Apple Juice Concentrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433920 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Apple Juice Concentrate Market Size

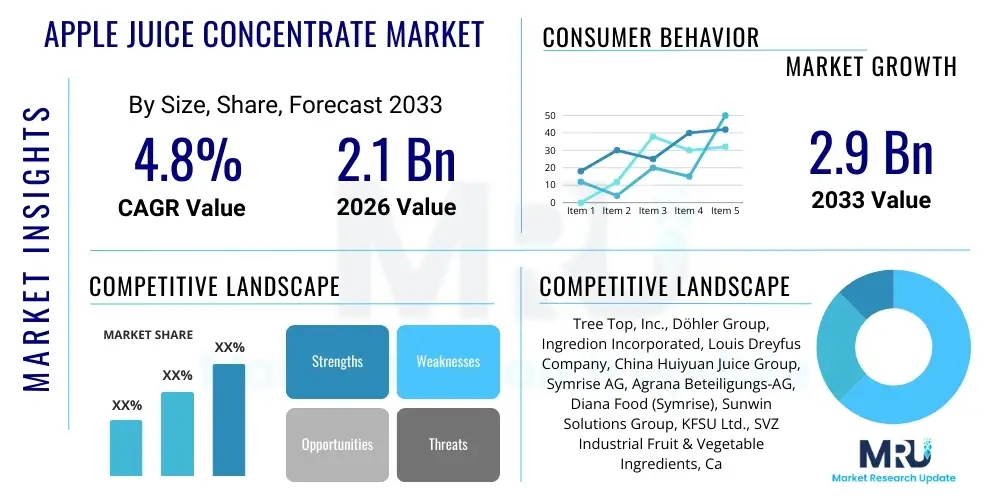

The Apple Juice Concentrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Apple Juice Concentrate Market introduction

The Apple Juice Concentrate (AJC) market encompasses the production, distribution, and consumption of apple juice where the natural water content has been significantly removed through evaporation processes. This concentration method provides substantial benefits, including reduced shipping costs, prolonged shelf life, and decreased storage space requirements, making it a highly valued ingredient across the global food and beverage industry. AJC serves as a foundational component in reconstituted juices, fruit blends, and increasingly acts as a natural sweetener or flavor enhancer in various food applications due to its neutral profile and inherent fructose content. The primary appeal of AJC lies in its versatility and economic efficiency compared to fresh juice, allowing manufacturers to maintain consistent product quality and supply chain resilience despite seasonal variations in raw apple harvests. Furthermore, the product category is segmented based on clarity (clear or cloudy) and Brix level, catering to specific formulation needs, from mainstream beverages to specialized industrial applications like cider fermentation bases.

Major applications of apple juice concentrate are predominantly found within the beverage sector, where it is reconstituted back to single-strength juice or utilized as a key component in smoothies, nectars, and functional drinks. Beyond beverages, AJC finds extensive application in the food industry, notably in confectionery, jams, jellies, dairy products, baked goods, and infant nutrition formulas, where its function extends beyond simple volume addition to providing natural sweetness and binding properties. The increasing consumer preference for products labeled as "natural" or "no added sugar" strongly propels the demand for AJC, particularly organic and not-from-concentrate varieties, as manufacturers strive to meet clean-label requirements. This shift aligns with broader public health trends focusing on replacing refined sugars with fruit-derived sweeteners, positioning AJC favorably against artificial alternatives.

Driving factors supporting the continuous expansion of the Apple Juice Concentrate market include the expanding global soft drinks market, particularly in rapidly urbanizing economies in Asia Pacific and Latin America, where demand for convenient, packaged fruit beverages is surging. Additionally, advancements in concentration and aseptic packaging technologies have ensured higher quality and flavor retention in the final product, overcoming previous concerns related to heat damage during processing. Coupled with the strategic necessity for multinational food and beverage companies to secure stable ingredient sources, the inherent logistical advantages of concentrates—such as reduced weight and volume for shipping—cement its role as an essential commodity in global ingredient trading. Regulatory shifts favoring transparent labeling further underscore AJC's importance as a natural and verifiable source of sweetness and fruit content.

Apple Juice Concentrate Market Executive Summary

The Apple Juice Concentrate (AJC) market demonstrates resilience, underpinned by robust demand from the global functional and packaged beverage sectors, despite facing significant supply chain volatility due to climatic impacts on raw apple harvests in key producing regions like China, Europe, and North America. Current business trends emphasize enhanced supply chain transparency, driving major processors toward vertical integration or establishing long-term, verifiable sourcing partnerships to mitigate risks associated with price fluctuations and quality consistency. The focus on sustainability has spurred innovation in processing, aiming for reduced energy consumption during the evaporation phase and minimizing waste, thereby appealing to environmentally conscious consumers and fulfilling corporate social responsibility mandates. Furthermore, product diversification is evident, with manufacturers increasingly offering specialized, high-Brix, or low-acid concentrates tailored for specific industrial applications, such as cider production or baby food manufacturing, optimizing performance and formulation costs for end-users.

Regional trends reveal the continued dominance of the Asia Pacific (APAC) region, particularly China, as both a major producer and a rapidly expanding consumer market, driven by rising disposable incomes and changing dietary habits favoring Western-style packaged foods and beverages. While mature markets in North America and Europe exhibit slower volume growth, these regions demonstrate a strong pivot towards premium segments, specifically organic apple juice concentrate (OAJC) and varieties derived from heirloom or specialized apple cultivars, commanding higher price points and reflecting a consumer willingness to pay for perceived health and ethical benefits. Europe, in particular, maintains stringent quality and residue standards, influencing global trading practices and pushing processors toward certified sustainable farming methods. Emerging markets in Latin America and the Middle East are experiencing significant uptake, driven by infrastructure improvements facilitating the distribution of packaged goods and local manufacturers seeking cost-effective, shelf-stable fruit bases.

Segmentation trends highlight the increasing importance of the Application segment, where Beverages remain the primary driver, though the Food Industry segment (including baked goods, breakfast cereals, and confectionery) is projected to show accelerated growth due to the application of AJC as a clean-label sweetener and humectant. Within the Type segment, Clear AJC continues to hold the largest market share due to its wide applicability in standard reconstitution and flavor blending, yet Cloudy AJC is gaining traction, particularly in health-focused drinks and smoothies, as it is perceived to retain more natural pulp components and dietary fiber. Crucially, the Source segment reflects a pronounced shift, with Organic Apple Juice Concentrate (OAJC) outpacing conventional growth, aligning with consumer demand for organic certification, non-GMO assurance, and overall product purity, signaling a major area of investment and differentiation for industry participants.

AI Impact Analysis on Apple Juice Concentrate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Apple Juice Concentrate market primarily revolve around three critical areas: supply chain predictive modeling, enhanced quality control systems, and optimization of raw material sourcing under volatile climate conditions. Consumers and industry stakeholders are keen to understand how AI-driven predictive analytics can forecast apple crop yields and quality months in advance, allowing processors to lock in contracts and manage inventory more effectively, thereby stabilizing the often-volatile input costs. Another major theme centers on the deployment of Machine Vision and IoT sensors in processing plants to continuously monitor Brix levels, acid composition, and potential contaminants during concentration, moving beyond traditional batch testing to real-time quality assurance, which directly impacts the premium pricing of high-grade concentrates. Finally, there is significant interest in how AI can optimize energy usage in the evaporation stage, minimizing operational expenditures and contributing to sustainability goals, thus ensuring the long-term economic viability of concentrate production.

The implementation of AI and related technologies such as machine learning algorithms is set to revolutionize the efficiency and quality control aspects of AJC production. AI-powered weather modeling and satellite imagery analysis enable highly accurate predictions of regional apple production, factoring in variables like disease incidence and localized weather stress, which reduces procurement risk and improves raw material allocation. In the processing environment, deep learning models are analyzing spectroscopic data collected from concentrate streams to identify deviations in color, turbidity, and chemical profiles instantaneously. This capability minimizes product loss by catching quality excursions early, ensuring that the final AJC adheres precisely to target specifications required by high-specification industrial buyers, such as baby food manufacturers who require impeccable consistency and purity.

Furthermore, AI plays a pivotal role in optimizing logistics and inventory management across the global supply chain, which is crucial for a commodity traded across continents. Machine learning models analyze global freight rates, seasonal demands, and geopolitical risks to recommend optimal shipping routes and storage locations for bulk concentrates, significantly lowering total cost of ownership for end-users. The continuous refinement of processing parameters—such as temperature, vacuum pressure, and flow rates during evaporation—using reinforcement learning techniques allows manufacturers to achieve the desired Brix levels with minimal energy expenditure and reduced thermal degradation, resulting in a higher quality concentrate with superior flavor profile preservation, a key differentiator in a competitive market.

- AI-driven Predictive Yield Forecasting: Enhances contract negotiation and raw material inventory management.

- Machine Vision Quality Control: Real-time monitoring of color, clarity, and Brix uniformity during processing.

- Supply Chain Optimization: Algorithms determine optimal logistics, reducing shipping costs and transit times.

- Energy Consumption Reduction: Optimization of evaporation parameters (temperature and pressure) to improve efficiency.

- Automated Flavor Profiling: AI analyzes chemical compounds to ensure consistent flavor replication across batches.

- Pest and Disease Detection: Utilization of drone imagery and AI to monitor orchard health, maximizing raw apple quality.

DRO & Impact Forces Of Apple Juice Concentrate Market

The dynamics of the Apple Juice Concentrate (AJC) market are influenced by a complex interplay of inherent industry drivers, external constraints, and emerging opportunities that collectively determine market trajectory and profitability. The primary driving force remains the global shift towards natural and fruit-based ingredients, positioning AJC as a superior alternative to high-fructose corn syrup and artificial sweeteners in meeting clean-label demands. However, this growth momentum is consistently challenged by the inherent volatility and price sensitivity of raw apple supplies, which are increasingly vulnerable to unpredictable weather patterns and catastrophic climate events, leading to significant fluctuations in concentrate pricing and supply security. Opportunities for growth are strategically concentrated in innovation surrounding low-Brix, high-fiber, and organic concentrate variants, aligning with consumer demand for healthier, less processed options and opening up new formulation possibilities in the functional food and beverage space.

Key drivers include the massive global demand from the reconstituted beverage industry, where AJC provides a cost-effective, consistent, and highly transportable base material that is easily utilized by bottling facilities worldwide. The intrinsic benefits of AJC—namely, its long shelf life achieved through aseptic packaging and its concentrated form—make it logistically superior to fresh or single-strength juice, ensuring minimal spoilage and efficient global trade. Furthermore, rising health consciousness, particularly in developed economies, encourages the use of AJC as a natural sweetener in baked goods, yogurts, and baby food, thereby diversifying the market beyond traditional beverage applications. The technological maturity in processing, ensuring minimal loss of flavor and nutrients during concentration, also maintains AJC's competitive edge.

Restraints significantly impacting the market include the dramatic price volatility of raw apples, often influenced by seasonal harvest yields in major producing nations like China, Poland, and the United States, creating procurement uncertainty and necessitating significant hedging strategies by large processors. Regulatory scrutiny regarding labeling practices, particularly in Europe, where 'added sugar' definitions are tightening, imposes pressure on manufacturers to clearly distinguish AJC used for reconstitution versus AJC used purely as a sweetener, potentially limiting its growth in certain product categories. Lastly, the high initial capital investment required for state-of-the-art evaporation, quality control, and aseptic packaging infrastructure creates high barriers to entry, concentrating market power among established global players. The impact forces show that while the market is driven by sustained consumer demand for convenience and natural ingredients, its growth rate is moderated by supply-side risks stemming from climate change and resource volatility.

Segmentation Analysis

The Apple Juice Concentrate market is broadly segmented based on Type, Application, Source, and Brix Level, providing a nuanced view of consumption patterns and industrial needs across the global market. Understanding these segments is crucial for strategic planning, as distinct processing methods and quality requirements are associated with each category. The dominance of the Beverage application segment underscores the historical and continued role of AJC in juice reconstitution, yet the growing demand for specialized concentrates across the Food Industry signals crucial diversification. The evolving preference for transparency and health drives the strong performance of the Organic segment, making it a premium growth driver within the larger market structure.

The segmentation by Type, specifically distinguishing between Clear and Cloudy AJC, caters directly to end-product aesthetics and processing requirements. Clear concentrate, which undergoes enzymatic treatment and filtration to remove all pulp and suspended solids, is favored for standard reconstituted juices and blends where clarity is paramount. Conversely, Cloudy concentrate, retaining some level of insoluble solids and often perceived as closer to fresh juice, is increasingly popular in higher-end, health-focused beverages that mimic the texture and appearance of "cloudy" or "pressed" juices, offering a distinct visual appeal and nutrient profile. The technical requirements and processing costs associated with achieving high clarity often influence the final pricing of the respective concentrates.

Segmentation by Brix Level (a measure of sugar content) is critical for industrial users, defining the concentration strength and subsequent dilution ratio. While concentrates between 40-60 Brix are standard for most reconstitution purposes, higher Brix levels (e.g., above 60) offer logistical advantages and are often sought by specific food manufacturers (like confectionery or bakery) for high-viscosity applications. This detailed market structure enables processors to optimize their product offerings and target specific high-value niche applications, moving beyond the commoditized bulk concentrate trade toward specialized ingredient solutions, further strengthening the market's overall profitability profile.

- Type

- Clear Apple Juice Concentrate

- Cloudy Apple Juice Concentrate

- Application

- Beverages (Reconstituted Juices, Nectars, Smoothies)

- Food Industry (Confectionery, Dairy, Bakery, Sauces)

- Cider and Alcoholic Beverages

- Infant Nutrition and Baby Food

- Source

- Conventional

- Organic

- BRIX Level

- 40 – 60 Brix

- Above 60 Brix

Value Chain Analysis For Apple Juice Concentrate Market

The value chain for the Apple Juice Concentrate market is extensive, starting from highly localized agricultural production and culminating in global distribution to food and beverage giants. The upstream segment involves the cultivation and harvesting of juice apples, where key activities include orchard management, pest control, and efficient harvesting techniques. This stage is crucial as the quality and cost of raw apples directly dictate the final product quality and manufacturing feasibility. Due to the high volume of apples required for concentration (typically 7-8 units of fresh apples for 1 unit of concentrate), processors often locate facilities strategically close to major apple growing regions to minimize transportation costs and ensure rapid processing after harvest, which is essential to prevent oxidation and maintain fresh flavor profiles.

Midstream activities involve the highly technical processing phase, which includes washing, crushing, pressing the fruit to extract juice, and the subsequent concentration process utilizing sophisticated evaporators (such as multi-effect falling film evaporators) to remove water while preserving volatile flavor components. Quality control is paramount here, involving filtration, clarification, pasteurization, and testing for Brix, acid, and heavy metal residues. The distribution channel is often bifurcated: direct sales occur when large processors supply AJC in bulk tankers or aseptic drums directly to multinational beverage companies with pre-negotiated long-term contracts. Indirect distribution involves trading houses, specialized ingredient brokers, and regional distributors who manage smaller volumes, inventory, and last-mile delivery to small- and medium-sized food processors globally.

The downstream analysis focuses on the end-users—primarily large-scale beverage manufacturers, but also specialized food sectors like baby food and confectionery. These customers demand strict adherence to specifications regarding flavor, clarity, and consistency, integrating the concentrate into their production lines for reconstitution, sweetening, or flavor base applications. The logistical efficiency and shelf-stability provided by the concentrate form drive its selection over fresh juice. Competitive advantages are often secured not just through price, but through reliable sourcing and quality verification (such as non-GMO or organic certification), placing significant pressure on processors to ensure full traceability from orchard to drum. The robustness of the supply chain, therefore, is a major differentiator in this commodity market.

Apple Juice Concentrate Market Potential Customers

The primary customer base for Apple Juice Concentrate spans the entire spectrum of the packaged food and beverage industry, with demand heavily concentrated among multinational corporations requiring reliable, high-volume ingredient supplies. Large-scale beverage companies specializing in fruit juices, sodas, and sports drinks represent the most significant end-users, utilizing AJC as a core component for juice reconstitution, providing standardized flavor and base sweetness across global product lines. These buyers prioritize quality consistency, competitive pricing, and the logistical dependability of aseptic bulk concentrates, necessitating long-term supply relationships with major processors capable of handling volumes in excess of thousands of metric tons annually.

Beyond the beverage sector, the food processing industry constitutes a rapidly growing segment of potential customers, particularly those seeking natural sugar alternatives and functional ingredients. This includes manufacturers of confectionery, jams, jellies, and sauces who utilize AJC for its humectant properties, natural sweetness, and ability to improve texture without the use of refined sugars, thus meeting clean-label requirements. The bakery sector also utilizes AJC in fillings and glazes. These customers value the neutrality of the flavor profile, especially in clear concentrates, which allows the natural characteristics of other ingredients to dominate while maintaining the desired level of sweetness.

Specialized segments, such as infant nutrition and high-end organic food producers, represent premium potential customers who demand the highest standards of purity, traceability, and certification (e.g., organic, non-GMO, low-pesticide residue). Baby food manufacturers are particularly critical buyers, demanding detailed documentation regarding the source and processing controls, often requiring specific, low-acid or high-Brix concentrates tailored to strict dietary standards for infants. The continuous growth in health and wellness trends ensures that potential customers increasingly value specialized, value-added concentrate solutions over generic bulk commodities, driving differentiation among suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tree Top, Inc., Döhler Group, Ingredion Incorporated, Louis Dreyfus Company, China Huiyuan Juice Group, Symrise AG, Agrana Beteiligungs-AG, Diana Food (Symrise), Sunwin Solutions Group, KFSU Ltd., SVZ Industrial Fruit & Vegetable Ingredients, Cargill, Incorporated, Citrus and Allied Essences Ltd., Kanegrade Ltd., Shandong Jinyuan Apple Juice Co., Ltd., Frusol GmbH, Refresco Group, Rauch Fruchtsäfte GmbH & Co KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Apple Juice Concentrate Market Key Technology Landscape

The technological landscape of the Apple Juice Concentrate market is dominated by advancements focused on maximizing flavor retention, minimizing energy consumption during processing, and ensuring aseptic product integrity. Core technology revolves around the evaporation phase, where modern multi-effect evaporator systems, particularly falling film and forced circulation units, are critical. These systems operate under high vacuum and low temperature, significantly reducing the thermal load on the juice, which is vital for preserving delicate aroma compounds and natural flavor notes that are often lost in conventional high-heat evaporation. Continuous technological refinement aims to reduce the Mean Residence Time (MRT) of the juice within the evaporator, thereby enhancing the final quality of the concentrate, making it highly suitable for premium juice reconstitution.

Beyond evaporation, significant technological progress is evident in the pre-treatment and quality control stages. Advanced ultrafiltration and microfiltration techniques are increasingly employed for clarification, replacing older, less efficient methods. These processes efficiently remove pectin, starch, and suspended solids, which are crucial for producing clear concentrates with stable clarity and extended shelf stability, while minimizing the use of chemical fining agents. Quality verification relies heavily on rapid analytical technologies, including Near-Infrared (NIR) spectroscopy and sophisticated chromatography systems, enabling real-time monitoring of critical parameters such as Brix, acid ratio, color intensity, and screening for residues or contaminants, allowing processors to immediately adjust operating conditions.

Finally, aseptic packaging technology is foundational to the AJC global trade, providing the means to store and transport concentrates without refrigeration for extended periods. Modern aseptic systems utilize high-barrier packaging (like multi-layered bags in drums or specialized tankers) that are sterilized and sealed in a sterile environment, guaranteeing product integrity and minimizing microbial risks. This logistical innovation is critical for expanding market reach into regions with limited cold chain infrastructure, facilitating global sourcing strategies for multinational food and beverage corporations and reinforcing the efficiency and resilience of the overall AJC supply chain.

Regional Highlights

Regional dynamics heavily influence the production capacity and consumption patterns within the Apple Juice Concentrate market, reflecting diverse agricultural capacities, regulatory environments, and consumer preferences. The Asia Pacific (APAC) region stands out as the major global production hub, largely dominated by China, which boasts extensive apple orchards and large-scale, cost-efficient processing facilities, positioning it as the primary exporter of bulk AJC worldwide. However, APAC is also rapidly growing as a consumption market, driven by expanding middle-class populations in India and Southeast Asia demanding packaged convenience foods and beverages, leading to increasing internal consumption of concentrates.

Europe represents a highly mature yet premium market, characterized by stringent quality controls, robust demand for organic concentrates, and a strong preference for locally sourced or European-certified products. Countries like Poland and Turkey are major regional producers, while Western European nations (Germany, UK) are significant consumers, driven by sophisticated health trends and high regulatory standards regarding pesticide residues and traceability. The European market dynamics often dictate the premium pricing for specialty concentrates, focusing heavily on low-Brix, high-purity ingredients for use in baby food and high-end organic beverages.

North America, led by the United States, is both a substantial producer, focusing on domestic supply and exports, and a massive consumer market. While North America faces challenges from high labor costs and water management issues, it excels in technological innovation and high-standard organic production. Consumption trends are shifting away from traditional reconstituted juices toward functional beverages and value-added fruit blends, driving demand for specialized AJC used as a natural sweetener in health-conscious products. Latin America and the Middle East & Africa (MEA) are emerging as important high-growth regions, characterized by increasing urbanization, rising consumption of packaged goods, and a growing need for imported, shelf-stable ingredients like AJC to fuel local manufacturing growth.

- Asia Pacific (APAC): Dominates global production, particularly China; high growth in consumption due to urbanization and increasing incomes.

- Europe: Focus on high-quality, organic, and certified concentrates; strict regulatory environment drives premiumization and advanced quality control.

- North America: Mature consumer market shifting towards specialized, natural, and low-sugar applications; strong focus on domestic supply chain efficiency.

- Latin America: Rapidly emerging market with increased manufacturing activity and reliance on imported concentrates for beverage production.

- Middle East and Africa (MEA): Growth driven by expanding packaged food industries and reliance on shelf-stable imported ingredients due to limited local fruit processing infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Apple Juice Concentrate Market.- Tree Top, Inc.

- Döhler Group

- Ingredion Incorporated

- Louis Dreyfus Company

- China Huiyuan Juice Group

- Symrise AG

- Agrana Beteiligungs-AG

- Diana Food (Symrise)

- Sunwin Solutions Group

- KFSU Ltd.

- SVZ Industrial Fruit & Vegetable Ingredients

- Cargill, Incorporated

- Citrus and Allied Essences Ltd.

- Kanegrade Ltd.

- Shandong Jinyuan Apple Juice Co., Ltd.

- Frusol GmbH

- Refresco Group

- Rauch Fruchtsäfte GmbH & Co KG

- Wild Flavors and Specialty Ingredients (ADM)

- Jingzhou Qinma Food Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Apple Juice Concentrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Apple Juice Concentrate?

The primary driver is the increasing global consumer demand for natural, fruit-derived ingredients and clean-label products, positioning AJC as a superior, cost-effective alternative to artificial sweeteners and refined sugars in mass-produced beverages and packaged foods.

How does the volatile raw apple supply affect the concentrate market?

Volatility in raw apple yields, largely due to climate variability, introduces significant price uncertainty for processors. This fluctuation necessitates sophisticated risk management strategies and long-term contracts to ensure stable, competitive pricing and continuous supply for end-users.

Which segment of the Apple Juice Concentrate market is experiencing the fastest growth?

The Organic Apple Juice Concentrate (OAJC) segment is exhibiting the fastest growth. This is driven by heightened consumer awareness regarding health, non-GMO requirements, and sustainability certifications, especially in developed markets like Europe and North America.

What role does technology play in improving the quality of AJC?

Key technologies like multi-effect falling film evaporators, advanced ultrafiltration, and real-time NIR spectroscopy are used to minimize heat damage during concentration, maximize flavor retention, and ensure stringent quality parameters (Brix, clarity, purity) are consistently met.

What are the main applications of Cloudy Apple Juice Concentrate?

Cloudy AJC, which retains natural pulp solids, is primarily utilized in high-end, premium beverages such as smoothies and pressed juices, where consumers prefer the visual and textural appearance that mimics fresh, unprocessed juice, often associated with higher nutritional value.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager