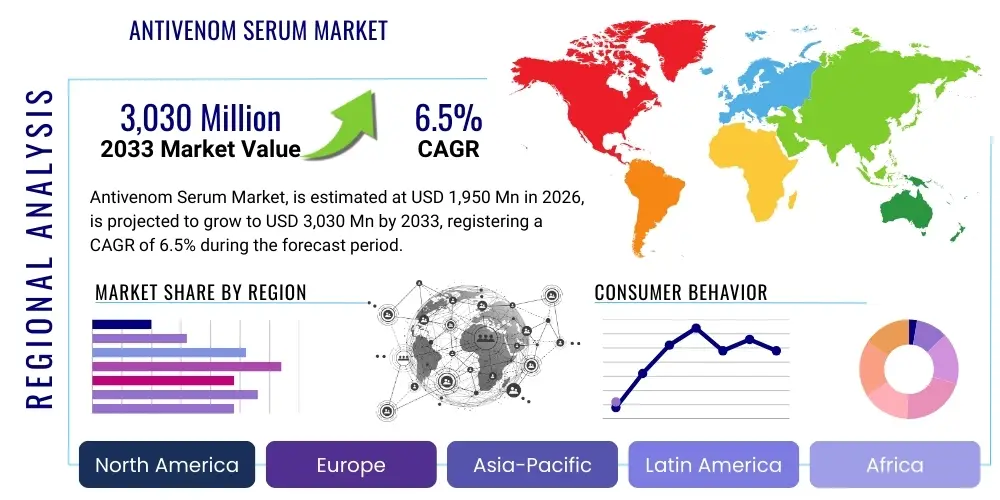

Antivenom Serum Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437945 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Antivenom Serum Market Size

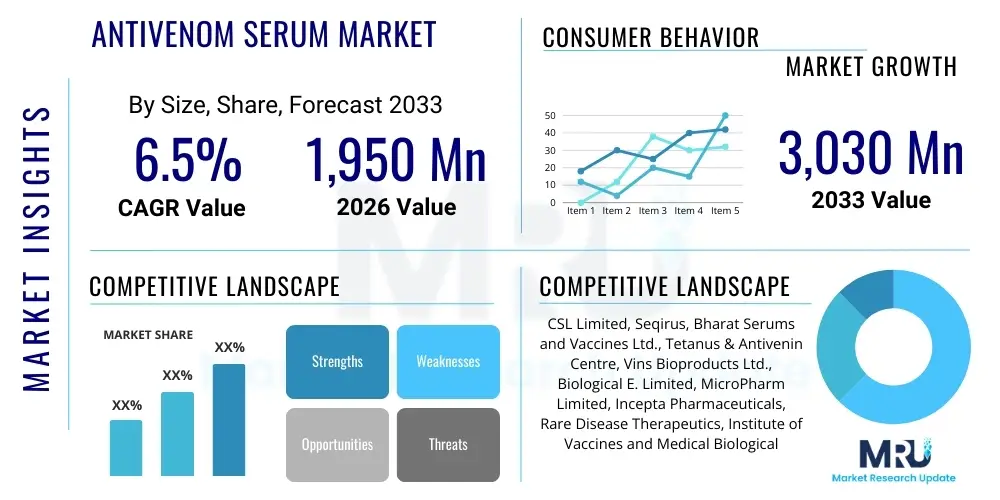

The Antivenom Serum Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1,950 Million in 2026 and is projected to reach USD 3,030 Million by the end of the forecast period in 2033.

Antivenom Serum Market introduction

The Antivenom Serum Market encompasses the production, distribution, and utilization of biological products designed to neutralize the toxic effects of venom following envenomation by snakes, spiders, scorpions, and other venomous creatures. Antivenoms, typically derived from the plasma of hyperimmunized animals (such as horses or sheep), contain specific antibodies that bind to and inactivate venom toxins. This crucial therapeutic sector is driven primarily by the high incidence of snakebite envenomation, recognized by the World Health Organization (WHO) as a neglected tropical disease, particularly prevalent in rural and agricultural regions across Africa, Asia, and Latin America. Market dynamics are heavily influenced by public health initiatives, government procurement policies, and infrastructural challenges related to rapid deployment and cold chain management.

Antivenoms are categorized primarily based on the species targeted (monovalent for a single species, polyvalent for multiple species) and the formulation (lyophilized powder or liquid solution). Major applications lie in emergency medical treatment settings, ensuring immediate availability in hospitals, clinics, and mobile medical units operating in high-risk zones. The efficacy and safety of modern antivenom products have improved significantly due to advancements in purification techniques, minimizing adverse reactions such as anaphylaxis. However, challenges persist regarding the cost-effectiveness, regional specificity of venoms (necessitating tailored antivenoms), and the long procurement timelines, often leading to shortages in the most affected areas.

The core benefits of antivenom serums are life-saving, representing the only effective treatment against severe envenomation. Driving factors include increasing global awareness of snakebite mortality, renewed investment from international health organizations (like WHO’s Roadmap for snakebite envenoming), demographic shifts leading to increased human-wildlife interaction, and ongoing research into next-generation recombinant and non-immunological antivenom alternatives. Furthermore, continuous efforts by manufacturers to optimize purification processes and enhance thermal stability are broadening the market reach, especially in regions lacking reliable cold chain infrastructure.

Antivenom Serum Market Executive Summary

The Antivenom Serum Market is characterized by robust growth, primarily fueled by public health focus on neglected tropical diseases and increasing government funding for venom-related injury treatment in endemic regions. Business trends indicate a move toward more purified F(ab')2 and Fab fragment antivenoms, which offer better patient tolerability and reduced risk of serum sickness compared to older whole immunoglobulin formulations. Key market players are investing heavily in establishing localized manufacturing and distribution hubs in Asia Pacific and Africa to overcome logistical hurdles. Strategic collaborations between pharmaceutical companies, local institutes, and non-governmental organizations (NGOs) are essential for ensuring product quality compliance and widespread accessibility, especially as demand surges in rapidly industrializing economies where occupational exposure remains high.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, driven by the extremely high burden of snakebite mortality in countries like India, Pakistan, and Bangladesh, coupled with the presence of major domestic antivenom manufacturers. However, Africa is projected to exhibit the highest growth rate due to severe existing supply gaps, improving healthcare infrastructure, and specific funding initiatives targeting neglected infectious diseases. North America and Europe, while having lower incidence rates, maintain a specialized market focus on antivenoms for exotic pets, native pit vipers, and specialized military or research applications, emphasizing advanced purification and stringent regulatory oversight.

Segment trends show that polyvalent antivenoms dominate the market due to their utility in regions where precise identification of the venomous species is challenging in emergency settings. The equine-derived segment remains the largest based on volume and historical reliance, though ovine-derived antivenoms are gaining traction due to perceived lower immunogenicity. Furthermore, the segmentation by end-user strongly favors hospitals and clinics, reflecting their role as primary administration points. Technological shifts are pointing toward the potential commercialization of synthetic antivenoms, promising a paradigm shift away from traditional animal-based production, which currently faces scalability and ethical constraints.

AI Impact Analysis on Antivenom Serum Market

User inquiries regarding AI's influence in the Antivenom Serum Market predominantly focus on its potential to address the chronic global shortage of effective, region-specific treatments, and accelerate the transition away from reliance on animal hyperimmunization. Key themes center on utilizing AI for novel drug target identification, optimizing therapeutic efficacy against diverse venoms, and enhancing supply chain predictability. Users expect AI to revolutionize the R&D process by facilitating the rapid discovery of synthetic inhibitors or small molecules that can neutralize venom components (toxinomics), thereby reducing the long lead times associated with traditional serum production. Furthermore, there is significant interest in how machine learning can analyze clinical data to predict optimal dosing strategies, personalize treatment based on patient parameters and envenomation severity, and model outbreak spread for preemptive supply chain adjustments.

The application of AI in antivenom production and logistics holds substantial promise for operational efficiencies. AI algorithms can be deployed to analyze complex venom compositions and identify highly conserved epitopes across different snake species, leading to the development of broader-spectrum, next-generation pan-specific antivenoms. In manufacturing, predictive maintenance and quality control powered by AI can minimize batch variability and ensure consistent product quality, which is critical for biological pharmaceuticals. For clinicians, AI-driven diagnostic tools using image recognition (e.g., analyzing bite marks or local tissue damage) or symptomatology are anticipated to significantly reduce the time-to-diagnosis, enabling faster administration of the correct antivenom and dramatically improving patient outcomes.

However, concerns revolve around the ethical deployment of AI, data privacy related to sensitive patient medical records (especially in regions with poor digital infrastructure), and the high computational cost required for complex toxinomic analysis. The integration of AI tools demands significant investment in specialized training for researchers and healthcare workers in endemic regions. Despite these challenges, the consensus among stakeholders is that AI will primarily serve as an enabling technology, significantly accelerating the development of recombinant antivenoms and optimizing the existing complex supply chain management necessary for delivering temperature-sensitive biologicals to remote populations.

- AI-driven Toxinomics: Accelerated identification and characterization of venom toxins and neutralizing targets.

- Drug Discovery Optimization: Screening large libraries of synthetic molecules or antibodies to develop non-animal derived antivenom alternatives.

- Personalized Dosing: Machine learning models to predict effective antivenom dosage based on patient, venom, and clinical parameters.

- Supply Chain Prediction: Predictive analytics for forecasting regional demand fluctuations and optimizing cold chain logistics to prevent critical shortages.

- Manufacturing Efficiency: Use of AI for quality control, batch consistency, and maximizing yield in hyperimmunization and purification processes.

- Diagnostic Support: Development of rapid, AI-assisted tools for identifying the responsible venomous species in clinical settings.

DRO & Impact Forces Of Antivenom Serum Market

The Antivenom Serum Market is driven primarily by the high global incidence of snakebite envenomation and increasing recognition by the WHO as a high-priority health challenge, leading to dedicated funding and treatment mandates. Restraints include the inherent limitations of traditional animal-derived production, characterized by long production cycles, high production costs, and potential for batch variability and adverse patient reactions. Significant opportunities arise from technological advancements, particularly the shift toward recombinant antibody technology and synthetic inhibitors, which promise safer, more scalable, and cost-effective antivenom solutions. These forces collectively shape the market's trajectory, mandating a balance between addressing immediate public health crises and investing in innovative, long-term therapeutic platforms to ensure global access.

Market Drivers focus heavily on expanding access in underserved areas. Governments and international aid agencies are increasingly focusing on procurement and distribution programs, particularly in South Asia and Sub-Saharan Africa, where agricultural workers are most vulnerable. Furthermore, improved surveillance and reporting mechanisms worldwide are providing more accurate data on the true burden of envenomation, pressuring governments to allocate appropriate resources. Another driver is the continuous refinement of purification techniques, leading to purer and safer products that reduce immunogenicity and improve patient compliance, thereby boosting physician preference for newer antivenom formulations.

Key Restraints include the technical complexity of matching antivenom specificity to geographically diverse venom compositions (intraspecies variability), which complicates large-scale standardization. Regulatory hurdles are substantial, especially in emerging markets, requiring extensive clinical trials to ensure safety and efficacy against local venom types. The dependence on large animal herds for plasma also introduces ethical concerns and logistical bottlenecks related to animal husbandry, veterinary care, and the necessity of specialized, expensive facilities. Impact forces are highly concentrated on public health policy shifts and technological disruption, where a breakthrough in recombinant antivenom development could rapidly diminish the market reliance on conventional plasma fractionation methods.

Segmentation Analysis

The Antivenom Serum Market is intricately segmented based on product type (monovalent versus polyvalent), source of antibodies (equine, ovine, etc.), formulation (lyophilized versus liquid), and end-user distribution channels. This segmentation is crucial for understanding specific regional demands, as the required product type varies significantly based on local fauna diversity; for instance, polyvalent products are essential in regions hosting multiple medically significant snake species, whereas monovalent products are preferred where single species dominate or where highly specific therapeutic action is required. Analyzing these segments provides strategic insights into manufacturing priorities and necessary supply chain adjustments to meet the urgent and often unpredictable needs of envenomation management globally.

- By Product Type:

- Monovalent Antivenom

- Polyvalent Antivenom

- By Source:

- Equine (Horse) Derived

- Ovine (Sheep) Derived

- Other Sources (e.g., Caprine, Recombinant)

- By End-User:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Defense and Military Settings

- By Formulation:

- Liquid Antivenom

- Lyophilized (Freeze-Dried) Antivenom

- By Distribution Channel:

- Government & Public Health Procurement

- Retail Pharmacies and Drug Stores

- E-commerce and Online Pharmacies

Value Chain Analysis For Antivenom Serum Market

The value chain for the Antivenom Serum Market is complex, beginning with highly specialized upstream processes involving venom extraction and animal hyperimmunization. The upstream phase requires secure venom collection facilities (often specializing in indigenous species) and robust infrastructure for maintaining healthy animal herds (horses or sheep). Ethical and safety regulations govern this initial stage rigorously. The efficiency and yield of the plasma collection process directly impact the final product cost. Manufacturers must maintain deep partnerships with venom laboratories and veterinary services to ensure consistency and availability of high-quality raw material necessary for subsequent processing.

The midstream and downstream segments involve the biopharmaceutical manufacturing process, including plasma fractionation (using techniques like ammonium sulfate precipitation), extensive purification (e.g., chromatography), and final formulation (lyophilization being favored for stability). Stringent quality control measures are integrated at every stage to ensure the neutralization potency and minimize non-specific proteins that could cause adverse reactions. Packaging must adhere to cold chain requirements, even for lyophilized products, to ensure stability up to the point of administration. This manufacturing stage requires high capital investment in certified sterile facilities compliant with international GMP (Good Manufacturing Practices) standards.

Distribution channels for antivenom are critical and often bifurcated into direct procurement by government health ministries and specialized indirect distribution through logistics partners trained in cold chain management. In endemic regions, direct sales to government stockpiles and public hospitals dominate, often facilitated by international bodies like WHO and UNICEF. The distribution network must be highly responsive, capable of delivering life-saving treatments rapidly to remote rural areas. Indirect channels, including retail and specialized hospital pharmacies in developed nations, cater primarily to zoo, exotic pet, or occupational safety markets, where demand is more predictable but requires high inventory specificity.

Antivenom Serum Market Potential Customers

The primary end-users and buyers of antivenom serums are government health ministries and public health institutions in countries with high incidence rates of snakebite envenomation, particularly across Asia, Africa, and Latin America. These governmental bodies act as bulk procurers to maintain national stockpiles and ensure equitable access, often utilizing tenders and centralized purchasing mechanisms. Non-governmental organizations (NGOs) such as Médecins Sans Frontières (MSF) and international health agencies like the World Health Organization (WHO) are also significant buyers, focusing on distribution in conflict zones and humanitarian crisis areas where local healthcare systems are compromised. Their purchasing decisions are often influenced by WHO prequalification status and demonstrated thermal stability of the product.

Secondary but crucial customers include private hospitals, clinics, and trauma centers, especially those located near agricultural or densely forested regions, where they require immediate access to specific and polyvalent antivenoms for emergency care. These facilities prioritize products with proven clinical efficacy, minimized adverse reaction profiles, and reliable supply availability. Specialized tertiary customers include research institutes focused on toxicology, university laboratories conducting venom component analysis, and veterinary clinics that require antivenoms for animal patients, including domestic animals and exotic species in zoos or private collections. The procurement cycles for these customers are generally smaller but require niche products catering to highly specific venom types.

Further potential lies within industrial and military sectors. Companies involved in resource extraction, agriculture, mining, or construction in high-risk tropical areas often maintain essential medical kits, including antivenom, for occupational safety protocols. Military organizations operating in tropical environments also represent a specialized end-user segment, demanding robust, thermally stable formulations for rapid deployment in challenging operational settings. The decision-making process for these industrial and defense buyers is heavily weighted towards reliability, shelf life, and ease of storage and administration in non-traditional medical environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,950 Million |

| Market Forecast in 2033 | USD 3,030 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CSL Limited, Seqirus, Bharat Serums and Vaccines Ltd., Tetanus & Antivenin Centre, Vins Bioproducts Ltd., Biological E. Limited, MicroPharm Limited, Incepta Pharmaceuticals, Rare Disease Therapeutics, Institute of Vaccines and Medical Biologicals (IVAC), Premium Serums and Vaccines Pvt. Ltd., Grifols S.A., Instituto Butantan, Haffkine Bio-Pharmaceutical Corporation Ltd., Serum Institute of India, Sanofi S.A., Merck & Co., Inc., Takeda Pharmaceutical Company Limited, Latoxan, Instituto Clodomiro Picado. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antivenom Serum Market Key Technology Landscape

The Antivenom Serum Market relies heavily on established biopharmaceutical technologies centered around plasma fractionation and antibody purification, primarily involving enzymatic digestion of whole immunoglobulin G (IgG) into active fragments like F(ab’)2 or Fab. The goal of this enzymatic cleavage is to enhance diffusion into tissues, reduce the size of the immunologically active component, and critically, eliminate the Fc fragment which is responsible for most adverse reactions such as serum sickness and anaphylaxis. Ultrafiltration, chromatography, and various tangential flow filtration methods are standard purification techniques used to achieve highly pure and concentrated antivenom solutions, reducing the reliance on older, crude precipitation methods and significantly enhancing product safety profiles across all major manufacturers.

A burgeoning technological segment involves recombinant antivenom development. Researchers are moving away from traditional animal-based immunization toward generating humanized monoclonal antibodies (mAbs) or antibody fragments that specifically neutralize individual venom toxins. This technology leverages phage display, yeast display, or hybridoma techniques to rapidly screen and select high-affinity binders. Recombinant technology promises several advantages, including infinite scalability, guaranteed batch consistency, elimination of ethical concerns associated with animal large-scale farming, and the potential to create pan-specific inhibitors that neutralize multiple toxins across different snake species, addressing the issue of venom variability more effectively than current polyvalent serums.

Further technological advancements impacting the market include formulation science focused on enhancing thermal stability, particularly important for distribution in tropical regions without reliable refrigeration. Lyophilization (freeze-drying) technology is crucial, converting the liquid product into a powder that significantly extends shelf life and reduces cold chain dependency, making storage and transport logistically feasible in remote areas. Additionally, high-throughput screening technologies are accelerating the mapping of complex venoms (venomics), providing the molecular blueprint needed for rational drug design and development of next-generation, non-immunological small molecule inhibitors that could potentially replace or complement antibody-based therapies in the future, marking a significant long-term shift in the therapeutic landscape.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market both in terms of consumption volume and production capacity, driven by the world's highest burden of snakebite mortality, particularly in populous countries such as India, Nepal, and Sri Lanka. The presence of major domestic manufacturers, governmental support for public health procurement, and high exposure risk among agricultural populations define this region. APAC is also a hub for polyvalent antivenom development tailored to the "Big Four" snake species.

- Africa: Expected to show the fastest market growth. Historically underserved and facing critical shortages, the region is now benefiting from renewed global health focus and donor funding (e.g., WHO's strategy). Key markets include Nigeria, Kenya, and South Africa. Challenges remain high concerning cold chain logistics and the high cost relative to local purchasing power, but increased aid and localized production efforts are driving expansion.

- Latin America: Represents a mature and highly localized market, characterized by strong governmental involvement and leading public sector manufacturers such as Instituto Butantan (Brazil) and Instituto Clodomiro Picado (Costa Rica). Antivenoms are highly specific to local pit vipers and coral snakes. The region serves as a model for public health control over antivenom distribution and quality assurance.

- North America: A niche, high-value market focused primarily on antivenoms for native pit vipers (e.g., rattlesnakes) and specialized products for exotic pets. Demand is stable and driven by robust healthcare infrastructure and high prices for advanced, specific antivenoms. Regulation is highly stringent, focusing on efficacy and safety, primarily managed by the FDA.

- Europe: Similar to North America, the market is specialized, catering mainly to low-incidence native species and specialized applications (zoos, travelers, military). Emphasis is placed on acquiring imported, high-purity antivenoms for rapid response protocols, often sourced from specialized manufacturers in other regions with high-quality purification standards.

- Middle East and Africa (MEA): While geographically diverse, the Middle East portion features moderate demand for scorpion and snake antivenoms, often procured through state-run health systems utilizing both domestic and European-sourced products. The high growth in the African sub-region drives the overall MEA growth projection, linked directly to humanitarian relief and infrastructural development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antivenom Serum Market.- CSL Limited

- Seqirus (CSL subsidiary)

- Bharat Serums and Vaccines Ltd.

- Vins Bioproducts Ltd.

- Biological E. Limited

- MicroPharm Limited

- Incepta Pharmaceuticals

- Rare Disease Therapeutics

- Institute of Vaccines and Medical Biologicals (IVAC)

- Premium Serums and Vaccines Pvt. Ltd.

- Grifols S.A.

- Instituto Butantan

- Haffkine Bio-Pharmaceutical Corporation Ltd.

- Serum Institute of India

- Sanofi S.A.

- Merck & Co., Inc.

- Takeda Pharmaceutical Company Limited

- Latoxan

- Instituto Clodomiro Picado

- Tetanus & Antivenin Centre

Frequently Asked Questions

Analyze common user questions about the Antivenom Serum market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary challenges facing the supply of antivenom globally?

The primary challenges include high production costs, dependency on traditional animal-based immunization (leading to long production cycles), high regional specificity requiring tailored products, and significant logistical hurdles related to maintaining a temperature-controlled (cold) supply chain in remote endemic areas.

How is the Antivenom Serum Market segmented by product type?

The market is segmented primarily into Monovalent Antivenom, designed to neutralize the venom of a single species, and Polyvalent Antivenom, which contains antibodies effective against the venoms of multiple medically significant species common to a specific geographic region.

What technological advancements are expected to disrupt the antivenom industry?

The market anticipates disruption from recombinant technology, involving the development of humanized monoclonal antibodies (mAbs) or synthetic inhibitors. These advancements promise safer, more scalable, and universally effective treatments compared to traditional plasma-derived products.

Which geographical region holds the largest share in the Antivenom Serum Market?

Asia Pacific (APAC) holds the largest market share due to the highest incidence of snakebite envenomation globally, dense agricultural populations, and the presence of several high-volume domestic antivenom manufacturers fulfilling regional demand.

What is the significance of F(ab')2 fragments in modern antivenom production?

F(ab')2 fragments are utilized in modern antivenoms because they retain full venom neutralization capability while having the Fc portion of the antibody removed. This purification significantly reduces the likelihood of adverse immune reactions such as serum sickness and anaphylaxis in patients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager