Antiperspirant and Deodorant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431338 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Antiperspirant and Deodorant Market Size

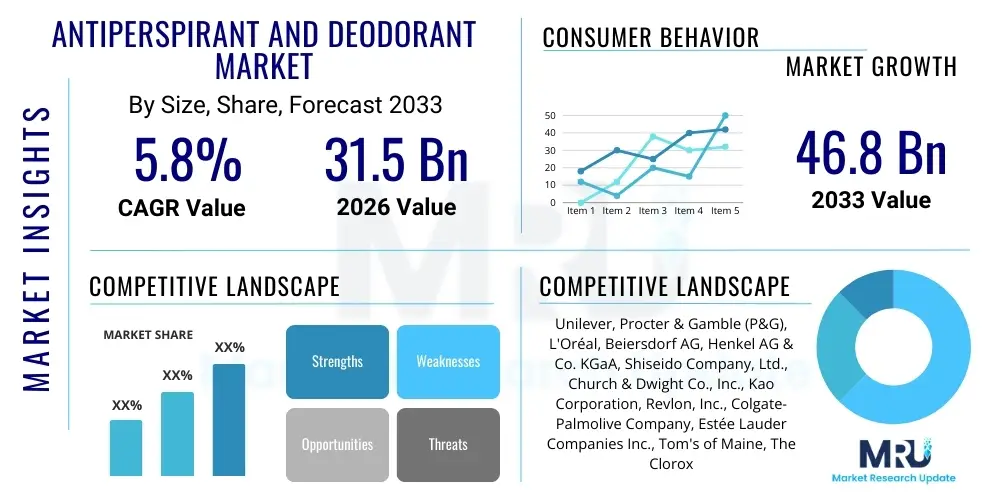

The Antiperspirant and Deodorant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 31.5 Billion in 2026 and is projected to reach USD 46.8 Billion by the end of the forecast period in 2033.

Antiperspirant and Deodorant Market introduction

The global Antiperspirant and Deodorant market encompasses a wide array of personal care products designed to control body odor and reduce sweating. Antiperspirants primarily function by blocking sweat glands, typically using aluminum-based compounds, thereby minimizing wetness. Deodorants, conversely, focus on neutralizing odor-causing bacteria without necessarily stopping perspiration. This market is fundamentally driven by rising global hygiene standards, increased consumer awareness regarding personal grooming, and growing disposable incomes, particularly in emerging economies. The product category includes various formats such as sticks, sprays, roll-ons, gels, and creams, catering to diverse consumer preferences regarding application, efficacy, and formulation ingredients.

Major applications of these products span daily personal care routines, sports activities, and specific medical needs (hyperhidrosis). The underlying principle of market growth is the continued urbanization and the expanding middle class globally, which elevates demand for convenient, effective, and sophisticated personal care solutions. The shift toward natural, organic, and aluminum-free formulations represents a significant directional pivot in product development, responding directly to consumer concerns about health and ingredient transparency. Furthermore, innovative packaging solutions and targeted products for specific demographics, such as high-performance formulas for athletes or sensitive skin variants, continue to fuel market expansion and maintain product relevance across all age groups.

The core benefits derived from utilizing antiperspirants and deodorants are enhanced social confidence, improved hygiene, and physiological comfort. Driving factors include sustained product innovation focused on extended wear protection (e.g., 48-hour or 72-hour efficacy claims), aesthetic enhancements (e.g., anti-stain technology), and the integration of advanced fragrances. Marketing strategies heavily emphasize emotional benefits linked to freshness and self-assurance. Regulatory shifts regarding key ingredients, such as triclosan or specific parabens, also influence formulation redesigns, mandating manufacturers to continually invest in research and development to align with global health and safety standards while still delivering superior performance.

Antiperspirant and Deodorant Market Executive Summary

The global Antiperspirant and Deodorant market is undergoing a robust transformation characterized by a distinct polarization between efficacy-driven clinical products and sustainability-focused natural alternatives. Key business trends include aggressive mergers and acquisitions among major multinational corporations seeking to acquire niche, clean beauty brands, thereby integrating sustainable practices and innovative ingredient technologies into their core portfolios. The competitive landscape is intensely focused on patenting novel delivery systems, such as advanced microencapsulation technology for sustained fragrance release, which differentiates premium offerings. Furthermore, dynamic pricing strategies and supply chain optimization are crucial business imperatives, particularly in managing the fluctuating costs of raw materials like volatile organic compounds (VOCs) and specialized natural extracts.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to rapid urbanization, increasing per capita spending on personal grooming, and the rising penetration of western-style hygiene habits among younger populations, particularly in countries like India and China. North America and Europe, while mature, remain dominant revenue generators, driving innovation in sustainable packaging (e.g., refillable systems, plastic-free materials) and premium functional ingredients. The Middle East and Africa (MEA) region presents significant untapped potential, fueled by warm climates and increasing brand awareness driven by international media exposure and localized marketing efforts addressing cultural preferences regarding scent and formulation texture. Regulatory harmonization efforts across regions also influence market entry strategies and product launch timelines.

In terms of segmentation trends, the Aerosol Spray segment, despite facing environmental scrutiny concerning VOC emissions, maintains substantial market share due to consumer familiarity and ease of application; however, the Stick and Roll-on formats are gaining traction, especially in eco-conscious markets due to their lower environmental impact and concentrated formulations. The Men's segment is expanding rapidly, moving beyond basic deodorizing properties to encompass specialized products focusing on skin health, antiperspirant strength, and sophisticated, complex fragrances. The rising prominence of specialized ingredients like activated charcoal, magnesium, and essential oils signals a decisive shift away from traditional chemical compounds toward formulations perceived as safer and more holistic by the discerning modern consumer.

AI Impact Analysis on Antiperspirant and Deodorant Market

Common user questions regarding AI's influence in the Antiperspirant and Deodorant market center around personalized product recommendations, supply chain efficiency, and the development of novel formulations using predictive modeling. Consumers frequently inquire about how AI can analyze individual body chemistry, climate conditions, and activity levels to recommend or create truly customized deodorant blends that maximize efficacy and minimize skin irritation. Manufacturers are intensely focused on utilizing AI and machine learning (ML) algorithms to optimize raw material sourcing, predict localized demand fluctuations with greater accuracy, and accelerate the discovery phase for sustainable, high-performance ingredients, thereby minimizing lengthy and expensive traditional laboratory testing procedures. This convergence of AI-driven customization and operational efficiency represents the cutting edge of modern market disruption.

- AI-driven personalized formulation development based on genomic and environmental data.

- Predictive demand forecasting and inventory optimization reducing waste and stockouts.

- Machine learning facilitated supply chain transparency and traceability of ethical ingredients.

- Robotic process automation (RPA) optimizing manufacturing processes and quality control.

- Enhanced customer service via AI chatbots diagnosing and recommending products for specific skin concerns or hyperhidrosis levels.

- Accelerated ingredient discovery for sustainable, non-irritating, and high-efficacy compounds.

- AI monitoring of social media trends and consumer feedback for rapid product iteration and brand positioning adjustments.

DRO & Impact Forces Of Antiperspirant and Deodorant Market

The Antiperspirant and Deodorant market is fundamentally shaped by a complex interplay of demographic shifts, health consciousness, environmental mandates, and technological advancements. Key drivers include the global increase in urbanization, which inherently elevates the importance of personal hygiene in close proximity social settings, coupled with sustained consumer demand for high-performance products offering multi-day protection and specialized benefits like anti-white-mark technology. Restraints primarily involve stringent regulatory scrutiny over traditional active ingredients, notably aluminum salts and certain preservatives, leading to market fragmentation as consumers seek 'cleaner' alternatives, alongside the environmental pressures associated with aerosol packaging and the disposal of non-recyclable materials. Opportunities abound in the development and marketing of refillable packaging systems, clinically tested products targeting specific skin conditions, and the expansion into untapped rural markets leveraging e-commerce and digital outreach, requiring strategic investment in sustainable innovation to capture future growth.

Market growth is significantly impacted by the rising prevalence of chronic conditions and allergies, prompting consumers to switch to hypoallergenic and dermatologically tested products, thus driving premiumization within the 'sensitive skin' segment. Furthermore, the socio-cultural influence of global celebrities and digital influencers consistently sets new trends in personal grooming, accelerating the adoption of new product formats and sophisticated fragrances across younger consumer demographics. The industry faces an impact force concerning raw material volatility, particularly for essential oils and sustainable packaging substrates, necessitating resilient sourcing strategies and robust hedging mechanisms to maintain stable profit margins across varied economic conditions. The overall impact forces compel manufacturers towards transparent labeling, ethical sourcing, and continuous reformulation to balance efficacy expectations with evolving regulatory and consumer demands for safety and sustainability.

Segmentation Analysis

The Antiperspirant and Deodorant market is meticulously segmented based on product type, format, end-user, distribution channel, and active ingredient composition, reflecting the nuanced needs of a diverse global consumer base. Segmentation allows manufacturers to tailor their marketing and product development efforts towards high-growth niches, such as premium clinical deodorants or eco-friendly solid sticks. The format segmentation, covering aerosols, roll-ons, and sticks, often dictates market share regionally, with sprays dominating in established markets and roll-ons gaining momentum in price-sensitive and eco-conscious areas. Ingredient-based segmentation, particularly the divergence between aluminum-based products and aluminum-free natural alternatives, is currently the most dynamic area, influenced heavily by ongoing consumer health debates and clean beauty trends.

- By Product Type:

- Antiperspirants

- Deodorants

- By Format:

- Aerosol Spray

- Stick/Solid

- Roll-on

- Gel/Cream

- By End-User:

- Men

- Women

- Unisex

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- Online Retail Channels

- Convenience Stores

- By Active Ingredient:

- Aluminum-based Compounds (e.g., Aluminum Chlorohydrate)

- Aluminum-free Compounds (e.g., Magnesium Hydroxide, Baking Soda)

Value Chain Analysis For Antiperspirant and Deodorant Market

The value chain for the Antiperspirant and Deodorant market begins with upstream activities centered on the sourcing and processing of specialty chemicals, fragrances, and sustainable raw materials like essential oils, waxes, and specialized polymers. This initial phase requires intensive quality control and compliance verification, particularly concerning ethical sourcing and environmental impact documentation. Key challenges upstream include managing the volatility in petrochemical-derived raw material costs and ensuring the stability and efficacy of natural ingredient extracts used in aluminum-free formulations. Strategic partnerships with specialized chemical suppliers and fragrance houses are critical here, as these components often define the final product's market differentiation and appeal.

The midstream phase involves manufacturing, packaging, and filling operations, which are increasingly automated and subject to stringent Good Manufacturing Practices (GMP). Manufacturers invest heavily in high-speed filling machinery capable of handling diverse formats (aerosols, sticks, roll-ons) while ensuring precision dosing and hermetic sealing. Downstream activities encompass logistics, distribution, and retail, where efficiency in warehousing and transportation is vital due to the high volume and low-cost nature of the products. The distribution channel is bifurcated into direct channels, such as brand-owned e-commerce platforms focusing on niche or premium products, and indirect channels, predominantly utilizing large supermarket chains, hypermarkets, and drug stores for mass market penetration.

The dominant distribution paradigm remains indirect, relying on the extensive reach and established consumer trust of major retail players. However, the rapidly expanding online retail segment (Amazon, Alibaba, dedicated brand sites) offers unprecedented opportunity for small, innovative brands to bypass traditional gatekeepers and achieve rapid market penetration, especially with sustainable and direct-to-consumer (D2C) specialized products. Successful companies manage this complex value chain by integrating robust data analytics tools to monitor inventory levels across global distributors, ensuring high service levels, and implementing traceability systems that bolster consumer trust regarding ingredient origins and manufacturing quality, thereby reducing risks associated with counterfeiting and product recalls.

Antiperspirant and Deodorant Market Potential Customers

The Antiperspirant and Deodorant market serves a vast and segmented base of potential customers defined primarily by gender, age, lifestyle, and specific physiological needs. The primary consumer groups include active adults (25-55) seeking high-efficacy, long-lasting protection suitable for demanding professional and physical activities. This demographic often prioritizes clinical strength antiperspirants and premium, sophisticated fragrances that align with their personal brand. A rapidly growing segment is Gen Z and young millennials (15-25), who are highly influenced by social media trends and place significant emphasis on sustainable, clean-label, and aesthetically pleasing packaging, driving demand for aluminum-free and vegan formulations sold primarily through online and specialty retail channels.

Other vital customer segments include individuals with sensitive skin or dermatological concerns, such as eczema or chronic hyperhidrosis, who require specialized, hypoallergenic, and often unscented products prescribed or recommended by dermatologists. The growth in the men's grooming segment represents a key opportunity, as male consumers increasingly seek deodorants formulated with skincare benefits, such as moisturizing or anti-inflammatory properties, moving beyond simple odor masking. Furthermore, customers in tropical and subtropical regions constitute a high-volume base due to climatic necessity, favoring formats like sprays and roll-ons for quick, refreshing application and superior wetness control, often prioritizing affordability alongside basic efficacy.

The evolution of the product offering, catering to unisex and gender-neutral consumers, reflects changing societal norms, broadening the market's reach beyond traditional gender binaries. These consumers often prioritize efficacy, subtle scent profiles, and ethical branding, leading to the success of minimalist, D2C brands. Ultimately, the market is defined by the universal need for freshness and confidence, making virtually every demographic, from teenagers to the elderly, a potential buyer, but with purchasing decisions heavily modulated by cultural context, economic capability, and increasingly, by concerns relating to health and environmental responsibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 31.5 Billion |

| Market Forecast in 2033 | USD 46.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, Procter & Gamble (P&G), L'Oréal, Beiersdorf AG, Henkel AG & Co. KGaA, Shiseido Company, Ltd., Church & Dwight Co., Inc., Kao Corporation, Revlon, Inc., Colgate-Palmolive Company, Estée Lauder Companies Inc., Tom's of Maine, The Clorox Company, Native Deodorant, Weleda. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antiperspirant and Deodorant Market Key Technology Landscape

The technological landscape of the Antiperspirant and Deodorant market is rapidly evolving, driven primarily by the need for superior efficacy, enhanced skin compatibility, and improved sustainability. A key area of innovation is microencapsulation technology, which involves embedding fragrances and active ingredients within microscopic shells. These capsules rupture due to friction or moisture (triggered by physical activity or sweating), providing controlled, continuous release of the product throughout the day, significantly extending the duration of freshness beyond traditional formulas. This approach not only maximizes performance but also allows manufacturers to use less fragrance while maintaining a powerful sensory experience, appealing to consumers seeking extended protection without heavy application.

Another dominant technological trend involves the development of novel aluminum alternatives for the clean beauty segment. Manufacturers are researching and utilizing bio-based active ingredients such as fermentation-derived enzymes, sophisticated mineral complexes like magnesium hydroxide and zinc ricinoleate, and advanced essential oil blends to neutralize odor-causing bacteria without blocking sweat ducts. These "functional natural" ingredients often require specialized stabilization technology to maintain shelf life and efficacy comparable to traditional synthetic counterparts. Furthermore, advanced packaging technology, particularly focused on achieving the optimal balance between pressurization, spray pattern consistency, and reducing the environmental impact of aerosol propellant systems (e.g., using nitrogen or alternative hydrofluorocarbons), remains a critical investment area.

Digital technology also plays a crucial role in product delivery and consumer interaction. Innovations include smart packaging integration (QR codes for traceability and product information), and the use of proprietary delivery systems that maximize absorption and minimize residue (e.g., fast-drying volatile silicones or specialized polymer films that prevent white marks on clothing). The adoption of artificial intelligence and high-throughput screening in R&D accelerates the identification of highly potent, non-irritating compounds, allowing companies to meet the escalating consumer demand for high-quality, scientifically backed, yet ethically formulated personal care solutions. This convergence of material science, formulation chemistry, and digital analytics is defining the competitive edge in the modern antiperspirant market.

Regional Highlights

Regional dynamics significantly influence product preferences, growth trajectory, and market saturation levels across the globe, necessitating localized marketing and formulation strategies.

- North America: This region is characterized by high consumer spending power and a mature market highly focused on product differentiation. Key trends include robust demand for clinical-strength antiperspirants and a significant uptake of aluminum-free, natural deodorants, driven by strong health and wellness trends. The US dominates regional revenue, exhibiting high willingness among consumers to pay premiums for brands emphasizing transparency, ethical sourcing, and specialized benefits like anti-chafing or skin moisturizing properties.

- Europe: The European market is highly regulated, particularly concerning cosmetic ingredients and environmental standards. Growth is driven by refillable and sustainable packaging solutions, aligning with strict EU mandates and strong consumer environmental awareness. Germany, the UK, and France are the major contributors, showing a preference for roll-ons and sticks over aerosols due to environmental concerns, while natural and organic certifications are essential for market penetration.

- Asia Pacific (APAC): The APAC region is the fastest-growing market globally, propelled by rising disposable incomes, improving hygiene awareness, and rapid urbanization, particularly in China and India. While price sensitivity remains a factor, the middle-class segment is rapidly adopting international brands and sophisticated fragrance profiles. The market sees strong demand for lighter, non-sticky formulations suitable for humid climates, with sprays and light creams gaining popularity.

- Latin America: This region shows a dominant preference for aerosol formats, valued for their cooling effect and wide coverage, especially in hot climates like Brazil. Market growth is closely tied to economic stability, but overall demand remains high due to climatic necessity and strong cultural emphasis on personal presentation. Localized brands and competitive pricing strategies are crucial for success.

- Middle East and Africa (MEA): Growth is driven by consistently hot weather conditions and high per capita expenditure on luxury and personal care items in the Gulf Cooperation Council (GCC) countries. The market favors strong, high-performance antiperspirants and rich, traditional fragrance notes. The emergence of modern retail infrastructure is facilitating greater product accessibility across the African sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antiperspirant and Deodorant Market.- Unilever

- Procter & Gamble (P&G)

- L'Oréal

- Beiersdorf AG

- Henkel AG & Co. KGaA

- Shiseido Company, Ltd.

- Church & Dwight Co., Inc.

- Kao Corporation

- Revlon, Inc.

- Colgate-Palmolive Company

- Estée Lauder Companies Inc.

- Tom's of Maine (Subsidiary of Colgate-Palmolive)

- Native Deodorant (Subsidiary of P&G)

- The Clorox Company

- Weleda

- Coty Inc.

- Avon Products, Inc.

- The Hain Celestial Group, Inc.

- Sanex (Owned by Colgate-Palmolive)

- Dr. Hauschka

Frequently Asked Questions

Analyze common user questions about the Antiperspirant and Deodorant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference driving market growth between antiperspirants and deodorants?

The primary driver of divergence is consumer focus on ingredients; antiperspirants, which use aluminum salts to block sweat, maintain market share based on efficacy, while deodorants, which neutralize odor using alternatives like magnesium or baking soda, drive the high-growth 'clean beauty' segment due to perceived health benefits and natural formulation preferences.

Which geographical region is expected to exhibit the fastest market growth rate?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly increasing disposable incomes, heightened awareness of personal hygiene standards among younger populations, and significant product penetration in previously untapped urban centers.

How is sustainability impacting the Antiperspirant and Deodorant market?

Sustainability is a major disruptive force, compelling manufacturers to invest heavily in plastic-free packaging, refillable containers, and waterless formulations. Consumer preference is shifting toward brands that demonstrate ethical sourcing, reduced carbon footprints, and transparent ingredient supply chains, especially in mature markets like Europe and North America.

What technological innovations are shaping product formulation?

Key technological innovations include microencapsulation for sustained release of active ingredients and fragrance, advanced ingredient discovery using AI for effective aluminum alternatives (e.g., bio-based enzymes), and specialized polymers to minimize residue and anti-stain issues across all product formats.

What are the main distribution channels driving sales globally?

While supermarkets and hypermarkets remain the dominant traditional distribution channels, online retail and e-commerce platforms are exhibiting the most rapid growth, facilitating direct-to-consumer (D2C) models and enabling niche, specialized, and premium brands to reach a broader, geographically dispersed consumer base efficiently.

The Antiperspirant and Deodorant market continues to showcase remarkable resilience and adaptability, driven by the core human desire for cleanliness and social confidence. The convergence of consumer demand for both clinical efficacy and natural, sustainable ingredients has catalyzed a period of intense innovation across formulation, packaging, and distribution strategies. Manufacturers are required to navigate complex regulatory environments and consumer skepticism regarding long-term health effects of traditional ingredients, fueling significant investment into research and development focusing on novel, bio-derived actives and advanced delivery systems. The market’s future trajectory is inextricably linked to the success of these sustainable and science-backed alternatives, positioning clean beauty as a mainstream expectation rather than a niche preference.

Furthermore, the competitive dynamic is heavily influenced by the speed at which companies can respond to localized trends. For instance, in Western markets, product differentiation is achieved through claims such as 'probiotic-enhanced' or 'pH-balanced,' appealing to the sophisticated wellness consumer. In contrast, emerging Asian markets prioritize value, convenience, and formulations tailored to high humidity, demonstrating the need for global players to maintain highly flexible product portfolios. Strategic geographic expansion, particularly through targeted digital marketing campaigns and leveraging the power of localized influencers, is essential for capitalizing on the robust consumption growth projected in the APAC and Latin American regions over the forecast period.

The role of digitalization, particularly in the supply chain, is becoming paramount for competitive advantage. The ability to use real-time data analytics to forecast demand for specific product formats (e.g., aerosol versus stick) and manage inventory across diverse retail environments (online, physical stores, pharmacies) minimizes wastage and ensures product availability, directly impacting customer satisfaction and market share. As AI and machine learning mature, their application in personalizing scent profiles and recommending products based on individual biological and lifestyle data will open up entirely new segments of hyper-customized offerings, potentially commanding significantly higher price points and further accelerating the premiumization trend observed globally. The structural integrity and long-term viability of the market depend on successful alignment with these dual imperatives of digital efficiency and sustainable innovation.

This detailed analysis underscores that while the Antiperspirant and Deodorant market is mature, it is far from static. The continuous evolution of consumer values toward health and environmental stewardship ensures a perpetual cycle of reformulation and innovation. Companies that prioritize investment in biodegradable ingredients, lightweight and refillable packaging, and transparent communication regarding their supply chains are best positioned to secure dominant market positions by 2033. The focus is shifting from simply masking odor to offering holistic skin health benefits and minimizing environmental impact, marking a fundamental transformation in how personal care products are conceptualized, manufactured, and marketed to a globally conscious consumer base.

The financial viability of new market entrants is increasingly reliant on their ability to disrupt established distribution monopolies through efficient e-commerce operations and powerful brand narratives centered on authenticity and clean ingredients. Traditional market leaders, in response, are aggressively acquiring these smaller, agile clean beauty brands to rapidly integrate innovative technologies and capture the growing demographic segment that prioritizes natural formulations. This M&A activity is expected to consolidate key technological expertise while simultaneously diversifying product offerings to mitigate risks associated with regulatory shifts and changing consumer preferences against traditional active ingredients. The market remains fiercely competitive, requiring constant vigilance on pricing, promotional activity, and swift product launch cycles to maintain visibility and customer loyalty in the crowded personal care space.

Final considerations for strategic planning must heavily weigh the impact of regulatory fragmentation. Divergent standards between the European Union, the United States, and emerging Asian economies regarding aluminum content, VOC limits, and labeling requirements impose significant complexity on global manufacturing and export operations. Companies must establish modular production capabilities and dynamic formulation adjustment processes to comply with regional mandates without compromising brand identity or product performance. Successfully navigating this regulatory labyrinth, while simultaneously meeting aggressive sustainability goals, will differentiate the market leaders from the lagging competitors throughout the forecast period ending in 2033.

The segment concerning the end-user remains critical, especially the distinct marketing required for men's versus women's products. Historically, women's products focused on floral or subtle scents, while men's products prioritized heavy musks and antiperspirant strength. Today, this distinction is blurring, with unisex and gender-neutral products gaining substantial traction, driven by younger consumers seeking functional simplicity and less gender-stereotyped packaging. This shift opens new avenues for innovation in scent creation and brand positioning, requiring marketers to emphasize performance and ingredient integrity over traditional gendered associations. Furthermore, specialized niches, such as deodorants for sensitive areas or products tailored for elderly skin, represent profitable, albeit smaller, segments demanding highly precise and targeted R&D efforts to meet unique physiological requirements.

Overall market health is supported by the universal, non-discretionary nature of these products in modern hygiene routines. Even during periods of economic contraction, the demand for basic personal care items, including antiperspirants and deodorants, tends to remain stable, classifying the market as recession-resilient. However, economic pressures can drive consumers down the value chain, shifting purchases from premium clinical brands to basic store brands, emphasizing the perpetual need for manufacturers to offer a well-tiered product selection that addresses various economic strata while maintaining brand equity and perceived quality across all price points. Effective management of brand perception and value proposition across economic cycles is thus integral to sustained market leadership.

Future growth will be significantly impacted by the increasing availability and penetration of natural and sustainable refill options. As environmental consciousness moves from a niche concern to a mainstream purchasing criterion, the logistical and technological capability to offer high-quality, convenient refill systems will be a decisive competitive factor. This involves not only redesigning packaging to be robust and reusable but also optimizing supply chains to handle reverse logistics or localized refill stations efficiently. The success of this transition requires substantial consumer education and infrastructure investment, but promises substantial long-term benefits in terms of customer loyalty and compliance with evolving environmental legislation globally.

The Antiperspirant and Deodorant market’s evolution is therefore a micro-reflection of broader consumer shifts towards wellness, transparency, and sustainability, layered onto foundational drivers of efficacy and convenience. Companies succeeding in this landscape will be those that master the complexity of advanced formulation chemistry, leverage digital intelligence for market agility, and commit unequivocally to environmentally responsible business practices, ensuring they are positioned for continued revenue capture through 2033 and beyond. This sophisticated balance of performance, ethics, and digital integration defines the next chapter of this essential personal care industry.

The focus on ingredient technology continues to intensify, particularly in the realm of odor neutralization versus germicidal action. Traditional formulations relied heavily on bactericides to kill the odor-causing bacteria. Modern, sophisticated natural formulations often utilize compounds that neutralize the odor molecules directly or create an environment less conducive to bacterial proliferation, without resorting to harsh chemicals that might disrupt the skin's microbiome. This shift requires advanced chemical engineering to maintain product stability and achieve comparable efficacy to traditional synthetic formulations, representing a considerable intellectual property investment area for key market players attempting to secure patents on next-generation active ingredients.

The role of regulatory bodies in shaping the market cannot be overstated. Health Canada, the FDA, and the European Commission continually review and update guidelines concerning the maximum allowable concentration of active ingredients, particularly aluminum compounds, due to ongoing, though inconclusive, consumer health debates. These reviews necessitate continuous reformulation cycles and substantial expenditure on clinical trials to substantiate safety and efficacy claims. Furthermore, regulations regarding volatile organic compound (VOC) emissions, particularly restrictive in regions like California, mandate significant changes in aerosol propellant systems, driving the trend toward sticks, roll-ons, and non-aerosol sprays, ultimately influencing the preferred format mix across different geographies.

The intersection of e-commerce and personalization offers the most potent near-term growth opportunity. Online sales channels allow brands to collect precise consumer data regarding usage habits, environment (climate), and specific skin concerns, enabling unprecedented levels of product customization. Direct-to-consumer models, facilitated by advanced AI-driven recommendation engines, can suggest specific ingredient blends or fragrance profiles tailored to an individual’s uploaded profile or previous purchasing history, creating high-value, niche segments that are inaccessible through traditional mass-market retail channels. This technological integration transforms the purchase decision from a generic commodity buy into a personalized wellness solution, justifying the premium pricing often associated with highly customized personal care items.

Strategic geographic segmentation must account for the diverse climates and cultural nuances globally. In Southeast Asia, where high humidity is prevalent, quick-drying, non-staining formulations are paramount, and packaging must withstand extreme heat and moisture. In colder, drier climates, consumers may prioritize formulations with added moisturizing or skin-conditioning agents. Cultural sensitivities, particularly regarding the strength and type of fragrance used, also dictate marketability, requiring localized adaptation of global product lines. Successful global brands exhibit the agility to maintain a cohesive brand identity while implementing highly localized formulation adjustments, packaging adaptations (e.g., language translation, regulatory symbols), and pricing strategies tailored to local purchasing power parity.

Finally, the focus on clinical validation is increasing across all segments. As consumers become more sophisticated and critical of marketing claims, the demand for dermatologically tested, clinically proven, and fragrance-free options is escalating. This is particularly true in the pharmacy and drugstore distribution channels, where products are often recommended by medical professionals. Manufacturers are increasingly partnering with dermatologists and running robust, placebo-controlled trials to support claims such as '72-hour protection' or 'hypoallergenic,' ensuring that product efficacy is grounded in verifiable science, which acts as a powerful differentiator in a crowded and often confusing marketplace of personal care commodities.

The imperative for clean labeling has become a non-negotiable standard for market access and consumer trust. Consumers actively seek products free from specific chemicals, including parabens, phthalates, triclosan, and synthetic colorants, often perceiving their exclusion as a proxy for product safety and quality. This movement has forced ingredient manufacturers to innovate rapidly, producing substitutes that perform equally well while meeting 'free-from' criteria. The complexity of clean formulations often results in higher production costs, driving price inflation in the natural segment, but consumers demonstrate a willingness to absorb this cost increase for products aligning with their health philosophies, ensuring the natural and organic segments maintain their above-average growth trajectory throughout the forecast period.

Furthermore, the competitive landscape is not static, continually being reshaped by investment dynamics, including venture capital flowing into disruptive sustainable startups and private equity interest in established, high-margin niche players. The consolidation trend seen in recent years (large multinationals acquiring successful D2C natural brands) is anticipated to continue, as established players seek to swiftly modernize their portfolios and capture younger, ethically driven consumer segments without the lengthy R&D required to develop clean formulations internally. This financial activity underscores the high strategic value placed on innovation within the sustainability and personalization dimensions of the antiperspirant and deodorant market.

Another emerging factor is the integration of products into specialized wellness and fitness routines. High-performance athletes and fitness enthusiasts represent a premium segment requiring specialized solutions—products offering superior wetness protection under extreme conditions, or anti-chafing benefits, often marketed with specialized branding and distribution through sports retailers or fitness centers. Marketing efforts targeted at this group emphasize clinical efficacy, resistance to water, and rapid-dry formulas, further segmenting the market based on lifestyle and functional requirements rather than just basic hygiene needs, thereby creating avenues for premium pricing and strong brand loyalty within specific activity-based communities.

Finally, the logistical challenges associated with diverse packaging formats are increasingly being managed through advanced manufacturing techniques. The shift towards solid stick and cardboard-based packaging requires different machinery and supply chain handling compared to pressurized aerosols. Achieving global scalability while managing this manufacturing diversity efficiently is a complex operational task. Companies successfully implementing advanced robotics and flexible manufacturing lines that can switch rapidly between different formats and container materials gain significant efficiency and cost advantages, crucial in maintaining competitiveness against regional players specializing in a single format type.

This report concludes that the Antiperspirant and Deodorant market stands at a critical juncture where technological advancements in sustainable and personalized formulations are intersecting with powerful consumer movements demanding transparency and ethical responsibility. Strategic success requires continuous adaptation, focusing on both efficacy and environmental stewardship to meet the sophisticated demands of the modern global consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager