API & Bulk Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435151 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

API & Bulk Drugs Market Size

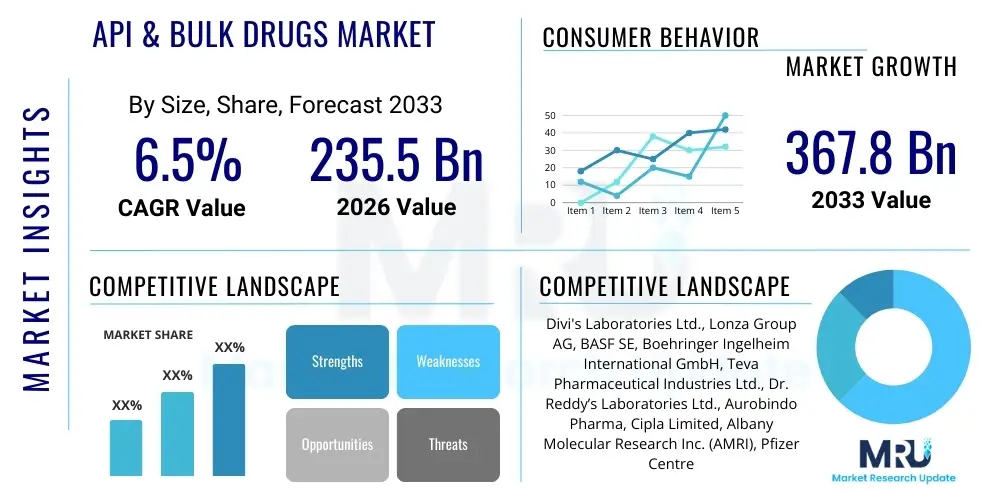

The API & Bulk Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 235.5 Billion in 2026 and is projected to reach USD 367.8 Billion by the end of the forecast period in 2033.

API & Bulk Drugs Market introduction

The Active Pharmaceutical Ingredients (API) and Bulk Drugs market forms the foundational layer of the global pharmaceutical industry. APIs are the core chemical components responsible for the therapeutic effects of a drug. Bulk drugs, often used interchangeably with APIs, refer to the raw materials used in the production of finished pharmaceutical formulations (FDFs). This market is critically important as the quality, sourcing, and regulatory compliance of APIs directly determine the efficacy and safety of all medicines globally. Key applications span across various therapeutic areas, including oncology, cardiology, central nervous system disorders, and infectious diseases, driving consistent demand.

The primary benefits associated with a robust API market include ensuring drug accessibility, stabilizing global supply chains, and fostering innovation in drug synthesis. The market is segmented based on synthesis type (synthetic/chemical and biotech), type of drug (innovator and generic), and application. The transition towards complex biological APIs (biologics) and high-potency APIs (HPAPIs) is reshaping manufacturing dynamics, requiring specialized infrastructure and stringent handling protocols. Geopolitical shifts and increasing focus on domestic manufacturing capabilities, particularly post-pandemic, are significant drivers in the current market landscape.

Driving factors propelling the growth of the API and Bulk Drugs market are primarily rooted in demographic and epidemiological trends. The aging global population, coupled with the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer, necessitates a continuous supply of therapeutics. Furthermore, advancements in drug discovery techniques, resulting in a higher number of approved drugs, directly increase the demand for corresponding active ingredients. Regulatory harmonization efforts and initiatives aimed at improving healthcare access in developing economies also contribute significantly to the sustained expansion of this essential market segment.

API & Bulk Drugs Market Executive Summary

The global API & Bulk Drugs market is characterized by intense globalization, significant regulatory scrutiny, and a palpable shift towards specialized and high-value synthesis techniques. Business trends highlight a strong focus on backward integration by large pharmaceutical companies seeking supply chain security, alongside increasing outsourcing to Contract Development and Manufacturing Organizations (CDMOs) for specialized or capacity-intensive manufacturing. The rise of biosimilars and generics continues to drive high-volume production of off-patent APIs, while the innovative segment commands premium pricing and necessitates advanced manufacturing technology, such as continuous flow chemistry and enhanced containment systems for HPAPIs. Companies are strategically investing in green chemistry and sustainable manufacturing practices to align with global environmental, social, and governance (ESG) standards, impacting long-term operational costs and market competitiveness.

Regionally, Asia Pacific, dominated by China and India, maintains its position as the global manufacturing hub due to cost efficiencies and established industrial ecosystems, though North America and Europe are rapidly scaling up domestic production capacity driven by national security and supply chain resilience mandates (e.g., US initiatives to secure critical drug supply). The regulatory environment, particularly concerning Good Manufacturing Practices (GMP) and supply chain traceability, remains a central factor influencing regional market dynamics. Emerging markets in Latin America and the Middle East are exhibiting higher growth rates, stimulated by expanding local pharmaceutical industries and increasing government expenditure on healthcare infrastructure, thus creating new avenues for API import and local formulation. However, geopolitical tensions and trade barriers pose consistent risks to efficient cross-border movement of bulk drug materials.

In terms of segmentation, the Synthetic/Chemical API segment currently holds the largest market share, catering primarily to small molecule drugs. However, the Biotechnology API segment is registering the fastest growth, propelled by the success of monoclonal antibodies, vaccines, and recombinant proteins, reflecting the industry's shift towards complex large molecule therapeutics. Within the application landscape, the oncology segment represents the most lucrative and fastest-growing area, necessitating specialized HPAPI production. The trend toward customized medicine and personalized therapeutics is further fragmenting the market, demanding greater flexibility and lower batch sizes from API manufacturers. Simultaneously, generic APIs, crucial for public health access, face intense price pressure, leading manufacturers to seek optimization through continuous manufacturing processes.

AI Impact Analysis on API & Bulk Drugs Market

Users frequently inquire about AI's capacity to revolutionize drug discovery and synthetic route optimization, seeking to understand if AI can significantly reduce the lead time and failure rates associated with identifying novel APIs or improving the yield of existing bulk drug processes. Key concerns center around the implementation cost, data integrity requirements for machine learning models, and the regulatory acceptance of AI-derived synthesis methods. Stakeholders are particularly interested in AI's role in predicting physicochemical properties, identifying potential toxicities early in the process, and streamlining complex chemical reactions, thereby lowering reliance on extensive, time-consuming wet-lab experimentation. The general expectation is that AI will primarily serve as an accelerator, enhancing efficiency and quality control across the entire API manufacturing lifecycle, rather than replacing fundamental chemical expertise.

The impact of Artificial Intelligence (AI) on the API & Bulk Drugs market is fundamentally transformative, particularly in the early stages of drug development and process chemistry. AI algorithms are increasingly deployed to analyze vast chemical databases, predict reaction outcomes, and design novel synthetic pathways that are both cost-effective and environmentally friendly. This computational capability significantly reduces the required experimental cycles, accelerating the time-to-market for new APIs. Furthermore, AI tools are vital for optimizing batch processes, predicting potential bottlenecks or contamination risks in large-scale production, and implementing predictive maintenance schedules for manufacturing equipment, thereby maximizing yield and operational uptime.

Beyond discovery and synthesis optimization, AI is playing a critical role in enhancing quality assurance and regulatory compliance. Machine learning models can analyze real-time data from process analytical technology (PAT) to monitor critical quality attributes (CQAs) continuously, ensuring that API batches consistently meet stringent purity and potency standards. This integration of AI-driven PAT systems facilitates the move toward fully automated and 'smart' manufacturing facilities, decreasing human error and improving traceability throughout the supply chain. This technological adoption necessitates significant investment in data infrastructure and specialized talent, representing a major strategic pivot for traditional API manufacturers aiming for high efficiency and flawless regulatory adherence.

- AI enhances drug target identification and API molecule design, reducing R&D timelines.

- Predictive modeling optimizes synthetic routes, improving yield and purity while minimizing waste.

- Machine learning algorithms analyze process analytical technology (PAT) data for real-time quality control.

- AI facilitates predictive maintenance of manufacturing equipment, reducing unplanned downtime.

- Accelerated identification of impurity profiles and potential toxicological risks in early development.

- Improved supply chain forecasting and inventory management through advanced predictive analytics.

DRO & Impact Forces Of API & Bulk Drugs Market

The API & Bulk Drugs market is primarily driven by the escalating global incidence of chronic diseases, necessitating sustained production of vital pharmaceuticals, alongside the substantial growth in the generic and biosimilar sectors which rely heavily on efficient, high-volume API manufacturing. Restraints include complex and rapidly evolving global regulatory hurdles (e.g., stringent quality guidelines from the FDA and EMA), high capital investment required for specialized facilities (especially for HPAPIs and biologics), and continuous pressure on pricing, particularly in highly competitive therapeutic segments. Opportunities abound in the shift towards advanced manufacturing technologies like continuous processing and green chemistry, and the strategic push by Western nations for supply chain de-risking and diversification away from traditional Asian hubs, creating localized growth potential. These factors collectively exert significant impact forces on the market, driving innovation in synthesis while simultaneously demanding cost reduction and absolute regulatory compliance.

Drivers: The dominant driver remains the increasing global demand for healthcare services, fueled by population expansion and greater health awareness. Technological advancements in chemical synthesis, allowing for the efficient production of complex molecules, also act as a major impetus. Furthermore, the expiration of patents for blockbuster drugs opens up the API market to generic manufacturers, leading to a surge in bulk drug production. Governments globally are also promoting local pharmaceutical manufacturing through incentives, further stimulating regional market growth and investment in infrastructure, especially in areas previously reliant on imports.

Restraints: Significant restraints include the volatility in the cost and availability of key raw materials and chemical intermediates, which directly impacts manufacturing margins. Environmental compliance costs are rising globally, forcing manufacturers to invest heavily in sustainable practices, which can increase short-term operational expenses. Moreover, the lack of skilled scientific personnel capable of handling highly sophisticated biotech and flow chemistry processes presents a persistent challenge, limiting the pace of technological adoption and expansion in certain regions.

Opportunities: Key opportunities lie in the expansion of contract manufacturing services, where CDMOs can leverage specialized expertise and capital investments to support both innovator and generic pharmaceutical companies. The development of high-potency APIs (HPAPIs) and biopharmaceuticals offers premium segments with higher profitability. Furthermore, the adoption of Industry 4.0 technologies, including automation, IoT, and AI, presents a pathway to dramatically improve operational efficiency, minimize waste, and ensure superior quality control, appealing strongly to global regulatory bodies and discerning buyers.

Impact Forces: The balance between price competitiveness, driven by genericization, and quality assurance, mandated by regulators, forms the core tension impacting this market. Geopolitical strategies centered on pharmaceutical sovereignty are pushing for localized supply chains, potentially fragmenting the global manufacturing network but increasing resilience. Technological disruption, particularly in biocatalysis and continuous manufacturing, necessitates rapid strategic adjustments by established players to avoid obsolescence, acting as a powerful force for internal restructuring and capital reallocation.

Segmentation Analysis

The API & Bulk Drugs market is meticulously segmented to reflect the diverse chemical complexity, regulatory pathways, and intended applications of the active ingredients. Primary segmentation pivots on the type of synthesis (synthetic chemical versus biotechnology), which distinguishes small molecule production from complex large molecule production. Further critical segmentation includes innovator APIs versus generic APIs, reflecting the competitive landscape and pricing power, and various therapeutic applications, which dictate the necessary manufacturing scale and specialized handling requirements. This granular analysis is essential for identifying specific growth pockets and understanding the differential demands placed on manufacturers across the globe.

The Synthetic Chemical APIs segment continues to dominate the market share due to its foundational role in traditional small molecule drugs, forming the backbone of generics production. However, the Biotechnology APIs segment, encompassing peptides, proteins, and monoclonal antibodies, exhibits the highest growth trajectory, driven by breakthroughs in biological research and the increasing approval rate of biologics. Manufacturers must choose specialized investment tracks, either focusing on high-volume, cost-efficient small molecule production or high-capital, complex biological synthesis, often requiring sterile and highly controlled environments.

Application-based segmentation reveals that the oncology sector consistently requires specialized HPAPIs and complex small molecules, resulting in high-value contracts. The cardiovascular and CNS segments, while mature, maintain massive volume requirements. Understanding these application trends guides CDMOs and in-house manufacturers in allocating R&D resources toward optimizing processes for the most promising therapeutic areas, ensuring alignment with global disease burden and pipeline forecasts.

- By Synthesis Type:

- Synthetic Chemical API (Small Molecules)

- Biotechnology API (Large Molecules)

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Vaccines

- Other Biologics

- By Type of Manufacturer:

- Captive/In-house Manufacturing

- Contract Manufacturing (CMO/CDMO)

- By Type of Drug:

- Innovator APIs

- Generic APIs

- By Application:

- Cardiology

- Oncology

- Central Nervous System (CNS)

- Respiralogy

- Infectious Diseases

- Endocrinology

- Others

Value Chain Analysis For API & Bulk Drugs Market

The API & Bulk Drugs value chain is a complex, multi-tiered structure beginning with raw material sourcing and culminating in the final formulated drug product. The upstream segment involves the procurement and processing of key chemical intermediates, solvents, and biological starting materials. The middle segment is the core of the market, focusing on the chemical synthesis, fermentation, or cell culture processes used to produce the API itself, which requires stringent quality control and regulatory adherence (GMP). The downstream segment involves the conversion of the API into finished dosage forms (FDFs) and subsequent distribution to healthcare providers and pharmacies. Efficiency and traceability across all stages are paramount due to the critical nature of the final product.

Upstream analysis reveals that the supply of crucial raw materials, often sourced from highly concentrated chemical manufacturing regions, presents the primary point of vulnerability. Fluctuations in geopolitical stability, environmental regulations in source countries, and transportation logistics significantly influence API production costs and timelines. Manufacturers often employ dual-sourcing strategies and backward integration to mitigate risks associated with reliance on single suppliers for key intermediates. Direct sourcing relationships and long-term contracts are common strategies used to stabilize the flow of these critical starting materials.

In the downstream segment, the distribution channel is bifurcated into direct sales to pharmaceutical companies (B2B) for FDF production and indirect distribution through specialized pharmaceutical wholesalers and agents. For large innovator companies, API transfer often occurs internally or directly to their preferred CDMO partners for formulation. Generic APIs utilize a wider, more competitive distribution network, often involving tenders and established global wholesale infrastructure. Effective supply chain management, supported by advanced tracking technologies, is essential to ensure product integrity and timely delivery, especially for temperature-sensitive biotechnology APIs.

API & Bulk Drugs Market Potential Customers

The primary customers and end-users of the API & Bulk Drugs market are global pharmaceutical companies, encompassing both large multinational corporations and smaller, specialized biotech firms. These entities require high-quality APIs as the essential component for manufacturing their final marketed drug products, including tablets, capsules, injectables, and topical formulations. Innovator pharmaceutical companies require novel APIs for their patented drugs, demanding close collaboration and specialized manufacturing capabilities from their suppliers. The bulk of the demand, however, comes from generic drug manufacturers who seek cost-effective, high-volume production of off-patent APIs to compete in global generic markets, placing significant emphasis on price, scalability, and consistent regulatory compliance.

Secondary but rapidly growing customer segments include Contract Development and Manufacturing Organizations (CDMOs), who purchase APIs or intermediates on behalf of their pharmaceutical clients, and also require API synthesis services. Research institutions and academic centers, though smaller in volume, represent consistent buyers of specialized, high-purity APIs for preclinical and clinical trials. Furthermore, national and regional health ministries, often through centralized procurement bodies, act as significant buyers of essential bulk drugs to maintain national drug stockpiles and support public health programs, particularly in infectious disease management and vaccination campaigns. Their purchasing decisions are highly price-sensitive but mandate rigorous quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 235.5 Billion |

| Market Forecast in 2033 | USD 367.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Divi's Laboratories Ltd., Lonza Group AG, BASF SE, Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Aurobindo Pharma, Cipla Limited, Albany Molecular Research Inc. (AMRI), Pfizer CentreOne, CordenPharma International, Merck KGaA, Piramal Pharma Solutions, Sun Pharmaceutical Industries Ltd., GlaxoSmithKline PLC, Cambrex Corporation, WuXi AppTec, Samsung Biologics, Thermo Fisher Scientific (Patheon), Siegfried Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

API & Bulk Drugs Market Key Technology Landscape

The technological landscape of the API & Bulk Drugs market is rapidly evolving, driven by the need for enhanced efficiency, improved quality, and compliance with increasingly strict environmental standards. Traditional batch processing is being supplemented, and in some specialized areas replaced, by continuous manufacturing (CM). CM offers substantial benefits, including reduced facility footprint, lower energy consumption, faster production cycles, and superior process control, enabling real-time release testing through integrated Process Analytical Technology (PAT). This shift is particularly crucial for generic manufacturers aiming to maintain competitiveness amidst fierce price erosion and for innovators seeking higher quality assurance for novel, complex molecules. Investment in these advanced systems, while high initially, promises long-term operational advantages and improved regulatory outcomes.

Another major technological focus is the advancement of green chemistry principles, specifically the adoption of biocatalysis and flow chemistry. Biocatalysis utilizes enzymes to catalyze chemical reactions with high selectivity, reducing the need for harsh solvents and minimizing waste products, aligning perfectly with sustainability goals and environmental regulations. Similarly, flow chemistry allows reactions to occur in small, confined channels under precise temperature and pressure control, enhancing safety, yield, and purity, particularly for hazardous or highly exothermic reactions. These technologies are crucial for the efficient synthesis of chiral compounds and complex intermediates, which are increasingly common in modern drug pipelines, positioning manufacturers who adopt them at a competitive advantage.

Furthermore, the integration of advanced digitalization, including the Industrial Internet of Things (IIoT) and sophisticated data analytics, is transforming API production into 'smart factories.' These systems enable comprehensive data logging, predictive modeling for yield optimization, and remote monitoring of critical process parameters (CPPs). For the high-growth biotechnology API segment, specialized technologies such as single-use bioreactors (SUBs) are gaining prominence. SUBs reduce the complexity and cost associated with sterilization and cleaning validation compared to traditional stainless steel bioreactors, offering flexibility and faster turnaround times for multi-product facilities, thereby accelerating the production cycle for novel biologics and vaccines.

Regional Highlights

The global API & Bulk Drugs market exhibits a diverse regional distribution, heavily influenced by manufacturing capabilities, regulatory environments, and regional healthcare expenditure. Asia Pacific (APAC) holds the dominant market share, primarily due to the massive manufacturing bases in India and China. These nations benefit from favorable government policies, a large pool of skilled chemists, and significantly lower operational costs compared to Western counterparts, making them the primary global suppliers for generic APIs and key chemical intermediates. However, this dominance is being challenged by increasing scrutiny over environmental compliance and quality control from international regulatory bodies, prompting continuous infrastructural improvements and transparency initiatives within the region. The high growth rate of APAC is sustained by the expansion of local pharmaceutical consumption markets, especially in Southeast Asia, driven by rising disposable incomes and improving healthcare access.

North America, led by the United States, represents the largest market in terms of value, driven by high R&D spending, a robust pipeline of innovator drugs, and premium pricing for novel APIs, particularly biologics and HPAPIs. Despite historically low production volume relative to Asia, recent strategic shifts, fueled by COVID-19 related supply disruptions and government mandates (such as Executive Orders on critical supply chain security), are accelerating the reshoring and diversification of API manufacturing. This drive is characterized by large investments in advanced manufacturing technologies, like continuous flow and automation, aimed at increasing domestic capacity and ensuring pharmaceutical independence. Regulatory excellence and stringent quality standards remain the defining characteristics of this region's API market.

Europe constitutes a mature and sophisticated market, demonstrating strong capabilities in complex chemical synthesis, particularly for innovator drugs and specialized intermediates. Countries such as Germany, Switzerland, and Ireland are key hubs for high-value API production and contract manufacturing, leveraging their expertise in complex chemistry and adherence to rigorous EU GMP standards. The European market is also at the forefront of adopting green chemistry practices and sustainable manufacturing, often setting global benchmarks for environmental compliance. Latin America and the Middle East & Africa (MEA) are emerging as high-potential regions. While currently smaller in volume, government efforts to establish self-sufficient pharmaceutical industries and increase local production, coupled with partnerships with major global CDMOs, are creating incremental demand and investment opportunities within these developing economies, particularly for essential generic bulk drugs.

- Asia Pacific (APAC): Dominant in volume and cost-effective generic API production; driven by India and China; experiencing regulatory tightening and infrastructural upgrades to meet global quality standards.

- North America: Leading market in value, focused on innovator drugs, biologics, and HPAPIs; significant trend toward reshoring manufacturing via advanced technologies for supply chain security.

- Europe: Strong base for complex synthesis, CDMOs, and green chemistry adoption; maintaining high standards for GMP compliance and specializing in high-value innovator APIs.

- Latin America (LATAM): Growing market with increasing focus on local formulation and government investment in healthcare, boosting demand for imported and locally produced bulk drugs.

- Middle East & Africa (MEA): Rapid expansion driven by healthcare infrastructure development and pharmaceutical localization initiatives; primarily focused on essential medicines and generics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the API & Bulk Drugs Market.- Divi's Laboratories Ltd.

- Lonza Group AG

- BASF SE

- Boehringer Ingelheim International GmbH

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Aurobindo Pharma

- Cipla Limited

- Albany Molecular Research Inc. (AMRI)

- Pfizer CentreOne

- CordenPharma International

- Merck KGaA

- Piramal Pharma Solutions

- Sun Pharmaceutical Industries Ltd.

- GlaxoSmithKline PLC

- Cambrex Corporation

- WuXi AppTec

- Samsung Biologics

- Thermo Fisher Scientific (Patheon)

- Siegfried Holding AG

- Mylan N.V. (Viatris)

- Shandong Xinhua Pharmaceutical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the API & Bulk Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between APIs and Bulk Drugs?

APIs (Active Pharmaceutical Ingredients) are the chemically active components responsible for the therapeutic effect of a drug. Bulk drugs is an older term often used interchangeably with APIs, particularly in regions like India, referring to the raw chemical substance used to produce the finished dosage form (FDF). Essentially, bulk drugs are the APIs in their raw form ready for formulation.

How is supply chain resilience being addressed in the API market?

Supply chain resilience is being enhanced through diversification of sourcing geographies (moving beyond over-reliance on single regions), implementation of mandatory dual-sourcing strategies, increased adoption of advanced, localized manufacturing technologies like continuous processing in North America and Europe, and the strategic stockpiling of critical intermediates.

What role do High-Potency APIs (HPAPIs) play in market growth?

HPAPIs are critically important in the market, particularly in the oncology segment, due to their therapeutic efficacy at very low doses. Their manufacturing requires specialized containment and expertise, resulting in higher capital investment and operational complexity, thus commanding a significant price premium and driving the value growth of the specialized API segment.

Which technology is most significantly impacting API manufacturing efficiency?

Continuous Manufacturing (CM) is currently the most impactful technology for efficiency. CM allows for uninterrupted production, smaller footprints, real-time quality monitoring via Process Analytical Technology (PAT), and significantly reduces batch-to-batch variability, leading to lower operating costs and faster production cycles compared to traditional batch methods.

What are the key regulatory challenges facing API manufacturers globally?

Key regulatory challenges include navigating varied and increasingly stringent Good Manufacturing Practices (GMP) across different jurisdictions (FDA, EMA), ensuring complete supply chain traceability, managing environmental compliance obligations, and dealing with frequent, often unannounced, inspections requiring impeccable data integrity and documentation practices across all operational sites.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager