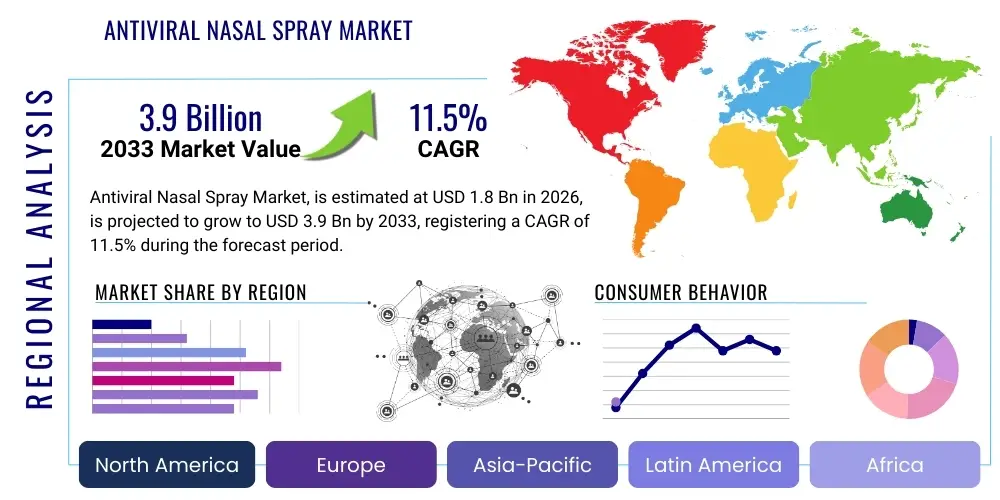

Antiviral Nasal Spray Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438785 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Antiviral Nasal Spray Market Size

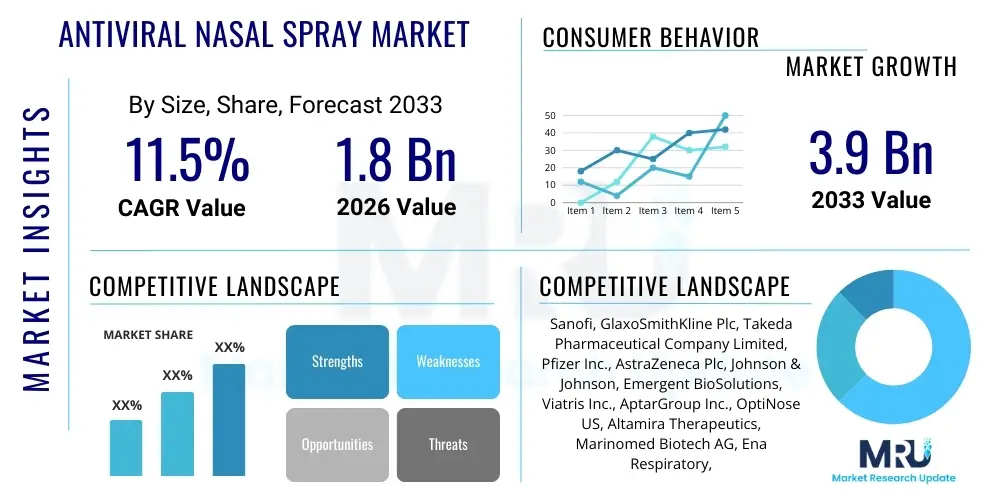

The Antiviral Nasal Spray Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033.

Antiviral Nasal Spray Market introduction

The Antiviral Nasal Spray Market encompasses pharmaceutical and medical device products designed for nasal administration to prevent or treat acute respiratory tract infections caused by various viruses, including influenza, rhinoviruses, and coronaviruses. These sprays function primarily by creating a protective physical barrier on the nasal mucosa, inhibiting viral entry or replication, or utilizing specific active pharmaceutical ingredients (APIs) such as nitric oxide, iota-carrageenan, or novel synthetic compounds to neutralize viral particles directly upon contact. The market is witnessing accelerated growth driven by heightened global awareness regarding respiratory hygiene and the urgent need for accessible, non-invasive prophylactic solutions in public health crises.

Major applications of antiviral nasal sprays span both prophylactic and therapeutic use cases. Prophylactically, they are crucial for individuals exposed to high-risk environments, such as healthcare workers or those in densely populated settings, aiming to reduce the initial viral load and prevent systemic infection. Therapeutically, they can be utilized in the early stages of infection to mitigate symptom severity and duration, acting as an adjunct to systemic antiviral medications. The core benefits include ease of administration, localized action minimizing systemic side effects, and rapid onset of protection, making them a highly attractive option for personalized preventive healthcare strategies against common and emerging respiratory pathogens.

Driving factors propelling this market include sustained investment in pharmaceutical research and development focusing on broad-spectrum antiviral agents, favorable regulatory pathways expedited in response to recent pandemics, and strong consumer demand for over-the-counter (OTC) preventive health products. Furthermore, the continuous emergence of novel viral strains resistant to traditional vaccines necessitates continuous innovation in topical antiviral delivery systems, ensuring the Antiviral Nasal Spray Market remains dynamic and central to future infectious disease management protocols globally.

Antiviral Nasal Spray Market Executive Summary

The Antiviral Nasal Spray Market is characterized by robust business trends focusing on strategic partnerships between pharmaceutical giants and specialized biotech firms to accelerate the commercialization of proprietary formulations, particularly those utilizing advanced delivery systems like nanoparticles and liposomes for improved mucosal retention. A significant trend involves the transition from purely barrier-forming solutions to compounds offering active neutralization capabilities, demanding complex clinical trials and higher investment in formulation science. Regulatory scrutiny remains a pivotal factor, with companies navigating fast-track approvals while ensuring long-term safety profiles, leading to intensive capital allocation toward post-market surveillance and efficacy studies across different demographic groups.

Regionally, North America maintains market leadership, propelled by high disposable income, established healthcare infrastructure, and favorable reimbursement policies for preventive medicines, alongside a strong culture of self-medication and early intervention. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market due to escalating population density, increasing prevalence of respiratory diseases, and rising government emphasis on establishing robust local manufacturing capabilities and procurement reserves for pandemic preparedness. European markets are driven by stringent quality standards and structured public health initiatives, often favoring medically regulated devices over pharmaceutical sprays, influencing segment trends towards polymer-based (e.g., cellulose or carrageenan) barrier products.

Segmentation trends highlight the increasing dominance of the prophylactic application segment, reflecting the broader societal shift toward preemptive health measures following global viral outbreaks. Formulation type segmentation shows a rapid expansion in the market share for nitric oxide and iodine-based sprays due to demonstrated efficacy in inactivating viruses quickly, challenging traditional inert polymer barriers. Distribution channels are experiencing a significant shift towards e-commerce and retail pharmacy chains, enhancing accessibility and driving consumer impulse purchases, particularly for OTC formulations that bypass prescription requirements, underscoring the market's trajectory towards mass market penetration.

AI Impact Analysis on Antiviral Nasal Spray Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) in the Antiviral Nasal Spray market frequently center on how these technologies accelerate the identification of potent antiviral agents suitable for mucosal delivery, optimize the complex formulation process to enhance bioavailability and stability within the nasal cavity, and improve the efficiency and predictive power of clinical trials. Users are particularly interested in AI's role in screening vast libraries of compounds (both natural and synthetic) for broad-spectrum activity against diverse respiratory viruses, a task that is computationally intensive and time-consuming using conventional methods. Furthermore, there is considerable public expectation that AI can personalize dosing regimens and administration schedules based on individual risk factors, environmental exposure data, and specific immunological profiles, moving the industry toward precision prophylaxis.

The primary concern users voice is related to the validation and regulatory acceptance of AI-discovered or AI-optimized formulations. Despite the speed benefits, the complex mechanisms by which AI models identify optimal molecular structures or predict mucosal absorption rates require rigorous traditional testing to gain approval from agencies like the FDA or EMA. Another key theme revolves around AI's ability to monitor global viral spread patterns and predict potential outbreaks, allowing manufacturers to dynamically adjust production volumes and distribution logistics, thereby preventing supply chain bottlenecks during peak infection seasons. This predictive capacity is essential for ensuring that antiviral nasal sprays are available precisely when and where they are most needed, maximizing their public health impact.

Ultimately, the influence of AI is revolutionizing the upstream R&D pipeline and the midstream manufacturing logistics of antiviral nasal sprays. AI algorithms can model fluid dynamics within the nasal cavity to optimize spray droplet size and deposition patterns, ensuring maximum coverage of the target site while minimizing systemic absorption. This optimization enhances therapeutic efficacy and safety. Furthermore, machine learning is increasingly applied to analyze real-world data (RWD) and patient compliance statistics from wearable devices or mobile apps, providing critical feedback loops that refine product instructions and marketing strategies, leading to improved user adherence and better overall market performance.

- AI accelerates the discovery and screening of novel, broad-spectrum antiviral agents suitable for nasal delivery.

- Machine Learning optimizes formulation parameters, predicting stability, solubility, and mucosal absorption kinetics.

- Predictive analytics enhance supply chain management and manufacturing scale-up in anticipation of viral outbreaks.

- AI models expedite clinical trial design and patient stratification, reducing time-to-market for new formulations.

- Natural Language Processing (NLP) assists in aggregating and analyzing global literature and regulatory guidelines, ensuring compliance.

- Sophisticated algorithms personalize prophylactic recommendations based on individual exposure risk and health data.

DRO & Impact Forces Of Antiviral Nasal Spray Market

The Antiviral Nasal Spray market is shaped by significant internal and external forces, categorized into Drivers, Restraints, and Opportunities (DRO). Key drivers include the persistently high global burden of respiratory viral infections, accentuated by increased frequency and severity of recent pandemics, which has institutionalized the concept of routine antiviral prophylaxis. Furthermore, rising public awareness and increased expenditure on personal health and hygiene, particularly in developed economies, push consumer adoption of easily accessible OTC preventive measures. The growing investment by governments in national strategic reserves of critical medical countermeasures, including locally acting antivirals, acts as a major market accelerator, providing financial stability and high-volume demand to manufacturers. These drivers collectively amplify the necessity and commercial viability of developing sophisticated nasal spray solutions.

Restraints primarily revolve around the stringent regulatory approval process required to validate both the safety and long-term efficacy of topical antivirals, especially concerning their potential impact on the delicate nasal microbiome and mucosal barrier integrity. A significant challenge is achieving consumer compliance, as prophylactic products require consistent and timely application, which can often be overlooked or administered incorrectly by the general public. High manufacturing costs associated with specialized delivery technologies, such as advanced particulate systems, coupled with difficulties in achieving patent protection for naturally derived active ingredients (like carrageenan), can impede sustained investment and market expansion. Moreover, consumer confusion regarding the difference between decongestants, saline washes, and true antiviral agents poses a marketing and educational restraint.

Opportunities are substantial, notably the potential for developing broad-spectrum antiviral sprays effective against multiple RNA viruses simultaneously, reducing the need for strain-specific treatments. Emerging markets in APAC and Latin America offer untapped potential due to large, susceptible populations and rapidly expanding healthcare access. The integration of antiviral sprays into combination therapies alongside traditional systemic drugs or vaccines, enhancing protection and treatment outcomes, represents a crucial growth pathway. Finally, leveraging advancements in material science to create bio-adhesive polymers that significantly prolong the residence time of the antiviral agent within the nasal cavity—thereby requiring less frequent application—constitutes a high-value technological opportunity that could fundamentally alter market dynamics and greatly improve user compliance.

Segmentation Analysis

The Antiviral Nasal Spray Market is comprehensively segmented based on its active ingredient type, application modality, and distribution channels, reflecting the diverse pharmacological approaches and end-user requirements within this therapeutic domain. Segmentation by type focuses on the molecular mechanism of action, differentiating products that rely on physical barriers from those utilizing chemical neutralization or host-directed immune modulation. The core purpose of segmentation is to allow pharmaceutical companies to tailor their research, marketing, and regulatory strategies to specific therapeutic niches, ensuring that product development aligns accurately with clinical needs and consumer preferences across various healthcare settings globally.

Application-based segmentation is crucial for defining the regulatory pathway and target user group, distinguishing between products intended for preventative use before anticipated exposure (prophylactic) and those used to reduce viral load and symptoms once infection is confirmed (therapeutic). Distribution channel analysis reveals key commercial pathways, highlighting the shifting balance between traditional prescription-based sales in hospital settings and the highly accessible, high-volume retail and e-commerce platforms that cater to OTC consumer demand for immediate preventive solutions. This structure provides a granular view of market dynamics necessary for strategic decision-making and forecasting competitive landscapes within specialized segments.

- By Type of Active Ingredient:

- Polymer-Based (e.g., Iota-Carrageenan, Cellulose Derivatives)

- Nitric Oxide (NO) Based

- Iodine/Povidone-Iodine Based

- Zinc and Trace Mineral Compounds

- Novel Small Molecule Antivirals

- By Application:

- Prophylactic Use

- Therapeutic Use

- By Distribution Channel:

- Retail Pharmacies and Drug Stores

- Hospital Pharmacies

- Online Pharmacies and E-commerce Platforms

- By End User:

- Adults

- Pediatrics

Value Chain Analysis For Antiviral Nasal Spray Market

The value chain for the Antiviral Nasal Spray market is complex, beginning with upstream activities focused heavily on specialized research and development, particularly the synthesis and sourcing of pharmaceutical-grade active ingredients (APIs) and advanced excipients. Upstream analysis involves specialized chemical manufacturers supplying high-purity polymers, inorganic compounds (like nitric oxide precursors), and novel synthetic antiviral molecules. Strict quality control and compliance with Good Manufacturing Practices (GMP) are critical at this initial stage, often involving partnerships with biotech labs specializing in molecular optimization and stability testing before scaling up production. High costs are typically concentrated here due to complex synthesis and regulatory requirements for novel APIs.

Midstream activities encompass formulation, manufacturing, and quality assurance. This phase is characterized by sophisticated technical processes, including aseptic filling, precise micro-dosing mechanism integration, and aerosol optimization to ensure consistent droplet size for targeted nasal deposition. Companies invest heavily in advanced manufacturing infrastructure suitable for sterile pharmaceutical production. The distribution channel, representing the start of the downstream phase, is segmented into direct sales (primarily to hospitals and large public health procurement bodies) and indirect sales (through wholesale distributors to retail pharmacies and, increasingly, e-commerce fulfillment centers). The efficiency of the cold chain, if required for certain formulations, significantly impacts the viability of the indirect channel.

Downstream analysis focuses on market access and consumer engagement. Retail and online channels are pivotal, requiring robust marketing, consumer education campaigns, and rapid inventory replenishment to meet sudden spikes in demand, especially during outbreak seasons. Indirect distribution through large pharmaceutical wholesalers provides broad geographical reach, while direct channels ensure preferential procurement by national health services for stockpile management. Effective navigation of the downstream market requires strong relationships with pharmacists and key opinion leaders (KOLs), who influence both prescription rates and consumer purchasing decisions for OTC products, ultimately linking high-quality manufacturing to patient access.

Antiviral Nasal Spray Market Potential Customers

The primary customer base for the Antiviral Nasal Spray Market is highly segmented, encompassing both the general consumer population seeking self-administered preventive care and specific institutional buyers prioritizing large-scale public health intervention. End-users fall into three main categories: individuals categorized as high-risk, institutional bodies responsible for infectious disease management, and the general healthy population seeking routine prophylactic protection. High-risk individuals include elderly populations, immunocompromised patients, people with chronic respiratory conditions, and essential workers (healthcare professionals, teachers) who face daily high exposure levels. These groups often utilize prescription-grade or highly validated OTC formulations based on physician recommendations, prioritizing maximum efficacy and safety profiles.

Institutional buyers, such as government agencies, military establishments, and large corporations, represent significant purchasers, especially in anticipation of or during active outbreaks. Their purchasing decisions are volume-driven, focusing on cost-effectiveness, long shelf life, and proven efficacy in reducing transmission rates across large groups. These organizations procure sprays for stockpiling and routine distribution to employees or citizens as part of broader public health strategies. The general healthy population represents the largest volume segment, driven by convenience, affordability, and marketing influence, using these sprays as a proactive measure during seasonal infection peaks or travel, favoring easily accessible, widely marketed OTC brands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi, GlaxoSmithKline Plc, Takeda Pharmaceutical Company Limited, Pfizer Inc., AstraZeneca Plc, Johnson & Johnson, Emergent BioSolutions, Viatris Inc., AptarGroup Inc., OptiNose US, Altamira Therapeutics, Marinomed Biotech AG, Ena Respiratory, ReViral Ltd., Virpax Pharmaceuticals, Opiant Pharmaceuticals, Sorrento Therapeutics, Nanovetores Group, Xylos Corporation, Novavax Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antiviral Nasal Spray Market Key Technology Landscape

The technology landscape within the Antiviral Nasal Spray market is dominated by advancements in enhancing drug residence time, improving deposition efficiency, and ensuring broad-spectrum antiviral activity. Crucial to this evolution is the utilization of mucoadhesive polymers, such as high-molecular-weight cellulose or chitosan, which bind electrostatically to the nasal mucosa, significantly extending the contact time of the active ingredient and thereby maximizing viral neutralization potential. This focus on bio-adhesion directly addresses the challenge of rapid clearance by mucociliary movement, ensuring that the therapeutic concentration is maintained for several hours, a critical factor for successful prophylaxis.

Another significant technological innovation involves sophisticated delivery systems, including Metered-Dose Nasal Sprays (MDNS) and nebulization technologies that precisely control droplet size. Optimal droplet size (typically between 20 µm and 120 µm) is essential to ensure deposition in the anterior nasal cavity and the turbinates, which are the primary sites of viral entry and replication, rather than being inhaled into the lungs or immediately dripping out. Furthermore, proprietary formulation techniques are leveraging microemulsions and liposomal encapsulation to protect sensitive antiviral molecules from degradation and enhance their penetration through the mucosal layer without causing irritation, balancing efficacy with patient comfort and compliance.

The development of novel active ingredients also represents a key technological frontier. This includes host-directed antivirals that interfere with general cellular processes required by multiple viruses, reducing the risk of viral resistance, rather than targeting specific viral proteins. Examples include certain nitric oxide formulations that rapidly denature viral proteins upon contact, and advanced iodine-based solutions optimized for minimal irritation. The combination of these advanced formulations with smart delivery devices that record usage data for compliance monitoring is further integrating the Antiviral Nasal Spray market with the broader digital health ecosystem, promising enhanced treatment adherence and real-world efficacy tracking.

Regional Highlights

- North America: Dominance Driven by Innovation and Preparedness

North America holds the largest market share, characterized by its mature pharmaceutical industry, high healthcare expenditure, and substantial government investment in pandemic preparedness programs that include large-scale procurement of antivirals. The region benefits from a robust ecosystem of specialized biotech firms and major pharmaceutical companies engaged in cutting-edge research, particularly in developing novel nitric oxide and broad-spectrum small molecule antiviral sprays. The swift regulatory response, often granting Emergency Use Authorization (EUA) during outbreaks, accelerates product adoption. Consumer awareness regarding the benefits of immediate intervention and prophylactic measures is exceptionally high, supported by extensive marketing and direct-to-consumer advertising, ensuring strong retail market penetration.

- Europe: Focus on Quality Standards and Public Procurement

The European market is defined by stringent quality standards enforced by the European Medicines Agency (EMA), often leading to a preference for polymer-based sprays classified as medical devices, which typically face lower regulatory hurdles than pharmaceutical drugs. Government and public health agencies are major purchasers, driving demand through structured immunization programs and public health campaigns emphasizing respiratory protection. Western European countries, particularly Germany and the UK, are key contributors, focusing on integrating these sprays into routine healthcare recommendations, although regional fragmentation in regulatory interpretation across member states can sometimes pose a challenge to unified market access strategies.

- Asia Pacific (APAC): Fastest Growth Due to Population Density and Rising Income

APAC is projected to exhibit the fastest growth, fueled by its immense population base, high prevalence of seasonal respiratory infections, and increasing urbanization, which leads to greater transmission risk. Rising disposable incomes in key economies like China, India, and South Korea allow for greater spending on preventative healthcare products. Governments across the region are strategically investing in local manufacturing capabilities for antiviral products to reduce reliance on Western imports, fostering a competitive landscape where local players often leverage traditional medicine insights combined with modern pharmaceutical technology. Educational initiatives aimed at improving hygiene practices further accelerate the adoption of accessible nasal spray products, particularly OTC formulations.

- Latin America (LATAM): Emerging Opportunities and Regulatory Heterogeneity

The LATAM market presents emerging opportunities, primarily driven by expanding access to essential medicines and improved healthcare infrastructure, particularly in Brazil and Mexico. However, market penetration is often hindered by economic volatility and significant regulatory heterogeneity across different countries, necessitating tailored market entry strategies. The demand is often concentrated in metropolitan areas, focusing on affordable, easily stored prophylactic solutions, often utilizing established global brands that have successfully navigated the varied national approval processes.

- Middle East and Africa (MEA): Strategic Investment and Disease Burden Management

The MEA region is characterized by strategic healthcare investments, particularly in the Gulf Cooperation Council (GCC) countries, focusing on establishing advanced healthcare systems and managing the significant burden of infectious diseases. Demand is driven by affluent urban centers and government initiatives aimed at protecting large influxes of travelers (e.g., religious tourism). In parts of Africa, the market is highly influenced by global aid organizations and public health programs, focusing on essential, cost-effective antiviral solutions for vulnerable populations facing high infectious disease risk.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antiviral Nasal Spray Market.- Sanofi

- GlaxoSmithKline Plc

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- AstraZeneca Plc

- Johnson & Johnson

- Emergent BioSolutions

- Viatris Inc.

- AptarGroup Inc.

- OptiNose US

- Altamira Therapeutics

- Marinomed Biotech AG

- Ena Respiratory

- ReViral Ltd.

- Virpax Pharmaceuticals

- Opiant Pharmaceuticals

- Sorrento Therapeutics

- Bausch Health Companies Inc.

- Merck & Co., Inc.

- Novavax Inc.

Frequently Asked Questions

Analyze common user questions about the Antiviral Nasal Spray market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary active ingredients found in commercial antiviral nasal sprays?

The primary active ingredients widely used include polymer-based agents such as Iota-Carrageenan, which create a physical barrier on the nasal mucosa to trap viruses, and chemical neutralizing agents like Nitric Oxide (NO) or Povidone-Iodine, which rapidly inactivate viral particles upon contact. Newer research focuses on proprietary small molecule antivirals and host-directed agents.

How do antiviral nasal sprays contribute to global pandemic preparedness strategies?

Antiviral nasal sprays serve as a critical layer of immediate protection, reducing initial viral load and transmission, thus complementing vaccination efforts. They are essential components in national stockpiles, providing an accessible, rapidly deployable countermeasure that can be distributed quickly to mitigate spread during the early stages of a novel viral outbreak before targeted vaccines become widely available.

Are antiviral nasal sprays used for prevention (prophylaxis) or treatment (therapy)?

Antiviral nasal sprays are effectively used for both prophylaxis and early therapeutic intervention. Prophylactically, they minimize the risk of infection after exposure. Therapeutically, they are used early in the course of an infection to potentially reduce viral shedding, shorten symptom duration, and decrease the overall severity of the illness.

What technological advancements are driving the efficacy of new nasal spray formulations?

Key technological advancements include the use of mucoadhesive polymers to extend the spray's residence time within the nasal cavity, the employment of advanced metered-dose systems for precise and optimal deposition of the drug, and the incorporation of encapsulated delivery systems (like liposomes) to enhance the bioavailability and stability of the active antiviral agents.

What are the major regulatory challenges facing the Antiviral Nasal Spray market?

Major regulatory challenges involve demonstrating consistent efficacy against multiple viral strains (broad-spectrum claims), navigating the distinction between medical device classification (for barrier sprays) and drug classification (for active APIs), and providing long-term safety data, particularly regarding the potential impact of continuous use on the integrity of the sensitive nasal mucosa and local microbiome.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager