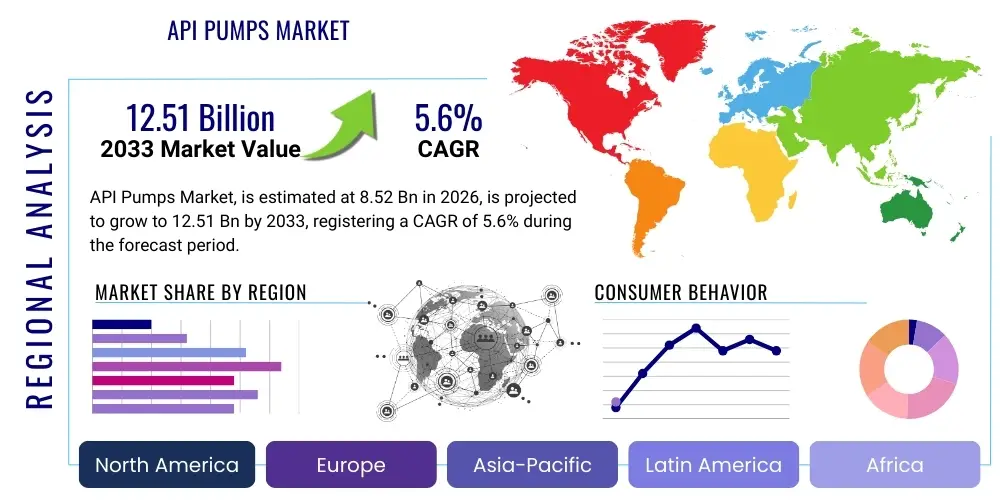

API Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440602 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

API Pumps Market Size

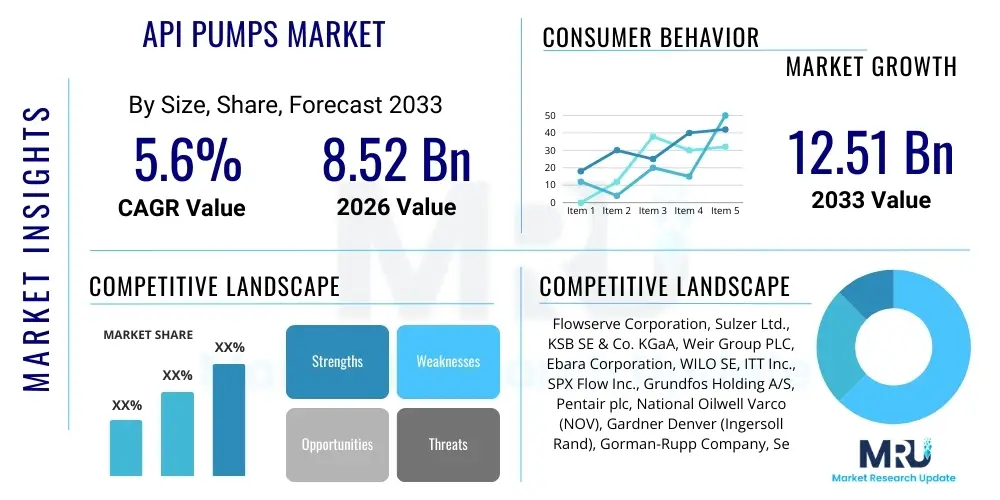

The API Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2026 and 2033. The market is estimated at USD 8.52 billion in 2026 and is projected to reach USD 12.51 billion by the end of the forecast period in 2033.

API Pumps Market introduction

The API Pumps market encompasses a critical segment of industrial pumping solutions designed and manufactured to meet the rigorous standards set by the American Petroleum Institute (API). These standards ensure high levels of safety, reliability, and efficiency, particularly in demanding environments such as oil and gas exploration, production, refining, and petrochemical processing. API pumps are engineered to handle a wide array of fluids, including hazardous, corrosive, abrasive, and high-temperature media, under extreme pressure conditions, thereby minimizing downtime and enhancing operational integrity in mission-critical applications.

The product description for API pumps highlights their robust construction, specialized materials, and advanced sealing systems, all conforming to specific API standards like API 610 for centrifugal pumps, API 674 for reciprocating pumps, API 675 for controlled volume pumps, and API 676 for rotary positive displacement pumps. These pumps are distinguished by their heavy-duty design, extended mean time between failures (MTBF), and adherence to strict performance and safety specifications. Major applications span across crude oil and natural gas production facilities, transmission pipelines, refineries, chemical and petrochemical plants, and power generation facilities, where uninterrupted operation and safety are paramount.

The primary benefits of adopting API pumps include enhanced operational safety due to their robust design and material integrity, extended equipment lifespan reducing total cost of ownership, and compliance with stringent environmental and regulatory requirements. Their reliability in harsh conditions contributes significantly to process uptime and productivity. Driving factors for this market include the global demand for energy, ongoing investments in oil and gas exploration and production, the expansion of petrochemical industries, and the continuous need for upgrading and maintaining existing industrial infrastructure to meet modern efficiency and safety standards.

API Pumps Market Executive Summary

The API Pumps Market is characterized by a confluence of evolving business trends, distinct regional dynamics, and specialized segmental growth trajectories, collectively shaping its future landscape. Business trends are heavily influenced by the global energy transition, which while pushing for renewables, still necessitates significant investment in conventional oil and gas infrastructure to meet current energy demands. This duality drives demand for highly efficient and reliable API pumps for both new projects and the maintenance, repair, and overhaul (MRO) of existing facilities. Furthermore, digitalization and automation are transforming operational practices, with an increasing emphasis on smart pumps integrated with Industrial Internet of Things (IIoT) technologies for predictive maintenance and optimized performance, leading to improved operational efficiency and reduced downtime. The market also observes a trend towards customization, where manufacturers are increasingly offering tailor-made solutions to meet specific client requirements for various challenging fluid types and operating conditions, alongside a strong focus on enhancing sustainability through energy-efficient designs and reduced emissions.

From a regional perspective, the market exhibits diverse growth patterns. North America, particularly the United States and Canada, remains a significant market driven by shale oil and gas production and robust refining capacities, coupled with stringent environmental regulations that favor API-compliant equipment. The Asia Pacific region, led by countries like China, India, and Southeast Asian nations, presents the fastest growth opportunities due to rapid industrialization, burgeoning petrochemical sectors, and substantial investments in new energy infrastructure projects. The Middle East and Africa continue to be cornerstone markets, fueled by large-scale upstream and downstream oil and gas projects aiming to leverage vast hydrocarbon reserves. Europe, while a mature market, sees steady demand driven by the modernization of existing chemical plants and the adoption of advanced pumping technologies to comply with strict safety and environmental standards. Latin America's market dynamics are influenced by the fluctuating global oil prices and ongoing investments in offshore and unconventional oil and gas exploration, particularly in countries like Brazil and Mexico.

Segmental trends highlight distinct patterns across pump types, applications, and end-user industries. Centrifugal pumps, specifically those conforming to API 610, dominate the market due to their versatility and widespread use in high-volume, continuous flow applications across refineries and petrochemical plants. Positive displacement pumps, including reciprocating and rotary types, maintain a critical niche, particularly in applications requiring high pressure, low flow, or precise dosing, governed by API 674, 675, and 676 standards. Application-wise, the oil and gas sector (upstream, midstream, and downstream) remains the primary revenue generator, followed closely by the chemical and petrochemical industries. The increasing complexity of feedstocks and processes in these sectors drives the demand for highly specialized and robust API pumps. Furthermore, within end-user segments, refineries and chemical processing plants are consistently significant consumers, emphasizing the need for pumps capable of handling corrosive and hazardous materials safely and efficiently. The shift towards cleaner fuels and advanced materials in manufacturing also impacts demand for pumps designed for specific chemical resistance and high-purity processes.

AI Impact Analysis on API Pumps Market

User questions regarding the impact of AI on the API Pumps Market frequently center on how artificial intelligence can enhance operational efficiency, predictive maintenance capabilities, and overall safety within critical industrial applications. Common inquiries explore the practical implementation of AI for real-time monitoring, anomaly detection, and optimizing pump performance to prevent failures, reduce downtime, and extend asset life. Users are keenly interested in understanding the integration challenges and benefits of AI-driven solutions, including the return on investment (ROI) from adopting smart pump technologies, the implications for existing infrastructure, and the potential for AI to aid in compliance with stringent API standards. There is also significant curiosity about how AI can contribute to energy efficiency, reduce environmental footprint, and address the skills gap in managing complex pump systems, highlighting a forward-looking perspective on leveraging AI for both operational excellence and sustainability in the API pumps domain.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, pressure, flow) from API pumps to predict potential failures before they occur, enabling proactive maintenance and reducing unscheduled downtime.

- Operational Optimization: AI-powered systems can monitor and adjust pump parameters in real-time to optimize performance, minimize energy consumption, and ensure the pump operates within ideal efficiency ranges, extending asset life.

- Anomaly Detection: Machine learning models identify subtle deviations from normal operating patterns, indicating potential issues or inefficiencies that human operators might miss, improving early fault detection.

- Enhanced Safety: By providing early warnings of potential malfunctions, AI contributes to a safer operational environment, reducing the risk of catastrophic failures and associated hazards, especially with volatile fluids.

- Remote Monitoring and Diagnostics: AI facilitates advanced remote monitoring capabilities, allowing experts to diagnose issues and provide guidance from off-site locations, improving response times and reducing field service costs.

- Demand Forecasting for Spares: AI can analyze historical usage and failure data to forecast demand for spare parts more accurately, optimizing inventory levels and ensuring critical components are available when needed.

- Improved Design and Engineering: AI can assist in the design phase by simulating pump performance under various conditions, optimizing designs for specific applications, and accelerating product development cycles.

- Supply Chain Optimization: AI-driven analytics can enhance the efficiency of the API pump supply chain by predicting market demand, optimizing logistics, and improving inventory management for both new pumps and replacement parts.

DRO & Impact Forces Of API Pumps Market

The API Pumps Market is profoundly shaped by a dynamic interplay of drivers, restraints, opportunities, and broader impact forces. A primary driver is the persistent global demand for energy, which necessitates ongoing investments in oil and gas exploration, production, and refining capacities, particularly in developing economies and regions with significant hydrocarbon reserves. The expansion of the chemical and petrochemical industries, driven by population growth and industrialization, also fuels demand for API-compliant pumps due to their critical role in safe and efficient processing of a diverse range of chemicals. Furthermore, stringent safety regulations and environmental standards globally compel industries to adopt reliable and robust API-standard pumps that minimize leaks, reduce emissions, and ensure operational integrity, thereby enhancing safety for personnel and the environment. The continuous need for upgrading and replacing aging infrastructure in mature markets also provides a steady impetus for market growth, as older, less efficient pumps are replaced with modern, API-compliant alternatives that offer better performance, higher energy efficiency, and lower maintenance costs.

However, the market faces significant restraints that temper its growth trajectory. The inherent volatility of crude oil and natural gas prices directly impacts investment decisions in the upstream and downstream sectors, leading to fluctuating demand for new equipment, including API pumps. High initial capital expenditure associated with purchasing and installing API pumps, which are generally more expensive than non-API compliant alternatives due to their specialized design and robust construction, can deter smaller players or projects with limited budgets. Additionally, the complex maintenance requirements and the need for highly skilled personnel to operate and service these sophisticated pumps contribute to higher operational costs, posing a challenge. The increasing global focus on renewable energy sources and the long-term energy transition towards decarbonization introduce a strategic restraint, potentially reducing future investments in fossil fuel infrastructure and consequently, the demand for traditional API pumps over the very long term, although this transition is gradual and conventional energy sources will remain vital for decades.

Despite these restraints, significant opportunities are emerging within the API Pumps Market. The ongoing digitalization and integration of smart technologies, such as the Industrial Internet of Things (IIoT), AI, and machine learning, offer substantial opportunities for innovation. These technologies enable advanced predictive maintenance, real-time performance monitoring, and operational optimization, leading to enhanced efficiency, reduced downtime, and lower total cost of ownership. The adoption of modular refineries and smaller-scale processing plants, particularly in remote or specialized applications, presents new avenues for API pump deployment that require compact, efficient, and highly reliable solutions. Furthermore, the expansion of chemical and petrochemical production capacities in emerging economies, particularly in Asia Pacific and the Middle East, provides a fertile ground for market growth. Manufacturers focusing on developing energy-efficient pump designs and incorporating advanced materials for increased corrosion and wear resistance also stand to gain a competitive edge by meeting evolving industry demands for sustainability and durability.

Broader impact forces also play a crucial role in shaping the API Pumps Market. Global economic cycles significantly influence industrial investment and project approvals, directly affecting demand. Geopolitical stability or instability in major oil and gas producing regions can disrupt supply chains, impact energy prices, and alter investment landscapes. Evolving environmental regulations, such as stricter emissions standards and waste management protocols, necessitate the use of pumps with superior sealing technologies and operational reliability, driving innovation and compliance requirements. Technological advancements, particularly in materials science and digital integration, continuously redefine performance benchmarks and enable the development of more efficient, durable, and intelligent pumping solutions. Lastly, supply chain disruptions, whether due to pandemics, trade disputes, or natural disasters, can impact the availability of raw materials and components, affecting manufacturing lead times and overall market stability, highlighting the importance of resilient and diversified supply networks for API pump manufacturers.

Segmentation Analysis

The API Pumps Market is comprehensively segmented based on various critical parameters, including pump type, material, application, end-user industry, and adherence to specific API standards. This detailed segmentation allows for a nuanced understanding of market dynamics, growth drivers, and demand patterns across different industrial landscapes. Each segment reflects distinct operational requirements and technological preferences, indicating where specific types of API pumps are most effectively deployed to meet stringent performance and safety criteria. The market overview suggests that while centrifugal pumps dominate due to their widespread utility in high-volume fluid transfer, positive displacement pumps maintain a vital role in specialized high-pressure or precise dosing applications. Material selection is paramount, dictated by the corrosive or abrasive nature of the fluids handled, ensuring longevity and operational safety in harsh industrial settings. The primary application and end-user segments, predominantly oil and gas coupled with chemical processing, underscore the market's reliance on sectors demanding utmost reliability and compliance with international standards.

- By Pump Type

- Centrifugal Pumps

- API 610 Horizontal Pumps (OH1, OH2, OH3, OH4, OH5, OH6)

- API 610 Vertical Pumps (VS1, VS2, VS3, VS4, VS5, VS6, VS7)

- Positive Displacement Pumps

- API 674 Reciprocating Pumps (Piston, Plunger)

- API 675 Controlled Volume Pumps (Metering Pumps)

- API 676 Rotary Pumps (Screw, Gear, Vane)

- Centrifugal Pumps

- By Material

- Cast Iron

- Stainless Steel (304, 316, Duplex, Super Duplex)

- Alloy Steels (Chrome Moly, Carbon Steel)

- Nickel Alloys

- Bronze Alloys

- Non-Metallic Linings

- By Application

- Upstream Oil and Gas (Exploration & Production)

- Midstream Oil and Gas (Pipelines, Storage)

- Downstream Oil and Gas (Refining, Petrochemicals)

- Chemical Processing

- Power Generation

- Water and Wastewater Treatment (Specialized API requirements)

- Mining

- Pharmaceuticals (Specific API standards for critical processes)

- By End-User Industry

- Oil & Gas Industry

- Petrochemical Industry

- Chemical Industry

- Power Industry

- Pharmaceutical Industry

- Others (General Manufacturing, Marine)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For API Pumps Market

The value chain for the API Pumps Market is a complex and highly integrated ecosystem, beginning with upstream raw material and component suppliers and extending through to downstream end-users and comprehensive after-sales services. The upstream analysis reveals that critical raw materials such as various grades of stainless steel, alloy steels, and specialized non-ferrous metals are sourced globally. These materials are essential for manufacturing robust pump casings, impellers, shafts, and sealing components that can withstand extreme pressures, temperatures, and corrosive environments inherent in API pump applications. Key component suppliers provide crucial elements like mechanical seals, bearings, electric motors, and control systems, which must also meet stringent quality and performance standards to integrate seamlessly into API-compliant pump designs. Relationships with these suppliers are often long-term, built on trust, quality assurance, and adherence to precise specifications, as the reliability of the final pump product is heavily dependent on the quality of its individual parts.

Moving downstream, the value chain encompasses the sophisticated manufacturing processes undertaken by API pump producers, who design, assemble, and rigorously test pumps to meet specific API standards and client specifications. These manufacturers often possess extensive engineering expertise and utilize advanced machining and fabrication techniques. Following production, the pumps enter the distribution channel, which can be direct or indirect. Direct distribution involves pump manufacturers selling directly to large end-users, such as major oil companies, national oil companies, or large engineering, procurement, and construction (EPC) firms, often through dedicated sales teams or project-specific contracts. This direct approach allows for close collaboration, customization, and comprehensive technical support throughout the project lifecycle. Indirect distribution, on the other hand, relies on a network of authorized distributors, agents, and system integrators who serve a broader base of smaller to medium-sized end-users across various industries and geographies. These indirect channels often provide localized sales support, inventory, and immediate technical assistance, extending the manufacturer's reach into diverse market segments.

The downstream segment culminates with the end-users and the crucial role of after-sales services. End-users, primarily in the oil and gas, petrochemical, and chemical processing industries, deploy these pumps in their critical operations, relying on their durability and performance for continuous production. Beyond the initial sale, the provision of comprehensive after-sales services is a significant value driver. This includes installation support, commissioning, ongoing maintenance (both preventive and corrective), spare parts supply, troubleshooting, and upgrade services. Many manufacturers also offer long-term service agreements, technical training for client personnel, and remote monitoring solutions to ensure optimal pump performance and longevity. The effectiveness of this service network directly impacts customer satisfaction, repeat business, and the overall reputation of the API pump manufacturer. The entire value chain is therefore characterized by a high degree of specialization, technical complexity, and a strong emphasis on quality and reliability at every stage to meet the demanding requirements of the API Pumps Market.

API Pumps Market Potential Customers

Potential customers for API pumps primarily encompass industries where the handling of hazardous, high-pressure, high-temperature, or corrosive fluids is routine, and where operational reliability and safety are non-negotiable. The largest segment of end-users are within the oil and gas industry, spanning the entire value chain from upstream exploration and production companies operating offshore platforms and onshore drilling sites, to midstream pipeline operators involved in crude oil and natural gas transportation and storage, and critically, to downstream refining and petrochemical processing facilities. These entities require API pumps for various applications such as crude oil transfer, gas processing, catalyst injection, product loading, and wastewater management within their complexes, where adherence to API standards ensures equipment integrity and minimizes environmental risks. Petrochemical plants, which convert petroleum products into a wide range of chemicals, are also significant buyers, utilizing API pumps for the safe and efficient transfer of reactants, intermediates, and final products in complex chemical synthesis processes.

Beyond the core oil and gas sector, the broader chemical industry represents another substantial customer base, particularly those engaged in the production of specialty chemicals, acids, bases, and other corrosive substances. These facilities often require pumps with specific material constructions and sealing arrangements to handle aggressive media, making API-compliant pumps an ideal choice for ensuring process safety and equipment longevity. Power generation plants, especially those that rely on fossil fuels, also constitute potential customers, utilizing API pumps for critical applications such as boiler feed water, condensate transfer, and cooling water circulation, where high reliability and continuous operation are paramount to electricity generation. While less common for API-specific applications, some highly critical industrial wastewater treatment facilities, particularly those associated with industrial complexes, may also opt for API-compliant pumps where the nature of the effluent or the required operational robustness demands superior standards. Furthermore, the mining industry, especially in specific processes involving corrosive slurries or chemicals, occasionally adopts API-standard pumps for their durability and robust performance in demanding environments, although this is a more niche application compared to oil and gas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.52 billion |

| Market Forecast in 2033 | USD 12.51 billion |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flowserve Corporation, Sulzer Ltd., KSB SE & Co. KGaA, Weir Group PLC, Ebara Corporation, WILO SE, ITT Inc., SPX Flow Inc., Grundfos Holding A/S, Pentair plc, National Oilwell Varco (NOV), Gardner Denver (Ingersoll Rand), Gorman-Rupp Company, Seepex GmbH, Vogel Pumpen (Xylem Inc.), Circor International, Inc., ClydeUnion Pumps (Celeros Flow Technology), LEWA GmbH, Apollo Pumps, Ruhrpumpen Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

API Pumps Market Key Technology Landscape

The API Pumps Market is experiencing a transformative technological evolution, driven by the imperative for enhanced efficiency, reliability, and safety in demanding industrial applications. A significant aspect of this landscape is the continuous advancement in materials science, leading to the development and adoption of exotic alloys, duplex and super duplex stainless steels, and advanced ceramic coatings. These materials offer superior resistance to corrosion, erosion, and cavitation, significantly extending pump lifespan and reducing maintenance requirements, particularly when handling highly aggressive or abrasive fluids. Furthermore, innovations in sealing technologies, including advanced mechanical seals and magnetic drives, are crucial for minimizing leaks of hazardous substances, improving environmental compliance, and ensuring process containment, which are paramount in API-regulated environments.

Another pivotal technological trend involves the integration of smart pump technologies and digital solutions. This encompasses the widespread adoption of the Industrial Internet of Things (IIoT) sensors for real-time monitoring of critical operational parameters such as vibration, temperature, pressure, flow rates, and power consumption. These sensors feed data into cloud-based platforms and analytical software, often powered by Artificial Intelligence (AI) and Machine Learning (ML) algorithms, to provide advanced diagnostics and predictive maintenance capabilities. Such systems can identify subtle anomalies, forecast potential equipment failures, and optimize pump performance proactively, moving away from traditional time-based maintenance to condition-based or predictive maintenance strategies. This not only reduces unscheduled downtime and operational costs but also enhances overall asset utilization and operational safety by preventing catastrophic failures.

Beyond sensing and analytics, the technology landscape also includes advancements in pump hydraulics and design. Computational Fluid Dynamics (CFD) modeling and Finite Element Analysis (FEA) are routinely employed to optimize impeller and volute designs, improving hydraulic efficiency, reducing energy consumption, and minimizing cavitation. Modular design principles are gaining traction, allowing for greater flexibility in configuration, easier maintenance, and quicker replacement of components. Furthermore, the development of variable speed drive (VSD) technology for electric motors powering API pumps is becoming standard, enabling pumps to operate at optimal speeds for varying process demands, which significantly reduces energy consumption and extends pump life. This holistic approach to technology, combining advanced materials, smart diagnostics, and optimized design, is continuously pushing the boundaries of performance and reliability in the API Pumps Market, ensuring they meet the evolving and stringent requirements of critical industries.

Regional Highlights

- North America: This region represents a mature yet robust market for API pumps, driven by extensive oil and gas exploration and production, particularly in shale formations (U.S. and Canada), and a highly developed downstream refining and petrochemical sector. Stringent environmental regulations and safety standards here mandate the use of API-compliant equipment, ensuring consistent demand for high-quality, reliable pumps for new projects, MRO activities, and infrastructure upgrades.

- Europe: The European API pumps market is characterized by a strong emphasis on modernization of existing chemical and petrochemical plants, coupled with a focus on energy efficiency and environmental compliance. Countries like Germany, the UK, and France lead in adopting advanced pumping technologies. While the oil and gas sector is less dominant than in other regions, the sophisticated chemical industry ensures a steady demand for specialized API pumps.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, propelled by rapid industrialization, burgeoning petrochemical complexes in China and India, and increasing investments in refinery expansion across Southeast Asia. The region's growing energy demand and the development of new industrial hubs are driving significant demand for API pumps, often balancing cost-effectiveness with API compliance.

- Middle East & Africa (MEA): This region is a cornerstone of the global oil and gas industry, boasting vast hydrocarbon reserves and continuous investments in large-scale upstream, midstream, and downstream projects. Saudi Arabia, UAE, and Qatar are key players, driving substantial demand for API pumps for new installations and the expansion of existing facilities, emphasizing robust and reliable solutions for extreme operating conditions.

- Latin America: The market in Latin America is heavily influenced by the dynamics of oil and gas production, particularly in countries like Brazil, Mexico, and Venezuela. Offshore exploration and unconventional resource development projects fuel the demand for API pumps. Economic stability and foreign investment play a critical role in the region's market growth for industrial equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the API Pumps Market.- Flowserve Corporation

- Sulzer Ltd.

- KSB SE & Co. KGaA

- Weir Group PLC

- Ebara Corporation

- WILO SE

- ITT Inc.

- SPX Flow Inc.

- Grundfos Holding A/S

- Pentair plc

- National Oilwell Varco (NOV)

- Gardner Denver (Ingersoll Rand)

- Gorman-Rupp Company

- Seepex GmbH

- Vogel Pumpen (Xylem Inc.)

- Circor International, Inc.

- ClydeUnion Pumps (Celeros Flow Technology)

- LEWA GmbH

- Apollo Pumps

- Ruhrpumpen Inc.

Frequently Asked Questions

Analyze common user questions about the API Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are API pumps and why are they critical in industry?

API pumps are industrial pumps designed and manufactured to meet the stringent standards of the American Petroleum Institute (API), ensuring high reliability, safety, and efficiency. They are critical in industries like oil and gas, petrochemical, and chemical processing because they handle hazardous, corrosive, or high-temperature fluids under extreme conditions, preventing failures, leaks, and ensuring operational integrity.

Which API standards are most relevant for industrial pumps?

The most relevant API standards for industrial pumps include API 610 for centrifugal pumps (widely used in refineries), API 674 for reciprocating pumps, API 675 for controlled volume (metering) pumps, and API 676 for rotary positive displacement pumps. Each standard specifies design, testing, and material requirements for specific pump types.

How does the API Pumps Market address environmental and safety concerns?

The API Pumps Market addresses environmental and safety concerns through strict design and manufacturing standards that minimize leaks, reduce emissions, and ensure robust containment of hazardous fluids. Advanced sealing technologies, robust material selection, and rigorous testing protocols mandated by API standards significantly enhance operational safety and environmental protection.

What role does digitalization play in the API Pumps Market?

Digitalization is transforming the API Pumps Market by enabling smart pump technologies. This includes integrating IIoT sensors for real-time monitoring, AI-powered predictive maintenance for early fault detection, and remote diagnostics. These technologies optimize performance, reduce downtime, lower operational costs, and enhance overall asset management.

What are the key growth drivers for the API Pumps Market?

Key growth drivers for the API Pumps Market include the continuous global demand for energy, expansion and modernization of petrochemical and chemical industries, stringent safety and environmental regulations requiring high-reliability equipment, and ongoing investments in upgrading and maintaining critical industrial infrastructure globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager