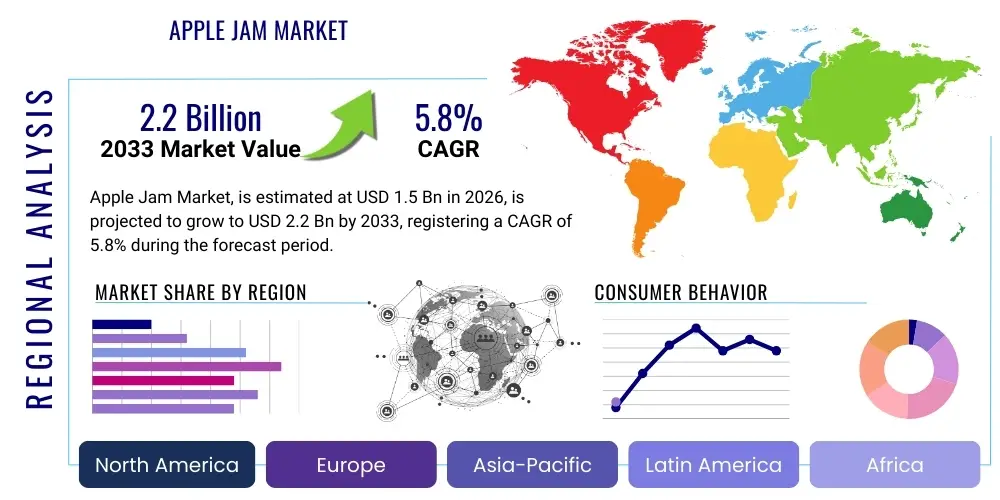

Apple Jam Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435299 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Apple Jam Market Size

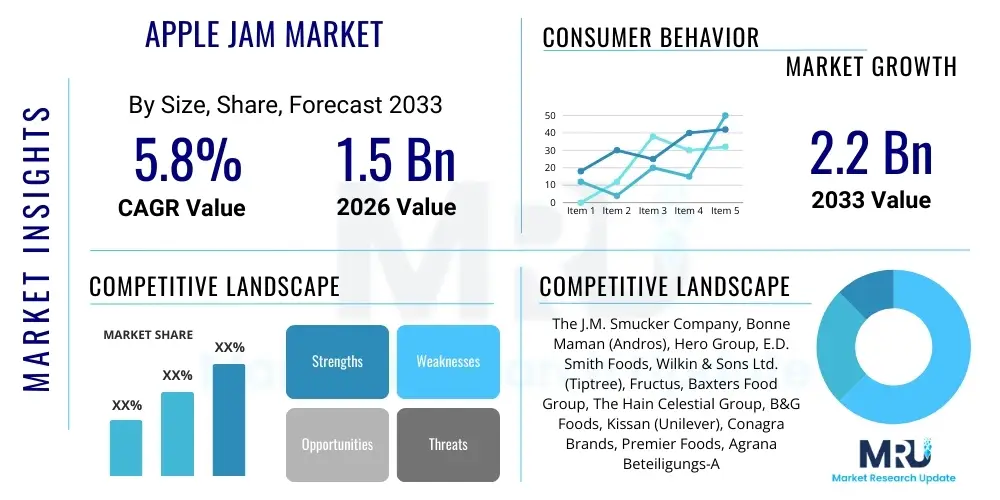

The Apple Jam Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fueled by rising consumer preference for natural fruit preserves, increased breakfast consumption trends globally, and innovative product development focusing on reduced sugar content and exotic apple varieties. The market expansion is particularly noticeable in emerging economies where processed food consumption is escalating rapidly due to urbanization and higher disposable incomes.

Apple Jam Market introduction

The Apple Jam Market encompasses the global production, distribution, and sale of preserves made primarily from apples, sweeteners, and gelling agents like pectin. This product category spans various formulations, including traditional jams, low-sugar preserves, and organic spreads, catering to diverse dietary and health preferences. Major applications of apple jam include usage as a breakfast spread, an ingredient in baking and confectionery, and as a condiment in gourmet meals. The product offers nutritional benefits, providing essential fiber and vitamins derived from apples, making it a relatively healthy option compared to synthetic spreads.

Driving factors for the market include the stable and consistent global production of apples, which ensures raw material availability, coupled with increasing consumer demand for convenient, shelf-stable food options. Furthermore, manufacturers are investing heavily in innovative packaging designs and sustainable sourcing methods, enhancing product appeal. The market dynamic is shifting towards premiumization, with consumers willing to pay more for products featuring high fruit content, artisanal preparation methods, and clear traceability of ingredients. This premium segment is a key driver of overall market value growth.

The global outlook for apple jam remains robust, supported by strong performance in retail channels, especially large-format supermarkets and rapidly expanding e-commerce platforms. Technological advancements in processing and preservation techniques, such as aseptic packaging, are extending shelf life and maintaining the flavor integrity of the final product, further encouraging widespread adoption across varied climates and geographies. This ensures the market can effectively meet growing international demand while maintaining stringent quality and safety standards mandated by regulatory bodies globally.

Apple Jam Market Executive Summary

The global Apple Jam Market is characterized by intense competition and a strong focus on health and wellness trends, driving product innovation toward low-sugar and functional variants. Business trends emphasize sustainable sourcing of apples, supply chain transparency, and aggressive digital marketing strategies targeting health-conscious millennials and Gen Z consumers. Key market players are heavily investing in vertical integration to control raw material quality and reduce operational costs, thereby gaining a competitive edge in price-sensitive segments. Mergers and acquisitions are common strategies deployed to expand geographic reach and diversify product portfolios, particularly acquiring smaller, specialized organic jam producers.

Regionally, North America and Europe maintain dominance, driven by mature consumption habits and high per capita spending on specialty food items, although Asia Pacific is emerging as the fastest-growing region due to rapid urbanization, increasing middle-class income levels, and the Westernization of dietary patterns. Specific regional trends include a shift towards locally sourced and regionally flavored jams in Europe and a heightened focus on aesthetically pleasing, gift-worthy packaging in the vibrant Asian markets. Regulatory scrutiny regarding labeling, especially sugar content and artificial additives, significantly influences formulation strategies across all major regions.

In terms of segmentation, the Organic Apple Jam segment is experiencing exponential growth, reflecting global consumer preference for certified natural products, despite its higher price point. The Distribution segment sees a critical shift, with online retail channels showing the highest growth CAGR, attributed to convenience and wider product selection, directly challenging the traditional dominance of supermarket chains. Segmentation by packaging indicates a continued preference for glass jars due to perceived quality and recyclability, though flexible pouches are gaining traction for portability and cost-effectiveness, particularly in the commercial and institutional sectors.

AI Impact Analysis on Apple Jam Market

User inquiries regarding AI's influence on the Apple Jam Market primarily revolve around optimizing agricultural yields, ensuring stringent quality control during processing, and enhancing supply chain efficiency, particularly concerning perishable raw materials. Users are keen to understand how predictive analytics can forecast apple harvests, minimizing waste and ensuring stable input costs for jam producers. Another major theme is the personalization of product offerings and marketing, where consumers expect AI to analyze purchasing patterns to recommend bespoke flavor profiles or packaging sizes. There are also significant concerns about the ethical implications of automation replacing manual labor in harvesting and processing facilities, focusing on maintaining the 'artisanal' perception of high-end jam products.

The application of Artificial Intelligence is revolutionizing the entire value chain, starting from precision agriculture techniques that monitor soil health and weather patterns to predict optimal harvest times for specific apple cultivars, thereby maximizing sugar content and flavor precursors necessary for quality jam. In the manufacturing phase, machine vision systems powered by AI are being implemented for automated quality inspection, identifying defective apples or contaminants with greater speed and accuracy than human inspectors, leading to improved product consistency and safety compliance. This reduces batch recalls and enhances consumer trust in mass-produced jams.

Furthermore, AI-driven tools are reshaping demand forecasting and inventory management. By analyzing complex variables such as seasonal variations, promotional activities, social media sentiment, and macroeconomic indicators, AI algorithms provide highly accurate sales predictions. This allows manufacturers to optimize production schedules, minimize warehousing costs, and ensure efficient distribution, especially for products with sensitive shelf lives. In marketing, AI is used to create hyper-personalized advertisements and recommend adjacent products (like cheeses or specialty bread), significantly boosting customer lifetime value and driving targeted sales growth across diverse distribution channels.

- AI-powered precision agriculture optimizes apple yield and quality consistency.

- Machine learning algorithms enhance automated quality control during fruit sorting and jam processing.

- Predictive analytics minimizes supply chain risks and optimizes raw material inventory levels.

- AI-driven demand forecasting improves production scheduling and reduces inventory spoilage.

- Natural Language Processing (NLP) analyzes consumer feedback for faster product innovation and flavor profiling.

- Personalized digital marketing campaigns driven by AI increase customer engagement and conversion rates.

- Robotics and AI-vision systems automate packaging and labeling, ensuring speed and accuracy.

DRO & Impact Forces Of Apple Jam Market

The Apple Jam Market is principally driven by the increasing global trend toward natural and clean-label food products, prompting consumers to seek spreads with high fruit content and fewer artificial additives. The market growth is also significantly propelled by rising disposable incomes in developing regions, enabling consumers to afford premium and specialty jam varieties. However, the market faces significant restraints, including the high volatility of global apple prices due to climate change impacts and agricultural diseases, which directly affects manufacturers' cost of goods sold. Furthermore, the rising awareness regarding high sugar intake poses a fundamental challenge, pushing consumers toward alternative spreads or low-sugar preserves, demanding costly reformulation efforts from market players.

Opportunities within the sector are abundant, particularly in the development and marketing of functional jams, enriched with ingredients like superfoods, prebiotics, or specific vitamins, appealing to the health-conscious demographic seeking added nutritional value in their daily diet. Expansion into emerging markets, such as Southeast Asia and Africa, where cold chain logistics are improving and Western food culture is penetrating deeper, represents a lucrative growth avenue. Strategic alliances with foodservice operators, including hotels, restaurants, and catering (HORECA) businesses, to supply customized bulk packaging, also provides a stable stream of revenue and market penetration.

The primary impact forces shaping the market trajectory include technological advancements in natural preservation techniques, minimizing the reliance on synthetic chemicals while extending shelf stability. Furthermore, intense regulatory pressure, particularly concerning nutritional labeling and sugar taxation (as seen in several European countries), forces companies to innovate their formulations rapidly. The pervasive influence of social media and online health influencers plays a critical role in consumer perception and purchasing decisions, acting as a major force in favoring niche, artisanal brands over established legacy producers, thus fragmenting market share and increasing the need for dynamic brand storytelling and transparency.

Segmentation Analysis

The Apple Jam Market is extensively segmented based on key parameters including Product Type (Conventional and Organic), Packaging Type (Glass Jars, Plastic Tubs, Pouches, and Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores), and End-Use (Household and Commercial/Institutional). Understanding these segments is crucial for manufacturers and retailers to tailor their production, marketing, and distribution strategies effectively, capturing diverse consumer needs and addressing specific operational requirements across the value chain. The complexity of these segmentations reflects the global diversity in consumer purchasing power, dietary restrictions, and preferred retail access methods.

The fastest-growing segment is undeniably the Organic Product Type, driven by widespread demand for clean ingredients, non-GMO products, and sustainable agricultural practices. In terms of distribution, online retail is demonstrating exceptional growth, facilitated by robust e-commerce logistics, particularly post-pandemic, offering convenience and a greater variety of international and niche brands that are often unavailable in local physical stores. Segmentation allows businesses to optimize SKU (Stock Keeping Unit) management, ensuring that products are correctly positioned for both premium pricing strategies (e.g., small glass jars of organic jam in specialty stores) and volume-based selling (e.g., large plastic tubs of conventional jam sold to the HORECA sector).

- By Product Type:

- Conventional

- Organic

- By Packaging Type:

- Glass Jars

- Plastic Tubs and Containers

- Flexible Pouches

- Others (Tins, Single-serve portions)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- By End-Use:

- Household

- Commercial (HORECA, Food Processing)

- By Flavor Profile (Sub-Segment):

- Plain Apple

- Mixed Fruit (Apple with Berries, Cinnamon, etc.)

- Spiced Varieties

Value Chain Analysis For Apple Jam Market

The Apple Jam Value Chain begins with upstream analysis focusing on agricultural production, specifically apple cultivation and harvesting. Key activities at this stage include selecting high-quality apple cultivars suitable for jam consistency (e.g., Gala, Fuji, or Granny Smith), efficient farming practices, and ensuring sustainable sourcing compliant with certifications like Fair Trade or organic standards. Upstream stability directly impacts the cost structure and quality of the final product, demanding robust supplier relationship management and long-term contracts to mitigate price volatility. Processing follows, involving washing, peeling, chopping, cooking with sweeteners and pectin, and sterilizing, where technological efficiency and energy usage are critical cost determinants.

Downstream analysis encompasses packaging, distribution, and final sales. Packaging plays a pivotal role in preserving the jam's quality and influencing consumer purchasing decisions; choices range from traditional glass jars to modern, lightweight pouches, each requiring specialized machinery and logistics handling. The distribution channel is highly diversified, operating both directly (via brand-owned e-commerce platforms or factory outlets) and indirectly through extensive networks of wholesalers, retailers, and food service distributors. Indirect channels, particularly large supermarkets and online marketplaces, dominate sales volume, necessitating strong agreements regarding shelving space, promotional support, and just-in-time inventory systems.

The distribution ecosystem requires sophisticated cold chain management for high-end or less-preserved variants, though most apple jams are shelf-stable. Effective direct distribution offers better margin control but requires significant investment in logistics infrastructure. Indirect distribution channels provide unparalleled market penetration but introduce multiple intermediaries, potentially diluting brand control and increasing final consumer pricing. Strategic management of both channels—leveraging online platforms for brand building and specialty retail for premium offerings, while relying on supermarkets for mass-market volume—is essential for optimizing the overall value proposition and ensuring broad market access globally.

Apple Jam Market Potential Customers

The primary end-users and buyers of Apple Jam span two broad categories: household consumers and commercial entities. Household customers represent the largest volume segment and include individuals and families who purchase jam for daily consumption, primarily as a spread for toast, bread, or usage in simple home baking. This customer base is highly segmented by demographic, ranging from health-conscious adults seeking low-sugar or organic options to parents buying conventional, budget-friendly jams for their children. Their purchasing decisions are heavily influenced by brand loyalty, promotional pricing, and perceived product quality, favoring easy-to-access retail formats like hypermarkets.

Commercial customers encompass the HORECA (Hotels, Restaurants, and Catering) sector, food processing industry, and institutional buyers (schools, hospitals, airlines). The HORECA sector demands bulk packaging (large plastic tubs or metal tins) and often seeks single-serve portion packs for convenience and hygiene, focusing heavily on consistency, extended shelf life, and competitive pricing for high-volume orders. Food processors, such as bakeries and confectionery manufacturers, utilize apple jam as a core ingredient in pastries, tarts, and filled products, prioritizing industrial-grade formulations that withstand high baking temperatures and provide consistent textural properties throughout the production process.

A burgeoning segment of potential customers includes consumers interested in specialty diets, such as vegan, gluten-free, or specific allergen-free products. Manufacturers can tap into this niche by securing relevant certifications and transparently communicating ingredient sourcing. Moreover, the gift market, particularly in Asia Pacific and affluent European markets, represents a high-margin opportunity, where consumers purchase premium, aesthetically packaged apple jams (often artisanal or limited-edition flavors) as corporate or festive gifts, valuing luxury positioning over strict cost efficiency. Targeting these diverse buying groups requires tailored product development and distinct marketing narratives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The J.M. Smucker Company, Bonne Maman (Andros), Hero Group, E.D. Smith Foods, Wilkin & Sons Ltd. (Tiptree), Fructus, Baxters Food Group, The Hain Celestial Group, B&G Foods, Kissan (Unilever), Conagra Brands, Premier Foods, Agrana Beteiligungs-AG, Duerr’s, Crofter’s Organic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Apple Jam Market Key Technology Landscape

The manufacturing process of apple jam relies heavily on specialized technologies aimed at maximizing flavor retention, extending shelf life, and ensuring food safety compliance. High-pressure processing (HPP) is an emerging technology gaining traction, offering a non-thermal pasteurization alternative that effectively inactivates pathogens while preserving the apple's natural flavor, texture, and nutritional compounds better than traditional heat sterilization methods. This technology addresses consumer demand for minimally processed, high-quality food products. Furthermore, Vacuum Cooking Technology is widely utilized, allowing fruit cooking at lower temperatures under reduced pressure. This prevents the oxidation and degradation of heat-sensitive compounds, resulting in a fresher, brighter color and a superior fruit flavor profile in the finished jam, which is a major quality differentiator in premium segments.

Packaging technology is another critical area of innovation. Manufacturers are increasingly adopting aseptic filling systems and modified atmosphere packaging (MAP) to enhance product stability and safety without resorting to excessive preservatives. In terms of material science, there is a substantial move towards sustainable and lightweight packaging solutions, including biodegradable plastics and fully recyclable glass jars, aligning with global environmental mandates and consumer expectations for eco-friendly products. Advanced labeling technologies, such as smart labels and QR codes, are also being integrated, providing consumers with instant access to product traceability data, ingredient sourcing, and nutritional information, boosting transparency and brand trust.

On the operational side, sophisticated sensor technology and Internet of Things (IoT) integration are optimizing the entire production line. IoT sensors monitor critical parameters during the cooking and blending stages—temperature, viscosity, and pH levels—providing real-time data for automated adjustments, minimizing batch variations, and reducing human error. Enterprise Resource Planning (ERP) systems, integrated with these IoT inputs, streamline inventory management, link demand forecasts with production scheduling, and manage complex global distribution logistics. These integrated digital technologies are fundamental for maintaining efficiency and compliance in a highly regulated and fast-paced consumer goods environment.

Regional Highlights

- North America (United States, Canada, Mexico): North America holds a substantial share of the global Apple Jam Market, characterized by high consumer spending power and a mature processed food industry. The region exhibits a strong demand for organic, low-sugar, and specialty apple jams, driven by widespread health and wellness trends. The US market, in particular, benefits from extensive marketing efforts by large food conglomerates and strong retail infrastructure, including major grocery chains and membership warehouse clubs. The consumer base is sophisticated, highly responsive to product certifications (e.g., USDA Organic, Non-GMO Project Verified), and increasingly utilizes online platforms for purchasing premium international brands.

- Europe (Germany, UK, France, Italy, Spain, Russia): Europe represents the largest revenue generator for the Apple Jam Market, rooted in a long history of fruit preserving traditions and strong established brands. Western Europe, notably the UK, Germany, and France, shows high per capita consumption, driven by traditional breakfast habits and strong penetration of artisanal and high-fruit-content jams, often regulated under Protected Designation of Origin (PDO) or similar quality schemes. The European market is highly sensitive to sustainability and ethical sourcing, pushing manufacturers toward biodegradable packaging and reduced carbon footprints.

Recent regulatory actions, including sugar taxes and stringent limits on artificial additives implemented across several EU member states, have significantly accelerated the shift toward reduced-sugar and natural sweetener formulations. This pressure drives substantial research and development investment within the continent. Eastern European markets, while slightly slower to adopt premium organic variants, are experiencing robust growth as modern retail chains expand and incomes rise, leading to increasing consumption of branded, packaged preserves, often replacing traditional homemade versions. The UK remains a key market, heavily focused on brand heritage and ethical supply chains.

- Asia Pacific (China, India, Japan, South Korea, Southeast Asia): Asia Pacific (APAC) is projected to witness the highest CAGR during the forecast period, transitioning rapidly from low-volume consumption to becoming a primary driver of global growth. This expansion is fueled by rising urbanization, the increasing nuclearization of families, and profound shifts in dietary preferences toward convenient, Western-style breakfast and snack foods. While traditional jam consumption was modest, the proliferation of international fast-food chains and coffee shops using apple jam in beverages and baked goods is rapidly popularizing the product.

China and India are the dominant markets in terms of volume potential, driven by vast populations and rapidly expanding e-commerce ecosystems that facilitate distribution in highly fragmented retail landscapes. Consumer preferences in APAC favor sweeter flavor profiles and aesthetically appealing, often smaller, packaging formats suitable for gifting or trial. Localized product development, such as incorporating regional fruits or spices with apple jam, is a critical strategy for market penetration. Investment in cold chain infrastructure and improvements in local food safety regulations are crucial prerequisites supporting this vigorous regional growth trajectory.

- Latin America (Brazil, Argentina): The Latin American market for apple jam shows steady growth, influenced by improving economic stability in major economies like Brazil and Mexico. The primary demand driver is the convenience offered by shelf-stable packaged foods, increasingly preferred over fresh items due to time constraints in urban centers. Price sensitivity remains a key factor, making conventional, large-format packaging popular, although niche demand for premium, imported brands is growing among affluent consumer segments. Local manufacturers often struggle with volatile import duties and fluctuating exchange rates, impacting raw material costs and final product pricing strategies.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, demonstrates significant potential, largely due to high expatriate populations and reliance on imported food products, leading to a strong demand for internationally recognized jam brands. High disposable income supports the purchase of premium and gourmet apple jam varieties in these urban hubs. In contrast, the African sub-region presents slower growth, constrained by lower consumer purchasing power and underdeveloped modern retail infrastructure, meaning sales are often concentrated in specific urban and institutional markets where Western influence is strongest.

The market landscape in Canada follows similar trends, emphasizing local sourcing and high-quality ingredients, often focusing on regional apple varieties. Regulatory standards, while robust, are largely harmonized across the region, focusing on accurate nutritional labeling and allergen transparency. Innovation often centers on unique flavor pairings, such as apple jam infused with maple syrup or exotic spices, to cater to evolving culinary demands within the competitive breakfast and baking ingredient sectors. The demand from the institutional segment, particularly hospitals and educational facilities, for single-serve, hygienic portions also contributes significantly to regional volume.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Apple Jam Market.- The J.M. Smucker Company

- Bonne Maman (Andros)

- Hero Group

- E.D. Smith Foods

- Wilkin & Sons Ltd. (Tiptree)

- Fructus

- Baxters Food Group

- The Hain Celestial Group

- B&G Foods

- Kissan (Unilever)

- Conagra Brands

- Premier Foods

- Agrana Beteiligungs-AG

- Duerr’s

- Crofter’s Organic

- St. Dalfour

- Welch's

- Polaner (B&G Foods)

- Orkla ASA

- Darbo

Frequently Asked Questions

Analyze common user questions about the Apple Jam market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Apple Jam Market?

The Apple Jam Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing consumer demand for natural fruit preserves and rising penetration in emerging economies.

Which segments are driving the maximum growth in the Apple Jam industry?

The Organic Product Type segment and the Online Retail Distribution Channel are experiencing the maximum growth. This trend reflects global health consciousness and the increasing consumer preference for convenient e-commerce purchasing platforms for specialty food items.

How does the volatile price of apples impact the Apple Jam Market?

Volatility in global apple prices, often caused by climatic factors, significantly restrains market stability by directly affecting the cost of raw materials and subsequently increasing manufacturers' operational costs, necessitating dynamic sourcing and hedging strategies.

Which region currently holds the largest market share for Apple Jam consumption?

Europe currently holds the largest revenue share in the Apple Jam Market, supported by established consumption traditions, high consumer spending on specialty food, and a strong presence of both global and artisanal jam manufacturers.

What role does technology play in modern Apple Jam production?

Key technologies like High-Pressure Processing (HPP) and Vacuum Cooking are crucial for maintaining flavor and nutritional integrity. AI is increasingly used for advanced quality control, demand forecasting, and optimizing supply chain logistics.

What are the primary challenges facing manufacturers in the premium jam sector?

Manufacturers in the premium sector face challenges related to maintaining the 'artisanal' perception while scaling production, navigating strict clean-label regulations, and managing the higher cost associated with organic certification and sustainable, traceable sourcing.

Is there a noticeable shift in consumer preferences regarding sugar content in apple jam?

Yes, there is a pronounced global shift towards low-sugar and no-added-sugar apple jam variants. This is a direct response to public health campaigns against high sugar consumption and regulatory pressures, particularly in Western markets.

How significant is the Commercial End-Use segment (HORECA) for market growth?

The Commercial End-Use segment, encompassing HORECA and food processing, is highly significant for volume growth, as it demands bulk packaging and specialized, consistent formulations used as industrial ingredients or single-serve options in hospitality settings.

Which distribution channel is expected to grow the fastest through 2033?

Online Retail is expected to record the fastest growth, benefiting from expanding digital infrastructure, enhanced logistics capabilities, and the convenience offered to consumers seeking diverse international and specialized apple jam products.

What is the impact of sustainable packaging on purchasing decisions?

Sustainable and recyclable packaging, particularly glass jars and biodegradable plastics, highly influences consumer purchasing decisions in developed markets, acting as a key differentiator and reflecting brand commitment to environmental responsibility.

Are there opportunities for functional apple jams (e.g., fortified with vitamins)?

Significant opportunities exist in developing functional apple jams fortified with ingredients like vitamins, dietary fiber, or prebiotics, catering to the growing demographic interested in food products that offer tangible health and wellness benefits beyond basic nutrition.

What role does Asia Pacific play in the future market outlook?

Asia Pacific is crucial for future growth, projected to be the fastest-growing region, driven by expanding middle-class populations, Westernization of breakfast habits, and rapid development of modern retail and e-commerce infrastructure across countries like China and India.

How do manufacturers ensure the consistent flavor profile of mass-produced apple jam?

Manufacturers ensure consistent flavor using standardized recipes, advanced mixing and cooking equipment (like vacuum cookers), and real-time monitoring via IoT sensors to maintain precise temperature and pH levels throughout the industrial batch processing cycle.

What are the most common packaging types used in the Apple Jam Market?

The most common packaging types include glass jars, favored for premium perception and recyclability, followed by plastic tubs and containers used frequently for bulk and institutional supply, and flexible pouches gaining popularity for travel and convenience.

How does the stringent food safety regulation affect the manufacturing process?

Strict food safety regulations necessitate significant investment in advanced sterilization technologies (like HPP), automated quality control (AI-powered inspection), and comprehensive traceability systems throughout the supply chain to prevent contamination and ensure rapid recall capability.

Which key players dominate the global Apple Jam Market?

Leading companies include The J.M. Smucker Company, Bonne Maman (Andros), and Hero Group, who leverage extensive global distribution networks and brand recognition to maintain dominant positions across conventional and specialty segments.

What competitive strategies are prominent among market entrants?

New market entrants often employ strategies focusing on niche specialization, such as organic, single-source apple varieties or innovative flavor combinations, marketed aggressively through digital channels to challenge established legacy brands.

How important is the concept of 'clean label' in the modern jam market?

The 'clean label' concept is critically important; consumers actively seek products with minimal, recognizable ingredients, free from artificial colors, preservatives, and high-fructose corn syrup, driving formulation changes across the entire industry.

What is the primary difference in purchasing behavior between household and commercial customers?

Household customers prioritize flavor, brand loyalty, and convenient packaging size, while commercial customers prioritize unit cost efficiency, bulk volume, consistency for large-scale application, and suitability for industrial processes or institutional serving.

How does AI contribute to personalized marketing of apple jam?

AI analyzes demographic data and past purchasing patterns to deliver hyper-personalized digital advertisements and product recommendations, suggesting specific flavor profiles or package sizes tailored to individual consumer preferences, maximizing conversion rates.

What challenges are specific to the Latin American apple jam market?

Challenges in Latin America include significant price sensitivity among consumers, high reliance on imports leading to volatile costs due to currency fluctuations, and varying levels of retail modernization across different national markets.

How is the packaging design evolving to meet consumer demands?

Packaging design is evolving toward greater transparency (allowing consumers to view the product), enhanced sustainability (recyclable materials), and aesthetically pleasing designs that convey a sense of premium or artisanal quality, especially for specialty segments.

What is the impact of health influencers on brand adoption in the jam sector?

Health and wellness influencers wield substantial power, especially over younger, health-conscious consumers, promoting niche organic or low-sugar jam brands through social media, significantly accelerating the adoption of new products over traditional mass-market options.

Are there specific apple cultivars preferred for jam production?

Yes, cultivars such as Granny Smith (for tartness and high pectin), Fuji, and Gala are commonly preferred, selected based on their sugar-to-acid ratio, texture retention after cooking, and inherent pectin levels critical for achieving optimal jam consistency.

What defines the 'specialty stores' distribution channel?

Specialty stores include dedicated gourmet food shops, delicatessens, and small organic markets that focus on carrying high-end, often artisanal or imported apple jams, typically serving consumers willing to pay a premium for unique and high-quality products.

How does the use of aseptic filling technology benefit jam manufacturers?

Aseptic filling technology allows manufacturers to fill sterilized jam into sterile packaging under sterile conditions, significantly extending the shelf life without relying heavily on high levels of artificial preservatives, thus meeting clean label demands.

What distinguishes apple butter from traditional apple jam in the market?

Apple butter is generally slower-cooked, denser, and contains fewer chunky fruit pieces compared to jam, often relies heavily on spices like cinnamon, and typically has a smoother consistency without added pectin, catering to slightly different culinary uses and flavor preferences.

What are the key characteristics of the organic apple jam sub-segment?

The organic sub-segment is characterized by certified non-GMO ingredients, sustainable farming practices, higher price points, greater transparency regarding sourcing, and strong consumer appeal among environmentally and health-conscious buyers.

How does climate change pose a risk to the Apple Jam supply chain?

Climate change poses a risk through unpredictable weather patterns, leading to volatile apple harvests, increased prevalence of pests and diseases, and potentially inconsistent fruit quality, all of which directly affect the reliable sourcing of raw materials for jam production.

What steps are manufacturers taking to reduce the sugar content in their products?

Manufacturers are reformulating recipes by replacing sugar with natural sweeteners like stevia, erythritol, or fruit concentrates, increasing the fruit content, and leveraging higher-quality pectin to maintain the desired gelling texture with reduced sucrose levels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager