Appearance Boards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438219 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Appearance Boards Market Size

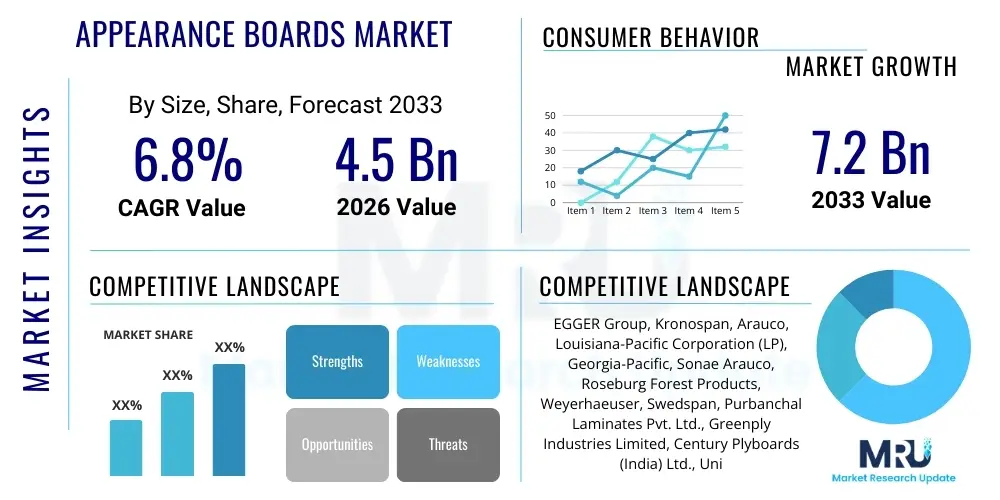

The Appearance Boards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Appearance Boards Market introduction

The Appearance Boards Market encompasses manufactured panel products specifically designed and finished for visible applications in construction, cabinetry, and furniture making. These panels are engineered wood products, laminates, or composites that offer aesthetic appeal combined with structural integrity and durability. Appearance boards are utilized when the final surface is not meant to be covered, requiring high-quality finishes, consistent coloration, and specialized textures. This market is highly sensitive to trends in interior design, architectural preferences, and sustainable building practices, leading to continuous innovation in material composition and surface treatments.

Major applications of appearance boards span residential housing, commercial fit-outs, high-end retail displays, and specialized furniture manufacturing. In residential construction, they are crucial for kitchen and bathroom cabinetry, custom shelving, and interior cladding. Commercially, they contribute significantly to office partitioning, reception areas, and hotel interiors where visual consistency and durability are paramount. The benefit derived from using appearance boards includes reduced labor costs associated with traditional finishing methods, superior material consistency compared to raw lumber, and the availability of highly customizable aesthetic options, ranging from realistic wood grain simulations to modern high-gloss finishes.

Driving factors propelling market expansion include the global boom in renovation and remodeling activities, particularly in mature economies, coupled with rapid urbanization and infrastructure development in emerging markets like the Asia Pacific region. Furthermore, increasing consumer preference for sustainable and eco-friendly building materials is boosting the demand for engineered wood products certified under standards such as FSC and PEFC. Technological advancements in surface printing and lamination techniques, allowing for hyper-realistic and durable finishes, further solidify the market's growth trajectory, offering architects and designers unprecedented flexibility.

Appearance Boards Market Executive Summary

The global Appearance Boards Market demonstrates robust growth driven primarily by shifting consumer demographics favoring DIY home improvement projects and increasing investment in commercial real estate globally. Current business trends indicate a strong move toward customization and specialization, with manufacturers offering bespoke aesthetic solutions, including textured and synchronization-enhanced laminates that mimic natural materials perfectly. Furthermore, supply chain resilience remains a critical competitive differentiator, particularly post-pandemic, forcing companies to localize production and diversify sourcing strategies to mitigate volatility in raw material costs, such specifically resins and wood fibers, which are essential components in the manufacturing process.

Regionally, the Asia Pacific (APAC) market is poised to exhibit the fastest growth, fueled by massive infrastructure projects, rapid expansion of the middle class, and significant investment in new housing units, especially in China and India. North America and Europe, while representing mature markets, maintain high market values due to stringent building codes driving demand for high-performance, fire-rated, and low-VOC (Volatile Organic Compounds) appearance boards, alongside substantial ongoing renovation activities. Latin America and the Middle East and Africa (MEA) are emerging as significant consumption centers, benefiting from economic diversification and increased foreign direct investment in hospitality and commercial development.

Segment trends reveal that Laminate Appearance Boards (LPL and HPL) continue to dominate the market share owing to their cost-effectiveness, versatility, and durability. However, the Wood Veneer segment is witnessing accelerated growth in the premium sector, catering to high-end design requirements emphasizing natural aesthetics. By application, the Residential Housing segment remains the largest consumer, but the Commercial Spaces segment, driven by rapid turnover in office and retail fit-outs, shows significant potential for accelerated market penetration, demanding sophisticated, durable, and easily maintainable surfaces.

AI Impact Analysis on Appearance Boards Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are optimizing production processes, improving quality control, and revolutionizing the design phase within the Appearance Boards sector. Key concerns center on whether AI-driven design tools will standardize aesthetics, potentially stifling creativity, and how predictive maintenance using AI can reduce operational downtime and material waste. Expectations are high regarding AI's ability to create custom, on-demand aesthetic profiles based on real-time market feedback and trends, enabling manufacturers to move toward mass personalization. Furthermore, users are keen to understand AI's role in supply chain optimization, specifically predicting fluctuations in raw material costs and demand patterns to enhance inventory management efficiency.

- AI-driven optimization of panel cutting and yield maximization, minimizing material waste during the manufacturing phase.

- Predictive maintenance algorithms monitoring machinery health (e.g., press lines, lamination equipment) to prevent unplanned downtime and ensure consistent product quality.

- Generative Design AI assisting architects and interior designers in rapid prototyping of custom surface textures and color palettes, responding instantly to client feedback.

- Machine Vision systems implementing advanced defect detection during lamination and finishing, ensuring zero-defect output for appearance-critical products.

- Enhanced inventory forecasting and supply chain resilience modeling using ML to predict demand variability and optimize stocking levels of diverse raw materials.

- Automated quality control checks for gloss levels, color consistency, and texture alignment across large production batches, surpassing human inspection capabilities.

- Personalized marketing and sales platforms utilizing AI to recommend specific appearance board types and finishes based on contractor purchase history and regional design preferences.

DRO & Impact Forces Of Appearance Boards Market

The Appearance Boards Market is influenced by a dynamic interaction of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the core impact forces shaping its trajectory. The primary driver is the global resurgence in residential construction and commercial refurbishment, necessitating durable and aesthetically pleasing interior surfaces. Simultaneously, technological breakthroughs in high-definition digital printing and synchronized embossing (EIR) techniques allow manufacturers to offer surfaces indistinguishable from natural wood or stone, appealing strongly to modern consumer tastes while offering superior performance characteristics like moisture and scratch resistance. These drivers are fundamentally accelerating product replacement cycles and increasing the perceived value proposition of engineered appearance boards over traditional materials.

However, the market faces significant restraints, notably the high volatility and increasing cost of key raw materials, including wood pulp, specialized resins, and overlay papers. Furthermore, stringent environmental regulations regarding formaldehyde emissions and VOC content necessitate substantial investment in advanced manufacturing processes, particularly in North America and Europe, which can increase the final product cost and potentially limit market access for smaller players lacking the necessary technological upgrades. The availability of substitute materials, such as polished concrete or specialized drywall finishes, also poses a competitive restraint, forcing continuous innovation in aesthetic superiority.

Opportunities for growth are abundant, primarily revolving around the expansion of sustainable product lines, such as those utilizing recycled content or bio-based resins, tapping into the growing green building movement. The increasing trend toward modular construction, where pre-finished appearance boards are essential for rapid assembly, presents a significant avenue for market penetration. The continuous development of functionalized boards, featuring antimicrobial properties or enhanced acoustic dampening, caters to specialized institutional markets like healthcare and education, offering premium pricing potential and differentiating products beyond simple aesthetic appeal. The convergence of these forces mandates that market participants adopt agile strategies focused on innovation, sustainability, and operational efficiency.

Segmentation Analysis

The Appearance Boards Market is comprehensively segmented based on material type, application, thickness, and finish, allowing for granular analysis of demand patterns and strategic focus areas for manufacturers. Understanding these segments is crucial for identifying high-growth niches, especially as technological advancements continuously blur the lines between traditional wood products and composite engineered panels. The segmentation reflects both the structural utility and the aesthetic requirement of the end-user, differentiating products used in high-traffic commercial environments from those intended for sensitive residential furniture applications, ensuring that performance specifications are met across the diverse value chain. Material segmentation, for instance, highlights the competitive landscape between cost-effective laminates and premium veneers, influencing overall market revenue distribution.

- By Material Type:

- Laminated Veneer Lumber (LVL)

- High-Pressure Laminate (HPL) Boards

- Low-Pressure Laminate (LPL) Boards

- Wood Veneer Boards

- Medium Density Fiberboard (MDF)

- Particleboard/Chipboard

- Specialty Composite Boards (e.g., Bamboo, PVC Composites)

- By Application:

- Residential Housing (Cabinetry, Flooring, Wall Panels)

- Commercial Spaces (Office Furniture, Retail Fixtures, Hospitality)

- Industrial Applications (Work Surfaces, Storage Systems)

- Transportation and Marine

- By Thickness:

- Below 10 mm

- 10 mm to 15 mm

- 15 mm to 20 mm

- Above 20 mm

- By Finish:

- Matte Finish

- Glossy Finish

- Textured Finish (Embossed-in-Register - EIR)

- Satin Finish

Value Chain Analysis For Appearance Boards Market

The value chain for the Appearance Boards Market begins with upstream activities, primarily involving the sustainable sourcing and processing of raw materials. This stage is dominated by forestry companies, chemical manufacturers supplying resins and adhesives, and paper producers for overlay and decorative layers. Key upstream challenges include fluctuating timber prices, ensuring FSC/PEFC certification compliance for sustainable sourcing, and managing the supply of specialized chemicals necessary for achieving low-emission standards (like E0 or CARB compliance). Efficient management at this stage directly impacts the unit cost and environmental profile of the final product, necessitating long-term contracts and strategic partnerships between material suppliers and panel manufacturers.

The midstream phase constitutes the core manufacturing process, involving primary panel producers (MDF, particleboard) and secondary processors who apply the decorative finishes (laminating, veneering, pressing). This stage is characterized by high capital expenditure for sophisticated press lines, sanding equipment, and specialized cutting technology. Quality control is paramount here, focusing on surface flatness, adhesion strength, and precise finish alignment. Integration strategies, where primary panel producers also handle lamination, are common among major market players, offering better control over quality and cost structures, thereby enhancing their competitive advantage in the global market.

Downstream activities involve distribution, sales, and installation. Appearance boards move through various channels, including direct sales to large furniture manufacturers (OEMs), distribution through specialized building material wholesalers, and retail sales via large home improvement chains catering to contractors and DIY consumers. Direct and indirect distribution channels coexist; direct channels offer better price control and faster feedback loops with large commercial clients, while indirect channels provide the necessary reach into fragmented residential markets. Logistical efficiency, minimizing transit damage to the finished surfaces, and providing timely delivery are critical success factors in the downstream segment, heavily influencing customer satisfaction and repeat business.

Appearance Boards Market Potential Customers

The primary consumers and end-users of appearance boards span across the entire construction and interior furnishing ecosystem, driven by the need for aesthetically pleasing, durable, and cost-effective surface solutions. Professional contractors and builders constitute a massive segment, utilizing these boards for large-scale housing projects, commercial fit-outs, and institutional constructions like schools and hospitals. These buyers prioritize bulk pricing, consistent quality, and certifications related to fire safety and emissions (e.g., Class A fire ratings or low-formaldehyde adherence), often entering into multi-year supply agreements with major manufacturers to ensure material availability and streamlined project execution.

Furniture manufacturers, ranging from large-scale producers of flat-pack furniture to high-end bespoke cabinet makers, form another critical customer base. These customers rely on appearance boards for consistency in surface finish, ease of machining, and variety of aesthetic options, demanding precise thickness tolerances and edge-banding compatibility. The rapidly growing segment of modular kitchen and wardrobe manufacturers, who require pre-finished, standardized components for quick assembly, drives innovation towards lighter, yet structurally sound, boards with durable finishes capable of enduring frequent handling during assembly and transportation.

Furthermore, independent interior designers, architects, and the DIY consumer segment represent growing market opportunities. Designers and architects seek specialized, aesthetically innovative, and sustainable product lines to differentiate their projects, often driving demand for high-end veneers or specialized textured laminates. The DIY consumer, typically accessing the market through retail chains, demands easy-to-handle, pre-cut, and instructional-supported products for small-scale home renovation and crafting projects, emphasizing accessibility and user-friendliness over specialized industrial performance characteristics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EGGER Group, Kronospan, Arauco, Louisiana-Pacific Corporation (LP), Georgia-Pacific, Sonae Arauco, Roseburg Forest Products, Weyerhaeuser, Swedspan, Purbanchal Laminates Pvt. Ltd., Greenply Industries Limited, Century Plyboards (India) Ltd., Unilin Group, Darex Board, Norbord Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Appearance Boards Market Key Technology Landscape

The Appearance Boards Market is heavily reliant on advanced manufacturing technologies that enhance both the structural integrity and the aesthetic realism of the final product. One of the most significant technological advancements is Synchronized Embossing-in-Register (EIR) technology. EIR aligns the surface texture precisely with the underlying printed decorative pattern (e.g., wood grain or stone pattern), creating a highly realistic three-dimensional feel and visual depth. This technology is critical for premium laminate and LVT (Luxury Vinyl Tile, where applicable to core board production) products, significantly boosting consumer acceptance by blurring the visual and tactile distinction between engineered and natural materials. Investment in highly precise EIR press plates and improved digital printing capabilities is a major competitive differentiator.

Another crucial area is the development of next-generation core materials, particularly those focusing on reduced weight while maintaining structural performance and low emissions. Manufacturers are utilizing advanced resin systems, including bio-based and non-added formaldehyde resins (NAF), to meet increasingly strict indoor air quality standards in key markets like Europe and North America. Continuous press technology, which allows for uninterrupted production of panels in variable lengths and thicknesses, has significantly improved manufacturing efficiency and reduced production costs. Furthermore, specialized coating technologies, such as anti-scratch and antimicrobial layers, are being integrated into the lamination process, extending the durability and hygienic applications of the boards, crucial for public and commercial spaces.

Automation and digitalization are also transforming the manufacturing landscape. Factories are increasingly deploying automated storage and retrieval systems (AS/RS) and robotics for handling large panels, minimizing surface damage and optimizing operational flow. The integration of IoT (Internet of Things) sensors across the production line enables real-time monitoring of temperature, pressure, and moisture content, facilitating proactive quality adjustments and reducing waste. These technological investments, while capital intensive, are essential for maintaining competitive edge, ensuring material consistency, and offering the customizable, high-quality finishes demanded by contemporary design standards globally.

Regional Highlights

Regional dynamics are critical to understanding the Appearance Boards Market, with demand patterns heavily influenced by local construction standards, economic development rates, and design preferences. The following regions and countries represent significant hubs of consumption and production:

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by rapid urbanization, significant government investment in affordable housing, and the expansion of domestic furniture manufacturing hubs in China, India, and Southeast Asia. India, in particular, shows immense growth potential due to increased domestic production capacity and soaring demand for ready-to-use engineered wood products in renovation cycles.

- North America (NA): A mature but highly valuable market characterized by strict environmental regulations (e.g., California Air Resources Board - CARB) and a high proportion of renovation and repair activities. Demand is robust for high-performance, low-VOC boards, and aesthetic trends favor realistic wood veneers and premium, durable laminates suitable for high-end residential kitchen and bath applications.

- Europe: Dominated by Germany, France, and the UK, this region sets global standards for sustainable sourcing (FSC/PEFC) and low-emission products (E0 standards). The market is highly competitive, focusing on innovation in surface technology, especially EIR finishes, and catering to the strong European modular furniture industry.

- Latin America (LATAM): Showing strong emergence, primarily driven by construction booms in Brazil and Mexico. The market is increasingly adopting engineered wood products to replace traditional materials, focusing on cost-effective yet durable solutions for large-scale social housing projects and commercial developments.

- Middle East and Africa (MEA): Growth is tied to hospitality and commercial real estate development in the GCC countries (UAE, Saudi Arabia). Demand here is skewed toward high-gloss and highly durable boards that can withstand the region's challenging climate conditions and meet the opulent design requirements of luxury projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Appearance Boards Market.- EGGER Group

- Kronospan

- Arauco

- Louisiana-Pacific Corporation (LP)

- Georgia-Pacific

- Sonae Arauco

- Roseburg Forest Products

- Weyerhaeuser

- Swedspan

- Purbanchal Laminates Pvt. Ltd.

- Greenply Industries Limited

- Century Plyboards (India) Ltd.

- Unilin Group

- Darex Board

- Norbord Inc.

- MASISA S.A.

- Kastamonu Entegre

- Panel Plus Co., Ltd.

- Fletcher Building Limited

- Sherwood Lumber

Frequently Asked Questions

Analyze common user questions about the Appearance Boards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from natural wood to engineered Appearance Boards?

The primary drivers include superior cost-effectiveness, enhanced material consistency (reducing waste and defects), greater resistance to moisture and scratches compared to natural wood, and the availability of highly realistic finishes achieved through advanced digital printing and synchronized embossing (EIR) technologies. Sustainability concerns and better utilization of raw materials also favor engineered options.

Which material segment currently holds the largest market share in the Appearance Boards Market?

Laminate Appearance Boards, particularly High-Pressure Laminates (HPL) and Low-Pressure Laminates (LPL) based on substrates like MDF and Particleboard, hold the largest market share. This dominance is due to their excellent balance of price, durability, wide aesthetic variety, and ease of maintenance, making them ideal for both residential and commercial applications globally.

How do stringent environmental regulations impact the cost structure of Appearance Boards?

Stringent environmental regulations, particularly concerning formaldehyde and VOC emissions (e.g., E0, CARB Phase 2 standards), necessitate the use of specialized, expensive low-emission resins and manufacturing processes. This requirement increases the raw material input costs and requires significant capital investment in production technology, thereby elevating the final price of compliant appearance boards in regulated markets like North America and Europe.

What role does the Asia Pacific region play in the future growth of the Appearance Boards Market?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market due to massive urbanization, high levels of infrastructure development, and a substantial increase in residential construction projects. The rapid expansion of local manufacturing capabilities and rising disposable incomes driving demand for high-quality interiors are key factors accelerating market penetration in countries such as China, India, and Vietnam.

What is the significance of Embossing-in-Register (EIR) technology in modern appearance boards?

EIR technology is highly significant as it provides a realistic, three-dimensional tactile surface that perfectly matches the underlying printed decorative pattern, mimicking the feel of natural wood grain or stone. This enhanced realism is crucial for consumer acceptance in the premium segment, driving demand for products that offer the aesthetics of natural materials with the performance benefits of engineered wood.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager