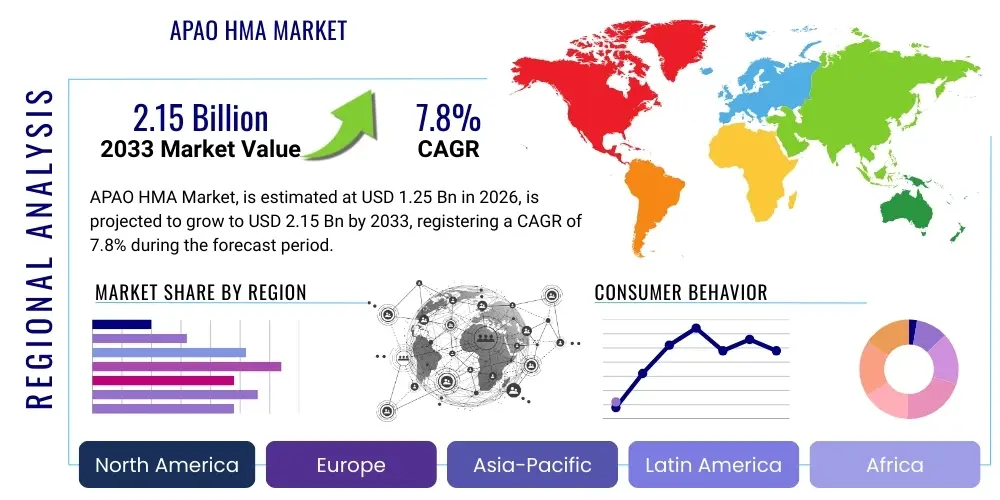

APAO HMA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437448 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

APAO HMA Market Size

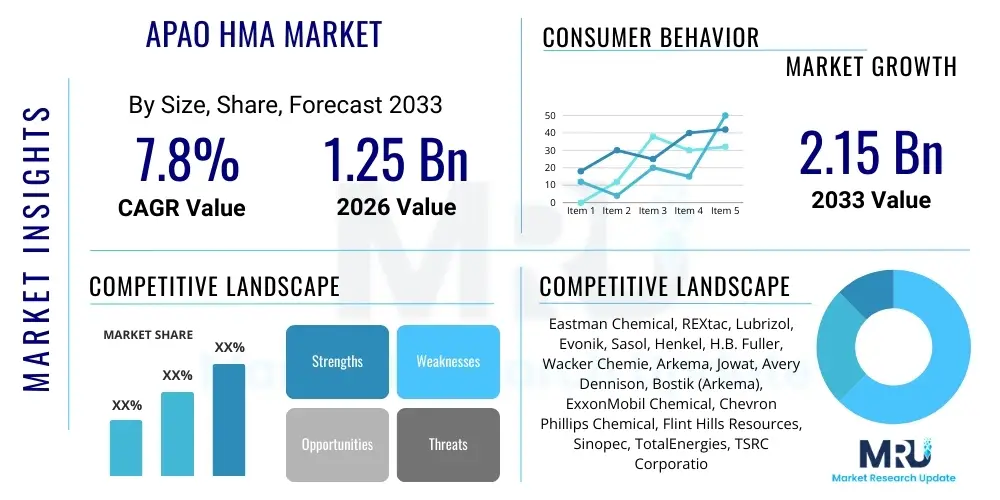

The APAO HMA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.15 Billion by the end of the forecast period in 2033.

APAO HMA Market introduction

The Amorphous Poly-Alpha-Olefin (APAO) Hot Melt Adhesive (HMA) market encompasses synthetic polymer-based adhesives derived primarily from the controlled polymerization of propylene, butene, and occasionally ethylene monomers. Unlike conventional semicrystalline polyolefin materials, APAOs possess a low degree of crystallinity, rendering them highly suitable for hot melt applications requiring flexibility, low viscosity, and excellent thermal stability. This unique polymer structure allows APAOs to maintain adhesion performance across a wide range of temperatures and substrates, including difficult-to-bond materials such as polypropylene (PP) and polyethylene (PE), which are increasingly prevalent in modern manufacturing and packaging.

APAO HMAs are broadly utilized across several major industrial sectors due to their cost-effectiveness and versatile performance profile. Key applications include nonwoven hygiene products (diapers, sanitary pads), durable goods assembly (automotive interiors, appliance bonding), construction materials (roofing, carpet backing), and large-scale product packaging. The increasing demand for lightweight and sustainable packaging solutions, coupled with the rising use of complex plastic substrates in the automotive industry to improve fuel efficiency, significantly drives the adoption of APAO-based adhesives. Their ability to deliver strong bonds rapidly in high-speed automated processes makes them indispensable components in modern assembly lines.

The primary benefits of APAO HMAs center around their superior thermal stability, which minimizes degradation during application and storage, leading to fewer machine shutdowns and reduced maintenance costs. Furthermore, APAOs generally exhibit good chemical resistance and maintain flexibility at low temperatures, crucial for applications subjected to extreme environmental conditions. Driving factors for market growth include stringent regulatory shifts favoring solvent-free adhesive systems (where HMAs excel), expanding infrastructure projects globally, and continuous innovation in metallocene catalysis technology, which allows manufacturers to tailor APAO properties with greater precision, yielding enhanced performance characteristics such as higher cohesive strength and narrower molecular weight distribution.

APAO HMA Market Executive Summary

The APAO HMA market is experiencing robust growth driven by accelerating industrialization in Asia Pacific and the persistent global focus on enhancing packaging efficiency and sustainability. Current business trends indicate a strategic shift by major adhesive formulators toward developing bio-based or partially renewable APAO variants to align with circular economy objectives and meet consumer demand for environmentally responsible products. Furthermore, strategic collaborations between polymer producers and equipment manufacturers are crucial, focusing on optimizing application systems to handle newer, lower-viscosity APAO formulations efficiently. The competitive landscape is characterized by moderate consolidation among large chemical companies, while specialized regional players focus on niche application segments such as medical tapes and specialized automotive trim bonding.

Regionally, the Asia Pacific (APAC) market dominates both consumption and production capacity, propelled by massive expansion in the construction sector, booming e-commerce necessitating high-volume packaging, and rapid growth in the disposable hygiene sector, particularly in China and India. North America and Europe, while representing mature markets, exhibit strong demand for high-performance APAO products, especially in automotive assembly and demanding construction applications where regulatory standards for material longevity and safety are exceptionally high. Europe, in particular, leads in adopting specialized APAOs compliant with REACH regulations and focused on minimizing Volatile Organic Compound (VOC) emissions, driving innovation toward next-generation catalyst technologies like metallocene APAOs.

Segment trends reveal that the metallocene APAO segment is poised for the fastest growth, primarily due to its superior performance characteristics, including enhanced heat resistance, improved adhesion, and lower odor compared to traditional Ziegler-Natta catalyzed APAOs. In terms of application, packaging remains the largest volume consumer, utilizing APAOs for case and carton sealing due to their rapid setting time and strong substrate compatibility. However, the hygiene product segment is expected to show the highest rate of growth, driven by increasing global population, rising disposable income, and continuous innovation in lightweight, flexible nonwoven materials requiring highly specialized and skin-safe adhesive solutions. This segmentation highlights a clear market dichotomy between high-volume, cost-sensitive standard applications and high-performance, specialized niche applications.

AI Impact Analysis on APAO HMA Market

User queries regarding the impact of Artificial Intelligence (AI) on the APAO HMA market predominantly focus on three critical areas: optimizing polymerization processes, enhancing quality control and consistency in adhesive manufacturing, and predicting raw material price fluctuations. Users are keenly interested in how machine learning algorithms can analyze complex reaction parameters (temperature, pressure, catalyst concentration) in real-time to maximize yield and fine-tune polymer properties such as melt flow index and molecular weight distribution, thereby reducing off-spec batches. Additionally, there is significant emphasis on leveraging AI-powered vision systems for automated, high-speed inspection of adhesive application beads in end-user industries (like packaging and nonwovens) to ensure zero-defect output and minimize material waste, leading to substantial cost savings and quality improvements across the value chain.

The implementation of predictive maintenance protocols driven by AI is another major theme, specifically related to the longevity and efficiency of HMA application equipment. By analyzing sensor data from pumps, nozzles, and melters, AI can anticipate equipment failure before it occurs, ensuring continuous operation in high-volume production environments. Furthermore, supply chain optimization using AI is gaining traction, where algorithms analyze geopolitical factors, commodity exchange rates, and historical data to forecast the volatile prices of key feedstocks like propylene and butene. This predictive capability allows APAO manufacturers to optimize procurement strategies, stabilize operating costs, and maintain competitive pricing, thereby mitigating risks associated with supply chain disruptions and margin erosion.

AI's role extends into sophisticated product development and simulation. Generative AI is increasingly used to simulate how new APAO formulations will interact with various substrates under different environmental stressors (humidity, heat, cold), drastically reducing the time and cost associated with traditional physical testing and R&D cycles. This capability accelerates the commercialization of novel, high-performance APAO products tailored for demanding applications such as electric vehicle battery bonding or extreme-weather construction. The integration of data analytics and machine learning transforms adhesive manufacturing from an empirical process into a data-driven science, providing APAO producers with a significant competitive advantage in customizing and scaling production efficiently.

- AI optimizes polymerization parameters (temperature, catalyst) for higher APAO yield and consistency.

- Predictive analytics stabilize volatile raw material procurement costs (propylene, butene).

- Machine learning enhances quality control through real-time, automated inspection of adhesive beads in end-user lines.

- AI-driven predictive maintenance minimizes downtime of HMA application equipment.

- Generative AI accelerates R&D by simulating new APAO formulations and substrate compatibility virtually.

DRO & Impact Forces Of APAO HMA Market

The APAO HMA market is dynamically shaped by a convergence of powerful drivers, structural restraints, and emerging opportunities, all interacting to define the strategic landscape. The primary driver is the pervasive trend toward sustainable, solvent-free manufacturing practices globally, which inherently favors HMAs over traditional liquid adhesives that rely on VOC-emitting solvents. Concurrent with this, the rapid expansion of disposable hygiene products and flexible packaging, particularly in developing economies, creates a high-volume, recurring demand base for cost-effective APAO solutions. However, market growth faces significant friction from the inherent volatility of petrochemical feedstock prices, as crude oil and natural gas derivatives form the basis of APAO production, creating uncertainty in long-term cost structures. Opportunities emerge from material innovation, specifically the development of bio-based monomers and specialized high-performance APAO grades designed for complex, high-stress automotive and electronic applications, allowing manufacturers to access premium segments.

The primary driving forces center on technological advancements in catalysis, notably the shift towards metallocene-catalyzed APAOs (mAPAO). This innovation yields polymers with narrower molecular weight distribution and lower crystallinity, offering superior performance attributes like cleaner processing, higher cohesive strength, and better thermal stability compared to conventional Ziegler-Natta APAOs. This technical improvement directly translates into enhanced efficiency for end-users in high-speed applications like nonwovens production and packaging lines. Simultaneously, the global focus on infrastructure renewal and sustainable building mandates in regions like Europe and North America pushes the demand for durable, weather-resistant APAO-based sealants and roofing adhesives, ensuring consistent market pull from the construction segment.

Restraints are dominated by the challenge of direct competition from alternative hot melt polymer technologies, such as Styrenic Block Copolymers (SBCs) and Ethylene Vinyl Acetate (EVA) resins, which possess strong footholds in various established applications. While APAOs offer superior adhesion to polyolefins, EVA often maintains a cost advantage in general packaging, and high-performance polyurethanes (PUR) often outperform APAOs in structural bonding applications requiring extreme heat resistance or chemical exposure. Furthermore, the complexity of scaling up highly specialized metallocene catalysis processes poses a technical barrier for smaller manufacturers, potentially leading to supply concentration among a few large global chemical entities. Despite these challenges, the ability of APAOs to adhere effectively to low surface energy substrates remains a powerful differentiating factor, especially in complex plastic assembly scenarios.

The long-term success of the APAO market hinges on leveraging key opportunities. One significant opportunity lies in addressing the burgeoning electric vehicle (EV) market, where APAOs are ideally suited for specialized applications such as module bonding, insulation attachment, and cable harnessing, capitalizing on the requirement for robust, lightweight, vibration-resistant adhesives. Another major opportunity is the penetration of APAOs into the pressure-sensitive adhesive (PSA) tapes and label market. By modifying APAO formulations to achieve the required tack and shear properties, manufacturers can displace conventional rubber-based PSAs, especially where improved UV resistance and thermal stability are required. The key impact forces include intense regulatory pressure favoring environmentally sound adhesive choices, fluctuating crude oil prices directly affecting margins, and the continuous innovation cycle that necessitates high R&D investment to maintain competitive product performance.

Segmentation Analysis

The APAO HMA market is meticulously segmented based on polymer type, application, and geography, reflecting the varied performance requirements and end-user industries. Segmentation by type differentiates between Conventional APAO (produced using Ziegler-Natta catalysts) and Metallocene APAO (mAPAO), with the latter commanding increasing market share due to its superior purity, controlled molecular architecture, and enhanced thermal properties, which meet the stringent demands of high-speed, sensitive manufacturing processes. Segmentation by application is crucial for understanding demand elasticity and specific performance specifications, ranging from high-volume, low-margin applications like packaging to high-specification, specialized uses in automotive and medical devices. This detailed analysis allows stakeholders to target investment, allocate resources efficiently, and customize product offerings to specific vertical market needs.

The dominance of the packaging segment highlights the core utility of APAO in carton and case sealing, leveraging their fast set time and good adhesion to recycled board stocks. However, the future trajectory of the market is heavily influenced by the hygiene and nonwovens sector, where increasing product complexity requires APAOs that offer exceptional flexibility, breathability, and reliable skin contact safety. This application demands extremely low-odor, low-VOC, and color-stable formulations. Conversely, the construction and assembly segments require APAOs with long-term durability, UV stability, and robust resistance to moisture and temperature extremes, showcasing the wide spectrum of technical demands placed upon APAO producers across different end-user verticals.

Regional segmentation remains vital, with APAC serving as the global manufacturing powerhouse driving volume growth, while North America and Europe lead in product innovation and adoption of advanced mAPAO grades. Understanding these regional dynamics, including local regulatory environments and commodity price variations, is critical for establishing effective global supply chain and pricing strategies. The ongoing transition toward sustainable materials globally necessitates that APAO formulations are continuously adapted to incorporate recycled or bio-based content without compromising essential adhesive performance attributes, further refining segmentation based on material source and environmental compliance.

- By Type:

- Conventional APAO (Ziegler-Natta Catalysis)

- Metallocene APAO (mAPAO)

- By Application:

- Packaging (Case and Carton Sealing)

- Nonwoven Hygiene Products (Diapers, Adult Incontinence, Feminine Hygiene)

- Assembly (Automotive, Furniture, Appliances)

- Construction (Roofing, Adhesives, Sealants)

- Pressure Sensitive Adhesives (Tapes, Labels)

- Other Applications (Medical, Filtration)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For APAO HMA Market

The value chain of the APAO HMA market begins with the upstream raw material procurement, dominated by petrochemical refiners who supply the necessary monomers, primarily polymer-grade propylene, butene, and potentially ethylene. This segment is highly consolidated and susceptible to global oil and gas market volatility. APAO manufacturers, occupying the core processing stage, convert these monomers through complex polymerization processes, often involving specialized Ziegler-Natta or advanced metallocene catalysts. The transition to metallocene catalysis necessitates significant capital expenditure and technological expertise, creating a barrier to entry. The ability of manufacturers to secure stable, competitive feedstock supply and efficiently manage catalyst costs directly dictates final product profitability and pricing competitiveness in the downstream market.

Moving downstream, the polymerized APAO pellets or granules are either sold directly to large end-users who formulate their own proprietary adhesive blends, or, more commonly, they are sold to adhesive formulators (e.g., Henkel, H.B. Fuller, Jowat). These formulators blend the base APAO polymer with various additives, including tackifiers (often hydrogenated resins), plasticizers (oils), waxes, and antioxidants, to create application-specific HMA formulations. This formulation stage adds significant intellectual value, tailoring characteristics such as open time, set speed, cohesive strength, and thermal resistance for demanding applications like high-speed packaging or complex automotive assembly. Distribution channels are bifurcated: large-volume end-users (OEMs, major packaging houses) often engage in direct procurement contracts with polymer producers or major formulators, ensuring stable supply and technical support.

Conversely, smaller and medium-sized enterprises (SMEs) typically rely on indirect distribution through specialized regional chemical distributors and value-added resellers. These distributors provide localized inventory management, technical application support, and small-batch ordering flexibility, which is crucial for maximizing market penetration across fragmented end-user segments like furniture manufacturing or small-scale general assembly. The final stage involves the end-user application via specialized hot melt dispensing equipment (e.g., Nordson systems), where the physical performance of the adhesive directly impacts manufacturing efficiency and product quality. Therefore, success in the APAO market often requires robust collaboration across the entire chain, from securing favorable propylene contracts upstream to providing comprehensive application troubleshooting support downstream.

APAO HMA Market Potential Customers

The potential customer base for the APAO HMA market is highly diverse, spanning sectors that require robust, high-speed, and reliable bonding of materials, especially polyolefin substrates. The primary end-users are large multinational corporations operating within the consumer goods, industrial manufacturing, and infrastructure sectors. In consumer goods, major manufacturers of disposable hygiene products (diapers and feminine care) are critical buyers, utilizing APAOs for structural integrity and elastic attachment, demanding extremely high consistency and minimal skin irritation potential. Similarly, major packaging corporations, particularly those serving the booming e-commerce and processed food industries, rely heavily on APAO HMAs for carton sealing, tray forming, and labeling due to their fast set speed and strong bond to recycled fiberboard.

In the industrial domain, Tier 1 and Tier 2 suppliers in the automotive sector represent a growing customer segment. They utilize APAOs for non-structural interior component assembly, carpet backing, headliner attachment, and increasingly in electric vehicle battery pack assembly for thermal management systems and insulation. These customers demand high-specification APAOs that offer superior heat resistance, vibration damping, and low-VOC profiles to meet stringent automotive interior air quality standards. Another significant customer group includes construction and civil engineering firms, particularly those involved in commercial and residential roofing, where APAOs are valued for their weather resistance and long-term sealing capabilities.

Furthermore, manufacturers of durable goods, such as appliances (refrigerators, washing machines) and furniture, use APAOs for component assembly where high mechanical strength is not mandatory but rapid assembly and temperature resistance are essential. The market also includes manufacturers of pressure-sensitive tapes and labels, who incorporate APAO formulations for customized adhesive backings, especially in industrial tapes requiring good chemical and UV resistance. The key common requirement across all these diverse end-users is the need for an adhesive solution that is application-efficient, cost-effective on a large scale, and compliant with increasingly strict health and safety regulations, positioning APAOs as a versatile, go-to solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical, REXtac, Lubrizol, Evonik, Sasol, Henkel, H.B. Fuller, Wacker Chemie, Arkema, Jowat, Avery Dennison, Bostik (Arkema), ExxonMobil Chemical, Chevron Phillips Chemical, Flint Hills Resources, Sinopec, TotalEnergies, TSRC Corporation, DIC Corporation, Lotte Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

APAO HMA Market Key Technology Landscape

The technological landscape of the APAO HMA market is primarily defined by continuous innovation in polymerization catalysis and advanced formulation techniques aimed at enhancing performance and sustainability. Historically, the market was dominated by Ziegler-Natta catalysts, which produce Conventional APAOs characterized by a broader molecular weight distribution and higher degree of crystallinity. While cost-effective, these polymers offer limited performance characteristics for specialized modern applications. The major transformative technology involves the increasing adoption of metallocene catalysts, which provide superior control over the polymerization process. Metallocene APAOs (mAPAO) exhibit a significantly narrower molecular weight distribution and lower polydispersity index, resulting in better thermal stability, reduced odor, enhanced specific adhesion to diverse substrates, and superior processing characteristics, such as lower viscosity at application temperature, enabling faster machine speeds in end-user lines.

Beyond catalysis, advancements in formulation technology play a critical role. This includes the development of highly specialized tackifiers, plasticizers, and stabilizers that are compatible with the complex amorphous polyolefin matrix. For instance, high-purity, hydrogenated hydrocarbon resins are often selected as tackifiers to improve adhesion and open time while minimizing color degradation and odor, which is particularly crucial for the hygiene segment. Furthermore, the integration of reactive technologies, such as incorporating small amounts of functional groups into the APAO backbone, allows for customized performance benefits, such as improved polarity or latent reactivity, enabling the creation of hybrid HMA systems that bridge the gap between traditional APAOs and high-end polyurethanes, broadening the application scope into more demanding structural assembly.

A significant emerging technology area is the pursuit of sustainability through the use of bio-based or recycled content in APAO production. While the base polymer remains petrochemical-derived, manufacturers are exploring bio-derived plasticizers and tackifiers to reduce the overall carbon footprint of the adhesive formulation. This shift aligns with global regulatory pressures and corporate sustainability mandates. Additionally, improvements in hot melt application equipment technology, such as precision slot coating, spray application, and optimized pumping systems, are intrinsically linked to APAO development. Newer mAPAO grades often require more precise temperature control and delivery mechanisms due to their lower melt viscosity, driving collaborative development between polymer scientists and equipment manufacturers to ensure maximum operational efficiency for the end-user.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC constitutes the largest and fastest-growing regional market for APAO HMAs, driven by aggressive infrastructural development, burgeoning middle-class populations, and the subsequent exponential growth in packaging demand from e-commerce and retail sectors. Countries like China and India are major manufacturing hubs, utilizing APAOs extensively in construction, automotive component assembly, and especially in the high-volume production of disposable hygiene articles. The region's market is characterized by intense price competition and a high focus on high-throughput, cost-effective APAO grades.

- North America (NA) High-Value Focus: North America represents a mature market focused on high-performance, specialized APAO applications, particularly in the automotive and durable goods assembly sectors, where adhesives must meet stringent quality and longevity standards. The transition toward electrification in the automotive industry is fueling demand for specialized APAOs used in battery components and lightweighting initiatives. Regulatory stability and high labor costs encourage automated, high-efficiency adhesive application systems, favoring premium mAPAO grades over conventional options.

- European (EU) Regulatory and Innovation Leadership: Europe is characterized by stringent environmental regulations (e.g., REACH, VOC limits) that strongly favor solvent-free HMAs, providing a structural advantage for APAOs. The region leads in adopting advanced, low-odor, and low-migration APAOs suitable for food-contact packaging and sensitive hygiene products. Innovation in the EU is focused on developing partially bio-based APAO formulations and utilizing them in highly technical construction and engineering assembly applications, prioritizing material safety and sustainability.

- Latin America (LATAM) Emerging Growth: LATAM is an emerging market for APAO HMAs, showing significant potential due to urbanization and increasing foreign direct investment in manufacturing, particularly in Brazil and Mexico. The packaging sector is the primary consumer, although the construction market provides steady demand. Market growth is sensitive to local economic stability and currency fluctuations, often relying on imported APAO raw materials or formulated adhesives from North American and European suppliers.

- Middle East and Africa (MEA) Infrastructure Expansion: The MEA region exhibits rising demand, largely concentrated in the GCC (Gulf Cooperation Council) countries due to massive construction and infrastructure projects, requiring durable sealants and adhesives resistant to high temperatures. The establishment of local nonwoven manufacturing facilities, particularly serving the hygiene market, further drives regional consumption. Market dynamics are heavily influenced by the availability and price stability of locally sourced petrochemical feedstocks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the APAO HMA Market.- Eastman Chemical Company

- REXtac LLC

- Lubrizol Corporation

- Evonik Industries AG

- Sasol Limited

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Wacker Chemie AG

- Arkema S.A.

- Jowat SE

- Avery Dennison Corporation

- Bostik (an Arkema company)

- ExxonMobil Chemical Company

- Chevron Phillips Chemical Company LLC

- Flint Hills Resources

- Sinopec Corp.

- TotalEnergies SE

- TSRC Corporation

- DIC Corporation

- Lotte Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the APAO HMA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Metallocene APAO (mAPAO) over Conventional APAO?

Metallocene APAO offers superior performance due to its narrow molecular weight distribution, resulting in enhanced thermal stability, lower viscosity (allowing for faster processing speeds), reduced odor, and better color stability compared to conventional Ziegler-Natta catalyzed APAOs. These attributes make mAPAO ideal for high-speed hygiene and specialized bonding applications requiring precise application and minimal volatile organic compounds.

How does the volatility of petrochemical feedstock prices impact the APAO HMA market?

The APAO HMA market is highly sensitive to the volatility of petrochemical feedstock prices, primarily propylene and butene. Since these monomers constitute the main raw material cost, price fluctuations directly affect the profitability margins of APAO manufacturers and adhesive formulators. This volatility necessitates sophisticated hedging and procurement strategies to stabilize long-term pricing for end-users.

Which application segment drives the largest demand volume for APAO hot melt adhesives globally?

The Packaging segment, specifically carton and case sealing, currently drives the largest demand volume for APAO hot melt adhesives. This is attributed to APAO's fast set time, strong adhesion to corrugated and recycled substrates, and cost-effectiveness required for high-volume automated packaging lines supporting global logistics and e-commerce growth.

Are APAO HMAs considered sustainable compared to other adhesive types?

APAO HMAs are generally considered more sustainable than solvent-based liquid adhesives because they are 100% solid and contain no volatile organic compounds (VOCs) that are harmful to the environment or human health. Ongoing R&D efforts are focused on improving their sustainability profile further by incorporating bio-based tackifiers and plasticizers to reduce reliance on purely petroleum-derived components.

What role do APAOs play in the expanding Electric Vehicle (EV) manufacturing industry?

APAO HMAs are increasingly utilized in EV manufacturing for non-structural bonding applications, including adhering thermal management insulation, cable harness fixation, and interior component assembly. Their flexibility, low-density characteristics, and resistance to vibration make them essential for producing lightweight and durable electric vehicle components, contributing directly to battery safety and overall vehicle efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager