creating demand for globally compliant preservatives, especially in cosmetics. In MEA, rapid population growth and expanding packaged food imports drive foundational demand for robust and cost-effective preservation solutions, often requiring stability against challenging climatic conditions (high heat and humidity), which is a key technical consideration for suppliers operating within these diverse geographical segments.

- North America: Focus on stringent pharmaceutical standards, advanced technology adoption (encapsulation), and high consumer demand for ‘clean label’ cosmetics.

- Europe: Driven by REACH compliance, early adoption of sustainable and natural alternatives, and strict restrictions on synthetic preservative lists (Annex V).

- Asia Pacific (APAC): Highest growth rate due to urbanization, expansion of the CPG and F&B sectors, and increasing regulatory complexity in key economies like China.

- Latin America (LATAM) & MEA: Emerging markets characterized by increasing domestic manufacturing, requiring climate-stable and cost-effective broad-spectrum preservatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antimicrobial Preservative Market.- Lonza Group AG

- BASF SE

- Ashland Global Holdings Inc.

- DuPont de Nemours, Inc.

- Clariant AG

- Akzo Nobel N.V.

- Dow Chemical Company

- Sharon Laboratories

- Symrise AG

- Brenntag AG

- Galaxy Surfactants Ltd.

- Chemipol

- Thor GmbH

- Merck KGaA

- International Flavors & Fragrances (IFF)

- LANXESS AG

- Kemin Industries

- Cargill, Incorporated

- Tate & Lyle PLC

- Wacker Chemie AG

Frequently Asked Questions

Analyze common user questions about the Antimicrobial Preservative market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the natural antimicrobial preservatives segment?

The primary driver is heightened consumer demand for clean-label products, coupled with increasing regulatory scrutiny and restrictions on synthetic preservatives like parabens and formaldehyde releasers, forcing manufacturers to adopt bio-based alternatives.

How do global regulations, such as the EU's REACH, impact preservative market trends?

Regulations like REACH fundamentally reshape the market by enforcing rigorous safety testing, data documentation, and restrictions on certain chemicals, leading to continuous reformulation efforts and favoring suppliers who provide compliant, well-documented, and safe ingredients.

What are the main technical challenges in replacing synthetic preservatives with natural ones?

Natural preservatives often lack the broad-spectrum efficacy, thermal stability, and low cost of synthetics. They can also face challenges regarding odor, color impact, and compatibility within complex cosmetic or food formulations, necessitating innovative delivery systems like encapsulation.

Which application segment holds the largest share in the Antimicrobial Preservative Market?

The Food & Beverage industry currently holds the largest market share, driven by the massive global consumption of packaged, processed foods and the mandatory requirement for extended shelf life and microbial safety to prevent spoilage and contamination.

How does encapsulation technology improve preservative performance?

Encapsulation technology enhances performance by protecting the active preservative agent from degradation, enabling controlled release over time, masking undesirable sensory characteristics, and improving compatibility with other sensitive ingredients in the final product formulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager