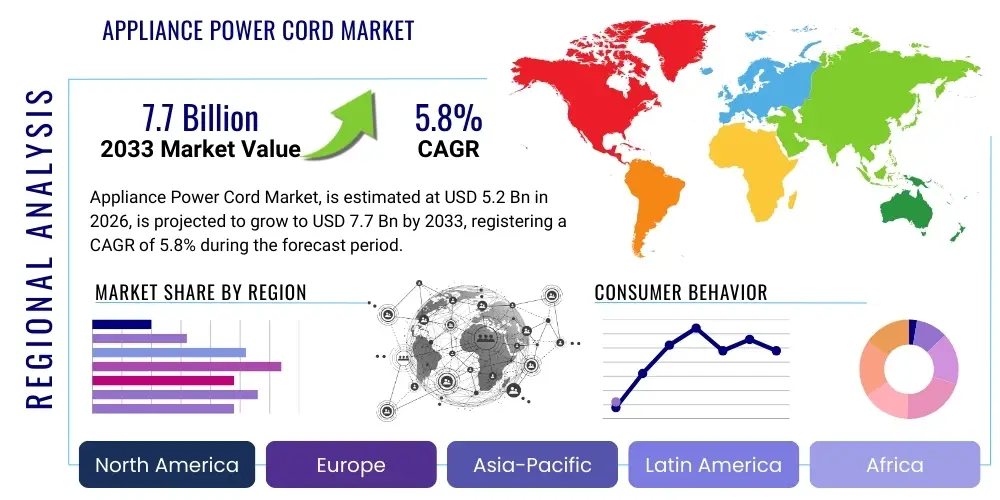

Appliance Power Cord Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435290 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Appliance Power Cord Market Size

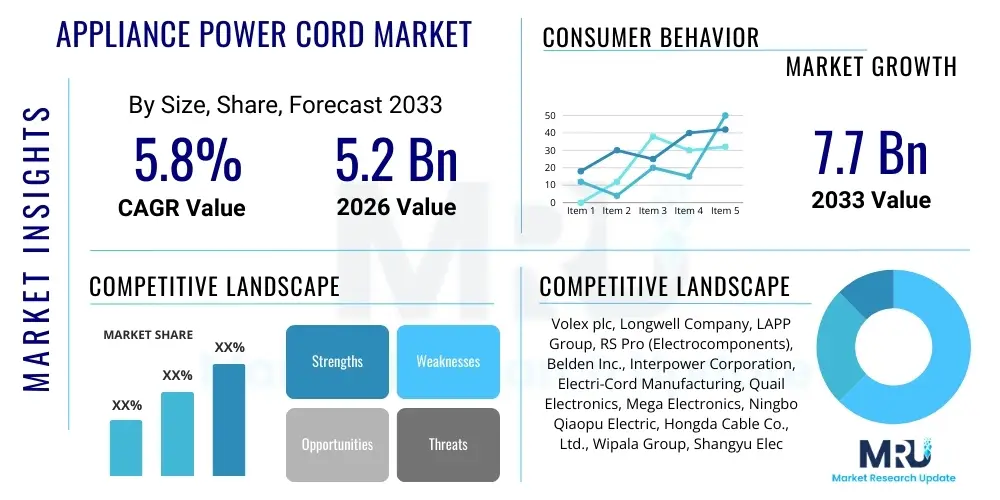

The Appliance Power Cord Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $7.7 Billion by the end of the forecast period in 2033.

Appliance Power Cord Market introduction

The Appliance Power Cord Market encompasses the global production and distribution of standardized or custom cables designed to connect electrical appliances to the main power supply (utility grid). These cords are fundamental components, ensuring the safe and efficient transfer of electrical energy required for appliance operation. Products within this market range significantly in specification, covering varying voltage ratings, current capacities, insulation materials (such as PVC, rubber, and TPE), and connector types, which are mandated by international safety standards (e.g., IEC, NEMA, JIS). The market is highly regulated due to inherent safety requirements related to electrical components, demanding strict compliance with fire resistance and stress relief guidelines. The continued global urbanization, coupled with rising disposable incomes, particularly in developing economies, fuels the demand for both major and small household appliances, driving the baseline expansion of the power cord segment.

Appliance power cords find major applications across residential, commercial, and industrial sectors. In the residential segment, they are integral to large appliances like refrigerators, washing machines, and ovens, as well as smaller devices such as blenders, toasters, and vacuum cleaners. Commercial applications include equipment used in hospitality (e.g., commercial kitchen equipment, cleaning machinery) and office environments (e.g., industrial printers, heavy-duty servers). The primary benefit these products offer is ensuring reliable and standardized electrical connectivity, flexibility, and portability for appliances, while adhering to stringent safety certifications that prevent electrical hazards, short circuits, and potential fires. The design complexity often depends on the required power load and the operating environment of the appliance.

Key driving factors accelerating market growth include the robust expansion of the consumer electronics industry, increasing replacement cycles for household appliances, and the rapid growth of the global housing market. Furthermore, continuous technological advancements focusing on efficiency and safety, such as the adoption of halogen-free materials and compliance with high-efficiency energy standards (like RoHS and REACH), necessitate updated power cord designs, stimulating innovation and market demand. The necessity of international compatibility, where a single appliance model may need dozens of regional plug variants, further expands the market complexity and volume.

Appliance Power Cord Market Executive Summary

The Appliance Power Cord Market trajectory is defined by several intertwined business, regional, and segment trends reflecting global manufacturing shifts and evolving consumer demands. Business trends highlight increasing consolidation among major cord manufacturers aimed at optimizing supply chains and achieving scale economies, especially in response to volatile raw material costs, particularly copper and plastics. There is a notable strategic shift towards automation in manufacturing to improve precision and reduce labor costs, concurrently meeting rigorous quality control standards imposed by regulatory bodies worldwide. Furthermore, sustainability is becoming a key business driver, pushing manufacturers towards implementing eco-friendly and recyclable insulation materials to align with global environmental mandates and consumer preferences for green products.

Regional trends indicate that the Asia Pacific (APAC) region dominates the market, driven by its status as the global manufacturing hub for consumer electronics and white goods, coupled with rapid infrastructure development and a burgeoning middle class in countries like China and India. North America and Europe remain mature markets characterized by high replacement rates and a strong emphasis on premium, specialized cords meeting strict safety and environmental standards (e.g., stringent UL and CE certifications). Latin America and the Middle East and Africa (MEA) present significant growth opportunities, spurred by increasing electrification rates and growing foreign direct investment in local assembly plants for appliances.

Segment trends show a decisive shift towards specialized and higher-rated power cords (15A and above) driven by the integration of smart home technologies and high-power demanding appliances such as induction cooktops and electric vehicle chargers utilizing household outlets. The Type segmentation reveals growing demand for Thermoplastic Elastomer (TPE) cords due to their superior flexibility, durability, and better environmental profile compared to traditional PVC, although PVC maintains market share due to its cost-effectiveness. In terms of application, the Major Appliances segment retains the largest volume share, but the Small Appliances and Portable Device segment is exhibiting the fastest growth, propelled by the proliferation of personal electronic devices requiring customized power solutions.

AI Impact Analysis on Appliance Power Cord Market

User inquiries regarding AI's impact on the Appliance Power Cord Market primarily center on three areas: optimizing the complex global supply chain, enhancing automated quality control during manufacturing, and predicting material cost fluctuations (especially copper and PVC). Users often question whether AI-driven predictive maintenance could lead to longer appliance lifespan, thereby impacting replacement cycle demand for cords. Key concerns revolve around integrating AI with legacy manufacturing equipment and ensuring that the data derived from smart appliances—which typically require higher quality cords for secure data transmission—translates into actionable insights for cord design optimization, particularly concerning heat dissipation and fatigue resistance. The expectation is that AI will not fundamentally change the physical product (the cord itself) but will radically improve the efficiency, customization, and safety testing processes associated with its production and procurement.

- AI-driven supply chain management optimizing inventory levels for diverse global plug configurations, minimizing waste and storage costs.

- Enhanced predictive quality assurance systems using machine vision and deep learning to instantly detect material defects or assembly flaws in high-speed production lines.

- Demand forecasting models powered by AI analyzing consumer purchasing patterns of smart appliances, enabling manufacturers to scale production of specific cord types (e.g., low-profile, high-flex TPE cords).

- Optimization of copper wiring processes and insulation extrusion through machine learning, reducing material usage while maintaining or improving conductivity specifications.

- AI algorithms analyzing regulatory updates across multiple jurisdictions simultaneously, ensuring rapid and compliant modifications to cord design specifications (AEO emphasis on regulatory compliance).

- Implementation of digital twins for simulating extreme environmental and stress testing conditions, accelerating R&D cycles for new, durable cord materials.

- Improved logistics planning utilizing AI to navigate complex international trade tariffs and shipping constraints for timely delivery of bulk appliance power cords to OEM assembly plants.

- AI support in sustainability tracking, verifying the origins and recyclability of raw materials used in insulation jackets to meet stringent environmental reporting standards.

DRO & Impact Forces Of Appliance Power Cord Market

The dynamics of the Appliance Power Cord Market are governed by a robust interplay of Drivers, Restraints, and Opportunities, which collectively define the Impact Forces shaping its trajectory. A primary Driver is the relentlessly increasing global manufacturing output of consumer electronics and white goods, especially in Asian economies, creating a perpetual demand for power connectivity solutions. This baseline demand is significantly amplified by the rising complexity and power consumption of modern smart appliances, which necessitate higher quality, more robust, and specialized power cords designed for continuous, high-load operation. Safety and regulatory harmonization, although sometimes acting as a constraint, fundamentally drives market expansion by requiring all manufacturers to upgrade and certify cords to the latest, often stricter, international standards (e.g., stricter requirements for fire retardancy and material toxicity), thus promoting innovation and replacement cycles.

Restraints in this market primarily involve the significant volatility of raw material prices, notably copper, PVC, and specialized plastics, which constitute a large portion of the Bill of Materials (BOM) for power cords. This instability frequently compresses profit margins, especially for mid-tier manufacturers who lack long-term hedging strategies. Furthermore, the market faces intense competition from low-cost, uncertified product manufacturers, particularly in unregulated or poorly regulated markets, posing safety risks and undermining certified producers. Another constraint is the inherent long lifespan of power cords—they typically outlast the appliances they serve—limiting replacement demand outside of manufacturing defective components or specific user damage.

Opportunities for growth are abundant, centering on technological advancement and market penetration. A major opportunity lies in the burgeoning smart home ecosystem, which requires power cords with integrated features such as tamper resistance, enhanced shielding, and specialized connection points suitable for IoT devices. The global push towards renewable energy and associated equipment, such as residential solar storage and dedicated EV charging appliances, presents a new high-value application segment requiring heavy-duty power cords. Furthermore, the focus on sustainable and halogen-free materials represents a significant competitive opportunity for manufacturers to gain market share in environmentally conscious regions like Europe and North America. Impact Forces are heavily weighted towards external economic factors (raw material costs) and internal regulatory shifts (safety standards), creating a constant pressure on manufacturers to maintain high quality while optimizing cost structures.

Segmentation Analysis

The Appliance Power Cord Market is highly fragmented and analyzed based on critical parameters including the type of insulation material used, the current rating capacity, the application type (appliance size), and the end-use sector. This segmentation provides a granular view of specific market needs, allowing manufacturers to tailor production and certification efforts. For instance, material selection directly impacts cost, flexibility, and compliance with environmental directives, while current rating defines the suitability for high-demand appliances. The segmentation demonstrates that while standardized cords (like those using PVC insulation) account for the highest volume due to their low cost and broad applicability in small appliances, the fastest revenue growth is derived from specialized, high-performance segments designed for industrial or smart residential applications.

Analyzing segmentation trends reveals that OEMs increasingly seek suppliers capable of providing global solutions—meaning a single supplier who can efficiently provide cords certified to UL (North America), VDE (Europe), CCC (China), and other regional standards. This demand for global compatibility drives consolidation and favors large, multi-national manufacturers. The shift towards higher-power electrical goods, such as tankless water heaters and heavy-duty laundry machines in residential settings, is disproportionately boosting the segment for 15A and 20A rated cords, requiring thicker gauge wire and superior stress relief components, thereby commanding higher average selling prices.

- By Material Type:

- Polyvinyl Chloride (PVC)

- Rubber

- Thermoplastic Elastomer (TPE)

- Other Specialized Polymers (e.g., Halogen-Free Flame Retardant materials)

- By Current Rating:

- Up to 10 Amperes (A)

- 11A to 15A

- Above 15 Amperes (A)

- By Application (Appliance Type):

- Major Appliances (Refrigerators, Washers, Dryers, Ovens)

- Small Appliances (Toasters, Kettles, Blenders, Vacuum Cleaners)

- Portable Devices and Consumer Electronics (Laptops, Gaming Consoles)

- By End-Use Sector:

- Residential

- Commercial (Hospitality, Office Equipment)

- Industrial (Heavy Machinery, Manufacturing Equipment)

Value Chain Analysis For Appliance Power Cord Market

The Value Chain for the Appliance Power Cord Market begins with upstream activities focused on raw material sourcing and preparation. This phase is highly concentrated and crucial, primarily involving the procurement of high-p-urity copper wire rods and various polymer compounds (PVC, TPE) necessary for insulation and jacketing. Copper refining and wire drawing are specialized processes, and the volatile commodity pricing in this upstream segment dictates significant cost pressure throughout the rest of the chain. Manufacturers often establish long-term contracts or employ hedging strategies to stabilize input costs, as fluctuations can severely impact the final product pricing. Material conformity to environmental standards, such as RoHS compliance (restricting hazardous substances), is also verified rigorously at this early stage.

The core manufacturing stage involves midstream processes, including wire extrusion, cabling, cutting, stripping, and the critical step of plug molding and assembly. Automation is vital here, ensuring high-volume output while maintaining the precision required for electrical safety and compliance. Manufacturers must manage a vast portfolio of molds corresponding to numerous international plug standards (e.g., Type A, C, G, I, etc.). The distribution channel is bifurcated into direct sales to Original Equipment Manufacturers (OEMs) and indirect sales through distributors and wholesalers catering to the aftermarket segment. Direct sales are predominant, characterized by large volume, long-term contracts with major appliance brands (like Whirlpool, Samsung, Haier). These relationships require high levels of supply reliability and immediate responsiveness to design changes.

Downstream activities involve the appliance OEMs integrating the power cords into their finished products, followed by distribution to retailers and end-users. The aftermarket segment is served by indirect channels, providing replacement cords directly to consumers or repair technicians. End-user feedback, especially concerning cord flexibility, durability, and stress relief performance, is crucial for continuous product improvement. Key drivers in the downstream segment are logistics efficiency and localized inventory management, ensuring that the correct regional plug types are matched with the corresponding appliances being shipped globally. This complex logistical requirement often necessitates strategic warehousing near major OEM assembly centers or consumer markets.

Appliance Power Cord Market Potential Customers

Potential customers and primary buyers in the Appliance Power Cord Market are overwhelmingly dominated by Original Equipment Manufacturers (OEMs) spanning the breadth of the consumer electronics and home appliance industries. These bulk purchasers require immense volumes of custom-specified cords, demanding highly competitive pricing, rigorous quality control documentation, and guaranteed adherence to global safety certifications. The relationship between the power cord supplier and the OEM is often deeply integrated, as the cord design must fit precisely into the appliance housing and meet specific internal thermal and mechanical load requirements. This includes global manufacturers of white goods such (e.g., refrigerators, washing machines, freezers) and brown goods (e.g., televisions, audio equipment).

Secondary, yet highly lucrative, customer segments include specialized industrial and commercial equipment manufacturers. This encompasses producers of professional-grade catering equipment, heavy-duty cleaning machinery, medical devices, and large-scale office equipment like high-volume data center cooling units or industrial printers. These customers prioritize reliability, durability under harsh conditions (e.g., high heat, chemical exposure), and often require specialized certifications beyond standard household compliance, such as hospital-grade or specific industrial enclosure ratings. Although the volume for this segment is lower than the residential OEM sector, the Average Selling Price (ASP) and profit margins are typically higher due to stringent specifications.

The aftermarket segment constitutes the third major customer group, primarily comprising electronics distributors, wholesalers, retail hardware stores, and independent appliance repair services. These buyers seek a wide variety of standardized replacement cords for maintenance, repair, and operation (MRO) purposes. For this segment, ease of access, rapid inventory replenishment, and competitive pricing for universal or semi-universal plug types are paramount. The emergence of e-commerce platforms has significantly boosted the direct-to-consumer sales of replacement power cords, offering consumers greater choice for upgrading or repairing existing appliances, further diversifying the distribution channel and customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Volex plc, Longwell Company, LAPP Group, RS Pro (Electrocomponents), Belden Inc., Interpower Corporation, Electri-Cord Manufacturing, Quail Electronics, Mega Electronics, Ningbo Qiaopu Electric, Hongda Cable Co., Ltd., Wipala Group, Shangyu Electric, Feller Engineering, Summit Electric Supply |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Appliance Power Cord Market Key Technology Landscape

The technological landscape of the Appliance Power Cord Market is primarily driven by advances in material science and enhanced manufacturing precision required for safety certifications. A significant technological focus is the transition from traditional PVC insulation to advanced, environmentally compliant materials such as Thermoplastic Elastomers (TPE) and various Halogen-Free Flame Retardant (HFFR) compounds. TPE offers superior flexibility, resilience to temperature variations, and increased durability, making it ideal for robotic or automated appliance applications where continuous movement is expected. HFFR materials address strict global environmental directives, particularly in Europe and parts of Asia, reducing the emission of toxic smoke and corrosive gases in the event of a fire, a critical factor for cords used in enclosed spaces or commercial buildings.

Another crucial technological development involves improving the strain relief and plug molding techniques. Modern power cords must withstand higher pull forces and repeated bending cycles, especially in small appliances and portable electronics. Manufacturers are leveraging advanced injection molding processes and sophisticated polymer composites to create strain relief boots that significantly extend the operational life of the cord-to-plug connection. Furthermore, the increasing integration of electronics directly into the plug head—such as power factor correction circuits or surge protection components, particularly in high-power applications—is pushing the boundaries of standard cord assembly technology, requiring precision soldering and encapsulation techniques usually reserved for complex electronic assemblies.

Manufacturing technology also plays a paramount role, utilizing high-speed, automated wire drawing and extrusion machinery integrated with continuous quality monitoring systems. These systems employ high-resolution sensors and computerized controls to ensure uniformity in wire gauge and insulation thickness across long production runs, minimizing tolerance variations that could compromise safety certifications. For global markets, rapid prototyping and tooling techniques for complex international plug standards allow manufacturers to quickly pivot production lines to meet diverse regional demands, improving time-to-market for globally distributed appliance models. The adoption of robust labeling and identification technologies, such as laser etching, ensures permanent traceability and easy verification of necessary certifications (UL, VDE), which is essential for both regulatory compliance and consumer confidence.

Regional Highlights

Regional dynamics are critical in the Appliance Power Cord Market due to the highly localized nature of electrical standards and plug types, necessitating regional manufacturing or highly adaptable global supply chains. The Asia Pacific (APAC) region stands as the undisputed market leader, responsible for both the highest volume consumption and production. This dominance is attributed to the presence of global manufacturing powerhouses for consumer electronics and appliances (e.g., China, South Korea, Japan, and Vietnam). Rapid industrialization, infrastructure growth, and the highest rate of new housing construction globally fuel continuous demand for connectivity solutions. Furthermore, domestic consumption is rising significantly across countries like India and Indonesia, supported by expanding middle-class populations acquiring their first major household appliances. The competitive landscape in APAC is intense, balancing cost-effectiveness with increasing regulatory pressure to comply with international safety norms for exported goods.

North America (NA) and Europe represent mature markets defined by stringent safety regulations and high-value product specifications. In North America, UL (Underwriters Laboratories) certification is the mandatory benchmark, leading to high barriers to entry for uncertified manufacturers. The market growth here is driven less by population expansion and more by replacement cycles, energy efficiency mandates (which may require new appliance specifications), and the increasing penetration of smart home appliances that demand highly reliable, often shielded, power connectivity. Europe mirrors this trend, prioritizing compliance with CE marking and directives like RoHS and REACH, placing significant emphasis on environmentally friendly materials (HFFR, TPE). The demand for specialized, high-current cords is growing rapidly due to the adoption of high-power kitchen equipment and localized electric heating solutions.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting strong potential, albeit facing challenges related to inconsistent infrastructure and varied regulatory environments. LATAM markets are benefiting from increased foreign investment in local assembly plants and rising consumer purchasing power, driving demand for standard household appliance cords. The MEA region, particularly the Gulf Cooperation Council (GCC) countries and parts of South Africa, is undergoing massive urbanization and construction booms, requiring large volumes of power cords for new residential and commercial developments. Growth in these regions often depends heavily on the political stability and standardization of electrical infrastructure, presenting opportunities for certified international manufacturers who can navigate diverse local standards and logistical hurdles. Investment in local manufacturing capabilities is increasing to circumvent complex import procedures and taxes, aligning production closer to the end-use appliance assembly lines.

- Asia Pacific (APAC): Market leader by volume and production capacity; driven by China, India, and ASEAN manufacturing and domestic consumption expansion.

- North America: Focus on high safety standards (UL certification), replacement market, and rapid adoption of smart appliances requiring premium cords.

- Europe: High demand for sustainable (HFFR, TPE) and certified components (VDE, CE); strong focus on environmental compliance (RoHS, REACH).

- Latin America (LATAM): Emerging growth market driven by infrastructure improvement and increasing OEM assembly operations in Mexico and Brazil.

- Middle East & Africa (MEA): Growth tied to urbanization, new construction projects, and electrification programs, requiring reliable, standardized bulk supplies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Appliance Power Cord Market.- Volex plc

- Longwell Company

- LAPP Group

- RS Pro (Electrocomponents)

- Belden Inc.

- Interpower Corporation

- Electri-Cord Manufacturing

- Quail Electronics

- Mega Electronics

- Ningbo Qiaopu Electric

- Hongda Cable Co., Ltd.

- Wipala Group

- Shangyu Electric

- Feller Engineering

- Summit Electric Supply

- General Cable Technologies Corporation (Prysmian Group)

- Southwire Company, LLC

- Alpha Wire

- Hubbell Incorporated

- Molex, LLC

Frequently Asked Questions

Analyze common user questions about the Appliance Power Cord market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the TPE power cord segment?

The TPE (Thermoplastic Elastomer) segment growth is primarily driven by superior performance characteristics compared to traditional PVC, including enhanced flexibility, chemical resistance, and better performance across wider temperature ranges. Crucially, TPE is often favored for its environmental profile, as it is non-halogenated and recyclable, enabling appliance OEMs to meet stringent global environmental regulations, particularly the RoHS and REACH directives imposed in major markets like Europe. This makes TPE essential for high-end, durable, and robotically-integrated appliances requiring sustained, flexible connectivity.

How do global safety regulations influence power cord manufacturing?

Global safety regulations, such as those enforced by UL in North America, VDE in Europe, and CCC in China, are the most significant constraints and drivers for power cord manufacturing. These standards dictate material composition (e.g., flame retardancy), electrical specifications (current and voltage ratings), mechanical performance (strain relief and pull tests), and labeling requirements. Compliance necessitates significant investment in testing, certification, and specialized manufacturing equipment. Failure to adhere to these standards prevents market access and poses severe liability risks, compelling manufacturers to maintain zero-defect quality control and pursue simultaneous multi-regional certifications for global appliance models (AEO focus on regulatory necessity).

Which application segment holds the largest market share in the Appliance Power Cord Market?

The Major Appliances segment (including refrigerators, washing machines, ovens, and dishwashers) holds the largest market share by volume and revenue. This dominance stems from the high unit volume of white goods manufactured globally and the requirement for robust, often higher-rated power cords (15A or higher) to handle peak load demands. Although the Small Appliances segment is growing faster due to the proliferation of consumer gadgets, the substantial material requirements and high ASP of cords supplied to major appliance OEMs ensure this segment maintains its leading position in overall market valuation.

What is the primary impact of copper price volatility on the market?

Copper is the core conductive material in power cords, and its price volatility directly impacts the profitability of power cord manufacturers. Since copper costs represent a significant portion of the total Bill of Materials, sudden price hikes can severely compress margins, particularly for fixed-price contracts with OEMs. Manufacturers often mitigate this risk through advanced commodity hedging strategies, implementing material-efficient designs, or passing on costs through price adjustments, often governed by specialized contractual clauses linked to commodity indices.

What technological trends are expected to define future power cord design?

Future power cord design will be defined by three key technological trends: first, increased integration of smart features, such as minimal embedded sensors or data transmission capabilities, to support the IoT ecosystem without compromising safety standards. Second, the widespread adoption of specialized high-performance materials (like TPE and HFFR) to meet durability and environmental mandates. Third, continued miniaturization and development of low-profile, high-flex cords to accommodate increasingly compact appliance designs while maintaining high current capacity, specifically addressing the needs of high-density electronic assemblies and sleek, modern household appliances.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager