Aortic Stents Grafts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438445 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Aortic Stents Grafts Market Size

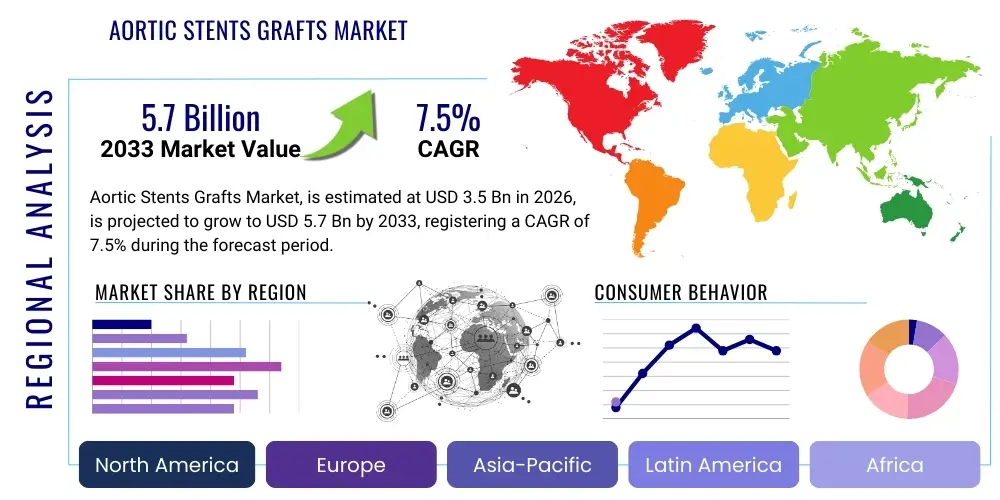

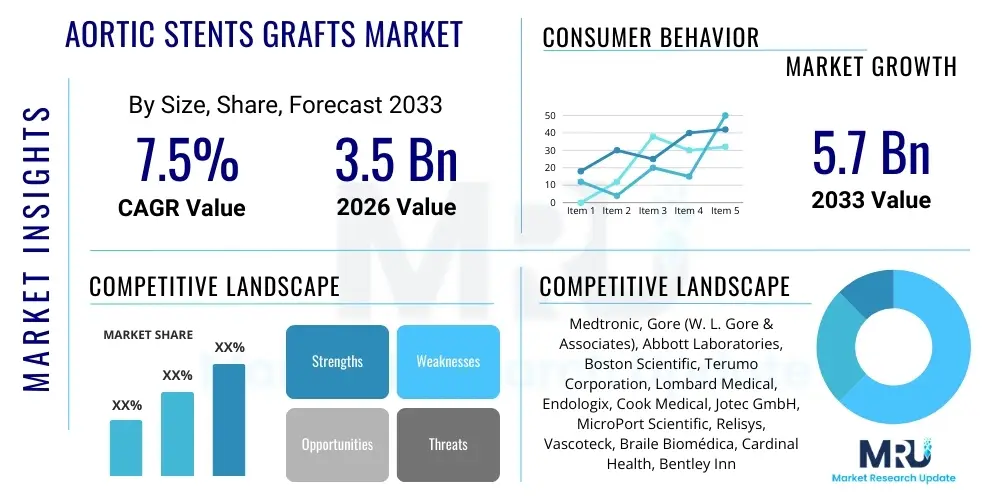

The Aortic Stents Grafts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033.

Aortic Stents Grafts Market introduction

The Aortic Stents Grafts Market encompasses devices specifically designed for the minimally invasive repair of aortic pathologies, predominantly aneurysms (Abdominal Aortic Aneurysm or Thoracic Aortic Aneurysm) and dissections. These devices, known as endovascular stent grafts, consist of a metallic frame structure (stent) integrated with a fabric covering (graft material, often made of polytetrafluoroethylene or polyester). The fundamental shift from open surgical repair to endovascular aneurysm repair (EVAR) or thoracic endovascular aortic repair (TEVAR) drives market expansion, offering significant patient benefits such as reduced hospital stays, faster recovery times, and lower procedural morbidity compared to traditional techniques. The primary applications involve preventing aneurysm rupture and maintaining blood flow through the aorta by excluding the diseased segment from systemic pressure.

The product description highlights sophisticated engineering, including advanced delivery systems designed for precise deployment in complex vascular anatomy, such as juxtarenal or thoracoabdominal segments. Key technological benefits include enhanced conformability to the native aorta, improved sealing capabilities to prevent endoleaks (a major complication), and long-term durability. Driving factors for this market are multi-faceted, notably the increasing global prevalence of cardiovascular diseases, particularly aortic aneurysms linked to an aging population, and significant ongoing innovations in device architecture, such as branched and fenestrated stent grafts tailored for complex cases involving visceral and renal arteries. Furthermore, the growing acceptance of minimally invasive procedures across major healthcare systems contributes substantially to sustained market growth.

Major applications of aortic stent grafts span both emergency and elective procedures. Electively, they are used to treat large, asymptomatic aneurysms identified through screening programs. In emergent settings, they are crucial for treating ruptures or acute dissections, where rapid intervention is paramount. The procedural benefits, including reduced trauma and improved patient outcomes, solidify the position of endovascular techniques as the standard of care for suitable patients. Continuous clinical research focusing on expanding the applicability of these grafts to patients with challenging anatomies, previously excluded from EVAR/TEVAR, further stimulates product demand and ensures the market remains highly dynamic and focused on optimizing long-term patient safety and efficacy.

Aortic Stents Grafts Market Executive Summary

The Aortic Stents Grafts Market is characterized by robust business trends centered on technological specialization, consolidation among key manufacturers, and expansion into emerging economies. Business trends reflect a strong focus on developing next-generation devices, specifically fenestrated and branched grafts (F/B-EVAR/TEVAR), to address complex aortic arch and thoracoabdominal aneurysms, significantly broadening the eligible patient pool. Regulatory approvals for these advanced systems are critical milestones driving revenue growth. Leading companies are strategically investing in clinical trials demonstrating long-term device efficacy and safety, leveraging evidence-based medicine to secure premium pricing and market share, particularly in established markets like North America and Western Europe, where reimbursement structures are favorable for innovative, high-value medical devices. Consolidation activities often involve acquiring niche players specializing in proprietary sealing technologies or customized manufacturing capabilities.

Regional trends indicate North America currently holds the largest market share due to high awareness, sophisticated healthcare infrastructure, and favorable reimbursement for endovascular procedures. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This accelerated growth in APAC is driven by rising health expenditure, increasing prevalence of risk factors such as hypertension and diabetes leading to aortic disease, and the rapid adoption of Western medical standards and minimally invasive surgical techniques in countries like China and India. Europe maintains a strong presence, characterized by rapid technology adoption and strong clinical guidelines promoting EVAR/TEVAR as first-line therapy, though growth rates might be slightly moderated compared to the rapidly developing APAC economies. Market players are establishing localized manufacturing and distribution hubs in APAC to navigate regional regulatory variations and access vast patient populations.

Segment trends confirm that the Endovascular Aneurysm Repair (EVAR) segment, treating abdominal aortic aneurysms (AAA), retains the largest share due to the higher incidence of AAA compared to thoracic aneurysms. However, the Thoracic Endovascular Aneurysm Repair (TEVAR) segment is experiencing faster growth, fueled by increased clinical utility in treating Type B aortic dissections and traumatic aortic injuries, along with the introduction of devices engineered specifically for the challenging aortic arch anatomy. In terms of end-users, hospitals remain the primary consumers, but the shift towards value-based care is encouraging the adoption of these procedures in specialized vascular clinics and increasingly sophisticated ambulatory surgical centers (ASCs) for suitable, low-complexity cases, optimizing resource utilization and patient flow management within the entire healthcare ecosystem.

AI Impact Analysis on Aortic Stents Grafts Market

Common user questions regarding AI's impact on the Aortic Stents Grafts Market revolve primarily around improving procedural accuracy, personalizing device selection, and enhancing post-operative monitoring. Users frequently ask: "Can AI predict the risk of endoleaks based on pre-operative scans?", "How will machine learning optimize stent graft sizing and placement?", and "Is AI used for real-time surgical guidance during EVAR/TEVAR?" The overarching theme is the transition from generalized sizing recommendations to precision medicine. Users anticipate that AI models, trained on vast datasets of computed tomography (CT) angiography images and clinical outcomes, will revolutionize surgical planning by identifying optimal device fit, predicting procedural success, and enhancing risk stratification for complex cases. The key concerns often relate to data security, the validation rigor required for AI algorithms in high-stakes vascular procedures, and the integration complexity of these tools into existing catheterization laboratory workflows, ensuring that AI augments, rather than replaces, the expertise of vascular surgeons and interventional radiologists.

Artificial intelligence and machine learning are poised to significantly enhance the safety and effectiveness of aortic stent graft procedures. In the pre-operative phase, AI algorithms utilize deep learning to analyze high-resolution volumetric CT data, automating the complex measurements required for aortic sizing (including neck angulation, diameter variability, and landing zone length). This automated measurement reduces inter-observer variability, minimizes human error in determining device size, and allows for highly precise simulations of device deployment and aortic wall interaction. Such precision is crucial for preventing complications like migration and Type I endoleaks, which are often correlated with suboptimal sizing. Furthermore, AI can generate predictive models for aortic remodeling post-procedure, aiding surgeons in selecting the most biomechanically suitable graft architecture (e.g., standard EVAR, FEVAR, or B-TEVAR) based on patient-specific hemodynamics.

During the interventional procedure, AI systems are beginning to be integrated with fluoroscopic imaging and navigation systems to provide real-time guidance, potentially reducing reliance on extensive X-ray exposure while ensuring accurate catheter and guide wire positioning. Post-operatively, AI plays a vital role in analyzing follow-up surveillance imaging (CT and ultrasound). Machine learning models are being developed to detect subtle signs of device failure or endoleak formation earlier than traditional human review, improving the timing of necessary secondary interventions. This integration of computational power across the patient journey—from diagnosis and personalized planning to acute intervention and long-term surveillance—positions AI as a critical enabling technology for improving long-term outcomes in the aortic stents grafts market, ultimately boosting the perceived value and efficacy of endovascular treatments.

- AI enhances pre-operative planning through automated, high-precision aortic measurements and personalized device selection.

- Machine learning algorithms predict procedural risks, such as endoleak probability and device migration likelihood, optimizing treatment strategies.

- Real-time image analysis using AI assists surgeons during deployment, improving accuracy and reducing fluoroscopy time.

- AI-powered simulation tools allow surgeons to virtually test different stent graft configurations prior to the actual procedure.

- Predictive analytics aid in post-operative monitoring, facilitating early detection of complications requiring secondary intervention.

DRO & Impact Forces Of Aortic Stents Grafts Market

The Aortic Stents Grafts Market expansion is primarily driven by the confluence of demographic shifts, technological refinement, and clinical guideline evolution, while simultaneously navigating significant cost constraints and the inherent complexities associated with long-term device durability. The paramount driving force remains the global aging population, as aortic aneurysms disproportionately affect individuals over the age of 65, leading to a continuously expanding target patient pool requiring prophylactic or emergency repair. The strong market preference for minimally invasive endovascular techniques (EVAR/TEVAR) over open surgery, underpinned by demonstrated benefits such as reduced recovery time and decreased perioperative mortality, acts as a profound market accelerator. Furthermore, continuous product innovations, specifically the commercialization and clinical acceptance of customized or off-the-shelf fenestrated and branched devices, are rapidly addressing anatomical limitations that previously mandated high-risk open surgery, thereby unlocking substantial untapped market potential and expanding the overall addressable market size.

However, the market faces structural restraints that moderate its overall growth trajectory. The most significant restraint is the extremely high cost associated with manufacturing and purchasing these specialized stent grafts, particularly the complex fenestrated and branched models, which places financial strain on healthcare systems and limits accessibility in resource-constrained economies. Secondly, the stringent and prolonged regulatory approval processes, particularly in major markets like the U.S. and Europe, necessitate extensive clinical trials and post-market surveillance, incurring massive R&D expenditure and delaying the commercialization of cutting-edge technologies. Additionally, concerns regarding long-term device durability, particularly the necessity for secondary interventions due to late endoleaks, migration, or structural failure, create a degree of clinical hesitancy and necessitate continuous, expensive post-operative monitoring, which is often viewed as a trade-off compared to the perceived definitive repair of open surgery.

Opportunities for future growth are concentrated in two main areas: geographical expansion and technological diversification. There is immense potential in penetrating emerging markets across Asia Pacific and Latin America, where economic growth is facilitating rapid modernization of healthcare infrastructure and increasing affordability of advanced treatments. Technological opportunities involve the development of smart grafts integrated with sensors for remote monitoring of pressure and blood flow, reducing the need for intensive imaging surveillance. Furthermore, advancements in bio-absorbable materials or drug-eluting coatings applied to the grafts could potentially reduce associated complications like chronic inflammation or tissue reactions. Impact forces are significant; the threat of substitutes, while low (as open surgery is highly morbid), requires continuous demonstration of superior endovascular outcomes. Competitive rivalry is high, pushing companies to invest heavily in robust clinical data, advanced delivery systems, and bespoke patient solutions to maintain differentiation in a fiercely competitive landscape focused on achieving long-term patency and complication-free survival.

Segmentation Analysis

The Aortic Stents Grafts Market is fundamentally segmented based on the device type used for endovascular repair, the specific anatomical location of the aneurysm being treated, and the end-user setting where these complex procedures are performed. The primary segmentation criterion is the product, dividing the market into devices designed for abdominal aortic repair (EVAR) and those for thoracic aortic repair (TEVAR). The complexity segment further distinguishes between standard straight tube or bifurcated grafts and highly specialized grafts, such as fenestrated and branched configurations, reflecting the market’s technological maturity and capability to treat increasingly complex patient anatomies. This segmentation is crucial as it dictates pricing strategies, regulatory pathways, and targeted marketing efforts within the vascular surgery community, allowing manufacturers to optimize their product portfolios to address distinct clinical needs effectively.

Segmentation by application clarifies the procedural focus, with Abdominal Aortic Aneurysms (AAA) traditionally holding the largest volume share due to higher incidence rates, while Thoracic Aortic Aneurysms (TAA) and Aortic Dissections represent a growing niche demanding specialized, robust device designs. The end-user analysis reflects the current structure of vascular healthcare delivery; while large hospitals and university medical centers dominate consumption due to the high-acuity nature of the procedures and the required infrastructure (hybrid operating rooms, specialized cath labs), the increasing sophistication of dedicated cardiovascular centers and Ambulatory Surgical Centers (ASCs) suggests a potential, albeit slow, shift in procedural location for low-risk, elective EVAR cases. Understanding these segments is paramount for strategic planning, forecasting, and resource allocation, ensuring that marketing campaigns accurately target the primary clinical decision-makers and procurement departments within each healthcare vertical.

Geographically, the market is highly segmented, reflecting disparities in healthcare spending, regulatory hurdles, and procedural volume adoption rates. North America and Europe lead in terms of revenue and adoption of premium, complex devices, driven by established reimbursement systems and mature vascular surgery practices. Conversely, the high growth potential lies within the APAC region, where rapid infrastructural development and increasing awareness of endovascular treatments promise substantial future market expansion. Further stratification based on material (e.g., PTFE, Polyester grafts) or fixation mechanism (suprarenal vs. infrarenal) allows for micro-analysis of competitive advantages and patented technologies, enabling a granular understanding of consumer preferences among vascular specialists who prioritize specific handling characteristics, radial force, or long-term biological compatibility of the devices deployed within critical segments of the aorta.

- By Product Type:

- Endovascular Aneurysm Repair (EVAR) Stent Grafts

- Thoracic Endovascular Aneurysm Repair (TEVAR) Stent Grafts

- Fenestrated Endovascular Aneurysm Repair (FEVAR) Devices

- Branched Endovascular Aneurysm Repair (BEVAR) Devices

- Aortic Arch Stent Grafts

- By Application:

- Abdominal Aortic Aneurysm (AAA)

- Thoracic Aortic Aneurysm (TAA)

- Aortic Dissection

- Traumatic Aortic Injury

- By End-User:

- Hospitals

- Specialized Cardiovascular Centers

- Ambulatory Surgical Centers (ASCs)

- By Material:

- Polyester/Dacron Grafts

- Polytetrafluoroethylene (PTFE) Grafts

Value Chain Analysis For Aortic Stents Grafts Market

The value chain for the Aortic Stents Grafts Market is highly specialized and knowledge-intensive, beginning with the upstream analysis dominated by specialized raw material suppliers and R&D entities. Upstream activities involve procuring highly biocompatible materials such as specialized Nitinol alloys for the stent frame, and medical-grade PTFE or polyester fabrics for the graft component. The sourcing and manufacturing of these precision components demand stringent quality control and high-level technical expertise, often supplied by a limited number of certified vendors, which can impact supply chain resilience and cost structure. Significant capital is deployed here for research and development focused on improving material flexibility, durability, and biocompatibility, particularly addressing issues related to inflammatory response and long-term structural integrity. This phase is characterized by intellectual property protection and complex patent landscapes surrounding material composition and advanced coating technologies.

The midstream phase focuses on complex manufacturing, assembly, and quality assurance of the final device, which is often custom-made or highly personalized, especially for fenestrated and branched grafts. Key manufacturers invest heavily in sophisticated automated and manual assembly processes within highly controlled environments (cleanrooms). Due to the precision required for coupling the stent and graft material and attaching the delivery system, labor and technological costs are substantial. Post-manufacturing, extensive non-clinical testing, sterilization, and rigorous quality control checks are mandatory before distribution. The distribution channel is crucial; it involves direct sales forces engaging vascular surgeons and interventional cardiologists (Direct Channel) and specialized third-party distributors (Indirect Channel) managing logistics, inventory, and regulatory compliance across diverse geographic territories. The direct channel is preferred for specialized products and complex clinical support, ensuring high-touch engagement with key opinion leaders.

Downstream analysis encompasses the final delivery, procedural utilization, and post-market surveillance. The market heavily relies on clinical education and support, requiring manufacturers to deploy highly trained clinical specialists to assist surgeons during complex cases, optimizing device deployment and troubleshooting. The end-users—hospitals and specialized centers—drive demand, purchasing based on clinical efficacy, brand reputation, cost-effectiveness, and reimbursement availability. Post-market surveillance is a mandatory, continuous activity, involving gathering real-world data on device performance, complication rates (e.g., endoleaks, migration), and long-term patency. This data is critical for demonstrating compliance to regulatory bodies (FDA, EMA) and informing future R&D iterations. The overall value chain is highly integrated, characterized by intense collaboration between R&D, manufacturing, clinical affairs, and sales to ensure devices are safe, effective, and readily available to the high-acuity patient population.

Aortic Stents Grafts Market Potential Customers

The primary consumers and end-users of Aortic Stents Grafts are the specialized healthcare institutions and professionals who diagnose, treat, and manage patients suffering from severe aortic pathologies. The core customer base consists of Hospitals, particularly large university-affiliated medical centers, tertiary care hospitals, and specialized cardiac/vascular institutions that possess the necessary infrastructure, including advanced hybrid operating rooms, dedicated catheterization labs, and multidisciplinary teams (vascular surgeons, interventional radiologists, cardiologists) required to perform complex EVAR and TEVAR procedures. These institutions act as the main purchasing decision-makers, influenced significantly by clinical outcome data, device performance, total procedure cost, and vendor clinical support, often negotiating large-volume procurement contracts for standard and complex inventory.

A secondary, yet rapidly growing, customer segment includes Specialized Cardiovascular Centers and increasingly sophisticated Ambulatory Surgical Centers (ASCs). While ASCs currently handle a smaller volume, they represent a critical area for market expansion, particularly for less complex, elective EVAR cases, driven by the shift towards outpatient settings and efforts to reduce overall hospital costs. These centers prioritize efficiency, rapid patient turnaround, and devices that require minimal inventory complexity. Furthermore, the individual vascular surgeon or interventional radiologist is a critical influencer customer, whose preference for a specific device platform (based on ease of use, technical success rates, and patient-specific suitability) directly dictates the purchasing decisions of the affiliated institution, emphasizing the importance of targeted clinical education and relationship building within the sales strategy.

Government agencies and large private payors also indirectly function as crucial customers through their reimbursement policies. Favorable national and regional reimbursement for EVAR/TEVAR procedures accelerates device adoption by reducing the financial burden on institutions and patients. Therefore, manufacturers must invest substantial effort in health economics and outcomes research (HEOR) to demonstrate the cost-effectiveness and clinical superiority of their devices, ensuring sustained market access. Ultimately, the buyers are institutions, but the selection criteria are overwhelmingly driven by the clinical requirements and evidence-based preferences of the highly specialized physicians who utilize these advanced life-saving devices on patients suffering from aortic aneurysms and dissections.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Gore (W. L. Gore & Associates), Abbott Laboratories, Boston Scientific, Terumo Corporation, Lombard Medical, Endologix, Cook Medical, Jotec GmbH, MicroPort Scientific, Relisys, Vascoteck, Braile Biomédica, Cardinal Health, Bentley InnoMed, Getinge AB, Innovein, Japan Lifeline, LivaNova, TransMedics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aortic Stents Grafts Market Key Technology Landscape

The technological landscape of the Aortic Stents Grafts Market is defined by continuous innovation aimed at increasing device conformability, enhancing sealing mechanisms, and expanding the anatomical eligibility for endovascular repair. A foundational technology involves the sophisticated use of Nitinol (a nickel-titanium alloy) for the stent frame, prized for its superelasticity and shape memory, allowing the graft to be crimped into a small delivery sheath and then self-expand to provide consistent radial force within the aorta. Recent advancements focus on optimizing stent geometry and longitudinal support to prevent kinking or migration, especially in highly angulated aortas. The key materials used for the graft fabric, primarily ePTFE (expanded Polytetrafluoroethylene) and polyester (Dacron), are continuously being refined for improved durability, reduced porosity, and enhanced biological compatibility to minimize inflammation and thrombus formation, which are crucial for long-term clinical success and device patency.

The most significant and transformative technological trend is the evolution of customization and complexity in graft design, epitomized by Fenestrated Endovascular Aortic Repair (FEVAR) and Branched Endovascular Aortic Repair (BEVAR) systems. FEVAR technology involves creating precise openings (fenestrations) in the graft fabric that align with critical branch arteries (like renal and visceral arteries), allowing for aneurysm exclusion while maintaining flow to vital organs. This requires highly sophisticated pre-operative planning utilizing advanced 3D imaging software and often involves patient-specific device manufacturing. BEVAR systems, employed predominantly for aortic arch and thoracoabdominal repairs, utilize internal or external branches integrated into the graft, demanding extremely complex delivery systems and precise intraoperative maneuvering. These advanced systems represent the pinnacle of current technology, significantly addressing high-risk patient populations previously deemed untreatable by standard EVAR.

Furthermore, the market is seeing advancements in delivery systems and imaging integration. Low-profile delivery systems are essential to minimize access site complications, enabling percutaneous closure of the entry site rather than surgical cutdown, further enhancing the minimally invasive benefit. Modern systems feature enhanced radiopaque markers and steerable sheaths, drastically improving visualization and control during deployment. Hybrid imaging techniques, combining fluoroscopy with intravascular ultrasound (IVUS) and fusion imaging (overlaying pre-operative CT data onto live fluoroscopy), are becoming standard, improving the accuracy of device positioning and reducing contrast medium use and radiation exposure. The future trajectory includes smart stent grafts incorporating embedded sensors for wireless monitoring of aneurysmal sac pressure, promising a revolution in post-procedural surveillance and timely identification of complications without relying solely on frequent, high-cost imaging modalities.

Regional Highlights

- North America: This region dominates the global Aortic Stents Grafts Market in terms of revenue share, driven by a high prevalence of aortic diseases, sophisticated healthcare infrastructure, rapid adoption of advanced surgical technologies, and established, favorable reimbursement policies for endovascular procedures. The United States, in particular, is the largest consumer, characterized by high procedural volumes and a strong focus on innovation, leading to the early and widespread adoption of complex devices like FEVAR and BEVAR. The presence of major market players and intensive R&D activities further solidifies its leading position, emphasizing quality outcome metrics and continuous technological improvements.

- Europe: The European market is the second largest, exhibiting mature growth supported by comprehensive health coverage, well-established clinical guidelines (like those from ESC and ESVS) promoting endovascular repair, and significant procedural standardization across key countries such as Germany, the UK, and France. Western Europe acts as a rapid adopter of complex grafts, benefiting from centralized regulatory bodies like the EMA, which, upon approval, facilitates broad market access. The demand is particularly strong for devices addressing complex anatomies, as European vascular centers often participate heavily in multinational clinical trials, driving evidence generation and device acceptance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market globally. This exponential growth is fueled by increasing healthcare spending, improvements in healthcare access, and the rapidly growing geriatric population in countries like China, Japan, and India. While initial adoption focused on standard EVAR, increasing economic prosperity and the expansion of specialized vascular surgery training programs are accelerating the uptake of advanced TEVAR and FEVAR devices. Regulatory harmonization and local manufacturing initiatives in countries such as China are expected to significantly reduce costs and stimulate market penetration, transforming APAC into a critical strategic priority for global stent graft manufacturers.

- Latin America (LATAM): The LATAM market, while smaller, presents steady growth opportunities. Market expansion is constrained by varied reimbursement levels and economic volatility but is supported by localized efforts to improve patient access to minimally invasive therapies. Key drivers include increasing clinical training initiatives and the rising incidence of risk factors for aortic disease. Brazil and Mexico lead the region in terms of procedural volume and infrastructure development, actively seeking cost-effective solutions that deliver high clinical value.

- Middle East and Africa (MEA): The MEA region represents a nascent but potentially lucrative market, highly fragmented based on economic development. Countries within the GCC (Gulf Cooperation Council), characterized by high per capita healthcare expenditure and state-of-the-art medical facilities, demonstrate high adoption rates for premium stent grafts. However, adoption is slow across many African nations, constrained by infrastructural challenges and affordability issues, necessitating focused public-private partnerships and distribution strategies targeting major urban centers and high-income patient populations seeking medical tourism options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aortic Stents Grafts Market.- Medtronic PLC

- W. L. Gore & Associates, Inc. (Gore)

- Endologix, Inc.

- Cook Medical LLC

- Boston Scientific Corporation

- Terumo Corporation

- Abbott Laboratories

- Jotec GmbH (A subsidiary of MicroPort Scientific Corporation)

- Lombard Medical, Inc.

- MicroPort Scientific Corporation

- Cardinal Health, Inc.

- Bentley InnoMed GmbH

- Artivion, Inc. (formerly CryoLife, Inc.)

- Japan Lifeline Co., Ltd.

- Bolton Medical (A subsidiary of Terumo Corporation)

- Merit Medical Systems, Inc.

- Getinge AB

- Relisys Medical Devices

- Braile Biomédica

- Innovein Technologies Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Aortic Stents Grafts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Aortic Stents Grafts Market?

The primary driver is the accelerating aging global population, which correlates directly with a higher incidence of aortic aneurysms (AAA and TAA). Additionally, the robust clinical evidence supporting the safety and efficacy of minimally invasive endovascular aneurysm repair (EVAR/TEVAR) over traditional open surgery strongly boosts market demand.

Which product segment holds the largest share in the Aortic Stents Grafts Market?

The Endovascular Aneurysm Repair (EVAR) segment, used for treating abdominal aortic aneurysms (AAA), currently holds the largest market share globally. This dominance is due to the significantly higher prevalence of AAA compared to thoracic aortic pathologies, though the Thoracic EVAR (TEVAR) segment is exhibiting faster growth rates.

What are the main risks or restraints associated with Aortic Stents Grafts?

Key restraints include the extremely high initial cost of complex stent grafts (e.g., FEVAR/BEVAR), the need for long-term patient surveillance due to the risk of device-related complications like endoleaks and migration, and the stringent regulatory approval pathways which delay the introduction of novel, innovative devices.

How is technological innovation impacting endovascular aortic repair procedures?

Technological innovation is rapidly expanding the addressable patient population by developing highly specialized devices such as fenestrated and branched stent grafts (F/B-EVAR/TEVAR). These advancements enable the treatment of complex, anatomically challenging aneurysms previously requiring high-risk open surgery, thereby improving patient outcomes and procedural versatility.

Which geographical region is expected to show the fastest growth rate in this market?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) during the forecast period. This acceleration is attributed to significant improvements in healthcare infrastructure, increasing healthcare expenditure, and the rapid adoption of minimally invasive treatment modalities in populous economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager