Antimony Tin Oxide ATO Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434054 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Antimony Tin Oxide ATO Powder Market Size

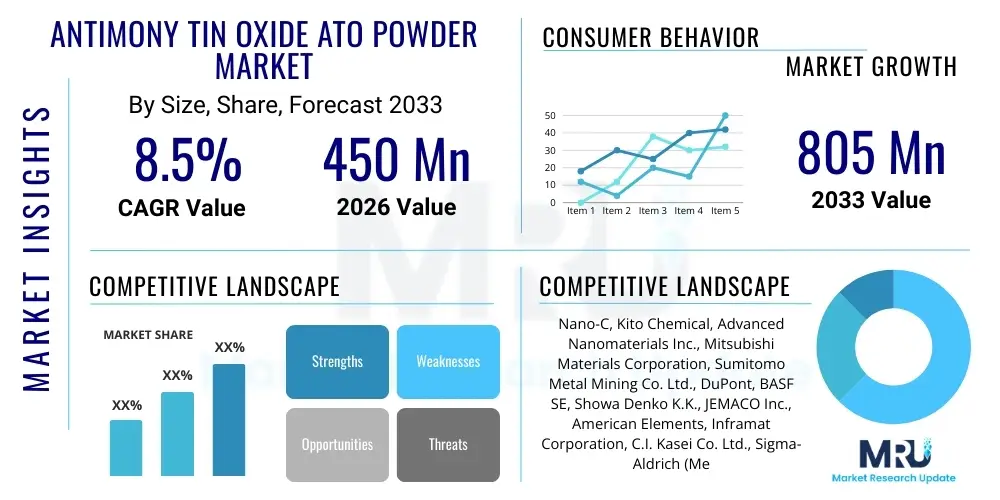

The Antimony Tin Oxide ATO Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033.

Antimony Tin Oxide ATO Powder Market introduction

The Antimony Tin Oxide (ATO) Powder Market encompasses the production, distribution, and utilization of this advanced compound, which is highly valued for its unique combination of electrical conductivity and optical transparency. ATO, a blue powder primarily composed of tin oxide doped with antimony, serves critical functions across several high-tech industries. Its primary market drivers are the increasing demand for high-performance anti-static materials in electronics and the growing adoption of energy-efficient solutions requiring infrared shielding, particularly in automotive and architectural glass.

Product descriptions of ATO emphasize its role as a functional additive, often incorporated into polymers, coatings, and inks. ATO powder is characterized by excellent dispersion stability and high thermal stability, making it superior to traditional conductive materials like carbon black or metallic nanoparticles in applications where visual clarity is paramount. Major applications include anti-static packaging, conductive polymers used in electronic component manufacturing, solar cells, and transparent heat-insulating coatings for buildings and vehicles. The compound’s ability to selectively block near-infrared radiation while maintaining high visible light transmission is a key benefit underpinning its utility in sustainable building technology and display technology.

The market growth is substantially driven by the rapid expansion of the consumer electronics sector, necessitating sophisticated anti-static protection for sensitive components, and the global push toward enhanced energy efficiency in infrastructure. Furthermore, advancements in nanoparticle synthesis and dispersion techniques are constantly improving the performance and reducing the loading requirements of ATO in end products, thereby expanding its applicability into highly demanding sectors such as aerospace and advanced sensor technology. Regulatory support for energy-saving materials further solidifies the market's trajectory.

Antimony Tin Oxide ATO Powder Market Executive Summary

The Antimony Tin Oxide (ATO) Powder Market is experiencing robust expansion, fundamentally driven by technological advancements in display panel manufacturing and sustained demand from the anti-static packaging industry. Current business trends indicate a strong move toward ultrafine and nano-sized ATO powders, which offer superior conductivity and transparency at lower loading levels, pushing manufacturers to invest heavily in advanced synthesis techniques such as hydrothermal and precipitation methods. Key players are focused on strategic collaborations and vertical integration to secure stable supply chains for raw materials (antimony and tin), which are subject to significant price volatility. Sustainability considerations are also becoming pivotal, with increased emphasis on solvent-free dispersion systems for ATO coatings.

Regionally, the Asia Pacific (APAC) dominates the ATO market, largely due to the concentration of major electronics manufacturing hubs in countries like China, South Korea, and Japan, which are the primary consumers of anti-static and EMI shielding materials. North America and Europe demonstrate steady, high-value growth, focused primarily on high-end niche applications such as aerospace coatings, smart glass, and high-specification architectural glazing, driven by stringent energy efficiency standards. Latin America and MEA are emerging markets, showing potential growth tied to infrastructure development and increasing regional electronic assembly operations.

Segment trends highlight the dominance of the coating segment by application, owing to the widespread use of ATO in anti-static films and conductive paints. By product type, the nano-powder segment is projected to exhibit the fastest CAGR, reflecting the industry's shift towards materials that enhance optical properties without compromising electrical functionality. The automotive sector, particularly for advanced driver-assistance systems (ADAS) and thermal management in electric vehicles (EVs), represents a high-growth segment, leveraging ATO's near-infrared reflective properties to reduce cabin heat load and improve battery efficiency.

AI Impact Analysis on Antimony Tin Oxide ATO Powder Market

User queries regarding the impact of Artificial Intelligence on the ATO market primarily revolve around optimizing material synthesis processes, enhancing quality control through automated inspection, and leveraging AI to predict optimal composite formulations. Users frequently ask if AI can reduce the cost and variability associated with nano-powder production, and how machine learning (ML) models can accelerate the discovery of new dopant ratios or particle morphologies for enhanced conductivity or heat reflection. The consensus themes indicate high expectations for AI to solve complex manufacturing challenges, particularly concerning batch-to-batch consistency in high-volume production and tailoring ATO properties precisely for specialized electronic applications, such as high-frequency shielding in 5G devices or precise thermal management in AI servers.

- AI-driven optimization of hydrothermal synthesis parameters (temperature, pressure, residence time) to achieve tighter particle size distribution and higher yield.

- Machine learning models utilized for predictive maintenance of specialized high-shear dispersion equipment, minimizing downtime and ensuring stable nanoparticle suspensions.

- Enhanced quality control using computer vision and AI algorithms for rapid, automated inspection of ATO powder morphology and aggregation status, exceeding traditional manual microscopy limits.

- Simulation and modeling via AI to predict the electrical conductivity and optical transparency of ATO composites based on varying particle size, dopant concentration, and matrix polymer type.

- Accelerated research and development by AI systems screening thousands of potential surface treatments or coupling agents to improve ATO compatibility with diverse organic solvents and polymers.

DRO & Impact Forces Of Antimony Tin Oxide ATO Powder Market

The ATO Powder market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and investment decisions. The key driver is the explosive growth in the electronics and display industries, where ATO is irreplaceable for its dual function of electrical conductivity and optical clarity, essential for touch screens, OLED displays, and anti-static flooring. However, the high cost and volatile pricing of raw antimony and tin act as significant restraints, prompting end-users to seek alternative conductive materials, albeit often with performance trade-offs. The primary opportunity lies in developing advanced nano-ATO materials suitable for next-generation smart windows and sophisticated near-infrared filtering in photovoltaic systems.

Impact forces currently favoring market expansion include stringent government regulations promoting energy-efficient building materials, which mandate the use of NIR-blocking coatings in architectural glass, a core application for ATO. The increasing sophistication of sensitive electronic components requires enhanced static dissipation, further solidifying the demand for high-performance ATO coatings and plastics. Conversely, the market faces strong competitive pressure from alternative conductive materials like Indium Tin Oxide (ITO) in certain display applications and emerging materials such as silver nanowires or specialized conductive polymers in anti-static contexts, forcing ATO manufacturers to continually enhance product purity and dispersion quality.

Furthermore, regulatory actions regarding heavy metal usage and environmental safety, though generally manageable for ATO, necessitate continuous investment in environmental compliance and waste management protocols, particularly in Europe. The market structure is highly dependent on specialized synthesis expertise, creating high entry barriers and concentrating market power among a few key global producers capable of consistently delivering high-quality, ultra-fine powders. This dynamic ensures that while pricing can be volatile due to raw material costs, the specialized nature of the product minimizes the direct substitution threat in critical applications.

Segmentation Analysis

The Antimony Tin Oxide (ATO) Powder market segmentation provides crucial insights into product specialization and end-user adoption patterns, allowing manufacturers to tailor their offerings strategically. The market is primarily segmented by particle size (nano-powder vs. micro-powder), application (coatings, plastics, fibers), and end-use industry (electronics, automotive, construction). Nano-powder ATO is the premium segment, commanding higher prices due to superior performance in terms of transparency and minimal light scattering, making it essential for optical and display applications. Conversely, micro-powder ATO is cost-effective and suitable for applications where high transparency is less critical, such as conductive paints and industrial anti-static flooring.

The application segmentation reveals that the coatings segment holds the largest market share, driven by widespread use in anti-static films, heat-reflective coatings on glass, and specialized transparent conductive layers. The plastics segment is growing rapidly, incorporating ATO into various polymer matrices for injection molding and extrusion processes, enabling static dissipation in electronic packaging and component housings. Understanding these segment dynamics is vital for market participants, as investment in R&D must align with the specific requirements of each segment—for instance, focusing on high dispersibility for coating applications and high thermal stability for polymer integration.

Geographic segmentation, detailed elsewhere, underscores the concentration of demand in Asia Pacific due to manufacturing infrastructure, while product innovation remains strong in North America and Europe. The overall segmentation structure demonstrates a mature, yet highly specialized, market where performance attributes (conductivity, transparency, thermal stability) dictate market positioning and pricing strategy. Manufacturers must continuously innovate to provide powders optimized for specific processing methods, such as water-based dispersion for green chemistry initiatives or highly concentrated pastes for roll-to-roll coating processes.

- By Product Type:

- Nano-sized ATO Powder (0–100 nm)

- Micro-sized ATO Powder (100 nm and above)

- By Application:

- Coatings (Films, Paints, Inks)

- Plastics & Polymers (Compounding, Masterbatches)

- Fibers and Textiles

- Ceramics

- By End-Use Industry:

- Electronics and Semiconductors

- Automotive (Heat-Insulating Glass, ESD components)

- Construction and Architecture (Smart Windows)

- Photovoltaics (Solar Cells)

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Antimony Tin Oxide ATO Powder Market

The value chain for the Antimony Tin Oxide ATO powder market begins with the extraction and refining of raw materials, primarily high-purity tin ore (cassiterite) and antimony ore (stibnite). This upstream segment is characterized by complex global supply chains and exposure to geopolitical risks and commodity price volatility. Manufacturers of ATO must secure reliable sources of these refined metals, which often involves specialized trading houses and long-term contracts. The critical midstream process involves the chemical synthesis of ATO powder, typically through high-temperature precipitation, co-precipitation, or hydrothermal synthesis. This manufacturing stage requires significant capital investment in reaction vessels and calcination equipment, alongside specialized expertise to control particle morphology, doping ratio, and surface area, which determine the final product quality.

The downstream analysis focuses on the transformation of raw ATO powder into usable industrial products, such as stable dispersions (slurries or pastes) and masterbatches (concentrated polymer pellets). Dispersions are crucial as ATO nano-particles tend to aggregate, and effective dispersion technology is essential for achieving desired optical and electrical properties in coatings and inks. These intermediary products are then sold to end-use manufacturers. Distribution channels are highly specialized; direct sales are common for large-volume customers in the electronics and chemical sectors, especially for customized nano-dispersions, ensuring technical support and quality control. Indirect channels involve chemical distributors who serve smaller-volume users or regional markets, providing localized inventory and technical service.

The primary direct distribution channels target major architectural glass producers, large electronics assembly plants requiring precise anti-static coatings, and polymer compounders integrating ATO into engineering plastics. Indirect sales leverage specialized chemical distributors with expertise in handling functional nanomaterials, providing access to geographically dispersed customers in the automotive aftermarket, small-scale textile finishing, and R&D institutions. The high-value nature of ATO necessitates robust technical service throughout the distribution network, ensuring end-users can correctly integrate the powder or dispersion into their complex manufacturing processes without compromising material performance.

Antimony Tin Oxide ATO Powder Market Potential Customers

Potential customers for Antimony Tin Oxide (ATO) powder are highly diversified across industries where static control, electromagnetic interference (EMI) shielding, and infrared heat management are critical functional requirements. The largest segment of end-users comprises electronics and semiconductor manufacturers. These companies utilize ATO in anti-static packaging films, cleanroom furniture coatings, and conductive layers for flexible electronic displays and printed circuit boards, ensuring the longevity and reliability of highly sensitive microelectronic components. Any firm involved in the handling or manufacturing of integrated circuits, memory chips, or advanced displays constitutes a primary customer base due to the non-negotiable requirement for Electrostatic Discharge (ESD) protection.

Another significant customer category is the architectural and construction sector, specifically manufacturers of smart glass and energy-efficient window systems. These buyers require ATO-based coatings to selectively block near-infrared radiation, dramatically reducing solar heat gain inside buildings without hindering visible light, thereby achieving significant energy savings. Similarly, the automotive industry represents a crucial potential customer base. Automotive glass manufacturers use ATO to manage thermal load in vehicle interiors, and EV battery and component producers use ATO-filled plastics for lightweight EMI shielding and anti-static applications within battery casings and electronic control units.

Furthermore, specialty chemical formulators and polymer compounders are vital intermediate customers. They purchase ATO powder in bulk to formulate custom dispersions, masterbatches, and conductive inks, which they subsequently supply to smaller end-users in textiles (for anti-static apparel), advanced plastics (for explosion-proof containers), and specialized coating operations. Given the complexity of handling nano-powders, many end-users prefer pre-dispersed ATO products, making these formulators key market influencers and buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nano-C, Kito Chemical, Advanced Nanomaterials Inc., Mitsubishi Materials Corporation, Sumitomo Metal Mining Co. Ltd., DuPont, BASF SE, Showa Denko K.K., JEMACO Inc., American Elements, Inframat Corporation, C.I. Kasei Co. Ltd., Sigma-Aldrich (Merck KGaA), Qingdao Xinguang Zhengwei Chemical Co., Shenzhen Nonferrous Metal Technology Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antimony Tin Oxide ATO Powder Market Key Technology Landscape

The technological landscape of the ATO market is dominated by synthesis methods aimed at controlling particle size and morphology, crucial for optimizing electrical conductivity and optical transparency. The transition from traditional solid-state reaction methods to wet-chemical routes, such as co-precipitation and hydrothermal synthesis, represents the most significant technological shift. Hydrothermal synthesis, in particular, allows for precise control over the doping ratio of antimony within the tin oxide lattice, resulting in highly crystalline, uniform, nano-sized particles (typically below 50 nm). This superior control minimizes light scattering, which is paramount for high-definition display applications and transparent solar coatings. Manufacturers are continually refining these processes to reduce energy consumption and achieve higher batch consistency.

A second critical area of technology focuses on surface modification and dispersion techniques. ATO nanoparticles inherently possess a high surface energy, leading to strong agglomeration in solvents, which severely compromises performance in coatings and plastics. The use of advanced organic surface coatings (e.g., silane coupling agents or proprietary polymer coatings) is essential to achieve stable, high-concentration dispersions (slurries). Technologies related to high-shear mixing, sonication, and milling are continuously being refined to break down residual aggregates and ensure the ATO remains uniformly suspended in water-based or solvent-based systems, meeting the demanding specifications of roll-to-roll processing and spraying applications without clogging or sedimentation.

Furthermore, there is increasing technological investment in composite material integration. ATO is often combined with other functional materials, such as specialized pigments or other metal oxides, to create multi-functional products—for example, combining NIR shielding with UV protection or enhanced color correction. Advances in polymer compounding technology, specifically the use of twin-screw extrusion with precise temperature control, are vital for incorporating high loadings of ATO masterbatches into thermoplastic resins (like PC, PET, or PVC) while maintaining the structural integrity and flow properties of the final plastic product. This enables ATO’s use in lightweight electronic housings and complex automotive components, pushing the boundaries of material performance and manufacturing efficiency.

Regional Highlights

The Antimony Tin Oxide (ATO) Powder market exhibits distinct regional dynamics, dictated primarily by the concentration of advanced manufacturing capabilities, regulatory frameworks, and economic growth rates.

- Asia Pacific (APAC): Dominates the global market in terms of volume consumption, driven by colossal electronics manufacturing industries in China, South Korea, and Taiwan. APAC is the global center for display production (OLED, LCD), flexible electronics, and high-volume anti-static packaging, making it the highest growth and consumption region. Investment in advanced materials research and localized ATO production is accelerating, often focusing on high-purity, cost-effective nano-powders.

- North America: Characterized by high-value niche applications, especially in aerospace, defense, and specialized high-performance architectural glass. Demand here is driven by rigorous performance specifications, military standards for EMI shielding, and a strong focus on energy efficiency in commercial building codes. Innovation in material science and advanced dispersion technology is robust in this region.

- Europe: Exhibits steady growth fueled by strict environmental and energy regulations (e.g., the European Green Deal), which mandate the use of highly insulating and reflective materials in new construction and automotive glazing. Germany and the UK are key consumers, particularly in the automotive sector for thermal management systems in luxury and electric vehicles, emphasizing sustainability and low volatile organic compound (VOC) formulations.

- Latin America (LATAM): An emerging market primarily driven by infrastructure projects and developing electronic assembly operations, particularly in Mexico and Brazil. Market growth is generally tied to foreign direct investment in manufacturing and local urbanization trends, creating demand for basic anti-static materials and architectural coatings.

- Middle East & Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries due to massive construction projects and the necessity for superior thermal control in extreme climates. ATO is highly sought after for use in architectural coatings that minimize solar heat gain, contributing directly to reduced air conditioning load and energy costs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antimony Tin Oxide ATO Powder Market.- Mitsubishi Materials Corporation

- Sumitomo Metal Mining Co. Ltd.

- Advanced Nanomaterials Inc.

- Nano-C

- Kito Chemical

- DuPont

- BASF SE

- Showa Denko K.K.

- JEMACO Inc.

- American Elements

- Inframat Corporation

- C.I. Kasei Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Qingdao Xinguang Zhengwei Chemical Co.

- Shenzhen Nonferrous Metal Technology Co.

- Nanjing Emperor Nano Material Co., Ltd.

- SkySpring Nanomaterials, Inc.

- Xuzhou Hongyun Antimony Industry Co., Ltd.

- Puducherry Nanotech

- Metal Nanopowders Inc.

Frequently Asked Questions

Analyze common user questions about the Antimony Tin Oxide ATO Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Antimony Tin Oxide (ATO) powder primarily used for?

ATO powder is primarily utilized as a functional additive in coatings, plastics, and polymers for dual purposes: providing transparent electrical conductivity (anti-static properties) and offering effective blocking or reflection of Near-Infrared (NIR) radiation for thermal management, particularly in smart windows and display screens.

How does ATO powder compare to Indium Tin Oxide (ITO) in conductive applications?

While ITO generally offers higher intrinsic conductivity, ATO is preferred in applications where solution processability, dispersion stability in various solvents, and low-cost anti-static requirements are critical. ATO is also more stable in certain chemical environments and offers superior performance in heat-reflecting architectural coatings.

What are the key technical challenges in manufacturing high-quality ATO nano-powder?

The main technical challenges involve achieving precise control over particle size distribution (typically below 50 nm) and preventing particle agglomeration during synthesis and dispersion. Consistent antimony doping levels are crucial to maintain uniform electrical properties across batches, demanding specialized wet-chemical synthesis methods like hydrothermal processing.

Which end-use industry is the fastest growing segment for ATO powder?

The fastest growing segment for ATO powder consumption is the Automotive sector, specifically driven by the rapid production of Electric Vehicles (EVs) and the increasing adoption of advanced thermal management systems, heat-insulating automotive glass, and specialized anti-static and EMI shielding components for battery packs and autonomous driving systems.

What factors restrain the overall market growth of Antimony Tin Oxide?

The primary restraint is the volatility and high cost associated with the raw materials, specifically antimony and tin, which are subject to supply chain disruptions and geopolitical pricing pressures. Competition from alternative materials, such as silver nanowires and conductive polymers, also restricts growth in specific high-performance conductive coating niches.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager