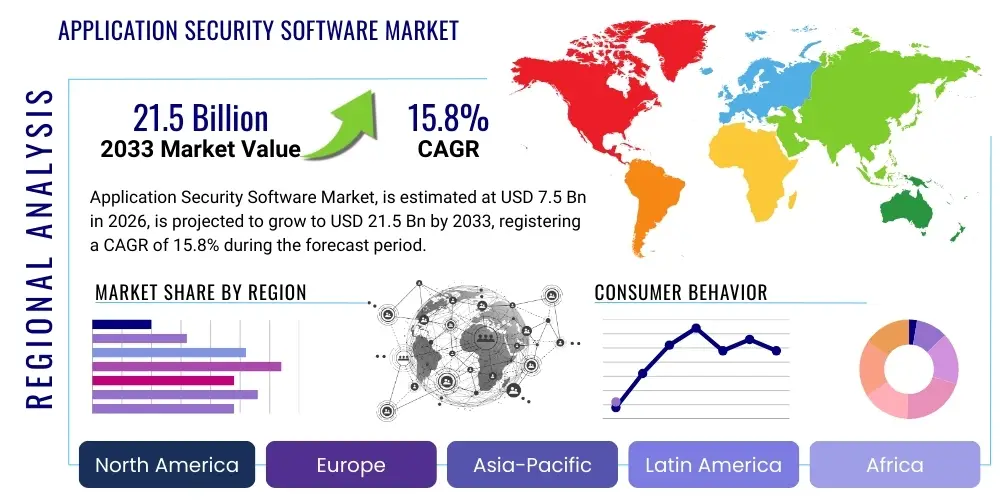

Application Security Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439074 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Application Security Software Market Size

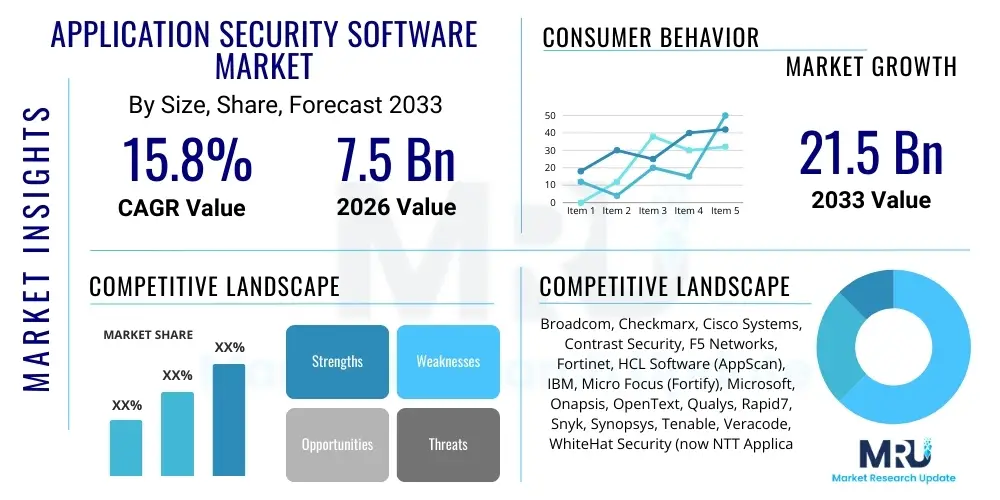

The Application Security Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $21.5 Billion by the end of the forecast period in 2033.

Application Security Software Market introduction

The Application Security Software Market encompasses tools and services designed to protect applications from external threats throughout their entire lifecycle, from design and development through deployment and eventual retirement. This necessity arises from the pervasive adoption of digital transformation initiatives, which dramatically increase the attack surface area, particularly in modern cloud-native and microservices architectures. Application security (AppSec) solutions are fundamental pillars of modern enterprise cybersecurity strategies, moving beyond traditional network perimeter defenses to secure the actual code and its operational context. These solutions facilitate the implementation of a "shift-left" strategy, integrating security testing and remediation processes early into the DevOps pipeline (DevSecOps), thereby reducing vulnerabilities before they reach production environments.

The product portfolio within this market is diverse, including Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), Interactive Application Security Testing (IAST), and Runtime Application Self-Protection (RASP), alongside Software Composition Analysis (SCA) for managing open-source risks. Major applications span across critical infrastructure sectors such as Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Healthcare, and Government agencies, all of which rely heavily on bespoke or complex commercial applications to manage sensitive data and operational workflows. The core benefit of adopting these sophisticated tools is risk mitigation, ensuring compliance with stringent regulatory frameworks like GDPR, HIPAA, and various industry-specific mandates, while simultaneously preserving brand reputation and avoiding costly breaches.

Key driving factors accelerating market growth include the exponential proliferation of mobile and web applications, the rapid transition of enterprise workloads to public and private cloud environments, and the increasing sophistication of cyber threats, particularly those targeting application layers (such as OWASP Top 10 vulnerabilities). Furthermore, the growing trend toward decentralized development using microservices and APIs demands specialized security solutions that can handle distributed environments efficiently. The continuous pressure on organizations to maintain security posture without hindering development velocity ensures sustained investment in automated, integrated AppSec platforms that offer seamless integration into Continuous Integration/Continuous Deployment (CI/CD) pipelines.

Application Security Software Market Executive Summary

The Application Security Software Market is experiencing profound shifts driven by the convergence of business trends focused on speed and regulatory pressures demanding robust protection. Business trends emphasize the adoption of DevSecOps practices, necessitating tools that automate security testing and provide high-fidelity results with minimal false positives, thereby allowing development teams to maintain agility. There is a noticeable movement away from traditional, siloed scanning tools towards unified platforms that offer comprehensive visibility across the application portfolio, integrating SAST, DAST, IAST, and SCA capabilities. Furthermore, the rising complexity of API ecosystems is fueling demand for specialized API security solutions that often incorporate AI-driven behavioral analysis to detect anomalies and protect critical data exchange points.

Regional trends indicate North America currently holds the largest market share, characterized by high technological maturity, the presence of major AppSec vendors, and robust regulatory compliance requirements across critical sectors like finance and technology. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by accelerated digital adoption, increasing cloud migration, and expanding regulatory oversight in emerging economies. Europe maintains a strong growth trajectory, largely mandated by stringent data protection laws (e.g., GDPR, NIS2 Directive) that penalize application vulnerabilities leading to data breaches, thus forcing companies to invest proactively in preventative security measures.

Segmentation trends highlight the increasing dominance of the Services component segment, reflecting the complexity of implementing and managing sophisticated AppSec programs, leading organizations to rely on specialized consulting and managed security services. Among technology types, Interactive Application Security Testing (IAST) and Runtime Application Self-Protection (RASP) are seeing rapid adoption due to their ability to provide high-accuracy, real-time testing within operational environments, bridging the gap between development and production security. Cloud deployment is rapidly outpacing on-premise solutions, aligning with enterprise cloud adoption strategies and offering scalability, lower operational overhead, and continuous update capabilities necessary for rapidly evolving security platforms. The BFSI sector remains the primary consumer due to the critical nature of the data handled and strict compliance obligations, though IT and Telecom are aggressively increasing spending to secure their distributed infrastructure and software supply chains.

AI Impact Analysis on Application Security Software Market

Common user questions regarding AI's impact on Application Security Software center on its capability to automate vulnerability discovery, enhance threat intelligence accuracy, and address the acute cybersecurity talent shortage. Users frequently ask: "How can AI reduce the number of false positives in SAST/DAST scans?" and "Will AI fully automate Level 1 security analyst tasks?" Another critical concern revolves around the potential for malicious AI (adversarial AI) to generate sophisticated zero-day exploits, requiring AppSec tools to evolve rapidly. Users generally expect AI to transition AppSec from a reactive, manual process to a proactive, predictive defense mechanism capable of understanding application context and behavioral patterns instantly. The key consensus is that AI/ML integration is inevitable and essential for handling the massive scale of code dependencies and real-time threat data generated in modern development cycles.

AI is fundamentally transforming AppSec by improving the precision and speed of vulnerability detection, thereby tackling the persistent challenge of alert fatigue and inefficiency associated with traditional scanning methodologies. Machine learning algorithms are now employed to learn patterns associated with successful breaches and benign code changes, allowing security tools to prioritize high-risk vulnerabilities that are most likely to be exploited. This prioritization ensures that development teams focus their limited resources on critical fixes, optimizing the remediation lifecycle. Furthermore, AI facilitates the automated generation of test cases (fuzzing) and helps map discovered weaknesses to specific compliance requirements, significantly reducing the manual overhead required for governance and reporting.

Looking ahead, AI is set to revolutionize Runtime Application Self-Protection (RASP) by enabling highly adaptive and context-aware defenses. AI-powered RASP agents can learn the normal behavior of an application in real-time, instantly identifying and neutralizing deviations indicative of an attack without relying solely on predefined signatures. This predictive capability is vital for securing complex, distributed microservices architectures where traditional perimeter defenses are inadequate. The market is increasingly valuing AI capabilities that not only detect but also recommend and sometimes automatically implement code remediation suggestions, integrating intelligence directly into the developer workflow and enhancing the effectiveness of the DevSecOps model.

- AI-driven vulnerability prioritization, reducing false positives in SAST and DAST results.

- Enhanced threat modeling and prediction through analysis of vast exploit datasets.

- Automation of security policy enforcement and compliance checking across CI/CD pipelines.

- Real-time behavioral analysis in RASP tools for instant anomaly detection and self-protection.

- Automated generation of sophisticated test cases (intelligent fuzz testing) to uncover deep vulnerabilities.

- Mitigation of advanced threats, including bot attacks and novel injection techniques, using machine learning classifiers.

DRO & Impact Forces Of Application Security Software Market

The Application Security Software Market is dynamically shaped by powerful drivers and countervailing restraints, creating significant opportunities that are currently manifesting as compelling impact forces. Key drivers include the acceleration of digital transformation, which places a heavier reliance on web and mobile applications, consequently broadening the threat surface. The widespread adoption of Agile and DevOps methodologies necessitates the integration of automated security tooling to maintain development speed without compromising code integrity. Moreover, stringent global regulatory frameworks, especially those mandating data protection and breach reporting, act as non-negotiable compliance drivers, forcing immediate and sustained investment in robust AppSec strategies. The exponential growth in API consumption and the proliferation of open-source components (requiring Software Composition Analysis, or SCA) further amplify the market's necessity, as both introduce significant, often unmonitored, third-party risk.

However, the market faces notable restraints, primarily concerning the persistent global shortage of skilled cybersecurity professionals capable of effectively implementing, managing, and interpreting results from complex AppSec platforms. The cost and complexity associated with integrating multiple AppSec tools—such as trying to make SAST, DAST, and SCA outputs harmonize—often result in operational friction and slow adoption, particularly among Small and Medium Enterprises (SMEs). Alert fatigue, resulting from high volumes of low-fidelity alerts or false positives generated by legacy scanners, diminishes developer productivity and leads to tool abandonment. Furthermore, the inherent difficulty in securing non-traditional environments like serverless functions and containerized applications presents technological challenges that vendors are still working to address seamlessly, slowing down adoption in highly modern, cloud-native environments.

Opportunities for growth are concentrated in the development and proliferation of highly integrated, next-generation solutions like IAST and RASP, which solve the latency and inaccuracy issues of their predecessors by operating within the application runtime. The increasing trend of consolidating AppSec capabilities into single, unified platforms offers opportunities for major vendors to capture larger market share by simplifying the DevSecOps toolchain for customers. Geographically, emerging economies in APAC and Latin America represent vast, untapped markets where digital adoption is high but security maturity is low, presenting major greenfield expansion opportunities. These drivers, restraints, and opportunities converge to create potent impact forces, chiefly the mandatory shift-left paradigm, where security becomes integral to coding rather than a final gate. This force favors vendors offering developer-friendly, highly accurate, and automated solutions, pushing legacy, scan-based tools into obsolescence and accelerating mergers and acquisitions aimed at capability consolidation and technological integration, particularly in AI-enhanced security and supply chain risk management.

Segmentation Analysis

The Application Security Software Market is meticulously segmented based on components, deployment methods, testing types, and the industry vertical served. This structured segmentation is critical for understanding market dynamics, as it reveals the distinct needs of various end-users and the specific technological solutions driving growth. The market's complexity demands specialized solutions, resulting in strong growth within segments offering automated, context-aware testing capabilities that align with modern development practices such as Agile and DevSecOps. The ongoing transition to cloud-native architectures continues to fundamentally redefine which deployment models and service types (managed services vs. self-service software) are most preferred by enterprises navigating digital transformation.

- By Component:

- Software

- Services (Professional Services, Managed Services)

- By Deployment Type:

- Cloud

- On-Premise

- By Testing Type:

- Static Application Security Testing (SAST)

- Dynamic Application Security Testing (DAST)

- Interactive Application Security Testing (IAST)

- Runtime Application Self-Protection (RASP)

- Software Composition Analysis (SCA)

- By End-User Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Government and Defense

- Healthcare

- Retail and E-commerce

- Manufacturing

- Others (Energy & Utilities, Education)

Value Chain Analysis For Application Security Software Market

The value chain for the Application Security Software Market begins with the upstream activities centered on core technology development and intellectual property creation. This involves sophisticated research and development (R&D) into advanced algorithms for vulnerability scanning, AI/ML models for behavioral analysis, and specialized agents for runtime protection (RASP/IAST). Key inputs at this stage include highly skilled security researchers, specialized coding expertise, and access to massive datasets of vulnerability intelligence and exploit patterns. Major vendors invest heavily here to maintain technological superiority, particularly in areas like identifying zero-day vulnerabilities and ensuring low false positive rates, which are crucial differentiators in a crowded market. Successful upstream integration ensures that the resulting software is capable of integrating seamlessly into diverse CI/CD environments.

Midstream activities focus on the delivery, integration, and initial deployment of the software or service. The distribution channel plays a vital role here, often relying on a mixed model incorporating direct sales to large enterprises and indirect channels through Managed Security Service Providers (MSSPs), Value-Added Resellers (VARs), and system integrators. MSSPs are particularly critical as they bridge the skills gap for end-users, offering managed AppSec programs that cover implementation, continuous monitoring, and reporting. The delivery mechanism is increasingly cloud-based (SaaS), which simplifies initial deployment and ensures continuous updates. Strategic partnerships with major cloud providers (AWS, Azure, GCP) are essential at this stage to optimize product performance and market reach.

Downstream activities involve post-sales support, continuous threat intelligence updates, and professional services, which constitute a significant portion of the total market value (the Services segment). Direct engagement involves the vendor offering specialized consulting for complex environment configuration, DevSecOps integration strategy, and compliance auditing. Indirectly, certified partners provide localized support and training, ensuring customers maximize the utility of the AppSec investment. The long-term value is captured through continuous subscriptions for software licenses and recurring managed services contracts, emphasizing the market's transition towards a Subscription as a Service (SaaS) model focused on high customer retention and ongoing value delivery through updated threat feeds and algorithm enhancements.

Application Security Software Market Potential Customers

Potential customers for Application Security Software are primarily organizations engaged in significant digital development, handling sensitive data, or operating in highly regulated environments. The prototypical buyer is the Chief Information Security Officer (CISO) or the Head of Application Development/DevOps team, with purchase decisions often involving input from both security operations and development engineering departments. Enterprises across the BFSI, Healthcare, and Government sectors represent the most crucial end-users, driven by a non-negotiable need for data integrity and adherence to stringent regulatory mandates like HIPAA, PCI DSS, and various national cybersecurity standards. These organizations typically require comprehensive, integrated solutions (SAST, DAST, IAST, and SCA) to manage large, complex application portfolios.

The IT and Telecom sector, encompassing cloud service providers, software developers, and telecommunication giants, constitutes another foundational customer base. These entities require robust AppSec solutions not only to protect their internal systems but also to ensure the security of the platforms and software they deliver to their own customers, making them early adopters of advanced technologies like IAST and RASP. The rise of e-commerce and digital services positions the Retail sector as a rapidly growing buyer segment, focused intensely on preventing financial data breaches, securing customer interactions, and defending against sophisticated web application attacks (WAF and DDoS protection combined with RASP).

Furthermore, the shift towards microservices and API-centric architectures means that any organization undergoing modern application modernization is a potential customer. This includes traditional Manufacturing and Energy & Utilities sectors that are incorporating IoT and connected systems, requiring rigorous security testing for embedded software and operational technology (OT) interfaces. The complexity of securing the software supply chain has also positioned specialized development firms and those utilizing extensive open-source libraries as crucial customers for Software Composition Analysis (SCA) tools, making supply chain security a pervasive requirement across all industry verticals, thus broadening the customer base significantly beyond traditional financial institutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $21.5 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom, Checkmarx, Cisco Systems, Contrast Security, F5 Networks, Fortinet, HCL Software (AppScan), IBM, Micro Focus (Fortify), Microsoft, Onapsis, OpenText, Qualys, Rapid7, Snyk, Synopsys, Tenable, Veracode, WhiteHat Security (now NTT Application Security), Zscaler. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Application Security Software Market Key Technology Landscape

The Application Security Software market is fundamentally defined by a core set of evolving technologies designed to identify and mitigate risks at different stages of the Software Development Life Cycle (SDLC). The landscape is currently dominated by four foundational methodologies: Static Application Security Testing (SAST), which analyzes source code without executing it to find structural vulnerabilities; Dynamic Application Security Testing (DAST), which tests running applications from the outside to identify exploitable issues; Interactive Application Security Testing (IAST), which combines both static and dynamic analysis during development or QA testing; and Runtime Application Self-Protection (RASP), which defends applications from within during production by monitoring execution flow and context. The increasing focus on the supply chain has catapulted Software Composition Analysis (SCA) into a mandatory tool, specifically designed to catalog and manage security risks associated with third-party and open-source components, which often account for the majority of modern application codebases.

Recent technological advancements are centered on enhancing automation and intelligence to address the speed and complexity of modern software delivery. The integration of Artificial Intelligence and Machine Learning (AI/ML) is the most significant trend, utilized across all testing types to reduce false positives, prioritize critical vulnerabilities based on exploitability likelihood, and accelerate remediation cycles. Furthermore, the industry is witnessing a strong movement towards consolidating these disparate technologies into unified, holistic platforms. These platforms provide a single pane of glass for security teams, ensuring consistent policy enforcement and streamlined reporting across the entire application portfolio, supporting a seamless DevSecOps workflow where security scans are non-blocking and deeply integrated into developer tooling like IDEs and source code repositories.

The rise of cloud-native development (containers, Kubernetes, serverless) has forced technological evolution, leading to the development of tools specifically designed for container security and configuration management (Cloud Security Posture Management - CSPM often overlaps). AppSec tools must now possess the capability to scan and secure Infrastructure as Code (IaC) templates (e.g., Terraform, CloudFormation) even before deployment, a paradigm known as Infrastructure as Code Security. This move ensures that the operational environment itself is secure from the outset, complementing traditional code analysis. The shift is towards continuous, context-aware testing that doesn't just detect vulnerabilities but also understands the runtime environment, the severity based on accessibility, and the corresponding mitigation techniques, ultimately driving high-fidelity, actionable security insights directly to the relevant developer.

Regional Highlights

The Application Security Software market exhibits diverse growth patterns and maturity levels across key geographical regions, influenced heavily by regulatory environments, technological adoption rates, and the concentration of major development hubs.

- North America: This region dominates the global market, driven by the presence of a large number of established AppSec vendors, high technological maturity, and substantial investment in cybersecurity across BFSI, IT, and government sectors. Stringent regulations, particularly in the financial and healthcare industries, mandate robust application protection, propelling the early and widespread adoption of advanced technologies like IAST and RASP. High software development expenditure and a strong focus on cloud-native security further solidify its leading position.

- Europe: Europe represents a mature market characterized by strong regulatory compliance requirements, most notably the General Data Protection Regulation (GDPR) and the impending Network and Information Security 2 (NIS2) Directive. These regulations prioritize application security and supply chain integrity, fostering high demand for governance-focused AppSec platforms and managed services. Western European countries, particularly the UK, Germany, and France, are key consumers, demonstrating strong growth in cloud deployment models.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, primarily fueled by rapid economic digitalization, massive penetration of mobile and web applications, and increasing government investments in digital infrastructure (e.g., India's Digital India initiative). While the security maturity varies across countries, regions like Japan, South Korea, and Australia are highly mature, whereas Southeast Asian nations are quickly ramping up AppSec adoption to combat escalating cyber threats and establish local data protection laws.

- Latin America (LATAM): Growth in LATAM is steady, driven by increasing internet penetration, expansion of cloud services, and modernization efforts across financial services and public sectors. Brazil and Mexico are the largest markets, focusing primarily on basic SAST/DAST solutions initially, but quickly moving toward managed security services due to limited in-house expertise.

- Middle East and Africa (MEA): MEA is an emerging market, with growth concentrated in the Gulf Cooperation Council (GCC) countries. High government spending on smart city initiatives and critical infrastructure protection, coupled with substantial cybersecurity budgets in the oil, gas, and finance sectors, drives demand. Adoption is often linked to major government projects and reliance on international vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Application Security Software Market.- Broadcom (Symantec)

- Checkmarx

- Cisco Systems

- Contrast Security

- F5 Networks

- Fortinet

- HCL Software (AppScan)

- IBM

- Micro Focus (Fortify)

- Microsoft

- Onapsis

- OpenText

- Qualys

- Rapid7

- Snyk

- Synopsys

- Tenable

- Veracode

- WhiteHat Security (now NTT Application Security)

- Zscaler

Frequently Asked Questions

Analyze common user questions about the Application Security Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SAST and DAST in application security?

SAST (Static Application Security Testing) analyzes application source code or binary files without executing the application to identify vulnerabilities in the code structure. DAST (Dynamic Application Security Testing) tests the application while it is running, simulating external attacks to find security weaknesses exploitable in the operational environment. SAST is effective early in the SDLC, while DAST provides critical insights into runtime behavior.

How does the shift to DevSecOps influence Application Security Software adoption?

The shift to DevSecOps mandates the integration and automation of security testing directly into the Continuous Integration/Continuous Deployment (CI/CD) pipeline. This requires AppSec software to be fast, provide developer-friendly feedback (Shift-Left), generate low false positives, and support APIs for seamless automation, favoring modern tools like IAST and automated SCA.

Which segmentation type is currently experiencing the highest growth in the AppSec market?

The IAST (Interactive Application Security Testing) and RASP (Runtime Application Self-Protection) technology segments are experiencing the highest growth. IAST is crucial for bridging the gap between development and testing by offering highly accurate feedback, while RASP provides crucial, context-aware protection for applications already in production environments, aligning with zero-trust principles.

What role does Software Composition Analysis (SCA) play in modern AppSec?

SCA is essential for identifying and managing security vulnerabilities and license compliance risks associated with open-source libraries and third-party dependencies used in an application. Given that open-source code often comprises 80% or more of modern applications, SCA is critical for mitigating software supply chain risks and ensuring compliance with community and proprietary licenses.

Which factors are driving the dominance of North America in the Application Security Software Market?

North America's market dominance is primarily driven by high technological maturity, substantial corporate cybersecurity budgets, early adoption of cloud and DevSecOps practices, and the presence of stringent data protection and industry-specific regulations (e.g., HIPAA, SEC mandates) that enforce high standards for application security across regulated industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager