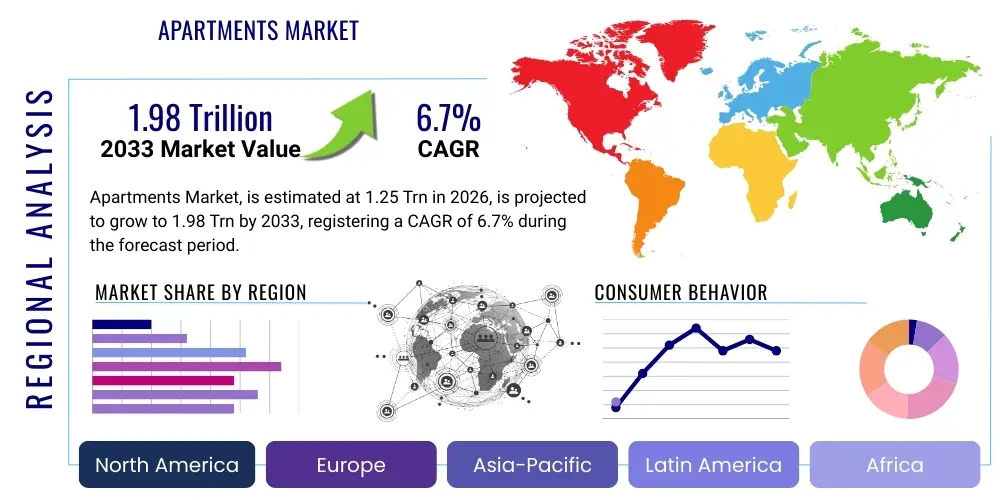

Apartments Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439459 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Apartments Market Size

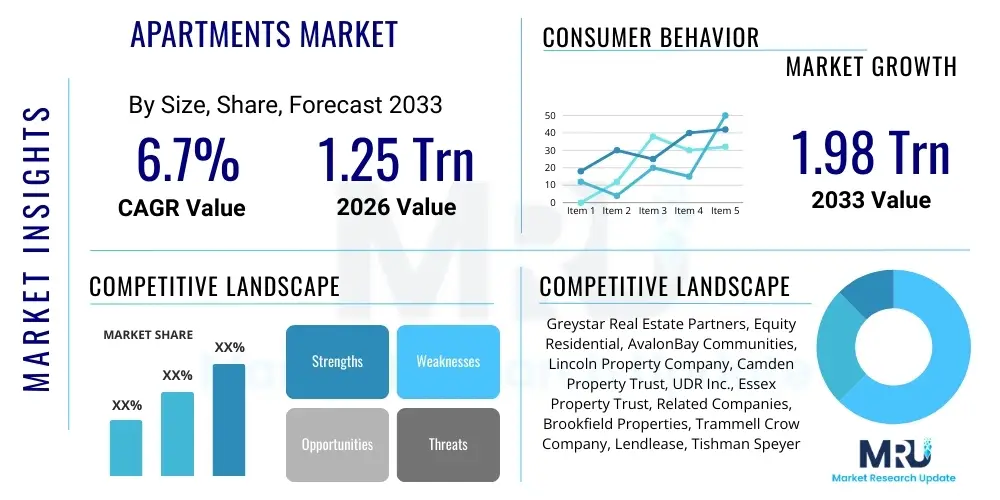

The Apartments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 1.25 Trillion in 2026 and is projected to reach USD 1.98 Trillion by the end of the forecast period in 2033.

Apartments Market introduction

The global Apartments Market encompasses a vast and dynamic ecosystem of residential units designed for individuals or families within multi-unit buildings, typically offered for rent or sale. This market is characterized by a diverse range of property types, from luxury high-rises in urban centers to affordable housing complexes in suburban areas, catering to varying socio-economic strata and lifestyle preferences. The increasing urbanization across developing economies, coupled with a growing global population and evolving demographic trends, continues to fuel sustained demand for apartment living solutions. This market plays a pivotal role in urban development, housing policy, and economic growth, reflecting broad shifts in consumer behavior and investment patterns.

Apartments, as a product, offer a unique blend of convenience, accessibility, and community amenities that often distinguish them from single-family homes. They are primarily utilized as primary residences, offering solutions for individuals seeking proximity to employment hubs, educational institutions, and recreational facilities. Major applications extend to student housing, corporate housing for temporary relocations, and even short-term rentals in tourism-heavy areas, showcasing their versatility. The inherent benefits include reduced maintenance responsibilities for tenants, access to shared facilities like gyms, pools, and co-working spaces, enhanced security measures, and often a lower entry cost compared to purchasing a standalone house. These advantages collectively contribute to their attractiveness, particularly for younger demographics and those prioritizing lifestyle over expansive private property ownership.

Driving factors for the sustained expansion of the Apartments Market are multifaceted and deeply interconnected. Rapid urbanization continues to be a primary catalyst, as more people migrate to cities for job opportunities and better infrastructure, increasing the demand for compact and accessible housing. Demographic shifts, such as delayed marriages, smaller family sizes, and a growing single-person household segment, further favor apartment living. Additionally, rising real estate prices for single-family homes in prime locations make apartments a more financially viable and attractive option for a significant portion of the population. Government initiatives supporting affordable housing, coupled with technological advancements in construction and property management, also contribute significantly to market growth, ensuring a steady supply meets the ever-growing demand.

Apartments Market Executive Summary

The Apartments Market is currently experiencing robust growth, driven by a convergence of compelling business trends, evolving regional dynamics, and intricate segmentation shifts. A key business trend observable across the industry is the increasing institutional investment in multi-family assets, signaling confidence in long-term rental income stability and appreciation potential. This is complemented by a sustained focus on developing mixed-use properties that integrate residential apartments with retail, office, and entertainment spaces, creating vibrant urban ecosystems and enhancing resident convenience. Furthermore, the adoption of sustainable building practices and smart home technologies is becoming a differentiating factor, attracting environmentally conscious tenants and tech-savvy occupants while also yielding operational efficiencies and reduced utility costs.

Regional trends exhibit significant variations that reflect local economic conditions, regulatory environments, and demographic pressures. North America and Europe continue to be mature markets characterized by steady demand, albeit with specific nuances such as increasing suburbanization post-pandemic in some areas, alongside a rebound in urban core living. The Asia Pacific region stands out as a high-growth market, propelled by rapid urbanization, a burgeoning middle class, and substantial infrastructure development in countries like India and China, leading to immense demand for new apartment constructions. Latin America and the Middle East & Africa also present emerging opportunities, with growing populations and increasing foreign direct investment driving construction activities, particularly in major metropolitan areas, though often constrained by varying levels of economic stability and investment attractiveness.

Segmentation trends reveal a clear bifurcation in demand and development strategies. The luxury apartment segment continues to thrive, catering to affluent consumers seeking premium amenities, prime locations, and high-end finishes, often supported by global wealth accumulation. Concurrently, the affordable and mid-market housing segments remain critically important, addressing the housing needs of a vast majority of the population and often benefiting from government subsidies or incentives. There is also a notable surge in demand for purpose-built student accommodation (PBSA) and senior living apartments, reflecting demographic shifts and specialized housing requirements. The rental market, in particular, is experiencing strong performance, driven by housing affordability challenges and a preference for flexibility among younger generations, which in turn influences investment into build-to-rent (BTR) projects across various geographies.

AI Impact Analysis on Apartments Market

Common user questions regarding AI's impact on the Apartments Market often revolve around concerns for job displacement in property management, the perceived dehumanization of resident interactions, data privacy and security implications, and the tangible benefits and return on investment for property owners and residents. Users are keen to understand how AI can genuinely enhance living experiences, streamline operations, and contribute to property value without compromising the personal touch. There is significant curiosity about AI's role in predictive maintenance, smart home integration, personalized services, and optimizing rental pricing, alongside a healthy skepticism about the practical implementation challenges and ethical considerations associated with widespread AI adoption in residential contexts.

- AI-powered predictive maintenance systems can analyze historical data from building sensors to forecast potential equipment failures (e.g., HVAC, elevators) before they occur, enabling proactive repairs, reducing downtime, and significantly lowering operational costs.

- AI chatbots and virtual assistants are being deployed to handle routine tenant inquiries, schedule maintenance requests, provide instant property information, and manage leasing applications 24/7, improving tenant satisfaction and freeing up property managers for more complex tasks.

- Dynamic pricing algorithms leverage vast datasets, including local market trends, competitor pricing, seasonal demand, and specific property attributes, to optimize rental rates in real-time, maximizing occupancy and revenue for landlords.

- Smart home technologies integrated with AI allow residents to control lighting, temperature, security systems, and entertainment through voice commands or automated schedules, enhancing convenience, energy efficiency, and overall living comfort.

- AI-driven analytics tools can process tenant behavior data (with privacy safeguards) to personalize amenity offerings, optimize community events, and tailor marketing efforts, fostering a stronger sense of community and reducing tenant turnover.

- Automated property showings and virtual tours powered by AI and augmented reality can provide prospective tenants with immersive experiences, allowing them to explore properties remotely and at their convenience, streamlining the leasing process.

- AI enhances security systems through facial recognition, anomaly detection in surveillance footage, and intelligent access control, providing residents with a safer living environment and assisting property management in quickly identifying and responding to potential threats.

- Energy management systems using AI can optimize building energy consumption by learning resident patterns and adjusting heating, cooling, and lighting systems accordingly, leading to substantial reductions in utility expenses and a smaller carbon footprint for the property.

- AI is increasingly used in property development for site selection, optimizing building design for sunlight and airflow, and even predicting construction timelines and costs with greater accuracy, leading to more efficient and sustainable projects.

DRO & Impact Forces Of Apartments Market

The Apartments Market is significantly shaped by a powerful interplay of drivers, restraints, opportunities, and broader impact forces that collectively dictate its trajectory and profitability. Key drivers include rapid urbanization, which continues to concentrate populations in metropolitan areas, inherently increasing the demand for multi-family housing. Demographic shifts, such as a growing younger workforce prioritizing flexibility and proximity to urban amenities, and an aging population seeking low-maintenance living options, further fuel this demand. Additionally, persistent affordability challenges in the single-family home market make apartment rentals a more accessible and practical housing solution for a substantial segment of the population, propelling sustained growth in the rental sector across various income brackets and geographic locations. These intrinsic factors create a robust underlying demand structure.

Despite these strong drivers, the market faces several notable restraints that can impede its expansion. High construction costs, influenced by rising material prices, labor shortages, and stringent regulatory compliance, make new development financially challenging and can lead to increased rental prices. Interest rate volatility and tightening lending standards for developers can also restrict access to capital, slowing down new project initiations. Furthermore, NIMBYism ("Not In My Backyard") and local zoning restrictions often create significant barriers to increasing housing density in high-demand areas, artificially constraining supply. Economic uncertainties, including potential recessions or employment downturns, can impact consumer confidence and purchasing power, subsequently affecting both rental demand and property investment, thereby introducing a layer of market fragility.

Opportunities within the Apartments Market are abundant and diverse, pointing towards avenues for significant future growth and innovation. The increasing demand for sustainable and smart living solutions presents a lucrative opportunity for developers to integrate green building materials, energy-efficient systems, and advanced smart home technologies, attracting environmentally conscious tenants and achieving higher market values. The expansion of niche segments, such as purpose-built student accommodation (PBSA), co-living spaces, and specialized senior living facilities, caters to specific demographic needs and offers differentiated investment prospects. Furthermore, leveraging big data analytics and AI for dynamic pricing, personalized tenant services, and predictive maintenance can unlock substantial operational efficiencies and enhance profitability. Global institutional investors continue to view multi-family assets as a stable, attractive investment class, providing ongoing capital for development and acquisition, especially in emerging markets with strong demographic tailwinds.

Segmentation Analysis

The Apartments Market is highly segmented, reflecting the diverse needs and preferences of a global population across various economic, demographic, and geographical contexts. This segmentation is crucial for understanding market dynamics, identifying specific demand clusters, and tailoring development and investment strategies. Key segments typically encompass distinctions based on ownership type, rental versus ownership models, apartment size and configuration, price points (luxury, mid-market, affordable), target demographics (students, seniors, families), and the level of amenities offered. Analyzing these segments provides a granular view of market performance, revealing opportunities for specialization and innovation in apartment offerings to cater to specific consumer niches and investment objectives across the housing spectrum.

- By Type:

- Luxury Apartments: High-end finishes, premium amenities, prime locations, catering to affluent residents.

- Mid-Market Apartments: Standard amenities, good quality construction, balanced affordability, targeting middle-income individuals and families.

- Affordable Apartments: Designed to be financially accessible, often with government subsidies or regulated rents, serving lower-income households.

- Student Apartments (PBSA - Purpose-Built Student Accommodation): Furnished units, often with communal study areas and social spaces, located near universities.

- Senior Living Apartments: Age-restricted communities, often with accessibility features, healthcare support, and social activities.

- Co-Living Spaces: Shared living arrangements with private bedrooms but communal kitchens, living areas, and amenities, fostering community.

- By Ownership/Occupancy:

- Rental Apartments: Units leased to tenants for a specified period, offering flexibility and reduced upfront costs.

- Condominiums (Condos): Individually owned units within a multi-unit building, offering property ownership benefits with shared maintenance.

- Co-operative Apartments (Co-ops): Residents own shares in a corporation that owns the building, granting them the right to occupy a unit.

- By Size/Configuration:

- Studio Apartments: Single room combining living, sleeping, and kitchen areas.

- One-Bedroom Apartments: Separate bedroom, living room, kitchen, and bathroom.

- Two-Bedroom Apartments: Two separate bedrooms, often suitable for small families or roommates.

- Three-Bedroom and Larger Apartments: Suited for larger families or those requiring more space.

- Loft Apartments: Open-plan units, often in converted industrial buildings, with high ceilings and large windows.

- By Location:

- Urban Core Apartments: Located in city centers, offering proximity to business districts, entertainment, and public transport.

- Suburban Apartments: Situated in quieter residential areas, often with more space and family-friendly amenities.

- Transit-Oriented Development (TOD) Apartments: Located near public transportation hubs, promoting sustainable commuting.

- By End-User:

- Young Professionals: Seeking modern amenities, connectivity, and proximity to work and social life.

- Families: Prioritizing space, safety, good schools, and family-friendly amenities.

- Retirees: Looking for low-maintenance living, accessibility, and community activities.

- Students: Requiring furnished, convenient, and affordable housing near educational institutions.

- By Amenities:

- Full-Service Apartments: Concierge, gym, pool, business center, pet services.

- Basic Amenities Apartments: Standard features, focusing on essential living.

- Smart Apartments: Integrated smart home technology, automated systems.

Value Chain Analysis For Apartments Market

The value chain of the Apartments Market is a complex and multi-stage process, beginning with raw land acquisition and culminating in tenant satisfaction and ongoing property management. It commences with upstream activities centered on land identification, feasibility studies, and securing necessary permits and financing. This initial phase involves market research to assess demand, environmental impact assessments, and extensive legal due diligence to ensure the viability and profitability of a proposed apartment development. Key players in this stage include land developers, urban planners, architects, engineers, and financial institutions, whose collaboration is critical for laying the groundwork for a successful project. Efficiency and strategic planning at this stage significantly influence the overall cost structure and timeline of the entire development, impacting its future competitiveness and return on investment for all stakeholders involved.

Midstream activities primarily encompass the construction and development phase, where the architectural designs are brought to life. This involves procuring building materials, managing construction teams, ensuring quality control, and adhering to strict project timelines and budgets. The choice of materials, construction techniques, and adherence to safety standards are paramount in this stage, directly influencing the durability, aesthetic appeal, and long-term maintenance costs of the apartment complex. General contractors, specialized subcontractors (e.g., electrical, plumbing, HVAC), material suppliers, and project managers are the main actors here. Post-construction, the focus shifts to interior design, landscaping, and the installation of fixtures and amenities, preparing the property for its target occupants and ensuring it meets market expectations and regulatory requirements for occupancy permits.

Downstream activities revolve around the marketing, leasing, and ongoing management of the completed apartment units. This phase is crucial for attracting and retaining tenants, maximizing occupancy rates, and ensuring consistent revenue generation. Marketing efforts can involve extensive digital campaigns, real estate portal listings, virtual tours, and on-site leasing offices. The distribution channel for apartments is predominantly direct, with property owners or their appointed property management firms directly engaging with prospective tenants. However, indirect channels also play a significant role, including real estate brokers, online listing platforms (e.g., Zillow, Rightmove, 99acres), and relocation services that assist corporate clients or international transferees in finding suitable accommodation. Post-leasing, property management services handle rent collection, maintenance, tenant relations, security, and amenity management, ensuring a positive living experience and preserving the asset's value, thereby completing the cyclical value creation process within the apartments market.

Apartments Market Potential Customers

The Apartments Market caters to an exceptionally broad and diverse range of potential customers, reflecting the fundamental human need for shelter, coupled with varying lifestyle preferences, financial capabilities, and demographic profiles. Primarily, individuals and families constitute the largest segment of end-users, seeking primary residences that offer convenience, security, and access to urban amenities. This includes young professionals drawn to city centers for career opportunities and social life, small to mid-sized families looking for space and good schooling in suburban developments, and single individuals prioritizing flexibility and a low-maintenance lifestyle. The appeal extends across income brackets, from those seeking luxury accommodations with extensive services to those requiring affordable housing solutions, making the market inherently inclusive and resilient to specific economic fluctuations.

Beyond traditional households, several specialized segments represent significant groups of buyers and renters. Students, particularly those attending universities or colleges, form a substantial customer base for purpose-built student accommodation (PBSA) or apartments conveniently located near educational institutions. Similarly, senior citizens, increasingly opting for independent yet supportive living environments, drive demand for age-restricted communities that offer accessibility features, communal activities, and often on-site care services. Corporate clients represent another vital segment, leasing apartments for temporary employee relocations, expatriate assignments, or short-term project accommodations, seeking fully furnished and serviced units that reduce logistical burdens for their workforce. This diversification of end-users underlines the market's adaptability and capacity to serve a multitude of housing needs.

Furthermore, the investment community forms a critical segment of "buyers" in the Apartments Market, albeit with a different motivation. Institutional investors, including pension funds, real estate investment trusts (REITs), and private equity firms, actively acquire apartment complexes as income-generating assets, viewing them as stable long-term investments with consistent rental yields and capital appreciation potential. Individual investors also participate, purchasing single units or small multi-family properties for rental income or future resale. These investors contribute significantly to market liquidity and development, indirectly serving the ultimate end-users by providing housing options. The interplay between these diverse customer groups – primary residents, specialized demographic groups, corporate entities, and financial investors – creates a dynamic demand landscape that continually shapes development, pricing, and service offerings within the global Apartments Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Trillion |

| Market Forecast in 2033 | USD 1.98 Trillion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Greystar Real Estate Partners, Equity Residential, AvalonBay Communities, Lincoln Property Company, Camden Property Trust, UDR Inc., Essex Property Trust, Related Companies, Brookfield Properties, Trammell Crow Company, Lendlease, Tishman Speyer, JLL (JLL Residential), CBRE (CBRE Multifamily), Alliance Residential Company, Crescent Communities, Lennar Multifamily Communities (LMC), Toll Brothers Apartment Living, Highwoods Properties, Simon Property Group (residential divisions). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Apartments Market Key Technology Landscape

The Apartments Market is undergoing a profound transformation driven by the integration of advanced technologies across its entire lifecycle, from design and construction to property management and resident experience. Building Information Modeling (BIM) software, for instance, has revolutionized the design and planning phase, enabling architects and developers to create detailed 3D models of apartment complexes. This not only improves design accuracy and reduces errors but also facilitates better collaboration among stakeholders, optimizes material usage, and allows for virtual walk-throughs before construction begins. Modular construction and prefabrication techniques are gaining traction, allowing for faster build times, enhanced quality control off-site, and reduced construction waste, addressing challenges related to labor shortages and escalating material costs. These foundational technologies streamline the initial phases of apartment development, setting the stage for smart integration.

During the operational phase, the proliferation of smart home technology has become a significant differentiator and expectation among modern tenants. Internet of Things (IoT) devices, including smart thermostats, lighting systems, security cameras, smart locks, and voice-activated assistants, are increasingly being integrated into apartment units. These technologies offer residents enhanced convenience, personalized comfort, and improved energy efficiency, often controlled via a centralized app. For property managers, these IoT ecosystems provide valuable data on utility consumption, potential maintenance issues, and resident preferences, enabling more proactive and efficient building management. Furthermore, robust Wi-Fi infrastructure and dedicated resident portals facilitate seamless communication, online rent payments, maintenance requests, and access to community amenities, fostering a more connected and responsive living environment.

Beyond individual units, property management itself is being redefined by digital solutions and artificial intelligence (AI). Property management software (PMS) platforms now offer comprehensive solutions for lease administration, accounting, facility management, and tenant communication, automating many routine tasks. AI-powered analytics tools are utilized for dynamic pricing optimization, analyzing market trends, competitor data, and occupancy rates to adjust rental prices in real-time, thereby maximizing revenue. AI chatbots and virtual assistants handle initial inquiries, schedule viewings, and provide instant support, improving lead conversion and tenant satisfaction. Predictive maintenance systems, driven by AI and sensor data, anticipate equipment failures, allowing for preventive repairs that reduce costly downtime. These technological advancements collectively enhance operational efficiency, elevate the resident experience, and provide a competitive edge in the rapidly evolving Apartments Market.

Regional Highlights

- North America: A mature market characterized by robust demand in both urban and suburban areas. Strong institutional investment, coupled with a growing preference for rental living among younger demographics, drives continuous development. Key trends include the growth of build-to-rent (BTR) models, smart home integration, and a focus on amenity-rich properties. Major metropolitan areas like New York, Los Angeles, Toronto, and Vancouver continue to see high demand, alongside a rise in secondary and tertiary markets.

- Europe: Diverse market with strong growth in Western and Northern Europe, fueled by urbanization, population growth, and high property prices making rentals attractive. Countries like Germany, the UK, France, and Spain are experiencing significant investment in multi-family housing. Emerging trends include increased sustainability mandates, co-living concepts, and the modernization of existing housing stock. Eastern European markets are also seeing growth as economies develop.

- Asia Pacific (APAC): The fastest-growing region, propelled by rapid urbanization, a burgeoning middle class, and massive infrastructure development, particularly in China, India, and Southeast Asian countries. High population density and limited land availability make apartments the dominant housing type. Key drivers include government initiatives to provide affordable housing, foreign investment, and the rise of smart cities. India and China are major hotspots for apartment construction.

- Latin America: An emerging market with significant potential, driven by demographic growth, increasing urbanization, and expanding economies in countries such as Brazil, Mexico, and Colombia. Demand is strong in major cities, often with a focus on mid-market and affordable housing. Challenges include economic volatility and varying regulatory environments, but sustained investment in infrastructure and housing projects continues to open up new opportunities for apartment developers.

- Middle East and Africa (MEA): A region of contrasts, with significant investment in luxury apartments and high-rise developments in wealthy Gulf Cooperation Council (GCC) states (e.g., UAE, Saudi Arabia) driven by expatriate populations and high-net-worth individuals. In contrast, many African nations face immense demand for affordable and mid-market housing due to rapid population growth and urbanization. Both regions present unique challenges and opportunities, with smart city initiatives and sustainable development gaining traction in more developed economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Apartments Market.- Greystar Real Estate Partners LLC

- Equity Residential

- AvalonBay Communities, Inc.

- Lincoln Property Company

- Camden Property Trust

- UDR Inc.

- Essex Property Trust, Inc.

- Related Companies

- Brookfield Properties (a subsidiary of Brookfield Asset Management)

- Trammell Crow Company (a subsidiary of CBRE)

- Lendlease Corporation

- Tishman Speyer Properties, L.P.

- JLL (JLL Residential & Multifamily Services)

- CBRE Group (CBRE Multifamily Investment Sales)

- Alliance Residential Company

- Crescent Communities LLC

- Lennar Multifamily Communities (LMC)

- Toll Brothers Apartment Living

- Highwoods Properties, Inc. (focus on mixed-use)

- Simon Property Group (residential components of mixed-use developments)

- Pinnacle Property Management Services, LLC

- Starwood Capital Group (through its multi-family investments)

- The NRP Group LLC

- Holt Residential

- Bell Partners Inc.

Frequently Asked Questions

Analyze common user questions about the Apartments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Apartments Market?

The Apartments Market is primarily driven by rapid global urbanization, which concentrates populations in cities and increases demand for multi-family housing. Key demographic shifts, such as smaller household sizes, delayed homeownership, and a growing single-person household segment, further boost the appeal of apartment living. Additionally, the increasing unaffordability of single-family homes in many urban areas makes apartments a more financially viable and accessible housing solution, particularly for younger generations and those seeking flexible living arrangements.

How is technology impacting property management and resident experience in apartment complexes?

Technology is profoundly transforming property management and resident experience. Smart home devices like thermostats, lighting, and locks offer residents enhanced convenience, personalized control, and improved energy efficiency. For property managers, technology provides AI-powered dynamic pricing tools to optimize rental rates, predictive maintenance systems for proactive repairs, and comprehensive property management software for streamlined operations, all contributing to increased efficiency, tenant satisfaction, and property value. Virtual tours and online leasing platforms also enhance the initial customer journey.

What are the key differences between rental apartments, condominiums, and co-operative apartments?

The primary difference lies in ownership structure. Rental apartments are leased from a property owner or management company, offering flexibility without ownership responsibilities. Condominiums involve individual ownership of a specific unit within a multi-unit building, along with a shared ownership interest in common areas. Co-operative apartments mean residents own shares in a corporation that owns the entire building, granting them the right to occupy a particular unit, but they do not directly own the real estate itself. Each option carries distinct financial and legal implications for the occupant.

Which regions are exhibiting the most significant growth in the Apartments Market, and why?

The Asia Pacific (APAC) region, particularly countries like China, India, and Southeast Asian nations, is exhibiting the most significant growth. This is primarily due to rapid urbanization, substantial population growth, a burgeoning middle class, and extensive infrastructure development. These factors collectively create immense demand for housing, making apartments a crucial and often primary housing solution in densely populated urban centers. North America and Europe also maintain steady growth, driven by institutional investment and evolving urban living preferences.

What investment opportunities exist within the specialized segments of the Apartments Market?

Significant investment opportunities exist within specialized segments such as Purpose-Built Student Accommodation (PBSA), senior living facilities, and co-living spaces. PBSA caters to the growing student population seeking convenient and amenity-rich housing near universities. Senior living addresses the needs of an aging demographic looking for accessible, low-maintenance living with supportive services. Co-living spaces tap into demand from young professionals and digital nomads seeking flexible, community-focused housing solutions. These niche markets offer diversified revenue streams and cater to specific, resilient demographic demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager