Apple Accessories Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438508 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Apple Accessories Market Size

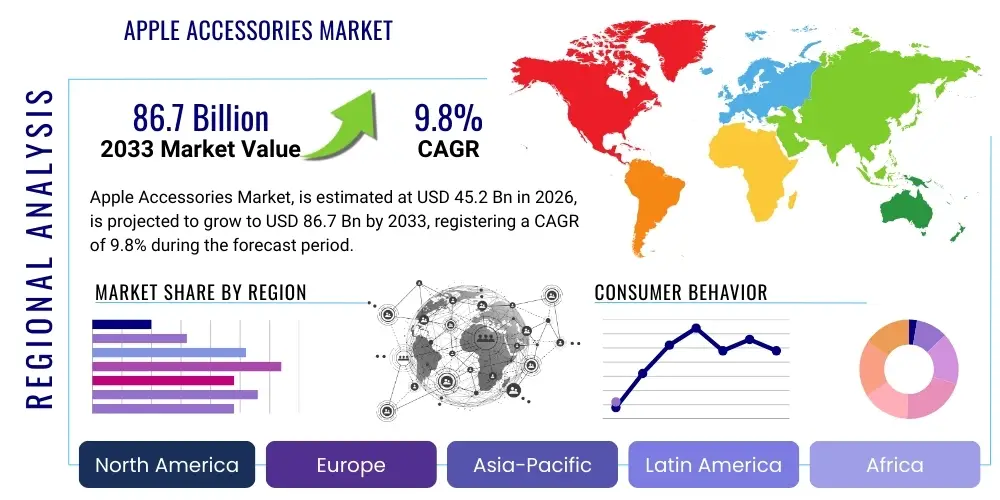

The Apple Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 86.7 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the sustained expansion of the Apple ecosystem, characterized by high customer retention rates, frequent product refreshes across major categories (iPhone, iPad, Mac, Apple Watch), and the increasing penetration of specialized, high-margin accessories such as premium audio devices (AirPods Pro), advanced charging solutions (MagSafe), and health-focused wearables attachments.

The consistent technological evolution within Apple’s core product lines necessitates the parallel development of compatible and functionally enhanced accessories, thus generating continuous demand. Factors such as the shift towards wireless connectivity, the growing consumer demand for personalized and aesthetically customized products, and the integration of sophisticated features like Ultra Wideband (UWB) chips into accessories are contributing significantly to market valuation. Furthermore, strategic licensing programs and the prevalence of third-party certified products (Made for iPhone/MFi) ensure a broad and competitive market landscape, driving innovation and expanding product availability globally, reinforcing the overall market expansion.

Apple Accessories Market introduction

The Apple Accessories Market encompasses a vast array of hardware peripherals and complementary products designed specifically to enhance the functionality, protection, and user experience of Apple devices, including iPhones, iPads, Macs, Apple Watches, and AirPods. This market spans multiple categories, such as protective cases, charging solutions (wired and wireless), audio peripherals, input devices (keyboards, styluses), and specialized connectivity adapters. The core value proposition of these accessories lies in their seamless integration with the Apple operating systems and hardware architecture, ensuring optimal performance and maintaining the aesthetic and premium standards associated with the brand.

Major applications of Apple accessories are diverse, ranging from maximizing productivity in professional environments through external monitors and specialized docking stations to improving personal fitness monitoring via bands and health sensors for the Apple Watch. Key benefits include extended device longevity through robust protection, enhanced portability, and superior audio fidelity, particularly with ANC-equipped AirPods. The market is driven fundamentally by the high volume of Apple device sales globally, coupled with the rapid technological obsolescence cycles that prompt consumers to upgrade their accessory portfolios. Moreover, the strong brand loyalty and the 'ecosystem lock-in' effect incentivize consumers to invest in compatible accessories that maximize interoperability and streamline their digital lives, further cementing market growth.

Apple Accessories Market Executive Summary

The Apple Accessories Market is currently experiencing accelerated growth driven by compelling business trends centered around connectivity, customization, and premiumization. A primary trend involves the widespread adoption of standardized yet proprietary technologies such as MagSafe for streamlined wireless charging and the use of Apple’s specialized H1 and W-series chips for instantaneous pairing and enhanced audio processing. Business trends indicate a strong move toward sustainable and eco-friendly accessory materials, driven by both consumer preference and Apple’s corporate environmental initiatives, thereby influencing the supply chain and product development of major accessory manufacturers.

Regionally, North America maintains market leadership, attributed to high purchasing power and early adoption of new Apple products, but the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by increasing disposable incomes, rapid urbanization, and expanding middle-class penetration, particularly in emerging economies like China and India. Segmentation trends reveal a significant shift toward the premium audio segment, where high-end noise-canceling headphones and professional monitoring gear compatible with Mac and iPad Pro are seeing robust demand. Furthermore, the ‘Health and Wellness’ accessory segment, including advanced Apple Watch bands and third-party health trackers, is expanding rapidly, capitalizing on the increasing consumer focus on personal health monitoring.

AI Impact Analysis on Apple Accessories Market

User queries regarding the impact of Artificial Intelligence on the Apple Accessories Market frequently revolve around personalized user experiences, the enhancement of existing Apple AI features like Siri through hardware, and the development of 'smarter' accessory functionality. Consumers are keen to understand how AI can facilitate predictive maintenance for accessories, optimize battery life based on usage patterns, and introduce truly adaptive noise cancellation in audio devices. A recurring theme is the expectation that AI will bridge the gap between simple peripherals and intelligent extensions of the core Apple devices, providing proactive assistance and reducing the need for manual configuration.

The deployment of machine learning models directly into accessories, or leveraging Apple's on-device AI capabilities, promises substantial performance uplift. For instance, future AirPods accessories may use AI to differentiate between environmental sounds and voice commands more accurately, enhancing both communication and safety features. Furthermore, supply chain management for high-demand accessories is being optimized using AI algorithms for demand forecasting, which directly impacts product availability and pricing stability for consumers. The future of premium accessories is intrinsically linked to their capacity to utilize AI for deeply personalized, context-aware interactions that go beyond simple functionality, offering users a genuinely seamless and intuitive extension of the Apple ecosystem experience.

- Enhanced Siri Integration: Accessories leveraging AI to improve voice command recognition accuracy and contextual awareness.

- Predictive Battery Optimization: Machine learning algorithms forecasting usage patterns to maximize accessory battery life and performance cycles.

- Adaptive Audio: AI-driven noise cancellation and transparency modes that dynamically adjust based on real-time environmental analysis.

- Personalized Health Insights: Apple Watch accessories utilizing AI to analyze sensor data for deeper, custom health and wellness feedback.

- Optimized Manufacturing: AI improving quality control and efficiency in the production of complex, miniaturized accessory components.

- Customization Recommendations: AI engines recommending the most suitable accessory based on user device type, usage habits, and aesthetic preferences.

DRO & Impact Forces Of Apple Accessories Market

The Apple Accessories Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its evolution and profitability. A primary driver is the recurring cycle of new product launches by Apple, which inevitably renders older accessories obsolete or necessitates the purchase of new charging and connectivity peripherals (e.g., transitions in port standards or introduction of MagSafe). The robust loyalty of the Apple user base, coupled with the high disposable income of the target demographic, ensures a stable and premium consumer demand. Furthermore, the continuous improvement in accessory quality and functionality, driven by the strict MFi licensing standards, encourages consistent consumer investment.

Restraints primarily revolve around the high price points of official and high-end certified accessories, which often leads consumers to seek out cheaper, potentially uncertified, alternatives. Market saturation in mature product categories, such as basic phone cases, creates intense price competition and limits margin potential for mass-market manufacturers. Another significant restraint is the persistent threat of counterfeiting, which dilutes brand trust and poses safety risks. Opportunities are expansive, particularly in emerging technological niches like augmented reality (AR) and virtual reality (VR) accessories compatible with Apple Vision Pro and related devices, and in the B2B sector focusing on enterprise deployment accessories for Mac and iPad fleets. The transition towards USB-C across all Apple devices presents both a short-term challenge (restraint) and a long-term opportunity for standardizing charging and connectivity solutions across the entire ecosystem.

Segmentation Analysis

The Apple Accessories Market is highly granular, segmented primarily by Product Type, Distribution Channel, and End-User. Analyzing these segments is crucial for understanding market dynamics and identifying high-growth niches. The segmentation by Product Type, encompassing Charging Solutions, Protective Cases, Audio Devices, Input Peripherals, and specialized Adapters, reveals distinct market behaviors; for example, the audio segment (driven by AirPods) commands premium pricing and high innovation investment, whereas the protective case segment is characterized by high volume and intense competitive pressure. Effective segmentation allows companies to tailor their marketing strategies, focusing either on mass-market penetration via e-commerce or premium positioning through exclusive Apple retail channels.

Further analysis reveals critical differences between distribution methods. Direct sales through Apple’s retail and online stores capture the highest margin and provide strong brand control, while third-party retail and e-commerce platforms offer scale and geographical reach. The distinction between End-Users—ranging from individual consumers and professional 'Prosumers' to large institutional buyers (Education and Corporate)—determines the demand for specific features, such as enterprise-grade security cases or specialized input devices optimized for graphic design workflows. The trend towards modular and multi-functional accessories, addressing both protection and power management needs simultaneously, is increasingly blurring traditional segment boundaries and driving cross-category innovation.

- By Product Type:

- Audio Devices (AirPods, Speakers, Headphones)

- Charging & Power Solutions (MagSafe, Adapters, Power Banks)

- Protective Cases & Sleeves (iPhone, iPad, MacBook)

- Input Devices & Peripherals (Keyboards, Mice, Apple Pencil)

- Connectivity & Storage (Hubs, Docks, External Drives)

- Wearable Accessories (Apple Watch Bands, Protective Covers)

- By Distribution Channel:

- Apple Authorized Resellers & Retail Stores

- E-commerce Platforms (Amazon, Specialized Online Retailers)

- Third-Party Retail Stores (Consumer Electronics Stores)

- Direct-to-Consumer (D2C) Online Sales

- By End-User:

- Individual Consumers

- Corporate/Enterprise

- Educational Institutions

- Healthcare Sector

Value Chain Analysis For Apple Accessories Market

The Value Chain for the Apple Accessories Market begins with upstream activities dominated by raw material suppliers, specialized component manufacturers (such as battery cells, custom chipsets, and specialized polymers), and industrial designers. Apple exerts significant influence upstream through its stringent MFi certification process, dictating component quality, integration standards, and increasingly, sustainability requirements. This pressure ensures that components are highly compatible and often proprietary, creating barriers to entry for uncertified manufacturers. Successful upstream players are those who can integrate sophisticated technologies like specialized chips (e.g., UWB) and maintain precise manufacturing tolerances.

Midstream activities involve core manufacturing, assembly, and quality assurance. This stage is geographically concentrated, primarily within East Asia, leveraging economies of scale and expertise in complex electronics assembly. Distribution represents a critical downstream component. Direct distribution, managed by Apple itself, maximizes control over pricing and customer experience. Indirect channels involve large global distributors, authorized resellers, and extensive e-commerce networks. The efficiency of the distribution channel is vital, given the rapid lifecycle of some accessories and the need to align supply precisely with the launch timing of new Apple devices. The effectiveness of the indirect channel heavily relies on strategic partnerships and inventory management systems to minimize stock-outs and excess inventory.

Apple Accessories Market Potential Customers

The primary potential customers in the Apple Accessories Market are broadly categorized into four groups: dedicated individual consumers, professional creators (prosumers), corporate entities, and the education sector. Dedicated individual consumers, forming the largest segment, seek protective, aesthetic, and functional accessories to enhance their personal devices. This group exhibits high brand loyalty and often invests in multiple accessories per device throughout its lifecycle, driven by trends and personalization needs. They are highly responsive to aesthetic design and seamless integration features.

The professional segment (prosumers and corporate users) represents the highest value per transaction, requiring specialized, high-performance accessories. This includes ergonomic input devices for intensive productivity tasks, specialized connectivity hubs for MacBooks used in media production, and enterprise-grade security solutions for iPads deployed in field services. These customers prioritize reliability, durability, and features that enhance workflow efficiency, such as multi-device pairing capabilities and rapid charging. The education sector is a significant bulk buyer, particularly for ruggedized cases for iPads and specialized input tools (like the Apple Pencil) utilized in classroom settings, emphasizing cost-effectiveness, volume purchasing discounts, and long-term durability to withstand high usage environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 86.7 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Logitech, Belkin International, Bose Corporation, Sony Corporation, Anker Innovations, Inc., Samsung Electronics (Accessory Division), Otter Products LLC, Zagg Inc., Sennheiser Electronic GmbH & Co. KG, Mophie (a Zagg brand), PopSockets, Nomad Goods, Inc., Twelve South, Satechi, Inc., Catalyst Lifestyle. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Apple Accessories Market Key Technology Landscape

The technological landscape of the Apple Accessories Market is defined by tight integration with proprietary Apple innovations aimed at creating a seamless, interconnected user experience. Central to this is the MagSafe technology, which utilizes magnet arrays for precise alignment and efficient wireless charging across the iPhone and MacBook lines, driving the adoption of specialized charging accessories and mounts. Furthermore, the incorporation of Apple's proprietary silicon, specifically the H1 and W-series chips, within audio peripherals like AirPods and Beats products ensures instantaneous pairing, reduced latency, and enhanced battery management. These chips facilitate advanced features such as Spatial Audio and automatic device switching, functionalities unavailable to generic accessories, thereby reinforcing the competitive advantage of certified products.

Another crucial technological development is the Ultra Wideband (UWB) technology, enabled by the U1 chip found in newer iPhones and integrated into accessories like the AirTag and specialized third-party finders. UWB allows for highly accurate, spatial awareness and directional positioning, which is rapidly being integrated into next-generation accessories for enhanced security, context-aware functionality, and device management. Sustainability technology also plays a growing role; manufacturers are investing heavily in recycled materials (e.g., bio-plastics, recycled aluminum) and modular designs to align with consumer demand for environmentally responsible products. This technological shift impacts not just the product design but also the manufacturing processes and supply chain logistics, positioning technology innovation as a critical differentiator beyond mere functionality.

Regional Highlights

Regional dynamics significantly influence the demand and competitive structure of the Apple Accessories Market, reflecting disparities in economic maturity, consumer preferences, and technological adoption rates. North America stands as the largest and most mature market, characterized by high disposable incomes and a substantial installed base of premium Apple devices. The region leads in the adoption of high-value accessories, particularly advanced smart home integration devices, professional-grade input peripherals, and sophisticated health monitoring accessories linked to the Apple Watch ecosystem. Competition is fierce, requiring manufacturers to continuously innovate and secure prominent shelf space in major retail and e-commerce channels.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This acceleration is fueled by the rapid expansion of the middle class, especially in emerging economies, leading to increased affordability of Apple devices. Countries like China and Japan are crucial for both consumption and manufacturing, with a strong demand for innovative, aesthetically diverse, and often highly customized protective accessories. Market players in APAC must navigate diverse regulatory environments and cultural preferences, focusing on localization of product design and distribution networks to capture the burgeoning consumer base.

Europe represents a stable, high-value market, driven by a strong emphasis on quality, durability, and increasingly, sustainability. European consumers are highly sensitive to environmental certifications and ethical sourcing, pushing accessory manufacturers towards circular economy principles and the use of recycled materials. Regulatory harmonization within the European Union, particularly concerning common charging standards (like the shift to USB-C), dictates technological shifts in the charging accessory segment. Meanwhile, Latin America and the Middle East & Africa (MEA) present untapped potential, constrained primarily by lower average device penetration rates but offering significant growth opportunities as infrastructure and economic stability improve, leading to increasing demand for foundational accessories such as protective cases and basic charging solutions.

- North America: Market leader with high penetration of premium and advanced accessory categories, driven by early technology adoption and high consumer spending power. Key areas include smart home integration and professional peripherals.

- Asia Pacific (APAC): Fastest growing market due to rising disposable incomes, urbanization, and a large, rapidly expanding installed user base, especially focused on customization and mobile-centric accessories.

- Europe: Stable growth market characterized by stringent demand for high-quality, durable, and sustainable products, heavily influenced by EU regulatory standards concerning electronic compatibility and environmental impact.

- Latin America (LATAM): Emerging market with focus on essential accessories (protection, basic charging), dependent on economic stability and expanding retail infrastructure.

- Middle East and Africa (MEA): Potential growth region where device penetration is increasing, driving foundational demand for protective and power management solutions in key metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Apple Accessories Market.- Logitech International S.A.

- Belkin International, Inc.

- Anker Innovations Technology Co. Ltd.

- Otter Products LLC

- Zagg Inc. (Including Mophie and Gear4 brands)

- Twelve South, LLC

- Satechi, Inc.

- Nomad Goods, Inc.

- Bose Corporation

- Sony Corporation (Accessory portfolio for Apple compatibility)

- Sennheiser Electronic GmbH & Co. KG

- Incipio, LLC

- Catalyst Lifestyle, Inc.

- Hyper by Sanho Corporation

- Razer Inc. (Mac-compatible peripherals)

- PopSockets LLC

- Native Union

- Ringke (Rearth Inc.)

- Spigen Inc.

- Puro S.p.A.

Frequently Asked Questions

Analyze common user questions about the Apple Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for premium Apple accessories?

Current demand is primarily driven by Apple's robust ecosystem lock-in, the shift towards proprietary technologies like MagSafe and UWB, and increasing consumer willingness to pay a premium for certified MFi (Made for iPhone/iPad/etc.) products that guarantee seamless integration, superior durability, and advanced functionality not available in generic alternatives. The frequent refresh cycle of core Apple devices also necessitates continuous accessory upgrades.

How significant is the role of MFi certification in market competition?

The MFi (Made for iPhone/iPad/etc.) certification is highly significant as it acts as a quality assurance benchmark and a crucial competitive differentiator. Accessories with MFi certification are trusted by consumers for safety, compatibility, and performance, allowing certified manufacturers to command higher price points and establish stronger brand credibility compared to non-certified competitors.

Which accessory segment is forecasted to experience the highest growth rate?

The Audio Devices segment, encompassing high-fidelity AirPods, high-end headphones, and specialized spatial audio accessories, is forecasted to experience high growth, alongside the Advanced Charging Solutions segment (MagSafe and multi-device docks). This growth is propelled by technological advancements, such as AI-driven noise cancellation and the increasing adoption of completely wireless charging standards across all device categories.

What impact does the transition to USB-C ports have on the accessory market?

The transition to USB-C across key Apple devices (iPhone 15, iPad, Mac) initially requires consumers to replace older Lightning-based accessories, providing a short-term sales surge for new cables and adapters. Long-term, USB-C promotes standardization and interoperability, potentially easing consumer costs but intensifying competition among third-party manufacturers providing versatile, universal charging and data transfer hubs.

What are the primary challenges faced by third-party accessory manufacturers?

Third-party manufacturers face challenges including navigating the strict and evolving MFi licensing requirements, intense competition from generic, low-cost manufacturers, and the constant threat of counterfeiting. Furthermore, keeping pace with Apple’s rapid technological shifts (e.g., sensor placements, chip integration) requires significant and frequent R&D investment to maintain market relevance and certified compatibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager